In this article we will consider the procedure for registration and taxation of financial assistance from the founder received in the form of:

- contributions to property and gratuitous transfer of property,

- financial assistance aimed at increasing the company’s authorized capital,

- financial assistance in the form of a loan.

The founder can provide financial assistance to the company:

- By providing a loan (transferring funds with the condition of their return).

- By making a contribution to the company’s property or in the form of a gratuitous transfer of property (without obligations to return the funds provided).

- Through the procedure for increasing the authorized capital (AC).

At the same time, account 83 “Additional capital” is indeed used to reflect a number of transactions related to the provision of financial assistance by the founders to their companies. But not in the situation of debt forgiveness under a loan agreement ─ even if the company does not plan to repay the loan.

Let's take a closer look at each type of financial assistance.

Registration and taxation of financial assistance from the founder

| Type of financial assistance | What to submit | What to consider | Tax consequences |

| Loan from the founder | Loan agreement | Help from the founder can be in the form of:

If the agreement does not contain a clause on interest or its absence, then according to clause 1 of Art. 809 Civil Code of the Russian Federation:

| Taxation of the loan amount: Money received/transferred under a loan agreement is not included in income/expenses (clause 10, clause 1, article 251 of the Tax Code of the Russian Federation, clause 12, article 270 of the Tax Code of the Russian Federation) Taxation of interest on a loan agreement: The amount of interest paid can be taken into account in expenses when calculating profit tax in full, except for interest on debt obligations within the framework of controlled transactions (clause 1 of Article 269 of the Tax Code of the Russian Federation, clause 2 of clause 1 of Article 265 of the Tax Code of the Russian Federation) - this is a standardized consumption (clause 3 of article 269 of the Tax Code of the Russian Federation) |

| Contribution of the founder to the company's property | Contribution to LLC: Formalize the decision of the general meeting of participants | The founder can make a contribution if such an obligation is provided for in the charter (Article 27 of Law No. 14-FZ dated 02/08/1998). | When calculating income tax, the contribution to property made by the founders in accordance with paragraphs. 3.7 clause 1 art. 251 Tax Code of the Russian Federation. About the risks of applying this norm. For profit tax purposes, the founder’s share in the authorized capital does not matter (clause 1, article 66.1 of the Civil Code of the Russian Federation, clause 3, article 27 of the Law dated 02/08/1998 N 14-FZ, article 32.2 of the Law dated 12/26/1995 N 208-FZ ). Unless otherwise provided by the charter, the contribution to the property is made in proportion to the shares of the company’s founders. |

| Contribution to JSC: Formalize the transfer of the deposit by agreement (the form of the agreement is not established by law) | The agreement must be approved by a decision of the board of directors (supervisory board), except in cases where a different procedure is provided for by the charter of a non-public joint-stock company (clauses 1-3 of article 32.2 of the Law of December 26, 1995 N 208-FZ). | ||

| Free receipt of property and property rights from the founder | Formalize the transaction with a contract (agreement) or a decision of the general meeting of participants ─ the specific form is not established by law | The gratuitous transfer of property according to the norms of civil law refers to a gift. When making a donation, take into account the requirements and restrictions from Art. 575 of the Civil Code of the Russian Federation. | The cost of property received free of charge is taken into account according to NU as part of non-operating income (clause 8 of Article 250 of the Tax Code of the Russian Federation). Financial assistance is not taken into account when calculating income tax if (clause 11, clause 1, article 251 of the Tax Code of the Russian Federation):

|

| Capital contribution | For LLC: Formalize the increase in the capital capital by decision of the general meeting of participants. After paying for the management company, make changes to the charter and register its new version with the Federal Tax Service. | Increase in capital:

(Clause 1, Article 19 of the Law of 02/08/1998 N 14-FZ). | Contributions to the management company are not taken into account as part of income when calculating income tax (clause 3, clause 1, article 251 of the Tax Code of the Russian Federation). |

| For a joint stock company: Registration and accompanying procedures will depend on the chosen method of increasing the authorized capital. | Civil legislation provides for 2 ways to increase the capital of a joint stock company:

(clause 1, clause 5, article 28; clause 1, clause 2, article 39 of the Law of December 26, 1995 N 208-FZ). |

Providing free assistance to the founder with a share of less than 50% of the authorized capital

Along with paid assistance, founders can make gratuitous contributions. The transfer of property by the founder when he owns more than 50% shares in the management company is not taxed in accordance with the provisions of clause 11 of Art. 251 Tax Code of the Russian Federation. The status of the founder (legal or individual) does not matter.

