Let's look at how to correctly calculate payment for a business trip in the 1C:ZUP 3 program. Let's look at the calculation in the general case, as well as in the case where a summarized accounting of working time is used for an employee.

- Start

- Working with the Business trip document

- Checking the calculation of average earnings and payment for a business trip

- Calculation of business trips based on average hourly earnings

- If a business trip starts in one month and ends in another

- Payment procedure and payment date for business trips

- Reflection of payment for business trips in accounting

Start

Working with the “Business Trip” document

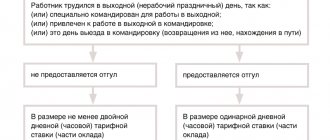

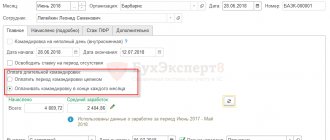

If the duration of a business trip is within one month, then payment based on the average for the entire duration of the business trip is accrued using the document Business trip . The same document used to issue the business trip order is used. For a user with a accountant profile, this document displays details that are not visible to HR officers: average earnings, accrued amounts, payment procedure for business trips:

All amounts in the Business Trip are calculated at the input stage by the user with the HR profile, but are not displayed on the form. When a document is opened by a user with a calculator profile, he immediately sees the calculated amounts; all that remains is to check them, approve the document by checking the Calculation approved and carry it out.

If multi-user work is not configured in the program, then the approval checkbox is not displayed in the document form; it is considered that the document is approved immediately when it is submitted.

If the start date of a business trip falls at the beginning of the month (for example, June 5), and the Business Travel was entered before the salary for the previous month was calculated (for example, the order was issued on May 30, the salary for May had not yet been calculated), then in order to take into account the salary employee's average earnings for the last month (May) in the Business Trip will need to be recalculated. To do this, you can use the arrow button:

Checking the calculation of average earnings and the amount of payment for a business trip

In general, to pay for business trips, the average daily earnings for one working day are determined. To do this, the employee’s earnings for the billing period (12 months preceding the month the business trip began) are divided by the number of days worked during this period:

To calculate the amount of payment for a business trip, the average daily earnings received are multiplied by the number of working days on the employee’s schedule during the business trip:

(Clause 9 of the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922)

You can view and, if necessary, adjust the data for calculating average earnings in the form Entering data for calculating average earnings , which is called up by clicking the button with the image of a green pencil:

Manual adjustments on this form will be shown in bold and will only affect the calculation of that trip, i.e. For subsequent calculations based on the average, manual adjustments are not saved.

Detailed information on how average earnings were calculated can be obtained in the printed form Calculation of average earnings - example in PDF.

Details of the calculation of the amount of payment for a business trip can be seen in the printed form. Detailed calculation of charges - example in PDF.

Pionov O.I. was on a business trip from June 5 to June 9, 2022.

The employee worked the pay period (from June 2022 to May 2018) in full, his earnings were: salary payment - 540,000 rubles, bonuses - 54,000 rubles.

The first part of the printed form Detailed calculation of accruals provides summary data on the calculation of average earnings:

In the billing period, the employee worked 247 working days.

The employee's average daily earnings were: (540,000 rubles + 54,000 rubles): 247 days = 2,404.86 rubles.

The second part of the form explains how the amount of payment for the business trip was obtained:

To calculate payment for a business trip, the average daily earnings are multiplied by the number of working days on the employee’s schedule during the business trip. The employee works on a five-day work schedule, with 5 working days during the business trip.

Payment for the business trip period will be: RUB 2,404.86. x 5 days = 12,024.30 rub.

More details about the calculation

The basis for calculations for the business trip period is the annual interval preceding the month in which the person went on a business trip on instructions from management. The average salary for a business trip is calculated using the formula:

Average income per day = Total payments to the employee for the entire billing period ÷ Number of days actually worked by the employee in the billing interval.

