What is the statute of limitations?

The statute of limitations is the time during which the creditor forcibly collects the debt from the debtor. In accordance with Article 196 of the Civil Code of the Russian Federation, the total period of this penalty is three years.

The beginning of the period is determined by the moment the debtor violates his obligations. If it is not possible to establish the moment of the violation, the period begins from the moment the creditor’s claims are presented.

The limitation period may be suspended for six months. This happens for the following reasons:

- force majeure prevents the filing of a claim;

- the defendant or plaintiff are members of the Armed Forces of the Russian Federation, which have been transferred to martial law;

- the government has established a deferment for this limitation period;

- laws governing specific relationships have been suspended or lost force.

A break in the statute of limitations occurs at the moment when the debtor returns part of the debt amount. After this, the deadline time is reset to zero and counted again.

The limitation period is restored in court. In this case, the reasons for the omission must be valid and related to the identity of the plaintiff:

- serious illness;

- helpless state;

- illiteracy, etc.

Thus, the term of the debt can be extended and last longer than the three years specified in the law. The accountant cannot write off the debt as overdue for a given period.

Can a creditor collect a debt from my relatives?

The creditor has the right to demand collection of the debt in court from the debtor himself, but with one caveat. He also has the right to demand payment from the guarantor or co-borrower of the debtor. And also from his legal successor.

The guarantor, co-borrower and legal successor may be a relative of the person. Therefore, debt collection from a relative with such a status is not excluded.

But simply from the relatives and friends of the debtor, who did not vouch for the solvency of the borrower, even if they live under the same roof with him, neither the creditor nor the collectors have the right to demand payment of the debt.

Documentation

It is the company's responsibility to monitor the progress of accounts payable.

The debt must be written off in the month in which this period expired.

Next, the accountant must recalculate income tax for the entire period after the statute of limitations. The written-off debt is included in the company’s income and submitted to the Federal Tax Service with an updated declaration.

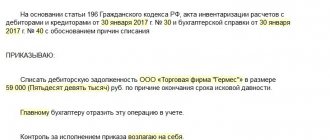

The write-off must be carried out as follows:

- compare balance and balance data in statement calculations;

- draw up a non-unified act, which is reflected in the regulatory documents of the organization or use the INV-17 form;

- make an accounting statement indicating the data for posting: contract details, certificate of completion of work, invoices, statute of limitations and amount of debt;

- create an order to write off an overdue debt.

The lender is obliged to keep the above documents for five years after write-off.

We destroy accounting documents

I would like to draw the attention of readers to the sanctions that can be applied to a taxpayer if he does not have primary documents. Let's look at the most common ones.

If the primary documents are destroyed after the established storage period, then good, you can sleep peacefully. But sometimes, when calculating the period, they are guided by general rules (specified in Law No. 209-FZ, the Tax Code of the Russian Federation and the List of the Ministry of Culture of the Russian Federation) and forget about special “reservations”, thus destroying documents that should have been kept. And this is where problems most often arise.

Failure by the taxpayer to submit documents to the tax authorities within the prescribed period

or other information provided for by the Tax Code of the Russian Federation and other acts of legislation on taxes and fees, entails the application of liability under Art. 126 Tax Code of the Russian Federation:

- if these documents do not contain signs of tax offenses provided for in Art. 119 and 129.4 of the Tax Code of the Russian Federation, the fine will be 200 rubles. for each document not submitted (Article 119 is devoted to the submission of tax returns, and Article 129.4 is devoted to notifications of controlled transactions);

- if the organization refuses to provide the documents it has or provides them with deliberately false information and such an act is not related to Art. 135.1 of the Tax Code of the Russian Federation (failure by the bank to provide certificates/statements on transactions and accounts), then the fine will be 10,000 rubles.

