Calculation formulas

In general, the calculation formula will look like this:

In this case, for an interest-free loan the formula is transformed:

To recalculate benefits on foreign currency loans, it is necessary to use the official exchange rate according to the Central Bank of the Russian Federation as of the date of income, i.e. last day of the month (clause 4 of article 226, clause 7 of clause 1 of article 223 of the Tax Code of the Russian Federation, letters of the Ministry of Finance No. 03-04-06/19792 dated 04/07/16, No. 03-04-07/15279 dated 18.03 .16, letter of the Federal Tax Service No. BS-4-11/ dated 03/29/16).

Date of receipt of income

Material benefit must be calculated on the date of receipt of income. This date will be the last day of each month during the period for which the employee received the loan. Therefore, determine the amount of material benefit monthly, regardless of the date:

- payment of interest;

- obtaining and repaying a loan.

For example, on January 31, 2016, on February 29, 2016, etc. Even if the contract was concluded before 2016.

This is stated in subparagraph 7 of paragraph 1 of Article 223 of the Tax Code of the Russian Federation and explained by the Ministry of Finance of Russia in letter dated March 18, 2016 No. 03-04-07/15279 (brought to the attention of tax inspectorates by letter of the Federal Tax Service of Russia dated March 29, 2016 No. BS -4-11/5338).

You can withhold tax from your next salary. The amount of withholding cannot exceed 50 percent of the payment. This follows from paragraph 4 of Article 226 of the Tax Code of the Russian Federation.

Situation: at what point should one determine the material benefit from saving on interest on an interest-free loan. The loan was issued to an employee in 2015, will it be repaid in 2016?

Determine material benefits on the last day of each month starting from January 31, 2016.

In this situation, it is necessary to apply the new rules that are in force from January 1, 2016. That is, income in the form of material benefits from interest-free loans is determined on the last day of each month. For the first time, this needs to be done only starting in January 2016, when the new procedure has already come into force.

During 2015, the person did not have any income in the form of material benefits. Because according to the old rules, until 2016, income in the form of financial benefits was calculated on the date of loan repayment. Since the interest-free loan was issued in 2015, and its repayment period is in 2016, then the first date of receipt of income will be January 31, 2016. This decision was given by specialists from the Russian Ministry of Finance.

The material benefit that you determine for the first time in the transition period is calculated from the date the loan was issued until January 31, 2016. In the future, until the loan repayment date, determine the income for each month on its last day (February 29, March 31, etc.).

This procedure follows from subparagraph 7 of paragraph 1 of Article 223 of the Tax Code of the Russian Federation. It is also confirmed by representatives of the Russian Ministry of Finance in private explanations.

An example of how to determine the material benefit of an interest-free loan. The loan was issued in 2015 with a maturity date in 2016

On October 1, 2015, Alpha LLC issued an interest-free loan to an employee in the amount of 600,000 rubles. The loan repayment period is March 31, 2016.

As of January 31, 2016, the accountant calculated personal income tax on material benefits for the period from October 1, 2015 to January 31, 2016.

The number of days in 2015 is 365, in 2016 – 366.

The refinancing rate (conditionally) from January 1, 2016 is 11 percent.

January 31, 2016:

Number of days of using the loan to calculate interest: – from October 2, 2015 to December 31, 2015 – 91 days; – from January 1 to January 31, 2016 – 31 days.

The amount of material benefits as of January 31 was: 600,000 rubles. × 2/3 × 11% : 365 days. × 91 days + 600,000 rub. × 2/3 × 11%: 366 days. × 31 days = 14,697 rub.

Personal income tax on material benefits for January: RUB 14,697. × 35% = 5144 rub.

In the future, the accountant calculates personal income tax at the end of each month of using the loan.

February 29, 2016:

The amount of material benefits as of February 29 was: 600,000 rubles. × 2/3 × 11%: 366 days. × 29 days = 3486 rub.

Personal income tax on material benefits for February: 3,486 rubles. × 35% = 1220 rub.

March 31, 2016:

The amount of material benefits as of March 31 was: 600,000 rubles. × 2/3 × 11%: 366 days. × 31 days = 3727 rub.

Personal income tax for material benefits for March: 3,727 rubles. × 35% = 1304 rub.

Taxation

Personal income tax

All responsibilities related to personal income tax in this case lie with the tax agent who provided the borrowed funds. Applicable rates:

- 35% for residents (clause 2 of article 224 of the Tax Code of the Russian Federation, letter of the Ministry of Finance No. 03-04-05/81521 dated 11/13/18),

- 30% for non-residents (clause 3 of article 224 of the Tax Code of the Russian Federation).

