ACCOUNTING FOR TRANSPORT COSTS

Transport costs are an integral part of the total costs of organizations. They include costs associated with transporting cargo or employees. Russian legislation does not have individual rules for accounting for these expenses, so each organization independently develops its own version of accounting for transportation costs.

Accounting of transport expenses

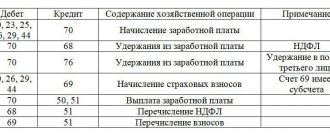

General requirements for the composition of costs recognized as expenses in accounting are contained in PBU 10/99 “Organizational expenses” [1]. The following accounts are used to account for them:

20 “Main production”;

26 “General business expenses”;

44 “Sales expenses”.

During the month, transportation costs can be reflected in whole or in part in the following accounts:

23 “Auxiliary production”;

25 “General production expenses”

with subsequent debiting to account 20 “Main production”.

For your information

The organization has the right to approve the procedure for distributing transportation costs in such a situation independently, enshrining it in its accounting policies.

For example, transportation costs can be distributed in proportion to the cost of purchased goods, their quantity, weight, or other characteristics suitable for a particular type of product.

When delivering materials or goods, it is necessary to take into account clause 11 of FSBU 5/2019 “Inventories”[2], which requires that transport costs be taken into account in the cost of goods and materials received. This procedure is used if, from the documents, it is possible to establish the amount of transportation costs incurred for the delivery of specific goods and materials.

Transport costs can be reflected in the cost of the goods or in the current expenses of the organization. Let's look at examples of reflecting transportation costs in accounting.

Reflection of transport costs in the cost of goods

A trade organization purchased goods from a supplier on a self-pickup basis. The organization does not have its own vehicles, and it has entered into an agreement with a transport organization for the delivery of this product from the supplier’s warehouse to its warehouse.

Since in this case transportation costs are associated with the delivery of the goods, they are taken into account in the cost of the delivered goods.

Reflection in accounting:

1. The goods are received and delivered to the warehouse of a trading organization (VAT is not assessed):

Debit of account 41 “Goods” sub-account “Central Warehouse” Credit of account 60 “Settlements with suppliers and contractors” - 500,000 rubles.

2. The services of a transport organization for the delivery of goods (excluding VAT) are reflected in the cost of the delivered goods:

Debit of account 41 “Goods” sub-account “Central Warehouse” Credit of account 76 “Settlements with various debtors and creditors” - 10,000 rubles.

3. The amount of VAT on the cost of services of the transport organization is reflected:

Debit of account 19 “VAT on purchased valuables” Credit of account 76 “Settlements with various debtors and creditors” - 2000 rubles.

4. The goods are transferred to the store for sale at actual cost:

Debit of account 41 “Goods” sub-account “Warehouse store” Credit of account 41 “Goods” sub-account “Central warehouse” - 510,000 rubles. (500,000 + 10,000).

Reflection of transport costs in the current expenses of the organization

A manufacturing enterprise bought lumber for 200,000 rubles. and transported them from the supplier’s warehouse using our own vehicles.

The company's vehicles regularly make trips to deliver purchased materials from suppliers and manufactured products to customers.

Based on the accounting policy, transportation costs are taken into account according to actual expenses - 35,000 rubles. - under account 26 “General business expenses”.

Reflection in accounting:

1. Material received from supplier:

Debit of account 10 “Materials” Credit of account 60 “Settlements with suppliers and contractors” - 200,000 rubles. (NDS is not appearing).

2. Transport costs reflected:

Debit of account 26 “General business expenses” sub-account “Transportation expenses” Credit of account 02 “Depreciation of fixed assets”; account 10 “Materials” sub-account “Fuels and lubricants” - 35,000 rubles.

Tax accounting of transport expenses

For tax accounting of transportation expenses, it is necessary to determine in the accounting policy whether they will be reflected as direct or indirect expenses.

For your information

An organization has the right to take into account transportation costs in current tax expenses if the requirements of Art. 252 of the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation) - expenses are economically justified, justified and documented by primary documents.

Trade organizations reflect transportation costs in accordance with Art. 320 of the Tax Code of the Russian Federation: the taxpayer has the right to determine the cost of purchasing goods, taking into account the costs associated with their acquisition. This cost is taken into account when selling goods (subclause 3, clause 1, article 268 of the Tax Code of the Russian Federation). Thus, expenses associated with the purchase of goods may:

• included in the cost of purchased goods

• or taken into account as distribution costs and not included in the cost of purchased goods.

