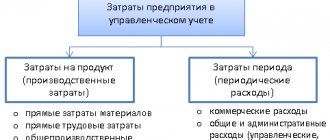

Definition

Manufacturing overhead costs are costs directly related to production activities. The main distinguishing feature from direct costs of manufacturing products is that the amounts cannot be attributed to a specific type of product. General production expenses may include costs for:

- depreciation deductions;

- equipment maintenance;

- payment for utility services;

- rent of industrial premises;

- wages for workers involved in the service process;

- other expenses.

Although costs are not directly related to any type of product, they must be taken into account when calculating production costs.

General production costs. How to write off

Question: The organization produces several types of products. Can she attribute all the general production costs accumulated on account 25 to the cost of production at the end of the month?

Answer: Variable overhead costs are written off to the cost of manufactured products, and semi-fixed costs are written off either to cost or directly to administrative expenses in the debit of subaccount 90-5.

Rationale: Account 25 “General production expenses” takes into account the costs associated with the maintenance and management of structural divisions of the main production. If the organization also has auxiliary production or, say, service facilities, then this account can also be used to account for the costs of servicing and managing divisions of these productions.

Such costs include, for example <*>:

— depreciation and repair costs of fixed assets used in production;

— real estate tax and land tax on industrial buildings and structures;

— rental of industrial premises;

— costs of electricity consumed by production equipment;

— costs of internal movement of raw materials and materials.

In other words, account 25 takes into account costs that are related to the production process, but cannot be directly taken into account in the cost of manufactured products. They are also called indirect. And all indirect general production costs are divided into variable and semi-fixed. And the order of their write-off <*> depends on which type the amounts on account 25 will be assigned to.

Variable costs are when their size depends on the volume of products produced, i.e. they increase when production increases and decrease when production decreases. This includes, in particular, the cost of electricity consumed by production equipment.

Such costs are written off from account 25 at the end of the month to the cost of production, i.e. make up the wiring: D-t 20, 23, 29 - K-t 25 <*>.

Conditionally fixed costs are costs, the size of which is not closely related to the volume of production (regardless of the volume of output, their size will be approximately the same). These are, for example, the rental of industrial premises, real estate and land taxes. An organization can spend this kind of expenses at the end of the month:

- or write off to the cost of manufactured products: D-t 20, 23, 29 - K-t 25;

- or directly attributed to administrative expenses: Dt 90-5 - Kt 25 <*>.

As we see, the organization has the right to include all costs recorded on account 25 in the cost of manufactured products. To do this, she needs to make an entry in the accounting policy that conditionally fixed overhead costs at the end of the month are written off to cost <*>.

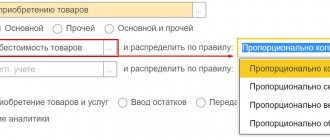

Moreover, in our case, the organization produces several types of products. This means that before including general production costs in the cost of each type of product, they need to be distributed. The organization determines the distribution methodology independently, based on the characteristics of its activities, and enshrines it in its accounting policies <*>. Can be distributed proportionally:

— direct costs of paying production workers;

— direct material costs;

— the sum of all direct costs included in the cost of a certain type of product;

— volume of product output in quantitative terms (pieces, tons, meters, etc.).

The concept of general expenses

The activities of any enterprise are necessarily connected with the functioning of its various departments. A production workshop cannot operate on its own without management and control employees. The products must then be stored and sold, which requires other personnel and premises. All this leads to the formation of costs that seem to be far from the production process, which are combined into the group of general business expenses.

They may include amounts necessary for:

- covering administrative and management expenses;

- remuneration for employees employed outside production;

- depreciation and repair of general purpose fixed assets;

- payment for rent of non-production premises;

- covering other expenses of a similar nature.

General business expenses are also written off to the cost of manufactured products in accordance with the rules of the enterprise's accounting policy.

What costs are considered direct costs?

Direct costs include:

- material costs;

- expenses for remuneration of workers involved in the production of goods, performance of work, provision of services, as well as contributions to extra-budgetary funds from these expenses;

27 Jun

2022 Interesting materials:

How to remove spam ads from your computer? How to delete several applications at once? How to delete several slides in a presentation at once? How to delete several bookmarks in Google at once? How to delete several bookmarks at once? How to delete all applications on Android at once? How to delete all applications from your phone at once? How to delete all bookmarks at once in Google Chrome? How to remove links from Google Chrome address bar? How to remove a link from your desktop?

Characteristics of overhead costs

General production and general business expenses are combined into a group of indirect costs that arise in the course of the enterprise's activities. It is difficult to trace the ratio of their amount to types of products and production time, so they are written off by the method of allocating costs in proportion to a given indicator.

General production and general business expenses are taken into account, highlighting separate cost items and departments (shops). This allows you to control the distribution of funds and identify the most expensive objects to maintain and manufacture.

Overhead costs in accounting data

General and general production expenses in total terms are reflected in synthetic accounts 25 and 26. Both accounts do not have a balance at the end of the month, since they serve to collect and distribute the costs of main production. The amounts are written off to account 20, making entries Dt 20 Kt 25/26. Some enterprises (for example, those providing intermediary services) account for all administrative and general business expenses on account 26, without using account 20.

Analytical accounting is also kept for accounts 25 and 26. Sub-accounts are opened for each workshop, as well as for individual items of general business expenses. When filling out, the accountant is based on data from primary documentation and other forms of accounting registers developed by the enterprise. Additionally, statements No. 12 and 15 are maintained to account for general production and general business expenses.

Accounting for general production expenses for tax purposes

- General taxation system.

