Postings at the receiving party when transferring OS for free use

In clause 12 of FSBU 6/2020 “Fixed assets”, valid from 2022, clause 23 of the Methodological guidelines for accounting for fixed assets, approved by order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n, valid until the end of 2022, it is indicated that fixed assets, received by the organization are reflected in accounting at historical cost.

One of the options for receiving these assets to an enterprise is to receive them free of charge from other institutions. For such fixed assets, the initial cost is the market price on the date they are reflected in the company’s accounts. Since 2022, PBU 6/01 and Methodological recommendations for accounting for fixed assets have lost force. Instead, FSBU 6/2020 “Fixed Assets” and FSBU 26/2020 “Capital Investments” apply. ConsultantPlus experts explained in detail how to correctly take into account changes in the initial cost of an operating system when applying new standards. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

The costs associated with the gratuitous receipt of fixed assets are accumulated on account 08, and the following entry is made:

Dt 08 Kt 98.

Additional costs (costs of delivery or bringing the OS into working condition) are also included in the debit of account 08:

Dt 08 Kt 60 (10, 23, 26, 76).

IMPORTANT! The gratuitous transfer of fixed assets from the donor is subject to VAT. But the organization receiving fixed assets cannot accept this tax for reimbursement and does not reflect information about it in accounting. For details, see the material “Is VAT paid when transferring property free of charge?”

VAT on additional expenses is reflected in the accounts:

Dt 19 Kt 60.

The commissioning of the facility is reflected in the following correspondence:

Dt 01 Kt 08.

Since assets received free of charge are recognized as other income, as depreciation is calculated, their value is written off on credit 91. In this case, two accounting entries are made - one reflects the amount of accrued depreciation, the second - the amount of deferred income included in other income:

Dt 20 Kt 02;

Dt 98 Kt 91.

Read about the nuances of accounting for property received free of charge in a typical situation from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

To learn more about operations with fixed assets, read the article “Accounting for fixed assets - accounting entries.”

Documenting

When transferring an item of fixed assets, draw up primary accounting documents containing the required details (Article 9 of the Law of December 6, 2011 No. 402-FZ). For example, this may be a unified form No. OS-1 (No. OS-1a, No. OS-1b), approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

The basis for drawing up the act is the technical documentation for the fixed asset, as well as accounting data (for example, turnover in account 02 “Depreciation of fixed assets” will allow you to fill in information about the amount of accrued depreciation). Draw up the act in two copies, one of which is given to the receiving party. When drawing up the act, do not fill out the section “Information on fixed assets as of the date of acceptance for accounting.” The recipient must fill it out in his copy of the act. Both copies of the deed must be signed and approved by both the donor and the donee.

In the act, indicate:

- number and date of drawing up the act;

- full name of the fixed asset according to the technical documentation;

- name of the manufacturer;

- place of transfer of the fixed asset;

- factory and assigned inventory numbers of the fixed asset;

- depreciation group number, useful life of the fixed asset and actual service life;

- the amount of depreciation accrued before the sale of the fixed asset, its residual value;

- information about the content of precious metals and stones;

- other characteristics of the fixed asset.

Also, the act must contain the conclusion of the commission that is created in the organization to control the disposal of fixed assets. The members of the commission must be the chief accountant, financially responsible persons and other employees appointed by the manager. The composition of the commission must be approved by the head of the organization by issuing an order.

This procedure is provided for in paragraphs 77–81 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Simultaneously with drawing up the act, enter information about the disposal of the fixed asset item in the inventory card. Develop the form of the inventory card yourself or use the unified form No. OS-6 (OS-6a), approved by Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7. Small enterprises can use the inventory book according to form No. OS-6b. In this case, inventory cards must contain the mandatory details provided for in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. Enter information on the basis of the transfer and acceptance certificate drawn up at the time of transfer of the fixed asset object, and the contract.

If an organization transfers fixed assets containing precious metals, it will have to draw up a report, the form of which is approved by Rosstat Resolution No. 88 of November 14, 2007. The report must indicate the amount of precious metals that was transferred along with the fixed asset.

How to transfer fixed assets to another organization free of charge

The gratuitous transfer of fixed assets is their disposal. Therefore, entries in the accounting accounts begin with writing off the original cost and depreciation:

Dt 01-2 Kt 01-1;

Dt 02 Kt 01-2.

