Who should pay the trade tax

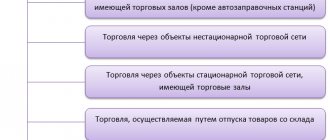

The trade tax was introduced in 2015; all organizations and individual entrepreneurs who are engaged in:

- trade through fixed network facilities with and without trading floors (shops and kiosks, with the exception of gas stations);

- trade through non-stationary network objects (tents, tables, counters, carts, delivery trade);

- organization of retail markets;

- trade in goods from a warehouse.

Do I need to pay a sales tax when selling online? Read here >>

Payment is mandatory for companies and individual entrepreneurs using the general taxation system and the simplified tax system. UTII for those activities for which payment of a trade tax is established cannot be applied in Moscow. Then you will have to switch to a different taxation system.

If you are on the list of those who pay the trade tax in 2022, you must submit a tax notice in the TS-1 form. From us you can download a notice of trade fee and a sample form for free.

What is subject to collection and when?

The levy is imposed on an object - property (movable and immovable) with the help of which trade was carried out at least once a quarter. However, it does not have to be owned by the payer.

The following objects are exempt from the vehicle:

- Pawnshops, sale of pledged items;

- Gas stations;

- Online stores with delivery of goods by courier or mail;

- Sales of related products in the provision of household services;

- Offices where there is no display of goods, but only where purchase and sale agreements are concluded;

- Trade in food products through public catering.

In Moscow, benefits have been established (exemption from payment of sales tax) for the following retail facilities:

- Vending machines;

- Objects located at fairs (for example, a pavilion at a seedling fair);

- Objects located in the retail market (for example, a stall in a clothing market);

- Retail trade in budgetary institutions;

- Postal service trade.

TC is paid quarterly. If the company has been trading for a month or two, then the fee will have to be paid for the entire quarter. The payment date is before the 25th day of the month following the reporting quarter. If the 25th falls on a weekend, then the last day of payment is considered the nearest working day.

If the vehicle is not paid on time or in full, a fine is imposed:

- In case of non-intentional non-payment - 20% of the fee + the fee itself;

- In case of intentional non-payment - 40% of the fee + the fee itself.

How to register as a trade tax payer

You need to register with the tax office at the place of registration of the property or at the place of registration of the organization or individual entrepreneur, if the premises are not used for trading.

If the retail outlet is registered in Moscow, and the legal entity is in another region, then you need to contact the Moscow Federal Tax Service at the place where the real estate is registered. This rule also applies to movable property.

Documents must be submitted no later than five days from the start of trading.

The tax office, within five working days after submitting the notification, will send a certificate of registration as a trade tax payer.

Income tax calculation

Regulatory regulation

The income tax payable to the regional budget can be reduced by the amount of the trade tax paid before the date of payment of the income tax or advance payment (clause 10 of Article 286 of the Tax Code of the Russian Federation).

In this case, the conditions must be met (Letter of the Federal Tax Service of the Russian Federation dated August 12, 2015 N GD-4-3/ [email protected] ):

- The organization must be registered with the Federal Tax Service as a trade tax payer by submitting a Notification. PDF

- You can only reduce the trade tax on the regional part of the advance payment (or income tax) that goes to the budget of the entity in which the trade tax is valid (at the moment - to the budget of the city of Moscow).

- The collection tax can be reduced only if both of these payments go to the budget of the same entity (currently the city of Moscow).

- If the amount of trade tax paid for a quarter exceeds the amount of income tax calculated for the same period, then the tax on the fee can be reduced only within the limits of the calculated tax amount. The balance of the trading fee can be taken into account based on the results of the current tax period, but the total amount to be reduced cannot exceed the annual income tax. At the same time, the tax paid for the 4th quarter can be used to reduce the tax for the year (if the fee is paid before the date of the annual payment - before March 28 inclusive) or advance payments for the 1st quarter of the next year (if the fee is paid after March 28).

If the trading fee for the 4th quarter of the current tax period is paid in the 1st quarter of the next year, then in 1C it will be included in the profit tax reduction for the 1st quarter. There is no technical possibility to take such an amount into account in the expenses of the 4th quarter.

Accounting in 1C

The calculation of income tax is carried out through the procedure Closing the month - the document Calculation of income tax in the section Operations - Closing the period - Closing the month.

Postings according to the document

The document generates transactions:

- Dt 44.01 Kt 68.13 storno - exclusion of the amounts of accrued and paid trade tax from expenses;

- Dt 90.07.1 Kt 44.01 storno - reversal of expenses based on the results of the last tax (reporting period);

- Dt 99.01.1 Kt 90.09 storno - recalculation of the financial result of the previous tax (reporting period);

- Dt 68.04.1 Kt 68.13 - reduction of income tax calculated to the regional budget by the amount of the trade tax.

Reporting

In the income tax return, the calculated and paid trade tax is reflected in:

In Sheet 02: PDF

- p. 265 “The amount of trade tax actually paid to the budget of a constituent entity of the Russian Federation since the beginning of the tax period”;

- page 266 “The amount of trade tax actually paid to the budget of a constituent entity of the Russian Federation for the previous reporting period”;

- p. 267 “The amount of trade tax by which calculated advance payments (tax) to the budget of a constituent entity of the Russian Federation for the reporting (tax) period are reduced.”

