Postings

A standard operation for every accountant, repeated monthly, is summing up financial results for the past period.

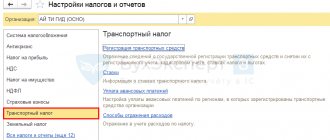

Which companies are required to pay transport tax? Tax legislation establishes that everyone must pay tax

VAT in the balance sheet VAT in the balance sheet is displayed in 3 lines: 1220 “VAT on

Depreciable property Depreciable property is fixed assets (fixed assets) and intangible assets (IF) available

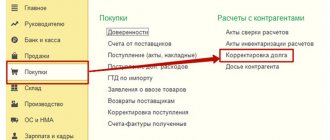

This article is devoted to how to reflect a contract, that is, transactions under an assignment agreement

Specifics of using account 46 in accounting Account 46 is active. Like the rest of the active ones

Concept and purpose The production structure of any industrial enterprise is built on the interconnection of its divisions. Here

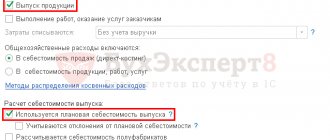

Production accounting in 1C 8.3 Accounting is simplified, but has its own characteristics. Within the article

Starting from version 3.0.59, “1C: Accounting 8” supports options for using PBU 18/02 “Accounting for calculations”

What is a cash book? The cash book (Form N KO-4) is used by all legal entities for