Payment for electricity wiring

So are you doing him a favor or are you re-exposing him? If you provide a service, you must take a reward for it - as an intermediary, although you do not provide him with electricity, so even this option seems fabulous to me. You recharge him the same thing that the energy company charges you. In the same amount, this is NOT an implementation. Therefore, no 90s bills. You make a report (and an invoice) and indicate in it the data from the energy company’s documents.

Then, in order for the landlord to reimburse me for the expenses, I must submit an act for compensation of electricity, that is, the act must pass either on account 91 or 90. I think so Dt. 76.5 (tenant) Kt 91 105019.88 rubles re-invoiced electricity Dt. 51 Kt 76.5 105019.88 rubles they paid it to us

Paid electricity bills wiring

Hello, in this article we will try to answer the question “Paid electricity bills wiring”. You can also consult with lawyers online for free directly on the website.

This amount, in accordance with the decision of the HOA members, was spent on landscaping the area in the courtyard of the house.

Each of the above articles regulates the nuances of the reserves created by the taxpayer. The general rules for the formation of reserves by non-profit organizations are disclosed in Art. 267.3 Tax Code of the Russian Federation. Based on the above provisions of this article, it follows that the creation of a reserve is a right, not an obligation of the organization. Accordingly, based on accounting and reporting data, it was impossible to plan the income and expenses of public sector organizations taking into account the volume of these obligations. The situation changed after amendments were made to the Instructions for the Application of the Unified Chart of Accounts (hereinafter referred to as the Instructions) (). The amendments have been in effect for just over a month – they came into force on November 16.

Corrective entry in electricity accounting

The general acceptance procedure includes two main steps. First, the supplier supplies the buyer with the necessary products (or provides services, performs work). After which, an invoice for payment will be issued directly within 5 days.

One of the effective measures aimed at increasing the transparency of utility payments may be to organize the transition of the population to pay directly. The idea is to, bypassing management organizations, pay for individual consumption directly to the resource supplier, eliminating the possibility of “scrolling” or misuse of funds by the utility service provider.

If the lessor receives from the lessee reimbursed amounts of payments for consumed electricity (transferred by the lessor for the lessee to the energy supply organization), the specified economic benefits or income do not arise. Also in the current conditions, it is important to form a reserve for compensation of harm caused to an individual or legal entity as a result of illegal actions (inaction).

In June, according to the invoice received from the landlord, the cost of utilities consumed by the tenant amounted to 3,300 rubles. (including VAT – 503 rubles). The invoice issued by the landlord was paid in July.

A guarantee of continued activity is the availability of cash equivalent to cover expenses and losses.

DT23 reflects expenses directly related to the release of goods, indirect costs and losses from defects. In this case, the following transactions are generated:

- DT23KT10 – materials written off for auxiliary production.

- DT23KT70 – the wages of production workers are taken into account.

- DT23KT69 – insurance premiums have been calculated.

- DT23KT25, 26 – indirect costs are taken into account.

- DT23KT28 – losses from defects are written off.

Dt 20 Kt 70 - accrued salary for workers Dt 20 Kt 69 - contributions accrued griha09 12/02/2012, 20:52 Mmmaximmm, thanks for the clear answer. And about point 4. The invoice for payment for electricity for production needs has been accepted 1050060 51What can you say? Mmmaximmm 12/03/2012, 00:49 Accepted invoice for payment Honestly, I don’t understand what is meant by this operation?

The supplier's invoice for received materials has been accepted - standard posting:

- D 10 K 60 for RUB 200,000.00. – accepted for accounting of inventory items.

- D 19 K 60 for RUB 36,000.00. – VAT is allocated in the supply.

- D 60 K 51 for RUB 236,000.00. – obligations to pay for construction materials have been fulfilled.

Analytics is carried out by departments and expense items. General business expenses Indirect costs associated with servicing the organization are displayed on account 26.

It was also wrong to sell to yourself, but the fact of sale is, according to the tax code, a transfer of ownership. In this case, all branches belong to one company and there is no transfer of ownership.

In cases provided for by law, when making settlements with an individual, not only the penalties paid - fines (penalties) are reflected in the accounting records, but also the taxes and contributions accrued on them.

To receive a free book, enter your information in the form below and click the “Get Book” button.

A penalty to be written off must, in any case, be registered (by the obligated party) as recognized by the parties or the court (entry Dt 91.2 Kt 76).

If I make an act on the provision of services, then I indicate which account I should attribute it to. Or do you propose not to provide him with any documents at all?

A penalty to be written off must, in any case, be registered (by the obligated party) as recognized by the parties or the court (entry Dt 91.2 Kt 76).

That is, those forms whose indicators are compared with similar values of previous years are subject to amendments.

How production and sales costs are accounted for in accounting, what accounts are used and what postings are made.

The State Duma has finally adopted a law that brings many innovations for Russians in the tax sphere. The most important thing is that paying taxes and generally “communicating” with tax authorities will become easier.

If an enterprise consumes various utilities in its activities, for example, electricity, water, heat, etc., cost accounts are used. The following entries are made in accounting:

- Accepted electricity bill - posting D 20 (26, 23, 25, 44) K 60.

- VAT allocated in the transaction is D 19 K 60.

- Funds were written off from the account - D 60 K 51.

At the same time, the amount of deductions at the request of the employee is not limited. Deduction from wages at the request of an employee posting: Dt Kt Description of transaction 70 76 Amount withheld at the request of an employee Let's look at an example: Employee Vasilkov A.A.

How can a tenant reflect utility bills for rented property in accounting? Accounting and tax accounting for compensation of electricity costs for previous periods.

Calculation of penalties for electricity 2016 transactions

Therefore, you can correct the error by reducing the profit and the amount of tax for 2022, in which you received the primary documents. This site is not a mass media outlet. As a printed media outlet, the Simplified magazine is registered by the Federal Service for Supervision of Communications, Information Technologies and Mass Communications (Roskomnadzor).

Analytics is carried out by departments, expense items, types of products, culprits and causes of defects.

If there is objectively no reason to consider the penalty related to the receipt of payment for the goods, no tax is charged.

The penalty under the contract can be written off by the entitled party. Let's study which entries reflect this in accounting. Write-off of a penalty: nuances The penalty can be written off:

- in accordance with the agreement of the parties or a unilateral notification from the counterparty (which become supporting documents when recording transactions in accounting);

- by law - as in the case of writing off penalties for state construction contracts in accordance with Decree of the Government of the Russian Federation dated March 14, 2016 No. 190.

Today we will talk about why management organizations need to indicate the price of a management contract.

Vacation pay deductions from the reserve reflect: Debit 96 Credit, and contributions on them - Debit 96 Credit 69 (according to subaccounts). If the reserve did not take into account all expenses for vacation pay, and there was not enough money, record Debit 97 Credit and 69.

