Providing funds for use by full-time employees of an organization is one of the measures of social support.

Often, issuing money on loan terms is used by administrative resources as a tool to reduce the tax burden. In any case, the legislation does not establish monetary debt as the prerogative of credit institutions.

Here is an example of a loan agreement between an organization and an employee:

The contract specifies essential terms, such as the interest rate for use and the installment period. The requirements of such an agreement are always beneficial to existing employees.

The use of such a tool at an enterprise helps not only to attract new successful employees, but also to retain true masters of their craft who have financial difficulties.

The company is obliged to withhold personal income tax from the forgiven debt

When an organization forgives a debt to an employee, he has income from which personal income tax must be withheld (clause 1 of Article 210, clause 1 of Article 226 of the Tax Code of the Russian Federation, clause 1 of Article 223 of the Tax Code of the Russian Federation).

In letter dated 04/12/2019 No. 03-04-05/26432, the Russian Ministry of Finance recalled that when determining the personal income tax base, all income of the taxpayer received by him, both in cash and in kind, is taken into account.

If the debt forgiveness was formalized by a gift agreement, 4,000 rubles can be deducted from the amount of the forgiven debt as tax-free financial assistance, and personal income tax must be withheld from the remaining amount (letter of the Ministry of Finance dated April 12, 2019 No. 03-04-05/26432)

Previously on the topic:

Loan debt forgiveness: what about personal income tax?

Personal income tax (NDFL)

When an employee is gratuitously released from the obligation to repay the loan, he or she receives economic benefit (income) in the amount of the forgiven loan debt (Clause 1 of Article 41 of the Tax Code of the Russian Federation).

Such income is recognized as an object of taxation and is taken into account when determining the tax base for personal income tax (clause 1 of article 209, clause 1 of article 210 of the Tax Code of the Russian Federation).

Personal income tax is calculated at a tax rate of 13% (clause 1, article 224 of the Tax Code of the Russian Federation).

The cost of gifts received by an employee from an organization does not exceed 4,000 rubles. for the tax period, is exempt from personal income tax (Clause 28, Article 217 of the Tax Code of the Russian Federation).

Since the employee did not receive any other gifts from the organization in the current calendar year, the amount of gratuitously forgiven debt in excess of 4,000 rubles is subject to personal income tax.

An organization that has forgiven an employee a debt free of charge, as a tax agent, is obliged to calculate and withhold the calculated amount of personal income tax from the employee’s income when paying income and pay the amount of personal income tax to the budget (clauses 1, 2, 4 of Article 226 of the Tax Code of the Russian Federation).

Personal income tax is calculated on the date of actual receipt of income by the employee, determined in accordance with Art. 223 of the Tax Code of the Russian Federation (clause 3 of Article 226 of the Tax Code of the Russian Federation). This article does not establish special rules for determining the date of actual receipt of income in case of gratuitous debt forgiveness. Since the employee receives this income in non-monetary form, the date of its receipt is determined in accordance with paragraphs. 2 p. 1 art. 223 of the Tax Code of the Russian Federation as the day of entry into force of the gift agreement.

Withholding personal income tax when paying income in kind is made from any funds paid to the employee, for example, from the wages due to the employee. At the same time, the withheld amount of personal income tax cannot exceed 50% of the amount of income paid in cash (clause 4 of Article 226 of the Tax Code of the Russian Federation).

The transfer of the amount of calculated and withheld personal income tax is made no later than the day following the day of payment to the employee of the income from which personal income tax was withheld (clause 6 of Article 226 of the Tax Code of the Russian Federation).

We also note that in the case under consideration, the employee was issued an interest-free loan, under which the employee generates income in the form of material benefits from savings on interest for the use of borrowed funds (clause 1, clause 1, article 212 of the Tax Code of the Russian Federation).