The taxpayer has the right to choose one of the proposed methods of accounting for the costs of delivering purchased goods to the warehouse. The procedure for forming the cost of purchasing goods is determined by the taxpayer in the accounting policy for tax purposes and is applied for at least two tax periods.

If transport costs are paid in excess of the price of the goods under the contract or delivery is carried out by a third-party organization, then for tax accounting purposes transport costs associated with the purchase of goods are always included in sales costs (Article 320 of the Tax Code of the Russian Federation).

If transportation costs are highlighted in the contract as a separate line, they must be taken into account separately from the price of the goods.

When taking into account transport costs related to the balances of unsold goods, their tax expense is determined by the average percentage for the current month, taking into account the carryover balance at the beginning of the month in the following order (see table).

In this case, the amount of transportation costs is distributed not to the actual balances of goods in the warehouse, but rather to the balances of goods, the ownership of which has not yet transferred to the buyer.

Calculation of the balance of transportation costs at the end of the reporting period

The company's tax records include:

800,000 rub. — total cost of goods sold in October;

150,000 rub. — cost of unsold goods at the end of October;

100,000 rub. — the amount of transportation costs for October;

30,000 rub. (account balance 44) - the amount of direct transport costs attributable to the balance of goods at the beginning of October.

Calculation of tax expenses:

• the amount of direct transportation costs to be written off in October:

100,000 rub. + 30,000 rub. = 130,000 rub.;

• the amount of goods sold in October, plus the amount of goods not sold at the end of the same month:

800,000 rub. + 150,000 rub. = 950,000 rub.

Let's define the average percentage as the ratio of the amount of direct costs to the cost of goods:

130,000 rub. / 950,000 rub. × 100% = 13.68%.

To determine the amount of direct expenses related to the balance of unsold goods, we multiply the average percentage by the cost of the balance of goods at the end of October:

150,000 rub. × 13.68% = 20,520 rub. This amount is not taken into account in tax expenses for October.

Let's calculate the amount of transportation costs that will be taken into account as part of direct tax expenses for October:

130,000 rub. – 20,520 rub. = 109,480 rub.

If a company sells several types of goods, then the amount of transportation costs that relate to unsold goods is determined by the total balance of goods. The Tax Code of the Russian Federation does not require the distribution of transport costs by type of goods.

Conditions for recording transportation costs

So, the procedure for accounting for transportation costs depends on the type of activity of the organization, the adopted accounting policy, as well as the delivery conditions for each transaction. But it is also important to find out whether the organization has the right to reflect the transportation costs incurred in its accounting.

The purchase and sale agreement stipulates which party bears the costs of delivering the goods to the buyer's warehouse. The same condition must be reflected in the invoice offer or public offer agreement.

The contract may stipulate that the costs of transporting goods are borne by the seller of goods, who delivers the goods to the organization’s warehouse. In this case, the buyer has no reason to record transportation costs associated with the delivery of goods.

Delivery of goods can be carried out by the buyer if the ownership of the goods is transferred to him not on his territory, but, for example, in the seller’s warehouse. The buyer can use his own vehicles or the services of a specialized transport organization, but in any case, transport costs will be reflected on his balance sheet and as part of his expenses.

Types of transport costs

To analyze, plan and account for transport costs, it is necessary to group them by type, for example:

• transport services of third parties;

• expenses for maintaining your own vehicles;

• use of personal vehicles of employees;

• rental of vehicles with and without crew.

In addition, depending on the type of activity of the organization and the volume of revenue within each type, in practice an additional analytical classifier for accounting for transport costs is used based on the requirements of the local technological process.

For example, in trading you can apply a classifier depending on the final destination:

• expenses associated with the purchase of goods (delivery of purchased goods to the warehouse of the trading company);

• costs associated with transporting goods between divisions of the company (from warehouse to warehouse);

• expenses associated with the sale of goods (delivery of sold goods to the buyer).

Let's analyze the two most used types of transportation costs.

