Is it necessary?

A special account is a bank account on which the security of an application for participation in procurements carried out for small and medium-sized businesses under 223-FZ, as well as 44-FZ is blocked - mainly for purchases worth more than 1 million rubles. Why mostly? Because the procurement legislation provides for the possibility for the customer to establish application security for purchases with a starting price and less than 1 million rubles. However, in practice, such cases are rare, and, in general, there is no security for applications for purchases worth less than 1 million rubles.

In addition, the security for an application for participation in a procurement under 44-FZ can be provided not only in the form of money that is blocked in a special account, but also in the form of a bank guarantee.

Therefore, if, for example, you decide to take part in a small purchase one-time or are ready to open a BG, you don’t have to open a special account.

By the way, in the Tender Plan you can find purchases for which application security is not required, simply by setting the value 0 in the corresponding column of the search form.

When is it needed?

Part 1 art. 44 No. 44-FZ assigns to customers, when conducting tenders, the opportunity to assign specific requirements to the form of securing applications. Currently, procurement under 44-FZ is carried out in two forms: paper and electronic. In the first case, opening a special account is not necessary. If the customer conducts an electronic auction, then the provision is carried out in the only way: by depositing a certain amount into the personal account of the ETP conducting a specific government procurement.

Important ! From July 1, 2022, customers have the right to transfer paper purchases electronically. And from January 1, 2022, this form of conduct will become mandatory.

According to 44-FZ

From October 1, 2022, the need to have special accounts under 44-FZ appeared for entrepreneurs and legal entities participating in electronic government procurement of the following types:

- open competition;

- competition with limited participation;

- auction;

- 2-stage competition.

The deposited money is needed to secure the applications themselves, not contracts. In fact, a special account for purchases under 44-FZ is always used when it comes to an electronic format.

Important ! To participate in procurements with a contract amount of up to 1 million rubles. collateral is not required on the basis of Decree of the Government of the Russian Federation No. 439 of April 12, 2022. Consequently, participants in such auctions do not need special accounts to secure applications. But if they win, they are required to transfer the winning fee to the account of a specific ETP.

According to 223-FZ

When carrying out large purchases under 223-FZ, special accounts are not needed. If representatives of small and medium-sized businesses participate in the auction, the customer may require security for the application.

In the case of such electronic government procurement, a special account is required under 223-FZ, with the help of which the necessary funds will be deposited into the ETP.

Opening a special account

You will need:

1. Find out whether the bank servicing the company’s main current account is included in the list of banks in which, in accordance with Government Order No. 1451-R dated July 13, 2018, participants can open special accounts. The full list of banks can be found on the official website of the EIS, but we will highlight the most popular:

- Sberbank of Russia;

- Alfa Bank;

- VTB;

- Otkritie Financial Corporation (this also includes Tochka Bank, popular among entrepreneurs);

- Tinkoff;

- Raiffeisenbank;

- Rosselkhozbank;

- Gazprombank;

- Sovcombank;

- Home Credit and Finance Bank;

- Rosbank.

It is convenient when the special account and the main settlement account are located in the same bank, especially if the number and amount of contributions are large. In this case, the period for transferring funds between accounts is minimal, in contrast to interbank transfers. But you can choose another bank to open a special account.

2. Make sure that using a special account will not cause problems:

- take into account the time of bank settlement operations;

- deadline for crediting funds to the account;

- possibility of emergency replenishment;

- the presence of commissions for transactions carried out on the account and their size;

- features of working with the account (for example, access through online banking).

3. And finally, the last step is to submit an application to open a special account directly to the bank. In some, you can do this remotely, without visiting the office.

A possible question from bank employees when opening a special account is for what purpose it is needed. Usually it is enough to explain for what type of trading it will be used - to work within the framework of 44-FZ or 223-FZ.

It doesn’t matter what kind of procurement you take part in - Tenderplan will include both government tenders and commercial tenders. Convenient search, mailing setup, analytics and procurement management in one service

Search tenders for free 14 days

Conditions for opening

Any procurement participant has the right to open a special account. He must do this in one of the 18 banks approved by Order of the Government of the Russian Federation No. 1451-r dated July 13, 2022. Other financial institutions do not have the right to issue special accounts to bidders. Approved banks agree to work with entrepreneurs and legal entities provided:

- submission of a complete package of necessary documents;

- availability of accreditation on one of the electronic platforms designated in the Order of the Government of the Russian Federation No. 1447-r dated July 12, 2018 (these include 8 regular and 1 closed specialized ETP);

- depositing a sufficient amount of funds to open an account (if such a fee is charged by the bank for registration).

