Rarely does the economic activity of an organization stand still. Accounting items do not remain completely unchanged, with the exception of goods, which in most cases are resold in the same form. Fixed assets also change: buildings are rebuilt and repaired, computers are updated, equipment is improved.

There are several types of OS conversions, in particular:

- Various types of repairs.

- Retrofitting (completion).

- Reconstruction.

- Modernization.

In this article we will look at two types that often cause confusion: modernization and reconstruction. Russian legislation traditionally does not contain uniform and specific concepts. Different documents give different definitions. For tax accounting purposes, those given in Article 257 of the Tax Code are used. For BU, you can use the data from PBU 6/01 and Methodological Instructions (links in the article test).

Work that changes the technological and service purpose of the OS, leading to the emergence of new qualities of the object, is classified as modernization .

Reconstruction is a change, reorganization of existing facilities associated with the improvement of production, increasing its performance, it is carried out on the basis of a project drawn up in order to increase capacity, improve the quality of products, etc.

In fact, in practice it is difficult to distinguish between these two types of changes and simple repairs. It is often more profitable for an organization to accept expenses as current (i.e., repairs), so it is important how the documentation is drawn up and what exactly is indicated in it. For example, the type of work can be determined even by the estimate, in which prices are indicated according to special collections. The key ones are design and technical documentation, instructions for equipment, etc. The most accurate is a project that will indicate a specific type of work. And yet, from an accounting point of view, the boundaries remain fluid.

To make it easier to understand, during modernization the object changes in a qualitative sense, its characteristics are improved and improved. For example, installing a new hard drive in a system unit owned by an accountant instead of the old one is a repair. If an additional hard drive is installed (memory is significantly increased) or a more powerful video card to make it possible to work in a special graphics program on the computer, then the PC is being upgraded.

By the way! Modernization is a type of reconstruction. To accurately determine the type of work, it is recommended to use - Regulations MDS 13-14.2000, construction standards VSN No. 58-88 (R), Letter of the Ministry of Finance of the USSR No. 80 dated 05.29.84, definitions given in paragraphs. 14 – 14.3 of Article 1 of the Town Planning Code and other similar documents.

Reconstruction is easier to explain using a building as an example. It is generally accepted that it affects load-bearing structures. Let's say there is a warehouse that you decide to convert into offices. Conduct full communications into it - water supply, sewerage, expand the electrical network, install ventilation, change the roof, install stairs and, perhaps, even install a new ceiling inside and build an additional floor for administrative offices, which means you are performing a reconstruction. If you just tidy up the floor, cover the walls with plasterboard, hang wallpaper, install electrical converters, you will get a renovation. Because, despite the change in the purpose of the premises, there was no major reconstruction.

Accounting

Most often, the decision on reconstruction and modernization is made on the basis of expert assessments (engineers, designers, builders, adjusters, etc. specialists) and acts of the relevant commission. It can be created by the enterprise itself or come from outside - as inspectors, for example, the parent organization or representatives of the supervisory authority.

In accounting, when reconstructing an operating system, the costs for it are collected in account 08 in a separate subaccount; programs may provide a ready-made subaccount or you will have to install it (let’s denote it as number 9 for convenience). The postings will look like this - Debit everywhere 08.9, on credit:

- 10 – materials have been transferred from the warehouse; you will need to issue invoice requirements and write-off acts.

- 70, 69 – wages and contributions from them for workers carrying out reconstruction (for self-financing), supporting documents – timesheets, work orders, payslips, accounting certificates.

- 23 – costs of auxiliary production (transport workshop, production of spare parts and mechanisms), internal documentation – orders, requirements, invoices for the release of materials to third parties.

- 25 – general production expenses (security, wages of the foreman of workers, if they are employed in different jobs, etc.).

- 26 – managerial (salary of manager, chief engineer, designer).

- 60, 76 – payment for services and work of third-party workers and organizations (contractors under GPC agreements, experts, consultants, lawyers, other specialists, carriers) – contracts, acts, consignment notes, invoices. The VAT amount is not included in the costs.

- 66, 67 – interest on a loan received for reconstruction is taken into account until the completion of the work performed and the putting into operation of the reconstructed building or other facility or from the moment the actual operation of the OS begins.

After all costs are grouped on account 08 and the OS is ready for further use, you can apply two options for accounting for the changes made:

- We take into account costs separately (in fact, as an independent object) on account 01. This possibility is provided for in paragraph 42 of section 3 of Methodological Recommendations No. 91n.

