The federal accounting standard for public sector organizations “Rent”, applied since 2022, has changed the procedure for reflecting lease accounting items by both the lender and the borrower. In the article, 1C experts consider in what cases the receipt of property for free use is reflected by the borrower, taking into account the application of the provisions of the “Rent” standard, and how such transactions are registered in the program “1C: Accounting of a public institution 8” edition 1 and edition 2. Cases of non-application are also considered "Rent" standard.

Legal regulation

According to Article 689 of the Civil Code of the Russian Federation, under an agreement for gratuitous use (loan agreement), one party (the lender) undertakes to transfer or transfers an item for gratuitous temporary use to the other party (the borrower), and the latter undertakes to return the same item in the condition in which it received it, subject to normal wear and tear or in the condition stipulated by the contract. The rules provided for in Article 607 “Rental Objects” of the Civil Code of the Russian Federation apply to the agreement for gratuitous use.

According to paragraph 2 of the Federal Accounting Standard for Public Sector Organizations “Rent”, approved. by order of the Ministry of Finance of Russia dated December 31, 2016 No. 258n, this standard has been applied since 2018 when reflecting in accounting assets, liabilities, facts of economic life, and other accounting objects arising upon receipt (provision) for temporary possession and use or temporary use of material valuables not only under a lease agreement (property lease), but also under an agreement for free use.

The Lease standard has changed the procedure for recording lease accounting items by both the lender and the borrower.

Previously, objects of movable and immovable property received from the balance holder (owner) of the property for free use were accounted by the borrower on off-balance sheet account 01 “Property received for use” at the cost indicated (determined) by the transferring party (owner), and under the inventory (account) number, assigned to the object by the balance sheet holder (owner) (clauses 333, 334 of the Instructions for the application of the Unified Chart of Accounts, approved by order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n.

According to paragraph 20 of the Lease standard, the accounting object of an operating lease (the right to use an asset) is reflected by the user (lessee) as part of non-financial assets (NFA) as an independent accounting object.

The initial recognition of an operating lease accounting object (the right to use an asset) is made on the date of classification of lease accounting objects in the amount of lease payments for the entire period of use of the property provided for in a lease agreement (property lease) or a gratuitous use agreement with simultaneous reflection of the lease obligations of the user (lessee) (creditor's rent arrears).

In accordance with paragraph 26 of the “Lease” standard, lease accounting items arising under gratuitous use agreements are reflected by the borrower in accounting at their fair value, determined as of the date of classification of lease accounting items using the market price method, as if the right to use the property had been granted for commercial (market) conditions.

Objects of accounting for operating leases on preferential terms (the right to use an asset) by the borrower are reflected taking into account the following provisions of paragraph 27.1 of the “Lease” standard.

Accounting for property for free use

Loan agreement

Under an agreement for gratuitous use (loan), one party (the lender) transfers the thing for temporary use to the other (the borrower), who is obliged to subsequently return it.

The most important feature of a loan is that the use of the thing is free of charge (Clause 1, Article 689 of the Civil Code of the Russian Federation). The contract must contain a direct and unambiguous indication of this nature of the relationship. This is an independent type of agreement, relations under which are regulated by a separate chapter. 36 Civil Code of the Russian Federation. At the same time, by virtue of clause 2 of Art. 689 of the Civil Code of the Russian Federation, the rules provided for in separate articles of Chapter. 34 “Rent” of the Civil Code of the Russian Federation, namely:

• the object of the contract may be non-consumable things, that is, property that does not lose its natural properties during use: land plots and other isolated natural objects, enterprises and other property complexes, buildings, structures, equipment, vehicles and other things (Article 607 Civil Code of the Russian Federation);

• the contract is concluded for a period determined by it (clause 1 of Article 610 of the Civil Code of the Russian Federation);

• separable improvements made by the borrower to property received for free use are his property, unless otherwise

not provided for by the contract (clause 1 of Article 623 of the Civil Code of the Russian Federation);

• the cost of inseparable improvements to property received free of charge, made by the borrower without the consent of the lender, is not subject to compensation, unless otherwise provided by law (clause 3 of Article 623 of the Civil Code of the Russian Federation).

