Starting from version 3.0.90 in 1C: Accounting 8, the order of reflecting material consumption has been optimized. The document “Consumption of Materials” now allows you to take into account the use of material assets in production, for the organization’s own needs, as well as the consumption of workwear, special equipment and other low-value equipment when transferring it to an employee. To confirm expenses, you can generate a materials write-off act, which is available in the list of printed document forms. 1C experts talk about new features of the program.

Reflections of the consumption of inventory items in 1C: Accounting 8

The use of materials in production and for the organization's own needs was previously reflected in the program by the document Requirement-invoice. The document made it possible to generate an act for writing off materials (to document expenses), but did not support off-balance sheet accounting of inventory items. Off-balance sheet accounting is supported in the document Transfer of materials into operation. But the printed form of the act for writing off materials is not available in this document.

Starting with version 3.0.90 of 1C: Accounting 8, the procedure for reflecting the consumption of inventory items has been optimized. Inventory and materials include materials, other inventories, as well as low-value equipment of insignificant value, which is not accounted for as fixed assets.

For information on accounting for low-value objects in 1C: Accounting 8, edition 3.0, see the article Accounting for low-value objects in 1C: Accounting 8.

The document Request-invoice has been renamed to Material consumption. As before, this document is available in the Warehouse and Production sections (hyperlink Material consumption (requirements-invoices)). But the updated document has additional features:

- two types of operations are used: Use of materials and Transfer to an employee;

- Cost accounting accounts can be indicated in the header of the document or in its tabular part;

- you can configure options for off-balance sheet accounting of inventory items when transferring them to an employee;

- When transferring material assets to an employee, a printed form of the act for writing off materials is available.

Write-off of materials: postings

The issuance of goods and materials from the warehouse to the workshop for the production of products/services, administrative needs or subsequent sale is reflected on the credit account 10. The cost of disposed goods and materials is written off according to the corresponding sub-accounts of account 10 with crediting to the production accounts - main (account 20) and auxiliary (account 23, 25,26,29), or calculations and results (accounts 62, 76, 90, 91):

| Situations | D/t | K/t |

| Materials released into production - posting | 10 | |

| Materials Issued - Posting for Auxiliary Processes | 10 | |

| Inventory and materials transferred to servicing facilities | 10 | |

| Inventory and materials were released for the functioning of the control apparatus (AU) | 10 | |

Sales of materials – wiring:

| 91/2 91/2 | 10 /VAT 91/1 |

The cost of materials when they are released into production is determined by one of three acceptable methods, which must be fixed in the company’s accounting policy.

You can write off inventory items:

- piece by piece, i.e. at the cost of each unit. Acceptable in small industries and when taking into account expensive materials;

- at average cost;

- using the FIFO method, i.e. at the actual cost of materials registered first in chronology.

Every year, the availability of materials in the storeroom and workshops is inventoried, i.e. verified with accounting data. Detected surpluses of inventory items are accounted for by the entry D/t 10 K/t 91/1, shortages of materials are accounted for by the entry D/t 94 K/t 10, indicating the disposal of inventory items to the account of shortages and damage. Subsequently, the company identifies the person responsible for the shortage, who then compensates for the damage or writes off these amounts as other expenses if it is impossible to determine the culprit.

Let's look at an example of how materials are written off for production and the transactions that accompany these operations.

Use of materials

The document Consumption of materials with the type of operation Use of materials is used to account for materials used in production and for the organization’s own needs, as well as to account for operations for processing customer-supplied raw materials. Own materials are indicated on the Materials tab, and customer-supplied raw materials are indicated on the Customer Materials tab.

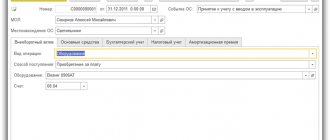

Setting up methods for specifying cost accounts is performed in the Cost Accounts form, which can be accessed by following the hyperlink located in the document header next to the Cost Accounts text (Fig. 1).

Rice. 1. Use of materials

If the switch is specified to be set to:

- In the header, then in the Cost Accounts form, you can specify the accounting account and cost analytics simultaneously for all materials used;

- In the list, accounting accounts and cost analytics are indicated in the tabular part of the document separately for each item.

Cost accounts are specified only for own materials; this setting does not apply to customer-supplied raw materials.

When posting a document, entries are generated for the debit of cost accounting accounts in correspondence with the material assets accounting accounts.

