Confirmation of income of an individual entrepreneur: when necessary

There are plenty of situations when an individual entrepreneur is obliged to provide information about his income. These may be the following cases:

- An individual entrepreneur applies for a loan from a bank;

- An individual entrepreneur needs to receive an allowance, subsidy, benefit, etc.;

- in some cases when traveling abroad.

Moreover, if people who work for hire can apply for a certificate confirming their income to their employer, where the issue is resolved quickly and competently, then individual entrepreneurs in this case have a problem - quite often entrepreneurs do not know how to correctly confirm their level of income for all kinds of authorities

Does the bank have the right to write off increased interest if it suspended the issuance of the loan before increasing it? If at the time of concluding the loan agreement the bank’s tariffs did not provide for a commission for early repayment, does the bank have the right to write it off after changing the tariffs? What circumstances do courts evaluate when considering cases of writing off fees for early loan repayment? View answers

What income will need to be verified?

Depending on the chosen taxation system, slightly different funds are legally recognized as income. If necessary, you need to confirm various forms of income:

- actual - to entrepreneurs working on the general taxation system, as well as the simplified taxation system and the unified agricultural tax (Chapter 23 of the Tax Code of the Russian Federation, clause 1 and clause 2 of Article 248 of the Tax Code of the Russian Federation);

- imputed - individual entrepreneur working on UTII (Article 346.29 of the Tax Code of the Russian Federation);

- possible – for patent entrepreneurs (Article 346.48 of the Tax Code of the Russian Federation).

NOTE! If an individual entrepreneur combines his taxation system with UTII or PSN, that is, combines forms of income, then the imputed or possible income will be included in the total actual amount.

Each type of income has its own characteristics in reflection and documentary evidence.

What is the procedure for assessing personal income tax on the income of an individual entrepreneur when renting out premises ?

Individual entrepreneur on OSNO: confirmation of income

The procedure for confirming income by individual entrepreneurs is clearly defined by law. If hired employees must provide state bodies and other organizations that require information about income with certificates in Form 2 of personal income tax, then individual entrepreneurs applying the general taxation regime are required to file a declaration in Form 3 of personal income tax. If you already have a declaration and it contains a mark of acceptance by a tax specialist, then it is advisable to obtain copies of it - they may also come in handy. In most cases, the individual entrepreneur will no longer need any additional documents or certificates.

Important! Photocopies of the declaration in Form 3 of personal income tax must also have the original marks of the tax authorities. Otherwise, the interested party may refuse to accept them due to invalidity.

For your information. Institutions that require proof of income sometimes have a very different approach in this regard regarding individual entrepreneurs. In particular, sometimes, in addition to the standard 3 personal income tax declaration, they may ask to provide a declaration for the last reporting tax period, according to the tax regime used by the entrepreneur.

When does an entrepreneur pay personal income tax?

According to paragraph 1 of Art.

23 of the Civil Code of the Russian Federation, an individual entrepreneur is an individual who conducts business activities and is registered as such. Thus, an individual entrepreneur, as an individual, is recognized as a personal income tax payer (clause 1 of article 207 of the Tax Code of the Russian Federation). The need to calculate the specified tax on income received by individual entrepreneurs from business is also indicated by the text of subsection. 1 clause 1 art. 227 Tax Code of the Russian Federation. When special regimes are applied, personal income tax together with VAT and property tax are replaced by one tax that meets the appropriate regime (Unified Agricultural Tax, Simplified Tax Tax, PSN). However, this only applies to income related to business activities. Income received by an individual entrepreneur not from business is regarded as the income of an ordinary individual and is subject to personal income tax, taking into account the requirements of Chapter. 23 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated April 23, 2013 No. 03-04-05/14057).

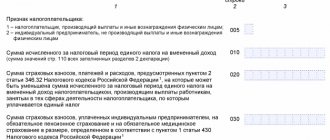

The obligation to submit a declaration to the individual entrepreneur on income received from business and expenses incurred is reflected in clause 5 of Art. 227 Tax Code of the Russian Federation. Such a declaration is drawn up on a form called Form 3-NDFL. In 2022, for 2022, 3-NDFL should be issued on an updated form, approved by order of the Federal Tax Service dated October 15, 2021 No. ED-7-11 / [email protected] You can download it for free by clicking on the picture below:

The update for previous years is submitted using the forms valid for the adjusted reporting periods.

