What to do if the documents are issued for an employee?

You can issue money on account only on the basis of an employee’s application addressed to the manager. It records the specific period for which the funds were issued (clause 4.4 of the Regulations of the Central Bank of the Russian Federation dated October 12, 2011 No. 373-P, hereinafter referred to as Regulation No. 373-P). The manager can set a deadline either in the form of a specific period (for example, 14 working days) or in the form of a specific date (for example, until June 9).

The legislation does not provide any exceptions for the situation when the accountable person is the head of the organization.

However, it is not entirely logical for a manager to write an application in his own name. There are two design options in this situation.

1. The application must contain the manager’s own handwritten note about the amount of cash and the period for which it is issued, the manager’s signature and date. If a manager takes money on account, he can write an order (memo) about its issuance, indicating the amount, the period for which the money is taken, the date and putting his signature.

2. You can leave “application” as the name of the document.

The wording “Please issue” can be replaced with the phrase “It is necessary to issue.” And in the header, instead of “director...”, indicate simply the name of the organization (for example: In LLC “Baza”).

Since the legislation of the Russian Federation directly states that it is the manager who affixes the visa on the application for the issuance of accountable amounts, the relevant question is how to transfer this authority to another employee. Such a need may arise, for example, during a vacation or illness of a manager.

There are two points of view on this matter.

The first is that the authority to endorse applications for the issuance of accountable amounts must be transferred by proxy. The fact is that only the head of an organization has the right to represent its interests without a power of attorney. The issuance of accountable amounts is associated with making a management decision on the expenditure of funds of a legal entity. Without appropriate authority, other employees do not have the right to make this decision.

The second position is as follows: to transfer powers, a power of attorney is not needed; it is enough to issue an order in any form. It is explained this way.

According to paragraph 1 of Article 185 of the Civil Code of the Russian Federation, a power of attorney is a written authority issued by one person to another person for representation before third parties. Representation in civil law means the execution of transactions by one person (representative) on behalf of another person (represented) (Clause 1 of Article 182 of the Civil Code of the Russian Federation).

Signing an application for the issuance of accountable amounts is not a transaction: this action is not aimed at establishing, changing or terminating civil rights and obligations. Therefore, a power of attorney is not required.

In our opinion, the first point of view is more reasonable and it is better to issue a power of attorney. In business practice, powers of attorney are issued not only for the actual conclusion of transactions, but also for the implementation of other “representative” functions. For example: a power of attorney is needed for an employee who takes documents on the organization’s ownership of real estate, if this employee is not the head of a legal entity.

If the accountable person has not accounted for the amount given to him, then a new advance cannot be issued to him.

For example, in the form of advance report No. AO-1 (approved by Resolution of the State Statistics Committee of Russia dated August 1, 2001 No. 55), a column is provided for the balance or overexpenditure of the amount of the advance previously received by the employee. But this does not mean that the employee has the right to report on several accountable amounts once.

An employee has the right to take money on account only after he has fully repaid the debt on the previously received advance.

This rule also applies to organizations that have only one employee – the manager. Violation of this norm may result in liability under Article 15.1 of the Code of Administrative Offenses of the Russian Federation. The fact is that the absence of advance reports in the company confirming the expenditure of previously issued funds, and the issuance of the next accountable amount to the employee, if he has a debt, leads to a violation of the law.

- from 4,000 to 5,000 rubles. – for officials of the organization (for example, a manager);

- from 40,000 to 50,000 rub. - for the organization.

In arbitration practice, there are precedents for holding people accountable in this situation (see, for example, the decision of the Arbitration Court of the Rostov Region dated January 11, 2013 No. A53-33625/2012).

In practice, the following situation is possible: after taking the money on account, the employee died. If an employer is faced with this situation, he must be aware of his rights, resolve issues quickly and sensitively, without infringing on the rights of the heirs of the deceased employee and acting within the framework of existing civil legislation.

It is important to consider that there are two points of view regarding the employer’s course of action in this situation.

The first is as follows. According to Article 1112 of the Civil Code of the Russian Federation, the inheritance does not include rights and obligations that are inextricably linked with the personality of the testator, as well as rights and obligations, the transfer of which by inheritance is not permitted by the Civil Code of the Russian Federation or other laws. For example, the obligations of a citizen-debtor that are terminated by his death are not included in the inheritance if the fulfillment cannot be carried out without his personal participation or the obligation is otherwise inextricably linked with the personality of the debtor (Article 418 of the Civil Code of the Russian Federation).

The obligation to report on accountable amounts and deposit unused money into the employer's cash register is regarded by supporters of this position as an obligation inextricably linked with the personality of the deceased.

Consequently, withholding the receivables of a deceased employee for accountable amounts from wages he did not receive is unlawful, as well as the requirement to repay the debt to his heirs. The debt of a deceased employee is considered uncollectible.

Supporters of this point of view, as a rule, refer to the letter of the Ministry of Finance of Russia dated February 24, 2009 No. 03-02-07/1-87, which discusses a similar situation.

The second position is as follows. The employer has the right to contact the heirs of the employee who took the money on account and who died, demanding repayment of the debt for the accountable amount. The debt can be written off either after the statute of limitations has expired, or in the case when the debtor has no heirs or none of them accepted the inheritance.

Supporters of this position believe that the employee’s obligation to return the money taken on account does not end with his death, can be fulfilled without his personal participation and is not inextricably linked with his personality. The employer has the right to contact the employee’s heirs in order to repay the debt on accountable amounts.