- We include expenses in the cost of the OS, increasing the initial cost established upon purchase or creation (the same paragraph 42 and paragraph 27 of section 4 of PBU 6/01).

The method must be prescribed in internal local regulations (primarily accounting policies). It is determined depending on the influence on the change in indicators that were initially accepted as the norm during creation (purchase) - power, class, SPI, etc.

Accounting for significant costs of repairing fixed assets of RSO

08.09.2021

The resource supplying organization at OSNO has been applying FAS 6/2020 “Fixed Assets” and FAS 26/2020 “Capital Investments” from 01/01/2021. According to clause 10 of FSBU 6/2020, independent inventory items also recognize the significant costs of an organization for repairs, technical inspection, and maintenance of fixed assets, with a frequency of more than 12 months or more than the usual operating cycle exceeding 12 months. These objects are depreciated in accounting. Does RSO have the right in accounting for the cost of a major overhaul, if the amount of costs is significant, to increase the initial cost of a repaired fixed asset item without identifying these costs as an independent fixed asset item? How are significant costs incurred in connection with capital repairs of fixed assets taken into account by RSO when calculating income tax? Are there any differences between accounting and tax accounting?

Accounting

OS repair - capital investment

In accordance with clause 5 of FSBU 26/2020

in accounting, an organization's expenses for the acquisition, creation, improvement and (or) restoration of fixed assets are recognized as capital investments. Capital investments include, in particular, costs for improving and (or) restoring an asset (for example, completion, additional equipment, modernization, reconstruction, replacement of parts, repairs, technical inspections, maintenance).

Capital investments are recognized in accounting if the following conditions are simultaneously met, listed in clause 6 of FAS 26/2020

:

– the costs incurred will ensure that the commercial organization receives future economic benefits for a period of more than 12 months or a normal operating cycle of more than 12 months; – the amount of costs incurred or an amount equivalent to it is determined.

Capital investments are recognized in accounting if the specified conditions are met, regardless of whether they were made during the initial acquisition, creation of fixed assets or during their subsequent improvement and (or) restoration.

The amount of actual costs when recognizing capital investments includes, among other things, costs for maintaining the operability or serviceability of assets used in making capital investments, routine repairs of these assets ( clause “g” clause 10 of FAS 26/2020

).

Based on clause 16 of FSBU 26/2020

capital investments do not include:

– costs for maintaining the operability or serviceability of the OS, their current repair (except for the case specified in paragraph “d”, paragraph 10

standard) (

paragraph “b”

);

– costs for unscheduled repairs of fixed assets caused by breakdowns, accidents, defects, improper operation, to the extent that such repairs restore the standard performance indicators of fixed assets, including useful life, but do not improve or extend them ( paragraphs "V"

).

Capital investments upon their completion, that is, after bringing the object of capital investments to a state and location in which it is suitable for use for the planned purposes, are considered fixed assets ( clause 18 of FSBU 26/2020

).

OS recognition

By virtue of clause 24 of FSBU 6/2020

the initial cost of a fixed asset item increases by the amount of capital investments associated with the improvement and (or) restoration of this object at the time of completion of such capital investments.

At the same time, according to the norm of clause 10 of FSBU 6/2020

The unit of accounting for fixed assets is an inventory item. An inventory item of fixed assets is recognized as:

– or OS object with all devices and accessories; – or a separate structurally isolated object intended to perform certain independent functions; - or a separate complex of structurally articulated objects that constitute a single whole and are intended to perform a specific job.

If one asset has several parts, the cost and useful life of which differ significantly from the cost and technical information of the object as a whole, each such part is recognized as an independent inventory item. Independent inventory items are also recognized as the significant costs of the organization for repairs, technical inspection, and maintenance of fixed assets with a frequency of more than 12 months or more than the usual operating cycle exceeding 12 months.

The organization independently sets the criterion for determining the significance of the amount of costs when carrying out repairs, technical inspection, and maintenance of fixed assets in its accounting policies.

Specialists of the Foundation "NRBU "BMC" in Recommendation R-51/2014 OK MASH "Costs for major repairs of fixed assets", adopted on August 19, 2014, indicated that the level of materiality can be established:

– as a percentage of the cost of major repairs to the original cost of the fixed asset being repaired; – as a percentage of the cost of major repairs to the initial or residual (book) value of the corresponding group of fixed assets; – in the form of a cost criterion determined for a homogeneous group of fixed assets.