If you need to adjust your reporting for 2022 - 2020, you can make your declarations here.

USN: confirmation of individual entrepreneur’s income

As for those individual entrepreneurs who use OSNO, for “simplified” people the 3rd personal income tax declaration serves as proof of income. But in addition to this, they can provide another important document as proof of the amount of income.

In particular, entrepreneurs who use a simplified tax regime in their work with an income minus expenses of 15% must keep a Book of Income and Expenses, which allows them to determine the tax base for calculating taxes. And if so, it means that this document contains all the necessary information about the income of the individual entrepreneur. That is, if necessary, a copy of the Book of Income and Expenses certified by a notary can be provided to any authority as a document confirming income.

Attention! By law, all entries made in the Income and Expense Book, including those related to income, must also have their confirmation, for example, bank statements, contracts, payment receipts, etc. These papers must be kept, since they may also need to be attached to this Book to prove income. In addition, individual entrepreneurs may need them in the event of a tax audit.

Filling out pages

Appendix 2 to the order of the Federal Tax Service, which approved Form 3-NDFL, contains the procedure for filling out the declaration. Before filling out, you should re-read these instructions to avoid possible errors.

Data needs to be entered only in certain pages indicated above, the rest remain empty and do not need to be submitted to the tax office.

First, you need to determine how the form will be filled out and submitted - manually, typewritten, in a program, electronically.

If the form is filled out on paper, be sure to use a pen with blue or black ink. The letters must be clear - capitalized and printed, and must clearly fit into the designated spaces. Empty cells are filled with a short line in the center. Correcting errors is not allowed; if the form is damaged, you must print a new one.

If the declaration is drawn up in electronic form, then the font must be courier new, size 16-18, the finished sample can be printed without borders of the cells.

Important points:

- the cost is indicated in rubles and kopecks;

- tax amounts - in full rubles;

- income/expenses in foreign currency are converted into rubles on the date of receipt of this income/expense;

- each page must have a number, individual entrepreneur’s tax identification number, last name, initials, signature;

- You only need to fill out 4 sheets and submit them to the tax office;

- filling begins with Appendix 2, then the second section, the first and title page, after which the sheets are numbered and folded in order.

You need to fill out 3-NDFL based on the data in the Income and Expense Accounting Book (ILC), which the individual entrepreneur must maintain throughout the year. Individual entrepreneurs are not required to keep accounting records; for the declaration, it is enough to have a KUDR, which can be drawn up in any form convenient for an individual entrepreneur.

When filling out the declaration, the entrepreneur needs to independently determine the actual income and expenditure part of his annual financial result and reflect it on the pages of form 3-NDFL.

Individual entrepreneurs pay advance payments throughout the year based on expected profits. The Federal Tax Service, based on individual entrepreneur data, determines the amount of advances that are paid based on the results of each quarter no later than the 15th day of the month following the reporting period.

At the end of the year, the individual entrepreneur must determine the amount of the advance paid and the actual amount of tax that needs to be paid based on real data.

The difference between the advance payment and the income calculated in the declaration must be paid to the budget. The need for additional payment arises if the tax payable according to real data turns out to be more than the advances paid. If you overpay, an individual entrepreneur can count on a refund of the overpaid tax.

What expenses can be taken into account?

IP expenses can reduce the tax base if they:

- actually paid in the reporting year;

- related to business activities;

- are documented;

- justified.

The following expenses can be classified as expenses:

- for raw materials, starting materials, semi-finished products, goods, fixed assets (material);

- for depreciation;

- to pay salaries to employees, etc.

If the expenses do not meet the above conditions, then the individual entrepreneur may not take them into account, but take a professional deduction of 20% of the annual income as a reduction in the tax base.

That is, the entrepreneur himself chooses what exactly he will accept as expenses - a deduction in the form of 20% of income or actual expenses subject to compliance with the conditions established by the Tax Code of the Russian Federation.

If there are few expenses or they are not supported by documents, then it is better to use a professional deduction.

Title page

You can fill out the first page of 3-NDFL first:

| TIN | TIN of an individual entrepreneur. |

| Correction No. | It is set to “0—” for the initial supply. If the declaration is corrected, the correction number is indicated. |

| Taxable period | Period code – 34 for individual entrepreneurs. |

| Year | 2019, if the declaration is filled out by an individual entrepreneur in 2022. |

| Tax authority | Federal Tax Service code where the report is submitted. |

| Taxpayer information | Include

|

| Information about the identification document | Include:

|

| Status code | Tax residents of the Russian Federation put “1”, non-residents – “2”. |

| Telephone | Contact information must be indicated with the city code. |

| Section "Reliability..." | Information about the person submitting the 3-NDFL declaration to the Federal Tax Service. |

Example of filling out a title page:

Section 1

This section is final and is filled in last after all the data is reflected on other pages.

If an individual entrepreneur must pay tax, then “1” is entered in field 010, and the amount to be transferred in field 040.

If the individual entrepreneur does not have an obligation to pay, then “3” is put in 010, and dashes in 040.

If an individual entrepreneur wishes to return funds from the budget at the end of the year, then “2” is entered in 010, and the amount to be returned in 050.

Lines 030 and 040 are filled in with data on KBK and OKTMO; these codes are entered into form 3-NDFL in any case, regardless of the annual financial results of the individual entrepreneur.

Example of filling out section 1:

Section 2

The section is important; it calculates the individual entrepreneur’s tax to be paid based on the tax base. It is important that all amounts are indicated excluding VAT (if an individual entrepreneur is its payer).

Filling out the lines of the second section of 3-NDFL:

| 1. Calculation of the tax base | |

| 002 | Individual entrepreneurs indicate “3”, which means “other”. |

| 010 | Revenue for the year excluding receipts from foreign companies (must be equal to the value of field 050 app. 3). |

| 020 | Total annual tax-free income (receipts from foreign companies are not included). IPs put zeros in this line. |

| 030 | The total annual taxable income is calculated as indicator 010 - 020. Individual entrepreneurs in this field indicate revenue from line 010. |

| 040 | The amount of deduction (professional for individual entrepreneurs) taken into account for the reporting year (equal to the value of field 060 app. 3). |

| 050 | Not filled in. |

| 060 | The tax base is equal to the difference between lines 030 and 040. |

| 2. Tax calculation | |

| 070 | Tax = Base from field 060 multiplied by rate from field 001. |

| 110 | Advances from field 070 app. 3. |

| 150 | Tax payable - if the tax amount from field 070 is greater than advances from field 110, it is calculated as the difference between the indicators of lines 070 and 110. |

| 160 | Tax refundable, if tax from 070 is less than advances from 110, is calculated as the difference between 110 and 070. |

Example of filling out section 2:

Appendix 3

The application calculates income from the activities of individual entrepreneurs and the amount of professional deduction, which reduces the base for tax calculation.

Line by line filling is presented in the table:

| 1. Type of activity | |

| 010 | Code of the type of activity from Appendix 5 to the Filling Out Procedure, individual entrepreneurs indicate 01, which means entrepreneurial activity. |

| 020 | Primary activity code – OKVED, specified during registration of individual entrepreneurs. |

| 2. Indicators for the tax base and tax | |

| 030 | Amount of annual income excluding VAT. |

| 040 | The amount of annual expenses excluding VAT (divided into four components indicated in lines 041, 042, 043 and 044). This field is filled in if the individual entrepreneur is able to confirm the expenses with documents, and they are truly related to business activities. If this is not the case, then you should fill out field 060, which indicates a professional deduction in the amount of 20% of expenses. |

| 3. Total | |

| 050 | Income from line 030 (if an individual entrepreneur has filled out several appendices 3 at different tax rates, then the total income for all lines 030 is calculated and entered in this field). |

| 060 | Either expenses from line 040 or 20% of income from line 030 are indicated. |

| 070 | Advances paid during the year (calculated by the tax authorities based on information about the profit of the individual entrepreneur). |

| 4. Information provided by peasant farms | |

| 080 | Only peasant farms fill in. |

| 5. Information about self-adjustment | |

| 090-100 | It must be filled out if the individual entrepreneur adjusted the tax base independently in accordance with clause 6 of Article 105.3 of the Tax Code of the Russian Federation. |

Lines 110-150 are not filled out by individual entrepreneurs; they are intended for individuals without a business background to indicate income from sources from Annexes 1 and 2.

Example of filling out Appendix 3:

How to confirm the income of an individual entrepreneur on UTII

Unlike other types of taxation, individual entrepreneurs located on UTII, if it is necessary to confirm income, find themselves in a slightly more difficult situation.

The thing is that to calculate taxation, it is not income that is used here, but types of activity. At the same time, the tax amount for each type of activity has a fixed value, based on their level of expected profitability, physical indicator and adjusting federal and regional coefficients. That is, the actual income that an individual entrepreneur receives on UTII actually, in any case, differs from what is assumed when calculating this tax. Moreover, the state does not in any way oblige entrepreneurs working on UTII to monitor and record their income.

What to do in this case?

Option two:

- regardless of the will of legislators, still keep records of income in a simplified form;

- prove profitability by presenting primary documents.

Here the first option requires some explanation. Almost all individual entrepreneurs who are “imputed” still control the level of their income in one way or another. Which, in general, is logical: every individual entrepreneur wants to be sure that his business is profitable and profitable, and also to clearly understand exactly how much income he has. However, the main question here arises not in the fact of accounting itself, but in what form it is carried out. For example, if these are ordinary magazines or notebooks filled out by hand, then of course they will not have any evidentiary value. It is important that income records are kept in documentary form, with official status assigned to internal accounting documents. This is possible if each such document has the appropriate details.

The law clearly defines the information that must be contained in the details confirming income on the “imputation”:

- Name;

- date and place of compilation;

- Full name IP;

- IP INN;

- individual entrepreneur registration number;

- signature and seal (if any) of the individual entrepreneur.

In addition, this document must include:

- the name of the business transaction performed;

- a specific amount of income or expense, if accounting is also carried out for expenses.

All accounting documents must be kept in chronological order, including all information about costs and profits without exception.

Attention! Since, according to UTII, the reporting tax period is one quarter, it is necessary to summarize the internal accounting of expenses and income once every three months. Based on the results of the year, it is necessary to display separate annual results.

Sample of filling out 3-NDFL in 2022 for individual entrepreneurs

For example, let’s enter the initial data according to which the individual entrepreneur will compile 3-personal income tax for 2022.

IP Pimenova A.A. manufactures kitchen furniture to individual orders and is a member of the Austrian company EximStankoSolutions Ltd. The individual entrepreneur has three children: the eldest have graduated from universities, the youngest is studying at school (he is 16 years old).

December 18, 2022 Pimenova A.A. received 2000 euros as dividends. To avoid double taxation, the Government of the Russian Federation signed a Convention with the Government of the Republic of Austria. In Austria, dividends are taxed at 15%. The official euro exchange rate as of December 18, 2022 is 69.6801 rubles.

| Index | Calculation of withholding tax in Austria | Tax calculation in 3-NDFL |

| Income | 2000 euros | RUB 139,360.20 (2000 x 69.6801) |

| Personal income tax rate | 15% | 13% |

| Tax withheld | 300 euros = 20,904 rubles. (2000 x 69.6801) | RUB 18,117 |

| As a result of offset, personal income tax is subject to refund from the budget | 20,904 – 18,117 = 2787 (rub.) | |

The individual entrepreneur uses the calculated data to reflect in Appendix 2 and Section 2 (page 003) the following example of filling out the declaration.

We present income from business activities and deductions for each quarter of 2022 in the table (rubles):

| Quarter 2019 | Income | Professional deduction | Standard deduction for the 3rd child (clause 4, clause 1, article 218 of the Tax Code of the Russian Federation)* | Calculation of the amount of personal income tax payable based on the results of the reporting and tax period | ||||

| Materials | Depreciation | Salary | other expenses | Total | ||||

| 1 | 390 000 | 170 000 | 30 000 | 100 000 | 9000 | 309 000 | 6000 | (390,000 – (309,000 + 6000)) x 13% = 9750 |

| 2 | 450 000 | 210 000 | 30 000 | 120 000 | 7000 | 367 000 | 0 | (450,000 – 367,000) x 13% = 10,790 |

| 3 | 510 000 | 250 000 | 30 000 | 130 000 | 7500 | 417 500 | 0 | (510,000 – 417,500) x 13% = 12025 |

| 4 | 470 000 | 220 000 | 30 000 | 110 000 | 8000 | 368 000 | 0 | (1,820,000 – (1,461,500 + 6000)) x 13% – (9750 + 10,790 + 12,025) = 13,260 |

| TOTAL | 1 820 000 | 850 000 | 120 000 | 460 000 | 31 500 | 1 461 500 | 6000 | (1,820,000 – (1,461,500 + 6000)) x 13% = 45,825 |

* The amount of income since the beginning of the year has exceeded 350,000 rubles. in March, so the deduction for the 3rd child is provided only in January and February 2022.

Based on the results of the reporting periods, the individual entrepreneur paid advances in the amount of 9,750 + 10,790 + 12,025 = 32,565 (rubles), and at the end of 2022, personal income tax from business activities payable will amount to 13,260 rubles. (45,825 – 32,565). Deductions per child – 6,000 rubles. This information will be reflected in appendices 3 and 5, as well as in the second section 2 (page 004).

In section 1, the payer will summarize the results for each BCC:

- Personal income tax payable on income from business activities will be 13,260 rubles;

- the amount of excessively withheld tax on dividends to be refunded is RUB 2,787.

Sample 3-NDFL 2022 for individual entrepreneur A.A. Pimenova. will look like this:

How to confirm income on PSN

Entrepreneurs working on the patent system, as well as on imputation, may not receive the same income as expected. So which one should be confirmed for various authorities - the real one or the one that was supposed?

Entrepreneurs on PSN have two documents to record and confirm income receipts:

- a patent that states the possible amount of income;

- an income book that reflects actual receipts.

To confirm the real income of an individual entrepreneur on the PSN, the above-mentioned book should be bound, its pages numbered, and preferably certified with the seal of the individual entrepreneur. Next, one copy of the book must be transferred to the tax office, then it will put its stamp on it, which will be a legal confirmation of the income of the entrepreneur on the patent.

Certificate of income of individual entrepreneurs in any form

Sometimes, beginning, inexperienced individual entrepreneurs think that to confirm their income they only need to write a certificate in any form and submit it at the place of request. This is wrong. Individual entrepreneurs cannot provide information about income to government agencies in the form of arbitrary certificates, even sealed and signed. Such papers will not be considered legal documents, and, therefore, will not have the slightest significance.

But! In some, very rare cases, such a certificate is still sufficient, although it must be accompanied by a certificate from the territorial tax office on the registration of individual entrepreneurs, a copy of the declaration for the last tax period with the tax stamp and either the Book of Income and Expenses, or some other or other internal documents confirming the profitability of the individual entrepreneur.

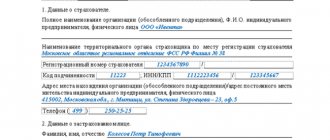

Data for the report

The final indicators are entered into the report from the Book of Income/Expenses and Business Operations (approved by order of the Ministry of Finance of Russia No. 86n, Ministry of Taxes of Russia No. BG-3-04/430 dated 08/13/2002), which is maintained by individual entrepreneurs to calculate the tax base for OSNO.

Income

In clause 1 of Appendix 3 of the report, individual entrepreneurs indicate a two-digit activity code from the list of Appendix No. 5 to the Procedure for filling out the declaration (01 - entrepreneurial activity), then in clause 1.2 the main OKVED code is put (it can be found out from the extract from the Unified State Register of Individual Entrepreneurs).

Income from business activities is indicated in paragraph 2.1 (page 030) of Appendix 3 of the report.

The heads of peasant farms in paragraph 4.1 of Appendix 3 prescribe the year of registration of the farm.

To reflect independent adjustment of the tax base and tax on transactions with related parties, clauses 5.1, 5.2 (pages 90, 100) of Appendix 3 of the declaration are intended.

The final income indicators are reflected in paragraph 3 of Appendix 3 (p. 050).

Tax deductions

Individual entrepreneurs on OSNO can exercise their right to professional tax deductions, thereby reducing the tax base and tax payable (clause 3 of Article 210 of the Tax Code of the Russian Federation). Professional deductions of individual entrepreneurs include those actually made and documented (Articles 221, 252, 253,265 of the Tax Code of the Russian Federation):

- expenses for materials;

- depreciation;

- payments to staff;

- other costs associated with doing business.

The total amount of expenses incurred is indicated on page 040 of Appendix 3, the breakdown is given in paragraphs 2.2.1 - 2.2.4 (pages 041-044). The result is recorded in paragraph 3 (p. 060) of Appendix 3.

If it is not possible to confirm expenses with documents, you can claim a deduction of 20% of the income received by the entrepreneur (from line 030) without any confirmation (clause 1 of Article 221 of the Tax Code of the Russian Federation).

The amount of professional deduction is indicated on page 060 of Appendix 3.

Other deductions

Entrepreneurs do not fill out Section 6 of Appendix 3 - it is intended for deductions permitted by clause 2.3 of Art. 221 of the Tax Code of the Russian Federation for individuals - contractors, authors and creators of scientific and artistic works.

In 3-NDFL for individual entrepreneurs for 2022, you can indicate other deductions if the individual has the right to them:

- standard - their list is given in Art. 218 of the Tax Code of the Russian Federation (for example, for a deduction for the first and second child, 1,400 rubles each, for the 3rd and subsequent children, 3,000 rubles each);

- social - according to amounts spent on treatment, training, charity within the approved limits (Article 219 of the Tax Code of the Russian Federation);

- property - when selling property that was not involved in business operations (Article 220 of the Tax Code of the Russian Federation).

For standard and social deductions, Appendix 5 of the declaration is used, for property – Appendix 6.

Advance payments

Individual entrepreneurs calculate advances on personal income tax independently. The amounts of indicators for business activities are entered on an accrual basis in the Calculation to Appendix 3 of the declaration. This is a new section in 3-NDFL.

First indicate:

- on pages 010-012 - income for the 1st quarter, 6 and 9 months (cumulative);

- on pp. 020-022 - taken into account professional deductions for the same periods;

- on pp. 030-032 - standard tax deductions.

Social and property deductions during the year do not affect the amount of advance payments of individual entrepreneurs, therefore they are not reflected on the specified sheet.

Then the tax base is calculated for each period (income minus deductions) - the results are entered on pages 040-042. Below, on pages 050-052, accrued advance payments are indicated (13% of the tax base).

The total amount of advances paid during the year is entered in page 070 of Appendix 3 of the declaration.

After reflecting all information about income, expenses and deductions, sections 2 and 1 of the declaration are completed last.

We will show you how to enter information into 3-NDFL for individual entrepreneurs using an example.

Confirmation of income of individual entrepreneurs in the tax office

Not a single law or regulation states that territorial tax authorities are required to issue any supporting documents about the income of individual entrepreneurs. However, the practice already established in some regions shows that if individual entrepreneurs contact the local tax service with a similar request, specialists issue such certificates. To do this you need:

- contact the district tax inspectorate;

- write an application in any form with a request to issue a certificate of income.

Within 30 days, the tax office will make a decision and either provide the required document or deny the request. It is worth noting that if the local tax service has refused to provide a certificate, there is no point in challenging it.

Filling out 3-NDFL for individual entrepreneurs in 2022

To submit 3-NDFL, use a new form in which:

- barcodes and codes of some fields have been adjusted;

- in Appendix 2 on income from sources abroad of the Russian Federation:

it is indicated that the exchange rates are given in rubles and kopecks;

- fields for tax-exempt income have been updated (clauses 60, 60.1, 66, Article 217 of the Tax Code of the Russian Federation);

- the reference to “Tax Code of the Russian Federation” is further abbreviated to “Code”;

To submit 3-NDFL for 2022, individual entrepreneurs must use the current form, taking into account these changes.

Validity period of the certificate confirming income

Different authorities have different requirements for the validity period of certificates confirming the profitability of individual entrepreneurs. But, as a rule, all documents confirming the income of an entrepreneur are suitable for presentation to various government and other structures during the period following the last tax reporting period. In any case, it is necessary to clarify the maximum limitation period for such documents in the institution where they are required to be presented.

As the above material shows, the main document confirming the income of an individual entrepreneur is the 3rd personal income tax declaration. However, it may additionally require other evidentiary documents, and different ones, depending on the tax system that the individual entrepreneur uses. In any case, entrepreneurs should keep separate records of all income with the collection and storage of all receipts.

What sheets does an individual entrepreneur fill out?

There are many sheets in the 3-NDFL tax return, but individual entrepreneurs must fill out only 4:

- the first with general information;

- section 1 indicating the amount of tax;

- Section 2 with calculation of tax payable;

- Appendix 3 to reflect the results of business activities.

Other sheets may be needed to fill out if the individual entrepreneur had other income besides entrepreneurial activity.

Individual entrepreneurs who do not carry out any operations in the reporting year must fill out the declaration in the zero version, while the following pages of the 3-NDFL form are filled out - the title page and two sections where zeros or dashes are entered instead of total values.