When is state registration required?

In paragraph 2 of Art. 689 of the Civil Code of the Russian Federation there is no reference to the rules of paragraph 2 of Art. 609 of the Civil Code of the Russian Federation, establishing the obligation of state registration of a real estate lease agreement. In Article 131 of the Civil Code of the Russian Federation, in the list of rights to real estate subject to registration, the rights of the borrower to temporary gratuitous use are not mentioned.

Thus, if an organization received a real estate property for free use under a loan agreement for a period of more than a year, the agreement is not subject to state registration. This is due to the fact that such registration is not provided for in Chapter. 36 of the Civil Code of the Russian Federation, nor the Federal Law of July 13, 2015 No. 218-FZ “On State Registration of Real Estate”.

There are exceptions to this rule. The following are subject to state registration:

• agreement for gratuitous use (loan) of a cultural heritage object (clause 2 of Article 609, clause 3 of Article 689 of the Civil Code of the Russian Federation, clauses 1, 9 of Article 51 of the Federal Law of July 13, 2015 No. 218-FZ);

• an agreement for the free use of a land plot, concluded for one year or more.

This follows from paragraph 2 of Art. 26 Land Code of the Russian Federation. The right to transfer a thing for free use belongs to its owner and other persons authorized to do so by law or by the owner (Clause 1 of Article 690 of the Civil Code of the Russian Federation). At the same time, a commercial organization does not have the right to transfer property for free use to a person who is its founder, participant, manager, member of its management or control bodies (clause 2 of Article 690 of the Civil Code of the Russian Federation).

Conclusion of an agreement

The agreement must be concluded in simple written form (clause 1 of Article 161 of the Civil Code of the Russian Federation).

Let us note that the contract is considered concluded if an agreement is reached between the parties in the required form on all its essential terms. These are:

• conditions on the subject of the contract;

• conditions that are defined by law or other legal acts as essential or necessary for contracts of this type;

• all those conditions regarding which, at the request of one of the parties, an agreement must be reached (clause 1 of Article 432 of the Civil Code of the Russian Federation).

Without them, the contract will be considered not concluded. Essential conditions are data that make it possible to definitely establish the property transferred under the loan agreement (clause 2 of Article 689, clause 3 of Article 607 of the Civil Code of the Russian Federation). The term of the loan agreement is not essential. In the absence of such a condition, the contract is considered concluded for an indefinite period (clause 2 of Article 689, clause 2 of Article 610 of the Civil Code of the Russian Federation).

Important details:

• the borrower is obliged to maintain the thing received for gratuitous use in good condition, carry out major and current repairs, and bear all expenses for its maintenance, unless otherwise provided by the agreement (Article 695 of the Civil Code of the Russian Federation);

• separable improvements made by the borrower to the received property are his property, unless otherwise provided by the agreement (Clause 2 of Article 689 of the Civil Code of the Russian Federation).

If the tenant has made, at his own expense with the consent of the landlord, improvements to the leased property that are inseparable without harm to the property, the tenant has the right, after termination of the contract, to reimburse the cost of these improvements, unless otherwise provided by the contract (Clause 2 of Article 623 of the Civil Code of the Russian Federation). We believe that this rule on compensation for the cost of inseparable improvements can be applied to relations regarding the gratuitous use of property.

At the same time, the cost of inseparable improvements made by the borrower without the consent of the lender is not reimbursed, unless otherwise provided by law (clause 2 of Article 689, clause 3 of Article 623 of the Civil Code of the Russian Federation).