Conclusion

We believe that if, at the time of completion of a major overhaul of a fixed asset (the costs of which are significant), the period between repairs does not differ significantly from the remaining useful life of the repaired asset, then the initial cost of this object can be increased by the repair costs.

If the remaining useful life of the repaired asset and the period between repairs differ significantly, then an independent asset should be reflected in the accounting records, the initial cost of which will be the cost of major repairs. The SPI of such an object can be set equal to the overhaul period (see also Recommendations for audit organizations, individual auditors, auditors for conducting an audit of the annual financial statements of organizations for 2012

, given as an appendix to

the Letter of the Ministry of Finance of the Russian Federation dated 01/09/2013 No. 07-02-18/01

).

Income tax

According to paragraph 2 of Art. 257 Tax Code of the Russian Federation

For profit tax purposes, the initial cost of fixed assets changes in cases of completion, additional equipment, reconstruction, modernization, technical re-equipment, partial liquidation of relevant facilities and on other similar grounds.

Costs for the repair of fixed assets and other property made by the income tax payer are considered as other expenses and are recognized for tax purposes in the reporting (tax) period in which they were incurred, in the amount of actual costs (clause 1 of Article 260 of the Tax Code RF

).

Clause 1 of Art. 324 Tax Code of the Russian Federation

In analytical accounting, the taxpayer forms the amount of expenses for the repair of fixed assets, taking into account:

1) grouping of all expenses incurred, including:

– cost of spare parts and consumables used for repairs; – expenses for remuneration of workers carrying out repairs; – other expenses associated with carrying out the specified repairs on our own;

2) costs of paying for work performed by third parties.

It turns out that the costs arising in connection with the repair of fixed assets include, among other things, the cost of spare parts.

When applying the accrual method, costs for repairs of fixed assets are recognized as expenses in the reporting period in which they were incurred, regardless of their payment, taking into account the features provided for in Art. 260 Tax Code of the Russian Federation

(

clause 5 art. 272 Tax Code of the Russian Federation

).

Costs for the repair of fixed assets are, as a rule, indirect expenses, therefore they are fully included in the expenses of the current reporting (tax) period ( Article 318 of the Tax Code of the Russian Federation

,

Letter of the Ministry of Finance of the Russian Federation dated May 4, 2012 No. 03-03-06/1/223

).

In accordance with paragraph 3 of Art. 260 Tax Code of the Russian Federation

To ensure, over two tax periods, and a more even inclusion of expenses for repairs of fixed assets, taxpayers have the right to create reserves for upcoming repairs of fixed assets in the manner established by

Art.

324 Tax Code of the Russian Federation .

For your information:

the possibility of creating reserves for upcoming repairs of fixed assets is not an obligation, but a right of the organization.

The taxpayer independently determines in the accounting policy the method of accounting for profit tax purposes for expenses for the repair of fixed assets ( Letter of the Ministry of Finance of the Russian Federation dated October 19, 2012 No. 03-03-06/4/104

).

Thus, for profit tax purposes, the procedure for accounting for expenses for the repair of fixed assets differs from the procedure for accounting for expenses for the completion, retrofitting, reconstruction, modernization and technical re-equipment of fixed assets, which increase the initial cost of the fixed asset and are subject to write-off for tax purposes through the depreciation mechanism in accordance with Art. 256 – 259.3 Tax Code of the Russian Federation

.

Officials emphasize: attributing the organization's expenses to expenses for repairs or reconstruction, modernization, technical re-equipment must be carried out in accordance with the norms of the Tax Code (see letters of the Federal Tax Service of the Russian Federation dated February 12, 2021 No. SD-4-3/1777

,

Ministry of Finance of the Russian Federation dated June 27, 2018 No. 03-03-06/1/44329

,

dated October 6, 2017 No. 03-03-06/1/65431

).

So, the costs of repairing fixed assets (including the costs of major repairs - Letter of the Ministry of Finance of the Russian Federation dated September 4, 2018 No. 03-03-06/1/63046

) are taken into account for profit tax purposes in accordance with

Art.

260 Tax Code of the Russian Federation .

If an organization does not create a reserve in tax accounting for upcoming repairs of fixed assets, costs incurred in connection with repairs of fixed assets, including capital ones, are included in other expenses in the period of their implementation (if the accrual method is used). For example, expenses in the form of the cost of spare parts used in OS repairs are recognized for profit tax purposes as they are released for repairs ( Letter of the Federal Tax Service of the Russian Federation dated April 2, 2018 No. SD-4-3/

[email protected] ). The fact that the costs of major repairs of operating systems may be significant does not change the established procedure for their accounting for profit tax purposes.

At the same time, it is important not to confuse the overhaul of operating systems with their reconstruction, modernization, technical re-equipment - from the point of view of taxation (as well as accounting), the correct classification of the work performed is important.

In paragraph 2 of Art. 257 Tax Code of the Russian Federation

The following concepts are given.

| Term | Definition |

| Work on completion, retrofitting, modernization | Work caused by a change in the technological or service purpose of equipment, a building, structure or other object of depreciable fixed assets, increased loads and (or) other new qualities |

| Reconstruction | Reconstruction of existing fixed assets associated with improving production and increasing its technical and economic indicators and carried out under the OS reconstruction project in order to increase production capacity, improve quality and change the range of products |

| Technical re-equipment | A set of measures to improve the technical and economic indicators of fixed assets or their individual parts based on the introduction of advanced equipment and technology, mechanization and automation of production, modernization and replacement of obsolete and physically worn out equipment with new, more productive ones |

Differences between accounting and tax accounting

The inclusion of costs for major repairs of fixed assets at a time at the time of their implementation as part of taxable expenses when calculating income tax and their reflection in accounting as part of capital investments with recognition as an asset means that tax and accounting data diverge. This discrepancy leads to the emergence of a taxable temporary difference in accounting and, as a consequence, a deferred tax liability (DTL) (Debit 68 (99) Credit 77). As depreciation accrues in accounting, IT will be written off (Debit 77 Credit 68 (99)).

Let us remind you: as of the reporting date, the difference between the book value of an asset or liability and its value accepted for profit tax purposes is a temporary difference ( clause 8 of PBU 18/02 “Accounting for corporate income tax calculations”

).

Taxable temporary differences lead to the formation of deferred income tax, which should increase the amount of income tax payable to the budget in the next reporting period or in subsequent reporting periods ( clause 11 of PBU 18/02

).

According to clause 15

of this document, deferred tax liability is understood as that part of the deferred income tax that should lead to an increase in income tax payable to the budget in the next reporting period or in subsequent reporting periods. Deferred tax liabilities are recognized in the reporting period in which taxable temporary differences arise.

* * *

We believe that in accounting it is possible to increase the initial cost of a repaired asset by the amount of costs for a major overhaul (when their value is significant), if the period between repairs does not differ significantly from the remaining SPI of the repaired asset. If the remaining useful life of the repaired asset and the period between repairs differ significantly, then an independent asset should be recognized in accounting, the initial cost of which will be the cost of major repairs.

If RSO, for profit tax purposes, does not create a reserve for upcoming repairs of fixed assets, expenses incurred in connection with repairs of fixed assets, including capital ones, are included in other expenses in the period of their implementation (if the accrual method is used).

Differences in accounting data (recognition of fixed assets) and tax accounting (recognition of expenses) lead to the emergence of a taxable temporary difference in the accounting records of RSO and, as a consequence, a deferred tax liability (Debit 68 (99) Credit 77).

Karavaikina E. E., expert of the information and reference system “Ayudar Info”

Send to a friend

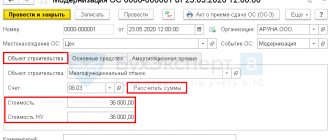

Calculation of the new depreciation rate

Depreciation is calculated almost continuously, with the exception of some cases:

- OS are preserved for a period of more than 3 months. This can also happen due to reconstruction. For example, during a large-scale reconstruction of a production building, in order not to interfere with work, or for safety reasons, the activities of part of the production or a separate workshop are suspended. Equipment is not used, vehicles are idle, etc. Management issues an order to send the OS for conservation, indicating the justification and planned period.

- The OS undergoes reconstruction (modernization) for more than 12 months. Moreover, if the object continues to be used, then the accruals do not stop. Example: a conveyor belt in a workshop is being modernized, but the production process is not suspended, the line is running.

For accounting purposes, the minimum initial cost of fixed assets is 40,000 rubles. Under normal conditions, it remains the same throughout use, but after drastic changes have been made, it must be adjusted, or rather, revised to correctly reflect depreciation.

