Standard postings in budgetary institutions

Accounting for seals in budget departments is much more difficult than in ordinary departments. Initially, a decision is made on which item needs to be reflected: 310 (if the seals will be used for more than a year) or 340 (use period less than 1 year).

Based on Instruction No. 157n, an object that has been used for more than a year is recorded as a fixed asset, regardless of its price. When the print has been used for less than a year. If the useful life is less than a year, then the seals are classified as inventories. The decision on this is made by the commission.

- If the acceptance was carried out as a fixed asset. The postings indicate the cost of all costs, including VAT. If it is less than 3 thousand rubles, then it is written off from the account and simultaneously reflected on it in 21 “Fixed assets worth up to 3 thousand rubles inclusive in operation.”

- When assigning a seal to the category “Material reserves”. If a decision is made to include them as inventory, then assignment to them occurs on the basis of the following documents:

- waybill;

- invoices;

- waybill;

- act of acceptance of the established form (0315004).

Accounting for the production of printed products

An advertising agency, under a contract, performs work on the production of advertising leaflets. In this case, another legal entity (printing house) directly prints the leaflets. The printing house for the rendered printing services, together with the act of services rendered and the invoice, issues an invoice in the TORG-12 form for the amount specified in the act. The printing house prints leaflets using its material assets. How should transactions for the production of leaflets under a contract be reflected in accounting? What documents should be completed when releasing leaflets to the final buyer (customer)?

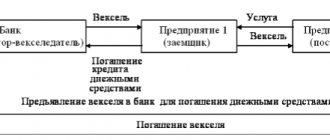

Under a work contract, one party (contractor) undertakes to perform certain work on the instructions of the other party (customer) and deliver its result to the customer, and the customer undertakes to accept the result of the work and pay for it (Clause 1, Article 702 of the Civil Code of the Russian Federation).

According to paragraph 1 of Art. 703 of the Civil Code of the Russian Federation, a contract is concluded for the manufacture or processing (processing) of a thing or for the performance of other work with the transfer of its result to the customer.

At the same time, under a contract concluded for the manufacture of an item, the contractor transfers the rights to it to the customer (clause 2 of Article 703 of the Civil Code of the Russian Federation).

Unless otherwise provided by the contract, the work is performed at the contractor’s expense - from his materials, with his forces and means (Clause 1 of Article 704 of the Civil Code of the Russian Federation).

According to paragraph 1 of Art. 711 of the Civil Code of the Russian Federation, if the contract does not provide for advance payment for the work performed or its individual stages, the customer is obliged to pay the contractor the agreed price after the final delivery of the work results, provided that the work is completed properly and on time or with the customer’s consent ahead of schedule.

That is, the customer’s obligation to fully pay the cost of the work is primarily due to the fact that the work was properly performed by the contractor and the customer accepted its results.

From the provisions of paragraph 2 of Art. 720 of the Civil Code of the Russian Federation it follows that the acceptance of work performed under a work contract is carried out with the preparation of a corresponding act or other document.

According to Art. 506 of the Civil Code of the Russian Federation, under a supply contract, the supplier (seller engaged in business activities) undertakes to transfer, within a specified period or terms, the goods produced or purchased by him to the buyer for use in business activities or for other purposes not related to personal, family, home and other similar use.

There are court decisions in which contracts for the manufacture of things are considered as mixed contracts containing elements of a supply contract and a work contract (see, for example, the resolution of the Ninth Arbitration Court of Appeal dated April 27, 2011 N 09AP-7611/11, the resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated 08.28.2007 in case No. A28-3957/2006-192/17, dated 09.18.2006 in case No. A82-15259/2004-45, resolution of the Federal Antimonopoly Service of the East Siberian District dated 04.04.2005 N A33-4823/04-C4- F2-1184/05-S2 and others).

In the situation under consideration, the organization, under a contract, produces advertising leaflets for the customer. At the same time, a printing house is hired to print them, which issues an act of rendered services and a bill of lading in the TORG-12 form for the same cost for the printing services provided.

According to clause 5 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n (hereinafter referred to as Regulation N 34n), the organization independently forms its accounting policy based on its structure, industry affiliation and other features of the activity, guided by the legislation of the Russian Federation on accounting, regulations of the Ministry of Finance of Russia and bodies granted by federal laws the right to regulate accounting.

