Postings

When purchasing a computer program, you can acquire exclusive or non-exclusive rights to it, from this

Accounting for fixed assets under the simplified tax system “income” “Simplers” who have chosen the object of taxation “income”, no expenses for

Home • Blog • Blog for entrepreneurs • How individual entrepreneurs deposit and withdraw money

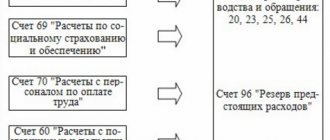

What general points are important to know about creating a reserve for repairs? As indicated

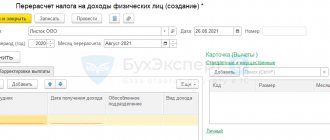

Documents that can be used to make accounting adjustments for personal income tax Document Recalculation of personal income tax Document Accounting operation

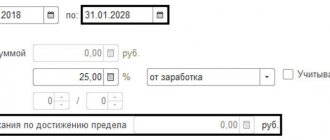

The salary intended to be paid for the performance of labor functions belongs to the employee who earned it. None

The circulation of inventory items arising in the course of the activities of any organization inevitably leads to losses,

Definition Manufacturing overhead costs are costs directly associated with production activities. The main distinguishing feature

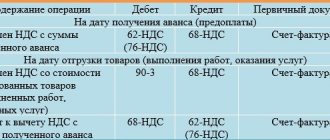

Recovered VAT - what is it? The question of VAT restoration arises in relation to the tax previously

Regulatory regulation Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 “On the peculiarities of the procedure for calculating the average