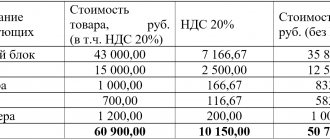

To calculate the new depreciation rate after reconstruction (modernization), you need to recalculate the cost of the fixed assets. To do this, we use the formula: NS = OS + M (P) , where OS is the residual value (as of the last date before completion of the work), and M (P) is the costs incurred. It is reasonable to take as reference the first day of the month following the completion of work.

Then we calculate the monthly depreciation rate (MRA): MRA = NS/SPI. Moreover, a new service life is taken taking into account the past period.

Example No. 1: A machine worth 360,000 rubles, its initial TPI is 36 months (3 years). Depreciation charges – 10,000 per month. It has been used for a year, after which it was decided to carry out modernization for 100,000 rubles, it lasts 1 month, as a result, the service life increases in general from 3 to 5 years. Let's calculate the new norm: 360,000 - 10,000*13 = 230,000 - residual value at the time of changes. 230000 + 100000 = 330000 - the new cost of the OS. SPI from the moment of modernization - 47 months (initial 36 months minus 13 months of use plus 24 “added”). 330000/47= 7021.28.

This option refers to the straight-line method of accounting for depreciation. As a rule, it is used most often (clause 60 of Guidelines No. 91n).

Depreciation during reconstruction

When carrying out reconstruction with a period of no more than 12 months, calculate depreciation on the fixed asset. If the reconstruction of a fixed asset takes more than 12 months, then suspend depreciation on it. In this case, resume depreciation after the reconstruction is completed. This procedure is established in paragraph 23 of PBU 6/01 and paragraph 63 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Situation: at what point in accounting should you stop and then resume depreciation on a fixed asset transferred for reconstruction for a period of more than 12 months?

For accounting purposes, the specific moment of termination and resumption of depreciation on fixed assets transferred for reconstruction for a period of more than 12 months is not established by law. Therefore, the month from which the accrual of depreciation for accounting purposes for such fixed assets stops and resumes must be established independently by the organization.

In this case, possible options could be:

- depreciation is suspended from the 1st day of the month in which the fixed asset was transferred for reconstruction. And it resumes from the 1st day of the month in which the reconstruction was completed;

- depreciation is suspended from the 1st day of the month following the month in which the fixed asset was transferred for reconstruction. And it resumes from the 1st day of the month following the month in which the reconstruction was completed.

Fix the chosen option for suspending and resuming depreciation in the organization’s accounting policies for accounting purposes.

Advice: in your accounting policy for accounting purposes, establish the same procedure for stopping and resuming depreciation on fixed assets transferred for reconstruction for a period of more than 12 months, as in tax accounting.

In this case, temporary differences will not arise in the organization’s accounting, leading to the formation of a deferred tax liability.

Features of tax accounting for depreciation

Differences in taxation relate to different systems - simplified tax system, OSNO. For the simplified system, there is a special procedure for writing off expenses (also simplified in its own way), in accordance with clauses 3 and 4 of Article 346.16 of the Tax Code of the Russian Federation. Let's consider the rules for accounting for depreciation in the tax system for the general system (they are partially applied to the simplified tax system):

- In the normal calculation of depreciation. 100% / SPI (in months) = coefficient by which the initial cost (IC) is multiplied.

- The second option is used when calculating the new norm after reconstruction. 100% / new SPI = new factor by which the updated initial cost of the fixed asset is multiplied.

Example No. 2 : Let's take the data from example No. 1, but now calculate the depreciation rate for NU purposes:

- 360000 + 100000 = 400000 new PS.

- 100% / 60 = 1,67%.

- 400000 * 1,67% = 6680.

For comparison: the original depreciation rate for tax accounting was:

- 100% / 36 = 2,78%.

- 360000 * 2,78% = 10008.

If the SPI has increased, then you need to make sure that it is not greater than the limit value in the depreciation group to which the fixed asset belongs (clause 1 of Article 258 of the Tax Code of the Russian Federation).

Note! From January 1, 2022, amendments made to the Tax Code in the fall of 2022 will apply. When the OS is re-preserved, depreciation continues to be accrued in the same order as before, but the SPI is not extended by the number of months of preservation, as was previously the case. Thus, for NU purposes, part of the cost will not be taken into account.

