Distribution costs for trading enterprises are those expenses that cannot be avoided when delivering goods to the buyer. This material will help you learn how distribution costs are accounted for and why and how they are calculated.

Accounting for such costs is based on the postulates of PBU 10/99, which contains only general requirements. Trade organizations often have to resolve complex issues arising from industry specifics on their own. These features will be discussed below.

The importance of distribution costs for trade organizations

Correct accounting of IOs is important, since their participation in the formation of financial results is almost decisive:

- ISO is one of the main indicators of the final functioning of the company;

- the amount of costs directly affects the amount of income received by the company from the sale of goods. Therefore, their optimization is a serious factor in increasing profitability and profitability.

- ISO level is the main guideline for determining the trade markup (its minimum value);

The extent to which a company can compete with companies operating in the same field depends on the ISO and its level.

Types of distribution costs in trade

Systematization of art involves organizing them according to common features:

| Classification criterion | Kinds | Examples |

| ∑ turnover | – conditional variables | ISO related to the preservation of goods, their packaging, sorting |

| – conditionally constant | Shock absorption; Money spent on rent | |

| – mixed | Employee salaries, other expenses | |

| Compound | – complex | Packaging and packaging costs, compliance with storage conditions |

| – single-element | Advertising spending | |

| Place of appearance | – internal | Personnel training and professional development; salary |

| – external | Transportation losses | |

| How are costs treated? | – straight | Transportation cost; costs of packaging product units, proper storage |

| – indirect | Amounts for management personnel, advertising expenses | |

| Economic nature | – clean | Relates to cash flow; advertising |

| – additional | Expenses for unplanned repairs; additional packaging | |

| Accounting in the company | – obvious | Depreciation of fixed assets; salary |

| – implicit | Opportunities missed, for example, income that could have been received | |

| Frequency of occurrence | – current | Salary; main content funds, inventory |

| – one-time | Payment for one-time work | |

| – other | Shipping costs | |

| Controllability level | managed (discretionary) | The amount of costs is set freely, depending on the position of the company |

| Unmanaged (non-discretionary) | Taxes, fees |

Analysis of the main distribution costs in trade and ways to reduce them

Distribution costs are one of the most important qualitative indicators of the economic activity of trading enterprises.

Distribution costs are the costs of living and embodied labor, expressed in monetary terms, associated with the process of moving goods from places of production to consumers. These include costs for remuneration of sales workers, transportation, preparation and storage of goods, etc.

Reducing distribution costs is a significant reserve for saving money at an enterprise and is achieved by improving the organization of trade, increasing the productivity of sales workers and expanding new, most progressive forms of trade.

To characterize distribution costs, two main indicators are used—the absolute size of distribution costs and their level as a percentage of turnover. The absolute size shows the total amount of costs associated with the circulation of goods, and the level of distribution costs shows the ratio of the total amount of costs to the volume of turnover.

The objectives of distribution cost analysis are:

- establishing the dynamics and degree of implementation of the plan for distribution costs;

- identification of unused reserves;

- exploring ways to further reduce costs;

- determination of the causes and factors that influenced the level and composition of distribution costs.

Analysis of distribution costs is carried out in the context of individual items based on business plan and accounting data.

Analysis of the general level of distribution costs

The analysis of distribution costs in practice usually begins with a comparison of the actual amount and level of costs of the reporting year with the corresponding indicators of the previous year. Accounting data is used to analyze the dynamics of distribution costs.

A number of factors influence the amount and level of distribution costs. Some of them are related to the characteristics of certain types of costs, others affect many cost items. These include:

- changes in the volume and structure of trade turnover;

- change in turnover rate;

- application of progressive forms of trade.

The volume of trade turnover has a very strong impact on distribution costs.