Definitely avoid prosecution under Art. 126 of the Tax Code of the Russian Federation is possible if the storage period for documents requested by tax authorities has expired and by the time of the request they had already been destroyed by the organization, but this will still need to be proven (see resolutions of the Federal Antimonopoly Service of the Ural District dated November 17, 2009 No. F09-8891/09-SZ in case No. A47-5018/2008; FAS of the North-Western District dated 07/06/2009 in case No. A05-8773/2008 (by the decision of the Supreme Arbitration Court of the Russian Federation dated October 13, 2009 No. VAS -13307/09, the transfer of this case to the Presidium of the Supreme Arbitration Court of the Russian Federation was refused)).

If, during an inspection, inspectors discover the absence (or are destroyed) of primary documents, invoices, accounting or tax registers, then the company may be fined in the amount (Article 120 of the Tax Code of the Russian Federation):

- 10,000 rub. – if the violation was committed during one tax period;

- 30,000 rub. – if the violation was committed during more than one tax period.

If it is discovered that the tax base is underestimated, the company will be fined in the amount of 20% of the unpaid tax amount, but not less than RUB 40,000. (clause 3 of article 120 of the Tax Code of the Russian Federation).

There cannot be two measures of tax liability for the same offense, so the organization can be punished either under Art. 126 of the Tax Code of the Russian Federation, or under Art. 120 Tax Code of the Russian Federation. These fines will not be cumulative.

The Code of the Russian Federation on Administrative Offenses also contains a number of provisions on fines for violating the terms of storage of documents. The size of the fine depends on the type of violation.

Article 13.25 of the Code of Administrative Offenses of the Russian Federation provides for fines for violating the terms of storage of documents, the obligation to store which is provided for by the legislation on joint-stock companies, LLCs, on state and municipal unitary enterprises, on pension and investment funds, as well as regulatory legal acts adopted in accordance with it. It turns out that here we are talking primarily about storing corporate documents

, appearing in this group of regulatory legal acts, to which most accounting documents do not fall.

But this includes, for example, the balance sheets of joint-stock companies, their profit and loss statements, and audit reports

(Clause 2.1.10 of the Regulations on the procedure and periods for storing documents of joint-stock companies, approved by Resolution of the Federal Securities Commission of Russia dated July 16, 2003 No. 03-33/ps).

List of LLC documents

, for the loss of which Article 13.25 of the Code of Administrative Offenses of the Russian Federation may be applied, is slightly different. It is given in Art. 50 of the Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies”. It is noteworthy that, among other things, it says that the LLC is obliged to store “other documents provided for by federal laws and other legal acts of the Russian Federation, the company’s charter, internal documents of the company, decisions of the general meeting of the company’s participants, the board of directors (supervisory board) of the company and the executive bodies of the company " Obviously, this includes financial statements.

The amount of fines under Art. 13.25 of the Code of Administrative Offenses of the Russian Federation are:

- from 2500 to 5000 rub. – for officials;

- from 200,000 to 300,000 rubles. - for legal entities.

In what cases are accounts receivable written off?

There are three legitimate reasons for debt forgiveness. They are confirmed by documentation from third-party organizations, the data of which is reflected in accounting and tax records.

The reasons for write-off are as follows:

- The organization cannot resolve in court the issue of collecting the debt from the debtor, since the statute of limitations has expired.

- The government agency signed the bailiff's report stating the impossibility of collection.

- The debtor ceased its organizational activities. The basis for write-off is an entry in the Unified State Register of Legal Entities on the liquidation of a legal entity.

Also, receivables are written off if legal costs for collection exceed the amount of the debt. Often, in such cases, the amount of debt is not large.

Writing off bad debts

Evolution of debt

1. Debt arises

The occurrence of receivables is a normal economic situation (clause 1 of Article 307 of the Civil Code of the Russian Federation). The Civil Code of the Russian Federation stands for the protection of the fulfillment of obligations: Art. 309 of the Civil Code of the Russian Federation defines the grounds for repayment - contracts, laws, business customs.

2. There are doubts about its repayment

If the debt is not repaid on time and there is no security for it (pledge, surety, bank guarantee), it becomes doubtful (Clause 1 of Article 266 of the Tax Code of the Russian Federation). The Tax Code of the Russian Federation thus defines debts incurred during the sale of goods, works, and services.

