Employees performing duties in hazardous working conditions have the right to receive milk or other equivalent products during their work shift (Article 222 of the Labor Code of the Russian Federation). Free issuance is carried out on the days the employee actually works in conditions with negative impact factors.

An internal document of an enterprise may provide for the provision of the cost equivalent of milk or equivalent products. Compensation is paid upon application of the employee in the amount of cost confirmed by statistical data for the region.

Reasons for obtaining milk

The presence of dangerous conditions of influence on the employee’s body is established by a special assessment of working conditions (SAW).

The event is planned, control is carried out at least once every 5 years. Negative influencing factors are present in the chemical, metallurgical, pharmaceutical and other types of industries. There are restrictions when providing employees with milk or other equivalent products. (click to expand)

| Condition for providing milk | Limitation |

| Harmful factors present during work performance | The right to provide milk arises when carrying out work confirmed by the SOUT and specified in Appendix No. 3 to the Order of Health and Social Development of the Russian Federation dated February 16, 2009 No. 45n |

| Issue rate | The employee is given 0.5 liters of milk regardless of the duration of the shift during work or at the end of it. No issuance will be made before work begins. When replacing a food product, the norm is determined in accordance with the law (Order No. 45n) |

| Dispensing products while limiting work time in hazardous conditions | The right arises when exposed to harmful factors for more than half the working time of the duration established by the position |

| Product delivery times | It is not allowed to issue products for subsequent or past work shifts, during vacations, non-working days |

Upon receipt of the results of the special assessment and assessment with a conclusion on the safety of work for a specific position with the absence of negative factors affecting the employee, the provision of dairy products is terminated.

Standards for issuing milk or equivalent food products

If, instead of milk (other products), an employee is given monetary compensation, its amount is determined on the basis of paragraphs 2, 4 of Appendix No. 2 to Order of the Ministry of Health and Social Development of Russia dated February 16, 2009 N 45n, which approves:

- Norms for the issuance of milk or equivalent food products;

- The procedure for making compensation payments in exchange for the provision of milk;

- List of harmful production factors, in the presence of which preventive consumption of milk is recommended.

This order also establishes that the specific amount of compensation is approved by the employer independently in a collective or labor agreement, in agreement with the representative body of employees.

Time tracking in hazardous conditions

An important point in obtaining products or equivalent is taking into account the time of work in conditions influenced by special factors.

Fixation is carried out taking into account the following features: (click to expand)

- Working hours are recorded in the timesheet.

- There is no separately developed document for recording work in hazardous conditions.

- Enterprises must independently develop a primary accounting form with additional lines for hourly control.

The benefit of receiving milk (replacement products) or compensation is provided for working at least half the time under special conditions.

Important! When calculating working hours, it is necessary to take into account the reduced duration of the work shift for places with high-risk factors. There is a list of specialties for which the time standard is set at 36-hour or other working week.

What are hazardous working conditions?

Harmful working conditions should be understood as those that are characterized by the presence at the enterprise of factors that negatively affect the health of workers and their capacity.

At the same time, working environment conditions do not fall into the category of harmful arbitrarily, but only after a special assessment of working conditions (SOUT), the procedure for which is prescribed in Law No. 426-FZ of December 28, 2013.

Article 14 No. 426-FZ contains a detailed classification of production according to the degree of harmfulness:

| Class of working conditions | Subclass of working conditions | Impact of adverse factors | Effect on the body |

| 1 - optimal | Absent or does not exceed the levels established by regulations | Harmless | |

| 2 - acceptable | Does not exceed the levels established by regulations | Restoring the body during a break or before the start of the next working day | |

| 3 - harmful | 3.1 (1st degree) | Exceeds regulatory levels | It takes a long period of time for the body to recover |

| 3.2 (2nd degree) | Probability of mild occupational diseases (after exposure for more than 15 years) | ||

| 3.3 (3rd degree) | The likelihood of moderate occupational diseases, which can lead to professional incompetence | ||

| 3.4 (4th degree) | The likelihood of severe occupational diseases, which can lead to loss of general ability to work | ||

| 4 - dangerous | Exposure levels are likely to endanger the life of the worker | High risk of acute occupational disease |

In order for a working environment to receive the status of harmful, an appropriate decision of the commission (SOUT) is required, which analyzes the negative impacts, compares them with standards and assigns a hazard class to the production. In this case, we will talk about guarantees and compensation.