Income and expenses associated with any disposal of fixed assets are reflected in account 91. Since the residual value relates to the organization’s expenses, it is debited to account 91:

Dt 91 Kt 01-2.

When transferring an OS free of charge, as well as when receiving it, additional costs may arise. They are reflected by wiring:

Dt 91 Kt 60 (76).

After this, a posting is made reflecting VAT on additional expenses:

Dt 19 Kt 60 (76).

Since VAT in this case is classified as an expense that is not taken into account for profit tax purposes, an accounting entry is made:

Dt 91 Kt 19.

The transfer of fixed assets on a free basis initially involves the accrual of VAT from the transferring party (such a transfer is considered a sale according to the provisions of Article 146 of the Tax Code of the Russian Federation, with the exception of cases specifically listed in the same article):

Dt 91 Kt 68.

As a result, the expenses incurred on account 91 are written off as losses to the enterprise. An accounting entry is prepared:

Dt 99 Kt 91.

Since the residual value and additional expenses cannot be taken into account when calculating income tax, a permanent tax liability arises, which is reflected:

Dt 99 Kt 68.

ConsultantPlus experts explained in detail how gratuitous transactions are taken into account for income tax purposes. If you don't have access to the system, get a free trial online.

How to arrange a free transfer of goods

Each operation in the course of business activities, including the gratuitous transfer of goods, is confirmed by primary accounting documents.

They must contain natural and monetary measures and all established mandatory details (Article 9 of the Law “On Accounting”). One of the required details is the date of compilation.

Since gratuitous transfer refers to transactions subject to VAT, you will determine the moment the tax base arises by the date of preparation of the primary accounting document (clause 1 of Article 167 of the Tax Code of the Russian Federation).

Which form you use as a primary form, write down in your accounting policy. If you are transferring goods, then this may be an invoice in the form No. TORG-12.

Postings in the budget if fixed assets were transferred free of charge

Just like private companies, budgetary organizations, within the framework of their legal capacity, can transfer OS free of charge or be their recipients.

In the budget, the main regulatory legal act regulating the correctness of registration of the gratuitous transfer of fixed assets in accounting accounts is Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n. In addition, depending on the type of organization, 3 more regulatory documents are used: order of the Ministry of Finance of Russia dated December 23, 2010 No. 183n - for autonomous institutions, order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n - for budgetary organizations, order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n - for state-owned enterprises.

For details of maintaining budgetary accounting of fixed assets, see the material “Budget accounting of fixed assets in 2022 (nuances).”

In government and budgetary organizations, when receiving fixed assets free of charge, it is necessary to take into account which budget manager of the institution that transfers the assets. Thus, only the account credit in the accounting entry will change:

- if organizations have the same fund manager - 030404310,

- if different managers - 040110180,

- other receipts - 040110100.

By debit in such a posting, the corresponding subaccounts of account 010100000 will always be used.

Disposal of fixed assets due to gratuitous transfer in budgetary and government organizations is reflected:

Dt 030404310 (040120200) Kt 010100000.

Since autonomous institutions do not have funds managers, free receipt of OS is possible either from the founders or from third-party organizations. The procedure for recording transactions for the gratuitous receipt and disposal of fixed assets on the accounts of such organizations is specified in Order 183n.

The legislation provides for cases when the gratuitous transfer of fixed assets is not subject to VAT taxation:

1. If fixed assets were transferred to a non-profit organization and they will be used to carry out the main activities reflected in the institution’s charter.

2. When transferring OS to government and local governments, state and municipal institutions, state and municipal unitary enterprises.

In other cases, the transferring party charges VAT.

In addition to the calculation of VAT, when transferring fixed assets free of charge, an important issue is their inclusion in income that affects the taxable base for income tax. Thus, when transferring within one budget level and during interbudgetary transfer, income from gratuitously received fixed assets is not taken into account.

If the assets were not received from institutions of the budget system, then you should pay attention to whether they came as a donation or under a gift agreement. Because in accordance with sub. 1 item 2 art. 251 of the Tax Code of the Russian Federation, only income in the form of donations is exempt from profit taxation. If property was received under a gift agreement, its market value is included in non-operating income (subclause 1, clause 4, article 271 of the Tax Code of the Russian Federation).

Transfer of winnings and prizes to competition winners

The transfer of winnings and prizes to individuals based on the results of contests, competitions and other events is also recognized as a gratuitous sale and is subject to VAT. In this sense, prizes are no different from gifts.