The accountant must transfer the tax to the budget no later than the day following the day it was withheld, and the calculated tax must be withheld from the first payment.

Insurance premiums

The accountant does not have any obligation to calculate insurance premiums (Article 420 of the Tax Code of the Russian Federation, letter of the Federal Tax Service No. BS-4-11/8019 dated April 26, 2017, clause 1 of Article 20.1 of Law No. 125-FZ dated July 24, 1998).

Features of the loan interest calculator

The loan agreement interest calculator allows you to get fairly accurate data. This is due to the fact that an error in calculations is possible only if false information is entered. You can almost instantly get any solution from both your computer and your smartphone.

Using the service:

- easy to calculate interest on a loan online on a card or in cash;

- use the current amount of debt and periods of arrears to see the amount of overpayment;

- draw up the most optimal payment schedule if you are planning to enter into an agreement.

Now you don’t need to waste time studying all the nuances of programs from microfinance organizations. You can also compare the data received from different microfinance organizations to choose the offer that suits you best.

The online interest loan calculator can also be used by citizens who do not want to waste time on independently calculating all overpayments. Here you just need to enter information to automatically get the calculation result.

Example

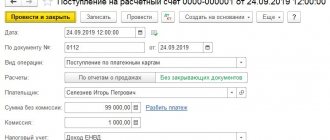

One-time repayment of the loan in full

Let's say at Romashka LLC engineer K.K. Klimov was issued an interest-free loan on 03/01/2021 in the amount of 30,000 rubles with the condition of repayment in full on 05/31/2021.

Official statistics of the Central Bank of the Russian Federation on changes in the key rate in 2021:

As of 01/01/2021 – 4.25%

From 03/22/2021 – 4.50%

From 04/26/2021 – 5.00%

From June 15, 2021 – 5.50%

While using the loan, the accountant made the following calculations:

| Month | Wed. | TO | Z , rub. | Calculation MB , rub. | Calculation of personal income tax, rub. |

| March 2021 | 4,50 | 30 | 30 000 | 2/3 x 4.50 x 30,000 / 365 x 30 = 73.97 | 73.97 x 35% = 26 |

| April 2021 | 5,00 | 30 | 30 000 | 2/3 x 5.00 x 30,000 / 365 x 30 = 82.19 | 82.19 x 35% = 29 |

| May 2021 | 5,00 | 31 | 30 000 | 2/3 x 5.00 x 30,000 / 365 x 31 = 84.93 | 84.93 x 35% = 30 |

| Total | 85 | ||||

Important: when calculating the number of days of using borrowed funds, the last day is taken into account, but the first day is not taken into account, unless otherwise provided by the terms of the concluded agreement.

Monthly loan repayment

Let's change the condition of the previous example: according to the terms of the agreement, the loan is repayable monthly in the amount of 10,000 rubles by deduction from accrued wages. Then the accountant’s calculation will look like this:

| Month | Wed. | TO | Z , rub. | Calculation MB , rub. | Calculation of personal income tax, rub. |

| March 2021 | 4,50 | 30 | 30 000 | 2/3 x 4.50 x 30,000 / 365 x 30 = 73.97 | 73.97 x 35% = 26 |

| April 2021 | 5,00 | 30 | 20 000 | 2/3 x 5.00 x 20,000 / 365 x 30 = 54.79 | 54.79 x 35% = 19 |

| May 2021 | 5,00 | 31 | 10 000 | 2/3 x 5.00 x 10,000 / 365 x 31 = 28.31 | 31.14 x 35% = 10 |

| Total | 55 | ||||

What is material benefit?

Taxpayers' income is subject to personal income tax at a rate of 13%.

For example, the employer withholds personal income tax of 13% from wages. But taxes are paid not only on money received, but also on money saved. If you took out an interest-free loan or a loan at a low interest rate, that is, below the marginal rate, then, according to the Tax Code, you received implicit income by saving on loan interest. This implicit income is called tangible benefit. In this case, you must pay tax on this income .

Example: Lugovoy S.V. I took out an interest-free loan from my employer. From the moment of receiving the loan from Lugovoy S.V. income arises in the form of a material benefit on which tax will be withheld.

Material benefits arise when receiving loans (credits) at a low interest rate, when purchasing goods (work, services) from persons and organizations that are interdependent in relation to you, as well as when purchasing securities at prices below market prices.

We will consider only the material benefits obtained from savings on interest for the use of borrowed funds, because this case is the most common.

Personal income tax on a loan to an employee

When an employee receives an interest-free loan from an employer, or when the interest rate in the contract is set at less than 2/3 of the refinancing rate, the employee receives a material benefit. The benefit arises from savings on interest on the loan. The employer is obliged to withhold personal income tax from this savings and transfer it to the budget.