Providing cash equivalent

The conditions for providing compensation are defined in Appendix 2 to Order No. 45n. General rules have been established:

- The cash equivalent is paid when this opportunity is fixed in the company’s internal documents - collective agreements, labor agreements or specially developed regulations.

- The amount of compensation is determined taking into account the position of the representative body of employees, the trade union, or the amount specified in the employment contract.

- Indexation is carried out in accordance with regional price increases. The organization must approve the timing of indexation. Information on prices set in retail trade is used. The amount of indexation is agreed upon with the employee representative or trade union body.

- The calculation is made monthly, at least once. The amount is determined as the cost of the product, calculated according to the norm for the days of actual work in conditions of increased harmfulness.

The deadline for settlement with an employee is not regulated by law and can be added to advance payments or wages. The calculation is carried out according to a separate statement or payment order.

Manager's order to make payments

To receive a cash equivalent, the employee’s personal initiative, specified in a written application, is required. The frequency of filing an application is not defined by law, which allows payments to be made based on a document submitted once. Cancellation of a monetary payment is also carried out upon a written request from the employee to the manager.

Compensation is provided to the applicant on the basis of an order issued by the enterprise. The document is issued in relation to one employee or several persons. The document states:

- The basis for receiving a sum of money. Links to legislative acts, internal company documents, and employee statements are provided.

- Information about the employee and position held.

- The calendar period for which the amount is accrued to the person.

- The cost of 1 liter of milk and a link to the basis for confirming the price.

- The total amount of cash equivalent.

- Details of positions and names of employees responsible for implementing the order.

The order is signed by the head of the enterprise. Information is communicated to persons involved in its implementation. The document is stored with general orders for the enterprise for 5 years. For payments in excess of the norm that require tax withholding, the order is stored simultaneously with documents for issuing wages to employees for 75 years.

Is compensation for milk subject to contributions – Lawyer Anisimov

As for cash payments in exchange for milk, they can be taken into account, in accordance with paragraph 3 of Article 255 of the Tax Code of the Russian Federation, as compensatory charges related to work hours and working conditions.

You can also use paragraph 25 of Article 255 of the Tax Code of the Russian Federation - other types of expenses incurred in favor of the employee, provided for by an employment or collective agreement.

However, it should be borne in mind that the presence of harmful working conditions must be confirmed by the results of workplace certification.

Otherwise, it will not be possible to write off the compensation paid as expenses when taxing profits. The source of financing for such payment will be net profit.

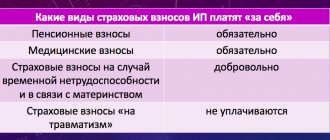

Benefits for insurance premiums are also given to monetary compensations related to the performance of work duties by an individual. Contributions to the Pension Fund and contributions to accident insurance.

Exemption of monetary compensation from insurance contributions makes it possible not to pay pension contributions, since these accruals have a single object of taxation and tax base (Federal Law of July 24, 2009 No.

No. 212-FZ

“On compulsory pension insurance in the Russian Federation”

) .

Regarding contributions for accident insurance: there is a direct rule in paragraph 11 of the List of payments for which insurance premiums are not charged to the Federal Social Insurance Fund of the Russian Federation (approved by Decree of the Government of the Russian Federation of July 7, 1999 No. 765).

According to this clause, the cost of milk or other equivalent food products issued to employees in accordance with the legislation of the Russian Federation, as well as therapeutic and preventive nutrition provided free of charge according to established standards, or, in appropriate cases, monetary reimbursement of the costs of their acquisition, is discounted.

