The legislative framework

When an organization acquires a plot of land, it is reflected in accounting in accordance with PBU 6/10, the Tax Code of the Russian Federation, since this object is a fixed asset, as well as the norms of land and civil legislation.

The Land Code of the Russian Federation contains instructions that you can buy and sell such plots that have been assigned a cadastral number. The Civil Code of the Russian Federation states that the purchase and sale agreement must necessarily indicate the location of the actual location of the plot, its price, as well as restrictions or encumbrances, if any (

What is included in accounting in an organization, from the PBK “Chief Accountant”?

In accordance with the requirements of Russian legislation, accounting in any organization

is carried out from the very beginning of its activities (from the moment of registration) until the end of its existence (liquidation, reorganization).

Accounting – preparation of financial statements by our company’s specialists implies:

- preparation of documentation for all business operations of the organization;

- entering data into a specialized accounting program, processing and systematizing it;

- calculation of wages of employees of the organization and various deductions for them;

- generation of a report depicting the financial result of activities;

- preparation of accounting and tax documentation and submission to the relevant regulatory authorities.

We carry out accounting in organizations

Moscow, Moscow region and other regions of the Russian Federation since 2000. The staff of our company is qualified specialists with extensive experience. During our activity, we have repeatedly proven our high professionalism and integrity, which is why today we already have more than 300 regular customers.

Accounting in organizations

Features of land registration

There are several criteria that a piece of land must meet to be recognized as a fixed asset:

- The organization buys land in order to use it in its main activity, or for the purpose of subsequent rental.

- The land use period is more than a year.

- The plot of land is not planned for resale in the future.

- A company that plans to purchase a new site plans to make a profit from its use.

Thus, the site is included in the organization’s fixed assets. If a land plot is necessary for further sale, then its value is not included in non-current assets, but is reflected in the goods account. The value of an object consists of the costs that the company incurred to purchase it. It includes the following amount:

- the cost of the plot under the purchase and sale agreement;

- amounts that were paid to intermediaries (for example, a real estate agency);

- state duty paid upon land registration;

- interest on loans if the purchase of land was made with the use of loan funds (in this case, the cost of the plot, interest on the loan increases only until it is classified as fixed assets);

- other amounts that were paid when purchasing the plot.

A land plot is not subject to depreciation either in accounting or tax accounting, since it does not lose its useful properties . Therefore, the cost of purchasing land will not be included in the cost of production. Only if it is sold will the costs associated with its purchase reduce the profit received.

Important! When exploiting a land plot, it should be remembered that its use must be in accordance with the State Real Estate Cadastre. Thus, it will not be possible to independently decide to build buildings on the site. For example, when production premises are needed, the organization must buy an industrial site.

Description of the account “Purchase of land”

Subaccount 08.01 “Acquisition of land plots” reflects the costs associated with the acquisition by an organization of land plots for industrial and agricultural purposes, which are on the state cadastral register, for development and for other purposes from state or municipal bodies, individuals and organizations at the original cost, taking into account: the amount paid to the seller, fees for registering property rights, information and consulting services, remuneration to the intermediary, costs for increasing land fertility, etc. Acquired land plots are not subject to depreciation.

Documentation procedure

The legislation does not provide for any special documents intended for recording land plots. The main document is the contract. In this case, you will need to prepare it in 3 copies, one of which is transferred to Rosreestr.

The transfer of land can also be carried out under an agreement, but in this case it must indicate that it is also an act of acceptance and transfer. You can choose the form for reflecting transactions with fixed assets in the company yourself, but such unified documents as OS-1, OS-6 and OS-6b can also be used.

Sometimes a company does not purchase a plot, but receives it as a contribution from the founder as a gift or in exchange for other property. In this case, an objective assessment of the land plot will be required, as well as its acceptance for registration at cadastral value . If a company leases a site, a lease agreement must be drawn up. For a long lease period, such an agreement must be registered with Rosreestr.

Acquisition of land plots

The tax base for land tax is the cadastral value of land plots recognized as an object of taxation (clause 1 of Article 390 of the Tax Code of the Russian Federation).

You can find out the cadastral value of a land plot on the Rosreestr website

The service is provided:

- in real time;

- for free.

The organization entered into an agreement with Estate Management LLC for the purchase of a land plot in the amount of 8,000,000 rubles.

On August 3, the seller transferred the land plot under the acceptance certificate.

On August 6, the state fee for registering property rights to the plot was paid and documents for registration were submitted.