Important! The tax rate on an employee’s material benefit will depend on his status. If the loan was received by a resident, then personal income tax will need to be withheld at a rate of 35%, and if the borrower is a non-resident - then at a rate of 30%.

The benefit arising to the employee and personal income tax are determined on the last date of each month during the entire term of the loan agreement. If the calculation is made depending on the refinancing rate, then the rate that is set on the calculation date is taken into account. It should also be remembered that since 2016 the refinancing rate has been considered equal to the key rate. Moreover, the value of this indicator changes quite often and before starting the calculation it is necessary to clarify its size (

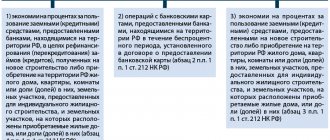

When MV is not subject to personal income tax

Same article 212 of the Tax Code of the Russian Federation predetermines cases in which MV is not subject to personal income tax under any circumstances.

| Exceptions (when MV from interest savings is not subject to personal income tax) | ||

| 1 | 2 | 3 |

| MV from banks related to card transactions throughout the entire interest-free period in accordance with the agreement | If the loan (credit) is provided for construction or for the purchase of housing (shares), plots of land for individual housing construction (or with residential buildings already existing on them) | If the loan (credit) is provided for the purpose of refinancing (on-lending) previously received funds for the construction (purchase) of housing, etc. |

As for paragraphs 2 and 3 of the table, in relation to their content, personal income tax is not withheld only if the borrower has the right to a property deduction under paragraphs. 3 p. 1 art. 220 Tax Code of the Russian Federation. This is a deduction in relation to real estate for the purchase of which borrowed funds were allocated. But this privilege must be confirmed.

Standard notification forms and certificates are used as supporting documents. The tax office prepares and issues them. The notification format was introduced by the relevant Order of the Federal Tax Service No. ММВ-7-11 / [email protected] dated January 14, 2015.

Notice of confirmation of the right to property deduction

The certificate format is recommended by Letter of the Federal Tax Service No. BS-4-11 / [email protected] dated January 15, 2016.

Reference

If the lending organization already has confirmation of the borrower’s right to the deduction, then a notification (or certificate) does not need to be submitted.

Loan agreement with employee

Despite the fact that when issuing a loan to an employee, the employer enters into an agreement with him, this has nothing to do with labor relations. Issuing a loan to an employee is a civil law agreement. The relationship between an employer and an employee, that is, respectively, a lender and a borrower, is regulated by Chapter 42 of the Civil Code of the Russian Federation. According to Art. 808 of the Civil Code of the Russian Federation, the issuance of a loan to an employee is accompanied by the conclusion of a loan agreement in writing. The contract must specify the following conditions:

- loan amount;

- the period during which the employee is obliged to return the money,

- interest rate for the use of funds.

If at least one of the terms of the agreement is not specified, the loan agreement may be declared invalid.

In accordance with Article 809 of the Civil Code of the Russian Federation, a loan agreement may be interest-free. That is, the employer has the right not to collect interest from the employee for the use of the money provided by him. However, such a condition must also be specified in the contract. If this condition is not specified, then the loan percentage will be determined depending on the key rate of the Bank of Russia.

The procedure by which a loan agreement is concluded is established by Chapter 42 of the Civil Code of the Russian Federation. When concluding such an agreement, the employer is recognized as the lender, and the employee is recognized as the borrower. With the conclusion of an agreement, both the lender and the borrower have certain rights and obligations. The responsibilities of the lender include transferring funds to the borrower, and the responsibilities of the borrower include returning the same amount of money, and in certain cases, interest. The loan agreement is considered concluded not from the moment the agreement is signed, but from the moment the funds are transferred to the borrower.

If an employee is given an interest-free loan, then he will have to repay only the due debt, and such a condition must be specified in the contract. If a loan is issued at a certain interest rate, then its size, as well as the procedure for paying interest, are also specified in the agreement.

Important! If the procedure for paying interest and terms are not provided for in the agreement, then interest will be paid every month until the borrowed amount is repaid, in accordance with Article 809 of the Civil Code of the Russian Federation.

In addition, the agreement may specify a condition on the use of borrowed funds for specific purposes. In this case, the loan is recognized as a targeted loan, and the borrower must provide the lender with the opportunity to control the process of using funds.

One of the important terms of the contract is also the loan repayment period. If a specific repayment period is not specified, the loan will need to be repaid within 30 days from the date of submission of the request for repayment. You can only repay an interest-free loan early. If the loan is provided at a certain percentage, then it can be repaid ahead of schedule only with the consent of the lender (810 of the Civil Code of the Russian Federation).