SZV-TD has already become a daily routine for many. ADV questionnaires with numbers 1, 2, 3 are not used so often, but their importance is also great. When you may encounter them, and how to fill them out, we will discuss in the current article.

Already starting in 2022, the Pension Fund is actively collecting information on the labor activities of citizens . Any personnel change is now duplicated online in the Pension Fund databases. All data received will be used for accurate calculations and prompt calculation of future pensions.

Updated ADV forms are used to register employed citizens in the individual (personalized) accounting system. Check your ADV formats, they must comply with the resolution of the Pension Fund of Russia board dated 12/07/20 No. 846p, otherwise you will lose precious time for correction.

It would seem that you can send an employee to the MFC or obtain an insurance number through State Services, but the employer is obliged to independently register the employed person (Article 65 of the Labor Code of the Russian Federation).

Can't keep up with changes? We’ll tell you what interesting things have already happened and what the results of the work in the first quarter are - a free webinar “Changes in labor legislation. Results for the first quarter of 2021. Prospects" March 25 at 10.00 Moscow time.

What does the document look like?

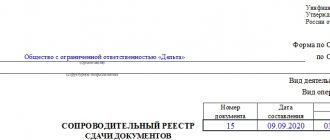

The new form of the accompanying inventory was approved separately by Resolution of the Board of the Pension Fund of the Russian Federation No. 485p dated September 27, 2019. Until February 2020, another form ADV-6-1 was in force, but now it is not used.

The updated form of the document is called “Inventory of documents submitted by the policyholder to the Pension Fund of the Russian Federation” and is one of the reporting forms regarding the provision of information about personalized registration of insured citizens to the Pension Fund of the Russian Federation.

ADV-1 - questionnaire for the insured person

Beginners will need work experience. The responsibility for informing the Pension Fund of the Russian Federation falls on the shoulders of the employer, but issuing SNILS (green policy) from 2022 is not necessary. The SNILS wording is also going out of circulation and is being replaced by ADI-REG.

To fill out the ADV-1 form you will need:

- Russian or foreign passport;

- registration address and place of residence (or temporary stay form for a foreigner);

- TIN;

- contact number;

- for very young professionals - a birth certificate.

It is required to comply with the deadlines for registering an employee with the Pension Fund. For foreign workers, a shorter time frame is established - 2 weeks from the date of signing the employment contract. Citizens of the Russian Federation must be registered before the 15th of the next month after admission. This is due to the need to report monthly on SZV-M.

The employee puts a personal signature , and the inventory (AVD-6-1) is certified by an authorized official of the employer. Both documents can be sent to the Pension Fund using EDF. No later than 5 working days, a notification will be sent in response, which must be familiarized to the employee against signature. Instead of a plastic certificate, he receives a white printed form and an electronic number.

Personal data checks - what to expect from Roskomnadzor? Watch our webinar “Roskomnadzor inspections: how to pass successfully and, if necessary, challenge the results.”

When to fill it out

The accompanying register is filled out when sending information to the Pension Fund using standardized forms:

- Questionnaire ADV-1 (sample of completion and current form in special material) - created when sending individual information of an employee to create an insurance certificate (SNILS or ADI-REG) for the first time.

- ADV-2 - if an employee has changed individual data and a replacement (update) of SNILS is necessary.

- ADV-3 - sending information to create a duplicate of SNILS if the employee has lost or misplaced it.

- SZV-K - when generating information about an employee’s length of service before 2002, it is compiled at the individual request of the Pension Fund of the Russian Federation.

- Other documents provided by the policyholder to the Pension Fund of the Russian Federation upon individual requests.

When to submit

The inventory should be sent to the Pension Fund when providing the following reporting forms:

- ADV-1 - contains individual information about the employee for the first registration of SNILS;

- ADV-2 - if it is necessary to replace or update SNILS due to an employee changing his individual data;

- ADV-3 - if it is necessary to issue a duplicate of SNILS due to loss or loss;

- SZV-K - contains information about the work experience of the insured person for the period until 2002;

- other documents provided upon individual requests.