How to reflect the use of inventory items in 1C:Accounting

Through the document “Consumption of materials”, when setting the type of operation “Use of materials”, materials used for production purposes, as well as for the company’s own needs, are taken into account. In addition, it is used to reflect the processing of raw materials supplied by customers. To indicate the type of materials, the corresponding tabs are used - “Materials” for your own for customer-supplied raw materials.

To set up ways to indicate cost accounts, you need to go to the “Cost Accounts” form through the link in the document header in the “Cost Accounts” field.

The “Indicated” switch can be set in two positions:

- “In the header” - then in the “Cost Accounts” form the user will be able to enter accounting accounts and cost analytics simultaneously for all used ones - then the user will enter accounting accounts and cost analytics in the document table for each item item.

Cost accounts need to be entered only for your own inventory items. This setting is not used for customer-supplied raw materials.

When the user posts the document, on its basis, transactions will be generated for Dt cost accounting accounts and Kt inventory accounting accounts.

Transferring materials to an employee

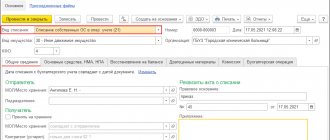

The document Consumption of materials with the type of operation Transfer to an employee is used to reflect the consumption of work clothes, special equipment and other low-value equipment with an insignificant cost when transferring it to an employee (Fig. 2).

Rice. 2. Transfer of materials to the employee

The same business transaction can be reflected in the document Transfer of materials into operation (Warehouse section).

An employee is selected from the Individuals directory and indicated in the Employee field.

In the document Consumption of Materials with the type of transaction Transfer to an employee an account for the cost of writing off materials, you can also indicate it in the header of the document or in its tabular section. When posting a document, entries are generated for the debit of cost accounting accounts in correspondence with the material assets accounting accounts. Additionally, transactions for off-balance sheet accounting are generated, and options for off-balance sheet accounting of material assets can be configured.

If the Account by employee switch is set to the Expense position, then material assets transferred to the employee are reflected in the debit of the MC off-balance sheet account “Tangible assets transferred for operation” and are immediately written off from the credit of the MC account. With this option of off-balance sheet accounting, the organization can control the consumption of materials transferred to employees for each employee. To do this, it is enough to generate any standard report, for example, the Balance Sheet for the MC account (Fig. 3).

Rice. 3. SALT according to account MTs.04

If the Account by employee switch is set to Expense and balance, then material assets transferred to the employee are reflected in the debit of the MC off-balance sheet account and remain assigned to this employee. With this option of off-balance sheet accounting, the organization can conduct an inventory of materials transferred to employees.

As in the program “1C: Accounting 8” ed. 3.0 reflect the consumption of materials for the organization’s own needs and when transferred to an employee

How to transfer inventory items to an employee in 1C:Accounting

To reflect the transaction of transferring work clothes and other inventory items with insignificant value to an employee, the document “Consumption of materials” is used. In this case, the type of operation is indicated - “Transfer to employee”.

In addition, you can use another document - “Transfer of materials into operation” in the “Warehouse” section.

When completing documents, you need to select the employee to whom the inventory items are transferred through the “Individuals” directory. It is indicated in the “Employee” column.

In the document “Consumption of materials”, when specifying the type of operation “Transfer to an employee”, cost accounting for writing off inventory items can be placed in the header or table of the document. When the document is posted, on its basis, correspondence will be generated for Dt cost accounting accounts and Kt inventory accounting accounts. In addition, off-balance sheet accounting transactions will be created, in which case the user can configure off-balance sheet accounting methods for inventory items.

When you set the “Account by employee” switch to the “Expense” position, the inventory and materials transferred to the employee will be reflected in the Dt of the off-balance sheet account “Tangible assets transferred for operation” and will immediately be written off from the Kt account. In this case, the company can control the consumption of inventory items transferred to employees separately for each employee. For these purposes, you can generate a standard report, for example, “Turnover balance sheet” for an off-balance sheet account of inventory items.

When the “Account by employee” switch is set to the “Expense and balance” position, the inventory items transferred to the employee will be reflected in the Dt of the off-balance sheet account and assigned to a specific employee. In this case, the company can conduct an inventory of inventory items transferred to employees.

