Postings

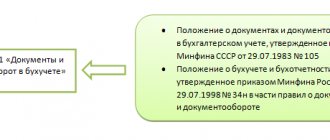

Regulatory basis for applying the new standard In our article we will look at the new accounting standard

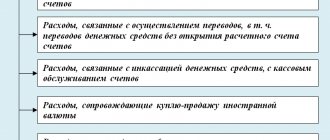

All organizations necessarily have to deal with credit institutions. The Bank provides services related to

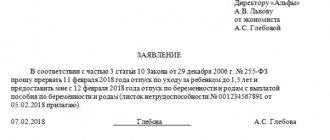

How to leave maternity leave: step-by-step instructions A woman has the right to leave maternity leave

In retail commodity organizations where goods are accounted for at sales prices, account 42 “Trading

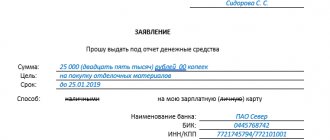

What to do if the documents are issued for an employee? You can issue money on account only for

The application of the act on write-off of fuels and lubricants (fuels and lubricants) occurs at all enterprises and organizations that

Clarifies the rules for disclosure of information about related parties in force since January 1, 2008.

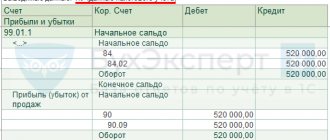

Losses incurred during the tax period can be written off as a reduction in the tax base in subsequent years.

Assets listed on the balance sheet of an enterprise and used in production processes have a limited service life.

The purpose of the statutory activities of non-profit organizations is not related to making a profit. Additionally, the NPO may