When reflecting in accounting the cost of work performed under a contract, an organization can use the provisions of the Methodological Recommendations on planning and accounting for the costs of production and sales of products (works, services) at printing enterprises (agreed with the Ministry of the Russian Federation for Press, Television and Radio Broadcasting and Mass Communications 25.11.2002, hereinafter - Methodological recommendations).

Clause 2.1 of the Methodological Recommendations states that production and sales costs include costs associated with the use of materials, fixed production assets, purchased products and semi-finished products, fuel and energy, labor, as well as other costs associated with the implementation of printing work ( production of products, provision of services) and included in their cost.

Accounting for expenses for the production and sale of publishing products must be organized in accordance with PBU 10/99 “Expenses of the organization.” All costs for the production and sale of publishing products are taken into account on synthetic accounting accounts specified in clause 4.7 of the Methodological Recommendations.

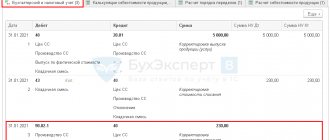

In the context of synthetic account 20 “Main production”, analytical accounting is maintained for each title (order) (clause 4.9 of the Methodological Recommendations).

Let us note that an organization can use to account for the planned (standard) cost of work performed and services rendered, having provided for this in the accounting policy, since account 43 is used only for accounting for finished products (clause 4.8 of the Methodological Recommendations).

Clause 4.14 of the Methodological Recommendations establishes that expenses for printing work are reflected in accounting on the basis of contracts with printing enterprises and invoices for payment, to which protocols for agreeing on contract prices, invoices and invoices for delivery of circulation must be attached. Expenses for printing work (excluding VAT) are reflected by posting to the debit of account 20 to the credit of account 60.

The object of cost accounting and calculation using the order-by-order method is each name (a separate order). Primary documentation for payment of royalties, payment of bills for printing, expenses for paper, cardboard, binding and other materials, etc. compiled with the obligatory indication of the title number (publishing number). The actual cost of circulation of each title (publishing issue) is determined after its completion. All direct costs are included directly in the cost of the order to which they relate (clause 5.3 of the Methodological Recommendations).

Thus, accounting for work performed on the production of leaflets specifically for order can be maintained without using account 43.

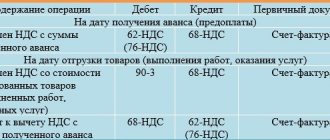

In this case, operations for the production of leaflets are accompanied by the following entries:

Debit 20 Credit 02, 10, 69, 70, etc.

— the costs of producing leaflets are taken into account;

Debit 20 Credit 60

- costs for printing services are taken into account.

In this case, it is advisable to account for the control leaflets themselves in an off-balance sheet account.

The chart of accounts for the accounting of financial and economic activities of organizations and instructions for its application (approved by order of the Ministry of Finance of Russia dated October 31, 2000 N 94n) provide for this account 002 “Inventory assets accepted for safekeeping.”

Debit 002

- leaflets are registered.

Note that if there is a delivery note for the printed edition, leaflets can also be capitalized as material assets in the warehouse, then it is necessary to make an entry in accounting:

Debit 10 Credit 60

- the printed edition is capitalized.

With this method of accounting for manufactured leaflets, printing services are not accepted as expenses; the cost of manufactured leaflets is written off as expenses by posting:

Debit 20 Credit 10

- the cost of the produced circulation is written off as expenses;

Debit 19 Credit 60

- VAT reflected;

Debit 68, subaccount “VAT” Credit 19

- VAT on printing services (circulation) is accepted for deduction;

Debit 62 Credit 90

- leaflets were sold to the customer on the basis of a work completion certificate;

Debit 90 Credit 20

- the cost of leaflets is written off;

Debit 90 Credit 68, subaccount “VAT”

- VAT is charged.

If the accounting of leaflets is kept on an off-balance sheet account, their disposal is accompanied by the entry:

Credit 002

- leaflets were transferred to the customer;

Debit 50 (51) Credit 62

- funds received from the customer.