On August 17, an extract from the Unified State Register of Real Estate about the transfer of ownership rights to the land plot was received.

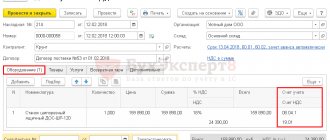

Document Acquisition of land plots

applies:

- the land was received under a transfer and acceptance certificate;

- the conditions for registration as a fixed asset have been met (clause 4 of PBU 6/01).

To register a land plot as an asset, you do not need to wait for the transfer of ownership (clause 4 of PBU 6/01 and paragraph 52 of the Guidelines for accounting of assets, approved by order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n).

To reflect in the program the receipt and registration of a land plot in a simplified way,

if there are no additional costs for its acquisition, it is enough to perform the following action:

- create and post a document Acquisition of land plots

(document

Receipts (acts, invoices )

type of operation

Land plots

).

Document type of operation Land plots

allows you to simultaneously carry out the following operations with a land plot:

- admission,

- acceptance for accounting.

Quick access to such a document is possible through the section OS and intangible assets – Receipt of fixed assets – Acquisition of land plots.

Added the ability to quickly create a directory item Fixed assets

.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- How to ensure order in the accounting of land plots from 2020...

- The procedure for accounting for operations to change the cadastral valuation of land plots has been clarified. The Ministry of Finance in Letter dated 05.29.2020 N 02-06-10/45902 explained that the change...

- Purchasing materials for operations not subject to VAT and transferring them for advertising purposes Let's consider the features of reflecting in 1C received materials intended for operations...

- Reg. operation Recognition of expenses for the acquisition of intangible assets for the simplified tax system...

Land plot: accounting and tax accounting

To account for a land plot in accounting, an 08 account is provided, to which a corresponding sub-account is opened . It opens for each new object. It reflects the costs that increase the cost of the object. The postings will be as follows:

| Business transactions | D | TO |

| Purchased land | 08.1 | 60 |

| Intermediary services, as well as state duty, are reflected | 08.1 | 76 |

| The land plot is reflected in accounting as fixed assets | 01 | 08.1 |

| If the land plot is purchased for the purpose of resale | 41 | 60 |

| Reflection of proceeds from sales if the plot was purchased for the purpose of resale | 62 | 91(90) |

| Write-off of the cost of the site | 91(90) | 01(41) |

| Reflection of other expenses for the sale of the site | 91(90) | 76,60 |

Important! When financial statements are prepared, land plots are reflected as non-current assets (the first section of the balance sheet).

How to quickly reflect the acquisition and registration of a land plot

How can you quickly reflect the acquisition and acceptance of a land plot in 1C: Accounting 8, edition 3.0, without including additional costs?

The video was made in the program “1C: Accounting 8” version 3.0.65.72.

To simultaneously reflect the receipt and acceptance of land plots for accounting without including additional expenses in their cost, the document Receipt (act, invoice)

with the type of operation

Land plots

.

Quick access to this type of receipt document is provided from the OS and intangible

using the hyperlink

Acquisition of land plots.

Document form Acquisition of land plots

simplified as much as possible, since for land plots it is not required to indicate the method of reflecting depreciation expenses, depreciation group, service life, VAT rate and invoice from the supplier. In the tabular part you only need to indicate the name of the purchased object and its cost.

To quickly enter a new object, just enter the name of the land plot in the appropriate field and select the Create command:

.

In this case, the Fixed Assets

does not open, but the details are automatically filled in:

- OS accounting group

(the value

Land plots

); - Location

and

MOL

(the values indicated in the header of the document are substituted); - The procedure for repaying the cost

(the value

Cost is not repaid

- for accounting purposes); - The procedure for including cost in expenses

(the value

Cost is not included in expenses

- for tax accounting purposes).

After posting the document, accounting entries are generated:

Debit 08.01.2 Credit 60.01 and Debit 01.01 Credit 08.01.2

- on the cost of acquired land plots.

For tax accounting purposes for income tax, the corresponding amounts are also recorded in the resources Amount NU Dt

and

Amount NU Kt

.

If an organization applies the simplified taxation system (STS) with the object “income minus expenses”, then entries are made in special registers for the purposes of the tax paid in connection with the application of the STS.

In addition to movements in accounting and tax accounting, the document also generates entries in the periodic information registers of the OS accounting subsystem, reflecting information about the land plot.

In addition to accounting and tax accounting movements, the document also creates entries in periodic information registers that reflect information about the fixed asset.