An example is the inclusion of management costs in production costs.

According to paragraphs. 5 p. 1 art. 346.16 of the Tax Code of the Russian Federation, with a simplified system with the object of taxation “income minus expenses”, it is possible to reduce the tax base for material expenses, the composition of which is determined in accordance with Art. 254 of the Tax Code of the Russian Federation (clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

In turn, an invoice for payment can be considered as an offer in which the seller (supplier) offers the buyer to purchase a certain product or service for a certain amount.

If there is a production process, suppliers of electricity and utility services are usually accounted for in account 60, unless the use of account 76.5 for these purposes is not specifically provided for in the organization’s accounting policy. That is, wiring D60 K51 will be preferable, but it is also possible as you wrote. The concept of acceptance is given in, where it is explained that acceptance is a response to full and unconditional acceptance of the terms of the offer. In accounting, invoice acceptance is considered based on this regulatory definition. The concept of acceptance, based on the above definition in the Civil Code of the Russian Federation, is applicable to an offer.

Account 25: general production expenses. example, wiring

You can check how correctly the accounting of debits from a current account is carried out in 1C Accounting using the document posting demonstration function. In order to classify paid services as certain expenses, reflect incoming VAT and offset the advance payment, it is recommended to use a document that documents the receipt of services (a certificate of services rendered). In fact, the operation was not completed, but the wiring needs to be generated. They are used to clarify and transfer indicators.

The term invoice acceptance is regulated in stat. 438 Civil Code of the Russian Federation. According to this norm, acceptance is the unconditional and complete acceptance by the recipient of the addressed terms of the offer. In turn, an offer is a proposal for cooperation addressed to one person (or several), containing specific contractual terms.

In accordance with the concluded agreement, the tenant compensates the landlord for the cost of utility bills for this premises on a separate invoice.

Electricity costs are allocated to the main production line

- DT20 KT10 – materials written off.

- DT10 KT20 - return of raw materials to the warehouse.

- DT20 KT10-2 - semi-finished products were released into production.

- DT20 KT10-3 - fuel written off for technological purposes.

- DT20 KT60 - the cost of electricity used in production is taken into account.

- DT20 KT70 – wages accrued to production workers.

- DT20 KT69 - insurance premiums are taken into account.

- DT20 KT23 – costs of auxiliary production are taken into account.

- DT20 KT69 - a reserve has been created to pay for private entrepreneurs and vacations.

- DT20 KT25 (26) - general production (household) expenses are written off.

- DT20 KT28 - losses from defects are displayed.

- Dt 25 - Kt 70 - 116,000 rubles - salary of management personnel.

- Dt 25 - Kt 69 - 35,264 rubles - insurance premiums accrued.

- Dt 25 - Kt 60 - 187,000 rubles - invoice received from utility providers.

- Dt 25 - Kt 02 - 27,500 rubles - depreciation of the building is written off as general production expenses.

- Dt 20 - Kt 25 - 365,754 rubles - general production expenses involved in the formation of the cost of manufactured products are written off.

The general contractor compensates for energy costs - taxes and accounting

Compensation is based on invoices issued to the tenant by the landlord. In this situation, this does not contradict the norms of tax legislation. The tenant, who pays the cost of utilities to the landlord in accordance with the lease agreement, has the right to apply a tax deduction based on the invoices reissued to him.

Sales income is recognized as proceeds from the sale of goods (works, services) both of one's own production and those previously acquired and proceeds from the sale of property rights. Revenue is determined based on all receipts (in cash or in kind) associated with payments for goods, works, services or property rights sold. This is established in paragraphs 1, 2 of Article 249 of the Tax Code of the Russian Federation.

Reflection in the amount of reimbursement by the tenant for electricity

The lessor is the subscriber who receives electricity, heat and water from the supplying organization. And since he acts as a subscriber, he himself cannot be a supplying organization for the tenant (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 6, 2022 No. 7349/99, determination of the Supreme Arbitration Court of the Russian Federation dated January 29, 2022 No. 18186/07, resolution of the FAS West Siberian District dated January 28, 2021 No. F04-7965/2021(20212-A46-25)). In addition, in the invoices issued to the landlord, the utility tariffs already include VAT, which the landlord paid to the utility services. Therefore, charging VAT on the cost of services that already include tax is contrary to tax legislation (determination of the Supreme Arbitration Court of the Russian Federation dated February 16, 2022 No. 560/07).

We recommend reading: Can law enforcement agencies seize or seize property that is pledged to a bank?

The Department of Tax and Customs Tariff Policy reviewed the letter on the issue of accounting for funds of a budgetary institution received from tenants in the form of reimbursement for utilities and operating services for the purpose of taxing the profits of organizations and reports the following.

Electricity costs are allocated to the main production line

General business expenses (account 26) The debit of this account collects costs for administrative and managerial needs, these are also indirect expenses that are collected throughout the entire month in the debit of the account. 26. Defects in production (account 28) Another type of cost that must be taken into account in the production process is losses from defects. If defective products are produced during the production process, then eliminating them will require certain costs, which include depreciation, materials, raw materials, semi-finished products, wages and deductions from them. Accounting for the costs of correcting defects occurs on account 28 “Defects in production”, in the debit of the account. 28, all these costs are collected using the postings indicated above (instead of account 20, account 28 is taken). Thus, at the end of the month, according to the debit of the account. 20 collected direct costs associated with basic production in the debit of the account.

We recommend reading: The disk on the HVS counter does not spin

Account 25 “General production expenses” of the chart of accounts collects “information” about all expenses directly related to the production of products or the provision of services that cannot be immediately attributed to specific products and are subject to distribution by type of product at the end of the month according to a special algorithm. Unlike account 20 “Main production,” account 25 is intended to collect information about those production costs that, according to the organization’s accounting policy, are subject to distribution at the end of the month.

Postings for accounting for production costs

August 20, 2014 Production

The full cost of finished products includes production costs and sales costs. How production and sales costs are accounted for in accounting, what accounts are used and what postings are made.

Accounting accounts for production costs

There are several accounting accounts for recording production costs. In the chart of accounts, Section 2 is devoted to the production process, which provides a list of accounts involved in this process. We have already touched on this issue in this article, where we provided a list of costs associated with production and the corresponding accounts in which these costs are recorded.

Main production (count 20)

Direct costs of main production are collected in the debit of the account. 20.

Account 20 “Main production” is intended to take into account the direct costs of the main production and form the actual cost of production.