The tax base for income in the form of material benefits on an interest-free loan is determined as the amount of interest calculated on the basis of 2/3 of the current refinancing rate established by the Bank of Russia on the date of actual receipt of the specified income (which follows from paragraph 1, paragraph 2, article 212 of the Tax Code of the Russian Federation ).

The date of actual receipt of income in the form of material benefits from savings on interest is determined as the last day of each month during the period for which the borrowed funds were provided (clause 7, clause 1, article 223 of the Tax Code of the Russian Federation). In this case, it does not matter how the loan obligation is repaid - in cash or otherwise (for example, as in this case, debt forgiveness).

The procedure for taxing personal income tax on income in the form of material benefits on an interest-free loan is discussed in detail in the consultation of M.S. Radkova.

In this consultation, records on the deduction of personal income tax from an employee’s income from material benefits from savings on loan interest are not provided.

Insurance premiums

Forgiveness of a debt arising from a loan agreement is not related to the employee’s performance of work duties, does not depend on the results of his work, is not an incentive or compensatory payment, and is not provided for by an employment (collective) agreement.

In this regard, the amount of the forgiven debt is not a payment made within the framework of the employment relationship, i.e. does not apply to payments provided for in paragraph 1 of Art. 420 Tax Code of the Russian Federation, clause 1, art. 20.1 of the Federal Law of July 24, 1998 N 125-FZ “On compulsory social insurance against accidents at work and occupational diseases” (hereinafter referred to as Law N 125-FZ). Accordingly, such payment is not subject to insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, as well as compulsory social insurance against industrial accidents and occupational diseases. The same conclusion (with regard to insurance premiums provided for in Chapter 34 of the Tax Code of the Russian Federation) can be drawn from Letter of the Federal Tax Service of Russia dated April 26, 2017 N BS-4-11/8019. This approach, in our opinion, can also be applied to insurance premiums provided for by Law N 125-FZ.

At the same time, this Letter explains that in cases where the issuance of loans to employees with subsequent debt forgiveness is of a systemic nature, the tax authorities may have a question about the validity of the tax benefit received by the payer of insurance premiums.

It should also be noted that in the case where debt forgiveness is formalized by a gift agreement in writing, the object is subject to insurance premiums provided for in Chapter. 34 of the Tax Code of the Russian Federation, does not arise on the basis of clause 4 of Art. 420 Tax Code of the Russian Federation.

For additional information on the issue of taxing the value of gifts to employees with these insurance contributions, see the Encyclopedia of Disputes on Personal Income Tax and Insurance Contributions.

Insurance premiums are not paid on forgiven debt

Insurance premiums for the amount of the debt forgiven to the employee are not charged, since contributions are paid only from the employee’s income received within the framework of an employment relationship or a civil contract. (Clause 1, 4 of Article 420 of the Tax Code and Clause 1 of Article 20.1 of the Law dated July 24, 1998 No. 125-FZ; letters of the Federal Tax Service dated May 30, 2018 No. BS-4-11/10449, dated April 26, 2017 No. BS-4- 11/8019).

Previously on the topic:

Not paying contributions from a forgiven debt to an employee? There are risks!

What should be contained in a loan agreement with an employee?

Receiving material benefits on the employer’s terms must be accompanied by conditions that are reflected in a special agreement:

- the form of the contract is only written, since the provision of money for use comes from the assets of the company (legal entity);

- the effective date of the document usually coincides with the day the employee actually receives the money;

- the amount of borrowed funds is established by agreement. Current legislation does not establish restrictions on the size of the loan. At the same time, for large loans, the employee should formalize the decision of the company’s participants. A meeting of founders will be appropriate if it is planned to transfer funds in the amount of more than a quarter of the enterprise’s assets;

- loan currency. Usually rubles. Only credit organizations have the right to issue borrowed funds in foreign currency equivalent;

- the amount of interest for the use of company funds. Often, employers provide interest-free loans to their employees. This condition is essential, therefore it is in the contract that the phrase “no interest is accrued” should be clearly formulated. Otherwise, the use of money will be subject to the provisions of the Civil Code (refinancing rate);

- The procedure and terms for repayment of the debt are established by agreement of the parties. In this case, the employee can either independently pay mandatory payments or receive wages minus monthly deductions. The terms of the agreement may provide for cases of establishing requirements for early repayment of debt.

