Last modified: January 2022

Within the framework of labor legislation, there is no clarity in the distinction between the terms “allowances” and “additional payments”. Unlike bonuses, they are paid on an ongoing basis not for present and future successes, but for results achieved in the past. Longevity bonus is “milk for the harmfulness received” for years of work associated with increased responsibility or a state of combat readiness and a risk factor not only for health, but also for life.

How to calculate length of service and experience

Long service allowances

As a rule, it is calculated in order to issue a pension prematurely. Not long ago it became clear that employees of the Federal Penitentiary Service have every chance to use this kind of service. In addition to them, they have every chance to count on:

- test pilots and other groups of aviation personnel

- persons performing geological exploration activities

- medical staff

- artistic staff

- working in law enforcement agencies

- military personnel

- astronauts

- employees of the fishing industry or fleets

- teachers

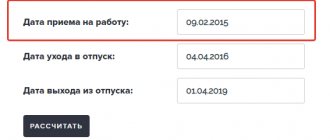

Length of service begins to be calculated if the length of service is more than a year. And this does not depend on whether it was permanent or general. It begins on the date indicated in the work book. However, please take into account that the calculation is carried out in full years, that is, if you have a special work experience of 7 years and 9 months, in this case, the working years in total are 7 years.

Before we talk about counting years of work, you need to understand what is meant by such a concept.

Work experience involves the total time period during which a person performed every job necessary for society, which provides him with the opportunity to purchase pension and social insurance, namely:

Staying on maternity leave

- Fulfilling your own labor obligations in one company or another.

- The period of time spent on business trips or going to study while maintaining your own job is also included in the calculation of work experience.

- The period of time spent serving in the army.

- Maternity leave for child care (until he is one and a half years old).

- The time spent in places of detention (people who were subjected to repression for political reasons), if afterward the rehabilitation of these persons occurred and the return of all civil rights to them.

There is also the concept of special work experience. Let's figure out what this means.

The following people fall under special work experience:

- who received a disability group (1 or 2) in the process of fulfilling their own work obligations

- people working in hazardous industries

- people entitled to benefits based on years of service (military, teachers, doctors)

But how to calculate work experience? For this operation we will need a work record book and a little time.

It is necessary to summarize the time intervals for which a person worked (including studying, being in the national service, serving in the army, being on maternity leave, which cannot be longer than one and a half years). First you need to count the years, then the months and days.

Who can receive the payment

Bonuses for length of service vary in size, it all depends on factors, both external and internal:

- The size of the salary and the dynamics of its increase. The salary increases - the additional payment increases. This is explained by the fact that it is calculated as a percentage of the salary. A year is not counted as two, like in the military.

- Region. For example, in the North, regional coefficients are increased. They increase the premium as they are included in the formation of the monetary allowance.

- Kind of activity.

Longevity bonuses for different categories of employees (by duration):

% bonus Ministry of Internal Affairs, firefighters, Ministry of Emergency Situations Budget positions Teachers, doctors, scientists

| 10% | 2-5 | 2-5 | 1-3 |

| 15% | 5-7 | 5-7 | — |

| 20% | 10-15 | 10-15 | 3-5 |

| 25% | 15-20 | — | — |

| 30% | 20-25 | more than 15 | more than 5 |

| 40% | more than 25 | — | — |

REFERENCE: the premium is set not only as a percentage, but also as a fixed amount.

How to get a bonus for experience

The additional payment for length of service in 2022 is calculated on the basis of the citizen’s work book, which is stored in the personnel department.

In addition, the presence of orders regarding the employee that explain his length of service is taken into account. The availability of the right to additional payment is determined by the personnel department of the enterprise where the person works.

Employees are required to issue an order to accrue an increase to the official salary to a specific person.

Rules for calculating the allowance

Having received an order for a percentage increase for length of service, the accounting department of the enterprise must be based on the calculation rules:

- When calculating the additional payment, the length of service obtained only at the main place of work is taken into account. Part-time work does not count.

- Other provisions for calculating the duration of their service apply to certain categories of persons undergoing military service. For example, a month of sunshine can be calculated in one and a half, two months.

- The work experience includes not only the time when a person worked on site, but also time intervals:

- maternity leave;

- the citizen actually did not work while maintaining his job.

- For social workers: the time spent working in government organizations is taken into account, regardless of who the enterprise was subordinate to. Earnings are calculated according to the wage regulations for the category of employees.

IMPORTANT: the employee should not wait long for the bonus for length of service to be calculated. Additional payment is made starting from the next month after the relevant order is issued. Accordingly, the right to it was obtained.

Example:

The personnel service is considering the possibility of awarding a bonus for the length of service to Maria Igorevna Brusnichkina. She works as a teacher. She began her career after college, in 2014, or more precisely on September 16. In three years, in 2022, her experience will be 3 years. She is entitled to 10% of her salary, but only from October.

REFERENCE: the presence of a bonus for length of service does not terminate the rights of citizens working at enterprises to other payments. If a person is entitled to several additional payments, they are added together.

To receive payments, the interested person must provide documents to the personnel service. Their list depends on the category of service. For example:

- for persons passing the Armed Forces - a military ID;

- work book (for employees of government organizations);

- documents (from the archive);

- orders (in case the citizen does not have a work book).

IMPORTANT: the employer cannot refuse to pay bonuses if they are established by law. If their appointment is the initiative of the head of the company, he can cancel the financial incentive.

Amount of additional payments

How to calculate the premium? There is no single size of payments, since this indicator is set as a percentage of the salary. Let's look at the example of employees of the Ministry of Internal Affairs:

It is necessary to calculate the salary for an employee of the Ministry of Internal Affairs: salary - 13,000, according to rank - 11,000, length of service - 20 years 1 m. Service life - from 20 to 25 years, he is entitled to a 30% bonus. This is seniority. Let's consider it as a simple example: (13000+11000)*30% = 8600 rubles. Allowance amount: 8600+13000+11000. Total 32600.

The legislator introduced bonuses for employees of the budgetary and military spheres. Commercial organizations, that is, private ownership, are not required to establish additional payments based on length of service. Their presence is the right of the employer and his attitude towards employees. No one can guarantee a citizen additional payments for length of service for working in such an organization.

In order to understand what you should expect, you need to familiarize yourself with the labor and collective agreement, bonus provisions, and other local acts of the company regulating the issue of remuneration.

If additional payments are established at the enterprise, they are determined as a percentage of the salary amount. If an employee was sick or was on a business trip, then usually the bonus is not counted. It is usually set by the employer. The minimum rate is 5%, the maximum is 30%.

If a private company has provided for the payment of a bonus for its staff, then it is obliged to familiarize the employee, upon signature, with the local act where the payment is prescribed. In particular, when clarifying the issue of the allowance, the act reflects the following information:

- size;

- calculation algorithm;

- accrual procedure.

The signature of the employees, indicating that they have read the act, is recorded in a journal or familiarization sheet (Article 68 of the Labor Code of the Russian Federation).

Supplement to pension for length of service

According to the explanation of the Pension Fund, citizens receiving pensions cannot count on an additional percentage of the total service life.

The fund's specialists had to explain this to the general public due to increasing rumors that pensioners with a long period of service may apply for a recalculation of the benefits they receive.

The duration of labor activity is determined when assigning state support.

REFERENCE: In some regions, incentive payments for seniority have been established for pensioners. It is necessary to find out the nuances from the social protection authorities. For example, in the Altai Republic an increase is provided for pensioners for length of service.

Increase in long service bonus in 2022

If there are special conditions, a certain category of citizens can count on an increase in the premium:

- Obtaining the status of “Veteran of Labor”.

- Women with 30 years of experience – additional accrual of one pension point.

- Men - with more than 35 years of experience - similar enrollment.