For profit tax purposes, expenses for the acquisition (production) of prizes awarded to the winners of drawings of such prizes during mass advertising campaigns are considered standard advertising expenses (Clause 4 of Article 264 of the Tax Code of the Russian Federation). Such expenses will be recognized in an amount not exceeding 1% of sales revenue, determined in accordance with Article 249 of the Tax Code of the Russian Federation.

If the holding of a contest or competition does not pursue advertising purposes, is not provided for by a collective agreement and is not included in the remuneration system, then the cost of winnings will not be included in expenses.

As for personal income tax, the cost of winnings and prizes received in competitions, competitions, games is taxed at the following rates (clauses 1, 2 of Article 224, clause 28 of Article 217 of the Tax Code of the Russian Federation):

- 35% - in terms of exceeding 4,000 rubles, if the event is held for the purpose of advertising goods, works and services;

- 13% and without applying a deduction of 4,000 rubles, if the event is held for other purposes (letter of the Ministry of Finance of Russia dated August 20, 2018 No. 03-04-05/58919);

- 13% - in terms of excess of 4,000 rubles, if the event is held according to decisions of the Government of the Russian Federation and representative authorities (letter of the Ministry of Finance of Russia dated November 14, 2018 No. 03-04-06/81966).

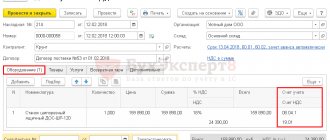

Let's look at how in "1C: Accounting 8" (rev. 3.0) you can reflect the transfer of prizes to the winners of a drawing held as part of an advertising campaign.

Example 2

| Modern Technologies LLC is participating in the exhibition in March 2022, where it is holding a prize draw among visitors for advertising purposes. A total of 10 prizes worth RUB 1,200.00 are being drawn. (including VAT 20% - RUB 200.00). The winners are determined by random sampling using a computer program. According to tax accounting data, the amount of expenses for holding prize draws does not exceed 1% of sales revenue for the current reporting period. |

It is also convenient to reflect the transfer of prizes using the Gratuitous Transfer document. The procedure for filling out the Products tab is similar to the procedure described in Example 1. Since prizes are given to an indefinite number of people, the Recipient field also does not need to be filled out.

On the Cost account tab in the Cost account field, you should independently set the required account (for example, account 44.01 “Distribution costs in organizations engaged in trading activities” with the expense type Advertising expenses (standardized)).

According to the Ministry of Finance of Russia and the Federal Tax Service of Russia, expenses in the form of VAT amounts paid by an organization when distributing advertising products free of charge cannot be taken into account when calculating income tax (letter of the Ministry of Finance of Russia dated March 11, 2010 No. 03-03-06/1/123, dated November 20, 2006 No. 02-1-07/92). This conclusion can be extended to the transfer of prizes to the winners of a drawing held as part of an advertising campaign. Therefore, in the VAT Account field, you should leave account 91.02, which is offered by the program by default (Fig. 3).

Rice. 3. Cost accounts for the transfer of prizes as part of an advertising campaign

After posting the Gratuitous Transfer document, the following accounting register entries are generated:

Debit 44.01 Credit 41.01 - for the cost of prizes (10,000 rubles). Debit 91.02 Credit 68.02 - for the amount of accrued VAT (2,000 rubles).

For tax accounting purposes for income tax, amounts are entered into special resources of the accounting register:

Amount Dt NU 44.01 and Amount Kt NU 41.01 - for the cost of prizes (10,000 rubles). Amount Dt PR 91.02 - for a constant difference (2,000 rubles).

In the month of transfer of prizes, after completion of the month-closing processing and completion of the regulatory operation Calculation of deferred tax according to PBU 18, a constant tax expense will be recognized:

Debit 99.02.3 Credit 68.04.2 - in the amount of 400 rubles. (RUB 2,000 x 20%).

The settlement certificate or summary invoice issued upon transfer of prizes will be recorded in the sales book with the transaction type code “10”. The cost of the prizes issued will be included in indirect expenses, which are reflected in the income tax return on line 040 of Appendix No. 2 to Sheet 02.

