The Tax Code of the Russian Federation regulates the lists and procedures for collecting excise taxes from manufacturers (or in some cases from sellers). This indirect tax is usually included in the cost of the finished product or in the tariff of the service provided. Despite the fact that legally this contribution is made by the company that produces, for example, alcohol, it is actually paid by the buyer due to the markup. In the article we will tell you about excisable goods - what they are, what applies to excisable products and by what rule the tax rate is calculated.

General information

The premium to the commodity value is determined by the state. It goes to the state budget with the aim of filling it, and also has the task of regulating the quantity of output and the quality of this product. All categories have a common distinctive feature - this is an area with high profitability and low production costs, which makes them accessible to taxation. Of all the taxes received by the state budget in Russia, this one takes up to 8%, which can be called a very large influx of funds into the treasury. Not only commodity units produced in the Russian Federation are subject to excise duty, but also those imported from abroad.

The payer can be either a manufacturer or a supplier, an importer, or a seller - a legal entity engaged in sales and receiving material assets during the transfer of ownership of a certain batch. Most often, the tax is assessed after production, but sometimes it must be paid by the person who sells the product, for example, if he received it as confiscated goods or after a court decision.

All excise products are regulated by regulations; its current list can always be found in Article 181 of the Tax Code of the Russian Federation.

The state often positions excise taxation as a measure to regulate sales. For example, an increase in prices for alcohol and tobacco should lead to a decrease in purchase and, accordingly, consumption.

Tax Code of the Russian Federation, Article 181 of the Tax Code of the Russian Federation

1. The following are recognized as excisable goods:

- 1) ethyl alcohol produced from food or non-food raw materials, including denatured ethyl alcohol, raw alcohol, wine, grape, fruit, cognac, Calvados, whiskey distillates (hereinafter also in this chapter - ethyl alcohol);

- 1.1) became invalid on July 1, 2012. — Federal Law of November 28, 2011 N 338-FZ;

- 2) alcohol-containing products (solutions, emulsions, suspensions and other types of products in liquid form) with a volume fraction of ethyl alcohol of more than 9 percent, with the exception of alcoholic products specified in subparagraph 3 of this paragraph.

For the purposes of this chapter, the following goods are not considered excisable goods:

- medicines that have passed state registration with the authorized federal executive body and are included in the State Register of Medicines, medicines (including homeopathic medicines) manufactured by pharmacy organizations according to prescriptions for medicines and the requirements of medical organizations, poured into containers in accordance with the requirements of the regulatory documentation agreed upon by the authorized federal executive body;

- veterinary drugs that have passed state registration with the authorized federal executive body and are included in the State Register of Registered Veterinary Drugs developed for use in animal husbandry on the territory of the Russian Federation, bottled in containers of no more than 100 ml;

- perfumery and cosmetic products bottled in containers of no more than 100 ml with a volume fraction of ethyl alcohol up to 80 percent inclusive and (or) perfumery and cosmetic products with a volume fraction of ethyl alcohol up to 90 percent inclusive with a spray bottle on the bottle, bottled in containers no more than 100 ml , as well as perfumery and cosmetic products with a volume fraction of ethyl alcohol up to 90 percent inclusive, bottled in containers up to 3 ml inclusive;

- wastes subject to further processing and (or) use for technical purposes, generated during the production of ethyl alcohol from food raw materials, vodka, liqueurs, complying with regulatory documentation approved (agreed upon) by the federal executive body;

- paragraphs seven through eight are no longer in force on January 1, 2007. — Federal Law of July 26, 2006 N 134-FZ;

- wine materials, grape must, other fruit must, beer must;

- 3) alcoholic products (vodka, liqueurs, cognacs, wine, fruit wine, liqueur wine, sparkling wine (champagne), wine drinks, cider, poiret, mead, beer, drinks made from beer, other drinks with a volume fraction of ethyl alcohol more than 0.5 percent, with the exception of food products in accordance with the list established by the Government of the Russian Federation;

- 4) became invalid on January 1, 2011. — Federal Law of November 27, 2010 N 306-FZ;

- 5) tobacco products;

- 6) excluded. — Federal Law of July 24, 2002 N 110-FZ.

6) passenger cars;

6.1) motorcycles with an engine power exceeding 112.5 kW (150 hp);

7) motor gasoline;

diesel fuel;

9) motor oils for diesel and (or) carburetor (injection) engines;

10) straight-run gasoline. For the purposes of this chapter, straight-run gasoline is defined as gasoline fractions, with the exception of motor gasoline, aviation kerosene, and acrylates, obtained as a result of:

- distillation (fractionation) of oil, gas condensate, associated petroleum gas, natural gas;

- processing (chemical transformations) of oil shale, coal, oil fractions, gas condensate fractions, associated petroleum gas, natural gas.

For the purposes of this chapter, the gasoline fraction is recognized as a mixture of hydrocarbons in a liquid state (at a temperature of 15 or 20 degrees Celsius and a pressure of 760 millimeters of mercury), simultaneously corresponding to the following physical and chemical characteristics:

- density not less than 650 kg/m3 and not more than 749 kg/m3 at a temperature of 15 or 20 degrees Celsius;

- the value of the temperature at which at least 90 percent of the mixture is distilled by volume (pressure 760 millimeters of mercury) does not exceed 215 degrees Celsius.

At the same time, for the purposes of this chapter, the following types of fractions are not recognized as gasoline fraction:

- fraction obtained as a result of alkylation (oligomerization) of hydrocarbon gases;

- a fraction in which the mass fraction of methyl tert-butyl ether and (or) other ethers and (or) alcohols is at least 85 percent;

- the fraction obtained as a result of the oxidation and esterification of olefins, aromatic hydrocarbons, alcohols, aldehydes, ketones, carboxylic acids;

- fraction obtained as a result of hydrogenation, hydration and dehydrogenation of alcohols, aldehydes, ketones, carboxylic acids;

- fraction, the mass fraction of benzene and (or) toluene and (or) xylene (including paraxylene and orthoxylene) in which is at least 85 percent;

- a fraction in which the mass fraction of pentane and (or) isopentane is at least 85 percent;

- a fraction in which the mass fraction of alphamethylstyrene is at least 95 percent;

- density not less than 750 kg/m3 and not more than 930 kg/m3 at a temperature of 20 degrees Celsius;

- the value of the temperature indicator at which at least 90 percent of the mixture is distilled by volume (at an atmospheric pressure of 760 millimeters of mercury) is in the range of not lower than 215 degrees Celsius and not higher than 360 degrees Celsius;

- 12) benzene, paraxylene, orthoxylene.

11) middle distillates. For the purposes of this chapter, middle distillates are mixtures of hydrocarbons in a liquid state (at a temperature of 20 degrees Celsius and an atmospheric pressure of 760 millimeters of mercury), obtained as a result of primary and (or) secondary processing of oil, gas condensate, associated petroleum gas, oil shale, for with the exception of straight-run gasoline, motor gasoline, diesel fuel, benzene, paraxylene, orthoxylene, aviation kerosene, stable gas condensate, at the same time corresponding to the following physical and chemical characteristics:

For the purposes of this chapter, benzene is a liquid with a content (by weight) of the corresponding simplest aromatic hydrocarbon of 99 percent.

For the purposes of this chapter, paraxylene or orthoxylene is a liquid containing (by weight) the corresponding xylene isomer (dimethylbenzene) 95 percent;

13) aviation kerosene.

