Accounting for income taxes on loans and credits is relevant for almost every organization. In accordance with the law, income tax should be reduced by interest paid under loan agreements. But if the company, on the contrary, issued a loan and thereby received a profit in the form of interest, the tax increases.

Features of calculating interest on a loan

Until 2015, an important rule was in force. There was a specially established amount of the “borrowed” interest received, which was to be included in expenses. Now everything has changed a little, and the following rules have come into force:

- There is no fixed amount of accrued interest when determining income tax. The exception is controlled transactions.

- Rationing is used in relation to those loans that, in accordance with the Tax Code of the Russian Federation, were recognized as controlled transactions.

Today, there are several principles for calculating and accounting for interest:

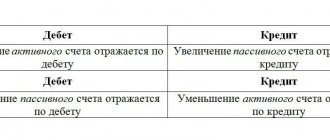

- Accounting, which requires that all interest rates be accounted for separately from the principal amount due.

- Summova. In this case, when calculating income tax, interest is reflected in the amount specified in the agreement. This will be the case unless the loan is recognized as a controlled transaction.

- Settlement. According to this principle, for all loans and credits there is a formula, which should be used to determine the amount of interest that can be included in expenses.

EXAMPLE No. 1.

In February 2015, the organization received a loan from the Russian founding bank in the amount of 6 billion rubles at a rate of 17% per annum. According to the terms of the loan agreement, the interest rate does not change throughout the entire term of the agreement.

Let's calculate the maximum amount of interest recognized for the purpose of calculating income tax for February 2015.

Since February 2, 2015, the key rate of the Central Bank of the Russian Federation is 15%.

Despite the fact that the key rate has been 14% since March 16, 2015, interest calculations take into account the key rate in effect on the date of receipt of loan funds. To recognize a transaction as controlled, the amount of accrued interest for 2015 must exceed 1 billion rubles (clause 2 of Article 105.14 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated August 16, 2013 No. 03-01-18/33535).

Then the upper limit of the interval rate is 180% of the key rate of the Central Bank of the Russian Federation (clause 1, clause 1.2, article 269 of the Tax Code of the Russian Federation):

15% x 1.8 = 27%.

Thus, the real loan rate is less than the maximum permissible rate, calculated based on the value of the interest rate interval.

Therefore, the organization fully recognizes the accrued interest in February 2015.

Controlled interest

The features of tax regulation by percentage include:

- Two-way action. It must be remembered that both the borrower's interest expenses and the lender's interest income are subject to rationing.

- Safe betting intervals. Any interest earned at such intervals must be fully tax included. Such intervals are indicated in clause 1.2 of Art. 269 of the Tax Code of the Russian Federation. Starting from 2022, all interest on ruble loans from controlled transactions is calculated the same way - at 75-125% of the Central Bank rate.

The interval rule has a number of features:

- If the rate is greater than the minimum of the interval, then interest income is calculated at the actual rate.

- If the rate is less than the maximum, then the expense is calculated at the actual rate.

- If the rate is outside the interval, pricing methods are applied.

Since 2022, there have been more cases where debt is considered manageable. The following have been added to all previously existing cases:

- If the company's share of participation is more than 25%.

- If the participation of a foreign company in the taxpayer goes through some other organizations, but provided that the share of participation in those organizations is more than 50%.

In order for interest on a loan to be recognized as uncontrollable, you must:

- Compare the loan amount with the organization’s own capital.

- Calculate maximum interest rates using the capitalization ratio.

- If there is no excess, then apply the actual rate.

Transactions are considered controlled in the following cases:

- If an interdependent person participated in the transaction and if the annual income from such transactions exceeded 1 billion rubles.

- If the transaction involved an interdependent person working under the simplified tax system and if the income exceeded 60 million rubles per year.

- If the interdependent person participating in the transaction works under the unified agricultural tax or under the UTII and the annual income was more than 100 million.

- Any transactions with offshore companies with an annual income of 60 million.

A transaction cannot be uncontrolled in the following cases:

- If both parties to the transaction are Russian companies (and not banks), guarantees were provided.

- If both parties to the transaction are registered or reside in the Russian Federation.

If, according to some parameters, it turns out that the transaction is controlled, the taxpayer is obliged to check the compliance of the applied market rate.

Features of expense recognition

According to the general rules, interest accrued on the basis of the actual rate, without restrictions, is recognized as expense (income) (paragraph 2, clause 1, article 269 of the Tax Code of the Russian Federation). However, in a number of cases, a special procedure has been established for the recognition of interest on debt obligations.

Special rules for controlled transactions

For controlled transactions, special rules are established for calculating interest taken into account for tax purposes.