In the statement of financial results, the cost of prizes is reflected in line 2210 “Business expenses”, and the amount of accrued VAT is reflected in line 2350 “Other expenses”.

| 1C:ITS For information on how to reflect the accrual of VAT for advertising distribution of goods, see the reference book “Accounting for Value Added Tax” in the “Accounting and Tax Accounting” section. |

Results

The gratuitous transfer of fixed assets is considered a receipt of assets if the organization is their recipient. In this case, correspondence is drawn up, the result of which is the inclusion of the amount of fixed assets received in the income of the enterprise.

If, on the contrary, an organization transfers an asset to someone, then for it it will be a disposal, which will subsequently be reflected in the accounts as a loss of the organization.

Accounting for gratuitous revenues in the budgetary sector differs from accounting for other enterprises and is regulated by its own legal regulations.

Sources:

- guidelines for accounting of fixed assets, approved. by order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n

- chart of accounts, approved by order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Reflection of the transfer of property from account 21 to 1C: BGU 8

To restore the balance of fixed assets accounted for in off-balance sheet account 21, use the document Write-off of fixed assets, intangible assets, legal assets with the type of write-off Write-off of own fixed assets in oper. accounting (21) and the flag enabled: Restore to balance . the Restore on balance flag, the Restore on balance tab appears .

On the Fixed Assets, Intangible Assets, Regulatory Assets , fixed assets are selected that are written off from off-balance sheet account 21. On the Balance Restoration , data on fixed assets that are written off from off-balance sheet account 21 are indicated.

On the Accounting transaction , select the standard transaction Write-off of fixed assets with restoration on the balance sheet and in the additional details indicate the full working account 401.10.172. The gratuitous transfer of a fixed asset is formalized by the document Transfer of fixed assets, intangible assets, legal acts with the type of transfer - Transfer of own fixed assets, intangible assets, legal acts on the balance sheet (101, 102, 103) and the standard transaction Gratuitous transfer to organizations of fixed assets, intangible assets, legal acts (401.20.280) .

More on the topic: Transfer of inventories to a third party

Published 05/19/2021

Initial cost

Fixed assets received free of charge are accepted for accounting at their original cost.

When forming the initial cost, consider:

- the market value of fixed assets determined on the date of their receipt under the gift agreement;

- associated costs associated with receiving the property and bringing it to a usable condition (for example, costs of assessment, delivery, installation, consulting services, etc.). A detailed list of such expenses is given in the table.

This procedure is provided for in paragraphs 7, 8, 10 and 12 of PBU 6/01.

Situation: how to determine the market value of fixed assets received free of charge in accounting?

Paragraph 29 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, states that the market price of a fixed asset should be determined based on the amount of money that can be received from the sale of this object or identical (homogeneous) fixed assets. To determine the market price, an organization can engage an independent appraiser. In addition, information on current market prices can be obtained from the manufacturer, statistical authorities, trade inspectorates and the media. This follows from paragraph 10.3 of PBU 9/99.

Advice: if an organization finds it difficult to evaluate a fixed asset received free of charge, apply the procedure that is used to determine market prices for tax purposes (Article 105.7 of the Tax Code of the Russian Federation). Firstly, it is spelled out in more detail. And secondly, this approach will avoid the difference between the initial cost of the object in accounting and tax accounting.

Recommendations for determining the market price given in paragraph 29 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, do not take into account that:

- there may be no transactions on the market for homogeneous (identical) fixed assets;

- the received fixed assets may have no analogues;

- Available sources may not provide information on current market prices for similar properties.

Therefore, when determining the market value of fixed assets received free of charge, it is advisable to use methods used for tax purposes.

During the operation of a fixed asset, its initial cost does not change. The exceptions are cases of completion (retrofitting), reconstruction, modernization, partial liquidation and revaluation of fixed assets. This procedure follows from paragraph 14 of PBU 6/01.

Situation: how to determine in accounting the initial cost of a fixed asset received free of charge from the founder? The founder's share in the authorized capital is more than 50 percent.

The procedure for forming the initial value of fixed assets received free of charge does not depend on who donated them. Therefore, include in the initial cost of fixed assets received from the founder:

- the market value of fixed assets determined on the date of their receipt under the gift agreement;

- associated costs associated with receiving property and bringing it to a state suitable for use (for example, costs of delivery, installation, consulting services, etc.).

This procedure is provided for in paragraphs 7, 8, 10 and 12 of PBU 6/01.