For the purposes of this chapter, aviation kerosene is recognized as liquid fuels used in aircraft engines that comply with the requirements of the legislation of the Russian Federation on technical regulation and (or) international treaties of the Russian Federation, as well as mixtures of such fuels;

14) natural gas (in cases provided for by international treaties of the Russian Federation);

15) electronic nicotine delivery systems. For the purposes of this chapter, electronic nicotine delivery systems are recognized as disposable electronic devices that produce an aerosol, vapor or smoke by heating a liquid for inhalation by the user (with the exception of medical devices registered in the manner established by the legislation of the Russian Federation);

16) liquids for electronic nicotine delivery systems. For the purposes of this chapter, liquid for electronic nicotine delivery systems is any liquid containing liquid nicotine in a volume of 0.1 mg/ml or more, intended for use in electronic nicotine delivery systems;

17) tobacco (tobacco products) intended for consumption by heating.

2. Lost power. — Federal Law of July 7, 2003 N 117-FZ.

What goods are excisable: list

Let's present a short table with the rationale for which regulatory act states that they belong to this category.

| Name of products that are subject to value added tax | Which paragraph and subparagraph of Article 181 regulates this? |

| Ethyl alcohol (excluding that classified as medical) | P. 1., sub. 1 |

| Any industrial products containing alcohol in a percentage of at least 9% | P. 1., sub. 2 |

| All alcohol in which the proportion of ethanol exceeds 0.5% | P. 1., sub. 3 |

| Tobacco and tobacco-containing products | P. 1., sub. 5 |

| Passenger vehicles, as well as motorcycles with a power of over 150 horsepower and an engine capacity of over 112.5 kW | P. 1., sub. 6 |

| AI, diesel fuel and motor oils | P. 1., sub. 7, sub. 8 and 9 respectively |

The remaining sub-items (from 10 to 14) are occupied by chemicals and compounds that can be classified as raw materials, for example, benzene or natural gas. The list of excisable goods is established by supervisory authorities, but it may be slightly modified, so representatives of manufacturing companies in these areas need to carefully monitor amendments. In addition, some points require explanation, which we want to give in our article.

It is also worth noting that a number of products, for example alcohol and tobacco, are subject to mandatory labeling. This measure is provided in order to regulate their turnover, as well as prevent the entry of counterfeit goods into stores and people. Each retail (as well as production and warehouse) point must be equipped with equipment - special cash registers, reading devices, software.

What goods are excisable?

The group of excisable goods in the Russian Federation is constantly changing. However, there are a number of products that have always been included in it and will not leave in the near future. These goods are excisable not only in our country, but also in almost all countries of the world. The list of such goods is established in Art. 181 of the Tax Code of the Russian Federation, according to which excisable goods include:

- Ethanol.

- Alcohol-containing goods in which the share of ethyl alcohol is more than 9%, with the exception of alcoholic products. Also exceptions in this case include:

- medicines;

- veterinary products bottled in containers not exceeding 100 ml in volume;

- perfumery and cosmetic products, the volume of which does not exceed 100 ml, and the proportion of alcohol is 80 and 90%, with a spray bottle, as well as with the proportion of ethyl alcohol up to 90% and a volume not exceeding 3 ml;

- waste from the production of ethyl alcohol, as well as alcoholic beverages, subject to their further processing and use for technical purposes;

- wine materials, wine, fruit and beer wort.

- Alcohol products.

- Tobacco products.

- Cars.

- Motorcycles with power exceeding 112.5 kW (150 hp).

- Automotive gasoline.

- Diesel fuel.

- Motor oils for injection and diesel engines.

- Straight-run gasoline.

- Aviation kerosene.

- Orthoxylene, paraxylene, benzene.

- Other mixtures of hydrocarbons in a liquid state.

- Natural gas.

- E-Sigs.

- Liquids for electronic cigarettes.

- Tobacco and products made from it, consumed by heating.

- Petroleum raw materials.

- Grapes used for wine production (from 01/01/2020).

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Types of excisable goods: what items apply to them

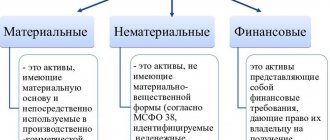

In fact, all product units can be divided into two groups:

- subject to mandatory labeling;

- not forcibly marked.

The first category includes two types of products:

- Tobacco packaged in packages and packs for retail sale. These are cigarettes, smoking mixtures, chewing and snorting powders, cigars and other varieties with nicotine.

- Alcohol bottled in containers from 50 ml to 100 liters and intended for retail sale. This list does not include beer and beer drinks (including those in kegs for bottling), as well as cider and mead. It is for this reason that some stores limit the alcohol range to only low-alcohol options, so as not to install special equipment for working with labeling.

Excise goods, products in the Russian Federation that are not subject to labeling, include vehicles, gasoline and diesel fuel, kerosene, alcohol, motor oil and other items from the table presented above.

Types of excisable goods

The entire list of excisable goods can be divided into 2 main groups:

- Subject to mandatory labeling.

- Not subject to mandatory labeling.

Group 1, as a rule, includes tobacco products packaged for retail sale and alcoholic products in containers from 50 ml to 100 l, with the exception of beer, cider, mead, as stated in paragraph 2 of Art. 12 of the Law “On state regulation of the production and turnover of ethyl alcohol, alcoholic and alcohol-containing products...” dated November 22, 1995 No. 171.

Goods not subject to labeling include all other goods from the list of excisable goods. Let's list some of them:

- cars;

- motorcycles with a power exceeding 112.5 kW (150 hp);

- motor gasoline;

- diesel fuel;

- motor oils for injection and diesel engines.

Who pays excise taxes

Indirect tax is charged to legal entities, private entrepreneurs, companies engaged in import and export, as well as all other market participants who carry out excise operations. In fact, such persons are manufacturers and importers, and much less often – sellers. Resellers and other types of intermediaries do not have to pay this fee. Taxpayers who make payments according to the list of excisable goods do not have the right to switch to a simplified tax system. Those organizations that are forced to work under UTII must also pay.

When does accrual occur?

There are several cases:

- When selling commodity units, that is, in the process of transferring ownership rights. This is a one-time charge; as a rule, it occurs at the time of sale of a batch from the manufacturer to the wholesale network, and secondary procedures are not subject to tax.

- When selling confiscated or ownerless commodity units. Roughly speaking, if the seller somehow receives a product that is included in the list of excisable goods, but the price has not yet been determined, a tax is also charged on these commodity units.

- When moving excise materials within the organization. It is very interesting to observe this using the example of distillery production. To make alcohol, you need alcohol. But it is also included in the list, so if an organization independently procures raw materials, then since 2011 it is necessary to pay excise tax on it even with “internal” transfer between departments.

- When importing from abroad.

Commentary on Article 181 of the Tax Code of the Russian Federation

The commented article defines a list of excisable goods.

Excise goods include:

— ethyl alcohol from all types of raw materials (with the exception of cognac alcohol);

— alcohol-containing products with a volume fraction of ethyl alcohol of more than 9%;

— alcoholic products;

- beer;

— tobacco products;

— passenger cars;

— motorcycles with engine power over 112.5 kW (150 hp);

— motor gasoline;

- diesel fuel;

— motor oils for diesel and (or) carburetor (injection) engines;

— straight-run gasoline.

Ethanol

In accordance with paragraph 1 of Art. 181 of the Tax Code of the Russian Federation, ethyl alcohol is recognized as an excisable product. It includes all types of ethyl alcohols (with the exception of cognac), regardless of their concentration, the type of raw materials from which they are produced, and the standard and technical documentation according to which they are manufactured (according to GOSTs, TUs, OSTs or pharmacopoeial articles).

According to the pharmacopoeial articles FS 42-3071-94 and FS 42-3072-94, the products manufactured according to them, representing a medicinal product, are not alcohol-containing products, but ethyl alcohol, and it is under this name that they are included in the State Register of Medicines and Medical Products.