For the purpose of calculating land tax, to reflect information on the state registration of land plots and their deregistration, a register of information is intended: Registration of land plots

.

Access to the specified register is carried out both from the fixed asset card (hyperlink Register

) and from the

Main

(

Taxes and reports - Land tax

-

Registration of land plots

).

Calculation and accrual of land tax is automatically performed at the end of the reporting period by a routine operation with the type Calculation of land tax

included in

the month end

.

Land revaluation

A land plot is a resource that does not change over time and does not lose its properties. Therefore, the period of effective use is not determined for it. Its cost cannot be recovered through depreciation. Until 2011, there was a ban on the revaluation of land plots recognized by the OS of the organization. But later this ban was lifted. Therefore, organizations have the right to decide to reassess it. This should be reflected in the company's accounting policies. When revaluing land plots, the organization must do this regularly. The company determines the procedure for such a procedure, as well as the rules for conducting it independently.

Cost adjustment occurs when using price indices determined by statistical bodies, or by directly bringing the cost into line with market values on a certain date. After the revaluation, a corresponding act is drawn up, which is signed by all members of the commission and the head of the company. Documents confirming the adequacy of the amount received at which the land will be reflected in accounting are attached to the act.

Important! When revaluing land, you should remember that it is only possible with accounting. The Tax Code of the Russian Federation does not provide for this possibility.

Tax accounting under OSNO

When purchase and sale transactions are concluded, the VAT tax base does not arise. The seller does not need to allocate VAT, and the buyer does not need to reimburse it. If the company is located on OSNO, then in the case of calculating income tax, the costs of purchasing the site are not included in the tax base. This can only be done if the plot is sold. An exception is the purchase of land from state or municipal authorities. In this case, the company determines the useful life of the land independently and during this period of time evenly applies the purchase price to taxable expenses. It should be remembered that this period should not exceed 5 years. The company can also include a taxable portion of the costs of purchasing land (30% of the base for the previous year) and continue to do so until the costs are paid in full. In this case, a difference arises between accounting and tax accounting, and hence the emergence of permanent tax differences.

Despite the fact that the land is classified as fixed assets, it is not subject to property tax. According to the clarifications of the Russian Ministry of Finance, an independent tax is provided for land plots, therefore they should not be included in the tax base for property tax. Land tax is calculated in accordance with Ch. 31 Tax Code of the Russian Federation. This is a local tax based on the cadastral value of the land. The tax rate is determined by the municipality, which may also provide benefits for it. Companies report land tax every quarter and make advance payments during the tax period.

Accounting

The building and the land plot underneath it, satisfying the conditions listed in clause 4 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n, are accepted for accounting as separate objects of fixed assets (OS).

Fixed assets are accounted for at their original cost (clause 7 of PBU 6/01).

The initial cost of fixed assets acquired for a fee is recognized as the amount of the organization's actual costs for their acquisition, the list of which is established in clause 8 of PBU 6/01.

In this case, such costs are the amount paid to the seller for the acquired building and land (paragraph 3, clause 8 of PBU 6/01).

Moreover, if the costs incurred by the organization are associated with the acquisition of several fixed assets at the same time, the amount of such costs is distributed between these objects on the basis of a base chosen and justified by the organization, for example, in proportion to the cadastral value of real estate objects. Such clarifications are contained in Letter of the Ministry of Finance of Russia dated June 28, 2013 N 03-05-05-01/24812.

The cost of the building is repaid through depreciation (clause 17 of PBU 6/01). Depreciation charges under the linear method of calculating depreciation are calculated monthly based on the original cost of the building and the depreciation rate calculated on the basis of the useful life of the building, which is established by the organization when accepting the building for accounting. This follows from clause 18, paragraph. 2, 5 clause 19, clause 20 PBU 6/01.

Land plot, in accordance with paragraph. 5 clause 17 PBU 6/01, not subject to depreciation.

USN and Unified Agricultural Tax

As for companies using the simplified tax system, the same rules are established for them as for companies using the main tax system. That is, they do not have the right to reduce their income by the amount of expenses associated with the purchase of a plot. However, in the case of resale of a plot, it is regarded as a product and costs can be taken into account when determining the simplified tax system. If a company pays the Unified Agricultural Tax, then it is provided with a special procedure for recognizing costs associated with the purchase of land. For example, a company can determine the period during which costs incurred will be written off. This period must be at least 7 years. However, there are certain requirements for the site. It must be paid for, used only for growing agricultural products, and also be in the process of state registration.