Accounting

Starting from the next month after the gratuitous transfer of a fixed asset, stop accruing depreciation on it (clause 22 of PBU 6/01).

In accounting, to reflect the disposal of property from fixed assets on account 01, open a separate subaccount “Retirement of fixed assets”. At the time of transfer of the object, reflect its original (replacement) cost in the debit of the account. For a loan - the amount of depreciation accrued during the period of operation of the disposed facility. In this case, make the following entries:

Debit 01 subaccount “Disposal of fixed assets” Credit 01

– the initial (replacement) cost of the retiring fixed asset is reflected;

Debit 02 Credit 01 subaccount “Disposal of fixed assets”

– reflects depreciation accrued during the period of operation of the facility.

As a result, the balance on account 01 “Retirement of fixed assets” will reflect the residual value of the transferred fixed asset.

The residual value of the transferred fixed asset and other costs associated with the gratuitous transfer (for example, costs of storage, packaging, maintenance, transportation, etc.) should be taken into account as part of other expenses (clauses 30 and 31 of PBU 6/01, clause 11 PBU 10/99 and Instructions for the chart of accounts (accounts 01 and 91)). Take into account the residual value at the time of transfer of the object, and other expenses - at the time of their occurrence (clauses 16 and 17 of PBU 10/99).

Determine the residual value using the formula:

| Residual value of fixed asset | = | Initial (replacement) cost of fixed assets | – | The amount of accrued depreciation during the operating period |

This procedure is set out in the Instructions for the chart of accounts (account 01).

Situation: when to write off the residual value of gratuitously transferred real estate in accounting - when signing an acceptance certificate for a fixed asset object or after state registration by the receiving party of the ownership of the received object?

When transferring real estate free of charge, write it off in accounting after signing the transfer and acceptance certificate.

If the disposal is associated with a gratuitous transfer, the property must be excluded from the fixed assets at the time of its transfer to the buyer (as of the date of drawing up the transfer and acceptance certificate) (clause 29 of PBU 6/01). Reflect this in the records regardless of whether state registration of the transfer of ownership of the object to the new owner took place or not.

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated March 22, 2011 No. 07-02-10/20.

Thus, when transferring real estate free of charge, write off its residual value from account 01 “Disposal of fixed assets” on the date of signing the transfer and acceptance certificate.

The organization does not generate income as a result of the gratuitous transfer of fixed assets (PBU 9/99, PBU 6/01).

To account for expenses associated with the gratuitous transfer of fixed assets, use account 91-2 “Other expenses.” On it reflect the residual value of the retired fixed asset item and other expenses associated with its transfer after state registration of the transfer of ownership of the object to the new owner (clause 16 of PBU 10/99).

Make entries on account 91 based on:

- gift agreements;

- act of acceptance and transfer of fixed assets;

- documents confirming the costs associated with the transfer of a fixed asset (for example, an act of provision of services by the transport company transporting the object, a pay slip for the payment of salaries to employees packaging the transferred object, etc.).

This procedure is provided for in Part 1 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

When reflecting expenses associated with the gratuitous transfer of a fixed asset, make the following entries:

Debit 91-2 Credit 01 subaccount “Disposal of fixed assets”

– reflects the residual value of the gratuitously transferred fixed asset;

Debit 91-2 Credit 10 (60, 69, 70, 76...)

– expenses associated with the gratuitous transfer of fixed assets are taken into account;

Debit 19 Credit 60 (76)

– VAT is reflected on costs associated with the gratuitous transfer of fixed assets (if the tax amount was presented by the supplier (performer)).

This procedure follows from the Instructions for the chart of accounts.

Situation: how to reflect in accounting the withdrawal by the owner of a fixed asset received in excess of the authorized capital of a unitary enterprise?

Unitary enterprises own property with the right of economic management or operational management (clause 2 of Article 113, clause 4 of Article 214, Articles 294 and 296 of the Civil Code of the Russian Federation, clause 1 of Article 2 of the Law of November 14, 2002 No. 161- Federal Law). State authorities or local authorities authorized to create such an enterprise can transfer property (including fixed assets) to a unitary enterprise both within the limits of the contribution to the authorized capital and in excess of the authorized fund (Article 13 of the Law of November 14, 2002 No. 161-FZ).

