Fixed assets include any property with which an organization can carry out its activities: equipment, instruments, machinery, buildings, structures, etc. An act on the commissioning of a fixed asset is drawn up when purchasing, constructing, modernizing, repairing, reconstructing the property of an enterprise, etc.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

What does the term “commissioning” mean and why is an act needed?

Operation means the use of a fixed asset for its intended purpose to achieve the tasks and goals of the enterprise, as well as the maintenance and maintenance of this property in working order.

The act of commissioning certifies the fact that the fixed asset, which is listed on the balance sheet of the enterprise or is just being accepted for accounting, meets all standards, is in good working order, does not have any breakdowns, malfunctions or defects, and from a certain date can be used in the company’s activities.

Accounting and documentation of the company's fixed assets

Throughout the entire cycle of using an OS object in an organization, any of its movements and transformations must be taken into account. For example, at the moment of receipt of an asset, its initial cost is formed. The receipt is documented by an OS acceptance certificate. And as soon as the object begins to be used, a commissioning certificate is drawn up.

Responsibility for registration and recording of all movements falls on a special commission that is created in the organization. The powers of the chairman and members of the special commission include certification of basic facts related to operations with OS.

For example, the commission is authorized to establish the initial cost of an acquired asset if its price is unknown. The commission also has the right to make decisions on the decommissioning or rationality of upgrading equipment. The composition and powers of the commission are approved by a separate order of the head.

The entire life cycle of a fixed asset in an organization is divided into five key stages. Moreover, each has specific accounting and documentation features.

Commissioning procedure

Commissioning is not the easiest procedure. In some cases, a huge amount of preparatory work is required first.

For example, when commissioning any structure or building, you need to:

- Prepare all technical documentation for the fixed asset, draw up a certificate of completion of work.

- At the same time, it is necessary to check the object for quality and compliance with all requirements - this work is carried out by highly qualified specialists from the contractor and customer, as well as regulatory structures.

- Then there is the process of interaction with the architectural department of the municipal institution about permission to put the facility into operation.

- And finally, a full comprehensive examination of him.

This example fully illustrates the stages of commissioning complex technical facilities, buildings and structures.

Important! Each stage requires written documentary support.

Of course, not all fixed assets are put into operation in such a complex way - household furniture and appliances, inventory and other simple items do not require highly specialized technological control, so in such cases, representatives of organizations are limited to a simple visual inspection and checking the papers attached to them.

Why is an order to put fixed assets into operation necessary?

When a company accepts an object or some other property on its balance sheet, it becomes necessary to prepare certain documents. One of them is an order to put new facilities into operation. This document is issued by the head of the receiving organization. It is on the basis of this order that the company receives or purchases fixed assets, capitalizes them, and registers them.

New objects can be added to the company’s balance sheet in various situations:

- donation;

- purchase;

- do-it-yourself production;

- production with the help of contractors;

- receipt as authorized capital;

- sponsorship.

After a special commission is created, a thorough inspection and verification of the object takes place. Experts determine its technical condition. If there are any defects, a defect report is additionally drawn up in form OS-16. When drawing up an order, special attention should be paid to the date of acceptance and commissioning of new fixed assets. It is from this date that tax records are kept.

As for the timing: the law does not define a clear period within which new facilities must be put into operation. As a rule, this is decided by the director of the organization.

Who draws up the act

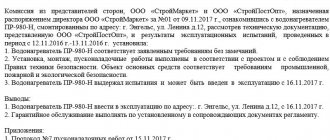

As a rule, the act is drawn up between two parties: the transferor of the fixed asset and the recipient of it, incl. putting into operation.

Representatives of the parties in most cases are directors of companies, their deputies or heads of structural divisions.

However, if necessary, a third party can be involved in the form of experts (this is especially true in cases of transfer of complex technical equipment, instruments, machinery, and various types of structures).

Depreciation of partially liquidated fixed assets

Depreciation on a fixed asset that has been partially liquidated will be calculated in accounting and tax accounting based on its new value.

Let's show this with an example. Example.

Depreciation during partial liquidation of fixed assets The initial cost of the warehouse building, formed in accounting and tax accounting, is 2,800,000 rubles. Its useful life is 25 years (300 months). Depreciation on the building is calculated using the straight-line method. The depreciation rate for the building will be: (1: 300 months) × 100% = 0.333%. The amount of monthly depreciation charges will be: RUB 2,800,000. × 0.333% = 9324 rubles. In May, the building was partially liquidated. Its cost decreased by 600,000 rubles. From June of the same year, the amount of monthly depreciation charges for the building will be: (2,800,000 rubles - 600,000 rubles) × 0.333% = 7,326 rubles.