The accountant's algorithm will be as follows:

- the boundaries of the time range that forms the basis of the calculations are determined. The months from the 1st to the last day of the month for the last year are taken into account, but the current month is not affected. For example, average earnings for a business trip are calculated, provided that the trip took place in September 2022. The calculation interval is September 2022 – August 2018;

- The total value of the employee’s income in the designated time interval is displayed. Only accrued amounts before tax are taken into account;

- income is adjusted for payments that should not affect average earnings for calculating travel allowances (for example, vacation pay, sick leave and other benefits accrued based on average income, amounts not related to the wage system);

- the number of days in the designated interval that were actually worked by the person is calculated;

- The average daily earnings are displayed, which are multiplied with the working days spent by the person on a business trip.

Calculation of business trips based on average hourly earnings

For employees with summarized working hours, business trip time is paid from their average hourly earnings. To do this, earnings for the billing period are divided by the number of hours worked during the billing period:

The amount of payment for a business trip in this case is determined as the employee’s average hourly earnings multiplied by the number of working hours during the business trip:

(Clause 13 of the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922)

Average hourly earnings are calculated in the Business Trip in the following cases:

- for employees with a summarized working time schedule;

- in the case of a non-full-day business trip, when on average you need to pay not for a whole working day, but only for a few hours.

Employee Lotosov L.L. A shift work schedule has been established, for which summarized working hours are kept. Lotosov L.L. was on a business trip from June 19 to June 23, 2022.

The employee has been working in the organization since May 2022, his earnings for the billing period amounted to 48,080 rubles, and he worked 188 hours.

To calculate average hourly earnings, earnings for the billing period are divided by the number of hours worked:

The average hourly earnings of an employee were: RUB 48,080. : 188 hours = 255.74 rubles.

The amount of payment for a business trip is obtained by multiplying the average hourly earnings by the number of hours during the business trip, according to the employee’s schedule:

Payment for the business trip will be: 255.74 rubles. x 24 hours = 6,137.76 rubles.

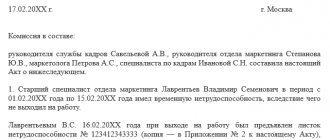

In what cases is average earnings calculated?

The term “average earnings” is used in regulatory documents to describe calculation rules in different cases. Sick days, vacations, business trips and others are paid based on average earnings. At the same time, average earnings are calculated in different ways. Thus, Federal Law No. 255-FZ dated December 29, 2006 and Government Decree No. 375 dated June 15, 2007 determine the procedure for calculating benefits for temporary disability, pregnancy and childbirth, and child care until the child reaches 1.5 years of age.

The general rules for calculating average earnings for cases where an employee was not at work, but according to the Labor Code such earnings were retained, are established in Article 139 of the Labor Code of the Russian Federation.

The calculation procedure is defined in Decree of the Government of the Russian Federation dated December 27, 2007 No. 922 (hereinafter referred to as Decree No. 922).

This article discusses the calculation of average earnings in accordance with Article 139 of the Labor Code of the Russian Federation and Resolution No. 922.

This resolution defines a different procedure for calculating average earnings for two cases:

1. Vacation and compensation for unused vacation.

2. Other cases provided for by the Labor Code of the Russian Federation (except for cases of determining the average earnings of workers for whom a summarized recording of working time is established).

Cases named in the Labor Code of the Russian Federation when average earnings are maintained:

- business trip (Article 167 of the Labor Code of the Russian Federation);

- passing a medical examination (Article 185 of the Labor Code of the Russian Federation);

- transfer of an employee to another job (Articles 72.2 and 182 of the Labor Code of the Russian Federation);

- donation of blood and its components (Article 186 of the Labor Code of the Russian Federation);

- employee participation in collective bargaining (Article 39 of the Labor Code of the Russian Federation);

- failure to comply with labor standards, failure to fulfill labor (official) duties through the fault of the employer (Article 155 of the Labor Code of the Russian Federation);

- etc.

The Labor Code of the Russian Federation establishes a non-closed list of cases of maintaining average earnings.