Free assistance from the founder if he owns a 50% or smaller share in the management company is subject to income tax in accordance with clause 8 of Art. 250 Tax Code of the Russian Federation. The tax base is the market valuation of the transferred property.

Accounting for the founder's contributions to property and gratuitous transfer of property

The founder can provide financial assistance to the company:

- money;

- non-monetary property: materials, goods, fixed assets, intangible assets.

Accounting for monetary financial assistance depends on the period in which it was received (within the year or after its end):

| Period for receiving financial assistance | Direction of use | Account correspondence | Contents of operation |

| Within the year | For any purpose | Dt 50 (51) Kt 83 | Received funds from the founder |

| After the end of the reporting year | To cover the loss reflected in account 84 | Dt 75 subaccount “Founders’ funds aimed at repaying losses” Kt 84 | A decision was made to pay off losses at the expense of the founders’ funds |

| Dt 50 (51) Kt 75 subaccount “Founders’ funds aimed at repaying losses” | Funds were received from the founders to cover losses |

Accounting for non-monetary financial assistance:

| Account correspondence | Contents of operation |

| Dt 08 Kt 83 | The market value of the freely received OS is reflected |

| Dt 01 Kt 08 | The OS received from the founder was accepted for accounting and put into operation |

| Dt 10 (15) Kt 83 | The market value of materials received free of charge is reflected |

Depending on whether the founder’s financial assistance is recognized for the purpose of calculating income tax, a constant difference is reflected in the accounting records (clause 4 and clause 7 of PBU 18/02 “Accounting for income tax calculations”, approved by Order of the Ministry of Finance of the Russian Federation dated 11/19/2002 N 114n).

Financial assistance from the founder in 1C: Accounting 8.3, basic version.

Content:

1. Financial assistance from the founder - accounting entries

2. Financial assistance from the founder - entries for tax accounting

In the event of a financial crisis, the founders can provide assistance to the enterprise. Help can be of two types: paid and gratuitous financial assistance from the founder. The funds received can be used to obtain loans, pay off debts, and so on.

In this article we will talk about how to correctly reflect the receipt of financial assistance from the founder in a standard software solution 1C: Accounting 8.3.

FINANCIAL ASSISTANCE FROM THE FOUNDER OF THE ACCOUNTING ENTRY

The receipt of funds into the organization from the founder is an increase in fixed capital, which cannot be the income of the enterprise; the basis in this situation is clause 2 of PBU 9/99.

The founder’s contributions are reflected in account 83 – “Additional capital”

The receipt of funds from the founder will be reflected by receipt at the organization's cash desk, the document "Cash receipt order" or to the current account with the document "Bank statement".

Let's look at an example:

The bank account received funds from the founder on August 16, 2022 in the amount of RUB 500,000.

According to the decision of the general meeting of founders, the monetary contribution to the program will be formalized in the document “Operations entered manually.” Let's create the wiring:

DT 75.01 - CT 83.09

Formation of transactions for financial assistance from the founder

We do not create entries in tax accounting (based on Article 251, clause 11 of the Tax Code of the Russian Federation).

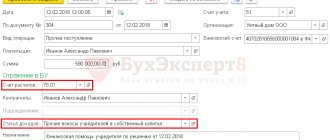

We will formalize the funds received to the current account with the document “Receipt to the current account.” Section “Bank and cash desk – Bank – Bank statements – Receipts”. In the document that opens in 1C: Accounting, ed. 3.0, select the type of operation “Other receipt”, fill in the payer field, which will be the founder.

Receipt to the current account

Particular attention should be paid to filling out the “Account” and “Income Item” fields. Account - indicate 75.01 “Calculations for contributions to the authorized capital.” Income item – indicate “Other contributions of founders to equity capital.” Type of movement – Receipts of cash deposits of owners (participants).

| Creating a document “Cash Flow Item” |

First you need to correctly configure the income items in the 1C: Accounting 8.3 configuration. After filling out all the fields, we will post the document, and the entries for the founder’s financial assistance will be generated:

Posting financial assistance to the founder in 1C: Accounting

Financial assistance from the founder - entries FOR TAX ACCOUNTING

Deposits are not taken into account for calculating income tax (Article 251 of the Tax Code of the Russian Federation) under the following conditions:

· if the property is transferred as a contribution in the manner established by the civil legislation of the Russian Federation (clause 3.7, clause 1, article 251 of the Tax Code of the Russian Federation);

· if the property received by the organization free of charge is transferred by the founder, whose participation share in the receiving company is more than 50% (clause 11, clause 1, article 251 of the Tax Code of the Russian Federation);

· if the property was received free of charge from an organization whose authorized capital consists of more than 50% of the contribution of the receiving organization (clause 11, clause 1, article 251 of the Tax Code of the Russian Federation).

To check the correctness of the reflection of transactions in 1C: Accounting, edition 3.0, we will generate a report “Analysis of account 75.01” or a balance sheet for account 75.01.

Analysis of account 75.01 in 1C Accounting, edition 3.0

Specialist

Natalya Krekhova

Accounting for financial assistance from the founder in the form of a loan

The following entries are made in accounting:

- Dt 51 (50) Kt 66 (67) ─ receiving a loan from the founder.

- Dt 91.02 Kt 66 (67) ─ monthly interest accrual under the loan agreement.

Interest on loan agreements must be included in income tax expenses on a monthly basis during the entire term of the loan agreement, regardless of the deadline for their payment stipulated by the agreement (Letter of the Ministry of Finance of the Russian Federation dated February 17, 2014 N 03-03-06/1/6387).

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Free financial assistance from the founder: taxation

In tax accounting, profit in the form of gratuitous financial assistance received from a legal entity or individual is included in non-operating income subject to tax. But, unlike accounting, gratuitous receipts from the founder are not always recorded in tax accounting. This depends on the size of the share in the authorized capital owned by the founder. Art. , 250, 251 of the Tax Code of the Russian Federation list cases when contributions transferred free of charge are not subject to taxation:

| Type of gratuitous assistance | When it's not taxed |

| Property, money | If the share of the helper in the authorized capital of the company is more than 50%. In this case, assistance from the founder is not considered taxable income. However, if the assistance was provided not financial, but property, and these assets were sold within a year from the moment they were accepted for accounting, then the income will have to be reflected. If the founder’s share in the management company is no more than 50%, the income received must be reflected, dating it to the day the assistance was received. It is necessary to evaluate property at market value, as in accounting. By the way, it is impossible to write off what they received in the form of assistance as expenses for “simplified” people, since only paid amounts can be attributed to their expenses. |

| The recipient company is the owner of more than 50% of the capital of the assisting company | |

| Money, property, property and non-property rights | Transferred to increase the company’s net assets with the target direction of monetary assistance fixed in the constituent documents |

This procedure is acceptable for enterprises of all forms of ownership. The preferential category of gratuitous financial assistance from the founder in terms of taxation includes an interest-free loan agreement, since no interest is accrued on the money, and the loan is returned at the end of the loan period. The company had no profit as such, which means that no tax is charged on the loan amount.

Funds can be donated

The easiest way to receive financial assistance from the founder is to draw up a gift deed . But this can only be done if the founder is an individual . If the founder is a legal entity, i.e. a company, then according to paragraph 1 of Art. 575 of the Civil Code of the Russian Federation, donations of more than 3,000 rubles between companies are prohibited. If this condition is violated, the transaction may be declared void - in accordance with Art. 168 Civil Code of the Russian Federation.

The company does not pay income tax with the help of the founder only if he owns more than 50% of the share in the authorized capital.

Without consequences and risks, the founder can transfer funds to his company when increasing the authorized capital.