When starting their own business, entrepreneurs do not always pay due attention to the issue of accounting. Some have heard that accounting for an individual entrepreneur is not required by law, others consider this issue to be of secondary importance, and still others say that there is nothing complicated here, and you can handle the accounting yourself.

In fact, setting up an individual entrepreneur’s accounting department from scratch is necessary already at the stage of planning business activities. Why?

There are several reasons for this:

- A competent choice of taxation system will allow you to choose the minimum possible tax burden. To ensure that you do not unknowingly fall under the definition of illegal tax schemes, practical tax planning for your business should be carried out by specialists, not dubious advisers.

- The composition of reporting, the timing of tax payment, and the possibility of obtaining tax benefits depend on the chosen regime.

- Violation of deadlines for submitting reports, accounting procedures, payment of tax and non-tax payments will lead to unpleasant sanctions in the form of fines, disputes with the tax service, and problems with counterparties.

- After registering an individual entrepreneur, you have very little time to choose a tax regime. So, to switch to the simplified tax system it is only 30 days after receiving the certificate. If you do not choose a tax system right away, you will work on OSNO. In most cases, this is the most unprofitable and difficult option for a beginning entrepreneur.

Do you need an accountant for an individual entrepreneur? Accounting support for individual entrepreneurs is definitely necessary. The only question is who will carry it out - a full-time accountant, a third-party provider of accounting services, or an individual entrepreneur himself?

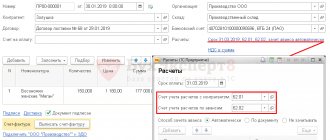

Free accounting services from 1C

Insurance premiums

Individual entrepreneurs pay their own insurance premiums. The amount of contributions is determined in advance, which is why they are called “fixed”.

So in 2022, the amount of fixed insurance premiums “for yourself”, for entrepreneurs with an income of up to 300 thousand rubles per year, is 36,238 rubles. Of these, pension contributions are 29,354 rubles per year, medical contributions are 6,884 rubles per year. The amount of contributions is determined by paragraph 1 of Article 430 of the Tax Code.

Contributions must be paid before the end of the reporting year, so contributions for 2019 must be transferred by December 31, 2022. To take them into account in deductions and evenly distribute the financial burden, it is better to pay contributions in equal parts every quarter.

The amount of the quarterly payment is 9059.5 rubles - this is one fourth of 36,238 rubles. When paying quarterly, the entrepreneur must pay contributions by the end of the quarter, that is, contributions for the third quarter are paid in September.

If an entrepreneur’s income is more than 300 thousand rubles, then, in addition to fixed contributions, he must additionally pay 1% of the excess amount to the Pension Fund. The payment deadline is July 1 of the year following the reporting year.

Let’s assume that the individual entrepreneur earned 450 thousand rubles in 2022. In this case, he must pay:

- 36,238 rubles until December 31, 2022;

- 1,500 rubles until July 1, 2022 - this amount is calculated as follows: (450,000 - 300,000) x 0.01 = 1,500 (rubles) - 1% of the amount of income over 300 thousand rubles.

Despite the fact that contributions go to the pension fund, the entrepreneur pays them to the tax office at the place of registration.

General taxation system (OSNO)

This system has no restrictions and is applied by default from the moment of registration of an individual entrepreneur.

Using the general system, the entrepreneur will have to administer the value added tax: calculate the difference between input and output VAT, and pay it to the budget. To do this, you need to take into account the amount of VAT on all the goods that you sold, and then subtract from it the amount of VAT on all the goods that you purchased. The slightest mistake leads to discrepancies in reporting with your customers and suppliers. The tax office strictly monitors this. In addition, the entrepreneur is required to pay personal income tax (13% of his income) and a fixed amount of insurance premiums.

The advantage of OSNO is that organizations using a common system are more willing to cooperate with those who allocate VAT in their accounting, as this allows them to reduce the amount of tax paid to buyers of your work, services or goods.

Let's look at an example:

An individual entrepreneur purchased some goods for subsequent sale. The purchase price is 12,000 rubles, the selling price of the goods is 18,000 rubles. VAT is 20% and is included in the price. The price consists of the cost of the goods and VAT:

Purchase price (RUB) = 10,000 + 2,000, where 2,000 is the VAT amount

Sales price (RUB) = 15,000 + 3,000, where 3,000 is the VAT amount

3,000 – 2,000 = 1,000 (rub.) – amount of tax payable

If suppliers did not allocate VAT, it would be impossible to deduct it, and the amount of tax payable would be 3,000 rubles.