Accounting for receipt of materials

To record operations on inventories, active account 10 “Materials” is used. There are several ways to receive materials:

- Purchase;

- Own production;

- Free transfer, etc.

Purchasing materials from a supplier

Let’s assume that Albatros LLC purchased a batch of inventory from a supplier in the amount of 59,000 rubles, incl. VAT 9,000 rub.

The accountant reflects the following postings for materials:

| Dt | CT | Description of wiring (operation) | Amount, rub. | Base |

| 60 | 51 | Payment for goods reflected | 59 000 | Payment order |

| 10 | 60 | The cost of the goods is reflected | 50 000 | Invoice |

| 19 | 60 | Incoming VAT reflected | 9 000 | Invoice |

Receipt based on advance reports

For example, an accountant gave an employee 10,000 rubles from the cash register. to purchase inventory. The employee purchased inventory in the amount of RUB 9,500, incl. VAT 1,449 rub.

Postings for accounting materials in accounting when received from accountable persons:

| Dt | CT | Description of wiring (operation) | Amount, rub. | Base |

| 71.1 | 50 | The amount of the advance payment is reflected | 10 000 | Account cash warrant |

| 10 | 71.1 | Inventory receipt reflected | 8 051 | Advance report |

| 19 | 71.1 | Incoming VAT reflected | 1 449 | Advance report |

Free admission

Omega LLC received a free batch of stationery in the amount of 2,700 rubles.

In the accounting records of Omega LLC, the gratuitous receipt of materials is reflected by the following posting:

| Dt | CT | Description of wiring (operation) | Amount, rub. | Base |

| 10 | 91.1 | Receipt of stationery is reflected | 2 700 | Accounting information |

Receipt from production

Capitalization of materials of own production can occur:

- At standard cost;

- At actual cost.

In the first case, account 40 “Output of products (works, services)” is used.

Let's assume that Langur LLC brings materials produced in its own workshop to the warehouse. The planned cost of materials is 9,500 rubles, the actual cost is 10,100 rubles.

Accounting entries for materials accounting:

| Dt | CT | Description of wiring (operation) | Amount, rub. | Base |

| 10 | 40 | Reflection of materials at planned cost | 9 500 | M-4 |

| 40 | 20 | Reflection at actual cost | 10 100 | Accounting information |

| 10 | 40 | Write-off of cost variance | 600 | Accounting information |

In the second case, when posting materials at actual cost, one transaction is created:

| Dt | CT | Description of wiring (operation) | Amount, rub. | Base |

| 10 | 20 | Receipt of materials from production is reflected | 10 100 | M-4 |

Accounting for material disposal

Inventory can be written off as expenses, sold, donated or damaged. The methods for writing off the cost of inventories are similar to the methods for determining the cost upon receipt. The organization establishes one of the selected methods in its accounting policy.

Write-off to expenses

Postings for accounting for materials in accounting when written off as costs will be as follows:

| Dt | CT | Description of wiring (operation) | Base |

| 20 | 10 | Materials released into main production | M-11 |

| 23 | 10 | Leave to auxiliary production | M-11 |

| 26 | 10 | Needed for general household purposes | M-11 |

| 25 | 10 | For general production needs | M-11 |

| 10 | 10 | Moving from warehouse to warehouse | Internal movement invoice |

Selling on the side

Dormidontov and K LLC sells goods worth 18,000 rubles, incl. VAT 2,746 rub. Cost of materials sold is 8,000 rubles.

Basic entries for accounting for materials when sold externally:

| Dt | CT | Description of wiring (operation) | Amount, rub. | Base |

| 62 | 91.1 | Reflection of the amount of revenue | 18 000 | Invoice |

| 91.2 | 68 | VAT on sales reflected | 2 746 | Invoice |

| 91.2 | 10 | The cost of materials has been written off | 8 000 | Accounting information |

| 51 | 62 | Payment received from counterparty | 18 000 | Payment order in. |

Free transfer

From the point of view of the Tax Code, the gratuitous transfer of materials is equivalent to sale, therefore this operation is subject to VAT.

Postings for materials during gratuitous transfer:

| Dt | CT | Description of wiring (operation) | Base |

| 91.2 | 10 | The write-off of materials is reflected at actual cost. | Invoice |

| 91.2 | 68 | VAT is charged on the market value of materials | Accounting information |

| 99 | 91.2 | Reflected loss from write-off of materials | Accounting information |