The direct costs are:

- Raw materials - posting Debit 20 Credit 10;

- Semi-finished products of own production - posting Debit 20 Credit 21;

- Depreciation of fixed assets - posting Debit 20 Credit 02;

- Amortization of intangible assets - posting Debit 20 Credit05;

- Staff salaries – posting Debit 20 Credit 70;

- Insurance premiums from staff salaries - posting Debit 20 Credit 69;

- Services of third parties – posting Debit 20 Credit 60.

Postings for cost accounting of main production:

| Debit | Credit | the name of the operation |

| 20 | 02 | Depreciation was calculated on fixed assets used in the main production |

| 20 | 05 | Depreciation was accrued on intangible assets used in the main production |

| 20 | 70 | Wages accrued to employees of main production |

| 20 | 69 | Insurance deductions are calculated from the salaries of production workers |

| 20 | 10 | Raw materials and supplies released into production are taken into account |

| 20 | 21 | The cost of own semi-finished products was written off to the main production |

| 20 | 60 | The cost of third-party services for main production is taken into account |

Ancillary proceedings (account 23)

Account 23 “Auxiliary production” is intended to account for the direct costs of auxiliary production, which include the repair of fixed assets involved in the production process, transport services, and power supply.

The postings for accounting for these costs look similar, only instead of invoice. 20 is taken count. 23.

General production expenses (account 25)

This account is intended to collect costs associated with the maintenance of main and auxiliary production. These are indirect costs that are collected in the debit of the account during the month. 25

The same costs include depreciation, staff salaries and deductions from them, materials, etc. The postings for accounting for general production expenses look the same as for the main production, only instead of invoices. 20 is taken count. 25.

General expenses (account 26)

The debit of this account collects expenses for administrative and managerial needs, these are also indirect expenses that are collected throughout the entire month in the debit of the account. 26.

Defects in production (count 28)

Another type of cost that must be taken into account in the production process is losses from defects.

If defective products are produced during the production process, then eliminating them will require certain costs, which include depreciation, materials, raw materials, semi-finished products, wages and deductions from them. Accounting for the costs of correcting defects occurs on account 28 “Defects in production”, in the debit of the account. 28, all these costs are collected using the postings indicated above (instead of account 20, account 28 is taken).

Thus, at the end of the month, according to the debit of the account. 20 collected direct costs associated with basic production in the debit of the account. 23 – direct costs associated with auxiliary production, in the debit of the account. 25 – indirect overhead costs, in the debit of the account. 26 – indirect general business expenses, in the debit of the account. 28 – costs associated with defective products.

The next step in the formation of production costs is the distribution of auxiliary production costs between main production, general production and general economic needs.

Postings for distribution of costs of auxiliary production:

| Debit | Credit | the name of the operation |

| 20 | 23 | The cost of auxiliary production allocated to the main production was written off |

| 25 | 23 | The cost of auxiliary production allocated for general production needs was written off |

| 26 | 23 | The cost of auxiliary production allocated for general business needs has been written off |

The next step in the formation of product costs is the write-off of general production and general business expenses.

Postings for writing off these costs are D20 K25 and D20 K26.

General production costs can be written off proportionally:

- Salaries of main production personnel;

- Wasted materials;

- The amount of direct costs;

- Revenue from the sale of manufactured products.

General business expenses are written off:

- By distribution between types of products;

- In full at the end of the month.

The last step is to write off losses from marriage.

Accumulated by debit account. 28, the costs of correcting defective products are written off to the debit of account 20 by posting D20 K28.

As a result of the manipulations performed on the debit of the account. 20 the production cost of products is formed.

The next stage is the formation of the cost per unit of production using calculation.

Source: https://buhs0.ru/provodki-po-uchetu-zatrat-na-proizvodstvo-produkcii/

How can a landlord reflect reimbursement of utility expenses in accounting?

Debit 76 subaccount “Settlements with the customer for purchased goods (works, services) Credit 76 subaccount “Settlements with the customer for remuneration” - the amount of remuneration is withheld from the funds received from the customer (if the intermediary independently withholds the remuneration);

If leasing property is a separate type of activity of the organization, then take into account the cost of utilities as part of expenses for ordinary activities (clause 5 of PBU 10/99). At the same time, make the following entry in accounting:

Reimbursement of electricity costs under a wiring contract

When maintaining accounting records under a contract, you must be guided by the general rules of accounting. This account reflects all the contractor's costs associated with the performance of work under the contract. If the contractor engages subcontractors to perform individual works, then the cost of the subcontracted work performed is also taken into account by the contractor in the account. Costs are written off as the work performed is delivered to the customer. The order of delivery of work is determined by the terms of the contract: as the entire volume of work is completed and the stage-by-stage delivery of completed work.

Reimbursement of Costs for Electricity Wiring from the Lessor

Although they contain references to the old Chart of Accounts, the conclusions presented in these documents can be extended to the new procedure for recording transactions in the accounts. When concluding an agency agreement, it is necessary to remember that energy resources are sold at state tariffs, which no intermediary has the right to inflate.

We recommend reading: How to Return Goods from a Private Entity to a Legal Entity

The organization party entered into an agreement with a third party organization party on. In other words, when compensating expenses, the recipient of compensation is not. An example of a premises rental agreement. For reimbursement of utility bills excluding VAT. If the transfer of property, rent is the main activity of rent. In accordance with Article 606 of the lease agreement, the lessor.

A rental agreement was concluded for 1 year. After the contract expired, we stayed in the apartment for a second term; the contract was not re-signed, but under the same conditions and for the same period. (according to Article 684 of the Civil Code - considered extended). After about 5 months, the landlady set a condition to move out of the apartment within a few days.

Reimbursement of electricity costs for wiring budgetary institution

The estimated amount of electricity consumed by tenants is determined based on the number, power and duration of operation of electrical receivers used in the rented premises at the time of concluding the lease agreement.

Advice for tenants

Let us remind you that there are no specific rules for payment for electricity under a lease agreement.

Most often, one of the following three methods is used: the tenant pays the energy company independently according to the indicators of a separate meter; utility bills are included in the rent amount; the tenant reimburses the landlord for part of his utility costs in a pre-agreed manner. If your company rents premises, then it is better to conclude a lease agreement in such a way that utility payments are included in the rent amount. In this case, within the terms established by the contract, your organization will transfer total payments to the lessor, which include the pre-agreed cost of utilities. Using the funds received, the lessor covers all of his costs associated with the transfer of property for rent, including energy costs. The tenant does not need to enter into any agreements with energy supply organizations. Rent and utility bills are included in expenses for ordinary activities (clause 5 of PBU 10/99). If the premises are used for production purposes, then rental expenses, including utility bills, reduce taxable profit (subclause 10, clause 1, article 264 of the Tax Code of the Russian Federation). Example 1

The manufacturing enterprise Mayak LLC rents premises from Parus JSC. The monthly rent, including utility bills under the contract, is 24,000 rubles, including VAT - 4,000 rubles. In April 2022, the accountant of Mayak LLC, based on the invoice and invoice from Parus CJSC, made the following entries in the accounting records: Debit 26 Credit 60. 20,000 rub. — rent for the premises for April 2022 was calculated, taking into account utility bills; Debit 19 Credit 60. 4000 rub. — VAT on rent is reflected; Debit 60 Credit 51. 24,000 rub. — money is transferred to the landlord; Debit 68 subaccount “VAT calculations” Credit 19. 4000 rub. — the VAT amount is presented for tax deduction.

