Who is affected by the changes in the procedure for conducting cash transactions?

To one degree or another, innovations in the procedure for conducting cash transactions affected all business entities. In particular:

- individual entrepreneurs and organizations that are small businesses (you will find the criteria for small businesses in this article);

- organizations that are not small;

- organizations with separate divisions;

- persons using cash registers or strict reporting forms (read more about accounting for funds when using online cash registers here);

- employers giving money to employees on account.

Let us now consider these changes in more detail.

The concept of cash discipline

Cash discipline of a company or entrepreneur is the procedure for conducting cash transactions. All cash payments (payment of salaries, acceptance of payment for products or services, transfer of proceeds to a current account, etc.) must be carried out through the enterprise's cash desk.

Each operation must be correctly executed with the appropriate type of document, otherwise there will be confusion in the income and expenses of the business. An accountant, a cashier, and in small enterprises a director usually works with such documents.

Conducting cash transactions: comparison of current and old rules

For clarity, we will present the main changes in the procedure for conducting cash transactions in the form of a table (comparison of current and previous rules, including taking into account those introduced by Directive No. 5587-U, effective from November 2022, and No. 4416-U of 2022).

| Operations affected by changes | Changes in the procedure for conducting cash transactions from November 30, 2020 | The procedure for conducting cash transactions, in force since 2017 |

| Issuance of money on account | The calculation rules have not changed except for the following aspects:

| To issue cash to an employee on account for expenses associated with the activities of a legal entity or individual entrepreneur, an expense cash order is drawn up in accordance with a written application of the accountable person, drawn up in any form, or an administrative document of the manager. The application or administrative document must contain a record of the amount of cash and the period for which it is issued, as well as the manager’s signature and date. If an application is drawn up for accountable amounts, then the manager is not required to indicate the amount of accountable funds and the period. The accountable himself can do this. And the manager will only sign and date it. Issuance on account is allowed if the recipient has not reported on the previous advance. |

| Interaction between the head office and department offices | Separate divisions have the right not to keep a cash book if they do not store funds, but hand them over to the cash desk of the parent organization. | An organization that has separate divisions (SU) has the right to independently establish the procedure and timing for transferring to the parent organization copies of the SE's cash book sheets, taking into account the deadline for drawing up accounting (financial) statements (clause 4.6 of Directive No. 3210-U). |

| Requirements for working with automatic devices for accepting and issuing money without the participation of employees (vending machines) have been approved. | The name of software and hardware has been changed to automatic devices for receiving and squeezing money without the participation of workers. They must automatically accept and issue banknotes and be able to recognize at least 4 machine-readable security features over the entire area of the banknote given in paragraph. 14–19 clause 1.1 of the Central Bank Regulations dated January 29, 2018 No. 630-P. | Software and hardware must be “able” to recognize banknotes based on 4 security features established by the regulations of the Central Bank. |

| New rules for accepting and issuing banknotes | When accepting banknotes, the cashier is required to check their solvency. At the same time, he is obliged to accept banknotes that do not contain signs of counterfeiting, are without damage or have abrasions, extraneous inscriptions, punctures, missing corners or edges and other minor damage. The cashier is prohibited from issuing banknotes that have one or more damages such as extraneous inscriptions of 2 or more characters, violation of the integrity of the banknote, a lost corner (more than 32 sq. mm) or a torn edge (7 mm or more in length), as well as other damage , specified in paragraph. 6–15 clause 2.9 of the Central Bank Regulations No. 630-P. Such banknotes should be handed over to the bank. | — |

| Identification of the recipient of funds | The cashier must ensure that cash is issued to the person indicated in the cash receipt order. Request for document verification. identification is excluded. | When issuing funds, the cashier is required to check the identity document. |

| Salary deposit | The rule about reflecting in the payroll the deposit of wages not paid on time is excluded. | On the last day of issuing cash intended for payment of wages, the cashier in the payroll record makes an entry “deposited” opposite the names and initials of employees who have not been issued cash, calculates and writes in the final line the amount of cash actually issued and the amount subject to deposit. |

You can learn about other innovations from ConsultantPlus materials by receiving free demo access to the K+ system.