Controlled transactions are transactions whose prices the tax authorities have the right to check for their compliance with market prices. Such transactions primarily include transactions between related parties. Interdependence between organizations is determined in accordance with the rules of Article 105.1 of the Tax Code of the Russian Federation, which establishes 11 grounds for recognizing persons as interdependent. For example, organizations are interdependent if one organization participates directly or indirectly in another organization and the share of such participation is more than 25 percent.

If the loan (credit) transaction is controlled, then interest is recognized as part of tax expenses (income) based on the actual rate, taking into account the provisions of Section. V.1 of the Tax Code of the Russian Federation on controlled transactions. That is, the market percentage is taken as a basis.

The provisions of paragraph 1.1 of Article 269 of the Tax Code of the Russian Federation require that the actual rate on a debt obligation be compared with the interval of maximum values (clause 1.2 of Article 269 of the Tax Code of the Russian Federation). Limit values are set depending on the currency in which the debt obligation is issued. The minimum and maximum values of the intervals are given in the table.

Table. Limit intervals for taxation of interest.

| Currency of the debt obligation | Minimum interval value | Maximum interval value |

| Ruble (from January 1 to December 31, 2015, if the transaction is recognized as controlled, under agreements concluded both before and after January 1, 2015) | 0% of the Bank of Russia key rate | 180% of the Bank of Russia key rate |

| Ruble (from January 1, 2016, if the transaction is not recognized as controlled) | 75% of the Bank of Russia key rate | 125% of the Bank of Russia key rate |

| Ruble (from January 1 to December 31, 2015, other transactions) | 75% of the Bank of Russia refinancing rate | 180% of the Bank of Russia key rate |

| Ruble (from January 1, 2016, other transactions) | 75% of the Bank of Russia key rate | 125% of the Bank of Russia key rate |

| Euro | EURIBOR rate + 4% | EURIBOR rate + 7% |

| Yuan | SHIBOR rate + 4% | SHIBOR rate + 7% |

| GBP | LIBOR rate + 4% | LIBOR rate + 7% |

| Swiss franc or Japanese yen | LIBOR rate + 2% | LIBOR rate + 5% |

| Other currencies | LIBOR rate in US dollars + 4% | LIBOR rate in US dollars + 7% |

If the actual rate “fits” into the designated interval (that is, for expenses it is below the maximum interval value, and for income - above the minimum), then the actually accrued interest is recognized as an expense (income).

Special rules for controlled debt

Debt is controllable if it arose (clause 2 of Article 269 of the Tax Code of the Russian Federation):

- before a foreign organization that owns (directly or indirectly) more than 20% of the authorized capital of a Russian organization;

- to a Russian organization that is an affiliate of this foreign organization (that is, a Russian organization can directly act as a creditor);

- under a debt obligation in respect of which a foreign organization or its affiliate acts as a guarantor, guarantor (that is, undertakes to ensure the fulfillment of the debt obligation).

In 2016, the outstanding debt of a Russian organization under a debt obligation is recognized as controlled:

- before a foreign organization that directly or indirectly owns more than 20% of the authorized (share) capital (fund) of a Russian organization;

- before a Russian organization recognized in accordance with the law as an affiliate of a foreign organization;

- in respect of which an affiliate or foreign organization acts as a surety or guarantor.

From 02/15/2016 to 12/31/2016, debt is not recognized as controlled for a Russian organization if the following conditions are simultaneously met (Article 2 of Federal Law No. 25-FZ dated 02.15.2016, hereinafter referred to as Law No. 25-FZ):

- the debt obligation did not arise to an interdependent bank;

- from the moment the debt obligation arose, the obligation was not terminated (fulfilled) by the above-mentioned guarantors (guarantors).

From January 1, 2017, the criteria for recognizing debt as controlled will change in accordance with Law No. 25-FZ.

Interest accrued on the amount of outstanding controlled debt is standardized. But, before calculating the maximum interest rate, we note that one more condition must be met: the amount of controlled debt to a foreign organization is more than 3 times (for banks, as well as organizations engaged in leasing activities - more than 12.5 times) must exceed the difference between the amount of assets and the amount of liabilities of the borrowing organization.

If the controlled debt, not repaid at the end of the reporting period, exceeds the specified limit, then the maximum percentage is calculated taking into account the capitalization ratio (clause 2 of Article 269 of the Tax Code of the Russian Federation). We are talking about the rule of “thin” capitalization. Its essence is that on the last day of each reporting period, the taxpayer determines the maximum amount of interest accrued on debt obligations and recognized as an expense. To do this, the amount of interest accrued for the reporting period must be divided by the capitalization ratio calculated as of the last reporting date of the reporting period in question. Moreover, from 01/01/2017, in the event of a change in the capitalization ratio in the next reporting period or at the end of the tax period compared to previous reporting periods, the maximum amount of expenses in the form of interest in these periods is not recalculated.