In our opinion, this point of view is more justified. It is indirectly confirmed by the resolution of the Federal Antimonopoly Service of the East Siberian District dated December 11, 2008 No. A58-170/06-F02-6199/08.

If, during the initial verification process, it turns out that the documents are issued in the name of the employee, then it is safer to formalize the reimbursed payment using a sales contract or a procurement act. Since if these expenses are taken into account according to the documents issued to the employee, then there is a high probability of their exclusion from the tax base during an audit by tax authorities, since in fact the employee acquired the goods and materials as his property, and then sold them to the employer.

Based on this, the employee has income subject to personal income tax (subclause 2, clause 1, article 228 of the Tax Code of the Russian Federation). For such income, the employee will need to report independently by submitting Form 3-NDFL to the Federal Tax Service at the end of the year. At the same time, he can take advantage of a tax deduction or reflect the purchase amount as expenses (subclause 1, clause 1, article 220 of the Tax Code of the Russian Federation).

IMPORTANT! The employer in this case is not a tax agent (letter of the Ministry of Finance of the Russian Federation dated December 7, 2011 No. 03-04-06/3-339).

An example of completing a tax return can be seen in the material “Sample of filling out a tax return 3-NDFL”.

In accounting, such an operation must be recorded with the following entries:

- Dt 76 Kt 50 - paid for goods and materials;

- Dt 10 (07, 08, 11, 41) Kt 76 - Inventory and materials are capitalized on the basis of a purchase act or a sales contract.

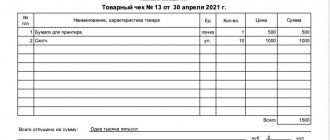

Continuation of example 2

Let’s assume that A.V. Alekseev did not have the company details with him and he made the purchase in his own name.

After checking the primary documentation, the accounting department decided to formalize the receipt of goods from an individual under a purchase and sale agreement. This was reflected in the accounting records with the following entries:

- Dt 41 Kt 76 - 35,477 rub. — goods are accepted for accounting;

- Dt 76 Kt 50 - 35,477 rub. — goods paid for to an individual.

However, if the employee acted on the basis of a power of attorney, and the purchase nomenclature corresponds to the purposes specified when issuing the DS for reporting, an advance report can be drawn up, even if the primary document is registered in the name of the employee.

Advice: in order to avoid disputes with inspectors and additional taxes when paying for purchases for an enterprise with employees’ personal funds, you must:

- Issue a power of attorney to the employee to purchase goods and materials.

- Receive from the seller a complete package of primary documents confirming the purchase (the documents must be issued to the company, not to the employee).

- The employee should write an application for compensation for the DS spent by him, attaching all the primary documentation to it (it is possible to prepare an advance report), and have the application endorsed by the manager.

Checking the attached documents

As a rule, employees collect everything that can be collected, including personal checks and other garbage, and simply dump it on the accountant’s desk - sort it out.

The situation is complicated by the fact that the list of supporting documents is not legally defined, and expenses are confirmed by a wide variety of documents (tickets, acts, checks, waybills, contracts, etc.). Therefore, you have to pay special attention to the execution of the attached documentation, first of all, cash receipts . According to Article 4.7 of Law No. 54-FZ, the check must contain the following details :

- name of company;

- TIN;

- date, time and place (address) of settlement;

- position, full name cashier;

- Title of the document;

- calculation sign;

- CCP registration number;

- FN serial number;

- website address for checking the FCC (fiscal cash receipt);

- shift number, serial number of the FCC for the shift;

- name of goods (works, services), quantity, price per unit, cost including discounts;

- calculation form;

- VAT (rate, amount);

- an indication of the taxation system;

- product code;

- QR.

Paper cash receipts may not be attached to the advance report in some cases, for example, if the place of business trip was one of those where, by virtue of the law, it is possible to make payments without a cash register, see paragraphs 3, 8 of Art. 2 of Law No. 54-FZ. Instead, you can attach a sales receipt, BSO. The check can also be submitted in electronic form (link to electronic document).

The details of the electronic fiscal check are named in the order of the Federal Tax Service of Russia dated September 14, 2022 No. ED-7-20/662. It can be printed and attached to the expense report.

If there are no required details, and also if the documents:

- faded;

- damaged;

- contain unreadable details;

- contain transactions that do not correspond to the nature of the reporting transaction,

they cannot be taken into account and, moreover, expenses cannot be reimbursed (accounted for) on their basis.

The person who provided such a document will have to either bring the correct document or return the money to the employer. Let us remind you that in the absence of supporting documentation, it is possible to take into account only daily allowances.

How is an advance report prepared?

To draw up an advance report, the established form can be used (AO-1, approved by Resolution of the State Statistics Committee of Russia No. 55), or an independently developed form. The front side of the report indicates the employee’s full name, his position and the purpose of the advance payment issued to him. On the reverse side there is a list of documents with which the employee can confirm his expenses. All attached documents are numbered in the order in which they were recorded in the JSC.

Having received an advance report from an employee, the accountant checks:

- targeted spending of funds;

- availability of supporting documents;

- correctness of the document;

- amounts of expenses, as well as accounting accounts.

After verification, the report is submitted to the director for approval and then accepted for accounting. The unused advance payment is handed over to the cashier, and a cash receipt order (PKO) is filled out. If there is an overexpenditure according to the advance report, then the required amount is issued to the accountable person using an expense cash order (RKO).

Personal income tax and insurance premiums

Regardless of the taxation system applied, money paid to an accountable person, provided there are supporting documents, is not taxed:

- contributions for compulsory pension (social, medical) insurance (Part 1, Article 7 of Law No. 212-FZ of July 24, 2009);

- contributions for insurance against accidents and occupational diseases (clause 1 of article 20.1 of the Law of July 24, 1998 No. 125-FZ).

