Expenditure cash order (RKO)

- This is one of the cash discipline documents that is drawn up each time

cash is issued from the cash register The RKO is formed in one copy by an accounting employee and signed by the head of the organization, the chief accountant, the cashier and the person receiving the funds.

note

, in 2022, a simplified procedure for maintaining cash discipline is in effect, according to which individual entrepreneurs are

no longer required

to draw up cash documents (PKO, RKO and cash book).

Free accounting services from 1C

Basic requirements of the Bank of the Russian Federation

Changes in the use of cash register systems, in particular, the introduction of online cash registers, entailed a number of adjustments in the procedure for recording cash transactions (instruction No. 4416-U dated June 19, 2017, which came into force on August 19, 2017).

The procedure for conducting cash transactions with cash on the territory of the Russian Federation is established by the Bank of Russia. It is uniform and mandatory for legal entities. It is necessary to establish a limit on the cash balance in the cash register by administrative document (order), which is calculated using a formula in accordance with the instructions of the Bank of Russia.

IMPORTANT!

Small businesses and individual entrepreneurs, in accordance with the letter of the Federal Tax Service of Russia dated 07/09/2014 No. ED-4-2/13338, have the right not to set a cash balance limit.

All cash transactions are documented with cash documents and reflected in the cash book. Operations for the receipt and expenditure of cash are recorded as receipt or expense cash orders (you can create one receipt and one expense order after the end of the shift).

Receipts and withdrawals of cash are reflected in the cash book, entries are made in it for each incoming and outgoing order. At the end of the working day, the cashier checks the cash in the cash register with the balance in the cash book and certifies the entries in it with a signature. If there is no movement of money through the cash register during the day, no entry is made in the book.

Expense cash order (form KO-2)

Home / Cash discipline

| Table of contents: 1. Procedure and methods for registering cash settlements 2. Issuance of money to the supplier 3. Payment of wages | 4. Instructions for filling out an expense order 5. Samples of filling out RKO 6. Fines for the absence and storage periods of cash registers |

A debit order is a unified form that is used to issue cash from the cash register of an individual entrepreneur or organization.

RKO is issued in the following situations:

- Transferring money to a credit institution for crediting to a bank account;

- Issuing cash to the accountant for the organization’s business expenses;

- Settlements with employees regarding wages;

- Issuing money to a company employee for their own needs (for example: providing financial assistance);

- Return or issuance of borrowed funds;

- Payment of income to founders;

- Payment of cash to the supplier.

Individual entrepreneurs are exempt from the mandatory use of cash discipline forms (RKO, PKO, cash book). But he can make an independent decision to use unified forms in data accounting.

In this case, each time cash is withdrawn from circulation, the entrepreneur draws up a settlement settlement, indicating as the basis for the payment of funds: “For own needs.”

Download the expense order in excel or word format

Download samples of filling out cash settlement services: Repayment of a loan from an LLC to the founder, Issuance of money on account,

Issue of mat. assistance, Payment of dividends to the founder, Payment of salary according to the statement,

For personal needs of individual entrepreneurs, Payment to the supplier, Cash delivery to the bank

Procedure and methods for registering cash settlements

The unified form of RKO (No. KO-2) was approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

The document is drawn up in one copy. Orders are numbered in order in a strict chronological sequence, with the countdown starting on January 1 of each new year.

RKO can issue:

- A company employee (cashier, accountant, etc.), appointed by order of the manager;

- Chief Accountant;

- The manager himself (if the company does not have a chief accountant or accountant on staff).

The order must bear the following signatures:

- The director (if the documents attached to the RKO already have the authorization signature of the head of the organization (IP), the director’s order may not be endorsed, and the “manager’s signature” field can be left blank);

- Chief accountant;

- Cashier;

- The person who received the money.

If the director of the company (IP) independently draws up the primary documentation, then on behalf of the company (IP) only the signature of the director (IP) is put on the cash register.