The written form of a loan agreement with an employee can be arbitrary. At the same time, if the enterprise has a practice of issuing funds for temporary use, the type of contract agreed with the accounting department should be used.

You should not neglect to indicate the purpose of issuing money, since this will directly affect the tax regime under which the issued loan falls.

Cannot be written off as income tax expense

There is no need to write off the amount of forgiven debt as income tax expense.

Such expenses do not meet the criteria of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation. All expenses must be economically justified and documented.

Debt forgiveness should be considered as a gratuitous transfer of property. In paragraph 16 and paragraph 12 of Art. 270 of the Tax Code of the Russian Federation directly states that the cost of expenses associated with the gratuitous transfer of property does not reduce taxable profit.

There are situations when the lender may consider the forgiven debt to be an expense. But to do this, he needs to prove that there was a commercial interest and debt forgiveness was economically beneficial. (Resolution of the Presidium of the Supreme Arbitration Court dated July 15, 2010 No. 2833/10)

If the loan was issued with interest, under the cash method of accounting at the time the debt is forgiven, interest must be taken into account as income. Since with the cash method of tax accounting, income is not only the payment received, but also the repayment of debt in another way (clause 6 of Article 250, clause 2 of Article 273 of the Tax Code of the Russian Federation)

VAT does not arise in this situation. On cash loans, VAT is not charged at all.

Civil relations

Under a loan agreement, one party (the lender) transfers into the ownership of the other party (borrower) money or other things determined by generic characteristics, and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal number of other things received by him of the same kind and quality . The loan agreement is considered concluded from the moment of transfer of money or other things (clause 1 of Article 807 of the Civil Code of the Russian Federation).

The condition for providing a loan without paying interest for the use of borrowed funds must be fixed in the loan agreement (clauses 1, 3 of Article 809 of the Civil Code of the Russian Federation).

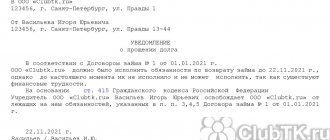

The debtor's obligation to repay the loan can be terminated by the creditor by forgiving the debt, if this does not violate the rights of other persons in relation to the creditor's property (clause 1 of Article 415 of the Civil Code of the Russian Federation). Note that gratuitous debt forgiveness is considered by the courts as a gift (Guide to Judicial Practice).

In this case, a gift agreement was concluded between the employee and the organization, providing for the gratuitous release of the employee from the obligation to the organization to repay the loan (Article 572 of the Civil Code of the Russian Federation). Since the donor is a legal entity and the value of the gift exceeds 3,000 rubles, the gift agreement is concluded in writing (clause 2 of Article 574 of the Civil Code of the Russian Federation). The gift agreement comes into force from the moment of its conclusion (signed by both parties) (clause 1 of article 425 of the Civil Code of the Russian Federation).

Nuances

Debt forgiveness can also be done orally. However, this does not guarantee debt forgiveness, since it is quite difficult to prove the absence of material obligations in practice. In addition, civil legislation provides for the mandatory conclusion of a written agreement on transactions if at least one of its participants is a legal entity.

It is possible that the enterprise’s employee also acts as a creditor under loan agreements, while the organization acts as a borrower. In this case, the citizen finances the company’s activities.

Find out how to take out a loan for maternity capital in the article: loan for maternity capital. Reviews of Alfa Loan Group can be found here.

Read about a loan from GlavFinance here.

Common mistakes

Error:

There was forgiveness of debt between individuals. The loan debt amounted to 3,500 rubles. The debtor paid personal income tax to the budget on the amount of economic benefit received.