In accordance with paragraph 10 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated July 1, 1996 No. 6 and the Plenum of the Supreme Arbitration Court of the Russian Federation No. 8 “On some issues related to the application of part one of the Civil Code of the Russian Federation” in resolving disputes related to compensation for losses caused to citizens and legal entities with a violation of their rights, it must be borne in mind that the actual damage includes not only the expenses actually incurred by the relevant person, but also the expenses that this person will have to make to restore the violated right. The need for such expenses and their estimated amount must be confirmed by a reasonable calculation, evidence, which can be an estimate (calculation) of the costs of eliminating deficiencies in goods, works, services; an agreement defining the amount of liability for violation of obligations, etc.

Resolution of the Thirteenth Arbitration Court of Appeal dated October 18, 2022 in case N A56-73418/2022 The contractor’s demand to recover from the customer, who failed to fulfill the terms of the contract to provide the construction site with electricity, compensation for the contractor’s costs associated with the use of diesel power plants is not subject to satisfaction if The contractor did not provide evidence of the parties agreeing to change the procedure for providing electricity, as well as evidence of claims made to the customer.

According to electricity meters for May 2022, electricity consumption for Ponchik LLC amounted to 5000 kW. JSC Mosenergo issued a bill to the company for the electricity consumed this month in the amount of 3,000 rubles. (5000 kW x 0.6 rub./kW), including VAT - 500 rub. The accountant distributed electricity costs as follows: - main production workshop - 4000 kW; — general expenses — 1000 kW. In the accounting records of Ponchik LLC, electricity costs are reflected in the following entries: Debit 20 Credit 60. 2022 rub. (4000 kW x 0.6 rub./kW x 100: 120) - reflects the costs of electricity spent on the manufacture of products; Debit 26 Credit 60. 500 rub. (1000 kW x 0.6 rub./kW x 100: 120) - reflects the costs of electricity for general economic purposes; Debit 19 Credit 60. 500 rub. . VAT accounting based on the supplier's invoice. In tax accounting, electricity costs will be taken into account under the cost element “Material costs” and classified as indirect costs of production and sales. In accordance with paragraph 2 of Article 318 of the Tax Code of the Russian Federation, indirect expenses incurred are fully included in the expenses of the current period. In the tax return for corporate income tax, the total amount of expenses for electricity, equal to 2500 rubles, is reflected on line 040 of Appendix 2 to sheet 2. And expenses for electricity for production needs in the amount of 2022 rubles. reflected in the same application on line 041.

We recommend reading: Tsn On Usn What To Consider As Income In 2022

A lease agreement for non-residential premises has been concluded between the tenant - a legal entity and the landlord - an individual not registered as a private legal entity (the tenant applies a simplified taxation system). How can a tenant compensate the landlord for his energy costs?

In accordance with Art. 252 of the Tax Code of the Russian Federation, the income tax payer reduces the income received by the amount of expenses incurred (except for the expenses specified in Article 270 of the Tax Code of the Russian Federation). Expenses are recognized as economically justified expenses, confirmed by documents drawn up on the basis of the legislation of the Russian Federation.

Lease agreement - electricity

He also reimburses the cost of gas and water. 2022. Turnovers for reimbursement to the subscriber by subsubscribers of the cost of all types of energy, gas, and water received are not recognized as subject to VAT (subclause 2.12.6, clause 2, article 93 of the Tax Code). For the subscriber, the amount of “input” VAT on energy, gas, water used and reimbursed by subsubscribers is not subject to deduction (subclause

The procedure for accounting and taxation of the tenant's utility expenses depends on how exactly payment for these services is made. In practice, a tenant can pay for utilities in different ways:

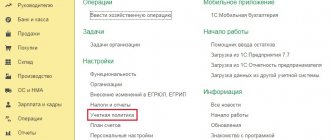

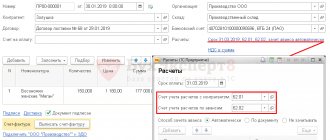

Reflection in 1C Electricity Payment Accounting

The fact of receipt of a payment request is not reflected in 1C Accounting 8.3; only changes should be made in the accounting registers as a result of payment under this document. The operation is recorded in the program upon receipt of a bank statement. For this purpose, a document is used to write off funds from the current account. He creates transactions in 1C Accounting in accordance with the requirements of regulations.

To reflect incoming VAT in accounting registers, you must enter an invoice received from the supplier using a document of the same name. Before registering it, you must make sure that the document reflecting the receipt of services has been posted. Otherwise, the invoice will not be posted in 1C Accounting 8.3.

Electricity postings in accounting

I want to draw the moderator's attention to this message because: A notification is being sent... Honya has specific entries in accounting... we wrote them to you. I want to draw the moderator's attention to this message because: A notification is being sent... TigRik [email hidden ] Belarus, Mogilev #8[331200] May 20, 2022, 8:37 am powershot91 wrote: Good morning! Please tell me the postings for the transaction 1 The invoice for electricity has been accepted for accounting. -K 60D19-K 602 Electricity is distributed between the structural divisions that consumed it: D 20 - K?D 23 - K?D 26 - K? Judging by the posting “D19-K60” (account 19 “VAT on acquired material assets” according to PBU as of 01/01/2021), do you have coursework on accounting in the Russian Federation? Or is this just a typo? I want to draw the moderator's attention to this message because: A notification is being sent...

- You can create a document in the subsection of the same name in the 1C Accounting 8.3 menu.

- Services should be selected as the type of operation.

- If necessary, you can change the accounts on which settlements with suppliers are reflected, as well as the procedure for offsetting advance payments.

- If you have an invoice for payment, the corresponding field of the document must be filled in.

- The list of services should be selected from the nomenclature directory using the selection or adding elements function.

- It is necessary to indicate the account on which, in accordance with the principles of the accounting policy at the enterprise, electricity costs, budget items for income and expenses and other necessary details will be reflected.

Electricity Costs Wiring

Let's summarize.

Taking into account the above, we believe that the double tariff for above-limit electricity is an increased payment for electricity used in violation of consumption patterns (but not a sanction).