RKO must be issued on the date of actual payment of money.

The form can be filled out in the following ways:

1. By hand on paper.

2. On a computer with mandatory printing:

- using editors Word, Excel, etc.

- using accounting programs and services presented on specialized websites.

3. In electronic form. This method is possible only if all persons required to sign the cash settlement agreement have qualified electronic signatures.

It is allowed to sign cash settlement agreements in a “combined” way (letter of the Central Bank of the Russian Federation dated August 11, 2014 No. 29-1-1-OE/3002):

- The chief accountant, whose workplace is geographically remote from the cash register, sends a form signed with a qualified electronic signature to the cashier.

- The cashier, making sure that the form is signed, prints out the document, obtains the recipient’s signature and signs the cash register himself.

Errors and corrections when registering cash settlements are not allowed!

When issuing funds according to an expense order, the cashier must follow the following rules:

- Check the cash register for the presence of signatures of the manager and chief accountant;

- Reconcile the passport data of the person receiving the cash with the data specified in the order;

- Check all applications named in RKO;

- Make sure that the recipient has recalculated the amount of money received in the presence of the cashier and signed the order;

- Put your signature on the RKO.

There is no stamp on the cash receipt slip.

The documents attached to the order must be stamped “Paid” indicating the current date.

The executed cash register remains with the company and is filed with the cashier’s report (the second copy of the cash book sheet). A record of the money issued is made in the cash book of the business entity.

Issuing money to the supplier

Cash withdrawal to the supplier's representative is possible only with a properly executed power of attorney. The original power of attorney remains with the purchasing company and is filed with the expenditure order.

If the power of attorney is intended for several payments, then its original must be kept at the cash desk of the purchasing company. For each payment, a certified copy of the power of attorney must be attached to the orders, and when making the last payment, the original must be attached to the cash settlement.

If the money is given to the head of the supplier company or individual entrepreneur, a power of attorney is not needed.

It should be remembered that on the day the payment is received, the supplier organization is obliged to generate a cash receipt for the amount of the payment made and transfer it to the purchasing company (in printed or electronic form).

Payment of wages

Payment of wages from the organization’s cash desk can be carried out in two ways:

1. Using payroll or payroll statements.

Salary statements have a certain validity period (no more than 5 working days). Money payable to employees may be kept in the cash register until the specified period has expired, or until the entire amount on the payroll has been paid in full before the end of that period.

An expense order is not generated either for the total amount on the statement or for amounts issued to employees before the expiration of the statement.

Such amounts are also not reflected in the cash book.

On the last day of the statement period, the cashier notes the deposited amounts, signs the document and submits it to the accounting department.

On the same day, the responsible employee (chief accountant, accountant, etc.) forms a cash settlement for the amount actually paid to the staff, indicates the order data on the last sheet of the statement and registers the cash settlement in the cash book.

If several statements are prepared (for different departments of the organization), you can draw up one cash register for the total amount of funds issued.

The cash settlement document issued for the statement is required only for entering the amount issued into the cash book and does not serve as confirmation of the transfer of cash. Accordingly, it is not required to indicate your full name. in the “Issue” line, passport data, and also put the recipient’s signature.

2. Payment according to RKO.

If the company has few employees, then you can issue wages by issuing a separate cash register for each person.

In such a situation, the RKO must contain the full name, passport details of the employee and his signature.

But if the employee does not appear on the day of payment of wages, a statement will be required, since it is the statement that confirms that the employer is not at fault for violating the deadline for paying wages.

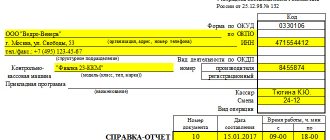

Instructions: how to fill out an expense cash order

- The line “Organization” indicates the full name of the company according to the constituent documents.

- The OKPO code specified in the Rosstat notification is entered in the “according to OKPO” cell.

- The line “Structural unit” is filled in if the organization has divisions.