The capitalization ratio is determined by dividing the amount of outstanding controlled debt by the amount of equity capital corresponding to the share of direct or indirect participation of this foreign organization in the authorized (share) capital (fund) of the Russian organization, and dividing the result by three (for banks and organizations engaged in leasing activities , - at twelve and a half).

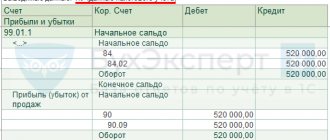

The amount of equity capital is determined according to accounting data as of the last day of the reporting period as the difference between the company's assets and the amount of its liabilities. The calculation does not take into account the amount of debt for taxes, fees, and insurance contributions to extra-budgetary funds.

After calculations of the maximum interest rate have been carried out, the amount of accrued interest not exceeding this indicator can be taken into account in expenses. The amount exceeding the limit must be attributed to dividends paid to a third party. They will be subject to income tax in accordance with paragraph 3 of Article 284 of the Tax Code of the Russian Federation (Clause 4 of Article 269 of the Tax Code of the Russian Federation).

Rationing of interest

If a company received a loan from its employee or any other individual, then the interest rates must be specified in the agreement. They are payment for the use of the borrowed amount. In such cases, companies can include all interest in tax amounts, there are no restrictions on this for uncontrolled transactions.

At the same time, the borrower is required to charge and withhold income tax. The borrower must transfer all interest to the lender minus personal income tax. The borrower makes payments to the budget within the time limits specified in the Tax Code. The borrower must indicate all interest income and taxes paid on it in reports and in the tax register.

If it is agreed that an individual will receive interest not in money, then personal income tax will be charged on all income paid by the borrowing company. If the borrower has no way to withhold personal income tax, then he must notify the tax authority and his lender about this.

If a loan was taken out to purchase an investment asset, then all interest on the loan is included in the item non-operating expenses. There is no difference whether it is a regular asset or an investment one. The price of an investment asset tends to increase by the amount of interest (but provided that borrowed funds were used to create the asset).

Important! If borrowed funds were used to pay dividends, interest may also be included as an expense.

EXAMPLE No. 2.

Let's change the condition of the previous example. Let's assume that funds were raised at a rate of 28% per annum.

The upper limit of the interval rate is 180% of the key rate of the Central Bank of the Russian Federation (clause 1, clause 1.2, article 269 of the Tax Code of the Russian Federation):

15% x 1.8 = 27%.

Thus, the real loan rate is higher (by 1%) than the maximum permissible rate, calculated based on the value of the interest rate interval.

Since the conditions provided for by the special norm (clause 1.1 of Article 269 of the Tax Code of the Russian Federation) are not met, we turn to the rules of paragraph 3 of clause 1 of Article 269 of the Tax Code of the Russian Federation. That is, the determination of interest recognized for profit tax purposes should be carried out taking into account the provisions of Section V.1 of the Tax Code of the Russian Federation.

In this situation, the taxpayer must apply the transfer pricing rules. That is, it is necessary to prove that the established interest rate under the loan agreement is the market one.

For this purpose, the organization must apply one of the five methods prescribed in clause 1 of Article 105.7 of the Tax Code of the Russian Federation. In this case, the priority for checking the compliance of the prices established in the contract with market prices is the method of comparable market prices (clause 3 of Article 105.7 of the Tax Code of the Russian Federation).

Let’s assume that the organization’s loan portfolio contains transactions with other lenders on comparable terms, the interest rate for which ranges from 20% to 29%.

In this case, the organization recognizes accrued interest in full in February 2015.

"Natural" interest

Interest can be paid not only in monetary terms. The loan can be issued in kind and any material assets can be used for payments - goods, products, etc. Even if such a loan has been issued, the agreement must still indicate the method of payment of interest. The terms for paying interest rates for a loan in kind are the same as for conventional loans.

Calculation of interest to the lender using the simplified tax system

If an individual who is a founder wants to take out an interest-bearing loan from a company operating under the simplified tax system, then the following rules apply:

- The agreement specifies the rules for paying interest. If there are no interest conditions, then the borrower undertakes to pay them every month until the debt is paid in full.

- It is very convenient for everyone working under the simplified tax system to pay the entire amount of interest. This is because all interest income must be recorded for the tax authority. This is done on the date when they actually arrive at the company’s cash desk or into its current account. For accounting, this does not play an important role, since in accounting the accrual of interest along with income should be displayed every month.

- Personal income tax is also paid on the material benefit from savings on interest. This only applies to cases where the contract rate is less than 2/3 of the Central Bank refinancing rate. Such calculations must be performed on the last day of the month throughout the entire period of use of borrowed funds.