If an entrepreneur or organization has not previously worked with procurement, then they will first have to undergo accreditation at one of the officially approved sites. These include:

- JSC "AGZRT";

- JSC "EETP" (Roseltorg);

- JSC "RAD";

- JSC "TEK - Torg";

- JSC "ETS" (national electronic platform);

- CJSC "Sberbank - AST";

- LLC "RTS - tender";

- LLC "ETP GPB";

- LLC "AST GOZ"

Each of them keeps records of special accounts of participants and, if necessary, the operator makes a request to block funds to the bank.

Important ! From January 1, 2022, instead of the register of electronic auction participants accredited by the ETP, a single register of procurement participants will be maintained on the EIS website. After this date, banks will check future owners of special accounts on it.

Opening date and service features

The deadline for opening a special account, subject to the provision of a complete package of documents, is 1 business day from the date of receipt of the application by the bank.

The bank's obligation to charge interest on the balance in a special account is legally established; however, the legislator did not indicate the amount of interest, so it differs greatly from bank to bank. For example, at Sberbank it is 0.01%, and at Tochka Bank it is from 0.5 to 4.5% on the minimum balance.

Opening and maintaining a special account is free, however, the law does not prohibit banks from charging a commission for transactions carried out on a special account . For example, Sberbank charges 50 rubles for each blocking.

During the period when funds are blocked by the operator of the electronic platform to secure an application for participation in the procurement, the participant does not have the right to dispose of these funds. In addition, regulatory authorities, for example, the Federal Tax Service, do not have the right to foreclose on such funds.

Which banks can I open in?

By law, the list of banks entitled to open special accounts for collateral is limited to 18 financial institutions. Their list includes the following banks:

- Sberbank;

- VTB;

- Gazprombank;

- Rosselkhozbank;

- Tochka-Bank;

- Alfa Bank;

- MKB-bank;

- FC "Otkritie";

- Raiffeisenbank;

- Rosbank;

- RRDB;

- Promsvyazbank;

- "AB Russia";

- Bank "Saint-Petersburg";

- Sovcombank;

- RNKB-bank;

- RosEvroBank;

- OTP Bank;

- UniCredit Bank.

If the account of an individual entrepreneur or legal entity is maintained by one of the listed financial institutions, it can:

- enter into an additional agreement with the servicing bank to use the current account as a special account (if such a possibility exists);

- open a special account for purchases by submitting a complete package of documents;

- contact any other approved bank with the most attractive terms of service.

The same clients who are served by other credit institutions are forced to open a special account to participate in purchases with other financial institutions from the list.

The requirements of the Government of the Russian Federation No. 626 of May 30, 2018 contain no restrictions on opening special accounts in several banks at once. Therefore, you can be served in 1, 2 or more institutions at the same time.

Opening order

A special account for procurement participants is opened in only 18 banks. Depending on the institution, this can be done in one or more ways:

- by personally contacting an office serving the business sector;

- by submitting an application on the bank’s website remotely (clients of some banks can send all documents through the remote banking system and even reserve an account in a few minutes if necessary);

- having gone through a simplified opening procedure through an electronic trading platform that is a partner of the bank (for example, VTB offers to open a special account under 44-FZ completely remotely and in a short time for accredited participants of the Roseltorg platform).

The list of documents for opening an account in all banks is approximately the same. It looks the same as when opening a regular current account:

- statement;

- contract;

- identification documents (for individual entrepreneurs - passport, for legal entities additionally papers confirming the authority of the applicant);

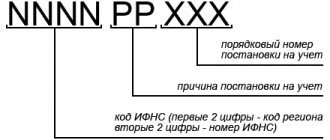

- registration papers (for individual entrepreneurs - certificates of TIN, OGRNIP, USRIP, for legal entities - constituent documents, extract from the Unified State Register of Legal Entities);

- permitting documents for conducting activities, if necessary (licenses, patents).

But you don’t have to confirm accreditation on the ETP - the bank checks this information independently.

It takes from 2 to 5 days to open, depending on the bank and its workload. After which it can be used to conduct transactions on special accounts.