- Then the serial number and date of issue of the document are indicated.

- Accounting account numbers or codes are entered in the “Debit” and “Credit” columns (if the company uses coding).

Individual entrepreneurs do not fill out these cells.

Operations for issuing cash are carried out on the credit of account 50 (a subaccount is also indicated in accordance with the company’s working chart of accounts).

The debit indicates the corresponding account, reflecting the purpose of issuing money from the cash register, for example:

- 51 – depositing cash to the company’s current account;

- 60 – payment to the supplier;

- 66 (67) – repayment of the loan to the borrower;

- 70 – settlements with personnel regarding wages;

- 71 – money was issued on account;

- 73 – financial assistance was paid;

- 75-2 – dividends were issued to the founders.

- “Structural unit code” is filled in if the unit that forms the cash register has a code.

- “Analytical accounting code” – filled in if such a code is available.

- The amount of cash issued in numerical terms is entered in the “Amount” cell.

- The “Purpose Code” field is filled in if the company uses a coding system.

- Full name is entered in the “Issue” line. of an individual in the dative case. When making payments between counterparties, you must indicate the name of the organization and full name. the employee receiving the money, the preposition “through” is used.

For example: Maxim LLC through A.M. Petrov. by power of attorney (details of the power of attorney are indicated).

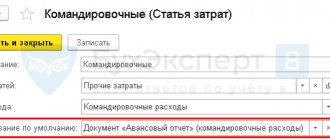

- The content of the operation is recorded in the “Base” field.

- In the line “Amount” the amount of money issued is deciphered in words, while kopecks are written in numbers.

- The “Attachment” line lists the names, numbers and dates of the attached documents.

- Then fill in the details of the manager (position, signature, surname, initials) and the chief accountant (signature, surname, initials).

- In the “Received” line, the amount of money received by the person is entered in words, kopecks are indicated in numbers.

- Next is the recipient’s signature and the date the money was received.

- The next line contains the passport details of the cash recipient.

- In the line “Issued” the signature, surname and initials of the cashier are affixed.

When filling out forms manually, you should put dashes in the empty cells. After entering the amount in words, you must cross out the blank space in the line to avoid falsification of cash settlements.

Sample of filling out cash receipt order 2022

Repayment of a loan from an LLC to its founder

Issuance of money on account

Issuance of financial assistance

Payment of dividends to the founder

Payment of wages according to the statement

Issuance of the bottom for personal needs of individual entrepreneurs

Payment for goods to the supplier

Transferring cash to the bank

Penalties for the absence of an expenditure order and document storage periods

For the absence or improper execution of primary documentation, inspectors may fine the company under Art. 120 Tax Code of the Russian Federation.

The amount of sanctions may be:

- 10,000 rub. – for violations committed during one tax period;

- 30,000 rub. – more than one period;

- 20% of the amount of unpaid tax, but not less than RUB 40,000. – if such actions led to an understatement of the tax base.

If non-compliance with the rules for conducting cash transactions is not related to the violations specified in paragraph 1 of Art. 15.1 Code of Administrative Offenses of the Russian Federation:

- Exceeding the cash payment limit and cash limit;

- Non-receipt or incomplete reflection of cash proceeds;

- Failure to comply with the procedure for storing available funds,

then administrative liability for such violations is not provided for by law.

Otherwise, the fines will be:

- 40,000 – 50,000 rub. - for legal entities persons;

- 4,000 – 5,000 rub. – for officials and individual entrepreneurs.

The company must store primary documents, which include cash settlements, for 5 years after the end of the reporting year.

Did you like the article? Share on social media networks:

- Related Posts

- Payroll (form T-53)

- Journal of registration of incoming and outgoing cash documents

- Cash payment limit in 2022

- Cash limit for LLCs and individual entrepreneurs in 2022

- Sample of filling out form T-51

- Cash book (form KO-4)

- Payroll register

- Sample of filling out form AO-1

Leave a comment Cancel reply

How are transactions processed?