The entrepreneur or founder in this case pays income tax of 20%. Profit is the difference between income and expenses, including general production expenses - Simplified taxation system. Under the simplified tax system, it is possible to pay tax on profit or on the income of an enterprise. In the first case, overhead costs are taken into account, in the second - not.

- UTII. Since UTII does not take into account expenses, income and profits, there is not even a need to keep track of indirect costs.

- Combining UTII with the general taxation system. This situation is possible when operating several industries. General production costs are distributed in proportion to the income of each industry, if it is not possible to actually account for them.

Typical entries for the debit of accounts 25, 26

Accounting for overhead costs includes collecting information about cost items for maintenance, servicing and fulfilling the needs of main and auxiliary production. Using account 26 pursues the same goals, only the amounts of administrative and management expenses are recorded. Over a certain period, the necessary information is collected in the debit of accounts 25 and 26.

In this case, the following postings Dt 25/26 can be made:

- Kt 02, 05 – depreciation of fixed assets and intangible assets has been accrued;

- Kt 70 – wages accrued to general production (administrative) personnel;

- Kt 69 – social benefits accrued. payments to employees involved in servicing workshops (management employees);

- Kt 76 – general production (general business) expenses include payment of utility bills;

- Kt 10 – materials were sent for the maintenance of production (administrative) facilities.

In addition to the account assignments discussed, others can be used. The main thing is not to violate the principle of double entry and follow the rule of an active account: credit in debit, write-off in credit.

Write-off

All general business expenses are collected in monetary terms as a debit turnover of account 26. When closing a period, they are written off to the main, servicing or auxiliary production, may be included in the cost of goods to be sold, charged to future expenses, or partially allocated to the enterprise's loss. In accounting, this process is reflected by the following entries:

- Dt 20, 29, 23 Kt 26 – OChR are included in the cost of production of the main, service and auxiliary production.

- Dt 44, 90/2 Kt 26 - general business expenses are written off in trading enterprises, to the financial result.

Loan transactions: write-off of overhead costs

The instructions for using the standard chart of accounts say that collective synthetic accounts 25 and 26 must be closed at the end of the month. This requirement means that all debit amounts are charged to account 20 (or 90 for general expenses). The accountant will record entries like:

- DT “Main production” CT “Overhead production expenses” – the amounts of general production expenses incurred for the needs of the main production shops are written off;

- Dt “Service production” Kt “Overhead production costs” – the amounts of overhead costs for remuneration of personnel of service production are attributed;

- DT “Auxiliary production” CT “General production expenses” – expenses for utility bills for auxiliary production facilities are written off;

- DT “Main production” CT “General business expenses” – general business expenses were included in the actual production cost;

- Dt “Cost of production” Ct “General expenses” – the amounts of administrative and managerial costs are written off to the cost of production.

Depending on which account the data from the debit turnover of general business expenses is credited to, the full or production cost of the products is formed.

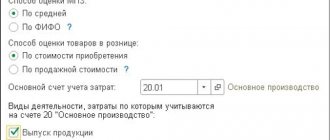

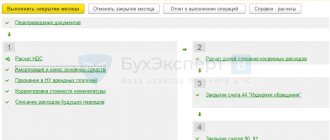

2.1) General production unit. Setting up expense items.

Setting up cost accounting for a general production unit also begins with filling out the expense item:

Expense type: “Production expenses”, in the distribution settings specify the value “Reflect on production costs”, set up the distribution rule for wages:

The “Regulated Accounting” tab is filled in with data to be reflected in reporting, as well as accounting accounts.

During the month, all expenses on account 25 are accounted for under the expense item with the specified settings. In the current example, general production expenses should be distributed across areas of activity on account 20 according to the distribution base “wages”.

Production cost

Costs arising in connection with the maintenance or maintenance of production facilities can be attributed to the final result in proportion to the amount specified by the accounting policy. The distribution of overhead costs aims to calculate the cost per unit of production at the exit from the workshop, taking into account all the costs of the industrial cycle.

The distribution of general production and general business expenses when using this method occurs in different ways: from account 25 the amounts are written off to the 20th account, and from 26 to 90. Thus, administrative, managerial and other overhead expenses in terms of general business expenses are not included in the production cost, but relate directly to the financial result.

This is one of the methods that can be applied in an enterprise. Production cost indicators allow you to analyze the profitability of a particular workshop and regulate the amount of costs for the production of certain types of products.

Cost and taxation

In order not to create additional registers for tax accounting purposes, it is better to account for overhead costs at the full production cost. The method involves writing off to the debit of account 20 both general production and general business expenses. The accountant’s choice of a method for attributing indirect costs to the cost of products should be based primarily on the provisions of the enterprise’s accounting policy.

General production expenses (account 25) and expenses for general business needs, together with data from account 20, make up the bulk of the cost of manufactured products. The data is used both for the purposes of accounting and analysis of the financial activities of the enterprise, and for tax service data.

Accounting for expenses of service industries and farms

Service industries and farms are those structural divisions of an enterprise that perform functions not directly related to the main activities of the enterprise. Such service industries and farms may include:

- objects of the social structure that are on the balance sheet of the enterprise (dormitories, kindergartens, clubs, clinics, hospitals, dispensaries, sanatoriums, etc.);

- farms for the production of products not related to the main activity of the enterprise (for example, a pig farm at a metallurgical enterprise - its products are used to provide meat for workshop canteens and social facilities of the enterprise).

The debit of account 29 is used to reflect direct expenses associated with the activities of service industries and farms. The credit of account 29 reflects the actual cost of products and services produced by service industries and farms.

IMPORTANT! Account 29 does not correspond with account 20, as follows from the Chart of Accounts and instructions to it, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n. This is explained by the fact that, according to the meaning of the transactions for which account 29 is provided, it should not reflect anything that could form the production cost of the types of main products produced.