Personal income tax. According to paragraph 3 of Article 217 of the Tax Code of the Russian Federation, all types of compensation payments established by the legislation of the Russian Federation within the limits of the norms, in particular, related to the performance of labor duties by the employee, are not subject to personal income tax. Therefore, cash compensation in exchange for milk is not subject to this tax.

Passing off milk as harmful! Is it subject to personal income tax? Can it be included in income tax expenses? Do I need to pay insurance premiums?

Vladimir Bad attitude to work, they are so clueless, they sit there, I haven’t been able to get compensation for treatment for more than half a year now, they keep chasing me, certificates, nothing Vladimir What a mess this inspection is, I’ve been waiting for payments for six months, still no, but they send me a receipt, quickly pay them, the creatures are sitting Vladimir I’m calling from opening until lunch - their nobility is NOT on the phone Stas Hello!

Did the tax service rightfully block the current account for non-payment of transport? Elena had difficulty getting through to the Federal Tax Service Inspectorate No. 5 of Moscow. A polite girl advised me to call back two other phone numbers that were not on the website.

Within a year and a half, Yuri discovered in my personal account that I had an overpayment of 1825 rubles. Submitted an application on February 23. 2022 about the return of funds - the return is still Olga I’m also trying to get through to Anna Anatolyevna, the situation is similar, no one picks up the phone and it’s also the fifth month, it feels like

Taxes when issuing milk to employees “for being harmful”

For workers engaged in work with hazardous working conditions, the provision of milk or other equivalent food products may be replaced, upon their written applications, with a compensation payment in an amount equivalent to the cost of milk or other equivalent food products.

Source: https://adanisimov.ru/oblagaetsja-li-vznosami-kompensacija-za-moloko.html

Withholding personal income tax from compensation amounts

Compensation payments provided to a person in accordance with legislative norms are not subject to taxation (clause 3 of Article 217 of the Tax Code of the Russian Federation). Amounts paid in excess of the norms are taxed in accordance with the general procedure. The compensation received by the employee is recognized as the person’s income related to the conduct of labor activities.

If the organization does not have an up-to-date operating system, the norms are not considered defined. Milk received by an employee from an enterprise or compensation issued in exchange for it is considered income of a person subject to personal income tax.

According to the Ministry of Finance, the income of persons whose working conditions are recognized as acceptable when issuing milk or the cash equivalent is not subject to the provisions on the exemption of amounts from personal income tax.

Director of the Department of Tax and Customs Tariff Policy I.V. Trunin

| Personal income tax is not withheld | Tax subject to withholding |

| SOUT carried out | SOUT was not carried out |

| A special assessment confirmed the presence of the influence of harmful factors | The special assessment confirmed the admissibility of the conditions and the absence of negative factors |

| Compliance with issuance standards | Products or compensation provided above the norm |

An example of income tax withholding. The company arranged an internship for the position of a welder for a student accepted under an educational contract without admission to the staff. The internship takes place in hazardous working conditions. When carrying out practical work, the student is given milk. Based on the clarifications provided by the Ministry of Finance of the Russian Federation (letter dated January 16, 2017 No. 03-04-06/1220), the accounting department withheld personal income tax. The exemption does not apply to non-employees.

Insurance premiums in the absence of workplace certification

All types of compensation payments established by the legislation of the Russian Federation (within the limits established in accordance with the legislation of the Russian Federation) related to the performance of labor duties by an individual (clause “and” clause 2, part 1, article 9 of the Federal Law dated July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, and the Federal Compulsory Medical Insurance Fund”).

The question remains controversial about the need to include in the base for calculating insurance premiums the cost of milk (compensation payments) issued to employees engaged in work with hazardous working conditions, if the company has not carried out a special assessment of working conditions.

Example No. 1

The company for the period 2013-2014. Milk was provided to employees on the basis of a collective agreement, salary slips, individual insurance contribution cards, and a list of positions. Milk was given to employees for whom milk was not provided in accordance with the workplace certification card for working conditions.