According to the rules of the Bank of the Russian Federation, registration of cash settlements, cash registers and cash books is carried out on paper or in electronic form. Electronically executed documents cannot be corrected after signing. It is allowed to make corrections to paper documents by indicating the date of correction, signatures of the persons who compiled the corrected document with surnames and initials. The chief accountant oversees the maintenance of the book.

IMPORTANT!

Individual entrepreneurs have the right not to draw up cash documents and not to maintain a cash book (clause 4.1 of Bank of Russia instructions 3210-U).

Cash transactions are carried out by a cashier appointed from among the employees of a legal entity or individual entrepreneur, or by the manager himself. Familiarization with responsibilities and rights is carried out against signature. The cashier has a seal with details (to confirm the transaction) and sample signatures of persons who are authorized to sign cash documents.

Let's take a closer look at the procedure for processing cash withdrawal operations from the cash register:

- depositing cash proceeds to a bank account;

- issuing wages and other payments to employees;

- issuance of accountable amounts, etc.

What is RKO?

A cash disbursement order (COS) is a cash discipline form confirming the issuance of cash from the cash register. Prepared by an accounting employee and certified by representatives of the organization:

- leader;

- chief accountant;

- cashier.

The person receiving the cash must also sign to confirm this fact.

Individual entrepreneurs have the right not to draw up cash documents, since from June 1, 2014, a simplified cash procedure has been applied to this category.

Procedure for processing transactions

| Cash issuance report |

|

| Delivery of cash proceeds to the bank |

|

| Issuing cash for salaries |

|

| Other issues |

|

All operations for issuing cash from the cash register are formalized using a debit order using a unified, optional for use from 01/01/2013, in accordance with Federal Law No. 402-FZ “On Accounting”, form No. KO-2. An expenditure order is issued with an entry made in the book on the day of the actual issuance of money.

An example of filling out a cash receipt order

Procedure and rules for registering cash settlements

The existing procedure for conducting cash transactions determines all the rules for drawing up the form.

The head of the company, senior accountant or individual entrepreneur has the right to fill out the fields of the document.

It is allowed to draw up a cash order in typewritten text, but there are no restrictions on any other method of filling out in the law.

Thus, handwritten text will also be legal; all letters must be easy to read.

You should be very careful when filling out the “base” line.

As practice shows, it is often simply left blank.

If wages are issued according to an expense order, then taxes and all necessary payments must be taken into account.

How to correctly fill out the details of the unified form KO-2 - instructions

A special form for filling out an expense order (KO-2) was approved by Resolution of the State Statistics Committee No. 88 of August 18, 1998.

The document is drawn up in one copy and must contain the necessary information in the fields for correct filling:

- organization - the name of the economic entity in accordance with the Charter of the enterprise;

- structural unit - department of the organization that issued the form; in its absence, a dash is entered;

- order number and date - the form is assigned a serial number according to the registration journal (KO-3), when writing the date, the day is first written, then the month and year, the day of issuance of funds is recorded;

- debit - accounting accounts are registered on which transactions for the issuance of funds and the code of the structural unit where they are issued should be reflected;

- loan - the number of the accounting account is recorded on the loan of which cash is issued (50 - Cash desk);

- the designated purpose code in the cash register is filled in when funds are spent from the cash desk of a non-profit institution, in other cases a dash is entered;

- amount, rub.kop. — the amount issued is written down in numbers;

- issue - personal information (full name) of the person to whom the funds are transferred;

- basis - description of the business transaction;

- amount - the funds issued are written in words from the beginning of the line with a capital letter, the currency designation is not abbreviated (rubles, ruble), if there is still space left for writing the amount, then a dash is written in this place;

- Appendix - details of the primary documentation that served as the basis for issuing the form.

Having filled out all the necessary information, the director and chief accountant of the company affix their signatures.

Next, the lines are filled in by the person who received the funds.