ConsultantPlus experts described a step-by-step algorithm for conducting cash transactions and maintaining cash discipline. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

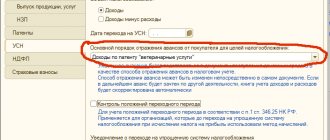

In addition to Instructions No. 3210-U, businessmen must comply with Instructions No. 5348-U dated 12/09/2019. According to this document, firms and individual entrepreneurs have the right to spend cash received for goods (work, services) sold exclusively for payment:

- employee salaries;

- insurance compensations under insurance contracts;

- remuneration for work/services, as well as for payment for goods (within 100 thousand rubles under one contract);

- accountable funds;

- for personal needs of individual entrepreneurs not related to entrepreneurship;

- returns for goods (work/services);

- issuing loans, etc.

Individual entrepreneurs can use a simplified method of conducting cash transactions. If you have access to ConsultantPlus, check whether you are accounting for the entrepreneur’s funds correctly. If you do not have access, get free trial access to the system and proceed to the Ready-made solution.

Let’s combine the requirements of the Central Bank Directives into a convenient scheme:

Current forms and samples

Since not all documents used to document cash transactions were abolished due to the introduction of online cash registers, we will list which cash documents were canceled in 2022 and which continue to be used.

So, for example, when making cash payments within an institution, you will have to generate special forms. The key purpose of cash settlements in an institution is the issuance of accountable money. For example, cash is issued from the cash register for the purchase of materials, travel expenses for employees and other payments. Registration of such transactions at the cash desk of the institution is carried out in a special way.

All expense transactions, that is, the withdrawal of cash from the cash register, are documented with an expense cash order.

So, for example, you should formalize the issuance of money to an employee of an institution.

Example of filling out RKO

Operations for the receipt of cash at the cash desk are formalized using a cash receipt order. Moreover, receipts can come not only from employees, but also from the bank’s current account to the organization’s cash desk. For example, an institution issues wages and benefits in cash.

Example of filling out the PQS

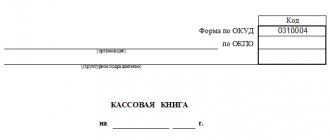

All expenditure and receipt transactions are recorded in a special document - a cash book, taking into account the chronological order of registration and maintenance of accounting data.

Filling example

Responsibility for violation of the rules for conducting cash transactions

And in conclusion, a few words about responsibility. For violation of the procedure for working with cash and the procedure for conducting cash transactions, administrative liability is provided under Art. 15.1 Code of Administrative Offenses of the Russian Federation. This is a fine: for officials - from 4 thousand to 5 thousand rubles, for legal entities - from 40 thousand to 50 thousand rubles.

In this case, violations include:

- making cash settlements with other organizations in excess of established limits;

- non-receipt (incomplete receipt) of cash to the cash desk;

- failure to comply with the procedure for storing available funds;

- accumulation of cash in the cash register in excess of established limits.

Read more about liability for violation of the procedure for conducting cash transactions in the article “Cash discipline and responsibility for its violation .

Cash limit

The cash limit is the maximum allowable amount of cash that can be kept in the organization's cash register at the end of the working day. Each enterprise sets the specific amount of this limit by internal order, based on its revenue amount using special calculation formulas given in the appendix to Directive No. 3210-U dated March 11, 2014. Cash in excess of the established limit should not be in the cash register; it must be deposited at the bank. An exception to this rule is allowed on paydays, as well as on weekends and non-working holidays, if the organization carried out cash transactions on these days.

Individual entrepreneurs and small businesses (enterprises with no more than 100 employees and no more than 400 million rubles in annual revenue from the sale of goods and services) from June 1, 2014 may not set a cash balance limit. A special order must be issued to ensure that a cash limit is not established. If such a decision is made, then all cash proceeds can be stored in the cash register without any restrictions.

We draw the attention of those individual entrepreneurs and LLCs that were already working with cash before June 1, 2014, which means they should have had an order to set a limit. This order needs to be reissued, because until June 1, 2014, Bank of Russia Regulation No. 373-P dated October 12, 2011 “On the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation” was in force, which has already been cancelled. The previous order based on this Regulation is invalid. You can set the same limit, you just need to change the basis of the order to Directive No. 3210-U dated March 11, 2014.