The general tax system is the most difficult to account for; most likely, you will have to hire an accountant or outsource accounting. It is not necessary to remain on OSNO; there are simpler tax regimes. Special regimes make life much easier for an entrepreneur, save time and provide preferential conditions. To switch to the special regime, you need to check whether your business meets the conditions for its application and write an application to the tax office.

Does an individual entrepreneur need accounting?

To answer the question posed, let’s take a closer look at the text of Federal Law-402. The mentioned Art. 6 declares:

- exemption from accounting for individual entrepreneurs;

- the need to keep records of NU indicators according to the type of business that has been chosen.

Does an individual entrepreneur need to formulate an accounting policy ?

Thus, tax accounting is necessary, with simultaneous exemption from accounting for individual entrepreneurs in any tax system.

Attention! An entrepreneur has the right to keep records of accounting indicators, but is not obliged to do so.

Properly organized accounting means the availability at any time of time of prompt and reliable information about the operation of the business, complete control over monetary and material resources.

In addition, often when organizing an individual entrepreneur, an entrepreneur starts small and then expands the business, transforming it into other forms (for example, registering an LLC), in which accounting is mandatory.

Question: An organization purchased a used car from an individual entrepreneur. The individual entrepreneur used the simplified tax system (“income”), did not keep accounting records, and the residual value was not formed. The individual entrepreneur is ready to provide documents on the purchase of the car and the period of use. For the purposes of calculating income tax, does an organization have the right to determine the useful life of a fixed asset independently based on the documents and information on the service life provided by the individual entrepreneur? View answer

Simplified taxation system (STS)

Can be used if the following conditions are met:

- annual turnover of the company is up to 150 million rubles;

- number of hired employees up to 100 people;

- cost of fixed assets (real estate, transport, equipment) – up to 150 million rubles.

It can be used by both solo entrepreneurs and large organizations.

There are two options for the simplified tax system:

- The object of taxation is “income minus expenses” - the tax rate will be 15% on the difference between income and expenses.

- The object of taxation is “income” - the tax will be 6% on all income.

When submitting an application to switch to the simplified tax system, an entrepreneur chooses which tax calculation object is suitable for him. You can only take into account income and pay 6% of income. This is beneficial if the costs are small, for example, when renting out premises. All cash receipts are reflected by the entrepreneur in the Income and Expense Book, and based on these data the amount of tax payable is calculated.

If the business involves large expenses, for example in the case of wholesale trade or construction, it is more profitable to pay a tax of 15% on the difference between income and expenses. In this case, both income and expenses are reflected in the Accounting Book. This option takes more time, but allows you to reduce the tax burden.

To optimally select the object of taxation, namely the amount on which tax will need to be paid, it is necessary to have a good knowledge of the structure of money flows. If you keep financial records, choosing an object is easy and simple.

You need to pay tax every quarter. Important – payments are calculated on an accrual basis, taking into account the previous period. Let's show it in more detail using an example:

An entrepreneur uses the “income minus expenses” object . Suppose that in the first quarter (from January to March) things were not going so well, and he managed to earn 70 thousand rubles, but had to spend 50 thousand:

70,000 - 50,000 = 20,000 (rub.) - profit for the first quarter

20,000 x 0.15 = 3,000 (rub.) – the amount of tax payable (15% of the profit amount)

In the second quarter (from April to June), the situation improved, and income amounted to 150 thousand rubles, and expenses - 30 thousand rubles:

150,000 - 30,000 = 120,000 (rub.) - profit for the second quarter

Let's sum up the profit for two quarters:

20,000 + 120,000 = 140,000 (rub.)

140,000 x 0.15 = 21,000 (rub.) – you need to pay to the budget for two quarters (15% of the profit amount)

This calculation scheme may seem complicated, because you can simply calculate payments separately for each quarter. However, in the declaration the tax amounts are reflected on an accrual basis. This calculation is also useful for correctly calculating deductions.