You can formalize the transfer of property for free use using an act of acceptance and transfer. It indicates who is transferring what property to whom, and provides a description of the condition of the property at the time of transfer. The act lists the documents and accessories that are transferred along with the thing (clause 2 of Article 691 of the Civil Code of the Russian Federation). The functions of the transfer and acceptance certificate can also be performed by a loan agreement if the thing is transferred upon its conclusion. In this case, the contract should indicate that its signing confirms the acceptance and transfer of property.

Such an agreement can be terminated in cases provided for by law or agreement. For example, if the borrower significantly worsened the condition of the thing or the lender did not warn about the rights of third parties to it when concluding the agreement (clauses 1, 2 of Article 698 of the Civil Code of the Russian Federation).

Accounting for income by the borrower

For the purpose of calculating income tax, receiving property for gratuitous use is a gratuitous receipt of property rights, and the economic benefit received by an organization from gratuitous use is qualified as non-operating income (Clause 8 of Article 250 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated August 27, 2019 No. 03-03 -07/65526, clause 2 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 22, 2005 No. 98).

During the term of the loan agreement, the borrower must calculate income based on market prices for the rental of identical property. This can be done on the last day of each month (clause 8, part 2, article 250, subclause 3, clause 4, article 271 of the Tax Code of the Russian Federation, clause 2 of the Information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 22, 2005 No. 98, letters of the Ministry of Finance of Russia dated 08/27/2019 No. 03-03-07/65526, dated 12/17/2018 No. 03-03-06/3/91535, dated 06/14/2017 No. 03-03-07/36870). Information on prices must be confirmed by the taxpayer - the recipient of the property (work, services) documented or by conducting an independent assessment.

An exception is the cases specified in Art. 251 of the Tax Code of the Russian Federation “Income not taken into account when determining the tax base.”

Unitary enterprises, educational institutions and non-profit organizations can take advantage of the benefit.

Unitary enterprises. Their activities are regulated by Art. 214, 294 and 295 of the Civil Code of the Russian Federation and the Federal Law of November 14, 2002 No. 161-FZ “On State and Municipal Unitary Enterprises”. A unitary enterprise is a commercial organization that is not endowed with the right of ownership of property assigned to it by the owner. The property of a unitary enterprise belongs by right of ownership to the Russian Federation, a subject of the federation or a municipal entity and is assigned to the unitary enterprise by right of economic management for possession, use and disposal. It should be noted that the exemption of a unitary enterprise from fees for the use of transferred property entails the preservation of funds by this enterprise. In this case, this may be tantamount to their receipt (Information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation No. 98, letters of the Federal Tax Service of Russia dated 03.20.2015 No. GD-4-3/ [email protected] , Ministry of Finance of Russia dated 02.25.15 No. 03-03-05/ 9332).

Educational institutions. When determining the income tax base, income in the form of property received free of charge by state and municipal educational institutions for conducting their main activities, as well as in the form of property received free of charge by organizations engaged in educational activities, which are non-profit organizations, for the implementation of educational activities ( subparagraph 22, paragraph 1, article 251 of the Tax Code of the Russian Federation). Despite the fact that this provision speaks of exemption from taxation only of income in the form of property received free of charge, and it does not say anything about property rights received free of charge, we believe that the approach of the regulatory authorities outlined in the previous section can be extended to the specified situation. Since the preservation of funds when exempt from fees for the use of property received free of charge by state and municipal educational institutions for the conduct of their main activities can be equated to their receipt, these incomes are not taken into account on the basis of subclause. 22 clause 1 art. 251 Tax Code of the Russian Federation.

Non-profit organizations. Property rights in the form of the right to free use of state and municipal property, received by decisions of state authorities and local governments by non-profit organizations to conduct their statutory activities, are classified as earmarked revenues, which are also not taken into account when determining the income tax base (subclause 16 Clause 2 of Article 251 of the Tax Code of the Russian Federation). It is necessary to take into account that the right to free use of state and municipal property must be obtained by non-profit organizations free of charge on the basis of decisions of state authorities and local governments. Thus, the right to free use of state or municipal property that it received to conduct its statutory activities is not recognized as income of a non-profit organization, if such a right was transferred by a corresponding decision of a state authority or local government body, which indicates the intended purpose of the transferred property (Letter of the Ministry of Finance of Russia dated 04/10/2018 No. 03-03-06/3/23640). The norm does not apply to state and municipal property that is not assigned to state or municipal enterprises for economic management or operational management.