However, leaflets have a tangible form, and during the process of production, storage and transportation they may lose their marketable appearance (for example, as a result of a fire or other situations); after production, leaflets can be stored for some time in the contractor’s warehouse. Therefore, it is necessary to keep quantitative records of them.

According to clause 2 of PBU 5/01 “Accounting for inventories” (hereinafter referred to as PBU 5/01), finished products are part of inventories intended for sale (the final result of the production cycle, assets completed by processing (assembly), technical and whose quality characteristics comply with the terms of the contract or the requirements of other documents, in cases established by law).

In our opinion, the leaflets produced correspond to the concept of finished products, since they are the end result of the production cycle. Therefore, the organization can keep records using account 43.

Accounting for finished products is regulated by the norms of PBU 5/01 and section 4 of the Methodological Instructions for Accounting for Inventories (approved by Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n, hereinafter referred to as the Methodological Instructions).

As follows from paragraph 59 of Regulation No. 34n, finished products can be assessed by the organization:

- at actual production cost;

- according to standard (planned) production costs;

- for direct cost items.

In the situation under consideration, the organization performs work according to a specific order and the production of leaflets is not mass production. In our opinion, in this case it is advisable to keep records at actual production costs (clause 205 of the Methodological Instructions).

The procedure for accounting for finished products must be fixed in the accounting policy.

If accounting for finished products is carried out at actual cost, typical accounting entries will be as follows:

Debit 20 Credit 02, 10, 69, 70, etc.

— the costs of producing leaflets are taken into account;

Debit 20 Credit 60

- costs for printing services are taken into account;

or:

Debit 10 Credit 60

- the printed edition is capitalized;

Debit 19 Credit 60

- VAT reflected;

Debit 68, subaccount “VAT” Credit 19

- VAT on printing services (circulation) is accepted for deduction;

Debit 43 Credit 20

- the cost of finished products (leaflets) has been determined;

Debit 62 Credit 90

- leaflets sold to the buyer;

Debit 90 Credit 43

- the cost of finished products is written off;

Debit 90 Credit 68, subaccount “VAT”

- VAT charged;

Debit 50 (51) Credit 62

- funds received from the customer.

Thus, the organization must independently decide on how the accounting will reflect operations for the production of leaflets under a contract, securing its choice in the accounting policy (clause 7 of PBU 1/2008 “Accounting Policy of the Organization”).

In accordance with Part 1 of Art. 9 of the Federal Law of December 6, 2011 N 402-FZ “On Accounting” (hereinafter referred to as Law N 402-FZ), each fact of economic life is subject to registration as a primary accounting document. Accounting is maintained on the basis of primary documents. The primary accounting document must be drawn up at the time of the transaction, and if this is not possible, immediately after its completion (Part 3 of Article 9 of Law No. 402-FZ).

All forms of primary accounting documents are approved by the head of the economic entity, and developed by the person entrusted with accounting (Part 4, Article 9 of Law No. 402-FZ). Law N 402-FZ does not provide for the mandatory use of forms of primary accounting documents contained in albums of unified forms. However, when developing their own forms, organizations can use unified forms approved by the State Statistics Committee of Russia as a model.

Primary accounting documents are accepted for accounting if they contain the mandatory details specified in Part 2 of Art. 9 of Law No. 402-FZ.

In accordance with clause 208 of the Methodological Instructions, finished products are released to buyers (customers) in organizations on the basis of the corresponding primary accounting documents - invoices. As a standard form of an invoice, form N M-15 “Invoice for the release of materials to the third party” can be used (approved by Resolution of the State Committee of the Russian Federation on Statistics dated October 30, 1997 N 71a). Organizations in various industries can use specialized forms (modifications) of invoices and other primary accounting documents drawn up when releasing finished products.

Let us note that to register the release of finished products in the situation under consideration, it is not advisable to use the unified form of consignment note (TORG-12), approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 N 132. This document refers to general documents for recording trade operations; it is used to register sales (release) of inventory items from a third party organization. Considering that the “Supplier” is indicated in the invoice form itself (TORG-12), it should be concluded that this document is used primarily to formalize the transfer of goods under a supply agreement.