The fact is that the amounts reimbursed to the accountable person are not remuneration for a completed task, but compensation for expenses incurred by him. These amounts were paid to the employee not as wages. In addition, they do not bring economic benefits (income) to the employee (Article 41 of the Tax Code of the Russian Federation).

Example of taxation of settlements with accountable persons

Let's look at all the above nuances using a specific example.

sends an employee on a business trip to obtain special materials for the production of a new type of product. The business trip estimate also includes a visit to a restaurant with a supplier representative to conclude a contract on more favorable terms. According to the application, the employee was given 32,000 rubles. under report for 4 days. According to internal regulations, the daily allowance is 1,000 rubles.

NOTE! If an employee is sent on a business trip to the northern regions of the Russian Federation, the employer is obliged to provide him with warm overalls. Read more here.

Upon return, the employee provided documents on expenses:

- hotel rent - 4,000 rubles. per day (hotel bill) (excluding VAT);

- fare - 2,000 rubles. each way (tickets) (VAT not allocated);

- daily allowance - 4,000 rubles. (1,000 rubles per day);

- checks from the restaurant - 9,600 rubles. a complete set of documents confirming the representative nature of these expenses.

For more details, see “How to properly document entertainment expenses - an example?”

Bill of lading for materials - 160,000 rubles. — under the terms of the contract, payment is made within 15 days after the goods arrive at the buyer’s warehouse.

Let's reflect this advance report in accounting:

- Dt 71 “Employee” Kt 50 - 32,000 rub.

- Dt 26 Kt 71 - 16,000 rub. - hotel accommodation;

- Dt 26 Kt 71 — 4,000 rub. - travel payment.

For entertainment expenses, the accountant made a calculation at the end of the month:

- The wage fund for the period “January - August” amounted to 600,000 rubles. 4% of them - 24,000. Until now, there have been no entertainment expenses. Thus, the entire amount can be accepted as expenses.

- Dt 26 “Representation expenses” K 71 - 9,600 rubles. (fully reflected in tax accounting).

- Dt 26 Kt 71 — 4,000 rub. - daily allowances are taken into account.

- Dt 70 Kt 68.01 - 156 rub. — personal income tax is charged on the difference between the daily allowance established in the organization and those established by law (4000 – 2800) × 13%.

- Dt 10 Kt 60 - 160,000 rub. — materials have been capitalized but not paid.

- Dt 71 Kt 50 - 1,600 rub. — overexpenditure issued to the employee in the amount of 1,600 rubles.

For more information about personal income tax on daily allowances in excess of the norm, read our material “How to correctly reflect daily allowances in excess of the norm in 6-personal income tax.”

By checking the expense report, the accountant may discover that the employee spent more money than the cashier gave him. Such overspending requires reimbursement, but only if it is justified.

In order for an overspend to be considered justified, the following conditions must be met:

- The employee spent the money to complete the task assigned to him by the organization. As a rule, the purpose of issuing funds to the account is indicated in the director’s order).

- The employee presented documents that confirm the overexpenditure of funds. This could be, for example, cash receipts.

If both of these conditions are met, the employee is returned the money. Otherwise, there is no need to return the money.

D71 K50 – expenses to the employee exceeding the money issued for the report were reimbursed.

Accountant of LLC "Company" Ivanov I.I. Stationery supplies for the accounting department were purchased. For this purpose, he was given 2,000 rubles on March 15. However, when buying stationery, Ivanov spent more money, namely 2800 rubles. The accountant provided an advance report and supporting documents for all funds spent.

| Business transaction | Wiring |

| Ivanov was given 2,000 rubles from the cash register on account | D71 K50 |

| Stationery purchased by Ivanov received | D10 K71 |

| VAT on purchased stationery has been taken into account | D19 K71 |

| VAT is written off from own funds | D91.2 K19 |

| Ivanov was compensated for expenses in excess of the amount given to him in advance against the report in the amount of 800 rubles | D71 K50 |

You can issue funds on account either from the cash register in cash or by bank transfer, that is, the money is transferred to the employee’s bank card. If an overspend occurs, the accountant may wonder whether it can also be transferred to a bank card.

The legislation does not provide a direct answer to this question. But the Treasury and the Ministry of Finance of the Russian Federation allow the transfer of money to an employee’s card. If you look at the advance report form itself, it provides for the only way to reimburse overruns - in cash. Therefore, the company will have to make its own decision on how to reimburse the money.

Until recently, reimbursement of expenses to an employee based on an advance report was carried out only after drawing up an order. Today, it is not necessary to draw up an order; it is enough to simply indicate this condition in the organization’s accounting policies. This may be stated in internal documents in the form of rules and deadlines for reimbursement of overexpenditures by the joint-stock company.

To justify the fact that there really was an overrun and the money was paid, the following conditions must be met: the expenses are justified and documented. In addition, the employee must draw up an expense report approved by the organization’s manager. The report is checked and certified by the manager.

After this, the accountable amounts are written off. The write-off is carried out on the basis of an advance report approved by the director. If the report does not pass the test (for example, the overspending is found to be unfounded), then it cannot be accepted for accounting.

Justified overspending

Money paid to an employee in order to reimburse overexpended accountable amounts will be included in expenses when calculating income tax and single tax when simplifying the difference between income and expenses. To do this, it is necessary to confirm their economic feasibility (clause 1 of article 252, clause 2 of article 346.16 of the Tax Code of the Russian Federation).

We invite you to read: Dismissal due to the death of an employee, article of the Labor Code of the Russian Federation, order

The calculation of the single tax under simplified income and the calculation of UTII does not affect the reimbursement of overspent accountable amounts to the employee, since organizations using these special regimes do not take into account any expenses at all (clause 1 of Article 346.14, clause 1 of Article 346.29 of the Tax Code of the Russian Federation).

Situation: is it possible to take into account when calculating income tax the cost of goods (work, services) purchased through an employee before the organization compensated him for the overexpenditure of the amounts issued for reporting for this operation?

The answer to this question depends on what accounting method the organization uses when calculating income taxes.

If an organization calculates income tax using the accrual method, then the moment of compensation to an employee for overexpenditure to recognize costs for purchased goods (work, services) is not important. Recognize expenses during the period in which they are incurred. This is directly stated in paragraph 1 of Article 272 of the Tax Code of the Russian Federation.

If an organization calculates income tax using the cash method, then expenses are considered incurred only after they are actually paid. Payment for goods (work, services) is recognized as the termination of a counter-obligation by the purchaser to the seller, which is directly related to the delivery of goods (work, services).

This is stated in paragraph 3 of Article 273 of the Tax Code of the Russian Federation. Article 273 of the Tax Code of the Russian Federation does not establish any specifics in the case of purchasing goods (work, services) through an employee (representative) of an organization. When the accountable pays for goods (work, services), the debt to the seller is repaid.

However, as employees of the Ministry of Finance of Russia explain, until the overexpenditure is reimbursed to the accountant, it cannot be assumed that these expenses were paid by the acquiring organization (clause 1 of Article 252 of the Tax Code of the Russian Federation). The organization will have actual expenses only after compensation for overexpenditures. Therefore, in order to recognize expenses in tax accounting, it is necessary that the organization fully reimburse the employee for the overexpenditure.

An example of compensation to an employee for expenses in excess of the amounts issued to him on account. The organization applies a general taxation system. Income tax is calculated using the cash method

Secretary of Alpha LLC E.V. Ivanova purchased stationery for the organization. On March 24, she was given 2,800 rubles for these purposes, but she spent more. Ivanova submitted to the accounting department an invoice, a cash receipt, a receipt slip and an invoice for the amount of 3,000 rubles. (including VAT - 458 rubles).

On March 26, the head of Alpha approved Ivanova’s advance report. On the same day, the purchased stationery was transferred to household needs. On March 31, the cashier of the organization gave Ivanova 200 rubles. (3000 rubles - 2800 rubles), which the employee spent in excess of the money received on the report.

The Alpha accountant reflected these transactions as follows.

Debit 71 Credit 50–2800 rub. – money was issued against Ivanova’s report.

Debit 10 Credit 71–2542 rub. (3000 rubles – 458 rubles) – stationery purchased by the employee was received;

Debit 19 Credit 71–458 rub. – VAT on purchased stationery is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19–458 rub. – VAT paid to suppliers is claimed for deduction.

Debit 71 Credit 50–200 rub. – the employee was compensated for expenses in excess of the amounts given to him on account.

Expenses for the purchase of stationery when calculating income tax in the amount of 2542 rubles. Alpha's accountant took into account in March.

Situation: is it possible for an organization to take into account in expenses the cost of goods (work, services) purchased through an employee in a simplified manner, before he was compensated for the overexpenditure of the amounts issued for reporting for this operation?

No you can not.

When calculating a single tax under simplification, an organization has the right to recognize expenses only after they are actually paid. Payment for goods (work, services) is recognized as the termination of a counter-obligation by the purchaser to the seller, which is directly related to the delivery of goods (work, services). This is stated in paragraph 2 of Article 346.

17 of the Tax Code of the Russian Federation. Article 346.17 of the Tax Code of the Russian Federation does not establish any specifics in the case of purchasing goods (work, services) through an employee (representative) of an organization. When the accountable pays for goods (work, services), the debt to the seller is repaid. However, until the overexpenditure is reimbursed to the accountable, it cannot be assumed that these expenses were paid by the acquiring organization (clause 2 of article 346.16, clause 1 of article 252 of the Tax Code of the Russian Federation).

The organization will have actual expenses only after compensation for overexpenditures. Therefore, when calculating a single tax under simplification, in order to recognize expenses, it is necessary that the organization fully reimburse the employee for the overexpenditure. A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated January 17, 2012 No. 03-11-11/4.

An example of compensation to an employee for expenses in excess of the amounts issued to him on account. The organization applies simplification. The organization pays a single tax on the difference between income and expenses

Alpha LLC applies a simplified tax system; it pays a single tax on the difference between income and expenses.

Secretary E.V. Ivanova purchased stationery for the organization (paper, staplers, pens, etc.). She was given 2,000 rubles for these purposes, but she spent 3,000 rubles. (including VAT - 458 rubles).

On February 11, the head of Alpha approved Ivanova’s advance report in the amount of 3,000 rubles.

On February 13, Ivanova was compensated in the amount of 1,000 rubles. (3000 rubles - 2000 rubles), which she spent in excess of the money given to her on account.

When calculating the single tax (on the difference between income and expenses) for the first quarter, the Alpha accountant included 3,000 rubles in expenses.

Failure to comply with the cash payment limit

The current legislation of the Russian Federation provides for a maximum amount of cash payments under one agreement - 100,000 rubles. (Clause 1 of Bank of Russia Directive No. 1843-U dated June 20, 2007).

This restriction applies to cash payments: between organizations; between an organization and an individual entrepreneur; between individual entrepreneurs.

Practitioners quite often ask how this rule relates to the issuance of cash to accountable persons - employees who are not registered as individual entrepreneurs and do not act as independent participants in business transactions.

The following must be taken into account. If an employee uses accountable amounts for settlements under contracts that he enters into on behalf of an organization (entrepreneur) by proxy (or under already concluded contracts), the cash settlement limit must be observed. This follows from the letter of the Bank of Russia dated December 4, 2007 No. 190-T.

When purchasing goods (works, services) through a representative, the actual payer is not considered the citizen making the payments, but the principal in relations with the representative (employer). In accordance with Article 182 of the Civil Code of the Russian Federation, a transaction made by a representative directly creates, changes and terminates the civil rights and obligations of the represented person.

It should be understood that settlements involving accountable persons include two different operations:

- issuing money to an accountable person;

- expenditure of these funds by the accountable person.

Any amount can be given to an employee on account, including more than 100,000 rubles, unless otherwise specified in the employer’s local document.

But when making payments to counterparties through an accountable person, the limit is 100,000 rubles. must be used under one contract.

It should be noted that according to the letter of the Bank of Russia dated December 4, 2007 No. 190-T, the legislation does not establish any time restrictions for making cash payments (for example, one business day), but contains a limit on the amount (100 thousand rubles) within one agreement. That is, this requirement cannot be circumvented by simply dividing the total payment into several one-time payments made on different days.

An urgent question is whether it is necessary to comply with the limit on cash payments if payments through accountable persons are made by an employer who is neither a legal entity nor an individual entrepreneur (IP). For example: notary.

A notary is not an individual entrepreneur.

Notarial activity is a special legal activity that is carried out on behalf of the state, is not entrepreneurship and does not pursue the goal of making a profit. This position is confirmed by the position of the Constitutional Court of the Russian Federation, set out in Resolution No. 15-P of May 19, 1998.

In tax legal relations, notaries engaged in private practice are equated to entrepreneurs (Article 11 of the Tax Code of the Russian Federation). In other respects, the legal status of private notaries is not identified with the legal status of individual entrepreneurs as individuals carrying out entrepreneurial activities without forming a legal entity from the moment of state registration as an individual entrepreneur.

Therefore, for the purposes of applying the limit when making payments through an accountable person, a notary cannot be equated to an individual carrying out business activities without forming a legal entity.

Quite often organizations and entrepreneurs act this way.

If at the end of the working day there is an excess balance in the cash register, it is given to the employee for reporting. The next day, this employee returns the money to the organization's cash desk.

This is done in order to avoid liability for exceeding the cash balance limit in the cash register. For this violation, the organization faces a fine of 40,000 to 50,000 rubles, and officials (for example, a manager) - from 4,000 to 5,000 rubles. (Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

This procedure does not contradict the law, however, there are exceptions - the activities of paying agents.

Activities for the payment agent to accept from the payer funds aimed at fulfilling the monetary obligations of an individual to the supplier for payment for work, services, as well as directed to government bodies, local governments and budgetary institutions under their jurisdiction, as part of the performance of their functions, established by the legislation of the Russian Federation, is regulated by Federal Law No. 103-FZ dated 03.06.2009 (hereinafter referred to as Law No. 103-FZ).

The paying agent is obliged to hand over to the credit institution the cash received when accepting payments for crediting in full to his special bank account (Clause 15, Article 4 of Law No. 103-FZ). In this case, use the issuance of money on account at the end of the shift to avoid liability under Art. 15.1 of the Code of Administrative Offenses of the Russian Federation is not permissible. This is confirmed, for example, by the decision of the Arbitration Court of the Saratov Region dated December 11, 2012 in case No. A57-18746/2012.

According to the case materials, proceeds from the payment terminal in connection with the receipt of small amounts of money were temporarily issued by the payment agent for reporting (for accumulation). And the amount generated in excess of 20,000 rubles. the paying agent immediately handed it over to the bank to replenish a special account. The organization believed that its actions did not constitute any offense. The court did not agree with this approach.

The objective side of the administrative offense provided for in Article 15.1 of the Code of Administrative Offenses of the Russian Federation is a violation of the obligation to deposit cash received from payers when accepting payments to a credit institution for crediting in full to a special bank account (accounts).

Lack of supporting documents

According to labor legislation, when used by an employee with the consent of the employer, the employee is compensated for expenses associated with the use of assets. In a situation where an employee used his personal money to pay for services or purchase goods, but did not receive an advance for this, the boss compensates for the expenses incurred by him.

Reimbursement of expenses according to the advance report is issued in the presence of a general order on the likelihood of such acquisitions by employees. This may be an order that describes persons or positions who can make acquisitions on behalf of the company.

Or you can include a similar clause in the accounting policy, personnel policy or financial circulation policy. The same internal acts can also prescribe rules for the circulation of documents for reimbursement of expenses.

Since when purchasing goods with his own money, the employee acts on behalf of the company, then, according to Art. 183 of the Civil Code of Russia, you need to attach documents that will secure the transaction.

They may be:

- An employee's claim for reimbursement of expenses, confirmed by the boss.

- A report on the money spent with attached documents for purchase and payment.

- An order on behalf of the boss to compensate the employee’s expenses.

Reimbursement of funds spent by the employee is made after the report verified by the cashier is approved by the head of the organization. Providing the necessary papers is important not only for the employee, but also for the boss.

Since they are the basis for including the costs incurred by the employee in the costs that will be taken into account when taxing the organization’s income.

If a company uses the cash method of accrual of costs, then costs incurred are recorded upon payment of goods and services. Subsequently, the costs are taken into account at the reporting time when the advance payment report is approved.

If there is an overrun, the excess amount is considered an organization's expenses only after it is paid to an employee of the organization. Thus, if the overexpenditure is issued after the advance payment report, then the costs are taken into account upon payment of funds to the employee in a certain tax period.

But within the framework of one agreement, the amount of payment made by the employee should not exceed 100 thousand rubles. The likely increase in the limit is monitored by a responsible person appointed by the head of the organization. Violation of the established order may be grounds for bringing officials to administrative liability.

We invite you to familiarize yourself with: Addendum to the appeal - sample 2022, in civil, criminal cases, in arbitration proceedings, how to write and submit, deadlines, legal advice

A good option to avoid the tax service’s nagging regarding VAT may be to additionally issue powers of attorney for a list of employees to make sudden acquisitions on behalf of the company. For expensive acquisitions, you need to make sure that the seller, based on a power of attorney, writes out the initial papers in the name of the company and not the employee.

But employees often make spontaneous purchases for work needs for small amounts. This could be office supplies, some consumables, or payment for minor household services. In such situations, tax risks are small.

Submission deadlines

The deadlines for submitting advance reports are set by a local act of the boss. The law does not contain strict restrictions on this matter, but the deadlines must be reasonable.

The deadline for submitting an advance report is determined depending on the purpose for which the accountable funds were issued:

- For travel expenses. If cash is issued against the report - until the end of the fifth banking day, which follows the day on which the employee completed his business trip. If payments were made after they were withdrawn from the card - before the end of the third banking day, which follows the day the employee completed his business trip.

- To execute a production and economic order before the end of the fifth banking day, which follows the day on which the employee completed the execution of the order.

If the organization’s cash desk does not have the required amount, the parties can agree to pay the funds in installments. At the same time, the boss must remember that for unfulfilled obligations on time, the employee may be entitled to compensation for damages.

In accordance with clause 2 of the Bank of Russia directive “On making cash payments” dated October 7, 2013 No. 3073-U, the company’s revenue received in cash at the cash desk can be spent only on specified needs:

- Social payments and wages.

- Payment for insurance.

- For the personal needs of a private entrepreneur.

- Payment for goods, work, services.

- Issuance of funds on account.

- Issuance of funds for given goods, which are paid in cash.

- Payments by a bank payment agent.

Therefore, to compensate for expenses, employees need to use another source of payment or deliberately withdraw funds from the account or transfer them to the employee’s bank card.

Ignorance of the rules for payments using bank cards

The issuance of funds (DS) against an advance report is carried out in strict sequence in accordance with clause 6.3 of the Bank of Russia instruction “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses” dated March 11, 2014 No. 3210- U. The employee must:

- Write an application for the issuance of DS indicating the purposes for their expenditure, the required amount, the date of preparation and the period for which the DS are issued.

IMPORTANT! The application must contain a visa from the manager, confirming the legality of issuing money on account.

- Receive the DS at the company's cash desk using a cash receipt order or to a bank card.

- Within three working days after the end of the period specified in the application, provide the accounting department with an advance report accompanied by properly completed primary documentation.

Accountable amounts can be issued in two ways:

- cash through the cash register;

- to a bank card.

The first method is more common. Cash for issuance on account can be obtained from a current bank account. In addition, the accountable amount can be issued from the proceeds received by the organization’s cash desk from the sale of goods (performance of work, provision of services).

The second method of issuing money on account most often involves giving the employee a corporate bank card. This card can be used to pay for travel and hospitality expenses, as well as other business transactions.

The actual documentation of handing over a card to an employee is not regulated by law. It is better to approve this procedure in the employer’s internal documents. In this case, the following questions need to be resolved:

- in which document the issuance and return of the card will be recorded (most often the employer keeps a log of the issuance of corporate cards);

- should an employee write an application for a card, and the manager issue a corresponding order;

- how to ensure the protection of information about the PIN code (you can, for example, equate this information to an official secret);

- what is the procedure if an employee loses a card (it is better to provide for the holder’s obligation to immediately report the loss of the card to the bank to block transactions on it).

Table 1. Accounting scheme for issuing accountable amounts using a corporate card.

Compensation for overspending on a salary card

Situation: is it possible to reimburse an employee for overspending of accountable amounts to the same bank card to which his salary is transferred?

The legislation does not contain a clear answer to this question.

The advance report form provides for only one form of compensation for overspent accountable amounts - cash. The same opinion was expressed by the Bank of Russia in letter dated December 18, 2006 No. 36-3/2408.

https://www.youtube.com/watch?v=bnIwd-OG4Fc

At the same time, in letter dated December 24, 2008 No. 14-27/513, when commenting on settlements for business trips, the Bank of Russia indicated that the issue of the possibility of using bank cards for settlements on accountable amounts does not fall within its competence. The previously issued letter was not canceled. Therefore, the organization must independently decide whether to be guided by this letter or not.

Some arbitration courts do not deny the possibility of reimbursement of overspending to an employee’s bank card. For example, in resolution dated February 11, 2008 No. A52-174/2007, the Federal Antimonopoly Service of the North-Western District indicated that the organization lawfully transferred accountable funds to the employee’s “salary” account.

And the employee, in turn, subsequently lawfully returned the unused accountable amounts from his bank account. These transactions were confirmed by the manager’s order (it recorded the possibility of issuing accountable amounts to employees by transferring them to bank cards), an employee’s advance report, a cash receipt order (on the basis of which the balance of the unused advance was returned to the organization), invoices, cash register checks , receipts.

To avoid unnecessary disputes with regulatory agencies, whenever possible, make all payments for accountable amounts through the cash desk. However, in any case, there is no responsibility for reimbursing the employee for overspending of accountable amounts to the same bank card to which his salary is transferred.

Errors when approving expense reports

The accountable person is obliged, within a period not exceeding three working days after the day of expiration of the period for which the money was issued on account, to present an advance report with attached supporting documents.

If an employee does not timely report on accountable amounts due to absence from work (for example, in case of illness), a special procedure applies. It is necessary to count three working days from the date following the day of expiration of the period for which the money was issued, “or from the day of going to work” (clause 4.

One of the pressing questions is how long after the date of submission by the employee (accountable person) the advance report must be approved. More precisely: can an employer deliberately delay the approval of an advance report without returning the overexpenditure (if any) to the employee?

It all depends on what period of approval of advance reports and settlements with employees is specified in the employer’s internal documents. Regulation No. 373-P contains a condition that the manager sets the time allotted for these procedures independently.

If the specified period is not established and there is, indeed, an untimely implementation of settlements with accountable persons to reimburse the recalculation, the question of responsibility for these actions arises.

Administrative liability for late approval of an advance report is not established in law. It is also not prohibited not to immediately compensate the employee for overexpenditure, but to make payments in installments. However, it is necessary to take into account the rules on the financial liability of the parties to the employment contract.

The employer's financial liability in case of violation of the established deadline for payment of wages, vacation pay, dismissal pay and other payments due to the employee is provided for in Article 236 of the Labor Code of the Russian Federation, according to which if the employer violates the established deadline for payment of wages, vacation pay, dismissal payments and other payments due to the employee, the employer is obliged to pay them with interest (monetary compensation) in the amount of not less than one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at that time from amounts unpaid on time for each day of delay starting from the next day after the established payment deadline for the day of actual settlement inclusive.

The concept of “other payments due to the employee” is not disclosed in this article, due to which other payments may also include expenses made by the employee from his own funds for a business trip, the purchase of property for the organization with the consent of the employer, which are subject to reimbursement to the employee upon approval by the employer advance report of an employee who incurred expenses from his own funds.

There are not many court decisions on this topic. As an example, consider the decision of the Ust-Yansky District Court of the Republic of Sakha (Yakutia) dated February 11, 2011 No. 2-13/2011, in which the court made the following conclusions:

- the inclusion of the employee’s expenses in account 71 indicates the employer’s agreement to offset the debt to the employee, the employer becomes financially liable for its actions in late payment to the employee of other payments due to the employee;

- if the advance report was never approved by the manager, interest is calculated from the date the employee submits the advance report to the employer.

It is worth noting that while there are no official explanations from regulatory agencies on this issue, as well as judicial practice at the federal level, organizations have a chance to avoid the accrual of interest under Article 236 of the Labor Code of the Russian Federation.

The following arguments can be used in court. Article 236 of the Labor Code of the Russian Federation states, as stated above, including “other payments due to the employee.” Reimbursement for overexpenditure of accountable amounts can be regarded not as payment, but as compensation. Article 236 of the Labor Code of the Russian Federation does not mention the application of interest to compensation provided for by current legislation.

In the first part of this section, we looked at the consequences of violating the procedure for approving an advance report by the employer. Let's analyze the reverse situation.

What happens if an employee does not timely submit an advance report for approval by the employer? Is it possible to bring such an employee to disciplinary liability?

A similar situation was the subject of consideration in the Decision of the Ust-Kut City Court of the Irkutsk Region dated April 10, 2013 No. 2-405. The court concluded that disciplinary action was unacceptable.

In accordance with the requirements of current labor legislation, a disciplinary sanction can be applied to an employee for violating labor discipline, that is, for a disciplinary offense.

A disciplinary offense is a culpable, unlawful failure or improper performance by an employee of his assigned job duties (violation of legal requirements, obligations under an employment contract, internal labor regulations, job descriptions, regulations, orders of the employer, technical rules, etc.).

An employee of an organization is not required to know the norms of Regulation No. 373-P (the need to report within three days) if, due to labor relations, his responsibilities do not include knowledge of this provision.

As a result of considering this case, the court also awarded moral damages to the employee.

The court's decision would have been different if the organization had had an internal document on settlements with accountable persons, which would have provided for a rule on the deadlines for submitting the advance report.

All employees should be familiarized with this document upon signature. In this case, the violation could be regarded as a disciplinary offense with the appointment of penalties provided for by law: warning, reprimand, dismissal.

Let us add that it is unacceptable to fine an employee (impose financial sanctions) for late submission of an advance report, as well as for other disciplinary offenses. Measures of financial responsibility in this case are not provided for by current legislation.

The employer can recover the amount of debt for unspent accountable amounts.

According to Article 392 of the Labor Code of the Russian Federation, the employer has the right to go to court in disputes about compensation for damage caused to the employer within one year from the date of discovery of the damage caused. If this deadline is missed for valid reasons, it may be restored by the court.

Answers to common questions

Question: Is it possible to make an entry about compensation for overexpenditure of accountable money in the advance report after it has been approved.

Answer: Yes, the law does not limit the period of time during which the employee must be compensated for overexpenditure. Therefore, a record of debt repayment can be made after the advance report has been approved.

Question: Who should fill out an advance report - an employee or an accountant?

Answer: The advance report is filled out by the employee to whom the funds were given in advance. The accountant only checks that the document is filled out correctly, as well as the presence of all the supporting documents listed in the report. But if necessary, you can fill out an advance report for the employee.

Compensation for overspending from the cash register

The amounts that the employee spent in excess of those received on the report, give him from the cash register. To do this, fill out a cash receipt order form No. KO-2. Indicate the number and date of this document in the line of the advance report “Overexpenditure issued by cash order.” This is provided for in the instructions approved by Resolution of the State Statistics Committee of Russia dated August 1, 2001 No. 55.

Situation: is it possible to make an entry about compensation for overexpenditure (details of the cash receipt order for which the payment was made) of accountable amounts in the employee’s advance report after its approval?

Yes, you can.

The period during which an organization must compensate an employee for overspending is not limited by law. Therefore, you can make an entry about debt repayment in the advance report even after its approval. The instructions approved by Resolution of the State Statistics Committee of Russia dated August 1, 2001 No. 55 do not contain a prohibition in this regard.

Situation: is it possible to reimburse an employee for overexpenditure of accountable amounts during his vacation?

Yes, you can.

There is no need to wait until the employee returns from vacation. Current legislation does not prohibit paying overages to an employee during the period when he is on vacation (Article 22 of the Labor Code of the Russian Federation, instructions approved by Resolution of the State Statistics Committee of Russia dated August 1, 2001 No. 55).

Therefore, if necessary, the organization has the right to reimburse the employee for overexpenditure while he is on vacation.

Situation: is it possible to reimburse an employee for overexpenditure of accountable amounts after the employee returns from vacation? The employee submitted an advance report and went on vacation the next day.

Yes, you can.

After the accountant has checked the expense report, it must be approved by the manager. The period during which the manager approves the expense report is not limited by law. He can do this a few days after the employee has submitted the report to the accounting department. The accounting department should pay the employee only after the manager approves the advance report.

Debit 71 Credit 50

– the employee is reimbursed for expenses exceeding the amount previously issued on account.

An example of compensation to an employee for expenses in excess of the amounts issued to him on account

Secretary of Alpha LLC E.V. Ivanova purchased stationery for the organization. On March 31, she was given 2,000 rubles for these purposes. But she spent 2100 rubles. For this amount, she submitted supporting documents to the accounting department (sales and cash receipts, where VAT in the amount of 320 rubles was allocated), there is no invoice.

On April 1, the head of Alpha approved Ivanova’s advance report.

On April 3, the Alpha cashier gave Ivanova an overexpenditure in the amount of 100 rubles. (2100 rub. – 2000 rub.).

Alpha's accountant reflected these transactions as follows.

Debit 71 Credit 50–2000 rub. – money was issued against Ivanova’s report.

Debit 10 Credit 71–1780 rub. (RUB 2,100 – RUB 320) – stationery purchased by the employee was received;

Debit 19 Credit 71–320 rub. – VAT on purchased stationery is taken into account;

Debit 91-2 Credit 19–320 rub. – VAT is written off at the expense of the organization’s own funds.

Debit 71 Credit 50–100 rub. – the employee was compensated for expenses in excess of the amounts given to her on account.

Documentation of the issuance of money in a report on the employee’s card

The accountable person must attach to the advance report documents confirming the amount and nature of the expenses incurred.

If accountable amounts are reimbursed to the employee in the absence of supporting documents, the tax consequences of this operation should be taken into account (see Table 3).

Table 3. Reimbursement of expenses to the accountable person in the absence of supporting documents

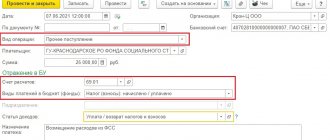

Inspecting inspectors from the Federal Tax Service, the Pension Fund of the Russian Federation and the Social Insurance Fund can easily attribute the accountable funds transferred to the employee’s card to his salary. The result will be additional calculation of salary taxes, insurance fees and penalties. To avoid these troubles, it is necessary to initially document the validity of issuing a report on the employee’s card.

“The issuance of funds on account can be made both in cash and in non-cash form.

In case of non-cash settlements with accountable persons, funds are transferred to their salary or personal cards from the organization’s current account.

The return of unused accountable funds can be carried out in non-cash form - in the form of a transfer from the accountable person’s card to the organization’s current account - or in cash - in the form of transferring cash to the organization’s cash desk.”

Then you need to put into effect an order on accountable persons and record in it a list of officials who can receive funds for reporting. If you have a small workforce, it will be more convenient to simply indicate a list of positions without the personal data of the employees. In this case, you will not have to redo the order when changing employees.

A sample order can be found in our article “Drawing up an order on accountable persons - sample 2019-2020.”

The next documentary justification for the provision of accountable funds to the card will be a personal statement from the employee or an order from the manager to issue funds on account. The law allows only one of these documents to be issued.

Read more about the current rules for issuing money on account here.

The mandatory details of the application (order) for issuing a report on the card include:

- the purpose of receiving accountable money;

- the amount of the requested sub-account;

- bank details of the card to which the report is issued;

- the period for which accountable money is provided;

- authorization signature of the manager (or a person who can sign such documents under a power of attorney from the manager);

- signature of the accountable person;

- Date of preparation.

Below are ready-made samples of an application and an order for issuing a report on a card.

Justified overspending

Overspending can be considered justified if the following conditions are met:

- the employee spent money on completing a task assigned by the organization (as a rule, it is indicated in the manager’s order to issue money on account);

- The employee presented documents confirming the existence of overspending (for example, cash receipts).

If one of the specified conditions is not met, the employee may not be reimbursed. These are the requirements of the instructions approved by Resolution of the State Statistics Committee of Russia dated August 1, 2001 No. 55.