With an increase in the volume of trade turnover, the absolute value of distribution costs increases, but their relative level decreases. This is due to the fact that various cost items and elements depend on the volume of trade turnover differently. In this regard, they are conventionally divided into two groups: variable and constant. Variables include costs that are directly dependent on the volume of trade turnover: transportation costs; employee salaries paid depending on the volume of trade turnover; expenses for part-time work, sub-sorting, packaging and storage of goods; natural loss of goods; packaging costs; interest on a loan and some others. Fixed costs include costs that are not related or little related to the volume of trade turnover: wages at fixed salaries; rent and maintenance costs; costs for current repairs and some others. Consequently, an increase in the volume of trade turnover may be accompanied by an increase in the absolute value not of all costs, but only of their variable part. Therefore, the level of distribution costs in general decreases with an increase in the volume of trade turnover. The level of distribution costs is affected not only by the volume, but also by the structure of trade turnover. The dependence of distribution costs on the structure of trade turnover is due to the fact that the level of costs for individual goods is not the same. Consequently, a change in the structure of trade turnover causes a change in both the absolute amount and the average level of distribution costs.

The value of distribution costs is affected by the acceleration of trade turnover. Acceleration of trade turnover, along with the release of working capital, ensures the delivery of goods to the consumer at the lowest cost. The faster goods turn over, the lower the amount of distribution costs and the lower the level of trading expenses.

Analysis of the main items of distribution costs

The distribution costs of wholesale and retail trade enterprises consist of the following main types of costs:

- salary expenses;

- transportation costs;

- expenses for maintaining fixed assets;

- costs associated with inventory;

- other expenses.

1. Analysis of wage costs .

Wage costs occupy a significant share of retail trade costs, which necessitates their careful analysis and the search for savings reserves. Wage costs are analyzed by dividing them by groups of employees. At retail trade enterprises, the salaries of sellers, packers, cashiers, controllers, checkers and administrative staff should be allocated. At wholesale trade enterprises, the salaries of packers, sorters, labelers and other workers are allocated.

When analyzing wage costs, reporting data is compared with planned indicators and data for the previous period and deviations are identified. If labor costs are exceeded, the reasons for this are identified and possibilities for reducing wage costs in the future are established.

Thus, the amount of wages depends on the size of trade turnover, the number and composition of workers, labor productivity and wage rates. The influence of these factors is calculated using the formula.

FOT = T * NW * W

where payroll is the wage fund for sellers; SZ - average salary of a salesperson; W is the average turnover per seller.

When studying the impact on the wage fund of the volume of trade turnover and labor productivity, it should be borne in mind that a shift in the structure of trade turnover is also hidden at work here. Wage costs when selling goods of different assortments fluctuate significantly due to their unequal labor intensity.

2. Analysis of transport costs. Transport costs in the total amount of distribution costs reach 20%. These include costs for rail, water and road transport. The size of transport costs largely depends on the suppliers, but especially on the retailers themselves. A reduction in transportation costs can be achieved by fully loading vehicles, reducing empty mileage, compressing vehicle days, increasing the use of trailers and tractors, expanding the practice of centralized and circular delivery of goods to the retail network, and selling goods based on samples.

The level of transport costs is influenced by a number of factors, the influence of which can be measured by chain substitutions or absolute differences. These factors include:

- changes in the volume and structure of trade turnover;

- changes in the share of transportation carried out using various vehicles;

- change in driving range;

- tariff change.

The result of the influence of the volume of trade turnover also carries with it the effect of changing its structure.

Regarding transportation costs, the fluctuation of amounts depending on the nature of the goods transported is very significant. The weight, volume, frequency of delivery and other characteristics of the goods affect the costs of its transportation. The influence of the structure of trade turnover on the amount and level of transport costs can be measured if the trade organization keeps records of them by product groups. However, this is very rare. Therefore, such a calculation is practically impossible to perform. The relationship between transport costs and the above factors can be represented as the following formula:

TP = T * P * TS

where TR is transportation costs; T - quantity of cargo; P - average vehicle mileage; TS - tariff rate.

3. Analysis of the costs of maintaining fixed assets. This group of distribution costs includes the costs of renting and maintaining fixed assets, as well as the costs of their current repairs.