How to reflect interest on a loan issued in tax accounting

BASIS: Income tax

When taxing profits, include interest received from the borrower as non-operating income (clause 6 of Article 250 of the Tax Code of the Russian Federation).

If an interest-free loan is provided, and the borrower and the lender are interdependent persons, the lending organization must also take into account unearned income in the form of interest when calculating income tax.

If the organization uses the cash method, reflect the income on the day the interest is actually received (clause 2 of Article 273 of the Tax Code of the Russian Federation).

If an organization uses the accrual method, the tax base must be increased on the day interest is calculated under the terms of the agreement. In this case, the following conditions must be met:

— if under the agreement the borrower pays interest for more than one reporting (tax) period, accrue it on the last day of each month of the reporting (tax) period for the entire duration of the agreement;

— if the fulfillment of an obligation under a contract depends on the value (or other value) of the underlying asset, and during the period of validity of the contract interest is accrued at a fixed rate, then pay attention to the following feature. Interest at a fixed rate is calculated on the last day of each month of the reporting (tax) period, and interest actually received based on the current value (other value) of the underlying asset - on the date of fulfillment of the obligation;

— if the loan agreement is terminated during a calendar month, interest must be accrued and included in income on the last day of the agreement.

This procedure is established by paragraph 6 of Article 271 and paragraph 4 of Article 328 of the Tax Code of the Russian Federation.

An example of calculating income tax on interest on a loan issued

On June 22, 2014, Alfa CJSC issued manager A.S. Kondratiev received a loan in the amount of 36,600 rubles. at 7 percent per annum. The loan and interest repayment period is August 6, 2014. The amount of interest on the loan is 316 rubles. (RUB 36,600 × 7%: 365 days × 45 days). The organization calculates income tax quarterly and uses the accrual method.

The contract period covers two reporting periods. Therefore, the Alpha accountant calculated the amount of interest for June 2014 separately: RUB 36,600. × 7%: 365 days. × 8 days = 56 rub.

This amount is taken into account when calculating income tax for the first half of 2014. When calculating income tax for nine months, the tax base will increase by the amount of interest accrued for July and August 2014.

For July: RUB 36,600. × 7%: 365 days. × 31 days = 218 rub.

For August: RUB 36,600. × 7%: 365 days. × 6 days = 42 rub.

Situation: how to take into account interest on a loan issued for more than one reporting period when calculating income tax (accrual method)? The contract was terminated early, and therefore the interest rate is reduced

When calculating income tax, interest received from the borrower is taken into account as part of non-operating income (clause 6 of Article 250 of the Tax Code of the Russian Federation). If an organization uses the accrual method, the tax base must be increased on the day interest is calculated in accordance with the terms of the agreement.

Moreover, if the terms of the agreement stipulate that the borrower pays interest for more than one reporting period, then they should be accrued monthly throughout the entire term of the agreement at the rate in effect at the end of each month. Accrued interest increases the tax base of the reporting period to which it actually relates. This follows from the totality of the provisions of paragraph 6 of Article 271 and paragraph 4 of Article 328 of the Tax Code of the Russian Federation.

During the term of the agreement, the specified procedure for accounting for interest does not change even if the parties to the transaction provide for the possibility of changing the interest rate. For example, its reduction upon early repayment of a debt obligation. This is confirmed by the Russian Ministry of Finance in letter dated June 23, 2010 No. 03-03-06/1/426.

However, upon the occurrence of such a circumstance, that is, at the time of termination of the contract (debt repayment), the organization has the right to recalculate the interest accrued for the entire period of the contract at a new rate (clause 6 of Article 271, clause 4 of Article 328 of the Tax Code of the Russian Federation). Since the interest rate has decreased, an excessively accrued amount of interest is formed in the tax accounting of the organization, which led to an excessive payment of income tax. This amount can be taken into account as part of non-operating expenses on the date of termination of the contract (clause 1, article 54, subclause 20, clause 1, subclause 1, clause 2, article 265 of the Tax Code of the Russian Federation).

The organization does not have any obligation to adjust the tax base by filing updated income tax returns for previous reporting periods.

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated September 25, 2009 No. 03-03-06/2/179.

For loans in kind (commodity loans), interest can be set both in cash and in kind. When calculating income tax, determine the amount of interest in kind based on the contract value of the transferred property or its market price, if it differs from the contract price (clause 5 of Article 274 of the Tax Code of the Russian Federation).

VAT

When issuing a loan in cash for the amount of interest on it, there is no need to charge VAT (subclause 15, clause 3, article 149 of the Tax Code of the Russian Federation). The organization that issued the cash loan is also not obliged to issue invoices for the amount of accrued interest (subclause 1, clause 3, article 169 of the Tax Code of the Russian Federation).

Interest (both in cash and in kind) received from the borrower for using a trade loan is subject to VAT. Calculate this tax as follows:

VAT = (Interest received from the borrower - Interest calculated based on the refinancing rate in force during the period for which interest is calculated) × 18/118 or 10/110 (depending on the type of property)

Calculate the tax only after actually receiving the interest.

This procedure follows from subparagraph 3 of paragraph 1 of Article 162 and paragraph 4 of Article 164 of the Tax Code of the Russian Federation.

For the amount of interest subject to VAT, draw up an invoice in a single copy and register it in the sales book (clause 18 of section II of Appendix 5 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

An example of calculating VAT on interest on a loan in kind issued to an employee. Interest received in cash

On January 11, 2014, Alfa CJSC issued manager A.S. Commodity loan to Kondratiev. The subject of the contract is 1000 kg of lime worth 118,000 rubles. (including VAT - 18,000 rubles), return period - January 26, 2014. According to the terms of the agreement, the borrower must pay Alpha an amount of 10 percent per annum for using the loan. The Alpha accountant reflected the accrual of interest under the loan agreement as follows.

In January: Debit 73-1 Credit 91-1 – 485 rubles. (RUB 118,000 × 10%: 365 days × 15 days) – interest accrued on the loan for January; Debit 51 Credit 73-1 – 485 rub. – interest received on the loan for January.

The amount of interest received, to the extent that it exceeds the refinancing rate, is included in the VAT tax base. The refinancing rate effective in January 2014 is 8.25 percent. The amount of interest calculated at this rate is: 118,000 rubles. × 8.25%: 365 days. × 15 days = 400 rub.

The amount of interest exceeding the interest calculated based on the refinancing rate was: 485 rubles. – 400 rub. = 85 rub.

The accountant calculated VAT on the amount of interest exceeding the refinancing rate as follows: 85 rubles. × 18/118 = 13 rubles;

Debit 91-2 Credit 68 subaccount “Calculations for VAT” – 13 rubles. – VAT is charged on the amount of income exceeding the interest calculated at the refinancing rate.

Invoice for the amount of 85 rubles. (including VAT - 13 rubles), issued in one copy, was registered by the accountant in the sales book.

An example of calculating VAT on interest on a loan in kind issued to an organization. Interest received in cash

On January 11, 2014, CJSC Alpha issued a loan in kind to OJSC Proizvodstvennaya (VAT payer). The subject of the contract is 12,000 sheets of galvanized iron in the amount of 600,000 rubles. (including VAT - 91,525 rubles), return period - until January 26, 2014. According to the terms of the agreement, the borrower must pay Alfa an amount of 14 percent per annum for using the loan. The Alpha accountant reflected the accrual of interest under the loan agreement as follows.

In January: Debit 76 Credit 91-1 – 3452 rubles. (RUB 600,000 × 14%: 365 days × 15 days) – interest accrued on the loan for January; Debit 51 Credit 76 – 3452 rub. – interest received on the loan for January.

The amount of interest received, to the extent that it exceeds the refinancing rate, is included in the VAT tax base. The refinancing rate effective in January 2014 is 8.25 percent. The amount of interest calculated at the refinancing rate is equal to: 600,000 rubles. × 8.25%: 365 days. × 15 days = 2034 rub.

The amount of interest exceeding the interest calculated based on the refinancing rate was: RUB 3,452. – 2034 rub. = 1418 rub.

VAT on the difference between the amount of interest calculated based on the interest rate and the amount of interest calculated based on the refinancing rate amounted to: 1,418 rubles. × 18/118 = 216 rubles;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 216 rubles. – VAT is charged on the amount of income exceeding the interest calculated at the refinancing rate.

Invoice for the amount of 1418 rubles. (including VAT - 216 rubles), issued in one copy, the accountant registered in the sales book.

An example of calculating VAT on interest on a loan in kind issued to an employee. Interest received in kind

ZAO Alfa issued manager A.S. Commodity loan to Kondratiev. On January 11, 2014, the borrower was given 500 sheets of galvanized iron in the amount of RUB 29,500. The cost of one sheet is 59 rubles/sheet (the same as the book value).

Interest for using trade credit is set in kind (50 sheets of galvanized iron of the same quality). According to the terms of the agreement, Kondratiev is obliged to pay interest when repaying the principal debt. On January 26, 2014, the debt to the organization was repaid along with interest. The Alpha accountant reflected the accrual of interest under the trade loan agreement as follows:

Debit 73-1 Credit 91-1 – 2950 rub. (59 rubles/sheet × 50 sheets) – interest accrued under the trade credit agreement; Debit 10 Credit 73-1 – 2950 rub. – materials were received as payment for using trade credit.