3. The debt becomes uncollectible

Signs of bad debt (clause 2 of Article 266 of the Tax Code of the Russian Federation):

a) the limitation period has expired (general – three years (clause 1 of Article 196 of the Civil Code of the Russian Federation), but no more than 10 years from the date of violation of the right (clause 2 of Article 196 of the Civil Code of the Russian Federation). There are also special limitation periods (clause 1 Article 197 of the Civil Code of the Russian Federation));

b) the obligation is terminated due to the impossibility of collection (the debtor or his property cannot be found, the bailiffs issue a resolution to terminate enforcement proceedings (see Federal Law No. 229-FZ of October 2, 2007));

c) the obligation is terminated on the basis of an act of a government body (and these are not the courts! see letter from the Ministry of Finance dated January 21, 2021 No. 03-03-06/2/3026);

d) liquidation of the debtor.

Expiration of the statute of limitations as a basis for debt write-off

If an organization has accounts payable, the statute of limitations for which has expired, write them off as non-operating income (clause 18 of Article 250 of the Tax Code of the Russian Federation), tax authorities are unlikely to challenge the increase in income.

But the write-off of accounts receivable will be closely studied. The expiration of the statute of limitations is one of the most important grounds for recognizing bad debt as non-operating expenses (clause 2, clause 2, article 265 of the Tax Code of the Russian Federation).

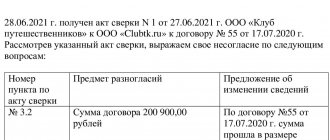

The limitation period cannot be changed by agreement of the parties, but can be extended by their actions. So, for example, if the debtor acknowledges his obligations by signing a reconciliation act, sending a letter of guarantee for payment to the creditor, paying part of the debt or penalties and interest under the agreement, the limitation period begins to run again (Articles 203, 206 of the Civil Code of the Russian Federation). At the same time, pay attention to whether the person who signed the letters and the reconciliation report has the authority to represent the organization (the general director has it, another employee needs a power of attorney).

To write off a bad debt, the creditor organization must collect documents confirming the expiration of the statute of limitations, otherwise the tax authorities will not recognize the written off debt as an expense.

Thus, in the resolution of the Moscow District Court of July 17, 2015 No. F05-8766/2015 in case No. A40-29510/2014, overdue accounts receivable in the amount of 1.3 million rubles. was excluded from expenses, since the taxpayer did not submit documents: an order based on the results of the inventory in form No. INV-22, an inventory act of settlements with buyers and suppliers in form No. INV-17, as well as a certificate for the inventory act of settlements, which should indicate documents confirming the amount and date of occurrence of receivables (contracts, payment orders, cash receipts, invoices, certificates of work performed (services rendered)). In the Ruling of the Supreme Court of the Russian Federation dated November 5, 2015 No. 305-KG15-13588, the conclusions of the lower courts were supported.

Conclusion:

comply with the law when preparing documents (clause 1 of article 252 of the Tax Code). To recognize losses on bad debts, there must be: contracts, invoices, acts, UPD, invoices, letters of claim, writs of execution, orders of the bailiff on the completion of enforcement proceedings, extracts from the Unified State Register of Legal Entities for the liquidated debtor, acts of reconciliation of mutual settlements (see . conclusions in the resolutions of the Volgo-Vyatsky District No. F01-2882/2018 dated July 24, 2018, and the Northwestern District No. F07-10763/2016 dated December 9, 2016).

The deadline has passed - we write it off. Will there be any problems?

Not so simple. Controllers can verify the business purpose for incurring the debt. For example, if an organization lent money or transferred an advance to a counterparty who obviously could not fulfill its obligations to return the funds, tax authorities will express doubts about the validity of the tax benefit when writing off the debt.

For example, in the Resolution of the Volga District Arbitration Court dated June 16, 2015 No. F06-24384/2015, the court expressed the opinion that it was impossible to recognize as expenses receivables with an expired statute of limitations, since they arose from the intention to purchase auto parts for the manager’s personal car. We paid an advance, but the spare parts were not supplied. The court considered this not economically justified. The amount, however, was small - 23 thousand rubles, but still.