In the “received” column, the amount of cash is recorded in words, as well as the date of its receipt and the personal signature of this citizen.

When issuing funds from the cash register, the responsible employee should consider the following points:

- The cashier has no right to issue cash without the signature of the chief accountant and director;

- funds are transferred in the presence of an identity document, the details of which are written down in the form;

- it is necessary to check the set of documents specified in the application;

- you should make sure that the recipient of the cash counts it in the presence of the cashier.

Having completed all of the above steps, in the next line the cashier writes down information from the recipient’s document. Then he signs and deciphers his signature.

The responsibilities of the company cashier include checking the form for correct completion of all lines and repaying it with the “Paid” stamp or the organization’s stamp indicating the date.

When the order is cleared, its data is entered into the cash book (KO-4), and it remains in the custody of the cashier.

The basis for issuing an expense warrant may be:

- proceeds for transfer to a bank account;

- issuing cash on account for the company’s business activities;

- travel expenses, financial assistance to an employee, the wording of the basis “for personal needs” is allowed;

- purchasing goods for the needs of the company.

Numbering

When preparing expense cash documents, it is necessary to ensure continuous numbering.

Should the amount be typed or written in by hand?

Currently, it is possible to fill out the “Received” line (the amount of funds is recorded in words) using a computer.

Also, current legislation does not prohibit the handwritten method of writing this column.

Who signs?

Form KO-2 is prepared by:

- Chief Accountant ;

- an accountant or other specialist of the enterprise (cashier), designated by the head of the company in an administrative document;

- the head of the organization, if an accountant is not included in the staffing table.

The expense document must contain the signatures of the head of the enterprise and the chief accountant (accountant) or the director and the cashier.

If the company does not have an accountant, then all cash transactions and execution of orders fall on the shoulders of the head of the company.

The date of compilation of cash settlements must correspond to the day of disbursement of funds.

Do you need a seal?

The stamp or seal of the organization is not placed on the document. The completed lines “base” and “attachment” in the form imply the presence of stamped documentation.

In this regard, the document is endowed with legal force even without a seal.

How to correct a mistake legally?

Cash documentation, including expense notes, cannot be corrected. This requirement applies in accordance with the instructions of the Bank of Russia No. 3210-U, clause 4.7.

If, nevertheless, an inaccuracy is found in filling out the lines of the form, then the only possible option for correcting the error is to issue a new document with changed information.

If, during an audit, tax inspectors find corrections in a cash order, it may be declared invalid or absent. This circumstance may lead to the organization being accused of storing unaccounted funds.

For example, for exceeding the established limit at the cash register. This offense is punishable by a fine of up to 50 thousand rubles (15.1 Code of Administrative Offenses of the Russian Federation). Methods for calculating the cash limit.

Having drawn up a new cash register, instead of the incorrect one, the previous document must be crossed out and attached to the cash book.

The order registration log contains information about the cancellation of incorrect form numbers. This entry is made in the notes.

Also, the incorrect entry is crossed out in the cash book, and the correct value is entered in place of the incorrect amounts. All amendments made are certified by the signatures of the cashier and chief accountant.

If a cashier makes mistakes in filling out forms, he must be asked for an explanation in writing, which should indicate the reasons for the misconduct. This paper will allow you to avoid conflicts with regulatory authorities.

Download free form and sample in word and excel format

Download a blank form for cash receipt order form KO-2 – word, excel.[/stextbox]

Sample of filling out RKO:

- for payment of vacation pay - sample;

- for a cash deposit to the bank (registration of delivery of proceeds) - sample;

- how to issue cash settlement when paying to a supplier through a cash register - sample;

- RKO upon dismissal - sample;

- for issuing wages according to the statement;

- for issuing a report.