The formulas for calculating average earnings are different for the first and second cases, but in each of them you need to know the billing period, the number of days worked in the billing period, and the actual earnings of the employee received in the billing period.

| 1C:ITS In the “HR Directory” in the section “Personnel records and settlements with personnel in 1C programs”, see more details about the procedure for calculating average earnings (except for calculating vacation and compensation for vacation); on calculating average earnings for the purpose of calculating vacation pay and vacation compensation. |

If a business trip starts in one month and ends in another

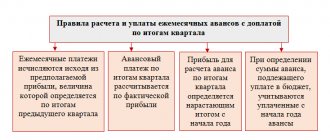

If a business trip begins in one month and ends in another, then in the 1C: ZUP 3 program there are two options for paying for it:

- payment for the entire period of the trip at once in full. In this case, payment is fully calculated in the Business Trip ;

- monthly payment. In the case of monthly payment, payment is immediately accrued only for the month the business trip began; this occurs in the Business Trip . Payment based on the average for the next month/months of the business trip period is calculated automatically when calculating salaries for the month - in the documents Calculation of salaries and contributions .

The option is selected in the Business trip using the switch Payment for a long business trip :

For example, if an employee is sent on a business trip for the period from June 28 to July 12, and the monthly payment option is selected, then in the Business Trip payment is accrued only for the period from June 28 to June 30:

Payment for the period from 01.07 to 12.07 is calculated when calculating salaries for July.

In this case, the same average earnings are used that were calculated in the Business Trip .

Typically, in practice, a monthly payment for a business trip is used. In order to use this default travel payment option, i.e. so that when creating a document, the option Pay for a business trip at the end of each month , it is necessary that in the settings for the composition of accruals and deductions (Settings - Salary calculation - Setting up the composition of accruals and deductions) on the Absence accounting , the Long business trips should be paid monthly checkbox is selected :

Actual earnings

When calculating average earnings, the employee’s actual earnings include all types of payments provided for by the remuneration system and accrued to the employee in the billing period, regardless of the source of funds. In other words, the calculation of the average includes all payments established by the employer in the remuneration system as wages.

In addition, the following are included in the calculation:

- allowances and additional payments to tariff rates and salaries for professional skills, experience, knowledge of a foreign language, combining professions, increasing the volume of work, etc.;

- payments related to working conditions (regional coefficients, additional payments for work in harmful, dangerous and difficult conditions, for working overtime at night, on days off);

- bonuses and remunerations provided for by the remuneration system, fixed in local regulations;

- other types of wage payments from the employer.

Please note that one-time bonuses that are not part of the remuneration system do not participate in the calculation of average earnings. In the 1C: Salary and Personnel Management 8 program, edition 3, all types of calculations for which the Accrual Purpose is set to Bonus are necessarily included in the calculation of average earnings.

The Include in accruals base when calculating average earnings flag in the calculation type card on the Average earnings tab for such accruals is set by default and is not available for switching. For bonuses that are not included in average earnings, you should create new types of calculation with Accrual Purpose - Other accruals and payments.

Payment procedure and payment date for business trips

In the Business trip , it is enough to correctly fill out the payment order for the business trip ( With salary , With advance payment or During the interpayment period ) so that the program automatically fills out payment forms correctly.

Income in the form of payment during a business trip for personal income tax purposes is accounted for using code 2000 Remuneration for the performance of labor or other duties; salary and other taxable payments to military personnel and equivalent persons. The date of receipt of this income is defined in the program as the last day of the accrual month, so filling out the Payment Date in the Business Trip is not as important as, for example, in the Sick Leave or Vacation .

Reflection of the amount of payment for a business trip in accounting

By default, the amount of payment for a business trip is included in the same method of reflection as the employee’s main salary.

If a business trip needs to be attributed to another reflection method, then the reflection method for a specific trip can be overridden - the choice of reflection method is made in the Business trip on the Additional :

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- The dates of the ticket and the start of the business trip are different: should contributions be calculated from the cost of the employee’s travel to the place of business trip? The Ministry of Finance answered this question in Letter dated September 23, 2020 N...

- Payment for long business trips (ZUP 3.0.24) ...

- The Ministry of Labor told how to calculate the standard time if an employee with a shortened working week switches to part-time working hours. Part-time and reduced working hours are two different modes...

- Test No. 58. Calculation of earnings during a business trip using the average daily...