Problems may arise when writing off receivables from a counterparty that is no longer in business. Inspectors will check whether the debtor had the opportunity to fulfill its payment obligations when concluding the transaction (clause 4 of the Federal Tax Service letter No. SA-4-7/26060 dated December 29, 2018), whether the creditor knew about this, and whether there was a business purpose for such a transaction.

The Ruling of the Supreme Court of the Russian Federation dated May 14, 2018 No. 301-KG18-4716 presents conclusions about the lack of economic justification for expenses in the form of bad receivables under loan agreements with an interdependent party that has ceased operations. The issue price is 100.8 million rubles.

However, controllers must prove the absence of a business purpose.

Good practice: Resolution of the Administrative Court of the North-Western District dated 02/09/2017 No. F07-63/2017 in case No. A13-2115/2015. The organization wrote off the receivables of a liquidated interdependent organization for RUB 39.7 million. But the court decided that the loans issued had a business purpose and were aimed at implementing an investment project that was supported by local authorities; the taxpayer provided loans to a company belonging to the same group as him in order to restore its solvency and purchase equipment; the taxpayer expected to receive future income from the implemented project.

Conclusion:

the business purpose of the debt, which the organization will write off as bad, can be checked, prepare documents and justification for its actions.

reporting

Send

Stammer

Tweet

Share

Share

Write-off sources

When a debt is deemed bad or uncollectible, it is written off through a special reserve for doubtful debts. Only those companies that use the method of calculating revenue by shipment can cover losses in this way.

The formation procedure is regulated by Art. 266 of the Tax Code of the Russian Federation. The amount of the reserve is determined based on the results of the inventory of the tax period and depends on the term of the debt:

- the full amount is written off if the debt period exceeds 90 days;

- if the period is from 45 to 90 days, the amount of the reserve is 50% of the receivable.

- debt is not included in the reserve amount if the debt period is less than 45 days.

If the company does not have a reserve or the amount of debt exceeds the planned indicators, then the debt is written off as non-operating expenses.

Another source of write-off is net profit. The accountant does not have the right to independently decide whether to include debt in the account of earned revenue. This conclusion is given by the company's management.

Statute of limitations for bringing to tax liability

The statute of limitations for bringing to tax liability is 3 years according to Article 113 of the Tax Code of the Russian Federation.

The statute of limitations for bringing tax liability is calculated differently depending on the offense.

If you committed a gross violation of the rules for accounting for income, expenses and/or taxable items, did not pay or did not fully pay a tax, fee, contribution, the statute of limitations begins to run from the day following the end of the corresponding tax period under Articles 120 and 122 Tax Code of the Russian Federation. This rule also applies to those taxes for which the tax period is a year.

In other cases, the period for bringing to tax liability is calculated from the day following the day of commission of the tax offense.

Accounting for writing off accounts receivable

If the counterparty has both accounts payable and receivable, it is necessary to carry out mutual settlements to determine the write-off amount.

The limitation period is tracked and recorded in documents such as:

- certificates of completed work and invoices confirming interaction;

- reconciliation reports;

- written and electronic requests and responses for debt repayment;

- payment and settlement documents.

The formation of accounting entries depends on the source of the write-off, and is formed according to the following forms:

- reserve for doubtful debts - Dt63 Kt60, Kt62, Kt76;

- other expenses - Dt 91-2 Kt60, Kt62, Dt76;

- write-off at the expense of net profit - Dt 84.

The written off debt remains in off-balance sheet account 007 and is written off after five years.

From what day do you count?