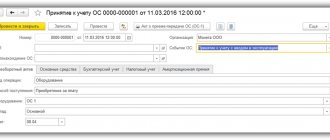

Postings for modernization and reconstruction

It is reflected as follows:

| Debit | Credit | Operation |

| 08 | 60 | The cost of modernization work by third-party organizations is reflected |

| 19 | 60 | VAT allocated |

| 68 | 19 | VAT deductible |

| 08 | 10 | Write-off of materials |

| 08 | 70 | Salary for employees who carried out the improvement |

| 08 | 69 | Insurance premiums for workers |

| 08 | 23 | Expenses of auxiliary production |

| 01 | 08 | Increased cost of OS after reconstruction |

Regulatory framework and local acts

I have already mentioned some of the documents required to carry out the work above. Throughout the organization, it is also necessary to develop and approve an accounting policy, including the specifics of accounting for fixed assets, as well as the specifics of repair, reconstruction, conservation, and depreciation.

Separate provisions may become part of the accounting policy, for example, “On the repair of fixed assets,” which specifically define tax and accounting for certain types of fixed assets or their homogeneous groups.

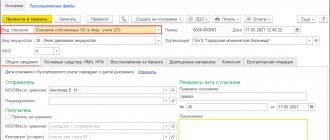

The following are often used as primary documents during OS operation:

- Invoice for movement. To reflect the movement of objects within the organization - between departments, workshops, buildings. When transferring to counterparties (for example, for rent), a different form is used.

- Acceptance certificate OS-3. It is drawn up upon transfer (receipt) for (from) repair (reconstruction, modernization, etc.) both within the organization and to a third party (contractor).

- Installation certificate OS-15. Usually used when purchasing or creating a fixed asset, when it requires assembly, installation and testing before launch. But if, for example, your equipment underwent modernization work in parts (this may be the case in the case of a single complex assembled from several components) and then you need to reassemble it, then it is also permissible to use this form.

- Inventory card. It reflects the main characteristics of objects and, accordingly, their changes, including useful life, initial cost, movement and revaluation data.

- To take into account the conservation of equipment, an order and an act are required. There are no approved forms, you can view them using the links.

There are many other forms (samples) on the Assistants website with comments on how to fill them out; to read them, just use the search.

Creating a reserve

I would like to highlight separately the issue with the reserve. At the very beginning, we discussed the definitions (which applies to the work discussed in the article), one thing can be said for sure - they have nothing to do with repairs. Its accounting is carried out in completely different ways for accounting and tax purposes.

Conclusion: the reserve created for repairs cannot be used for other purposes, including reconstruction or modernization. During an on-site inspection or upon request for documents, the Federal Tax Service, having discovered such transactions, will certainly force a recalculation and accrue depreciation, and will deduct the expenses reflected as repairs.

Note! If the use of reserves for purposes not provided for by law has led to an underestimation of the tax base, you will have to submit amended declarations and pay additional taxes and penalties. Both the organization and the manager will receive administrative fines for violations in tax and accounting records and incomplete payment of taxes.

You can use part of the net profit to carry out the specified work. In the postings to account 84, the reconstruction of the operating system is as follows (we focus on the recommendations of the Chart of Accounts and instructions for its use):

- D 84 “Net profit” K 84 “PE to be distributed” - we reflect the amount that we are going to use for work (usually the exact amount is unknown, the size of the estimate and design data is taken into account).

- D 84 “Private emergency subject to distribution” K 84 “Reconstruction of operating systems” - indicate the actual amount spent.

- D 84 “Reconstruction of OS” K 60 (76, 70, 26, 25, 69, 10) - various expenses for performing work at the expense of profit are reflected.

The accounting procedure must be fixed in the accounting policy, and the subaccounts to account 84 - in the working chart of accounts.

Through inventory accounting

So, let’s say the customer buys the necessary materials and checks in at his warehouse.

Now he needs to display the transfer of valuables to the Contractor, which means he needs to create a warehouse for this, which you will call “Contractor”.

The transfer of materials itself will be formalized through a special document called “Transfer of Goods.”

The only disadvantage of this method is that documents are not issued in printed M-15 form and if you need it, you will have to create it manually. When your counterparty reports on where and how much material he used, you will need to collect all the costs in the “Request Invoice” document.

If your counterparty still has some unspent valuables, then they need to be processed back to your warehouse through a document called “Transfer of Goods.”

This method is quite good for those who do not want to do manual adjustments, but most often they use the second method, which we will write about below.