Services of a third party transport organization

To reflect such services in accounting, you must have the following set of documents:

1. Contract or invoice for the carriage of goods.

2. Certificates of acceptance of services provided.

They are drawn up monthly in any form in two copies, one for each of the parties. The acceptance certificate for services provided is the basis for attributing costs under the transportation contract to the cost price, as well as for drawing up an invoice by the contractor for VAT calculations. It is necessary in cases where the cost of services, in addition to transport, includes payment for additional services, for example: ensuring the constant readiness of vehicles for expedited delivery at the request of the organization, etc. The details of the act must comply with Article 9 of the Federal Law “On Accounting” No. 402 - Federal Law dated December 6, 2011

3. Waybills (BW) for the transportation of goods belonging to the organization.

TTN performs mainly two functions:

• firstly, it serves as evidence of the existence of legal relations between the shipper and the carrier for the transportation of goods and, accordingly, a means of legal protection of the interests of the parties in the event of a dispute;

• secondly, it regulates the relations of the parties under the contract for the carriage of goods, determining the conditions of transportation. When accepting the cargo, the carrier has the right to make reservations in the waybill, in particular regarding deficiencies in the packaging of the cargo. If the contract stipulates that the goods are delivered to the buyer's warehouse by road, in addition to the TORG-12 consignment note (or UPD), a TTN form 1-T[3] is also issued, regardless of who delivers the goods - the buyer, the seller or a specialized carrier[ 4].

Moreover, if the delivery of goods is carried out by the supplier and the cost of delivery is highlighted as a separate line, such a supply agreement will be mixed (sale of goods and its delivery, which is regulated by the rules applied to transportation contracts). Therefore, the buyer must also have a consignment note (issued by the supplier) and a tax identification number.

If the delivery of goods is organized by a forwarder, in addition to the bill of lading, the consignment note (if the buyer is the consignee), an order to the forwarder and a forwarding receipt are required[5].

If there is no properly executed bill of lading, the fact that the carrier accepted the cargo and provided transportation services may be considered unproven by the court. In this case, the existence of a contractual relationship between the parties may be confirmed by other evidence.

4. Invoices. They are issued by the transport company to the organization in accordance with the requirements of Art. 169 of the Tax Code of the Russian Federation, are drawn up within five days from the date of drawing up the acceptance certificate for services provided and on the basis of this act.

Invoices are the basis for recording VAT paid to the contractor, as well as for accepting it for offset, subject to the conditions established by the Tax Code of the Russian Federation.

Thus, if you plan to use the services of a third-party transport organization, make sure that you have completed the primary documents. And if you have properly completed documentation, it will be easier for you to control the feasibility of these expenses. In addition, this way you will minimize tax risks when audited by a regulatory authority.

Costs of maintaining your own vehicles

These expenses include, in particular:

• expenses for fuels and lubricants (all types of fuel - gas, gasoline, diesel fuel, oils and lubricants, etc.);

• expenses for technical inspection;

• expenses for the purchase of “winter” tires;

• car washing costs;

• fee for storing a car in a paid parking lot, etc.

Such expenses are classified as expenses for ordinary activities[6]. Expenses for the maintenance of official transport are reflected under the corresponding cost item - as a rule, as part of general business expenses by debiting account 26 “General business expenses” and crediting accounts 10, 69, 70, etc.

The amount of expenses for fuel and lubricants is reflected in accounting on the basis of data on the mileage of the vehicle indicated in the waybills, according to the fuel consumption standards approved by the organization.

The amount of expense is reflected in the debit of the cost accounting account in correspondence with the credit of account 10 subaccount “Fuel”.

The main document for accounting for the use of fuels and lubricants is waybills, which not only justify the costs of fuels and lubricants, but also generally confirm the economic feasibility and production orientation of the costs associated with the use of vehicles.

For your information

The current mandatory details and the procedure for filling out waybills are approved by Order of the Ministry of Transport of Russia dated September 11, 2020 No. 368, which is used by organizations and individual entrepreneurs operating passenger cars.

Organizations not related to transport can develop their own form of waybill taking into account the requirements of Order No. 368 and the mandatory details specified in Part 2 of Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (as amended on July 26, 2019).

Excessive fuel consumption in accounting is included in other expenses, but in tax accounting it does not reduce the tax base. Basic fuel consumption rates are established by Methodological Recommendations[7]. At the same time, in a letter dated June 22, 2010 No. 03-03-06/4/61, the Russian Ministry of Finance allowed the taxpayer to be guided by technical documentation and (or) information provided by the car manufacturer until the adoption of an order from an organization approving the standards developed in the prescribed manner.