To get the payment amount for the second quarter, subtract the advance payment for the previous period (3,000 rubles):

21,000 - 3,000 = 18,000 (rub.) - advance payment for the second quarter.

The deadline for making advance payments is no later than 25 calendar days from the end of the reporting period. Thus, the payment for the first quarter must be paid before April 25, for the second - before July 25, for the third - before October 25. If you miss a payment, there will be no fines, but the tax office will charge penalties. The final payment for the year is due by April 30 of the following year; the tax for 2019 will need to be paid in full in 2022.

The amount of the advance payment is reduced:

- the amount of insurance premiums paid by the employer for employees (the deduction will be up to 50% of the tax amount);

- for the amount of insurance premiums paid by individual entrepreneurs “for themselves” (up to 100% of the tax amount).

If the entrepreneur from the previous example works alone and pays fixed insurance premiums, for this he can reduce the amount of tax by the entire amount of insurance premiums paid (9059.5 rubles for the first quarter) and pay nothing. In the second quarter, the situation is as follows: the amount of advance payments for two quarters can be reduced by 18,119 rubles (the amount of fixed contributions for two quarters):

21,000 - 18,119 = 2881 (rub.) - the amount that will need to be paid.

Important - if the object of taxation “income minus expenses” is selected, at the end of the year you will need to calculate:

- The standard tax rate is 15% of the difference between income and expenses.

- Minimum tax rate of 1% of income.

You must pay the tax whose amount is greater. Even if there are more expenses than income and the business closes the year with a negative result, you need to pay 1% of the income. Let's take the following data as an example:

Tax according to the simplified tax system: (290,000 - 262,000) x 0.15 = 4,200 (rub.)

Minimum tax: 308,000 x 0.01 = 2900 (rub.)

You need to pay 4,200 rubles.

If the object of taxation is “income” , then only income is taken into account. Let's calculate the tax for the year using the data from the previous example:

290,000 x 0.06 = 17,400 (rub.) – amount of tax payable (6% of income)

If an entrepreneur has hired employees, he can reduce the tax by the entire amount of insurance premiums, but not more than 50% of the tax amount.

17,400 / 2 = 8,700 (rub.) – 50% of the tax amount, which can be written off from insurance premiums for employees.

In our example, the amount payable, taking into account the maximum deduction, will be 8,700 rubles.

If the entrepreneur in the example works alone, he can use a deduction in the amount of insurance premiums paid for himself (their fixed amount for the year is 36,238 rubles) and reduce the tax to zero.

The declaration is submitted to the tax office at the place of registration of the entrepreneur once a year, before April 30 of the year following the reporting year. For 2022, reporting will be required by April 30, 2020. The declaration is submitted in any case, even if the tax at the end of the year is zero or if no activity was carried out at all.

The simplified tax system allows you to reduce the time spent on accounting. Another advantage is that the tax amount can be reduced using deductions. However, there remains the need for constant accounting, reflection of all income and expenses, and tax calculation.

Ekaterina Danilova , PR specialist at the TaxCOACH Business Structuring Center:

“This is the second time I have been operating as an individual entrepreneur. For the last few years I have been providing marketing services. I chose a simplified taxation system, income only, 6%. I have no employees, I report only for myself. Once a year I submit a declaration, which I fill out myself. It contains 3 pages. Filling out takes about 30-40 minutes + I spend 10-15 minutes filling out receipts and paying taxes (online). After which I either go to the post office to send the declaration by registered mail, or take it to the Federal Tax Service office. This takes about an hour. I spend another 10-15 minutes filling out receipts for paying fixed contributions (insurance and pension) in December. Thus, I spend 2-2.5 hours a year on accounting. In the first year of work, in addition to the main declaration, I had to submit 2 “clarifications”; the correct version turned out only the third time, but I remembered the procedure for filling it out. Now I use it as a sample, and the declaration is accepted from the first “take”. Thanks to the fact that I studied this issue on my own, I save at least 24 thousand rubles annually.”