Previously, policyholders provided other documents, for example, a list of documents on accrued and paid insurance premiums and the insurance experience of insured persons, transferred by the policyholder to the Pension Fund of the Russian Federation or form ADV-6-3, which is no longer used in connection with the publication of the Resolution of the Board of the Pension Fund of the Russian Federation dated September 27. 2019 No. 485p.

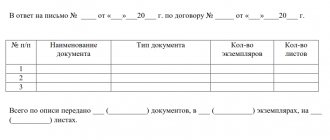

Structure of the accompanying inventory

The standardized register consists of four conditional blocks:

- The first block contains information about the policyholder. Here you must indicate the registration number of the institution issued by the Pension Fund, then enter the TIN, KPP and indicate the name. When changing the name or in other exceptional cases, we indicate additional information in the “Note” field.

- The second block is a tabular part, which presents the reporting forms named above. Here the policyholder indicates the number of documents sent to the Pension Fund.

- The third block is filled out during electronic document management with the OPFR. The block contains the package number assigned by the policyholder’s electronic system upon dispatch, and after receipt, the OPS system assigns a special number to this package.

- The fourth block is information about the contractor and the head of the insured organization, their signatures.

Form ADV-6. List of documents submitted by the employer to the Pension Fund of Russia

Form ADV-6 is provided by the employer to the territorial body of the Pension Fund of the Russian Federation as part of a bundle of incoming documents submitted starting from the 2002 billing period. Filled out according to the following scheme:

1. Codes for OKUD and OKPO are temporarily not indicated.

2. Details of the employer submitting the documents:

Pension Fund registration number: required. The number under which the employer is registered as a payer of contributions to the Pension Fund is indicated, indicating the region and district codes according to the classification adopted by the Pension Fund.

Format: XXX-XXX-XXXXXX.

Taxpayer Identification Number: required. The taxpayer identification number is indicated.

Checkpoint: required to be filled out. The reason code for registration is indicated.

Name (short): required. The short name of the organization is indicated.

3. Notes: to be filled in by a Pension Fund employee when receiving a stack of documents.

4. Number of documents in a pack: required to be filled out. The number of documents in a bundle of the corresponding type is indicated.

5. Number of the bundle of documents assigned by the policyholder: the serial number of the bundle of documents assigned by the policyholder is indicated.

6. Registration number of the bundle in the territorial office of the Pension Fund of Russia: filled in by a Pension Fund employee when receiving a bundle of documents. The incoming number is indicated, under which a stack of documents was registered at the territorial office of the Pension Fund of Russia.

For forms SZV-1 or SZV-3

(must be completed when submitting information on forms SZV-1 or SZV-3 for periods before 01/01/2002)

7. Reporting period: the year for which information is provided is indicated. Cannot be filled in if the value of the “Billing period” attribute has already been specified.

8. Information on earnings (remuneration) and income for the reporting period, taken into account when assigning a pension (total for a stack of documents):

Total accrued

including temporary disability benefits and scholarships

The details are filled out in accordance with the rules for filling out forms SZV-1 and SZV-3. The total values in rubles and kopecks for the entire pack are indicated.

9. Details: Performer, Signature, Explanation of signature must be filled out.

10. Details: Name of the manager’s position, Signature, Explanation of signature must be filled out.

The inventory is supplemented with the words: “I assure that the contents of all documents included in the bundle consisting of the above number of forms are correct.”

11. Date: must be filled in (DD name of the month YYYY).

12. M.P.: stamp is required.

Documents for submission to the Pension Fund

Working with the Pension Fund requires the employer to have the following documents:

| Message about opening a bank account | This document can be obtained from the financial institution where the account is opened. After opening an account, a message must be sent to the Pension Fund within a week. A similar procedure is used when the account is closed. |

| Notification in case of changes in the details to which contributions and pension contributions are received | A similar document is sent to pensioners when the payment details of the organization have changed (change of bank or current account used). |

| Application for testing | Such a document may be required when an organization wants to make a demand for the return to its accounts of contributions that were paid in excess. |

| Application for clarification of the payment made | This form makes it possible to find a payment that has been lost or is of a dubious nature, and will receive the necessary information regarding it. |

General information about the ADV-6-1 form

Previously, the ADV-6-1 form was regulated by Resolution of the Board of the Pension Fund of the Russian Federation No. 2p dated January 11, 2017. Currently, this standard has lost its relevance, and the document has become regulated by Resolution of the Board of the Pension Fund of the Russian Federation No. 485-p dated September 29, 2019.