In this case, the production of leaflets is carried out under a contract. In our opinion, an organization can only issue an invoice for the release of finished products, indicating in it the contract and other additional information, since clause 2 of Art. 720 of the Civil Code of the Russian Federation does not prohibit the execution of another document, instead of an act of completion of work under a contract. This possibility is also presented by Law No. 402-FZ.

In the situation under consideration, it is also possible to issue a certificate of completion of work, in which a reference is made to the fact that the manufactured products are released to the customer using the invoice “N__” “date”.

Let us note that in the above court decisions, as documents confirming the execution of work on the manufacture of products on the basis of a contract, the courts accepted both invoices without acts of work performed, and acts of work performed without invoices, and invoices together with acts. The courts, when making certain decisions, consider business transactions on their merits, and whether it is possible to determine from the submitted documents what operations were carried out by business entities.

The texts of the documents mentioned in the experts’ response can be found in the GARANT legal reference system.

Stay up to date with the latest changes in accounting and taxation! Subscribe to Our news in Yandex Zen!

Subscribe

How to fill out the register of seals and stamps

All seals and stamps must be strictly taken into account. There is a special magazine for this. It contains their imprints and information about which department they were transferred to, with the signature of the responsible persons. The journal contains 8 columns:

| No. | Name of seal/stamp | Imprint | Issue for use | Return | Note | |||

| position and full name of the recipient | signature, date of receipt | position and full name of the recipient | signature, date of receipt | |||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

- The first column indicates the serial number.

- In the “Name of the seal” column, its purpose is indicated, for example, “Stamp for documents”.

- In the third column, a print is required; it must be clear and not blurry.

- Column No. 4 indicates, for example: “sales manager Kovalenko A.M.”

- In column 5 - the signature of the responsible person indicating the date of receipt.

- Columns 6-7 are filled in similarly to columns No. 4 and 5, only in case of a return.

- The “Note” line is filled in if the seal is destroyed, indicating the act number and date of preparation.

The journal must be filled out in handwritten form, since it requires the original signature of the responsible persons. The names of the columns may change depending on the needs and activities of the organization. There is no strictly established form of the Journal. The form is not regulated by law.

Despite this, it must be conducted in compliance with all strict reporting requirements:

- Sequential numbering of pages is required;

- the magazine must be laced;

- the document is stamped and signed by the director;

- The magazine is kept in an iron safe.

The legislation does not require the presence of columns in the Journal. The organization has the right to adjust them, depending on its activities.

If the seal is missing

When it turns out that one or more cliches have been lost (stolen), a written complaint to the police is necessary. Based on the certificate issued by the department, a new seal is ordered. The incident must be reported to the registration authority, bank and media.

The organization appoints a commission that documents the incident and makes a decision on the degree of guilt of the person responsible. If the guilt is obvious, the employee faces disciplinary action. An o is created in the Journal and the act number is indicated.

Ready-made printed versions of the Magazine offered by stationery stores range from twenty to six hundred pages. After the last page of the document is completed, it is sent to the archive. The print magazines are transferred there for eternal storage.

Thus, all seals of the enterprise are recorded in a special journal. This facilitates control and gives the organization legal and economic protection.

Top

Write your question in the form below

Storage of seals and stamps in the organization

The method of storing seals and stamps depends on their type and purpose. The round seal (main) is located in a safe, to which only the head of the organization has access. In case of his long absence, it is handed over to the responsible employee against signature.

Auxiliary seals and address stamps are kept by responsible employees who use them to perform daily work. It is also stored in sealed metal cabinets, to which a certain circle of people have access. Stamps must be in sliding drawers.

The procedure for carrying out the destruction procedure

Today, the state does not regulate in any way the procedure for either the production or destruction of seals, so organizations must independently develop a regulatory framework for these actions. However, in general, the procedure for recycling cliches is approximately the same:

- First, the management of the enterprise makes a decision to destroy seals and stamps that have lost their relevance (this can be made in relation to one seal, several or even all).

- Then an order is issued, which is a catalyst for starting this process.

- Based on the order, a special commission is created, which carries out the destruction of stamped items.

- To record the fact of disposal, a detailed report is drawn up.

It should be said that in some cases, organizations do not destroy seals and stamps themselves, but transfer this right to third-party companies.