The amount of interest received, to the extent that it exceeds the refinancing rate, is included in the VAT tax base. The refinancing rate effective in January 2014 is 8.25 percent. The amount of interest calculated at the refinancing rate is: RUB 29,500. × 8.25%: 365 days. × 15 days = 100 rub.

The amount of interest exceeding the interest calculated based on the refinancing rate was: 2950 rubles. – 100 rub. = 2850 rub.

The accountant calculated VAT on the difference between the amount of interest accrued based on the terms of the agreement and the amount of interest accrued based on the refinancing rate as follows: 2850 rubles. × 18/118 = 435 rubles;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 435 rubles. – VAT is charged on the amount of income exceeding the interest calculated at the refinancing rate.

Invoice for 2850 rub. (including VAT - 435 rubles), issued in one copy, was registered by the accountant in the sales book.

An example of calculating VAT on interest on a loan in kind issued to an organization. Interest received in kind

CJSC Alpha issued a loan in kind to OJSC Manufacturing Company Master. On January 11, 2014, the borrower was given 500 sheets of galvanized iron in the amount of RUB 29,500. (including VAT - 4500 rubles). The cost of one sheet without VAT is 50 rubles/sheet, with VAT – 59 rubles/sheet.

Interest for using trade credit is set in kind (50 sheets of galvanized iron of the same quality). Under the terms of the agreement, the “Master” undertakes to pay interest upon repayment of the principal debt. On January 26, 2014, the debt to the organization was repaid along with interest. The Alpha accountant reflected the accrual of interest under the trade loan agreement as follows:

Debit 76 Credit 91-1 – 2950 rub. (59 rubles/sheet × 50 sheets) – interest accrued under the loan agreement; Debit 10 Credit 76 – 2500 rub. (50 rubles/sheet × 50 sheets) – materials were received as payment for using the loan; Debit 19 Credit 76 – 450 rub. (2950 rubles - 2500 rubles) - reflects the “input” VAT on the cost of materials received in payment of interest for using the loan.

The amount of interest received, to the extent that it exceeds the refinancing rate, is included in the VAT tax base. The refinancing rate effective in January 2014 is 8.25 percent. The amount of interest calculated at the refinancing rate is: RUB 29,500. × 8.25%: 365 days. × 15 days = 100 rub.

The amount of interest exceeding the interest calculated based on the refinancing rate was: 2950 rubles. – 100 rub. = 2850 rub.

The accountant calculated VAT on the difference between the amount of interest accrued based on the terms of the agreement and the amount of interest accrued based on the refinancing rate as follows: 2850 rubles. × 18/118 = 435 rubles;

Debit 91-2 Credit 68 subaccount “VAT calculations” – 435 rubles. – VAT is charged on the amount of income exceeding the interest calculated at the refinancing rate.

Invoice for 2850 rub. (including VAT - 435 rubles), issued in one copy, was registered by the accountant in the sales book.

Situation: how to take into account when calculating the income tax VAT, which was charged on the difference between the interest calculated based on the terms of the agreement and the refinancing rate?

The amount of VAT accrued on the difference between the interest calculated under the agreement and the refinancing rate can be taken into account in reducing taxable profit.

The organization has the right to take into account as other expenses the amounts of taxes accrued as required by law (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation). An exception is the mandatory payments listed in Article 270 of the Tax Code of the Russian Federation.

Clause 19 of Article 270 of the Tax Code of the Russian Federation establishes that when calculating income tax, taxes imposed on the buyer (acquirer) of goods (work, services, property rights) are not taken into account. However, the accrual of interest under a loan agreement is not related to the purchase of goods (work, services, property rights). Consequently, the provisions of paragraph 19 of Article 270 of the Tax Code of the Russian Federation do not apply to relations under a loan agreement (accrual of interest under a loan agreement).

Since the Tax Code of the Russian Federation does not contain any other restrictions, the amount of VAT accrued on the difference between the interest calculated under the agreement and the refinancing rate can be taken into account in reducing taxable profit (subclause 1, clause 1, article 264, clause 1, article 252 Tax Code of the Russian Federation). When applying the accrual method, do this immediately after VAT is accrued to the budget (subclause 1, clause 7, article 272 of the Tax Code of the Russian Federation). When using the cash method - after paying tax (subclause 3, clause 3, article 273 of the Tax Code of the Russian Federation).

However, it is possible that following this point of view may lead to conflict with inspectors. Arbitration practice on this issue has not developed.