According to the clarifications of the Ministry of Finance of Russia, to reflect in the accounting of fixed assets received by a unitary enterprise in excess of the amount of the authorized capital, it is necessary to use account 83 “Additional capital”. In this case, property received in excess of contributions to the authorized capital must be reflected in the debit of property accounting accounts, for example, in accounts 08, 10, 15, 41, 43, etc. This scheme of accounting entries is recommended by letters of the Ministry of Finance of Russia dated January 27, 2012 No. 07-02-18/01 and dated June 9, 2011 No. 07-02-06/104.

The right to economic management (operational management) of property is terminated in the event of its seizure from the enterprise by the owner (clause 3 of Article 299 of the Civil Code of the Russian Federation).

Reflect the write-off of a fixed asset from the balance sheet due to its withdrawal by the owner in accounting with the following entries:

Debit 91-2 Credit 75

– the debt to the owner is reflected in the amount of the residual value of the property that he is seizing;

Debit 01 subaccount “Disposal of fixed assets” Credit 01

– the initial (replacement) cost of the retiring fixed asset is reflected;

Debit 02 Credit 01 subaccount “Disposal of fixed assets”

– reflects depreciation accrued during the period of operation of the facility;

Debit 75 subaccount “Contribution by the founder of property in excess of the amount of the authorized capital” Credit 01 subaccount “Disposal of fixed assets”

– the obligation to the owner has been repaid;

Debit 83 subaccount “Contribution by the founder of property in excess of the amount of the authorized capital” Credit 91-1

– part of the additional capital is written off in the amount of the residual value of the retired fixed asset;

Debit 83 subaccount “Contribution by the founder of property in excess of the amount of the authorized capital” Credit 84

– the remaining part of the additional capital attributable to the disposed fixed asset item is written off (clause 15 of PBU 6/01).

The fact that exactly such entries must be made when the property of a unitary enterprise is seized by the owner is indicated in the recommendations to auditors sent by letter of the Ministry of Finance of Russia dated January 22, 2016 No. 07-04-09/2355, letter of the Ministry of Finance of Russia dated July 8, 2015 No. 07-01-06/39246.

Thus, when the owner withdraws from a state unitary enterprise property received by him in excess of the size of the authorized capital, no expense arises in accounting (letter of the Ministry of Finance of Russia dated January 22, 2016 No. 07-04-09/2355).

An example of reflecting in accounting the withdrawal of a fixed asset received by a unitary enterprise in excess of the amount of the authorized capital

In January, the state unitary enterprise Alpha received a car from the owner in excess of the amount of the authorized capital. In the same month, the car was registered and put into operation (for management needs). According to the acceptance certificate, the cost of the car is 100,000 rubles.

When determining the useful life, the organization applies the Classification of fixed assets, approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1. The car is included in the third depreciation group. The useful life of the vehicle is five years (60 months). According to the accounting policy, depreciation on fixed assets is calculated using the straight-line method.

The annual depreciation rate for the car was: (1: 5 years) × 100% = 20%.

The annual amount of depreciation is equal to: 100,000 rubles. × 20% = 20,000 rub.

The monthly depreciation amount was: RUB 20,000. : 12 months = 1667 rub.

In February, by order of the owner, the car was seized from Alfa. To reflect the disposal of property from fixed assets, the organization’s accountant opened a sub-account “Disposal of fixed assets” to account 01 “Fixed assets”.

Alpha's accountant made the following entries in accounting.

January:

Debit 75 subaccount “Settlements with the founder” Credit 83 – 100,000 rubles. – the founder’s debt for the value of the property in excess of the authorized capital is reflected;

Debit 08 Credit 75 “Settlements with the founder” – 100,000 rubles. – a car was received in excess of the authorized capital;

Debit 01 Credit 08 – 100,000 rub. – the fixed asset was accepted for accounting and put into operation.

February:

Debit 26 Credit 02 – 1667 rub. – depreciation was accrued for February;

Debit 91-2 Credit 75 – 98,333 rub. – the debt to the owner is reflected in the amount of the residual value of the property that he is seizing;

Debit 01 subaccount “Disposal of fixed assets” Credit 01 – 100,000 rub. – the original cost of the seized car is reflected;

Debit 02 Credit 01 subaccount “Disposal of fixed assets” – 1667 rubles. – depreciation accrued over the period of operation of the vehicle is written off;

Debit 75 subaccount “Contribution by the founder of property in excess of the amount of the authorized capital” Credit 01 subaccount “Disposal of fixed assets” - 98,333 rubles. – the obligation to the owner has been repaid;

Debit 83 subaccount “Contribution by the founder of property in excess of the amount of the authorized capital” Credit 91-1 – 98,333 rubles. – part of the additional capital is written off in the amount of the residual value of the retired fixed asset;

Debit 83 subaccount “Contribution by the founder of property in excess of the amount of the authorized capital” Credit 84 – 1667 rubles. – the remaining part of the additional capital attributable to the disposed fixed asset is written off.