Deadlines for submitting tax reports and paying taxes for individual entrepreneurs using the simplified tax system of 6% in 2022

| Period | Payment term under simplified tax system 6% |

| 4th quarter 2022 | declaration and tax for 2022 – until 05/03/2018 |

| 1st quarter 2022 | advance payment – until 04/25/2018 |

| 2nd quarter 2022 | advance payment – until July 25, 2018 |

| 3rd quarter 2022 | advance payment – until October 25, 2018 |

| 4th quarter 2022 | declaration and tax for 2022 – until 04/30/2019 |

Unified tax on imputed income (UTII)

An individual entrepreneur can use UTII subject to the following conditions:

- number of hired employees up to 100 people, including individual entrepreneurs;

- the activity is carried out in the territory where the regime has been introduced;

- The company's activities are not carried out within the framework of a simple partnership or trust management.

Imputed income is the income that the state establishes (imputes) to an entrepreneur. It may correspond to real income, or it may differ greatly from it - both up and down. You need to decide whether such a regime is beneficial or not based on the characteristics of your business.

The peculiarity of UTII is that the amount payable remains unchanged and does not depend on income. This is convenient for those entrepreneurs who want to understand how to do their own accounting and save time on filling out declarations.

The amount payable is calculated as the amount of imputed income multiplied by the tax rate. The UTII rate is 15%, but by decision of the local authorities it can be reduced to 7.5%.

In retail trade, the basis for calculating the basic profitability, and therefore the tax, is the area. If sales are small in a huge store, then it may be more profitable to pay tax under a simplified system. And if a small retail space brings in a lot of income, then it is better to choose UTII with its fixed rate.

A single tax on imputed income can be applied in retail trade, the provision of household services, catering services, car repairs and other areas. The full list can be found in Article 346.26 of the Tax Code.

Formula for calculating imputed income:

VD = BD × K1 × K2 × Physical indicator value,

Where

BD – basic profitability for a certain type of activity;

K1 – deflator coefficient, approved by order of the Ministry of Economic Development;

K2 is a coefficient that takes into account the specifics of doing business and is approved by decisions of municipalities.

The value of a physical indicator is a quantitative characteristic that depends on the activities of the organization; in retail trade it is the number of square meters of the sales floor, in the field of consumer services it is the number of employees.

For an example of calculation, let's take a store with an area of 20 square meters. For retail trade, the basic profitability is 1,800 rubles per square meter. The deflator coefficient in 2022 is 1.915. Let’s take K2 equal to 0.7 (for the city of Bryansk in 2022).

1800 x 20 x 1.915 x 0.7 = 48,258 (rub.) – imputed income for the month

48,258 x 3 = 144,774 (rub.) – imputed income for the quarter (monthly amount multiplied by three)

UTII for the quarter will be:

144,774 x 0.15 = 21,716 (rub.) – 15% of the amount of imputed income

If the store had the same real “revenue”, but used a simplified system with the “income” object, it would have to pay 8,868 rubles for the quarter:

144,774 x 0.06 = 8,686 (rub.) – 6% of the amount of imputed income

Maria Chalaya , founder of the Zelenka smoothie market:

“At the launch stage of my project and in the first six months, I hired an accountant to fill out tax returns. He did the accounting for 2 quarters. I am an individual entrepreneur on UTII, and after six months I decided to do my own accounting, since it is quite easy with the tax system I have chosen. It takes me about 30-40 minutes to create a tax return, which is an acceptable time for me. I also pay taxes and other fees myself. I think that this is beneficial for small businesses, since it does not require special time and mental expenditure and saves money, which will not be superfluous at the start of the business. The main thing is to understand the issue, preferably with the support of an expert in the field.”

For UTII, the same deductions apply as for the simplified tax system:

- if an individual entrepreneur works without hired employees, he can write off the entire tax at the expense of insurance premiums;

- if you have employees, then 50% of the tax amount can be written off from insurance premiums paid for employees or for yourself.

If the entrepreneur from the previous example does not have hired personnel, and he paid fixed insurance premiums for the quarter, he can reduce the tax for the quarter by 9,059 rubles. In this case, the amount payable will be:

21,716 - 9059 = 12,957 (rub.)

Deadlines for submitting UTII declarations: quarterly, before the 20th day of the month following the reporting month.

payment is due by the 25th day following the reporting day. So the tax for the second quarter of 2022 will need to be paid before July 25, and for the third quarter - until October 25.

UTII is a convenient tax regime. It is very easy to figure out how to do accounting yourself, because the tax amount changes no more than once a year and does not depend on profit.