During the inspection of the Federal Social Insurance Fund of the Russian Federation, it was concluded that the base for calculating insurance premiums was underestimated by the amount of payment for milk, since the working conditions of workers were not recognized as harmful as a result of a special assessment of working conditions (before 01.01.2014 - certification of workplaces).

However, the court sided with the company based on the following arguments.

The basis for issuing milk or therapeutic and preventive nutrition to an employee is his actual employment in work associated with harmful production factors.

The above standards do not provide for certification as a condition for providing compensation.

That is, carrying out certification and recognizing the working conditions of individual workplaces as acceptable in terms of chemical, biological and physical factors does not relieve the employer of the obligation to provide compensation to the employee on the days of actual employment in work associated with the presence of harmful production factors in the workplace.

Clause 14 of the Norms and Conditions for the Distribution of Milk stipulates that other issues related to the free distribution of milk or other equivalent food products are resolved by the employer independently, taking into account the provisions of the collective agreement.

And during the period under review, the company had a collective agreement in force for 2012 - 2014, which provided for the employer’s obligation to provide milk to employees working in hazardous working conditions.

The general director of the company, in agreement with the trade union committee, approved a list of professions and positions with hazardous working conditions, which include free milk (with a milk distribution rate of 0.5 liters per shift).

In accordance with clause 13 of the Order of the Ministry of Health and Social Development of the Russian Federation dated February 16, 2009 No. 45n, the basis for an employer’s decision to stop providing free milk or other equivalent food products to employees are:

- availability of results of a special assessment of working conditions;

- consent of the primary trade union organization or other representative body of employees (if the employer has one) to terminate the free distribution of milk or other equivalent food products to employees based on the results of a special assessment of working conditions at their workplaces.

If the employer does not have data on the results of a special assessment of working conditions or fails to comply with the above requirements, the procedure for free provision of milk or other equivalent food products, which was in force before the entry into force of Order No. 45n dated 02.16.2009, is maintained.

The company's trade union organization refused to give consent to stop the free distribution of milk or other equivalent products to employees whose workplace certification results for working conditions did not reveal harmful production factors or exceeding established standards for them.

Thus, the free provision of milk or other equivalent products is not made dependent on the results of certification of workplaces (Decision of the Voronezh Region AS dated July 5, 2016 No. A14-1610/2016).

Consequently, before the certification of workplaces, the company is obliged to provide workers engaged in work with hazardous working conditions with free milk in accordance with the adopted collective agreement.

Failure to carry out certification is not a basis for additional assessment of insurance premiums and can only serve as the basis for conclusions about violation of labor laws (Resolution of the Autonomous District of the North-Western District dated 08.08.2016 No. A44-3876/2015).

A similar legal position is contained in the Resolutions of the Court of Appeal of the Novgorod Region dated August 8, 2016 No. A44-3876/2015, the Seventeenth Arbitration Court of Appeal dated November 26, 2015 No. A71-6244/2015, and the Court of the West Siberian District dated June 18, 2015. No. A27-8720/2014 and dated 06.11.2014 No. A27-7912/204, AS of the Volga-Vyatka District dated 09.10.2014 No. A79-8337/2013, FAS of the Ural District dated 25.04.2014 No. F09- 2274/2014.

Taxation of contribution compensation

Payments to employees are subject to contributions to the funds, except for amounts exempt from taxation. Compensation equivalent to the cost of milk is not subject to contributions (clause 2, clause 1, article 422 of the Tax Code of the Russian Federation). An enterprise may provide dietary products in excess of established standards at the expense of the employer based on the order of the manager. Excess distributions or equivalent payments are subject to tax.

When insuring against industrial injuries, the provision of milk is not subject to contributions, except in cases of receipt of the cash equivalent (Article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ). The peculiarity of deductions for compensation payments is due to the need to prevent occupational diseases. Consumption of milk and analogues helps eliminate carcinogens and other harmful substances from the body. When working with certain types of metals, employees are provided with fermented milk products.