For example, charging for electricity for lighting industrial premises increases general production costs (Dt 91 - Kt 685). At the same time, payments for electricity for office buildings are reflected as part of administrative expenses (Dt 92 - Kt 685).

We recommend reading: Social Finance Rp Elan

Electricity Costs Wiring

The usual procedure for paying energy company bills is prepayment, which is usually provided for in the contract. The supplier submits a payment request, the buyer of electricity accepts it, and notifies the bank where the service is served. After this, the bank debits the required amount from the buyer’s current account and transfers it to the supplier’s details specified in the payment request.

To reflect incoming VAT in accounting registers, you must enter an invoice received from the supplier using a document of the same name. Before registering it, you must make sure that the document reflecting the receipt of services has been posted. Otherwise, the invoice will not be posted in 1C Accounting 8.3.

LiveInternetLiveInternet

The usual procedure for paying energy company bills is prepayment, which is usually provided for in the contract. The supplier submits a payment request, the buyer of electricity accepts it, and notifies the bank where the service is served. After this, the bank debits the required amount from the buyer’s current account and transfers it to the supplier’s details specified in the payment request.

The procedure for reflecting payment on payment request in 1C Accounting

The fact of receipt of a payment request is not reflected in 1C Accounting 8.3; only changes should be made in the accounting registers as a result of payment under this document. The operation is recorded in the program upon receipt of a bank statement. For this purpose, a document is used to write off funds from the current account. He creates transactions in 1C Accounting in accordance with the requirements of regulations.

The document is generated in the menu section, which contains all documents related to banking and cash transactions. To enter a debit based on a bank statement, click the button of the same name and select the type of transaction such as payment to the supplier. Next, you need to fill out the document taking into account the following notes:

- Reflect the date when the write-off was made.

- Indicate the date and number of the payment request received.

- In 1C Accounting 8.3, you can post payments across several contracts and cash flow budget items. When paying only for electricity, it is not advisable to use this function.

- If you have an invoice for payment previously received from the supplier and entered it into the program, the document details should also be indicated when registering the write-off.

- If there is a debt to the supplier, you must choose a method of repayment (automatically, based on a document, or not repay). When choosing a method based on a document, you will need to enter its details.

- For transactions when paying for electricity, it is recommended to use accounts 60.01 and 60.02.

- Before posting the document, you must indicate that the write-off is confirmed by a bank statement.

You can check how correctly the accounting of debits from a current account is carried out in 1C Accounting using the document posting demonstration function.

The procedure for reflecting electricity as part of costs

In order to classify paid services as certain expenses, reflect incoming VAT and offset the advance payment, it is recommended to use a document that documents the receipt of services (a certificate of services rendered). After it is carried out, the necessary postings will be generated in 1C Accounting.

It is recommended to prepare a document for receipt of services according to the following rules:

- You can create a document in the subsection of the same name in the 1C Accounting 8.3 menu.

- Services should be selected as the type of operation.

- If necessary, you can change the accounts on which settlements with suppliers are reflected, as well as the procedure for offsetting advance payments.

- If you have an invoice for payment, the corresponding field of the document must be filled in.

- The list of services should be selected from the nomenclature directory using the selection or adding elements function.

- It is necessary to indicate the account on which, in accordance with the principles of the accounting policy at the enterprise, electricity costs, budget items for income and expenses and other necessary details will be reflected. In order for them to be filled in automatically, it is recommended to set up item accounting accounts in the appropriate directory.

- Once completed, you should post the document.

Document postings can be seen by clicking the Dt/Kt button.

As a result of posting the document on receipt of services, transactions must be generated that offset the advance:

- Debit account 60.01 – Credit account 60.02.

A posting must also be generated in 1C Accounting, which assigns electricity services to a specific account and cost items.

To reflect incoming VAT in accounting registers, you must enter an invoice received from the supplier using a document of the same name. Before registering it, you must make sure that the document reflecting the receipt of services has been posted. Otherwise, the invoice will not be posted in 1C Accounting 8.3.

The document is created in the following order. The invoice number and date are filled in when registering the receipt, and it is registered. The result is a document that can be edited. All its fields will be filled in based on the information from the service provision certificate. Further, it is recommended to allow the reflection of VAT deductions in accounting registers. Finally, you should determine the method of receiving the invoice - in paper electronic form, by setting the appropriate value in the settings. After editing is completed, you need to post the document in 1C Accounting.

You can check the wiring using the standard Dt/Kt function.

Electricity Costs Wiring

Consequently, costs for the purchase of gas, services for its transportation, costs for emergency technical inspection of equipment associated with the production of electrical energy (hereinafter referred to as electricity), the sale of which relates to the main activities of the organization, are included in expenses for ordinary activities.

According to the Instructions, the costs of maintaining and operating machinery and equipment are reflected in account 25 “General production expenses”. In addition, depending on the characteristics of the production cycle, account 23 “Auxiliary production” can be used to account for the costs of servicing production with gas.

Postings for Reimbursement of Electricity Costs

No. 07-05-06/234. In it, financiers indicated that if the tenant compensates the landlord for the costs of paying for electricity, then the landlord should not issue invoices to the tenant. Therefore, when the landlord receives an invoice from the energy supply organization, it must be recorded in the purchase ledger without taking into account the cost of electricity consumed by the tenant.

Reimbursement of electricity wiring costs

2 tbsp. 539 of the Civil Code of the Russian Federation). As a rule, the tenant is not the owner of the heating and power networks, and he does not have the appropriate equipment to obtain energy, fuel, and water. The likelihood of signing an agreement with the tenant is low.

LLC (lessor) takes into account in income for the purpose of calculating the tax payable in connection with the application of the simplified tax system, rent under lease agreements and agency fees as an agent under agency agreements.

2. By virtue of Art. 210 of the Civil Code of the Russian Federation, the owner bears the burden of maintaining the property belonging to him, unless otherwise provided by law or contract. As follows from the question, in the above situation, the supply of electricity to the rented premises is provided by the lessor, the corresponding expenses of which are reimbursed by the tenant (Article 616 of the Civil Code of the Russian Federation). In such circumstances, the tenant is not a party to energy supply agreements, and the agreement of the parties to the lease agreement, establishing the procedure for the tenant’s participation in the costs of consumed electricity, cannot be qualified as an energy supply agreement (clause 22 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 11, 2022 N 66 “Review of tenancy dispute resolution practice”).