ADV-6-1 is an inventory provided by the employer to the Pension Fund of the Russian Federation when submitting various reports. In particular, it should be filled out in the following situations :

- when providing personal information about an employee to generate an insurance certificate (SNILS) for the first time for a subject (form ADV-1);

- in circumstances when personal information about a citizen has been corrected, as a result of which an adjustment to SNILS is required (form ADV-2);

- due to the provision of information for the formation of a duplicate of SNILS, if the subject has lost the document, or the paper has fallen into disrepair (it has been damaged in any way due to various reasons);

- when systematizing information about an employee’s length of service until 2002 (form SZV-K). This form must be issued at the individual request of the fund;

- other papers provided by the employer of specific employees at individual requests from representatives of the Pension Fund of the Russian Federation.

The inventory form is unified, and any additions to the existing form are illegal. So, the document is divided into the following parts :

- Information about the employer who provides documentation to the Pension Fund of the Russian Federation.

- The number of documents provided as part of personalized accounting for each type of form.

- The lower part of ADV-6-1. This section must be completed when the employer provides information about the length of service, staff salaries, and accrued contributions to the Pension Fund of the Russian Federation. It is required to enter the full amount of deductions, staff income and the period for which these accruals are made.

The last block includes visas for the employee responsible for issuing ADV-6-1 and the company manager.

ADV-6-1: sample filling

The procedure for completing ADV-6-1 is as follows:

The first block is reserved for information about the policyholder. Therefore, you will need to indicate the registration number assigned to the enterprise in the Pension Fund of the Russian Federation, mark the TIN, KPP codes and write down the name of the company. In the event of a name change and other exceptional situations, additional explanatory information should be disclosed in the “Notes” section.- Then follows the tabular part, where the reporting forms are recorded, within which the inventory was drawn up according to the ADV-6-1 form. In this cell, the manager must note the total number of papers provided for consideration by the Pension Fund of the Russian Federation.

- Further information is noted in the presence of electronic document flow with the OPFR. In this section, you should note the package number assigned to the company by the relevant electronic system upon dispatch. After receiving the documents, the OPS assigns a special number to the designated documents.

- After this, you need to record general information about the contractor and manager of the insurance company, as well as affix their signatures.

Forms in force since 2010

Forms SZV-6-1, SZV-6-2 and SZV-6-3

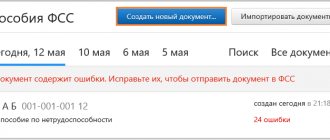

The Kontur.Extern service implements personalized accounting forms for submitting information to the Pension Fund:

SZV-6-1 – information on accrued and paid insurance contributions for compulsory pension insurance and the insurance period of the insured person (replacing SZV-4-1);

SZV-6-2 – register of information on accrued and paid insurance premiums for compulsory pension insurance and the insurance length of insured persons (replacing SZV-4-2);

SZV-6-3 – information on the amount of payments and other remunerations accrued by payers of insurance premiums - policyholders in favor of an individual;

ADV-6-2 – inventory of information transmitted by the policyholder to the Pension Fund of the Russian Federation (replacement of ADV-11);

ADV-6-3 - a list of documents on accrued and paid insurance premiums and the insurance experience of the insured person, transferred by the policyholder to the Pension Fund of the Russian Federation (replacement of ADV-6-1);

ADV-6-4 - inventory of documents containing information on the amount of payments and other remunerations accrued by payers of insurance premiums - policyholders in favor of an individual

A video explaining in detail how to fill out forms SZV-6-1, SZV-6-2 and ADV-6-2 (ADV-6-3, as a rule, is generated automatically).

When did you give up?

In 2012, individual information (forms SZV-6-1, SZV-6-2, ADV-6-2, ADV-6-3) was provided quarterly:

- until May 15, 2012 for the 1st quarter of 2012;

- until August 15, 2012 for the 2nd quarter of 2012;

- until November 15, 2012 for the 3rd quarter of 2012;

- until February 15, 2013 for the 4th quarter of 2012.