A comment:

If the amount of debt is 4 thousand rubles or less, personal income tax is not paid. Also, no tax needs to be paid if the debt was forgiven as a gift.

Error:

When a debt was forgiven between individuals, no act of reconciliation of mutual settlements between the lender and the debtor was drawn up; the debt forgiveness was agreed upon orally, and the rights of third parties were infringed.

A comment:

In the event that there is no act of reconciliation of mutual settlements, there is no written agreement on debt forgiveness, there is no evidence of sending the debtor a notice of the desire to forgive him the debt, the rights of third parties related to the creditor’s property are infringed, or the reconciliation act contains contradictory provisions, the transaction debt forgiveness may be recognized as not concluded in court.

Debt forgiveness between individuals (peculiarities of drawing up a debt forgiveness agreement)

In order to officially forgive a debt to an individual, it is necessary to draw up an act of reconciliation of mutual settlements with the debtor, after which the terms of the transaction are recorded in writing:

- a clearly and precisely formulated desire of the lender to forgive the borrower’s debt;

- information about the debtor’s obligation existing at the time of debt forgiveness with reference to the loan agreement (if there is no information about the existence of a debt, the court has the right to recognize the debt forgiveness agreement as not concluded, see Resolution of the Federal Antimonopoly Service of the Eastern Military District dated September 10, 2009 in case No. A39-1176/2009 );

- amount of debt;

- conditions for debt forgiveness, if any.

For a debt forgiveness transaction to be considered concluded, it is necessary to conclude a separate agreement, an additional agreement to the concluded agreement, or a gift agreement.

You can familiarize yourself with a sample agreement on debt forgiveness for an individual by clicking on the following ⇒ link.

Debt forgiveness between individuals - basic provisions

When it comes to debt forgiveness between individuals, in most cases we mean the termination of obligations under a loan agreement. The possibility of forgiveness of a debt to a borrower is regulated by Article 415 of the Civil Code. According to the provisions of this article, the lender (creditor) has the right to cancel the borrower’s debt in full or in part.

The main thing is that the following conditions are met, otherwise debt forgiveness will not be considered valid:

- on the part of the debtor there should be no objections to the forgiveness of his debt (if the lender subsequently refuses to accept funds to pay the debt, the borrower can transfer the money to the court or a notary);

- the rights of third parties related to the creditor's property must not be infringed.

It is important to take into account some features of the debt forgiveness transaction - if due diligence is not exercised, the transaction will be qualified as the conclusion of a gift agreement.

To prevent this from happening, 3 conditions must be met:

- the creditor’s will to forgive the debt must be free of charge - see Art. 572 of the Civil Code of the Russian Federation (that is, the creditor should not present any additional requirements that will make debt forgiveness possible);

- the court must determine the fact that the creditor is going to relieve the borrower from the need to pay the debt as a gift - see paragraph 3 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 No. 104;

- the debt forgiveness agreement must indicate the lender’s lack of intention to benefit the borrower (for example, you can explain the expediency of debt forgiveness and write that such a concession will help continue cooperation with the borrower or recover at least part of the funds without filing a lawsuit).

How to apply for debt forgiveness between legal entities

Provisions of Art. 415 of the Civil Code of the Russian Federation gives the creditor the authority to forgive and write off debts in relation to debtors from among legal entities. The criterion for the legality of a transaction is the absence of facts of violation of the debtor’s rights. If the other party has objections to the forgiveness of debt amounts, it must notify the creditor of this.

Question: How to take into account income in the form of the amount of forgiven debt and interest under a loan agreement for income tax purposes? View answer

The date of debt forgiveness is the day the debtor receives from his creditor a written notification of the amnesty of specific obligations. Another option for documenting the transaction is drawing up a bilateral debt termination agreement. The agreement must include the following information:

- the amount of accumulated debt that is expected to be forgiven;

- details of the contractual documentation, in accordance with which financial obligations of a credit nature appeared on one party;

- primary documents confirming the occurrence of the debt;

- circumstances and conditions under which the debt will be considered written off.