- Men with a duration of 35+5 years – a conversion of 5 coefficient units occurs.

In addition, citizens who have worked in the field of agriculture with more than 30 years of experience are entitled to apply for the bonus. The premium is fixed at 25%.

Order a free legal consultation

Length of service of civil servants

So, to correctly calculate the additional payment for employees involved in the public service, it is necessary to study the percentage rates of the additional amount, which directly depend on the length of service:

Teacher

- Experience from 1 to 5 years provides the right to purchase an additional 10% of the added salary

- if the experience ranges from 5 to 10 years, you can hope for perhaps a 15% additional payment

- 20% is given to officials who have worked for the benefit of the country for at least 10-15 years

- 30% - the maximum possible amount of bonus for years of service - is allocated to employees who fulfill their labor obligations for 15 years or more

Specific figures depend on the budget and economic situation of the company. One should not lose sight of the fact that state employees are regularly awarded bonuses and other funds as an incentive to perform their job duties well, directly depending on the position held, the type of activity performed by the employee, and labor obligations that are placed on his shoulders beyond generally accepted standards.

For example, a position may be related to the lower and higher groups, according to this, the increase ranges from 60 to 200% of the salary. If a native of the Russian Federation in his own work comes across information that is considered secret, which must be signed in a special document, the degree of secrecy of the papers determines the additional amounts of 5-75% of the salary.

If the employee is directly involved in protecting state secrets, the increase for years of service is formed in the amount of 10-20% of the official salary, depending on the duration of fulfillment of professional obligations.

Is it possible to purchase a number of allowances at once? Of course, it is possible, but only if they are not considered incompatible relative to each other.

Let’s imagine this case: an employee works, regularly communicates with classified information, and has 11 years of work experience. In the total amount of this kind, the employee will receive a whole list of additional payments:

- financial plan incentive for supporting a national secret

- amount added for length of service performing work in a specific field

- additional payment, which is required to be provided in the amount of 20% for the number of years worked

Example 4

The employee is engaged in educational work in a special correctional orphanage. Rate – 1. Previously, this person had rank 10 in the ETS. Worked in the field of educational institutions for 3 years (10%).

Salary based on position – 3,278 rubles.

Rate + specifics of work 3278x(1+0.2+0.2) = 4589 rub.

0.2 – bonus for working in an orphanage. 0.2 – bonus for working in a special institution.

4589%10=458.9 – bonus for teaching experience. 4589+458=5047.9 rubles final salary.

Example 5

A person works as a teacher of his native language in one of the republics of the Russian Federation. He teaches first through fourth grades at a comprehensive boarding school.

His teaching load is 24 hours a week. Qualification: first category. This employee is assigned a class, and accordingly he has a bonus for class management. Twenty-four hours a week are spent checking notebooks. The teacher has 2 years of teaching experience (10%).

Net salary – 3,589 rubles.

Then 3589×1.168×1.15 = 4820.7.

Where 1.168 is an increase in salary for the first category. 1.15 additional payment for the specifics of the work.

We calculate the bonus for the hours actually worked (4820.7×24 hours)/20 hours. = 5784.8.

This person receives 15% for class management (4820.7 × 0.15 = 723.1 rubles).

We calculate the extra charge for checking notebooks (4820.7×0.15)x24h./20h. = 867.7 rub.

3589%10=358.9 rubles – bonus for teaching experience. And that’s 5784.8 + 723.1 + 867.7 + 358.9 = 7734.5 – the final salary with all allowances.

Length of service in the Ministry of Internal Affairs

Employees of the Ministry of Internal Affairs

The Ministry of Internal Affairs did not stand aside, and is also involved in rewarding workers for their years of service. Special job requirements make it possible to claim additional incentives issued every month in addition to the basic salary. In accordance with all norms established by law, bonus amounts are awarded to employees of the Ministry of Internal Affairs who work in the following list of structural units:

- central office of the state Ministry of Internal Affairs

- Main Directorate of the Ministry of Internal Affairs of the city of Moscow and the Moscow region

- duty departments

- parts of temporary accommodation for lawbreakers who have not reached the age of majority

- cavalry units

For example, if an employee is engaged in caring for horses, bonuses range from 10-100% of the additional salary of a police officer. The size of the additional payment amount is affected by the level of threat and harmfulness of the activity performed, responsibility and the possibility of acquiring an occupational disease in the future.