If the property was received for free use from the founder

According to sub. 11 clause 1 art. 251 of the Tax Code of the Russian Federation, income in the form of property received free of charge by a Russian organization from:

• an organization, if the authorized capital of the receiving (transferring) party consists of more than 50% of the contribution of the transferring (receiving) organization;

• an individual, if the authorized capital of the receiving party consists of more than 50% of the contribution (share) of this individual.

At the same time, only property received from members of the organization owning more than 50% of shares in the authorized capital is excluded from the tax base. The position of the Russian Ministry of Finance is that the transfer of property rights under subclause. 11 clause 1 art. 251 of the Tax Code of the Russian Federation (Letter dated 04/05/2019 No. 03-03-06/1/23924). In other words, organizations that received property from their founders (shareholders) under a loan agreement, regardless of the size of their share in the authorized capital, must include income from the gratuitous use of property as non-operating income.

Borrower's expenses

You need to pay attention to the text of the loan agreement. The point is that Art. 695 of the Civil Code of the Russian Federation, imposing on the borrower the obligation to maintain the received item in good condition, including carrying out routine and major repairs, as well as to bear all expenses for its maintenance, contains a clause allowing for the establishment of a different procedure for the distribution of these expenses directly in the contract. So, before carrying out repairs or including insurance costs in expenses, you need to make sure that the contract does not transfer the corresponding responsibilities to the lender.

The borrower receives the right to take into account in expenses the amounts spent on the maintenance of the received property, including the costs of its repair, insurance, etc., if, of course, the received property is used in carrying out activities aimed at generating income (subclause 2, clause 1, art. 253, Article 260 of the Tax Code of the Russian Federation).

Tax accounting with the lender

The transfer of property for free use, regardless of its type, is recognized as subject to VAT (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated October 23, 2018 No. 03-07-11/75858, Resolution of the Far Eastern District Administrative District dated May 15, 2019 in case No. A51-16899/2018). The lender, transferring the property for use to the borrower, pays this tax to the budget. The VAT base can be determined equal to the rental cost of a similar fixed asset (clause 1 of Article 105.3, clause 2 of Article 154 of the Tax Code of the Russian Federation). The invoice should be drawn up in one copy, because the recipient of the property cannot deduct VAT.

It should be noted that the provision of services for the transfer of fixed assets for free use to state authorities and local governments, as well as state and municipal institutions, state and municipal unitary enterprises (subclause 5, clause 2, article 146 of the Tax Code) is not subject to VAT. RF).

VAT accrued in connection with the transfer of property for free use cannot be taken into account in expenses for the purposes of calculating income tax (clause 16 of Article 270 of the Tax Code of the Russian Federation). When transferring property for free use, taxable income

Fixed assets transferred for free use should be excluded from depreciable property (except for fixed assets transferred for free use to state authorities and local governments, state and municipal institutions, state and municipal unitary enterprises, in cases where this obligation established by the legislation of the Russian Federation) (clause 3 of Article 256 of the Tax Code of the Russian Federation). The lender does not charge depreciation starting from the 1st day of the month following the month in which the fixed asset was transferred for free use (clause 2 of Article 322, clause 6 of Article 259.1 of the Tax Code of the Russian Federation).

The lender can resume the calculation of depreciation in the manner applied before the transfer of property for free use starting from the 1st day of the month following the month in which the fixed asset was returned by the borrower (clause 2 of Article 322, clause 7 of Article 259.1 Tax Code of the Russian Federation).