NOTE! The agreement must be supported by all documents mentioned in its text (copies of agreements, initial forms).

For an agreement to have legal force, it must contain information about the creditor and debtor (names, details), the subject of the transaction, the amount to be repaid, the absence of objections from the parties, and the economic justification for the need for such a step. The last requirement is recommended to be taken into account in order to prevent the possibility of treating the transaction as a donation transaction.

How to reflect in the debtor's accounting the forgiveness of the debt to pay for purchased goods (works, services)?

An economic justification may include obtaining material benefits from debt forgiveness:

- the debtor undertakes to provide a discount on subsequent deliveries;

- the emergence of the possibility of concluding new promising cooperation agreements between the parties.

An agreement to forgive all or part of the debt may be part of a debt restructuring program developed by enterprises. This compromise option avoids transferring the debt to the bad category.

BY THE WAY , to minimize the risk of disputes with regulatory authorities, the forgiveness agreement recommends not writing off the entire amount of the existing debt, but only part of it.

In the text of the agreement, you can indicate that the transaction is not an act of donation; the debtor undertakes to repay the remaining part of the debt within a certain time frame. If there is evidence that debt collection will cause material losses for the creditor, they must be stated in the text of the agreement.

IMPORTANT! In an agreement on debt forgiveness, all wording must be extremely precise and clear in order to prevent the possibility of their interpretation in favor of the version of donation of assets, which is prohibited between legal entities under Art. 575 of the Civil Code of the Russian Federation.

An additional condition for recognizing a transaction as valid is the presence of a current reconciliation report between interested parties confirming the amount of debt. Algorithm of actions of the lender:

- drawing up a reconciliation report with the debtor;

- sending a notice to the debtor of the intention to forgive him all or part of the debt;

- waiting for objections from the other party;

- If there are no contradictions between the parties to the transaction, the procedure is documented: a forgiveness agreement or an additional agreement to the current supply or service agreement is drawn up.

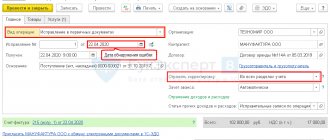

How to issue a loan to an employee: accounting

All transactions related to the provision of loans to employees must be accounted for on account 73 “Settlements with personnel for other operations”, subaccount 1 “Settlements on loans provided”. The postings will be as follows:

| Business transaction | D | TO |

| A loan was issued to an employee | 73.1 | 50 (51) |

| Interest accrued | 73.1 | 91.1 |

| The loan (part of the loan), interest on it or withheld from salary has been paid | 50 (51) | 73.1 |

| Personal income tax is withheld from the employee’s material benefit | 70 | 68.1 |

| The amount of the loan forgiven to the employee is written off as expenses | 91.2 | 73.1 |

When possible

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The most common situation is when an employee borrows money or goods from the company. The procedure for debt cancellation will be regulated in this case by the company’s internal rules.

For example, such a promotion may be announced in connection with certain events: payment of half of the debt by a citizen, a significant date in the activities of the enterprise - the anniversary of the formation of a holding company, etc. An employee also has the opportunity to forgive a debt if he has a difficult life situation or has been experiencing financial problems for a long time difficulties.

Credit institutions of any form do not write off debts to borrowers: banks, microfinance organizations, pawnshops, etc.

Debt forgiveness can also be applied to a citizen who is the founder of a company.

It is also possible to cancel debts owed by an enterprise in relation to an employee under contracts for the purchase of goods, works or services, assessed as the amount of the contract.

Debt forgiveness is also possible if the organization is declared insolvent – bankrupt. The procedure for canceling debt in this case is regulated by Law No. 127-FZ.

Elimination of debt is also possible by concluding a settlement agreement during the judicial review of the dispute. Again, the rules on forgiveness apply only in cases where such an action does not violate the rights of other creditors.