When calculating income tax, underaccrued depreciation on the liquidated part of a fixed asset should be written off depending on which depreciation method the taxpayer uses.

If the linear method was applied to a partially liquidated object, the amount of underaccrued depreciation is included in non-operating expenses (clause 8 of Article 265 of the Tax Code of the Russian Federation).

If depreciation is calculated using a non-linear method, then the objects are decommissioned in the manner established by paragraph 13 of Article 259.2 of the Tax Code of the Russian Federation. When liquidating a fixed asset that is being decommissioned, the company excludes it from the depreciation group (subgroup) on the date of withdrawal of this object, but without changing the total balance. Therefore, if a non-linear method was chosen, then the amount of underaccrued depreciation must continue to be written off as part of the total balance of the depreciation group, and not as a lump sum as part of non-operating expenses.

Expert "NA" E.V. Chimidova

How to draw up an act correctly

The act refers to primary documentation, therefore, since 2013, the requirement to draw it up according to a strict unified template has been abolished. Today, enterprises and organizations have every right to compose it in any form or according to a template developed and approved within the company.

Important condition : in its structure and content, the act must comply with certain standards of office work, business documentation and the rules of the Russian language.

The document must include some mandatory information:

- a link to the agreement, to which the act is an annex, as well as the number, date, place of its creation;

- enter information about the enterprises that form the act;

- indicate the name of the fixed asset, the address at which it is installed or put into operation;

- describe the tests and inspections to which the fixed asset was subjected, as well as their results;

- the conclusions should record the suitability of the fixed asset for further use and the date from which it can begin to be used in work.

If there are any additional accompanying papers, they must be noted in the act as a separate item.

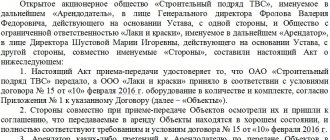

Instructions for filling out the act

Although there are no strict requirements for the execution of this act, it is necessary to remember the standards for drawing up business documents.

To correctly draw up the act, you should adhere to the following recommendations:

- At the top there should be a “header” that states which agreement this act is an annex to. The date, number and place of drawing up this agreement are noted. Many companies note the name, details and position of the manager here.

- The title of the document is indicated in the center of the sheet. Below is detailed information about the facility that is planned to begin operation. You should also note the address and location where the new equipment will be installed.

- Information about organizations that take part in the preparation of the document is indicated. The act also includes the responsible persons who are members of the commission.

- The process of carrying out inspections and tests is described, and their results are noted.

- The commission makes a conclusion by noting whether the inspected object is suitable for work. Also, responsible persons determine the date from which the operation of this facility can begin.

- If any additional documents are attached to the act, they must also be mentioned in a separate paragraph.

- The document indicates which employee becomes responsible for storing new fixed assets.

- At the bottom of the document, members of the commission put their signatures with transcripts.

After drawing up, the act should be stored with other current primary documents of the company in a separate folder.

After the end of the validity period, the act can be transferred to the archive of the enterprise, where it must be kept for the period established by the internal regulatory documents of the organization or the legislation of the Russian Federation.

How to properly draw up a deed

The law does not provide any special requirements for both the content of the document and its execution. The act can be written on a regular sheet of paper or on the organization’s letterhead. All necessary information can be entered by hand (with a ballpoint pen of any dark color, but not a pencil) or printed on a computer.

There is only one condition that must be observed without fail: the presence of “live” signatures of all people present when the fixed asset was put into operation. At the same time, the use of facsimile autographs, i.e. printed in any way is unacceptable.

It is not necessary to certify the act using enterprise seals - this must be done only in cases where this norm is prescribed in the company’s local regulations: since 2016, the use of stamp products by legal entities is at their discretion.

The act is printed in at least two copies , but if necessary, additional copies can be made.

Depreciation of used fixed assets

If a company acquired a fixed asset that was already in use, its initial cost is determined based on the contractual purchase price and the costs associated with the acquisition.

The amount of depreciation accrued on this fixed asset by the previous owner should not be taken into account.

To charge depreciation on such fixed assets, you must determine their useful life.

note

When determining the useful life of a used fixed asset, the increasing factor applied by the previous owner should not be taken into account.

If the purchased used fixed asset has been used for at least its useful life in accordance with the classification, then its useful life can be determined independently, taking into account safety requirements. In this situation, you need to take into account the period during which the fixed asset can still work.

Used fixed assets are included in the depreciation group (subgroup) in which they were included by the previous owner (clause 12 of Article 258 of the Tax Code of the Russian Federation).