Payment to a milk worker for harmfulness

Quantity August 4, 2021

Employees engaged in work with hazardous working conditions are given milk or other equivalent food products.

Upon written request from employees, the provision of milk according to established standards may be replaced by monetary compensation in an amount equivalent to the cost of milk.

Free milk is provided to employees on days of actual employment at jobs with hazardous working conditions. Harmful working conditions are confirmed by workplace certification results.

The rate of free milk distribution is 0.5 liters per shift, regardless of the duration of the shift.

Procedure for paying compensation in exchange for milk

The amount of compensation payment is accepted as equivalent to the cost of milk with a fat content of at least 2.5% or equivalent food products in retail trade at the employer’s location.

Compensation payments must be made at least once a month.

Personal income tax when issuing milk to employees

As a general rule, income in the form of the cost of milk is not subject to personal income tax.

Milk is not subject to personal income tax only within the norm (0.5 liters per shift) and precisely for those days when the employee is actually engaged in hazardous work.

Insurance premiums

Milk that is harmful within normal limits is not subject to insurance premiums.

The question remains controversial about the need to include in the base for calculating insurance premiums the cost of milk given to employees engaged in work with hazardous working conditions, if the company has not carried out a special assessment of working conditions.

Does this income need to be reflected in the 2-NDFL certificate?

No. Providing milk or compensation to an employee within the normal limits is not income

individual.

In addition, compensation payments within the norms are not included in the calculation of insurance premiums and Form 6-NDFL.

Accounting entries

Since monetary compensation that replaces the provision of milk is not wages, account 73 “Settlements with personnel for other operations” should be used to reflect it in accounting records.

For example:

| Debit 20 (23, 25) Credit 73 | reflected in expenses is the amount of compensation due to employees in exchange for the provision of milk |

| Debit 73 Credit 50 | payment of compensation to workers is reflected |

● Calculation of insurance premiums ● Reporting on forms 2-NDFL and 6-NDFL

Payment to a milk worker for harmfulness

Employees engaged in work with hazardous working conditions are provided with milk or other equivalent food products.

Upon written request from employees, the provision of milk according to established standards may be replaced by monetary compensation in an amount equivalent to the cost of milk.

Free milk is provided to employees on days of actual employment at jobs with hazardous working conditions. Harmful working conditions are confirmed by workplace certification results.

The rate of free milk distribution is 0.5 liters per shift, regardless of the duration of the shift.

Errors when making payments

Error No. 1. Harmful conditions during the performance of official duties are determined by the SOUTH. If during the verification process during the next certification the absence of negative factors is revealed, the terms of employment change. An addition to the employment contract regarding changes in conditions is drawn up with a 2-month notice. The position regarding the continuation of the distribution of milk and analogues during the notice period is erroneous. After the conditions are recognized as being normal, the supply of milk and equivalents is stopped immediately after approval of the assessment and agreement with the team representative.

Error No. 2. When particularly harmful elements of influence are identified, individuals are provided with dietary nutrition. It is erroneous to continue providing milk along with preventive nutrition. Once food is assigned, other distributions stop.

Answers to common questions

Question No. 1. Does the employer have the right to force an employee to receive the cash equivalent in exchange for milk and analogues? (click to expand)

The employee has the right to choose; the manager does not determine the possibility of replacement or force him to submit an application for a cash equivalent. An employer's refusal to provide products violates the employee's rights. The change from a natural product to a cash payment and vice versa can be carried out at the initiative of a person an unlimited number of times.

Question No. 2. How to document the cost of milk for payment of compensation and inclusion of the amount as expenses?

To obtain accurate information about the cost, an organization can enter into an agreement with the regional body of Rosstat to receive information on a monthly basis. Certificates received under the contract are paid services. The second way to obtain information is to print out the data from the official website of the authority.