Services of a private accountant for individual entrepreneurs under the simplified tax system of 6%: cost per month *

| Number of documents per month | Cost with simplified tax system 6% |

| from 1 to 20 sets of documents | from 5775 rub. |

| up to 40 sets of documents | from 7350 rub. |

| up to 60 sets of documents | from 10500 rub. |

| up to 120 sets of documents | from 13650 rub. |

| up to 180 sets of documents | from 19950 rub. |

| up to 240 sets of documents | from 25200 rub. |

| up to 350 sets of documents | from 31,500 rub. |

* the cost of services is approximate, the final prices depend on the number of employees in the enterprise, the type of activity, markups for the type of contracts or complex transactions, as well as circumstances leading to different accounts of transactions (for example, combining the taxation system with UTII, etc.)

Accounting services for individual entrepreneurs on the simplified tax system 6% not only ensure compliance with the requirements of current legislation in matters of reporting and transfer of mandatory payments. A well-organized accounting system allows you to control all areas of the enterprise’s activities and plan further development based on objective information.

Patent tax system (PTS)

This is a special regime that involves acquiring a permit to carry out activities at the tax office. The advantage of a patent is that the amount to be paid is determined immediately, and the entrepreneur can estimate the tax burden. In addition, in some cases a patent is more profitable than the simplified tax system.

The list of activities for which a patent can be used is determined by the authorities of the subject of the federation, in particular, these include retail trade, household and transport services. The subject of the federation also establishes the amount of potential income, on which the amount of tax to be paid depends. The tax amount is determined as the product of the rate and potential income.

The tax rate is 6%. According to the laws of the constituent entities of the federation, it can be reduced to 0% - these are the so-called tax holidays for first-time registered entrepreneurs in the production, scientific and social spheres. Also, according to the laws of the Republic of Crimea, the rate can be reduced to 4% for certain categories of taxpayers.

On the PSN, the entrepreneur is required to maintain an Income Book. This document reflects all the income of the entrepreneur from his activities. This is necessary so that the tax authorities have the opportunity to check whether income restrictions are being observed. In addition, the Income Accounting Book will allow you to restore data in the event that an entrepreneur loses the right to use a patent and it will be necessary to calculate taxes according to the general system.

A patent is purchased for a period of one month to a year. Short terms are beneficial for seasonal business - renting out housing in resort towns, selling New Year's souvenirs, etc.

Depending on the validity period of the patent, payment terms :

- if the patent term is from one to six months, the amount is paid in a lump sum until the patent expires;

- if the period is more than six months, the tax is paid as follows: a third of the tax during the first three months of the patent’s validity, the remaining amount until the end of the patent’s validity.

PSN is transparent for the taxpayer. The entrepreneur knows exactly how much money needs to be paid; there is no need to submit declarations. However, you still need to keep track of your income. The disadvantage of the patent system is that there is no way to use deductions and reduce the amount of tax.

Accounting for individual entrepreneurs on a patent

Entrepreneurs who have chosen PSN for their activities, just like all other individual entrepreneurs, may not keep accounting, since they carry out tax (clause 1 of Article 346.53 of the Tax Code of the Russian Federation) in accordance with the procedure approved by order of the Ministry of Finance of Russia dated December 22, 2012 No. 135n .

For information on individual entrepreneur reporting on PSN, see the article “Individual entrepreneur reporting on PSN - pros and cons.”

IMPORTANT! The absence of the need for accounting for entrepreneurs entails that they do not have to submit financial statements.

How to do your own accounting

- The general taxation system is the most difficult to account for, so an entrepreneur who does his own accounting is better off paying attention to special regimes.

- A simplified taxation system involves accounting for income and expenses and makes it possible to choose the object of taxation and the tax rate. Tax can be reduced by using deductions in the amount of insurance premiums.

- Single tax on imputed income - determines in advance the amount that must be paid to the budget, depending on the basic units of profitability. The tax amount can also be reduced by the amount of contributions paid.

- Patent system - a patent can be purchased for a short period of time, the entrepreneur knows in advance how much tax will need to be paid. You need to keep records of your income.

Figuring out how to do accounting yourself is not that difficult. This does not require much time, saves money on hiring an accountant and allows you to better control your business. The main thing is to choose the optimal regime and keep abreast of innovations in tax legislation.