If you want to refuse to establish a cash limit, then you cannot simply cancel the previous order in the order about this. According to the tax authorities, the cancellation of the old order does not mean the cancellation of the limit as such, but only the cancellation of the previous calculated limit amount, which means that the new limit is equal to zero. In this case, any amount of cash in the cash register at the end of the day will be above the limit. Strange logic, which, nevertheless, can deprive the organization of 50,000 rubles (the amount of the fine for violation of cash transactions for an LLC). Based on this, the new order must contain wording like “Keep cash in the cash register without setting a limit on the balance in the cash register.” This phrase is also suitable for those who are issuing a cash limit order for the first time.

Results

There are no plans to make any changes to the procedure for conducting cash transactions in 2022. The rules as amended in 2022, effective from 11/30/2020, continue to apply. Some of the innovations affected the procedure for working with accountants. Other changes were related to the separation and handling of damaged banknotes.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Use of cash registers in 2022

Economic entities are implementing online cash registers in stages.

In accordance with paragraph 4 of Art. 7 of the Federal Law of 07/03/2016 No. 290, from 02/01/2017 new cash register equipment can only be used through a fiscal data operator. From 07/01/2017, the obligation to use only the new cash register came into effect, that is, from this date the registration of cash register equipment was stopped in the manner established by the old version of the law dated 05/22/2003 No. 54-FZ (as amended on 03/08/2015). The transition took place in several stages. And now almost all organizations and individual entrepreneurs working with cash must use online cash register systems. In accordance with the rules for conducting cash transactions, in 2022, KKM has the right not to apply to companies operating:

- named in clause 2 of Art. 2 54-FZ; in remote and hard-to-reach places;

- in the field of religious rites and ceremonies, the sale of religious objects;

- pharmacy organizations in rural areas;

- to provide parking spaces on state-owned land plots;

- paid library services;

- accepting cash for utilities;

- educational services to the population;

- provision of services in the field of physical culture and sports;

- provision of services by cultural and creative centers.

For clarity, we will present the step-by-step procedure for implementing the new edition of Law No. 54-FZ in the form of a block diagram.

Today, there are already more than 100 models of online cash registers, and the existing OFDs ensure the transfer of data from cash registers to the OFD, Federal Tax Service and Unified State Automated Information System.

For each online cash register, the OFD collects and updates a lot of parameters: opening and closing times of the shift, amount of cash, average receipt, etc. This means that any point of sale can now be checked via the Internet in a matter of minutes. In addition, the built-in services of some OFDs allow you not only to store the received data, but also to generate various reports.

After the introduction of online cash registers, all their owners, starting from 08/19/2017, are required to perform the following actions through their personal account of the cash register equipment (clause 1 of Chapter I of the order of the Federal Tax Service of the Russian Federation dated 05/29/2017 No. ММВ-7-20 / [email protected] ):

- respond within three days to requests from the Federal Tax Service received through your personal account;

- report non-use of CC machines or within three days from the date of elimination of identified violations during its use;

- report your agreement or disagreement with the data received from the Federal Tax Service about detected violations within one working day.

The transmitted information must be signed with an enhanced qualified electronic digital signature (EDS). After receiving such a message, the Federal Tax Service must confirm the fact of receipt by placing a receipt in the cash register office. Information and documents can also be transmitted on paper to the tax authorities.

Cash settlement limit

According to the latest changes to the Tax Code, registered individual entrepreneurs and companies can pay ordinary citizens in cash for any amount. And when dealing with cash between individual entrepreneurs and companies, organizations, entrepreneurs, you must adhere to a limit of 100,000 rubles per agreement. The exception is the following calculations:

- payment of wages to individual entrepreneurs' employees;

- customs payments;

- issuance of accountable funds.

The restriction applies not only to one-time payments, but also to the accumulative system. For example, an LLC receives 7,000 rubles daily from one individual entrepreneur for services rendered, but as soon as the amount of payments reaches 100,000 rubles, it will need to switch to non-cash payment. Also, the limit will not be affected by the duration of the contract - if the LLC is late in paying the individual entrepreneur for goods, then in order to receive the balance of the debt in the amount of more than 100,000 rubles, several new contracts will need to be concluded.

Compliance with the limit is monitored by the Federal Tax Service, and violators face a fine.