Since in paragraph 1 of Art. 181 of the Tax Code of the Russian Federation does not provide for the exclusion from the list of excisable goods of ethyl alcohol produced in accordance with the specified pharmacopoeial articles, regardless of the fact that this alcohol is registered as a medicinal product, it is an excisable product.

Cognac alcohol is not recognized as an excisable product if two conditions are met:

1) if, in accordance with Federal Law No. 171-FZ of November 22, 1995 “On state regulation of the production and circulation of ethyl alcohol, alcoholic and alcohol-containing products,” it is produced in accordance with state standards and technical specifications approved by the authorized federal executive body;

2) if, in accordance with Decree of the Government of the Russian Federation of July 23, 1996 N 874 “On the introduction of state registration of ethyl alcohol from food raw materials, alcoholic, alcohol-containing food products and other alcohol-containing products,” it has passed state registration with the Ministry of Agriculture and Food of the Russian Federation.

If before January 1, 2001, denatured alcohol was completely exempt from excise taxes, then after this date this alcohol is recognized as an excisable product in accordance with paragraphs. 1 clause 1 art. 181 Tax Code of the Russian Federation. However, subject to the conditions provided for in Art. 183 of the Code, as amended, was in force until the end of 2005, operations for the sale of denatured ethyl alcohol and denatured alcohol-containing products were exempt from paying excise taxes. From January 1, 2006, in accordance with the amendments made by Federal Law of July 21, 2005 N 107-FZ, from Art. 183 of the Code excludes provisions on exemption from excise taxes for these operations.

Alcohol-containing products

In accordance with paragraphs. 2 p. 1 art. 181 of the Tax Code of the Russian Federation, excisable goods are alcohol-containing products with a volume fraction of ethyl alcohol of more than 9 percent (solutions, emulsions, suspensions and other types of products in liquid form).

From January 1, 2001, the range of excisable goods also included denatured alcohol-containing products, which until that time were not subject to excise taxes. Operations for the sale of these products are subject to excise taxes from January 1, 2006. Corresponding amendments to Ch. 22 of the Tax Code of the Russian Federation was introduced by Federal Law of July 21, 2005 N 107-FZ.

In addition to alcohol-containing products with a volume fraction of ethyl alcohol up to 9 percent inclusive, the alcohol-containing products listed below are not recognized as excisable goods.

Federal Law No. 134-FZ of July 26, 2006 introduced significant changes to the procedure for calculating and paying excise taxes. There have been changes to the list of goods that are not recognized as excisable. First, please note the following. If the wording of Art. 181, valid until January 1, 2007, it is written “for the purposes of this chapter the following alcohol-containing products are not considered as excisable goods,” then in the new edition this phrase reads: “The following goods are not considered as excisable goods.” What is the significance of this amendment? Let me remind you that at the beginning of 2006 the question arose whether the head fraction of ethyl alcohol, which, on the one hand, is a waste of alcohol production, and on the other, was classified as a waste product by Federal Law of November 22, 1995 N 171-FZ. the concept of "ethyl alcohol". Now, after changing the wording of Art. 181 of the Tax Code of the Russian Federation, for excise taxation it does not matter whether this waste is an alcohol-containing product or ethyl alcohol. The head fraction of ethyl alcohol is exempt from paying excise taxes, since, as already mentioned, it is a waste product of alcohol production. But this is not the only change that concerns alcohol and liquor production waste. From Art. 181 excludes the provision that in order to be exempt from excise taxes on such waste it is necessary that they be included in the State Register of Ethyl Alcohol from Food Raw Materials, Alcohol and Alcohol-Containing Products in the Russian Federation. The fact is that the need to maintain such a register is excluded from Federal Law of November 22, 1995 N 171-FZ.

Medicinal, therapeutic and prophylactic,

diagnostic tools

The following are not subject to excise taxes:

— medicinal, treatment-and-prophylactic, diagnostic products that have passed state registration with the authorized federal executive body and are included in the State Register of Medicines and Medical Products;

- medicinal, therapeutic and prophylactic products (including homeopathic drugs), manufactured by pharmacies according to individual recipes and the requirements of medical organizations.

Thus, the basis for exemption from paying excise taxes on these products is their registration by the Ministry of Health and Social Development of the Russian Federation, and when they are manufactured by pharmacy organizations according to individual recipes and the requirements of medical organizations - recipes and requirements certified in the prescribed manner.

The commented article provides for the exclusion from the list of excisable goods of alcohol-containing medicines dispensed not only according to individual prescriptions, but also according to the requirements of medical organizations.

It should be borne in mind that one of the conditions for the exemption of alcohol-containing medicines from excise taxes is the sale of these products by the organizations producing them in containers that meet the requirements of state standards of medicines (pharmacopoeial articles), approved by the authorized federal executive body. If the medicine is made according to an individual prescription, then it must be poured into the container prescribed by the doctor's prescription.

According to Art. 17 of the Federal Law of June 22, 1998 N 86-FZ “On Medicines”, the manufacture of medicines in a pharmacy is carried out according to doctors’ prescriptions based on medicines registered in Russia. In accordance with Art. 19 of Law N 86-FZ, medicines manufactured in pharmacies according to doctors’ prescriptions are not subject to state registration. Pharmacies are obliged to sell medicines only in quantities necessary to fulfill medical prescriptions (Article 32 of Law No. 86-FZ). Consequently, in the case of the manufacture of medicinal and therapeutic and prophylactic products (including homeopathic drugs) by pharmacies, in order to recognize these products as non-excise goods, recipes and requirements of medical organizations must contain data on the dosage of the drug and be certified in the prescribed manner. At the same time, taking into account the specifics of the manufacture of alcohol-containing medicines according to individual recipes and the requirements of medical organizations, the requirement to bottle them in containers determined by pharmacopoeial articles does not apply to the conditions for the exemption of these drugs from excise taxes.

The production of alcohol-containing medicines according to pharmacopoeial articles included in the State Register of Medicines is carried out only by organizations that have licenses for the production of medicines, in accordance with quotas for the purchase of ethyl alcohol issued by the Ministry of Health and Social Development of the Russian Federation. This is established in the Decree of the Government of the Russian Federation of August 27, 1999 N 967 “On the production and circulation of alcohol-containing medicines and perfumery and cosmetic products (products).”

Veterinary drugs

Veterinary drugs that have undergone state registration with the authorized federal executive body and are included in the State Register of Registered Veterinary Drugs developed for use in animal husbandry on the territory of the Russian Federation are not subject to excise taxes.

Thus, in order to be exempt from excise taxes, these products must be registered with the Ministry of Agriculture and Food of the Russian Federation and entered into the State Register of Registered Veterinary Drugs developed for use in livestock farming on the territory of the Russian Federation. Veterinary drugs are not excisable goods only if they are bottled in containers of no more than 100 ml.

Perfume and cosmetic products

Perfumery and cosmetic products that have passed state registration with the authorized federal executive body, which since October 1, 1999, in accordance with the above-mentioned Decree of the Government of the Russian Federation of August 27, 1999 N 967, are not subject to excise taxes. .

Thus, in order to receive excise tax benefits on alcohol-containing perfumery and cosmetic products, the taxpayer must submit to the tax authorities a registration certificate issued by the Ministry of Health and Social Development of the Russian Federation, which must indicate that the product is classified as an alcohol-containing perfumery and cosmetic product.

Please note: From January 1, 2006, in order to recognize alcohol-containing perfumery and cosmetic products as non-excisable goods, they must be bottled in containers of no more than 100 ml (until 2006 - no more than 270 ml). The corresponding amendment was introduced by Federal Law No. 86-FZ of July 28, 2004 “On Amendments to Chapter 22 of Part Two of the Tax Code of the Russian Federation.”