Sample RKO for payment of vacation pay:

Sample cash settlement for a contribution to a bank:

Sample payment settlement when paying to a supplier:

Sample RKO upon dismissal:

Order filling procedure

Now let's look at how to fill out a cash receipt order, step by step:

- In the line “Organization” the name of the legal entity is indicated in accordance with the data of the Unified State Register of Legal Entities. If an organization has branches, representative offices or other separate divisions, they are sometimes assigned codes. In this case, in the line “structural unit” the name of such unit is indicated in accordance with the constituent documents, and in the column “Code of structural unit” the code of such unit is indicated.

- Mandatory numbering of the expenditure order is not established by law. When deciding on numbering, the order should be established by a local act.

- The date of the order is the date the cash is issued from the cash register.

- The “Debit” column indicates the accounting accounts on which cash withdrawal transactions are to be reflected. Examples of operations are shown in the table below.

- In the “Credit” column, the cash flow account at the cash desk is indicated in accounting account 50.01 “Cash of the organization.”

- The amount of funds received is indicated in numbers in the column “Amount, rub. cop." and in words in the corresponding lines of the order. The entry is made from the beginning of the line with a capital letter.

- The column “Targeted Purpose Code” is filled in only if targeted funding has been received at the cash desk.

- In the “Issue” line, fill in your full name. recipient of the money.

- In the line “Base” - the content of the business transaction (for example, for crediting to the account of VID LLC in the bank PJSC Svet).

- In the line “Appendix” - the name and details of the primary documents (bill of lading, delivery and acceptance certificate, decision on the payment of dividends, order on the payment of financial aid, etc.).

- In the “By” line - the recipient’s passport details and details of the power of attorney (if any).

After issuing the money, the cashier signs the cash order and keeps it along with the original or a copy of the power of attorney (if the recipient acts on its basis).

How to fill out the RKO correctly?

The form must be filled out on the same day of the actual expenditure of cash.

The presence of corrections in the RKO is unacceptable. Compiled in one copy and kept at the cash desk to confirm the transaction.

Filling out the details of the RKO form:

- OKPO code is the statistical code of the organization; if not, a dash;

- The name of the organization is filled in completely; abbreviations approved by its Charter are also acceptable;

- The structural unit that issued the order is indicated (if there is no unit, this column is crossed out);

- All cash orders are registered in the journal (form No. KO-3), the number and date of the document correspond to the entry in it;

- In the “Debit” column the following is coded:

- structural unit (if not, a dash);

- correspondent account for cash expenditures from the cash register;

- if analytical accounting is used, its code (otherwise - a dash);

- The “Credit” column reflects the accounting account - 50 (cash);

- The amount of expenditure is indicated in rubles and kopecks;

- The “Bases” contain information about the purposes for which these funds were issued;

- In the lines “Amount” and “Received” the amount is indicated in words with a capital letter without indentation from the beginning. The abbreviation of the words “ruble” and “kopeck” is unacceptable; kopecks are written in numbers. The remaining free space on the line is crossed out;

- The “Appendix” line indicates information about the primary documentation on the basis of which cash was issued from the company’s cash desk.

All signatures must have transcripts. The person who receives the funds writes down the full amount, puts down the date of receipt and certifies with a signature.

How RKO is free

You can download the expense cash order in form KO-2, that is, its structure fully complies with the requirements of the law, on our website using the link below:

NOTE! It is important not only to download the current RKO form in one of the presented formats, but also to make sure that the file does not have a “read-only” attribute (otherwise it will not be possible to edit it on a PC). To do this, you need to find it on the disk, right-click on it, select “Properties” and, if necessary, uncheck the corresponding attribute.

Downloading the cash receipt order is only half the battle; the next task will arise - to fill it out correctly. Let's consider the key points of this procedure.

Results

An expense cash order is filled in when funds are issued from the cash register. The rules for filling it out are strictly regulated and are regulated for the most part by instruction No. 3210-U. In 2022, you need to fill out the RKO according to the well-known rules.

Sources:

- Directive of the Bank of Russia dated March 11, 2014 No. 3210-U

- Resolution of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.