If an organization decides not to take into account the accrued tax in reducing taxable profit, a permanent difference and a corresponding permanent tax liability will arise in accounting (clauses 4, 7 of PBU 18/02). Reflect its accrual by posting:

Debit 99 subaccount “Permanent tax liabilities” Credit 68 subaccount “Calculations for income tax” - reflects the permanent tax liability.

simplified tax system

Regardless of the object of taxation, when calculating the single tax, include interest on the loan agreement as part of income (paragraph 3, paragraph 1, article 346.15 of the Tax Code of the Russian Federation). Do this only after the interest has actually been received from the borrower (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

An example of calculating a single tax when simplifying interest on a loan issued

On June 22, 2014, Alfa CJSC issued manager A.S. Kondratiev received a loan in the amount of 40,000 rubles. at 7 percent per annum. The loan and interest repayment period is August 6, 2014. The amount of interest on the loan is 345 rubles. (RUB 40,000 × 7%: 365 days × 45 days). According to the terms of the agreement, interest is paid along with the repayment of the principal debt. The following entries were made in Alpha's accounting:

June 22: Debit 73-1 Credit 50 - 40,000 rubles. - a loan was issued. Debit 73-1 Credit 91-1 – 61 rub. (RUB 40,000 × 7%: 365 days × 8 days) – interest accrued for June.

July 31: Debit 73-1 Credit 91-1 – 238 rubles. (RUB 40,000 × 7%: 365 days × 31 days) – interest accrued for July.

August 6: Debit 73-1 Credit 91-1 – 46 rubles. (RUB 40,000 × 7%: 365 days × 6 days) – interest accrued for August; Debit 50 Credit 73-1 – 40,000 rub. – the loan is returned; Debit 50 Credit 73-1 – 345 rub. – interest received.

The Alpha accountant reflected the amount of interest paid in the book of income and expenses for nine months.

UTII

The object of UTII taxation is imputed income (clause 1 of Article 346.29 of the Tax Code of the Russian Federation). Therefore, neither the money (property) issued to the borrower nor the interest received on the loan will affect the tax base for UTII.

Situation: is it necessary to charge income tax on the amount of interest on a loan issued if the organization is transferred to pay UTII?

Answer: yes, it is necessary.

Operations related to the provision of loans go beyond the scope of activities with which an organization can pay UTII (clause 2 of Article 346.26 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 14, 2008 No. 03-11-05/122). Accounting for income and expenses for such operations must be kept separately (Clause 7, Article 346.26 of the Tax Code of the Russian Federation). Include interest on the loan received from the borrower in non-operating income. The amount of this income must be taken into account when calculating income tax (clause 6 of Article 250 of the Tax Code of the Russian Federation).

OSNO and UTII

Transactions related to the provision of loans (including the receipt of interest) are taken into account according to the rules of the general taxation system. Since they do not relate to the types of activities for which UTII is applied (clause 2 of Article 346.26 of the Tax Code of the Russian Federation).

Personal income tax and insurance premiums

Regardless of what taxation system the organization that issued the loan uses, it may have responsibilities as a tax agent for personal income tax (clause 1 of Article 226 of the Tax Code of the Russian Federation). The fact is that when issuing a loan to an employee (or other citizen), the latter may receive a material benefit in the following cases:

— providing him with an interest-free loan; — providing a loan at interest if the interest rate is lower than the refinancing rate.

This is stated in subparagraph 1 of paragraph 1 of Article 212 of the Tax Code of the Russian Federation.

From the amount of material benefit received by the borrower (citizen) from saving on interest, personal income tax must be calculated (clause 1 of Article 210 of the Tax Code of the Russian Federation).

The amount of material benefit does not need to be accrued:

— contributions for compulsory pension (social, medical) insurance (part 1 of article 1, part 1 of article 7 of the Law of July 24, 2009 No. 212-FZ);

— contributions for accident insurance (clause 1 of article 20.1 of the Law of July 24, 1998 No. 125-FZ, letter of the Federal Insurance Service of Russia dated August 14, 2001 No. 02-10/05-5360).

Tax obligations when providing a loan

Any loan agreement is an agreement between the parties that the borrower is provided with money or any valuable property, and he undertakes to repay the debt on time. When concluding such agreements without interest charges, the following tax obligations arise:

- VAT. Here, the form in which the loan was issued is of great importance. There is no need to pay VAT if the loan was issued in cash. This is due to the fact that in this case there is no transfer of ownership. You don't even need to create an invoice here. If the loan was provided in the form of an item, then VAT exemption is not provided. The lender must send the client an invoice with allocated VAT within 5 days from the moment of transfer of things. Thus, it turns out that when issuing a loan not in cash, VAT is calculated already at the time of transfer of property.

- Income tax. Any property transferred under a loan agreement cannot be included as an expense when taxing profits.

- Insurance premiums. There are no insurance premiums for loans. This equally applies to pension, medical and social insurance contributions, as well as those that are listed as contributions for injuries.