In addition, according to the Federal Law of July 21, 2005 N 107-FZ, from January 1, 2006, perfume and cosmetic products in metal aerosol packaging are not excisable goods.

Federal Law No. 134-FZ of July 26, 2006 introduced significant changes to the procedure for calculating and paying excise taxes. From January 1, 2007, household chemical goods in metal aerosol packaging and perfumery and cosmetic products in metal aerosol packaging will be recognized as excisable.

As for perfumery and cosmetic products in other packaging, they will continue to be exempt from excise taxes, but the conditions under which this exemption is granted have changed. Such products should contain no more than 90% alcohol (inclusive) if there is a spray bottle on the bottle (i.e., in practice, it should also be an aerosol package). At the same time, the requirement for state registration of these products and that they must be bottled in containers of no more than 100 ml remains.

Alcohol-containing waste

Waste generated during the production of ethyl alcohol from food raw materials, vodka, alcoholic beverages, subject to further processing and (or) use for technical purposes is not subject to excise taxes. The specified waste must comply with regulatory documentation approved (agreed upon) by the federal executive body, and must be included in the State Register of Ethyl Alcohol from Food Raw Materials, Alcohol and Alcohol-Containing Products in the Russian Federation.

Thus, alcohol-containing waste is exempt from excise taxes, subject to the following conditions:

1) there is a state registration certificate;

2) products are sent for further processing or used for technical purposes.

The organization and conduct of state registration of alcohol-containing waste generated during the production of ethyl alcohol from food raw materials, vodka, alcoholic beverages and subject to further processing or use for technical purposes is entrusted to the Ministry of Agriculture and Food of the Russian Federation.

In some cases, alcohol-containing waste is not used for processing, is not sold, but is sent for destruction. Should excise tax be charged in this case? To answer this question, remember that waste disposal is not recognized as an operation subject to excise taxes. Consequently, when destroying alcohol production waste, excise taxes are not charged.

Household chemicals in aerosol packaging

Household chemicals in aerosol packaging are not subject to excise taxes. In accordance with the amendments made to the commented article by Federal Law No. 57-FZ of May 29, 2002 “On introducing amendments and additions to part two of the Tax Code of the Russian Federation and to certain legislative acts of the Russian Federation”, from January 1, 2002 dated Only those household chemicals packaged in metal aerosol packaging are exempt from paying excise taxes.

Alcohol products

According to paragraphs. 3 p. 1 art. 181 of the Tax Code of the Russian Federation, excisable goods are alcoholic products, which include drinking alcohol, vodka, alcoholic beverages, cognacs, wine and other food products with a volume fraction of ethyl alcohol of more than 1.5%.

Wine materials, in accordance with the Tax Code of the Russian Federation, are not included in the list of excisable goods. Consequently, excise taxes are not charged on them.

Cars and motorcycles

In accordance with paragraphs. 6 clause 1 art. 181 of the Tax Code of the Russian Federation, the list of excisable goods includes passenger cars and motorcycles with an engine power exceeding 112.5 kW.

The classification of motor vehicles used for the transport of passengers is regulated by GOST R 52051-2003 “Motor vehicles and trailers. Classification and definitions".

According to the specified GOST, vehicles used to transport passengers and having, in addition to the driver’s seat, no more than eight seats, belong to passenger cars (category M1). If there are more than eight such seats, these vehicles are classified as buses (category M2, M3).

Based on the above, if vehicles (in particular, minibuses) have no more than eight passenger seats, they are recognized as excisable goods. If there are more than eight passenger seats, the vehicle is not subject to excise tax.

Straight-run gasoline

Clause 4 of Art. 1 of the Federal Law of July 24, 2002 N 110-FZ “On introducing amendments and additions to part two of the Tax Code of the Russian Federation and some other acts of legislation of the Russian Federation”, which came into force on January 1, 2003, the list of excisable goods was supplemented straight-run gasoline.

The inclusion of straight-run gasoline in the list of excisable goods to a certain extent helps to solve the problem of its use for the purpose of illegal production of excisable petroleum products. As is known, the technology for the production of motor gasoline makes it possible to obtain it not only by processing petroleum products at an oil refinery, but also by mixing straight-run gasoline with the necessary chemical additives in railway tanks, in fuel trucks, and directly in the storage facilities of gas stations. Volumes of gasoline obtained by mixing were in most cases exempt from excise taxation, since straight-run gasoline was not subject to excise tax, was exported from factories, and after the above technological operation was sold as high-octane gasoline.

Under straight-run gasoline for the purposes of Ch. 22 of the Tax Code of the Russian Federation refers to gasoline fractions obtained as a result of refining oil, gas condensate, associated petroleum gas, natural gas, oil shale, coal and other raw materials, as well as products of their processing, with the exception of motor gasoline and petrochemical products. The gasoline fraction is a mixture of hydrocarbons boiling in the temperature range from 30 to 215 ° C at an atmospheric pressure of 760 mm Hg. Art.

The inclusion of straight-run gasoline in the list of excisable goods means that taxpayers are required to submit excise tax declarations to the tax authorities indicating the volumes received in physical terms. Until January 1, 2005, excise taxes were not charged on these volumes, since Art. 193 of the Tax Code of the Russian Federation established a zero excise tax rate for straight-run gasoline.

Federal Law N 107-FZ changed the situation. In order to eliminate the interest of persons in the unlawful application of the zero rate in order to evade paying excise duty on motor gasoline, from January 1, 2006, the excise tax rate on straight-run gasoline is established in the amount of 2,657 rubles. per ton.

When excise taxes are not charged

Indirect tax is not imposed on those products that are not listed in Article 181 of the Tax Code of the Russian Federation. The following goods are considered excisable, but not subject to a tax rate:

- Everything presented in the list, if they are produced within the same enterprise not for the purpose of sale in this form, but for the next production stage. That is, when transferring raw materials from one department to another. This rule does not apply only to the pair alcohol - alcohol-containing drinks.

- Organizations engaged in export, that is, selling their products abroad. Here, the exporter must first submit an application to the tax service confirming the activities and volumes of supplies. Why this is so is because the receiving party will impose its own tax on the imported shipments. This is the basis of international trade, allowing such turnover to be profitable. It is for this reason that sometimes it happens that the same object in the stores of the country of origin is more expensive than on the shelves of the so-called “abroad”, because they have less excise tax.

In both cases, in order to get rid of “extra” added value, you should carefully keep records of all operations performed.

Article 181 of the Tax Code of the Russian Federation. Excise goods

The commented article defines a list of excisable goods.

Excise goods include:

- ethyl alcohol from all types of raw materials (with the exception of cognac alcohol);

- alcohol-containing products with a volume fraction of ethyl alcohol of more than 9%;

- alcoholic products;

- beer;

- tobacco products;

- passenger cars;

- motorcycles with engine power over 112.5 kW (150 hp);

- motor gasoline;

- diesel fuel;

- motor oils for diesel and (or) carburetor (injection) engines;

- straight-run gasoline.

Ethanol

In accordance with paragraph 1 of Article 181 of the Tax Code of the Russian Federation, ethyl alcohol is recognized as an excisable product. It includes all types of ethyl alcohols (with the exception of cognac), regardless of their concentration, the type of raw materials from which they are produced, and the standard and technical documentation according to which they are manufactured (according to GOSTs, TUs, OSTs or pharmacopoeial articles).

According to the pharmacopoeial articles FS 42-3071-94 and FS 42-3072-94, the products manufactured according to them, representing a medicinal product, are not alcohol-containing products, but ethyl alcohol, and it is under this name that they are included in the State Register of Medicines and Medical Products.