Situation: how to formalize and reflect in the accounting of a unitary enterprise the transfer of communal infrastructure systems and other public utility facilities, enshrined in the right of economic management, under a concession agreement?

When registering transactions carried out under concession agreements, be based on the provisions of Law No. 115-FZ of July 21, 2005.

In the situation under consideration, communal infrastructure systems and other public utility facilities are assigned to unitary enterprises with the right of economic management, therefore the owner of these facilities can:

- remove them from economic management and transfer them directly to the concessionaire without participation in the concession agreement of the unitary enterprise;

- make a decision on the transfer of objects to the concessionaire without their removal from economic management (Part 4 of Article 3 of the Law of July 21, 2005 No. 115-FZ).

In the latter case, the unitary enterprise is endowed with certain powers of the grantor, defined by the concession agreement (Part 1.1 of Article 5 of the Law of July 21, 2005 No. 115-FZ). In such a situation, the right of economic management is retained by the unitary enterprise (clause 3 of Article 299 of the Civil Code of the Russian Federation).

Document the transfer of the object of the concession agreement - the fixed asset - with an acceptance certificate (Part 4.1, Article 3 of Law No. 115-FZ of July 21, 2005). The concession agreement may determine that the authority to sign documents related to the transfer of objects is delegated to the unitary enterprise. In this case, it is his representatives who sign the acts on the part of the grantor.

During the term of the agreement, the object of the concession agreement is accounted for on the balance sheet of the concessionaire separately from its property. The concessionaire also charges depreciation on it. This follows from the provisions of Part 16 of Article 3 of the Law of July 21, 2005 No. 115-FZ.

There is currently no approved procedure for accounting for transactions involving the transfer of property to the balance sheet of the concessionaire under a concession agreement in the accounting records of the transferring party. The chart of accounts also does not contain a special account for recording transactions within the framework of the execution of the concession agreement. Therefore, the organization must independently develop this procedure and consolidate it in its accounting policies for accounting purposes (clause 7 of PBU 1/2008). In this case, to reflect relations with the concessionaire in terms of transferred property, it is advisable to use account 76 “Settlements with other debtors and creditors”. You can open a sub-account for it “Operations under a concession agreement”.

At the time of transfer of property, the objects reflected on the balance sheet of the unitary enterprise in account 01 “Fixed Assets” should be written off (clause 29 of PBU 6/01, clause 76 of the Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n). It is also necessary to write off the depreciation accrued on these objects.

Record the write-off of the object of the concession agreement transferred to the concessionaire in the accounting of the unitary enterprise with the following entries:

Debit 76 subaccount “Operations under concession agreement” Credit 01

– the write-off of property transferred to the concessionaire is reflected;

Debit 02 Credit 76 subaccount “Operations under concession agreement”

– the write-off of the amount of accrued depreciation on the property transferred to the concessionaire is reflected.

An example of how the transfer of public utility facilities within the framework of a concession agreement is reflected in the accounting of a unitary enterprise

The city administration, which is the founder of the municipal unitary enterprise "Alpha", decided to transfer the water supply system under a concession agreement to LLC "Proizvodstvennaya". At the time of transfer, this object was assigned to the Alpha Municipal Unitary Enterprise with the right of economic management. The initial cost of the object, according to the accounting data of MUP "Alpha", is 5,000,000 rubles, depreciation accrued at the time of transfer is 2,000,000 rubles.

After signing the transfer and acceptance certificate in the accounting of MUP "Alfa", the accountant made the following entries in the accounting:

Debit 76 subaccount “Operations under the concession agreement” Credit 01 – 5,000,000 rub. – the write-off of property transferred to the concessionaire is reflected;

Debit 02 Credit 76 subaccount “Operations under the concession agreement” – 2,000,000 rubles. – the write-off of the amount of accrued depreciation on the property transferred to the concessionaire is reflected.