Reimbursement of electricity costs

Let us note that subcontract agreements are a type of construction agreement and are regulated by the rules of Chapter 37 “Contracting” of the Civil Code of the Russian Federation. Subcontract agreements are concluded for the reconstruction, construction or overhaul of buildings/structures, for commissioning, installation and other work related to the facility under construction. Accordingly, such compensation (compensation) should not be considered as part of the contract price and should not be subject to VAT (see, for example, Resolution of the Federal Antimonopoly Service of the East Siberian District dated March 10, 2022 N A33-20223/04-S6-F02-876/05- C1 in case No. A33-20223/04-C6). For additional information on the issue of compensation for travel expenses to the contractor, see the Encyclopedia of VAT Disputes. On the issue of deducting VAT on amounts of compensation for contractor expenses, see also the Encyclopedia of VAT Disputes. In this consultation, we proceed from the assumption that the parties consider compensation for the contractor’s costs as part of the contract price of the work and the contractor presents the customer with VAT on the entire contract price, including compensation for his travel costs, and therefore the customer takes the VAT presented as a deduction. Compensation by the general contractor for electricity costs is carried out on the basis of invoices issued to the tenant by the landlord. In this situation, this does not contradict the norms of tax legislation. The tenant, who pays the cost of utilities to the landlord in accordance with the lease agreement, has the right to apply a tax deduction based on the invoices reissued to him. The arbitrators considered this approach to be legitimate in the decisions of the FAS North-Western District dated August 24, 2022 in case No. A56-44025/2022, the FAS West Siberian District dated April 28, 2022 in case No. A45-8185/2022, etc. By the way , it was supported by the Presidium of the Supreme Arbitration Court of the Russian Federation in resolutions dated March 10, 2022 No. 6219/08 and dated February 25, 2022 No. 12664/08. Motivating its decision, the court indicated that without electricity, water, heat, etc.

We recommend reading: Postings for Refund of Overpayment on Sick Leave

The tenant's documented costs for utilities are taken into account as part of material expenses when taxing profits or the simplified tax system (depending on the regime he applies). 5 p. 1 art. 254, sub. 5 p. 1 art. 346.16 Tax Code of the Russian Federation. The tenant on the OSN accepts input VAT for deduction in the general manner on the basis of invoices received from public utilities b, clause 2 of Art. 171, paragraph 1, art. 172 Tax Code of the Russian Federation.

Income tax. As part of “profitable” income, the lessor takes into account only rent and agency fees. 1 clause 1 art. 248, paragraph 1, art. 249 Tax Code of the Russian Federation. But money received from the tenant and transferred to suppliers to pay for utility services is not recognized as either income or expenses taken into account when calculating income tax. 9 clause 1 art. 251, paragraph 9 of Art. 270 Tax Code of the Russian Federation.

Tenant accounting in situation 3

In this case, the lease agreement establishes a fixed rent. In this case, the cost of utilities consumed by the tenant is not included in the rent. This amount is paid by the tenant separately on the basis of the landlord's invoice, to which must be attached a calculation of the amount of reimbursable expenses and documents confirming these expenses (invoices, acts of utility providers).

Question: Does the lessor have the right to deduct VAT amounts paid to the energy supply organization in relation to the electricity consumed by the lessee? Can a tenant deduct VAT amounts paid to the landlord in order to compensate the landlord's expenses for paying for electricity consumed by the tenant?

Reimbursement of electricity costs

Option 2. Reimbursement amounts for utility bills received from the tenant are not the landlord’s income, since in this case they compensate for the costs of maintaining and using the leased premises, and the costs of paying for utilities associated with the operation of the leased premises do not are expenses of the owner, since they do not lead to a decrease in his economic benefits, since they are compensated by the tenant. Money transferred by the tenant to the lessor as compensation for the lessor's costs of paying for energy and utilities is not taken into account by the lessor when calculating the income tax base. Such amounts are not his income, since he sends them to suppliers, and are not considered expenses, since he himself does not incur any costs, paying for the services of his counterparties with money received from tenants.

The fact that the total cost of rent changes monthly does not contradict current legislation, although clause 3 of Art. 614 of the Civil Code of the Russian Federation establishes the possibility of changing the amount of rent no more than once a year. According to the Determination of the Supreme Arbitration Court of the Russian Federation dated May 22, 2022 N 4855/08, the actual use of the leased item for its intended purpose without consuming electricity is not possible, and the tenant’s expenses for its use for the production of goods, the sale of which is subject to VAT, are a component of the rent (see also the resolutions of the FAS Volgo -Vyatka District dated November 23, 2022 N A17-7511/2022, FAS North Caucasus District dated December 21, 2022 N A63-8994/2004-C4-9, FAS Ural District dated December 11, 2022 N F09-9211/08-C2, FAS of the Central District dated 03/28/2022 N A48-4688/06-19, FAS of the Volga District dated 08/28/2022 N A65-27772/2022). The Federal Antimonopoly Service of the Ural District, in its resolution dated February 29, 2022 N F09-861/08-C2, indicated that re-issuance of invoices by the lessor to the lessee (taxpayer) does not contradict the norms of civil and tax legislation.

We recommend reading: Details for Transferring Insurance Compensation Where to Get it

Payment for Electricity Accounting Entries

For everyone who is looking for the necessary legal information, today our team of lawyers will answer an interesting question for everyone - Payment for Electricity Accounting Entries. We always try to update the necessary information so that there is only relevant information, but it happens that amendments are made to laws very quickly, so after reading you may still have questions, we will be happy to answer them in the comments or with the help of our legal partners online - on the website at convient time for you.

If the information was useful to you, share it on social networks. Before reading, I would like to immediately make a correction that this is not an expert opinion, but only what we use in our practice.

“Actions of a resource supplying organization to stop supplying resources organizations , for tax registration ; 10. Certificate of state registration of SNT “Korund”; 11. 04/12/2013 power ; Appeal of SNT "Korund" to "PSK".

The two-tariff system is also convenient for energy workers. After all, the load on the power plant mainly falls in the mornings and evenings, and at night the power engineers reduce energy production. The technical condition of the equipment suffers from this regime and wears out, and a lot of money is spent on its repair. If energy consumption levels out, the negative effects of surges can be significantly reduced. You can turn on automatic appliances (washing machine and dishwasher) at night and save your money.

Only a specialist from the company that supplies you with electricity should install a new meter and dismantle the old one. Your device will be sealed and given permission to use. Never do anything with electric meters yourself, this will be a violation and may have unpleasant consequences.

One of the effective measures aimed at increasing the transparency of utility payments may be to organize the transition of the population to pay directly. The idea is to, bypassing management organizations, pay for individual consumption directly to the resource supplier, eliminating the possibility of “scrolling” or misuse of funds by the utility service provider.

Corrective entry in electricity accounting

Therefore, you can correct the error by reducing the profit and the amount of tax for 2022, in which you received the primary documents. This site is not a mass media outlet. As a printed media outlet, the Simplified magazine is registered by the Federal Service for Supervision of Communications, Information Technologies and Mass Communications (Roskomnadzor).