Since paragraph 1 of Article 181 of the Tax Code of the Russian Federation does not provide for the exclusion from the list of excisable goods of ethyl alcohol produced in accordance with the specified pharmacopoeial articles, regardless of the fact that this alcohol is registered as a medicinal product, it is an excisable product.

Cognac alcohol is not recognized as an excisable product if two conditions are met:

- 1) if, in accordance with Federal Law No. 171-FZ of November 22, 1995 “On state regulation of the production and circulation of ethyl alcohol, alcoholic and alcohol-containing products,” it is produced in accordance with state standards and technical specifications approved by the authorized federal executive body;

- 2) if, in accordance with Decree of the Government of the Russian Federation of July 23, 1996 N 874 “On the introduction of state registration of ethyl alcohol from food raw materials, alcoholic, alcohol-containing food products and other alcohol-containing products,” it has passed state registration with the Ministry of Agriculture and Food of the Russian Federation.

If before January 1, 2001, denatured alcohol was completely exempt from excise taxes, then after this date this alcohol is recognized as an excisable product in accordance with subparagraph 1 of paragraph 1 of Article 181 of the Tax Code of the Russian Federation. However, subject to the conditions provided for in Article 183 of the Code as amended until the end of 2005, operations for the sale of denatured ethyl alcohol and denatured alcohol-containing products were exempt from paying excise taxes. From January 1, 2006, in accordance with the amendments made by Federal Law No. 107-FZ of July 21, 2005, provisions on exemption from excise taxes for these transactions were excluded from Article 183 of the Code.

Alcohol-containing products

In accordance with subparagraph 2 of paragraph 1 of Article 181 of the Tax Code of the Russian Federation, excisable goods are alcohol-containing products with a volume fraction of ethyl alcohol of more than 9 percent (solutions, emulsions, suspensions and other types of products in liquid form).

From January 1, 2001, the range of excisable goods also included denatured alcohol-containing products, which until that time were not subject to excise taxes. Operations for the sale of these products are subject to excise taxes from January 1, 2006. Corresponding amendments to Chapter 22 of the Tax Code of the Russian Federation were made by Federal Law No. 107-FZ of July 21, 2005.

In addition to alcohol-containing products with a volume fraction of ethyl alcohol up to 9 percent inclusive, the alcohol-containing products listed below are not recognized as excisable goods.

Federal Law No. 134-FZ of July 26, 2006 introduced significant changes to the procedure for calculating and paying excise taxes. There have been changes to the list of goods that are not recognized as excisable. First, please note the following. If the wording of Article 181, in force until January 1, 2007, says “for the purposes of this chapter, the following alcohol-containing products are not considered as excisable goods,” then in the new wording this phrase reads: “The following goods are not considered as excisable goods.” What is the significance of this amendment? Let me remind you that at the beginning of 2006 the question arose whether the head fraction of ethyl alcohol should be subject to excise taxes, which, on the one hand, is a waste product of alcohol production, and on the other hand, Federal Law of November 22, 1995 N 171-FZ was classified as "ethanol". Now, after changing the wording of Article 181 of the Tax Code of the Russian Federation, for excise taxation it does not matter whether this waste is an alcohol-containing product or ethyl alcohol. The head fraction of ethyl alcohol is exempt from paying excise taxes, since, as already mentioned, it is a waste product of alcohol production. But this is not the only change that concerns alcohol and liquor production waste. The provision that in order to be exempt from excise taxes on such wastes must be included in the State Register of Ethyl Alcohol from Food Raw Materials, Alcohol and Alcohol-Containing Products in the Russian Federation has been excluded from Article 181. The fact is that the need to maintain such a register is excluded from Federal Law of November 22, 1995 N 171-FZ.

Medicinal, treatment-and-prophylactic, diagnostic agents

The following are not subject to excise taxes:

- medicinal, treatment-and-prophylactic, diagnostic products that have passed state registration with the authorized federal executive body and are included in the State Register of Medicines and Medical Products;

- medicinal, therapeutic and prophylactic products (including homeopathic drugs), manufactured by pharmacies according to individual recipes and the requirements of medical organizations.

Thus, the basis for exemption from paying excise taxes on these products is their registration by the Ministry of Health and Social Development of the Russian Federation, and when they are manufactured by pharmacy organizations according to individual recipes and the requirements of medical organizations - recipes and requirements certified in the prescribed manner.

The commented article provides for the exclusion from the list of excisable goods of alcohol-containing medicines dispensed not only according to individual prescriptions, but also according to the requirements of medical organizations.

It should be borne in mind that one of the conditions for the exemption of alcohol-containing medicines from excise taxes is the sale of these products by the organizations producing them in containers that meet the requirements of state standards of medicines (pharmacopoeial articles), approved by the authorized federal executive body. If the medicine is made according to an individual prescription, then it must be poured into the container prescribed by the doctor's prescription.

According to Article 17 of the Federal Law of June 22, 1998 N 86-FZ “On Medicines,” the manufacture of medicines in a pharmacy is carried out according to doctors’ prescriptions based on medicines registered in Russia. In accordance with Article 19 of Law No. 86-FZ, medicines manufactured in pharmacies according to doctors' prescriptions are not subject to state registration. Pharmacies are obliged to sell medicines only in quantities necessary to fulfill medical prescriptions (Article 32 of Law No. 86-FZ). Consequently, in the case of the manufacture of medicinal and therapeutic and prophylactic products (including homeopathic drugs) by pharmacies, in order to recognize these products as non-excise goods, recipes and requirements of medical organizations must contain data on the dosage of the drug and be certified in the prescribed manner. At the same time, taking into account the specifics of the manufacture of alcohol-containing medicines according to individual recipes and the requirements of medical organizations, the requirement of bottling them in containers determined by pharmacopoeial articles does not apply to the conditions for the exemption of these drugs from excise taxes.

The production of alcohol-containing medicines according to pharmacopoeial articles included in the State Register of Medicines is carried out only by organizations that have licenses for the production of medicines, in accordance with quotas for the purchase of ethyl alcohol issued by the Ministry of Health and Social Development of the Russian Federation. This is established in the Decree of the Government of the Russian Federation of August 27, 1999 N 967 “On the production and circulation of alcohol-containing medicines and perfumery and cosmetic products (products).”

Veterinary drugs

Veterinary drugs that have undergone state registration with the authorized federal executive body and are included in the State Register of Registered Veterinary Drugs developed for use in animal husbandry on the territory of the Russian Federation are not subject to excise taxes.

Thus, in order to be exempt from excise taxes, these products must be registered with the Ministry of Agriculture and Food of the Russian Federation and entered into the State Register of Registered Veterinary Drugs developed for use in livestock farming on the territory of the Russian Federation. Veterinary drugs are not excisable goods only if they are bottled in containers of no more than 100 ml.

Perfume and cosmetic products

Perfume and cosmetic products that have undergone state registration with the authorized federal executive body, which since October 1, 1999, in accordance with the above-mentioned Decree of the Government of the Russian Federation of August 27, 1999 N 967, is not subject to excise taxes.

Thus, in order to receive excise tax benefits on alcohol-containing perfumery and cosmetic products, the taxpayer must submit to the tax authorities a registration certificate issued by the Ministry of Health and Social Development of the Russian Federation, which must indicate that the product is classified as an alcohol-containing perfumery and cosmetic product.

Please note: From January 1, 2006, in order to recognize alcohol-containing perfumery and cosmetic products as non-excisable goods, they must be bottled in containers of no more than 100 ml (until 2006 - no more than 270 ml). The corresponding amendment was introduced by Federal Law No. 86-FZ of July 28, 2004 “On Amendments to Chapter 22 of Part Two of the Tax Code of the Russian Federation.”

In addition, according to Federal Law No. 107-FZ of July 21, 2005, from January 1, 2006, perfume and cosmetic products in metal aerosol packaging are not excisable goods.

Federal Law No. 134-FZ of July 26, 2006 introduced significant changes to the procedure for calculating and paying excise taxes. From January 1, 2007, household chemical goods in metal aerosol packaging and perfumery and cosmetic products in metal aerosol packaging will be recognized as excisable.

As for perfumery and cosmetic products in other packaging, they will continue to be exempt from excise taxes, but the conditions under which this exemption is granted have changed. Such products should contain no more than 90% alcohol (inclusive) if there is a spray bottle on the bottle (i.e., in practice, it should also be an aerosol package). At the same time, the requirement for state registration of these products and that they must be bottled in containers of no more than 100 ml remains.

Alcohol-containing waste

Waste generated during the production of ethyl alcohol from food raw materials, vodka, alcoholic beverages, subject to further processing and (or) use for technical purposes is not subject to excise taxes. The specified waste must comply with regulatory documentation approved (agreed upon) by the federal executive body, and must be included in the State Register of Ethyl Alcohol from Food Raw Materials, Alcohol and Alcohol-Containing Products in the Russian Federation.

Thus, alcohol-containing waste is exempt from excise taxes, subject to the following conditions:

- 1) there is a state registration certificate;

- 2) products are sent for further processing or used for technical purposes.

The organization and conduct of state registration of alcohol-containing waste generated during the production of ethyl alcohol from food raw materials, vodka, alcoholic beverages and subject to further processing or use for technical purposes is entrusted to the Ministry of Agriculture and Food of the Russian Federation.

In some cases, alcohol-containing waste is not used for processing, is not sold, but is sent for destruction. Should excise tax be charged in this case? To answer this question, remember that waste disposal is not recognized as an operation subject to excise taxes. Consequently, when destroying alcohol production waste, excise taxes are not charged.

Household chemicals in aerosol packaging

Household chemicals in aerosol packaging are not subject to excise taxes. In accordance with the amendments made to the commented article by Federal Law No. 57-FZ of May 29, 2002 “On introducing amendments and additions to part two of the Tax Code of the Russian Federation and to certain legislative acts of the Russian Federation”, from January 1, 2002 from payment Only those household chemicals packaged in metal aerosol packaging are exempt from excise taxes.

Alcohol products

According to subparagraph 3 of paragraph 1 of Article 181 of the Tax Code of the Russian Federation, excisable goods are alcoholic products, which include drinking alcohol, vodka, alcoholic beverages, cognacs, wine and other food products with a volume fraction of ethyl alcohol of more than 1.5%.

Wine materials, in accordance with the Tax Code of the Russian Federation, are not included in the list of excisable goods. Consequently, excise taxes are not charged on them.

Cars and motorcycles

In accordance with subparagraph 6 of paragraph 1 of Article 181 of the Tax Code of the Russian Federation, the list of excisable goods includes passenger cars and motorcycles with an engine power exceeding 112.5 kW.

The classification of motor vehicles used for the transport of passengers is regulated by GOST R 52051-2003 “Motor vehicles and trailers. Classification and definitions".

According to the specified GOST, vehicles used to transport passengers and having, in addition to the driver’s seat, no more than eight seats, belong to passenger cars (category M1). If there are more than eight such seats, these vehicles are classified as buses (category M2, M3).

Based on the above, if vehicles (in particular, minibuses) have no more than eight passenger seats, they are recognized as excisable goods. If there are more than eight passenger seats, the vehicle is not subject to excise tax.

Straight-run gasoline

Paragraph 4 of Article 1 of the Federal Law of July 24, 2002 N 110-FZ “On introducing amendments and additions to part two of the Tax Code of the Russian Federation and some other acts of legislation of the Russian Federation”, which came into force on January 1, 2003, lists excisable goods was supplemented with straight-run gasoline.

The inclusion of straight-run gasoline in the list of excisable goods to a certain extent helps to solve the problem of its use for the purpose of illegal production of excisable petroleum products. As is known, the technology for the production of motor gasoline makes it possible to obtain it not only by processing petroleum products at an oil refinery, but also by mixing straight-run gasoline with the necessary chemical additives in railway tanks, in fuel trucks, and directly in the storage facilities of gas stations. Volumes of gasoline obtained by mixing were in most cases exempt from excise taxation, since straight-run gasoline was not subject to excise tax, was exported from factories, and after the above technological operation was sold as high-octane gasoline.

For the purposes of Chapter 22 of the Tax Code of the Russian Federation, straight-run gasoline means gasoline fractions obtained from the refining of oil, gas condensate, associated petroleum gas, natural gas, oil shale, coal and other raw materials, as well as products of their processing, with the exception of motor gasoline and products petrochemicals. The gasoline fraction is a mixture of hydrocarbons boiling in the temperature range from 30 to 215 degrees. C at atmospheric pressure 760 mmHg. Art.

The inclusion of straight-run gasoline in the list of excisable goods means that taxpayers are required to submit excise tax declarations to the tax authorities indicating the volumes received in physical terms. Until January 1, 2005, excise taxes were not charged on these volumes, since Article 193 of the Tax Code of the Russian Federation established a zero excise tax rate for straight-run gasoline.

Federal Law N 107-FZ changed the situation. In order to eliminate the interest of persons in the unlawful application of the zero rate in order to evade paying excise duty on motor gasoline, from January 1, 2006, the excise tax rate on straight-run gasoline is established in the amount of 2,657 rubles. per ton.

How to determine excise tax rates on excisable goods

Every year there is a review and establishment of new values. Typically, such operations are carried out 2-3 years in advance so that manufacturers can plan their cash and commodity turnover. There are usually three types of bets:

- Specific, they are hard. They are distinguished by a fixed markup for each unit of delivery. They are installed most often and currently apply to all types of products except tobacco. For example, in 2022 in Russia one liter of sparkling wine must be paid additionally at the rate of 40 rubles.

- Ad valorem. They vary, depend on the price of the product itself, and are calculated as a percentage. Now they are actually not used.

- Combined. From the name it is clear that they include both accrual systems. This happens, for example, with cigarettes. There is a single rate (at the moment it is 1966 rubles for every thousand cigarettes), in addition to this, 14.5% of the price of the pack is charged. It is for this reason that prices for cheap tobacco itself are so high.

How to calculate excise taxes on a list of excisable products

The calculation procedure is quite simple. It is necessary to determine the tax base and then multiply it by the rate. If it is solid and fixed, then there will be no difficulties. In the case of combined calculations, the percentage cost markup will additionally need to be summed up.

The basic rule is separate accounting of all items, for example, in alcohol production it is necessary to separately count how many liters of sparkling wine and how many liters of liqueur were produced and sold. If you consider the entire displacement as one line, you will have to multiply it by the highest rate.

The tax base is calculated monthly. If we are talking about the types of excisable goods sold that are related to the mandatory labeling system, then the production volume can be calculated based on the records in the Unified State Automated Information System (EGAIS) system. Accordingly, it is in the interests of the manufacturer that actual supplies correspond to those recorded.

The buyer sees in a separate line how much he is forced to deduct as part of this tax, as well as the amount of VAT. All this is recorded in invoices (if for some reason there is no excise tax, this must be noted in the appropriate line), but during retail sales a separate amount is not taken out of the total price.