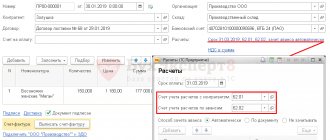

Calculation of fuel and lubricant costs

The organization purchases fuel and lubricants for company vehicles. During August, fuel was filled into the car tank three times (all prices are indicated without VAT):

• August 2 – 70 liters at a price of 20 rubles. for 1 liter in the amount of 1400 rubles;

• August 10 - 60 liters at a price of 19 rubles. for 1 liter in the amount of 1140 rubles;

• August 20 - 70 liters at a price of 22 rubles. for 1 liter in the amount of 1540 rubles.

According to the waybills and standards established by the organization, 170 liters of gasoline were consumed in August.

According to the accounting policy, write-offs are made at average cost.

Let's calculate the amount of fuel and lubricants subject to write-off in the month of August.

First, we determine the average cost per unit of materials (1 liter):

(1400 rub. + 1140 rub. + 1540 rub.) / (70 l + 60 l + 70 l) = 20.4 rub.

Then the cost of gasoline to be written off will be:

20.4 rub. × 170 l = 3468 rub.

Reflection in accounting:

Debit account 20 Credit account 10 sub-account “Fuel in tanks” - 3468 rubles. — the cost of fuel and lubricants for the month of August was written off.

Structure and content of transportation and freight forwarding contracts

To provide services, a transportation contract is concluded between the carrier and the shipper (cargo owner).

Contract of carriage

The subject of the transaction is the organization of a transport operation, therefore, in the relevant section of the contract, it is useful for an individual entrepreneur to indicate the legislative norms governing the interaction of the parties in the transportation process (Civil Code of the Russian Federation, Chapter 40 “Transportation”).

Under the contract of carriage, the carrier is obliged to present the transport for loading at the specified place and time. Besides:

- The vehicle must be in good working order and suitable for transporting the declared goods.

- The carrier is obliged to transport the goods along the agreed route.

- The cargo must be delivered within the time limits that were agreed upon when discussing the order and recorded in a written agreement.

- If there is a forced delay of the vehicle en route, the carrier promptly informs the customer about all the circumstances impeding the delivery of goods.

The customer is obliged to provide complete information about the cargo being transported - name, type, total quantity. And we also need a schedule indicating the points for delivery of vehicles for loading. The customer prepares all shipping and transport documentation for the transported cargo and pays for the freight of the vehicle.

Transport services of an individual entrepreneur are paid after submitting the relevant invoices and invoices. Payment may be charged as a fixed amount or per unit of transport work.

A transaction for the transportation of goods will be mutually beneficial only if the rights and obligations of the parties are clearly stated in the contract

The carrier is responsible for providing vehicles for loading on time and for failure to meet delivery deadlines. The section of the contract “Penalties” indicates the amount of payments for violation of transportation deadlines.

In addition, the carrier is responsible to the customer for the complete or partial loss of cargo, its damage, deterioration in quality and loss of presentation due to improper execution of the transportation contract. When signing an agreement, an individual entrepreneur needs to determine at whose expense the assessment of the amount of damage will be carried out.

The customer is responsible for:

- improper fulfillment of one's obligations under the contract;

- damage caused to the carrier;

- unjustified refusal to pay for carrier services;

- late payment of invoices issued under the contract;

- untimely release of the vehicle.

Transport forwarding agreement

The transport expedition agreement is concluded between the customer and the transport forwarder.

Forwarding services today represent not only the execution of a transport operation, but also the provision of services for consolidation, storage, warehousing, and cargo handling in accordance with the customer’s instructions. Modern forwarders advise on the choice of method and route for cargo delivery, resolve tax issues, deal with insurance, and coordinate transportation processes. The entire range of forwarding services is divided into four groups:

- delivery,

- stevedoring,

- tallyman,

- warehouse

You can still guess what delivery and warehouse services are, but let’s define stevedoring and tally services.

Stevedoring services - loading, unloading and transshipment operations at an intermediate point. Tallying services involve counting the number of units of cargo when loading and unloading cargo from a vehicle. Cargo and transport inspection services are called survey services. Typically, survey and tally services are provided in a comprehensive manner.

The authoritative international organization UNCTAD divides all freight forwarders into freight forwarders of the following specializations:

- attorneys;

- commission agents;

- warehouse owners, cargo keepers;

- lessors of container and trailer parks;

- carriers.

