State duty is a payment that is charged for receiving any government service. Deregistration of an individual entrepreneur from tax registration is one of these services. The state fee for closing an individual entrepreneur in 2022 is only 160 rubles, but in some cases it may not be paid at all.

When you can avoid paying a fee for closing an individual entrepreneur

There is no fee for registration actions at the Federal Tax Service if the applicant’s documents are sent electronically. This rule applies not only to the closure of individual entrepreneurs in 2022, but also to the registration of a business, as well as changes to state registers.

If an individual entrepreneur has a strengthened qualified signature, then he can save a little and send only an application in form P26001 to the Federal Tax Service. He will not have to pay the fee.

Fill out an application to close an individual entrepreneur

But if the entrepreneur does not have his own digital signature, then you can try other options for closing an individual entrepreneur without a fee:

- contact the MFC, which works with the Federal Tax Service through the electronic document management channel (this possibility must be clarified in the center itself);

- send the documents through a notary, who will certify them with his signature (the cost of the service starts from 1,000 rubles).

The second method should be considered if the entrepreneur is far from his place of registration or cannot personally contact the registration authority of his region.

Payment order for an extract from the Unified State Register of Legal Entities: filling out a payment order for an extract from the Unified State Register of Legal Entities

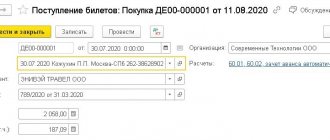

Here is a sample of filling out a payment order:

Fields [62] and [71] are not filled in; they are needed for bank employee records.

The document number is entered in field [3].

Field [4] is intended to indicate the day the payment order was issued in the format DD.MM.YY.

Field [5] must contain information about the type of payment. We write:

- [By mail], if the document is sent through a post office;

- [Urgent] if the contribution needs to be taken into account as soon as possible;

- [Electronically], if the money will be transferred by electronic payment;

- [___] if you pay in person.

Props [101]:

- <01> for LLC;

- <09> for individual entrepreneurs;

- <10> for a notary;

- <11> for a lawyer;

- <12> for the head of a peasant farm;

- <13> for individuals.

Field [6] must contain the amount to be paid in words, and [7] in numbers.

[60] – TIN (consists of ten digits for an LLC and twelve digits for an individual entrepreneur), [102] – KPP (entrepreneurs do not fill out), [8] – name of the paying enterprise (or initials of the entrepreneur), [9] – No. accounts from which funds are debited; [10] – bank name, [11] – BIC, [12] – correspondent. account) of the payer. [13] – bank of the Federal Tax Service - recipient of the money, [14] – BIC, [15] – account. [16] – name of the Federal Tax Service, [17] – Account No., [61] – Taxpayer Identification Number, [103] – Checkpoint. [19], [20], [23] remain blank.

- In part [18]<Type of transaction> we put <01> (i.e. we indicate that this is a payment document);

- In [21] -<Payment order> – set <5>;

- <Code> [22] we have <0>.

[104] – KBK, [105] – OKTMO, [106] – Basis of payment: TP (current payment).

[107] – zero value. [108] – document number -<0>. [109] – Date of registration of the payment. Field [24] -<Purpose of payment>. The line must contain information that you are requesting an extract from the Unified State Register of Legal Entities or specific information about the company.

In addition, you will see at the bottom of the document [43] “M.P.” (place of printing). It is needed if the payment order is submitted in paper form, but LLCs and individual entrepreneurs have the right to refuse to put it in then.

And finally, the area [44] contains handwritten or electronic signatures of people who have the right to sign such documents.

Area [45] is allocated for bank marks.

A payment receipt for filling out by an individual is made easier due to the fact that all entry lines are provided with hints. The information provided is exactly the same as in the payment order issued by the legal entity.

A sample of filling out a payment document by an individual for receiving an extract from the Unified State Register of Legal Entities

Here is a sample of entering data into a payment slip issued by individuals for information from the register (published on the tax service website).

A sample of filling out a payment order by a legal entity for receiving an extract from the Unified State Register of Legal Entities

Here is a sample of entering data into a payment slip issued by individuals for information from the register (published on the tax service website). The names of the companies and the amounts paid are taken arbitrarily as an example.

Where to pay the fee

To deregister an individual entrepreneur, you must contact the registration authority of your region. These are specialized tax inspectorates that carry out registration activities for the entire region or large city. In addition, you can submit documents to a multifunctional center that provides business services.

It is important that the receipt for payment of the state fee for closing an individual entrepreneur is paid to the details of the Federal Tax Service or the MFC where you are submitting the documents. Some applicants make the mistake of transferring the fee to the details of their inspection, where they are registered by registration. In this case, the closure of the individual entrepreneur will be refused and the documents must be submitted again.

A sample receipt for the state fee for closing an individual entrepreneur can be asked at the registration inspection or the MFC, but it is easier to prepare a payment document on the Federal Tax Service website.

Amount of state duty and methods of payment

The state fee for registering an individual entrepreneur is 800 rubles, but in some cases you can register without paying a fee - this depends on the method of submitting documents.

In 2022, the following methods exist:

- Personally at the Federal Tax Service

. The duty in this case is paid at 100%. - Through MFC

. There is no need to pay a fee. - In electronic form

through the online service of the Federal Tax Service (an electronic signature is required). There is no need to pay a fee. - By mail

with a valuable letter with a list of attachments. The duty in this case is paid at 100%. - Through a notary

. In this case, he will sign the application with his digital signature, and there will be no need to pay the fee.

You can exercise the right not to pay a fee only if you submit documents through the MFC, a notary or electronically, having certified them with your digital signature

.

The fee must be paid before submitting documents for registration. There is no expiration date for the fee for such payment, so if you have already paid the fee and registration is postponed, you will not have to pay it again. But if you change your mind about registering an individual entrepreneur, you can apply for a refund of the fee only within three years.

You can pay the state fee in the following ways

:

- Through the service on the Federal Tax Service website and the State Services portal

. This is one of the most convenient payment methods - the details are entered automatically by the services, you only need to fill in the fields with your data. There is no transfer fee. - In Internet banking

. Payment of fees is available in the personal accounts of many modern banks. - Cash at a bank branch

. To do this, you will need to print a receipt with ready-made details from the Federal Tax Service website. - Via terminal/ATM

. Many of them charge a commission, in addition, you will either have to search for the required inspection using the Taxpayer Identification Number (TIN) or find it using a pre-printed receipt using a barcode. - Through mobile applications

. Currently, there are many applications through which you can pay fines, taxes and duties by card or from an electronic wallet. Usually it is quite easy to find the necessary details in them, but the commissions are also large. In addition, you should carefully read reviews about the application - there are fraudulent programs that simply write off money from the card without transferring anything anywhere.

You can receive a ready-made receipt with the correct details for payment, as well as a complete package of documents, free of charge in our service for preparing documents for individual entrepreneur registration.

Please note: the state fee is paid on behalf of the future entrepreneur. If the fee is paid by another individual. person, then in the purpose of payment you must indicate for whom exactly the amount is being paid.

Are you opening a sole proprietorship? Get all documents quickly and for free!

Our online service will create all the documents for registering an individual entrepreneur for you, including a receipt for payment of the state fee. The service takes into account all new requirements of the law and the Federal Tax Service. You will only need to fill out the form according to the prompts, save and print the package for filing with the tax office. We will also include submission instructions.

Get documents

Get documents

How to prepare a receipt in the Federal Tax Service

The Tax Service has developed a convenient service called “Payment of State Duty”. Follow the link and select the taxpayer category. In addition, you need to select the type of payment document.

If you need a receipt for payment of the state fee for closing an individual entrepreneur for payment in cash or by card, then indicate “payment document”. To pay the fee from the entrepreneur’s current account, the “payment order” option is intended.

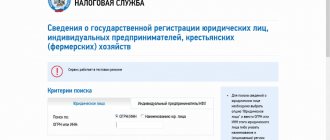

At the next step, you need to select the desired value from the drop-down lists, KBK (18210807010011000110) will be entered automatically. If you apply to the tax authority to close an individual entrepreneur, this is how the fields should be filled out.

Now you need to select the address at which the individual entrepreneur is registered. Usually this is a permanent registration in the passport; if it is not there, indicate the address of temporary registration of residence.

Next, provide the full name of the entrepreneur who is ceasing to operate. If you want to pay the state fee online, be sure to enter your TIN.

When choosing an online payment option, the service will prompt you to select a payment method. In our example, this will be the website of a credit institution.

As you can see, the index of the payment document and the recipient of the payment (at the address we indicated is MIFTS Russia No. 46 for Moscow) have already been entered automatically.

Pay attention to the service’s warning: “When paying state fees online, you must request a payment receipt from the bank through which the payment was made. Having a receipt for the payment made is mandatory when applying for state duty services at the Federal Tax Service.”

Below are the logos of credit institutions through which the state duty for the liquidation of individual entrepreneurs is transferred. Select the appropriate one and complete the payment.

How to prepare a receipt for paying the fee through a bank if you do not want to make the payment online? To do this, you do not need to indicate the payer’s TIN in the payer’s details.

As you can see, the service warns that electronic payment is not possible and offers to download the payment document in PDF format. All fields of the receipt are filled in automatically, all that remains is to print the document and pay at the bank in cash or by card.

Where to pay, payment options

There are several ways to pay the state fee.

- Directly at any bank. When paying a state fee, no commission is charged (but not in all cases, so it’s better to check).

- Through a payment terminal of any bank. There may be a commission here.

- Through the mobile application of any bank. True, in the Sberbank application there is no special option for state tax duties, but you can enter the details and pay:

- You can pay the state duty through the Federal Tax Service website. Moreover, this service will allow you not only to pay online, but also to simply generate a payment document and print it in order to pay later in another way. At the same time, the problem with finding details is solved.

- If a government service is provided to an organization (ordering an extract from the Unified State Register of Legal Entities, for example), then the state duty can be paid from its current account.

- There are various payment systems (Qiwi, Elexnet, etc.), through the terminals of which you can also pay state tax duties. There will also most likely be a commission.

Repeated payment of the fee if the Federal Tax Service refuses to open an individual entrepreneur

If the inspectorate refuses to register you as an individual entrepreneur due to incorrectly filled out papers or an incomplete package of documents, you may not pay a fee when applying again

.

Previously, a fee had to be paid for each registration attempt. Now you can correct the error within three months and contact the inspectorate again without paying a fee. Moreover, there is no need to resubmit the entire package of documents

- it is enough to provide the document in which the error was made, or which was missing during the first application. However, this can be done without paying a fee only within three months from the first registration attempt and only once. If some information is submitted incorrectly the second time, you will have to pay the fee again for the next attempt.