UrDela.ru

Part 1. The following are recognized as excisable goods:

1) ethyl alcohol from all types of raw materials, with the exception of cognac alcohol;

2) alcohol-containing products (solutions, emulsions, suspensions and other types of products in liquid form) with a volume fraction of ethyl alcohol of more than 9 percent.

For the purposes of this chapter, the following goods are not considered excisable goods:

medicinal, therapeutic and prophylactic, diagnostic products that have passed state registration with the authorized federal executive body and included in the State Register of Medicines and Medical Products, medicinal, therapeutic and prophylactic products (including homeopathic drugs), manufactured by pharmacies according to individual recipes and requirements medical organizations, poured into containers in accordance with the requirements of state standards of medicines (pharmacopoeial monographs), approved by the authorized federal executive body;

veterinary drugs that have passed state registration with the authorized federal executive body and are included in the State Register of Registered Veterinary Drugs developed for use in animal husbandry on the territory of the Russian Federation, bottled in containers of no more than 100 ml;

perfumery and cosmetic products bottled in containers of no more than 100 ml with a volume fraction of ethyl alcohol up to 80 percent inclusive and (or) perfumery and cosmetic products with a volume fraction of ethyl alcohol up to 90 percent inclusive with a spray bottle on the bottle, bottled in containers no more than 100 ml ;

wastes subject to further processing and (or) use for technical purposes, generated during the production of ethyl alcohol from food raw materials, vodka, liqueurs, complying with regulatory documentation approved (agreed upon) by the federal executive body;

paragraphs seven through eight are no longer in force on January 1, 2007. — Federal Law of July 26, 2006 N 134-FZ;

3) alcoholic products;

4) beer;

5) tobacco products;

6) excluded. — Federal Law of July 24, 2002 N 110-FZ.

6) passenger cars and motorcycles with an engine power exceeding 112.5 kW (150 hp);

7) motor gasoline;

diesel fuel;

9) motor oils for diesel and (or) carburetor (injection) engines;

10) straight-run gasoline. For the purposes of this chapter, straight-run gasoline refers to gasoline fractions obtained from the refining of oil, gas condensate, associated petroleum gas, natural gas, oil shale, coal and other raw materials, as well as products of their processing, with the exception of motor gasoline and petrochemical products.

For the purposes of this article, the gasoline fraction is a mixture of hydrocarbons boiling in the temperature range from 30 to 215 degrees. C at an atmospheric pressure of 760 millimeters of mercury.

Part 2. Lost force.

— Federal Law of July 7, 2003 N 117-FZ. ‹ Article 180 (Tax Code of the Russian Federation). Peculiarities of fulfilling the taxpayer's obligations under a simple partnership agreement (joint activity agreement) Up Article 182 (Tax Code of the Russian Federation). Object of taxation ›

How to choose and input excise taxes on excisable goods

In a normal batch purchase situation, the tax amount should be included in the wholesale cost of the product. If excise raw materials were used for the production of another, secondary product, then the costs for it were included in expenses, which means that the amount of costs can be reduced. Under conditions:

- the tax base for raw materials and the final result must be of a single volume;

- First, you should actually pay the tax in full, and then take advantage of the tax deduction opportunity;

- You will need official documentary evidence of transactions - invoices, customs declarations and other documents.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

When to make transfers to the budget

The deadline for filing reports and payments is the 25th day of the calendar month following the day when the transactions were carried out. An exception is the distillation of gasoline and the denaturation of ethyl alcohol; for them, the reference date is the 25th date following within three months after the given tax period.

Another feature concerns producers of alcoholic beverages. They are required to split payments and make an advance payment no later than the 15th. Subsequently, the payment can be deducted. For those who have a bank guarantee confirming that in case of non-payment, the bank undertakes to transfer payment, an exemption is provided.

Ethanol

Now, in a nutshell, we will tell you why the following goods are excisable if they contain ethanol.

Concept

The definition of the term is given in Federal Law No. 171. This is a substance with the formula C2H5OH, made from natural or synthetic raw materials, including raw alcohol and denatured alcohol. When assigning a liquid to this category, the criteria listed in the relevant regulatory documents - GOST, OST, TU - are taken into account.

Kinds

The classification of dozens of varieties is based on:

- raw material;

- forcing method;

- cleaning depth;

- the presence of harmful impurities or additives, their concentration.

Which of the following is subject to excise tax?

All presented varieties, excluding cognac spirit, are subject to excise taxation. This was enshrined in a 2007 decree. At the same time, a single rate was fixed - 23.5 rubles per 1 liter.

Article 181. Excise goods

Article 181. Excise goods

[Tax Code] [Tax Code of the Russian Federation, Part 2] [Section VIII] [Chapter 22]

. The following are recognized as excisable goods:

- 1) ethyl alcohol produced from food or non-food raw materials, including denatured ethyl alcohol, raw alcohol, distillates provided for by legislation on state regulation of the production and circulation of ethyl alcohol, alcoholic and alcohol-containing products and on limiting the consumption (drinking) of alcoholic products ( hereinafter also in this chapter - ethyl alcohol);

- 1.1) became invalid on July 1, 2012. — Federal Law of November 28, 2011 N 338-FZ;

- 2) alcohol-containing products (solutions, emulsions, suspensions and other types of products in liquid form) with a volume fraction of ethyl alcohol of more than 9 percent, with the exception of alcoholic products specified in subparagraph 3 of this paragraph, wine materials, grape must, fruit must. For the purposes of this chapter, the following goods are not considered excisable goods:

- medicines that have undergone state registration with the authorized federal executive body and entered and (or) included in the State Register of Medicines, medicines for medical use in order to form a common market for medicines within the Eurasian Economic Union, information about which is contained in a single register registered medicinal products of the Eurasian Economic Union;

- medicines (including homeopathic medicines) manufactured by pharmacy organizations according to prescriptions for medicines and the requirements of medical organizations, bottled in containers in accordance with the requirements of regulatory documentation agreed upon by the authorized federal executive body;

- alcohol-containing perfume and cosmetic products in metal aerosol packaging;

- alcohol-containing household chemical products in metal aerosol packaging;

- alcohol-containing perfumery and cosmetic products in small containers;

- veterinary drugs that have passed state registration with the authorized federal executive body and are included in the State Register of Registered Veterinary Drugs developed for use in animal husbandry on the territory of the Russian Federation, bottled in containers of no more than 100 ml;

- wastes subject to further processing and (or) use for technical purposes, generated during the production of ethyl alcohol from food raw materials, vodka, liqueurs, complying with regulatory documentation approved (agreed upon) by the federal executive body;

- beer wort;

6) passenger cars;

6.1) motorcycles with an engine power exceeding 112.5 kW (150 hp);

7) motor gasoline;

diesel fuel;

9) motor oils for diesel and (or) carburetor (injection) engines;

10) straight-run gasoline. For the purposes of this chapter, straight-run gasoline is defined as gasoline fractions, with the exception of motor gasoline, aviation kerosene, and acrylates, obtained as a result of:

- distillation (fractionation) of oil, gas condensate, associated petroleum gas, natural gas;

- processing (chemical transformations) of oil shale, coal, oil fractions, gas condensate fractions, associated petroleum gas, natural gas.

For the purposes of this chapter, the gasoline fraction is recognized as a mixture of hydrocarbons in a liquid state (at a temperature of 15 or 20 degrees Celsius and a pressure of 760 millimeters of mercury), simultaneously corresponding to the following physical and chemical characteristics:

- density not less than 650 kg/m3 and not more than 749 kg/m3 at a temperature of 15 or 20 degrees Celsius;

- the value of the temperature at which at least 90 percent of the mixture is distilled by volume (pressure 760 millimeters of mercury) does not exceed 215 degrees Celsius.