Each of the listed forwarders offers a certain range of services related to transportation - consolidation and deconsolidation of cargo, formation of shipments, tonnage reservation, warehousing and safekeeping, rental of cargo packaging equipment. The specifics of the work of an individual entrepreneur - a forwarder - determine the content of the forwarding agreement, and also answer the question of who the forwarder is for the customer - an attorney, commission agent, warehouse owner, agent or carrier.

The section “Subject of the agreement” indicates the scope of regulation of relations between the forwarder and the customer. It is clear that the activities of an individual entrepreneur and his transport forwarding services completely determine the content of the text of this article.

The customer issues an order to the forwarder to transport the goods. To document this operation, there is a special FIATA form.

Execution of the FIATA proforma, the issuance of which formalizes the order to the forwarder, is mandatory for international transportation

Then the forwarder accepts (confirms) the fact of acceptance of the order. Proof of this is the receipt of the FIATA forwarder.

The reverse side of the FIATA proforma, which confirms that the forwarder has accepted the customer’s order for execution

The forwarder prepares transport and all necessary documents for the cargo. At the request of the customer, the forwarder can participate in the development of transport terms of the purchase and sale agreement.

The obligations and responsibilities of the forwarder and the customer are determined by the “General Conditions of Activities of Russian International Freight Forwarders” and the Civil Code of the Russian Federation: Chapter 40 “Transportation”, Chapter 41 “Transport Forwarding”, Chapter 47 “Storage”, Chapter 49 “Order”, Chapter 51 “Commission” , Chapter 52 “Agency”, Chapter 37 “Contracting”.

Control of transport costs

When planning the costs of maintaining company vehicles, it is recommended to compare:

• the amount of money invested in the purchase of new cars (if necessary);

• the planned amount of costs for their operation (including transport tax);

• planned volume of their monthly trips;

• liquid value of cars

and the average cost of renting vehicles or services of transport organizations.

Based on the results obtained, it will be possible to draw a conclusion about the efficiency of use or the level of need for having your own vehicles.

The organization must systematically control the costs of its own vehicles. This will make it possible to identify non-production expenses and theft of the organization’s property when operating its own fleet.

Possible options for non-production losses:

• travel for personal needs;

• overestimation of fuel consumption standards;

• open drain of fuel and lubricants;

• fraud at fuel depots of enterprises, etc.

The primary task of control is to prevent both one-time precedents and systematic actions. Theft may be indicated by:

• systematic unreasonable excess consumption of fuel and lubricants;

• indication of routes in the waybill that do not correspond to production goals;

ە times and dates of machine refueling that do not correspond to working hours.

During control actions, routes must be checked for correct mileage and rationality.

If it turns out that non-production losses arose due to the fault of the employee, the amount of damage can be recovered with his consent. If the employee does not agree to voluntarily compensate for the damage, it can only be recovered through the court, proving that the employee is at fault for this overspending.

The position of the organization will also be quite justified, according to which the culprit must not only reimburse the purchase price of fuel and lubricants, but also compensate for the costs associated with its delivery and storage: the employee is obliged to compensate the employer for the direct actual damage caused to him, which regulates this case (p. 238 of the Labor Code RF).

Losses through no fault of employees are written off as other expenses in the period of their identification based on the manager’s decision on the source of their write-off.

An important block of control activities is checking the availability and correct completion of the following documents in the organization:

1) when writing off fuel and lubricants:

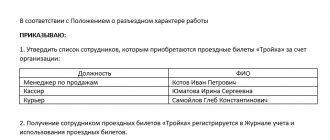

• orders from the head of the organization approving fuel consumption standards (see example);

• waybills;

• documents on payment for fuel or advance reports, if the fuel was purchased through an accountable person;

• acts on write-off of inventories.

2) when writing off expenses for storing vehicles in paid parking lots:

• storage agreement (safety receipt (receipt) - for short-term (one-time) parking of a motor vehicle (for a period of no more than 24 hours));

• documents confirming payment for services (payment order, bank account statement, cash register receipts, sales receipts, BSO);

3) when writing off expenses for the provision of services for washing and maintaining vehicles:

• contract, act of provision of services;

• cash register checks, sales receipts, receipts, BSO (when paying in cash).

When is the act used?

The Act on the provision of transport services is widely used.

It is not an independent document, but serves as an integral annex to the corresponding agreement, which is usually drawn up between two organizations, one of which orders services for the transportation of goods or passengers, and the other performs them. In this case, the type of transport does not matter: it can be cars, trucks, buses, water or even air vehicles.

- Form and sample

- Online viewing

- Free download

- Safely

FILES