As for lost or stolen stamps, it is impossible to draw up a disposal report in relation to them - in such cases it is necessary to submit appropriate applications to the tax service and the police.

Checking the condition of seals and stamps

The procedure can be planned, or it can be carried out if there is suspicion of the use of a counterfeit seal. In any of the above cases, a special commission is assembled. Based on the results of the inspection, a report is drawn up and submitted to the head of the organization. It outlines identified problems, shortcomings and recommendations for eliminating them.

When dismissing an employee, the general director sends a commission to establish the fact of the presence of seals, as well as to establish their authenticity. Based on the results, an acceptance and transfer act is drawn up, with which the new employee must be familiarized. An experienced expert can even identify the authenticity of a seal visually; if suspicions arise, then to confirm them, the subject of research is sent to the laboratory.

How to replace seals

To introduce a new seal on an organization, it is necessary to destroy the old one. The following options exist:

| Disposal in-house | Seeking help from a specialized stamp organization |

| Produced by a specially appointed commission | The stamp is submitted to a third-party stamp organization |

After execution of the order, an act is drawn up indicating the following data:

| Along with the seal, a set of documents is provided:

|

When recycling on your own, the act must be kept throughout the entire duration of the organization’s activities in order to avoid controversial disputes. If the seal is lost, the recycling procedure will not be possible. To obtain a new print, you must provide the above set of documents along with a certificate from internal affairs, which establishes the fact of the loss.

It is also necessary to notify the registration authority about the theft and submit advertisements in the media. It is imperative to report the incident to the bank where the company's current account is opened in order to prevent the withdrawal of funds from the current account. The company chooses the disposal method itself

Features of the accounting document

The journal helps to quickly determine in which department a particular seal can be found, when and to whom it was issued, whether it was lost, destroyed, etc.

There are no strict legislative regulations regarding the form of the document. The organization itself can develop the layout of the Journal and include the necessary columns in it. According to the Russian Federation standard (GOST R 6.30-2003), the following mandatory requirements apply:

- pagination

- document lacing and sealing wax

- manager's signature

- safe storage

The Journal contains the name of the enterprise or its division, the start and end period of maintenance. Accounting is carried out in a table that usually includes four columns:

Form of the finished magazine

- number

- name of the stamp or seal

- issuance

- return

If there is a need for specification, the columns are made composite. For example, the “Issue” column can be divided:

- purpose of issuance

- date

- time

- recipient's last name

- painting, etc.

Some organizations add columns that represent the impression of a seal or stamp. The “Notes” column is often used, where, in addition to comments, you can note the date of destruction of the cliche, the reason for its liquidation and the number of the act by which this action is formalized.

Filling out the Journal in electronic form is not carried out. Records are made only in handwritten form, since each line requires the signatures of the print users and the person responsible for accounting.

Key points on control of seals and stamps

Organizations were always required to have round seals, which necessarily contained information about the name of the company and its address. Federal Law No. 82 FZ speaks not about the obligation, but about the right to have such a seal.

It follows from the same law that information about seals must be contained in the charter. Despite the fact that the law does not prescribe the mandatory presence of a seal, the company’s activities without it are simply impossible. It is required:

- upon acceptance (if this is the first place of employment) and dismissal of an employee;

- when submitting documents to the tax authorities (certified copies, declarations on paper);

- submission of reports to the Social Insurance Fund and the Pension Fund of Russia;

- preparation of internal personnel documentation, writing letters and much more.

Answers to common questions

Question No. 1. Do I need to register a new seal?

Mandatory registration has been cancelled, you can do this if you wish to assign a registration number.

Question No. 2. Can I use logos and graphics in prints?

This is not prohibited if it does not constitute unfair competition and hidden advertising of the organization.

Question No. 3. Is it necessary to destroy the seal when reorganizing a company?

No, it is not necessary, but it is better to recycle it to avoid questions.

Question No. 4. What is the difference between a seal and a stamp?

The stamp does not have legal force, but serves to facilitate work.

Question No. 5. Is the accounting of seals different in private and budgetary organizations?

Yes, the chart of accounts in a budget organization is completely different, and accordingly, the accounting of seals is very different.