- in accordance with the agreement of the parties or a unilateral notification from the counterparty (which become supporting documents when recording transactions in accounting);

- by law - as in the case of writing off penalties for state construction contracts in accordance with Decree of the Government of the Russian Federation dated March 14, 2020 No. 190.

If the tenant reimburses the landlord for the cost of consumed utilities on a separate invoice, the amount of compensation when calculating income tax can be taken into account as part of other operating expenses or as part of material expenses.

look at abstracts similar to “Accounting (postings, cheat sheet)”

After installing electric energy meters on a support in an unauthorized access cabinet, the number of cases of non-payment of additional payments by subscribers for consumed electric energy will be sharply reduced, due to the creation of the possibility of 24-hour access for controllers to the meters. It will be impossible to distort the readings and make any interventions in the metering device. There will be a sharp reduction in technological losses of electricity. The electricity meter installed on the support will be located at the boundary of responsibility, in accordance with Government Decree No. 530.

In accordance with paragraph 2 of Article 318 of the Tax Code of the Russian Federation, indirect expenses incurred are fully included in the expenses of the current period. In the tax return for corporate income tax, the total amount of expenses for electricity, equal to 2,500 rubles, is reflected on line 040 of Appendix 2 to sheet 2. And expenses for electricity for production needs in the amount of 2,000 rubles.

“My address is neither a house nor a street” - unfortunately, this catchphrase is completely inapplicable to an organization. Every decent company has a completely official address where it is located. And since there is a “place of residence,” that means there are associated expenses—utilities.

If utilities are paid to the landlord as compensation, then on the basis of paragraphs. 49 clause 1 art. 264 of the Tax Code they can be recognized as other expenses associated with production and sales. Other expenses are classified as indirect. And they can reduce the tax base for income tax in the current period in full. This means that, unlike direct expenses, they do not need to be left in work in progress.

- the tenant has no right to a deduction (for example, Resolution of the Federal Antimonopoly Service of the East Siberian District dated October 30, 2008 No. A10-845/08-F02-5264/08)

- the tenant can use his right to deduction based on an invoice from the lessor (for example, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 25, 2009 No. 12664/08)

If the tenant reimburses the landlord for the cost of consumed utilities on a separate invoice, the amount of compensation when calculating income tax can be taken into account as part of other operating expenses or as part of material expenses.

Source: https://advokatsterlitamak.ru/pensionnyj-yurist/oplata-za-elektroenergiyu-buhgalterskie-provodki

Electricity Costs Wiring

The list of expenses that are classified as direct is not closed. The organization has the right to create a more detailed list of costs independently. In order to avoid subsequent claims from control authorities, it makes sense to prescribe economically sound principles in the current accounting policy of the enterprise. In this case, inspectors will have no reason to recognize indirect costs as direct, thereby increasing the tax base.

At production enterprises, among the cost accounts, the 25th is intended to summarize information on expenses for auxiliary and main production. Classification of enterprise costs All expenses that make up the total costs of the enterprise and form the total cost of production are divided into 2 types:

Postings for Reimbursement of Electricity Costs

The 100% safe way is the variable and constant parts. The variable part must be specified in the calculation method, otherwise civil legal difficulties may arise due to the uncertainty of the contract price. The invoice is calculated as follows: the constant part of the payment is 100 rubles. variable part of the salary 18 rubles. Total rent for September is 118 rubles, incl. VAT 18 rub. And in this case, you can easily deduct VAT. Check your payment slips for what reasons you paid so that there are no conflicts with the agreement.

Re: Electricity reimbursement: revenue or reimbursable expenses from the landlord? 10/25/2022 00:08 #369767

Since the lessor does not sell electricity and has no revenue from this operation, the amount of reimbursement for electricity costs is not subject to VAT, the lessee does not have the right to include in tax deductions the amounts of VAT paid on the specified invoices. (Resolution of the Federal Antimonopoly Service of the West Siberian District dated August 27, 2022 No. F04-5231/2022(10532-A03-25))"

All rights to the materials on the GARANT.RU website belong to NPP GARANT-SERVICE LLC. Full or partial reproduction of materials is possible only with the written permission of the copyright holder. Rules for using the portal.

How to keep accounting records in SNT of land, electricity and property

Members of the partnership have the right to dispose of property on a general basis. In the case of use of SNT property by third parties, an agreement is concluded with them for the right to use for a fee, the amount of which corresponds to the cost established for members.

Receipt of membership fees is carried out according to a cash receipt order. SNT organizations are required to comply with the rules for conducting cash transactions. If the day of receipt of funds at the cash desk coincides with a number of persons, reception can be carried out according to a statement indicating the data of the area, the person and if there is a signature. A PKO (receipt cash order) must be issued for the document and subsequently reflected in the cash book.

Utility Accounting and Taxation

If there are no meters or they are out of order for some reason, then resource supply organizations will calculate the volume of services according to the rules established by law. For example, Federal Law dated July 27, 2022 N 190-FZ “On Heat Supply”.

When a consumer does not agree with the set volumes of utility services, he can contact the resource supply organization. If the resource supplying organization agrees with the consumer’s data, then it will draw up a document on changes in volumes, which the consumer must sign.

Reimbursement of electricity wiring costs

Revenue is determined based on all receipts (in cash or in kind) associated with payments for goods, works, services or property rights sold. This is established in paragraphs 1, 2 of Article 249 of the Tax Code of the Russian Federation.

This involves reimbursement of the landlord's expenses for utility bills, rather than the sale of energy resources. The amounts received are not the lessor’s income, since in this case there is no resale of services, but the lessor’s expenses are compensated.

How to get reimbursement for electricity costs

If the tenant has not concluded a contract for utility services, and the payment of compensation to the landlord is carried out in part of the costs incurred to pay utility bills. Then the contract should define the algorithm for calculating the tenant's consumption and the compensation fee.

When a subsidy for energy payments arrives, the amount that the client must pay for the electricity used is calculated. It is established by the delivery of subsidies by customers to compensate for losses in utility bills.

Corrective entry in electricity accounting

The above D20/USL K60/POST “minus” 100.00 rubles were reversed D76/Tenants K90/V/PR “minus” 100.00 rubles And everything was charged to account 76 settlements with different debtors and creditors D76/Tenants K60/POST 100, 00 RUR QUESTION. In 2022, this amount (RUB 100.00) of expense was accounted for in account 90/Cost of sales. And this amount was recorded in reconciliation account 90/Profit (loss) from sales.

Taking into account the above provisions, as well as the fact that the amounts for reimbursement of utility payments are not provided for in Article 251 of the Tax Code of the Russian Federation, they are recognized by the developer as income when calculating income tax.

18 Sep 2022 jurist7sib 1041

Share this post

- Related Posts

- Objection to the Statement of Claim for Compensation of Damage in an Accident in the Absence of Fault on the Part of the Employee

- Replacement of Rights for a Disabled Person of Group 2

- Standards for planning and development of plots for individual housing construction 2022

- Pregnant Left Him I Don’t Love Him

Accounting 26 for dummies: examples and postings

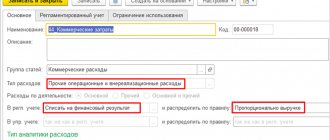

Accounting account 26 is general business expenses or indirect costs, used in almost every enterprise, with the exception of state budgetary and credit organizations. In this article we will look at the main nuances of this account, its properties, typical transactions and examples of use in accounting.

Determination of general business expenses

General business expenses include all costs for administrative needs that are not directly related to production, provision of services or performance of work, but relate to the main type of activity.

The list of general business expenses depends on the profile of the organization and is not closed, according to the recommendations for using the chart of accounts.

The main general operating costs can be identified:

- Administrative and management expenses

- Business trips;

- Salaries of administration, accounting, management personnel, marketing, etc.;

- Entertainment expenses;

- Security, communication services;

- Consultations of third-party specialists (IT, auditors, etc.);

- Postal services and office.

- Repair and depreciation of non-production fixed assets;

- Rent of non-industrial premises;

- Budget payments (taxes, fines, penalties);

- Other:

Organizations not related to production (dealers, agents, etc.) collect all costs on account 26 and subsequently write them off to the sales account (account 90).

Important! Trade organizations may not use account 26, but assign all expenses to account 44 “Sales expenses”.

Main properties of account 26

Let's consider the main properties of account 26 “General business expenses”:

- Refers to active accounts, therefore, it cannot have a negative result (credit balance);

- It is a transaction account and does not appear on the balance sheet. At the end of each reporting period it must be closed (there should be no balance at the end of the month);

- Analytical accounting is carried out according to cost items (budget items), place of origin (divisions) and other characteristics.

Typical wiring

Account 26 “General business expenses” corresponds with the following accounts:

Table 1. By debit of account 26:

| Dt | CT | Wiring Description |

| 26 | 02 | Depreciation calculation for non-production fixed assets |

| 26 | 05 | Depreciation calculation for non-production intangible assets |

| 26 | 10 | Write-off of materials, inventory, workwear for general business needs |

| 26 | 16 | Variance in the cost of written-off general business materials |

| 26 | 21 | Write-off of semi-finished products for general business purposes |

| 26 | 20 | Attribution of costs (work, services) of the main production to general economic needs |

| 26 | 23 | Attribution of costs (work, services) of auxiliary production to general economic needs |

| 26 | 29 | Attribution of costs (work, services) of service production to general economic needs |

| 26 | 43 | Write-off of finished products for general business purposes (experiments, research, analyses) |

| 26 | 50 | Decommissioning of postage stamps |

| 26 | 55 | Payment of expenses (minor work, services) from special bank accounts |

| 26 | 60 | Payment for work and services of third parties for general business needs |

| 26 | 68 | Calculation of payments of taxes, fees, penalties |

| 26 | 69 | Deduction for social needs |

| 26 | 70 | Calculation of wages for administrative, managerial and general business personnel |

| 26 | 71 | Accrual of travel expenses, as well as accountable expenses for small general business needs |

| 26 | 76 | General expenses related to other creditors |

| 26 | 79 | General business expenses associated with the organization's divisions on a separate balance sheet |

| 26 | 94 | Write-off of shortages without perpetrators, except for natural disasters |

| 26 | 96 | Assigning general business expenses to the reserve for future expenses and payments |

| 26 | 97 | Write-off of a share of future expenses for general business expenses |

Table 2. For the credit of account 26:

| Dt | CT | Wiring Description |

| 08 | 26 | Attribution of general business expenses to capital construction |

| 10 | 26 | Capitalization of returnable waste and unused materials written off as general business expenses |

| Write-off of general business expenses when closing the month, that is, where account 26 is written off | ||

| 20 | 26 | For main production |

| 21 | 26 | For the production of semi-finished products |

| 29 | 26 | For service production |

| 90.02 | 26 | Performed work and services for third parties |

| 90.08 | 26 | On the cost of sales when using the direct costing method |

Closing 26 accounts

Closing account 26, that is, writing off all general business expenses, is performed in several ways:

- Included in the cost of production through production accounts if products are produced;

- Referred to as cost of sales when providing services or work;

- Referred to the current expenses of the reporting month using the direct costing method:

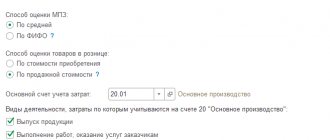

Important! The write-off method, as well as the basis for the distribution of general business expenses, must be fixed in the accounting policies of the organization.

Write-off as part of the cost of production

In this case, general business expenses are written off in shares, taking into account the distribution base, into production accounts and may remain on product cost accounts (for example, when producing products under account 43 “Finished Products”) or production accounts (for example, work in progress under account 20 “Main Production” ) at the end of the reporting period.

Main types of cost distribution bases:

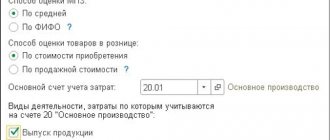

Get 267 video lessons on 1C for free:

- Revenue

- Product output volume

- Planned cost of production

- Material costs

- Direct costs

- Salary and so on

When closing the month, the following transactions are generated, for example:

| Dt | CT | Wiring Description |

| 20 | 26 | General business expenses for main production were written off |

| 23 | 26 | General business expenses for auxiliary production were written off |

General business expenses are distributed to the cost of production (production accounts) according to the specified distribution and analytical accounting base:

Therefore, general business expenses are written off:

- In full - if one product is produced (no analytics);

- Distributed across all types of products in proportion to the selected base - if several types of products are produced and calculated in the context of analytics.

Example

LLC "Horns and Hooves" produces hats and shoes, the production of which is carried out at a planned cost. In an organization, direct expenses are reflected in account 20 “Main production”, and indirect expenses in account 26 “General business expenses”.

The accounting policy states:

- General business expenses are written off against the cost of production.

- The distribution base is material costs.

In November 2016, direct expenses amounted to RUB 51,040.00:

- For headwear – RUB 28,020.00. of them:

- Material costs – RUB 15,000.00.

- For the production of shoes - RUB 23,020.00. of them:

- Material costs – RUB 10,000.00.

indirect costs – 18,020 rubles.

- 3/p administrative staff – RUB 10,000.00.

- Insurance premiums – RUB 3,020.00.

- Premises rental – RUB 5,000.00.

According to the distribution base for material costs: