Postings

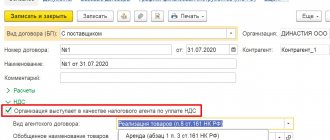

Let's consider the features of reflecting in 1C the acceptance of VAT for deduction when offsetting advances received from

FSBU 6/2020 “Fixed assets”, mandatory for use from 2022, allows enterprises to depreciate fixed assets

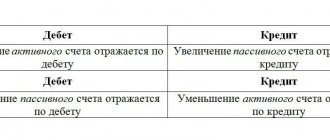

What are accounting entries? Every day millions of payments are made around the world. They are made like

Right to vacation If an employee is hired under an employment contract, the employer is obliged to provide annual

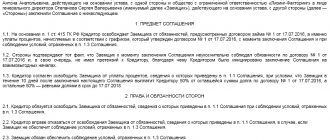

What is the statute of limitations? The statute of limitations is the time during which the creditor

Statistics on the import and export of waste paper The Russian market for recycled materials is gradually transforming, but not enough yet

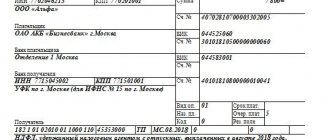

When a PKO is formed According to the law, a receipt order is documentary evidence that

As it was before In the recent past, officials had a clear opinion - to divide the VAT deduction

How to apply for debt forgiveness between legal entities Important! Article 575 of the Civil Code of the Russian Federation prohibits

Expense cash order (RKO) is one of the cash discipline documents that is issued when