Interest-bearing loans have the following differences:

- They are not subject to VAT.

- Interest on the loan goes to the item “non-operating income”.

- Personal income tax is paid if an individual receives benefits by saving on interest.

- Insurance premiums are not paid in this case either.

Registration

If the controlled debt, not repaid at the end of the reporting period, exceeds more than three (12.5 for banks and leasing organizations) times the amount of equity capital, then the maximum percentage is calculated taking into account the capitalization ratio (clause 3 of Article 269 of the Tax Code of the Russian Federation ).

We are talking about the rule of “thin” capitalization. Its essence is that on the last day of each reporting period, the taxpayer determines the maximum amount of interest accrued on debt obligations and recognized as an expense. To do this, the amount of interest accrued for the reporting period must be divided by the capitalization ratio calculated as of the last reporting date of the reporting period under review (from January 1, 2022, in the event of a change in the capitalization ratio in the next reporting period or based on the results of the tax period compared to previous reporting periods, the maximum the amount of interest taken into account in expenses in these periods is not recalculated):

PP = PF / KK

,

Where

PP

– the maximum amount of interest recognized as an expense;

PF

– actual accrued amount of interest;

QC

– capitalization ratio.

The capitalization ratio is determined by dividing the amount of outstanding controlled debt by the amount of equity capital corresponding to the share of direct or indirect participation of this foreign organization in the authorized (share) capital (fund) of the Russian organization, and dividing the result by three (for banks and organizations engaged in leasing activities , - at twelve and a half):

CC = (ZN / Ski) / 3 (12.5) = (ZN / (SK x D)) / 3 (12.5)

.

Where is ZN

– the amount of outstanding controlled debt;

Ski

– the amount of equity capital corresponding to the share of direct or indirect participation of a foreign organization in the authorized (share) capital (fund) of a Russian organization;

SK

– the amount of equity capital of the Russian company;

D

– the share of participation of a foreign company in the authorized (share) capital (fund) of a Russian company.

The amount of equity capital is determined according to accounting data as of the last day of the reporting period as the difference between the company's assets and the amount of its liabilities. The calculation does not take into account the amount of debt for taxes, fees, and insurance contributions to extra-budgetary funds.

After calculations of the maximum interest rate have been carried out, the amount of accrued interest not exceeding this indicator can be taken into account in expenses.

Federal Law No. 374-FZ of November 23, 2022 amended the procedure for determining the maximum amount of interest on foreign currency debts incurred before January 1, 2022 (clause 3 of Article 8 of Law No. 374-FZ).

Thus, for the period from January 1, 2022 to December 31, 2022, when calculating the maximum interest rate on such foreign currency debts, it is necessary to recalculate foreign currency controlled debt at the Central Bank exchange rate as of the last reporting date, but not higher than the Central Bank exchange rate as of February 28, 2020. The ruble exchange rate on this date was 71.6458 rubles/euro and 65.6097 rubles/dollars. USA.

Equity must be determined without taking into account exchange rate differences arising from the revaluation of claims (liabilities) expressed in foreign currency in connection with changes in the Central Bank exchange rate from February 28, 2020 to the last date of the reporting (tax) period for which the capitalization ratio is determined.

The amount exceeding the limit must be attributed to dividends paid to a third party. They will be subject to income tax in accordance with paragraph 3 of Article 284 of the Tax Code or personal income tax in accordance with paragraph 3 of Article 224 of the Tax Code (clause 6 of Article 269 of the Tax Code of the Russian Federation).

Let us remind you:

The following tax rates are applied to the tax base determined on income received in the form of dividends:

1) 0 percent - for income received by Russian organizations in the form of dividends, provided that on the day the decision to pay dividends is made, the organization receiving dividends continuously owns at least 50 percent of the contribution (shares) for at least 365 calendar days. in the authorized (share) capital (fund) of the organization paying dividends or depositary receipts giving the right to receive dividends in an amount corresponding to at least 50 percent of the total amount of dividends paid by the organization.

If the organization paying dividends is foreign, a zero tax rate is applied to organizations whose state of permanent location is not included in the list of states and territories approved by the Ministry of Finance of the Russian Federation that provide preferential tax treatment and (or) do not provide for the disclosure and provision of information when conducting financial transactions. operations (offshore zones);

2) 13 percent - on income received in the form of dividends from Russian and foreign organizations by Russian organizations, not taxed at a rate of 0 percent, as well as on income in the form of dividends received on shares, the rights to which are certified by depository receipts;

3) 15 percent - on income received by a foreign organization in the form of dividends on shares of Russian organizations, as well as dividends from participation in the capital of an organization in another form.

Let's look at an example.