At the same time, for the purposes of this chapter, the following types of fractions are not recognized as gasoline fraction:

- fraction obtained as a result of alkylation (oligomerization) of hydrocarbon gases;

- a fraction in which the mass fraction of methyl tert-butyl ether and (or) other ethers and (or) alcohols is at least 85 percent;

- the fraction obtained as a result of the oxidation and esterification of olefins, aromatic hydrocarbons, alcohols, aldehydes, ketones, carboxylic acids;

- fraction obtained as a result of hydrogenation, hydration and dehydrogenation of alcohols, aldehydes, ketones, carboxylic acids;

- fraction, the mass fraction of benzene and (or) toluene and (or) xylene (including paraxylene and orthoxylene) in which is at least 85 percent;

- a fraction in which the mass fraction of pentane and (or) isopentane is at least 85 percent;

- a fraction in which the mass fraction of alphamethylstyrene is at least 95 percent;

- a fraction in which the mass fraction of isoprene is at least 85 percent;

- 11) middle distillates. For the purposes of this chapter, middle distillates are mixtures of hydrocarbons in liquid or solid state (at a temperature of 20 degrees Celsius and an atmospheric pressure of 760 millimeters of mercury), obtained as a result of primary and (or) secondary processing of oil, gas condensate, associated petroleum gas, oil shale , the density indicator values of which do not exceed 1015 kg/m3 at a temperature of 20 degrees Celsius, with the exception of:

- straight-run gasoline;

- cyclohexane;

- motor gasoline;

- the factions specified in paragraphs eight through fifteen of subclause 10 of this clause;

- aviation kerosene, Jet-A1 aviation kerosene;

- diesel fuel;

- high-viscosity products, including motor oils for diesel and (or) carburetor (injection) engines;

- petrochemical products obtained in the processes of chemical transformations occurring at temperatures above 700 degrees Celsius (according to the technological documentation for the technological equipment through which chemical transformations are carried out), dehydrogenation, alkylation, oxidation, hydration, esterification;

- gas condensate, a mixture of gas condensate with oil, directly obtained using technological processes of deethanization and (or) stabilization and (or) fractionation (subject to the combination of the fractionation process with the process of deethanization and (or) stabilization);

- oil;

- bitumen, asphalt, coke, carbon black, sulfur;

- other products that are a mixture of hydrocarbons in a liquid state (at a temperature of 20 degrees Celsius and an atmospheric pressure of 760 millimeters of mercury), containing more than 30 percent of aromatic, unsaturated and (or) oxygen-containing compounds.

For the purposes of this chapter, high-viscosity products are mixtures of hydrocarbons in liquid or solid state (at a temperature of 20 degrees Celsius and an atmospheric pressure of 760 millimeters of mercury) obtained as a result of the use of at least one of the following technological processes:

- catalytic dewaxing;

- hydroisodewaxing;

- dewaxing with selective solvents;

- deasphalting with propane;

- selective purification;

- deoiling of paraffins.

For the purposes of this subclause, mixtures of highly viscous products with non-excisable goods are recognized as highly viscous products.

In this case, such mixtures of hydrocarbons, their mixtures with non-excisable goods must correspond to one or more of the following physical and chemical characteristics:

- kinematic viscosity at a temperature of 100 degrees Celsius is 2.2 centistokes or more;

- the flash point in an open crucible is more than 80 degrees Celsius and the pour point does not exceed minus 35 degrees Celsius.

Petroleum raw materials, when performing operations with which at least one of the following conditions are met, are not classified as middle distillates:

- petroleum raw materials are sold (transferred) by an organization that is a user of subsoil resources, provided that such petroleum raw materials are obtained from a mineral extracted by an organization that is a user of subsoil resources;

- petroleum raw materials obtained as a result of processing petroleum raw materials are subsequently sold (transferred) by the organization that owns the processed petroleum raw materials, which has a certificate of registration of the person carrying out operations for processing petroleum raw materials, mixed with petroleum raw materials that are extracted minerals for such an organization, and (or) with petroleum raw materials purchased by such an organization from subsoil user organizations for which such petroleum raw materials are extracted minerals, provided that the specified mixture is transported by a main pipeline;

- petroleum raw materials are sold (transferred) by one organization that has a registration certificate of a person performing operations on processing petroleum raw materials, to another organization that has the specified certificate and (or) a certificate of registration of a person performing operations on processing middle distillates, subject to further processing of such raw materials specified by another organization, including on the basis of an agreement on the provision of oil processing services to it;

- petroleum raw materials when they are sent for processing by an organization that has a certificate of registration of a person performing operations on processing petroleum raw materials at production facilities owned by such an organization or an organization that directly provides such an organization with services for the processing of petroleum raw materials, including on the basis of a contract for the provision its services for the processing of petroleum raw materials;

- petroleum raw materials upon receipt (receipt) by an organization that has a certificate of registration of a person performing operations for processing middle distillates, and (or) a certificate of registration of a person performing operations for processing petroleum raw materials, in the event of its further processing by the specified organization, including on the basis of an agreement on the provision of services for the processing of petroleum raw materials;

- 12) benzene, paraxylene, orthoxylene.

For the purposes of this chapter, benzene is a liquid with a content (by weight) of the corresponding simplest aromatic hydrocarbon of 99 percent.

For the purposes of this chapter, paraxylene or orthoxylene is a liquid containing (by weight) the corresponding xylene isomer (dimethylbenzene) 95 percent;

13) aviation kerosene.

For the purposes of this chapter, aviation kerosene is recognized as liquid fuels used in aircraft engines that comply with the requirements of the legislation of the Russian Federation on technical regulation and (or) international treaties of the Russian Federation, as well as mixtures of such fuels;

13.1) petroleum feedstock.

For the purposes of this chapter, petroleum feedstock is a mixture of hydrocarbons consisting of one component or several of the following components:

- oil;

- gas condensate is stable;

- vacuum gas oil (at a temperature of 20 degrees Celsius and a pressure of 760 millimeters of mercury with a density of more than 845 kg/m3 and with a kinematic viscosity at a temperature of 80 degrees Celsius of more than 3 centistokes);

- tar (at a temperature of 20 degrees Celsius and a pressure of 760 millimeters of mercury with a density of more than 930 kg/m3);

- fuel oil;

- 13.2) is no longer in force on April 1, 2022. — Federal Law of July 30, 2019 N 255-FZ;

- 14) natural gas (in cases provided for by international treaties of the Russian Federation);

- 15) electronic nicotine delivery systems, devices for heating tobacco. For purposes of this chapter, electronic nicotine delivery systems are defined as electronic devices used to convert electronic nicotine delivery system liquid into an aerosol (vapor) inhaled by the consumer. For the purposes of this chapter, tobacco heating devices are electronic devices used to generate tobacco vapor inhaled by the consumer by heating tobacco without burning or smoldering;

- 16) liquids for electronic nicotine delivery systems. For the purposes of this chapter, liquid for electronic nicotine delivery systems is any liquid containing liquid nicotine in a volume of 0.1 mg/ml or more, intended for use in electronic nicotine delivery systems;

- 17) tobacco (tobacco products) intended for consumption by heating;

- 18) grapes. For the purposes of this chapter, excisable grapes are those used for the production of wine, sparkling wine (champagne), liqueur wine with a protected geographical indication, with a protected designation of origin (special wine), wine materials, grape must or for the production of alcoholic beverages, including processing grapes, the variety or mixture of varieties of which is determined by the technical documents for their production, fractional distillation of the resulting wine materials and their aging (at least three years) in oak barrels or oak bottles or in contact with oak wood until the properties determined by the specified technical documents are achieved (hereinafter referred to as alcoholic beverages) drinks produced using full cycle technology).