Since 2011, in order to correctly calculate additional payments to employees of the Ministry of Internal Affairs, it is necessary to take into account the share for individual achievements. Acquiring a scientific degree and significant achievements in one of the types of sports also imply financial approval, which ranges from 5-30% of the salary. It is expected that such incentives will make it possible to improve the quality of personnel working in the Ministry of Internal Affairs.

Length of service of military personnel

The military is located in the 1st group of employees together with the police, the Ministry of Internal Affairs and the Ministry of Emergency Situations. It's easy to calculate the premium:

Ministry of Emergency Situations

- Employees who have worked from 2 to 5 years have every chance of receiving a 10% bonus

- military personnel working for 5-10 years have the right to expect an additional payment of 14% to their salary every month

- served for 10-15 years - you will receive an additional 20% to your official earnings

- work for at least 15-20 years – an additional payment of 25% is accepted

- civil servants reward military personnel who have worked for 20-25 years with a 30% bonus

- military servicemen who have given 25 years of their life or more to the Fatherland receive 40% of their official earnings

The characteristics of the obligations and the place of service in the military directly have a great influence on the size of the bonus for years of service.

If these are aviation units, and the workers belong to the crew of airplanes and helicopters that take part in various types of tests, the month of fulfilling their labor obligations is counted as 2, and so on for the entire time of work.

In addition, a special incentive calculation formula is used in relation to bonus amounts for military personnel who constantly conduct parachute training, are in the professional composition of military maritime structures, etc.

Examples of calculating allowances

Example 1

An employee teaches Russian in grades five to eleven in a comprehensive school in one of the Russian villages. His normal teaching load is twenty-two hours a week. This teacher is assigned his own class, where he is the class teacher. Twenty-two hours are also spent checking students' notebooks. Previously, before the innovations, this teacher had the tenth category in the ETS. The teacher has worked in the educational field for more than 5 years, but less than eight. The salary for this position of this teacher is 3,278 rubles.

This person also receives a 25% bonus for working in the village: 3278 x 1.25 = 4097.5

We calculate the fee for hours worked: (4097.5x22)/18=5008.1

Additional payment for class management – 20%: 4097.5x0.2=819.5

Additional payment for checking notebooks (22 hours) – 15%: (4097.5x0.15)x22/18=751.2

Based on teaching experience, another 20% of the net salary is accrued, 3,278%20 = 655 rubles. 6,578 + 655 = 7,233 rubles - a full salary.

Example 2

A man works as a mathematics teacher from grades five to eleven in a secondary school-gymnasium in a rural area. His teaching load: fifteen hours a week. This person has the title “Honored Teacher”, and also has the highest qualification category. His responsibilities also include managing the office. It takes five hours a week to check notebooks. The salary based on his position is 3,589 rubles. This man has been working in the educational sector for 7 years (20% bonus).

3589x1.255x1.08x(1+0.25+0.25)=6810.3 rubles

According to this formula, 1.255 is an increasing coefficient for the category of his qualifications. 1.08 – for the title. 0.25 – bonus for working in the village. 0.15 – salary increase coefficient for the specifics of the work.

Based on all of the above, his salary will be equal to 6810.3 rubles. We calculate the bonus based on length of service: 3589%20=717 rubles. 6810+717=7527 rubles.

Example 3

A woman works as a teacher in preschool education. Has an allowance for working in rural areas. This teacher also has the highest qualification category. Her bet is 1.5.

The salary for her position is 3,589 rubles.

Based on the formulas described above, we have the following 3589×1.255×1.25 = 5630 rubles.