The procedure for calculating SID depends on the terms of the transaction:

| The date of fulfillment of the obligation has been determined | The execution date is not determined or is determined “on demand” |

| In this case, the limitation period for receivables of legal entities begins to be calculated from the moment when the period of fulfillment of the obligation ends (completed, expired or expired) (clause 2 of Article 200 of the Civil Code of the Russian Federation). | In this situation, the limitation period is calculated from the moment the creditor submits demands for the fulfillment of accepted obligations. Or count it at the end of the period for fulfilling obligations, if it is provided for by the terms of the transaction and presented to the debtor. |

| Example: The terms of the supply agreement provide for the seller’s obligation to deliver products no later than September 10, 2022. If the seller violates the terms of the transaction, then the statute of limitations begins to run from September 11, 2020. If the buyer does not take action before September 11, 2023 (3 years), then it will be impossible to recover the debt. | Example: Under the terms of the contract, the customer is obliged to pay for the work no later than 10 working days from the date of its full completion and acceptance. The certificate of completion of work was signed on September 1, 2020. Therefore, the customer is obliged to make payment until September 14 inclusive. And already from September 15, 2020, LEDs begin to leak. |

Memo to an accountant on how to calculate correctly.

Tax accounting for writing off accounts receivable

Accounts receivable are written off for the same reasons as accounts payable:

- The organization cannot resolve in court the issue of collecting the debt from the debtor, since the statute of limitations has expired.

- The government agency signed the bailiff's report stating the impossibility of collection.

- The debtor ceased its organizational activities. The basis for write-off is an entry in the Unified State Register of Legal Entities on the liquidation of a legal entity.

The debt is recognized as bad and written off against the reserve for doubtful debts or non-operating expenses. After completing the documents, recalculation of VAT is required.

If the debtor is an individual, then payment of commissions is subject to taxation and is accounted for as other income with code 4800.

If an organization uses the simplified tax system, then receivables are not kept in tax accounting.

Accounting records of accounts receivable are kept for four years.

Writing off debt based on the statute of limitations: accounting and tax accounting

Accounting entries are reflected in debt accounts in correspondence with the income account as of the date of the inventory:

| D 60 (62, 76) – K 91.1 |

| D 91.2 – K 60 (62, 76) or, if a reserve was created: D 63 – K 60 (62, 76) D 007 (for 5 years the amount is listed on the balance sheet) |

In tax accounting, a creditor increases taxable income, and a debtor can reduce the income (profit) tax base, but must be justified and documented.

conclusions

- It is necessary to write off receivables based on the expired statute of limitations or a decision of the bailiffs.

- Before writing off, it is necessary to carry out mutual settlements with the counterparty.

- The write-off occurs against the reserve for doubtful debts or non-operating expenses.

- Writing off debt at the expense of net profit is made by a general decision of the organization’s management.

- Organizations that use the simplified tax system with the cash method of calculating income reflect accounts receivable only in accounting.

What happens after 3 years?

Three years after the start of calculation of the limitation period, that is, from the date of the first delay, this period ends. Consequently, the period during which the creditor has the right to go to court to collect the debt ends.

However, if 3 calendar years have passed since the date of delay, this does not mean that the statute of limitations has definitely expired. There is the following reason for this: the statute of limitations may be suspended or interrupted.

The grounds for suspending the limitation period are:

- Obstacles in filing a claim in the form of force majeure;

- The presence of the debtor in the troops brought under martial law;

- Moratorium imposed;

- Suspension of the legal act regulating these legal relations;

- Out-of-court dispute resolution procedure.

In all these cases, the limitation period is, as it were, “paused.” As soon as the grounds for suspension disappear, the period continues.

In addition, the deadline may also be interrupted. The reason for this is actions that indicate that the debtor acknowledges the debt, that is, the debt does not remain in the status of “unconfirmed accounts payable.” From this moment, the statute of limitations for writing off loan debts is renewed and begins to count again.

What can interrupt the statute of limitations? The simplest thing is the debtor’s recognition of his debt, in whole or in part. For example, a bank or collection agency writes you a letter - citizen Ivanov, have you borrowed 100 thousand rubles from a bank with the letter X? And even your answer was yes, but what do you care about my debt? - will be interpreted by the court (when the case comes to court) as a fact of recognition of the debt. And from the date of this answer, the statute of limitations will begin to run again. Yes, the creditor will again have exactly three years to collect the debt!