Rates

The special account is intended to secure purchase orders, so the list of transactions performed by the owner will not be so large. The greatest interest of clients concerns commissions for transfers, opening and maintenance fees, and interest on deposits. Here are the tariffs of the most famous Russian banks:

| Bank | Opening cost | Cost of service per month | Interest accrual on balance (% per annum) | Request to block funds |

| Sberbank | 0 rub. | 0 rub. | 0,01% | 50 rub. |

| VTB | 0 rub. | 0 rub. | 0,01% | From 50 to 100 rub. depending on the tariff |

| Raiffeisenbank | 1,700 rub. | 950 rub. | 0,01% | For free |

| Tochka (branch of FC Otkritie) | 0 rub. | 0 rub. | 5%, but not more than 3,000 rubles. per month | For free |

| Alfa Bank | When opening a current and special account at the same time - free of charge, otherwise opening - 3,300 rubles, maintenance - from 220 to 6,900 rubles. depending on the tariff. | 0,01% | For free | |

Sberbank opens a special account separately without taking into account the conditions for tariffs for servicing current accounts. The financial institution does not charge any money for this service and maintenance. Money in a special account is kept solely for use as security for participation in procurement. At the same time, it is serviced without charging additional fees, but requires payment of a commission for each request to block funds. In some banks, an existing account may be designated as a special account, subject to the conclusion of an additional agreement.

What happens to the money in the special account?

They are blocked by the operator of the electronic platform. The amount to be blocked is equal to the amount of security for the application for participation in the procurement, indicated in the notice of procurement, and for most procurement procedures ranges from 0.5 to 5% of the initial maximum contract price.

This blocking occurs automatically within two hours from the end of submitting applications for participation in the procurement procedure.

In other words, you submitted the application, made sure that the required amount is in the special account, and then everything happens without your participation.

After blocking funds, the operator of the electronic platform sends a corresponding notification to the participant. The wording in this notification can be different, and sometimes even a little scary, for example: “Funds in account 407028...in the amount of XXX...are blocked.” It looks like not very pleasant notices from the tax office. However, in reality this is a positive notification confirming the successful blocking of funds in a special account.

Unblocking of funds is also carried out by the operator of the electronic platform within 1 business day after the occurrence of one of the following events:

- the participant has withdrawn the application;

- the customer canceled the procurement procedure;

- the participant’s application was not allowed to participate based on the results of its consideration by the customer;

- the participant did not take part in the electronic auction;

- the participant did not win the procurement, but his application was recognized as appropriate based on the results of consideration of applications by the customer;

- conclusion of a contract - for the participant recognized as the winner.

In addition, a fee is debited from a special account, which is charged to the participant in the event of winning the procurement procedure. Let us recall that the amount of such a fee is 1% of the initial maximum contract price, but not more than 5,000 rubles for regular purchases, and not more than 2,000 rubles for procedures in which only small and medium-sized businesses can participate. Most sites also add VAT to this amount.

You may also be interested in:

How to behave during interrogation at the tax office

For a business owner or employee, being summoned for questioning by the Federal Tax Service is an unpleasant situation.

Tax inspectors use this tool when conducting desk or field tax... Read more→

Current account for small business: how to open

According to current legislation, when registering with the Federal Tax Service, legal entities must have an open account with a credit institution.

It is through him that all settlements with counterparties will have to be carried out, ... Read more→

Registration with extra-budgetary funds

After state registration of a legal entity, the tax inspectorate within 5 working days sends information about the organization to the Social Insurance Fund and the Pension Fund of the Russian Federation, as well as to the State Statistics Committee.

On… Read more→

Important

You can view the status of a special account only in the Internet bank; the functionality of electronic platforms does not provide the ability to display the balance on their personal accounts. Therefore, be careful and periodically check the status of your account, because if at the right time there is no money in the special account, you will not be able to participate in the procurement procedure - the application will be rejected by the electronic signature operator .

There may be several special accounts, you can open them, and at the time of submitting an application, simply select the one you need in a special column.

Some banks charge a fee for inactivity on the account, if such a condition was specified in the agreement. Therefore, if you plan to use a special account not often, we recommend that you check before opening an account whether such a condition is in your agreement. And, if there is one, the period during which the absence of transactions on the account will allow the bank to recognize it as inactive, the amount of the commission and the conditions for activation.

Operations carried out by the bank on a special account

- blocking and termination of blocking of funds in accordance with the law. The purpose is to limit the participant’s rights to dispose at his own discretion of the funds located in his special account in the amount of the application security, within the established period in accordance with Art. 44 44-FZ;

- transfer of the application security amount to the account in which transactions with funds received by the customer are recorded;

- transfer to the appropriate budget of the Russian Federation.

Each ETP operator must enter into an agreement on interaction with each bank, according to the list established by the Government of the Russian Federation. And the bank, in turn, receives the right to open a special account for participants after concluding this agreement. The bank is responsible for transactions carried out by it on a special account.

Interaction between the ETP and the bank occurs in electronic form. The operator is responsible for the accuracy and timeliness of information in accordance with the agreement.

Funds are not returned to the participant if he is included in the register of unscrupulous suppliers (RNP) in accordance with Article 104 of 44-FZ.

What can you read if you want details?

- Article 44 of the Federal Law No. 44-FZ - it contains information on securing applications for participation in procurement procedures;

- RF PP No. 564 of May 10, 2022 - on the procedure for writing off fees for participation in procurement by operators of electronic platforms;

- RF PP No. 626 dated May 30, 2022 - contains requirements for a special account agreement and the terms of interaction between banks and electronic platforms;

- Letter of the Ministry of Finance No. 24-06-08/79659 dated November 6, 2022 - in it the department answers frequently asked questions regarding working with special accounts;

- Government Order No. 1451-R dated July 13, 2018 - contains a list of banks that can open special accounts.

Advantages and disadvantages of using a special account

If there are funds in the participant’s special account, the bank accrues interest for using them, including during the time they are blocked to secure an application. The amount of such interest is determined by the special bank account agreement concluded by the procurement participant.

In case of delay in the return of funds, the participant has the right to demand payment of penalties. The penalty is accrued for each day of delay in fulfilling the obligation, starting from the day following the day of expiration of the obligation. Such a penalty is established in the amount of one three hundredth of the key rate of the Central Bank of the Russian Federation in effect on the date of payment of the penalty on the amount not returned on time or on the amount the blocking of which should be stopped.

The above is undoubtedly a beneficial condition for the procurement participant. However, there are also disadvantages to this scheme. The Government of the Russian Federation has given electronic platforms the right to charge a fee from a participant for winning procurements conducted electronically:

- 1% of NMCC, but not more than 5 thousand rubles;

- 1% of NMCC, but not more than 2 thousand rubles. (for SMSP and SONKO).

How much will the special account cost?

The law does not limit the right of a bank to set its own tariff rules. Therefore, when choosing a financial institution, you should carefully study all the terms of service. Let's compare the most popular banks:

- Sberbank: opening and maintaining an account is free. For each blocking of money on behalf of the ETP, the bank will deduct 59 rubles of commission from the account.

- VTB: they will charge the client 3,000 rubles for opening an account. In the future, for each month during which transactions took place, an account maintenance fee will be charged - from 1,000 to 5,000 rubles, depending on the chosen plan.

- Alfa-Bank - the bank charges new clients an account opening fee of 3,300 rubles. Monthly maintenance will cost from 220 to 6900 rubles.

- Promsvyazbank - all services are provided free of charge.

Experts advise carefully studying the information offered by banks. Most financial institutions are ready to open an account for free and not charge the client money for its services, but all other transactions will have to be paid at established rates.

All banks charge interest on the balance, including temporarily blocked amounts. Its value is minimal - about 0.01%.

Limit on number of accounts

Since there are no restrictions prescribed by law, legal entities and individual entrepreneurs can open as many special-purpose accounts as they like, both in one and in different banks. It is important not to get confused between them and to ensure the receipt of funds in a timely manner before submitting proposals for tenders of interest, so as not to be rejected. Even the lack of one ruble can nullify all efforts.

Terms of service special accounts in Sberbank in 2021

Tariffs for servicing special accounts at Sberbank remain one of the most attractive in the industry, for this reason the bank occupies a leading position in the number of clients whose application for special accounts. service was approved. Tariffs for the most popular accounts are the same:

- opening an account is free;

- maintaining an account and providing access to Sberbank Business Online is free;

- processing one request to block funds – 50 rubles;

- provision of information about operations and cash settlements - on a contractual basis.

Under such conditions, you can open a special. an account for participation in government procurement and tenders, for conducting an election campaign, raising funds for major repairs of an apartment building, etc.

How to pay from a special account?

After signing a contract with the customer, the ETP sends a request to the financial institution requesting the transfer of funds. The bank transfers the required amount from the participant’s special account to the account of the trading platform operator.

If there are insufficient funds on the balance sheet, ETP has the right to demand money from the counterparty. In this case, the winner of the tender must independently transfer funds using the operator’s details or report the missing amount to his personal balance on the site.

How to close a special account?

The special account is closed upon the owner’s application, which is drawn up in the bank’s form. If at the time of submitting the document the funds on the balance sheet are blocked, this will not serve as a reason for terminating the contract with the financial structure. In such a situation, the movement of amounts on the account will be suspended until the appropriate permission is received from the ETP.

In the case of a state defense order, a special account is allowed to be closed only after receiving notification from the customer about the execution of the contract. After the message is received, the bank will consider the application from the account owner and stop servicing it. If there are funds left on the balance, they can be received in cash at a branch of the servicing financial institution or transferred to an existing account.

Do you need a special account?

Open in just 1 day Leave a request