1.255 is an increasing coefficient due to the teacher having the highest category. 1.25 – allowance for work in rural areas. We add the profit for the hours actually worked, we have 8,445 rubles - a full salary.

3589%20=717 rubles – long service bonus. 8445+717=9162 rubles, full salary.

Length of service in private companies

The working years in relation to those working in individual firms are formed in the text of the employment contract, which is signed by the employer. Exactly the same data may be displayed in a whole list of other provisions and papers that apply to company employees:

- collective agreement

- document regulating monetary incentives

- LNA

Material compensation can be paid either every month or once for a certain number of months. You should carefully consider what is noted in the employment contract.

How to calculate the length of service of the Federal Penitentiary Service

Calculation of years of work for employees of the Federal Penitentiary Service is carried out in accordance with the Resolution of the Council of Ministers, which also applies to the Ministry of Internal Affairs. This includes:

- fulfillment of labor obligations in the Federal Penitentiary Service

- military service

- labor activity in the structure of the Ministry of Internal Affairs

- fulfillment of labor obligations in the Ministry of Emergency Situations, etc.

In addition, the full period of internship, the period of maternity leave, which should not exceed one and a half years, as well as training in a specialized field are added to this time. Length of service provides some additional payments to wages. Their size is determined by internal regulations. Everyone can calculate the production of years independently, for which you only need a calculator.

The procedure for paying bonuses to employees according to current salary rules

After the changes made to the Labor Code of the Russian Federation, from October 3, 2016, the terms of payment of not only vacation pay (Article 136 of the Labor Code of the Russian Federation) and payment upon dismissal (Article 140 of the Labor Code of the Russian Federation), but also wages were legally limited.

The calculation of wages for the past month must now be carried out within 15 calendar days following this month (Article 136 of the Labor Code of the Russian Federation). Accordingly, taking into account the preservation of the wording in the Labor Code of the Russian Federation requiring payment of wages every half month, the timing of advance payments has also become more specific. Now it must be issued in the second half of the month for which it was accrued, maintaining a 2-week interval between the advance and salary.

However, questions remain regarding the payment of bonuses. Although the bonus provided by the wage system is a salary, it is not always calculated at the same frequency as wages. Therefore, the Ministry of Labor of Russia (information dated September 21, 2016, posted on the ministry’s website) recommended that the regulatory act on bonuses reflect an indication of both the month of bonus accrual and the month (or specific date) of bonus payment.

Specifying a payment month means that the premium must be paid no later than the 15th day of the corresponding month. If only the month of accrual is indicated, then the deadline for payment of bonuses will be the 15th day of the month following the month of their accrual (letter of the Ministry of Labor of Russia dated August 23, 2016 No. 14-1/B-800).

For more information about the procedure for paying bonuses under the Labor Code of the Russian Federation, read this article.

Long service pension

If the work experience in a particular field is quite extensive, then a person has the opportunity not to wait for retirement age, but to retire early.

A distinctive feature of this type is that the pension will be paid not from the Pension Fund, but at the expense of other organizations, for example: military pensions are paid by the military registration and enlistment office.

Pension

In order to hope to receive it, civil servants must have fifteen years of work experience; before leaving, they must have one year of permanent work experience, and leaving work for a good reason. Military personnel must reach the age of 45 or have more than 20 years of service. Cosmonauts and pilots are required to have a work experience of 25 (20) years for men (women), and to stop their own work due to state of health or other circumstances.

The pension itself is calculated depending on the salary. It is multiplied by 50% + interest for the prevalence of the required length of service 3 or 1 for any year in excess (maximum 85%). And then it is multiplied by the reducing indicator introduced by law. You can calculate your pension using the calculator on the Pension Fund website.

A complete list of persons applying for length of service can be found on the Pension Fund website. Each specialty has its own standards of length of service and probable preferences. In addition, individuals have the opportunity to purchase an ordinary civil pension.

Top

Write your question in the form below