Accounting for preferential rent in “1C: Public Institution Accounting 8”

The receipt, in accordance with the agreement, of non-financial assets related to operating leases on preferential terms for free-term use is reflected by the institution (user) of non-financial assets in the corresponding analytical accounts of account 0 111 40 000 “Rights to use non-financial assets” and the credit of account 0 401 401 82 “Future income from the gratuitous right of use” in the amount of fair (market) value for the period of use of the transferred non-financial assets (clause 41.1 of the Instructions for the use of the Chart of Accounts for Budget Accounting, approved by order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n, clause 67.3 of the Instructions on the application of the Chart of Accounts for accounting of budgetary institutions, approved by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n).

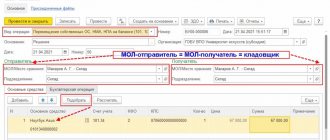

In the program “1C: Public Institution Accounting 8”, edition 1 and edition 2, this operation is reflected in the document Acceptance for accounting of rights to use OS, legal acts.

Depreciation on objects of registration of the right to use property received by an institution for free use related to operating leases is carried out in the amount of monthly lease payments and is reflected in accounting records (clause 19 of Instruction No. 162n, clause 26 of Instruction No. 174n):

Debit 0 401 20 224 “Expenses for depreciation of rights to use an asset” Credit to the corresponding analytical accounting accounts account 0 104 40 000 “Depreciation of rights to use an asset”.

At the same time, in the same amount, the accounting records reflect the assignment to the financial result of the current period of deferred income from obtaining the right to use the asset (under lease agreements on preferential terms):

Debit 0 401 40 182 “Future income from gratuitous right of use” Credit 0 401 10 182 “Income from gratuitous right of use”.

In the program “1C: Public Institution Accounting 8”, these operations are reflected in the document Accrual of depreciation of rights to use OS, legal acts.

Please note that from 01/01/2019, in accordance with the Procedure for applying the classification of operations of the general government sector (approved by order of the Ministry of Finance of Russia dated November 29, 2017 No. 209n, as amended by order of the Ministry of Finance of Russia dated November 30, 2018 No. 246n), the following KOSGU codes are used to reflect income from preferential rent :

- 182 “Income from the gratuitous right to use an asset provided by organizations (except for the public administration sector and public sector organizations)”;

- 185 “Income from the gratuitous right to use an asset provided by public sector organizations”;

- 186 “Income from the gratuitous right to use an asset provided by the general government sector”;

- 187 “Income from the gratuitous right to use an asset provided by other persons.”

Termination of the right to use an asset (subject to full execution of the contract) (disposal of an operating lease accounting object) is reflected in accounting entries in the corresponding analytical accounting accounts (clause 41.1 of Instruction No. 162n, clause 67.3 of Instruction No. 174n):

Debit 0 104 40 000 “Depreciation of rights to use assets” Credit 0 111 40 000 “Right to use non-financial assets”

- in the amount of the book value of the right to use the asset.

In the 1C: Public Institution Accounting 8 program, edition 1 and edition 2, this operation is reflected in the document Termination of rights to use OS, legal acts.

| 1C:ITS Budget For more information about the reflection in “1C: Accounting of a State Institution 8” of operations on preferential lease by the borrower, see the articles published in the methodological support for standard configurations of edition 1 and edition 2 of the BGU1 and BGU2 program. |

Free use from the borrower

Borrower under a loan agreement for gratuitous use of property:

- BU

- does not receive income (clause 2 of PBU 9/99); - NU

- recognizes non-operating income (clause 8 of Article 250 of the Tax Code of the Russian Federation).

Expenses associated with the execution of a loan agreement, including the maintenance of the received property, can be recognized for income tax purposes, provided that the expenses (Article 252 of the Tax Code of the Russian Federation):

- economically justified;

- documented.

The borrowing organization determines the amount of income based on market prices for the rental of similar property. The income assessment must be confirmed by documents or an independent examination.

The income assessment should not be lower (clause 8 of Article 250 of the Tax Code of the Russian Federation):

- residual value – for depreciable property;

- costs of acquisition or production - for other property.