Calculation of income tax to the budget of a constituent entity of the Russian Federation for 2022, taking into account the reduction in the amount of trade tax:

Learn in more detail the reflection of the sales tax in terms of advance payments

See also:

- Registration of an object subject to trade tax

- Payment of trade tax

- Trade fee under the simplified tax system

- Deduction for trade fee in the simplified tax system assistant

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Payment of the trade fee Filling out a payment order for the payment of the trade fee is associated with a number of…

- The trade tax rate will change in 2022 Trade tax payers will face important changes in 2022. Increased...

- Calculation of trade fee...

- Postponement of payment deadlines for local taxes and trade fees You do not have access to view To gain access: Complete a commercial…

What's changed in 2022

From January 1, 2022, a new trade tax rate has been established in Moscow for non-stationary retail facilities in the Central Administrative District of the city. Now it is 40,500, not 81,000 rubles, as before. For stationary ones, it remains the same.

From July 1, 2022, the sales tax rate for objects with sales floors up to 50 sq.m. reduced by 10%, for sales areas up to 300 sq. m - by 2-10% (depending on the area of the object). And for objects with an area of more than 300 sq. m. the rate was raised to 75 rubles per sq. m. m.

The amount of tax in Moscow depends on the type of trade, the location of the facility and the area of the hall. Use our online trade fee calculator to calculate >>

Who doesn't pay the trading fee?

Entrepreneurs using the patent system and payers of the unified agricultural tax are exempt from payment. In addition, the trade fee is not paid by legal entities that, when registering, indicated the following main types of activity:

- hairdressing and beauty salons, laundry services, dry cleaning and dyeing of textiles and fur products;

- repair of clothing and textiles for household purposes, repair of shoes, leather goods and watches, as well as jewelry;

- production and repair of metal haberdashery and keys.

The benefit only applies to properties with an area of less than 100 square meters. m, in which the area occupied by equipment for displaying and displaying goods is no more than 10% of the total.

Catering services, including the sale of purchased products, if it is an integral part of these services, are not recognized as trading activities (Letter of the Ministry of Finance No. 03-11-11/40960 dated June 5, 2019). Therefore, catering organizations do not have to pay a sales tax.

What happens if you don't pay the trading fee?

If you have not notified the tax office, this is equivalent to conducting business without registering. You face a fine of 10% of the income received during the period during which you traded without notifying the Federal Tax Service, but not less than 40,000 rubles. In addition, the amount of the trade fee cannot be deducted under the single tax under the simplified tax system.

Although the trade tax was introduced back in 2015, many entrepreneurs still do not understand everything. We have prepared answers to the main questions.

Frequently asked questions and answers about trade fee

Results

The deadlines for transferring trade fees to the budget are given in the Tax Code of the Russian Federation, despite the fact that this fee is a payment at the local level, i.e., it largely depends on the rules established by the region. The deadlines for these periods correspond to the 25th of the month following the end of each quarter. At the beginning of 2020, the only region using such a fee is Moscow.

Sources:

- Tax Code of the Russian Federation

- Law of Moscow “On Trade Fee” dated December 17, 2014 No. 62

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

I trade through the premises I rent. Who pays the sales tax, the tenant or the landlord?

— The one who carries out trading activities pays. If you rent a commercial property, then you are the payer, not the landlord.

How to pay tax if I combine the simplified tax system and a patent?

— Entrepreneurs who combine the simplified tax system and a patent need to understand the scope of the activity within which trade is carried out. Trade tax for individual entrepreneurs on the simplified tax system in Moscow is mandatory. If trade occurs within the framework of patent activity, there is no need to pay tax. If you trade through the same store simultaneously under a patent and the simplified tax system, you must register as a payer of the trade fee and pay only for those square meters that are involved in trading activities under the simplified tax system. If it is physically impossible to divide the area by type of activity, you will have to pay for all square meters of the store.

How to determine the area of the sales floor for the purpose of calculating the sales fee?

— The total area is calculated on the basis of inventory and title documents. They must contain information about the purpose, design features and layout of the premises, as well as information confirming the right to use the point. Calculate the fee rate using an online calculator >>

If I trade on the retail market, do I have to pay a trading fee?

- No. Trading fees in relation to activities related to the organization of retail markets are paid only by management companies.

If I qualify for benefits and are exempt from trade tax, do I need to submit a notification to the tax office?

- Yes need. In this case, along with the notification, it is necessary to submit documents confirming the right to receive benefits. And in the notification indicate the benefit code. Download the notice of registration as a trade tax payer >>

Reflection of the fee in the declaration according to the simplified tax system

“Simplers” report on their activities using a declaration according to the simplified tax system, which provides a separate section 2.1.2 for trade tax payers. It is filled out by those persons who have elected to tax their income. Individual entrepreneurs and organizations working with the “income/expenses” object include the fee in the expenditure part, showing it in pp. 220-223 of section 2.2.

In section 2.1.2, persons with the object “income” show:

- Income from the beginning of the year to the end of each quarter (pp. 110-113);

- Corresponding tax for each period (pp. 130-133);

- Contributions and benefits issued to employees that reduce tax (pp. 140-143)

- Fee paid since the beginning of the year, broken down by period (pp. 150-153);

- The fee by which the tax can be reduced (advance on it) (p. 160-163) - if the fee for the period is greater than the result of the difference in income from p. 130-133 and contributions and benefits that reduce it from p. 140-143, then the result of the difference is indicated; if the fee is less, then it can be fully accepted as a reduction in the simplified tax

An example of reflecting the fee in section 2.1.2 of the tax return: