- November 27, 2018

- Finance

- Anna Grekova

Various financial instruments can be used in relations between business entities. These include securities, among which a promissory note occupies a special place. It can be used by both individuals and legal entities.

The legal procedure for filling out and circulating a security form, as well as the list of necessary details, was established back in August 1937 by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR No. 104/1341 “On the implementation of the provisions on bills of exchange and promissory notes.” This resolution was approved within the framework of the Geneva Convention.

On March 11, 1997, Federal Law No. 48-FZ “On bills of exchange and promissory notes” was adopted. He confirmed that the said Resolution in the Russian Federation operates in the same way as in the Soviet Union. So, a bill of exchange is a security that has long proven itself as an instrument of commodity-money relations.

What is a bill of exchange

A bill is a security that certifies debt obligations. The easiest way to explain the meaning of the concept of a bill of exchange is to compare it with a promissory note written on a specially made valuable form. Only a receipt is tied to a specific transaction, and a bill of exchange serves to indicate a specific obligation. It does not indicate for what the funds should be transferred; the main emphasis is on how much, when and where the funds will be transferred.

A bill of exchange is issued by the debtor - the drawer - who undertakes to pay the agreed amount on time in a specific place to the person who presents the form of the bill - the holder of the bill. The amount in it can only be indicated in monetary units.

A bill of exchange is a security, therefore it can only be produced on paper; there are no electronic analogues. This debt document can be printed or filled out by hand on plain paper, indicating all the necessary parameters of the debt obligation. If the amount of debt is significant, it is recommended to purchase specialized forms that have a certain degree of protection against forgery. If significant defects are noticed on the form of the promissory note, the authenticity of the debt obligation may be questioned.

Types and features of bills

A bill of exchange is a written promissory note of a form strictly established by law, issued by the drawer (borrower) to the holder of the bill (creditor), giving the latter the unconditional right to demand from the drawer payment by a certain date the amount of money specified in the bill.

The concepts of a promissory note and a bill of exchange and their differences:

1. A promissory note is a document containing a simple and unconditional obligation of the drawer to pay the holder a certain amount at a specified time and in a specific place.

A promissory note is issued by the debtor. At its core, it is an IOU.

2. A bill of exchange (draft) is a document that is an instruction from the drawer (drawer) to the drawee (payer) to pay the remitee (third party) a certain amount at a specified time and in a specific place.

The difference between a promissory note and a bill of exchange is that a bill of exchange, unlike a promissory note, involves three parties:

Drawer - drawer,

The drawee is the payer,

The recipient or holder of a bill.

Together with the bill of exchange, an acceptance is issued, proving the payer’s consent to pay the bill.

A promissory note is a special case of a bill of exchange, in which two parties are involved due to the fact that the drawer and the payer are one person. A promissory note does not require acceptance, since the very fact of issuing the bill automatically means consent to its payment.

At the same time, both a bill of exchange and a promissory note can be transferred from one holder to another. To do this, it is necessary to issue an endorsement - an endorsement on the reverse side of the bill.

Other common types of bills and their definitions:

1. A discount bill is an interest-free bill placed at a price below par, that is, taking into account the discount.

2. An interest-bearing bill is a bill with a fixed interest rate. It is issued for the purpose of accumulating income as a deposit instrument. The advantage of such bills is that they can also be used to pay off counterparties.

3. An interest-free bill of exchange is a bill that does not contain an interest rate clause, or has a zero interest rate and a maturity date “at sight”.

Procedure for drawing up the document

So, the bill must be drawn up on paper. Filling out a promissory note will not seem like a difficult task if you know what mandatory details must be included in it.

The form of the debt document must necessarily contain the following items:

- the name in the language in which it was compiled;

- unconditional obligation to pay the specified amount;

- prescription of the due date for payment and the place at which it must be made;

- name of the bill holder;

- address and date of drafting the bill;

- name and signature of the drawer.

If any of the document details are not specified accurately, the authenticity of the document may be disputed. If one of the details is not specified at all, the bill will not have legal force.

How to correctly calculate the debt collection period on a bill of exchange. According to the experience of lawyers

Due to missing the deadline, the court refused to collect the debt on the bill. The Supreme Arbitration Court of the Russian Federation managed to prove that the term is calculated differently.

OJSC Rosagroleasing was the holder of a promissory note for 300 thousand rubles, issued in 2007 by OJSC Sberbank (hereinafter referred to as the issuer, the bank). Under this bill, the drawer undertook to unconditionally pay the amount specified in it to the peasant farm (this was the lessee of the company) or, by his order, to another person. The due date for payment of the bill is upon presentation, but not earlier than 01/23/08. However, the company holding the bill did not manage to present the bill for payment on the due date.

The possibility of making a claim from an “overdue” bill of exchange in court is confirmed in paragraphs 21 and 22 of the resolution of the Plenum of the RF Armed Forces and the Plenum of the Supreme Arbitration Court of the Russian Federation dated December 4, 2000 No. 33/14 “On some issues in the practice of considering disputes related to the circulation of bills of exchange” (hereinafter referred to as the resolution No. 33/14). The highest courts have clarified that failure to present a bill of exchange for payment within the period specified therein does not exempt the drawer from making payments on the bill in the event of a claim being brought within the established limitation period. In other words, a demand for payment on a promissory note can be asserted against the drawer by filing a lawsuit in court.

The company filed a statement of claim to collect the bill of exchange debt from the bank only on January 23, 2012 (the last day of the statute of limitations). The court of first instance satisfied the requirements (decision of the Moscow Arbitration Court dated June 29, 2012). But on appeal this decision was overturned (ruling of the Ninth Arbitration Court of Appeal dated 08/21/12). The appellate instance cited the expiration of the statute of limitations. In her opinion, it expired a year ago - 01/23/11, that is, three years after the date indicated on the bill - 01/23/08. Moreover, the company presented the original bill of exchange in court only on May 22, 2012.

What did the lawyers do?

The company's legal department was faced with the task of proving in cassation that the appellate instance was mistaken and in fact the statute of limitations had not been missed. As part of this task, the first question was what moment should be considered the starting point for starting to calculate the three-year limitation period: 01/24/08, as the court of appeal believed, or 01/24/09, as the company representatives and the first instance believed? The second question: does it matter for the conclusion that the statute of limitations has passed that the original bill of exchange was not presented simultaneously with the claim - on the last day of the statute of limitations (calculated from January 24, 2009), but later?

The deadline for presenting a bill of exchange for payment established in Article 34 of the bill of exchange provision is the deadline for fulfilling obligations, and not the limitation period.

Legal position regarding the beginning of the limitation period.

It would seem that the fact that the statute of limitations in this case should have been calculated from 01/24/09 should not have raised any doubts. According to Articles 34 and 77 of the bill of exchange regulations, a promissory note with a maturity date of “at sight” must be presented for payment within one year from the date of its issuance. In this case, the drawer may establish that a promissory note with a maturity date of “at sight” cannot be presented for payment before a certain date. In this case, the one-year period for presenting the bill for payment is calculated from this date. Considering that in this case the bill of exchange indicated the payment period “at sight, but not earlier than 01/23/08”, the company could submit demands for payment of the bill of exchange to the bank before 01/23/09 (inclusive). Consequently, the three-year limitation period for going to court began on 01/24/09 and its last day was 01/23/12.

The Supreme Arbitration Court of the Russian Federation clarified back in 1997 that the period for filing claims against the drawer of a promissory note begins to run from the date of payment (clause 25 of the information letter dated July 25, 1997 No. 18 “Review of the practice of resolving disputes related to the use of a bill of exchange in economic circulation” ). There is a similar explanation in paragraph 22 of Resolution No. 33/14: claims against the drawer arising from a promissory note are extinguished after three years from the date of payment, and the beginning of the three-year period is determined by the day of payment in accordance with the terms of the bill. But, given that in the situation under consideration, the bill was not presented for payment, the question arose: what should be considered the day of the payment deadline - the day of its beginning (01/23/2008) or the day of its end (01/23/2009).

The main difficulty was that arbitration courts (more precisely, judges, since different approaches could be found even in judicial acts of the same court) did not have unity on the issue from what starting point the statute of limitations should be counted in similar circumstances.

Legal position regarding the moment of presentation of the original bill of exchange.

The appellate instance drew attention to the moment the original bill of exchange was presented in court in connection with another clarification from resolution No. 33/14. Within the meaning of the last paragraph of paragraph 23 of this resolution, the demand for payment of the bill by filing a claim in court is considered to be the proper presentation of the bill for payment. Therefore, this situation is subject to the requirements for the procedure for presenting a bill of exchange for payment - in particular, the need to present the original bill of exchange to the drawer (clauses 38, 77 of the bill of exchange regulations). In this case, the original bill of exchange was presented by the plaintiff only at the court hearing on 05/22/12, that is, beyond the three-year limitation period, even if we count it from 01/23/09. This argument could be objected to by the fact that, according to the version of the Civil Code that was in force at the time the claim was filed, the running of the statute of limitations is interrupted by filing a claim in the prescribed manner (paragraph 1 of Article 203 of the Civil Code of the Russian Federation as amended). After the break, the limitation period begins anew. This means that in this case, the day after the filing of the claim, the limitation period began to run from the beginning, and, thus, the original bill of exchange was presented within the limitation period.

Appealing judicial acts.

The cassation court agreed that the statute of limitations began not from 01/23/08, but from 01/23/09. But she still considered the statute of limitations to have expired due to the fact that the original bill of exchange was presented in court only on May 22, 2012 (resolution of the Federal Antimonopoly Service of the Moscow District dated December 26, 2012).

Appeal to the Supreme Arbitration Court of the Russian Federation.

“Judging by the fact that the same courts made opposite decisions in cases with similar circumstances, we realized that only the Presidium of the Supreme Arbitration Court of the Russian Federation can put an end to this issue. Actually, in the supervisory complaint we focused on the fact that in judicial practice there is no uniform position on how to calculate the limitation period for bill of exchange disputes if the payment period is formulated as “upon presentation, but not earlier than such and such a date” “says Andrei Figol.

Nota bene!

According to the new edition of the Civil Code, from the date of application to the court in the prescribed manner for the protection of a violated right, the statute of limitations does not run throughout the entire time that judicial protection is carried out (clause 1 of Article 203 of the Civil Code of the Russian Federation as amended, which came into force in September 2013 ).

Three judges of the Supreme Arbitration Court, considering the appeal, confirmed the existence of grounds for transferring the case to the Presidium for consideration. As a result, the supervisory authority sided with the company (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 5, 2013 No. 5054/13). She clearly indicated that in the present case, taking into account the terms of the bill itself and its failure to present it for payment, the last day of the three-year limitation period of the bill of exchange was 01/23/12, which means that the company filed a claim in court within this period. In addition, the Presidium of the Supreme Arbitration Court of the Russian Federation stated that the courts erroneously linked the expiration of the bill of exchange limitation period with the date the company presented the original bill of exchange at the court hearing. In this case, the company filed the claim within the three-year statute of limitations, after which the statute of limitations ceased to run during the entire period while the legal defense was carried out. This means that the fact that the bill was presented only during the consideration of the case was no longer significant for the conclusion that the statute of limitations had expired. Thus, the Presidium of the Supreme Arbitration Court of the Russian Federation actually applied in this case the approach that is formulated in the new edition of the Civil Code (clause 1 of Article 203 of the Civil Code of the Russian Federation). As the basis for this conclusion, he referred to Article 71 of the provisions on the bill (it states that the limitation period is valid only in relation to the person against whom the action interrupting the limitation period was committed), as well as the first paragraph of Article 70 and Article 77 of the provisions on bill of exchange

What has been achieved?

The Presidium of the Supreme Arbitration Court of the Russian Federation canceled the judicial acts of the appellate and cassation instances, leaving in force the decision of the court of first instance to collect the bill of exchange debt. The Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 05.11.13 No. 5054/13 contains a clause that judicial acts that have entered into legal force in cases with similar factual circumstances can be revised on the basis of paragraph 5 of part 3 of Article 311 of the Arbitration Procedure Code of the Russian Federation, if there are no other options for this. obstacles. The formality of the bill is manifested in the fact that the absence of at least one of the required details deprives the bill of legal force.

In clause 5 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 25, 1997 No. 18 “Review of the practice of resolving disputes related to the use of a bill of exchange in economic circulation” (hereinafter referred to as Information Letter No. 18) the following is stated. The inclusion in the text of the bill of exchange of a condition that the payment period is established by an indication of a probable event is a violation of the requirements for the form of the bill of exchange and entails its invalidity.

Note!

The lack of bill of exchange force in a document does not prevent it from being considered as a debt document of a different legal nature - a promissory note. This position was expressed in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 23, 1996 No. 6385/95. The legal holder of a bill is not required to prove the existence and validity of his rights, since they are presumed to exist and be valid. The burden of proof to the contrary lies with the bill debtor (Resolution of the Thirteenth Arbitration Court of Appeal dated October 15, 2010 No. A56-1419/2010).

Payment deadline

The period for which a promissory note is issued is established by the parties to the transaction by agreement. The legislation provides for issuance for a period of:

- A clearly defined date.

- Upon expiration of a certain period from compilation.

- Specific time from presentation.

- Upon presentation.

If the form of the bill contains any other term, then such debt obligation will be considered invalid.

If the payment period is not specified in the document, then the obligation must be fulfilled upon presentation.

Procedure for settlements on debt obligations

Let us dwell in more detail on the scheme and rules for settlements with debt securities. Both the drawer and the holder of the bill can be a legal entity or an individual.

The first action that begins settlement with promissory notes is the direct issuance of a security by the buyer to ensure payment on a due date in the future to the supplier for the goods delivered or the service rendered.

Next comes the provision of a service or delivery of goods.

On the agreed date, the holder of the promissory note must present the promissory note for payment.

Finally, redemption of the security follows, that is, full payment of the amount of money specified in the document by the drawer. At the same time, the debtor who has paid the bill has the right to demand from the former creditor a receipt for the full amount of payment. When a promissory note is repaid, the inscription “repaid” is placed on the document, and the text of the obligation is crossed out. It is not allowed to force the supplier of inventory items or services to accept payment on a bill of exchange earlier than the date established in it.

BILLS: Types, procedure for execution, terms of issuance of bills

A bill of exchange is a debt security that certifies the debt of one person (debtor) to another person (creditor), expressed in monetary form, the rights to which can be transferred to any other person by order of the owner of the bill without the consent of the debtor.

When carrying out business activities, any company takes part in transactions for the purchase and sale of goods, works, services, which leads to the emergence of mutual settlements with other organizations, which are carried out based on the terms of such transactions.

At the same time, mutual settlements can be carried out not only in cash, but also in other means of payment. One such means is a bill of exchange. According to the provisions of Article 143 of the Civil Code of the Russian Federation, a bill refers to securities.

Note: A security is a document certifying (in compliance with the established form and mandatory details) property rights, the exercise or transfer of which is possible only upon presentation.

With the transfer of a security, all rights certified by it in the aggregate are transferred (clause 1 of Article 142 of the Civil Code of the Russian Federation). Securities are classified as objects of civil rights in accordance with Article 128 of the Civil Code of the Russian Federation and, in accordance with paragraph 2 of Article 130, are recognized as movable property.

A bill of exchange is a debt security that certifies the debt of one person (debtor) to another person (creditor), expressed in monetary form, the rights to which can be transferred to any other person by order of the owner of the bill without the consent of the debtor. The issue and circulation of bills are carried out in accordance with bill law.

In accordance with the provisions of Article 1 of the Federal Law of the Russian Federation dated February 21, 1997. No. 48-ФЗ “On bills of exchange and promissory notes” No. 48-ФЗ, on the territory of the Russian Federation the Decree of the Central Executive Committee and the Council of People's Commissars of the USSR “On the entry into force of the Regulations on bills of exchange and promissory notes” dated 07.08 is applied. 1937 No. 104/1341.

Decree No. 104/1341 considers two types of bills: promissory notes and bills of exchange.

Also in the theory of bill law, other types of bills are distinguished: 1) treasury bills, 2) bronze bills, 3) friendly bills, 4) counter bills.

And depending on the security: 1) secured, 2) unsecured.

Bills of exchange are also conventionally divided into:

1. Trade or settlement bills

By commodity is meant a bill of exchange used for settlements between organizations and their counterparties in transactions related to the purchase and sale of goods, works, and the provision of services.

2. Financial bills.

Financial bills are bills whose transactions are not related to purchase and sale transactions. Including bills of exchange that are security for a loan obligation.

Bill of exchange issued by a legal entity

A legal entity, as an economic entity, can become a drawer by issuing a debt document to secure its obligations. In this case, a promissory note of a legal entity can become a payment document, ensuring mutual settlement between the buyer and seller. Or a financial and credit instrument, when a legal entity repays the debt for acquired inventory items, becoming a debtor on the bill.

Depending on the circumstances and necessity, the holder of the bill can use the promissory note in different ways:

- hold the security until its maturity date;

- submit the document to the credit institution. In this case, the holder of the bill receives the funds immediately, but pays the bank a discount for discounting the bill;

- pay off your debts with a bill of exchange by transferring it by endorsement.

What does endorsement of a bill mean?

The holder of a bill, as a participant in commodity-money relations, can use someone else's debt obligation as a payment document for his own calculations. In this case, on the form of the bill, or on an additional sheet attached to the form, an inscription about the endorsement of the document is affixed. This is a special inscription that indicates that the rights of claim under the security are completely transferred to another person. The promissory note literally should say “pay to favor.”

The person transferring the bill is called the endorser. The organization receiving the right of claim is called the endorser.

The endorsement on a bill of exchange can be of two types:

- Personal endorsement, in which the endorser writes the name of the new owner of the security: pay to the order the name of the endorser organization or the last name, first name, patronymic of an individual.

- A blank endorsement may consist only of the signature of the previous holder of the bill without indicating the acquirer's right to demand repayment of the bill. The legal entity supplements the signature with a seal. The blank endorsement may also include the phrase “pay to bearer.”

The transfer inscription must not contain errors or blots. Incorrect inscriptions are crossed out, and the correct wording is indicated below.

There can be any number of such endorsements by the time the promissory note is repaid. In this case, the debt obligation is fulfilled to the actual owner of the security at the time of its payment.

If the endorser does not wish to subsequently transfer the rights to claim the fulfillment of the debt obligation, then when making the endorsement he must put the inscription “without negotiability”. This will prohibit the transfer of the bill of exchange to another person in the future.

What is the aval of a promissory note

The document form can be marked with the inscription Aval. This is security for payment of a bill of exchange. In other words, it is a guarantee from a third party that the security will be repaid on time. The one who guarantees the bill is called an avalist. This can be any business entity other than the drawer.

An avalized bill is a security that becomes more reliable when it has collateral. Banks often put an aval on the form of a legal entity’s debt obligation. In this case, the bill becomes secured by a bank payment, and the bank receives a commission.

To affix an aval, a simple signature of the avalist on the form of the bill, or on an additional attached sheet called an allonge, is sufficient.

Settlements on bills

Let us now consider how settlements for the payment instruments under consideration can be carried out in practice. The most important condition characterizing a promissory note is the maturity date. In accordance with the provisions of the Resolution of the USSR Council of Ministers, the corresponding payment document can be issued for the following period:

- scheduled for a specific date;

- correlating with the moment of presentation of the bill;

- correlated with the moment of drawing up the payment document;

- involving payment of a debt upon presentation of a bill of exchange.

Documents in which the terms are indicated differently than in the specified paragraphs or require sequential calculation are considered invalid.

In accordance with the provisions of the Resolution of the USSR Council of Ministers, bills that are payable at sight must be transferred to the drawer for redemption within 1 year from the date of drawing up the document. At the same time, the debtor has the right to pay the creditor earlier or stipulate a longer period. Also, the settlement period for bills of exchange can be adjusted taking into account the position of the endorser.

The debtor may establish that a payment obligation payable upon sight cannot be transferred by the creditor for repayment earlier than a specific date. If, for example, a bill of exchange is issued for one or several months, then settlements on it must be made on the corresponding day of the month in which the debt is repaid. If there is no 31st day in a particular month, which corresponds to the day the bill was drawn up, then settlements are made on the 30th.

It may well be that the corresponding payment document will be issued for a month and a half. In this case, you first need to count, as follows from the provisions of the Resolution of the USSR Council of Ministers, whole months. It is possible that the bill will be assigned at the beginning, middle or end of the month. In this case, the settlement dates will fall on the 1st, 15th or last day of the month, respectively. In the text of the bill, you can specify a specific number of days after which the debt will have to be repaid - for example, “eight days” or “twenty days”. At the same time, it is permissible to write “half a month” - in this case the bill is considered issued for 15 days.

If a promissory note (or bill of exchange) must be paid on a specific day and place that uses different dating principles, then the due date must be used based on the appropriate criteria - based on the calendar of the place where the payment is made. The text of the bill may specify other conditions for determining dates in the event of a discrepancy between calendar standards.

What bill of exchange is called a bill of exchange?

The main difference between a bill of exchange, also called a draft, and a simple one is that it is not the drawer himself who must make the payment on the bill, but the business entity that is the debtor to him. In other words, when making payments using an ordinary bill of exchange, initially, when issuing a security, only two entities are participants in the inventory turnover: the debtor and the creditor. When using a bill of exchange for settlements in business activities, three business entities become parties to the transaction:

- The organization receiving the right to demand payment under a draft.

- A person who transfers his debt to the recipient to his debtor.

- Actually, the payer of the bill himself, who has outstanding financial obligations to the drawer.

The issuer of a bill of exchange is called the drawer, the payer of the bill is called the drawee, and the beneficiary is called the remitee.

Thus, the draft allows you to shift your obligations to your debtor. In this case, the creditor of the business entity and its debtor pay directly, bypassing intermediate settlements. To be paid, a bill of exchange must undergo an acceptance procedure.

Canceled bill

A redeemed bill is a debt paper (bill) in the possession of the principal debtor (drawer, acceptor, suscriptor), without the possibility of presenting an asset to make payment.

Repaid bill: legislative basis

By law, the holder of the bill can demand repayment of the debt paper within the period agreed upon by the parties. To exercise this right, he must fulfill several requirements - present the asset in the specified place, within a certain period of time and to the proper party. The person, place and terms of repayment are specified in the details of the debt paper.

A redeemed bill is a debt paper, the obligations under which are fulfilled in compliance with all procedures defined at the legislative level. So, if you want to receive payments on a debt security, its holder fills out an application, which states:

— details of the debt paper; — your demand for repayment of the asset; — preferred form of payment; — basic instructions for making payments.

The bill can be considered repaid if the payer is present at the address specified in the debt paper and payment is made in the agreed amount. If the asset holder cannot receive his funds (for example, he is not allowed into the house where the payer is), then the owner of the bill also has the right to go to court and declare non-repayment.

A redeemed bill is an asset that has passed all stages of verification before making payments. In this case, the examination of a debt paper consists of checking:

- authenticity and validity of the bill; — continuity of endorsements. This is where the sequence of endorsements is checked.

The payer can verify that the bearer of the debt paper is actually its holder. If the recipient of funds is an individual, the debtor (payer) may require to present a document confirming his identity. If the recipient of the funds is an entrepreneur, then in addition to checking a passport or other document, the drawer has the right to verify the authority of the party receiving funds under the debt paper. The role of a supporting document is often performed by a copy of the order appointing a specific person as a representative of the company when receiving funds under the bill.

If the recipient of the funds (holder of the debt paper) has not provided identification documents, then the drawer (debtor) still should not refuse to make payments. In such situations, the court is always on the side of the recipient (the holder of the bill), because the second party (the drawer) has not stated its objections in court.

Repaid bill: features of calculations

The law states that payments are made against the bill of exchange, that is, the payer cannot demand the debt security from the holder until it is repaid. In turn, the owner of the note has the right not to transfer the asset until he receives his funds.

The form of settlements between the asset holder and the payer is regulated by the Civil Code of the Russian Federation and a group of regulatory documents. They stipulate that the bill is considered repaid when an agreement to make payment is formalized in writing. For example, the payer can make an appropriate entry on the other party’s application with a proposal for the form of payment and a requirement to make payments. Also, the repayment of the bill is often stipulated in the transfer and acceptance certificate, which is signed by both parties.

When settling in cash, the bill for which the debtor has paid the entire amount to the holder is considered redeemed. In the case of an entrepreneur (legal entity), it is worth taking into account the restrictions on the maximum amount of cash (set by the Central Bank of the Russian Federation).

Repayment of a bill of exchange can also be made in non-cash form - by transfer of a check, collection, payment order or letter of credit.

The holder of the debt security must provide details to make payments. If the account for transferring funds is not specified, then the payer has the right to transfer money to repay the bill of exchange to the notary, taking into account the additional fee for payment of notarial services (0.5% of the transferred amount).

The process of repaying a bill when choosing a non-cash form of payment can take a long time. In such a situation, the risk of the payer increases that the holder of the debt security will not return the asset even after making the payment.

Repayment of a debt security can be carried out in the presence of the holder. In this case, the payer makes payments, and the owner of the bill transfers the debt paper to the other party. This situation is an ideal option for repaying a bill. But for this, both parties to the transaction must be clients of the same bank, which rarely happens.

If the transfer of a debt security is made before its repayment (payments are made by the drawer), then the holder of the bill is at risk. This is due to the fact that after receiving the document, the debtor may refuse to repay, because the basis for making payments is in his hands.

Repayment of bills using checks and letters of credit is almost never used. Of all the non-cash forms, collection is the most popular.

Procedure for drawing up a draft

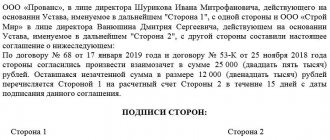

Like a regular debenture, a transferable security has certain drafting requirements. The required details of a bill of exchange are as follows:

- name of the security in the language of preparation;

- an unconditional obligation to pay;

- details of the participant in the commodity-material transaction who will be obliged to repay the bill and pay the amount specified in it;

- immediate payment deadline;

- place of settlement of the draft;

- the name of the recipient of the bill of exchange - the holder of the bill of exchange;

- address and date of compilation;

- signature of the person issuing the bill.

The procedure for filling out a draft must meet the same requirements as the execution of a regular promissory note discussed above.