In the expenses of the group under consideration, the largest share is occupied by the costs of renting and maintaining premises. When analyzing these expenses on the basis of contracts, the correctness of the established rental rates, the calculation of depreciation amounts in accordance with approved standards and the accuracy of the distribution of expenses for individual reporting periods are checked.

The rent depends on two values: rental rates and the size of the area. The influence of these factors on the amount of rent can be determined by the method of chain substitutions.

The amount of depreciation of fixed assets consists of monthly deductions made according to established standards. The amount of depreciation rates depends on the type and nature of fixed assets. The amount of depreciation included in distribution costs depends, therefore, on two values: the depreciation rate and the cost of fixed assets, the influence of which can be established by the method of chain substitutions.

4. Costs associated with inventory. This group of expenses includes the costs of storing goods, their processing and packaging, commodity losses, expenses and losses on packaging, and credit costs.

The costs of storing goods, processing them and packaging express labor costs associated with the continuation of the production process in the sphere of circulation.

The costs of storing goods, handling them and packaging reach significant amounts. Their level and share are constantly growing. However, with proper organization of storage, sorting and packaging, some increase in costs for these purposes should to a certain extent be offset by reductions in costs for other items. For example, pre-packaging of goods leads to an increase in labor productivity and, consequently, to savings in the wage fund of sellers. Refrigeration costs reduce losses of goods during storage.

When analyzing the costs of part-time work, sub-sorting, packaging and storage of goods, the impact on this group of costs of the volume and structure of trade turnover, prices for packaging materials is examined, compliance with cost standards is checked and the economic efficiency of measures to improve the organization of storage, sorting and packaging of goods is revealed.

In the practice of planning and accounting, commodity losses are divided into two groups:

- natural loss of goods in transit and during storage;

- loss of goods in excess of established norms.

When studying the level of planned losses, it should be taken into account that for individual goods average rates of natural loss are established depending on the time of year, distance and methods of transportation.

Losses of goods in excess of established norms arise, as a rule, as a result of violations and mismanagement. The amount of these losses must be carefully checked on the basis of primary documents from the point of view of the legality of their write-off and correct inclusion in distribution costs. The size of commodity losses is influenced by a number of factors. First of all, the level of commodity losses is favorably influenced by the consolidation and specialization of trading enterprises. In large trading enterprises that have the necessary material conditions, storage is organized not only in compliance with general requirements, but also taking into account the individual characteristics of the goods.

The level of commodity losses is directly dependent on the size of inventory and the speed of turnover.

Reducing inventories in order to bring them to normal, and most importantly, liquidating stocks of slow-moving goods is accompanied by a decrease in commodity losses.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

Fundamentals of synthetic accounting of distribution costs

Active account 44 is intended for maintaining synthetic accounting. According to its debit, the accountant collects the amounts of expenses incurred in the course of the main activity, and the credit is calculated to write them off. The debit balance shows which ISOs for goods not yet sold are in stock at the end of the reporting period.

The following entries are made in the accounting of art:

| Debit | Credit | Explanation |

| 44 | 02 | For depreciation. OS amount |

| 05 | For the volume of depreciation. intangible assets | |

| 10 | Write-off of materials used for packaging product units and keeping them safe | |

| 60 | For the services provided for supply, security | |

| 68 | Calculation of taxes and other deductions related to art | |

| 70, 69 | Earnings and social contributions of employees | |

| 71 | Write-off of amounts spent on business trips and entertainment needs | |

| 94 | The amount of shortages and losses from damage to goods and materials (relevant for reducing taxes) |

The write-off of expenses is reflected as follows:

Dt 90.2 Kt 44

Important! On loan account 44, costs are written off to determine the final financial result - profit or loss.

Accounting for distribution costs and financial results from the sale of goods

Distribution costs are the costs of trading organizations associated with promoting goods to the final consumer. They characterize labor, material and other costs in the sphere of circulation.

Distribution costs are taken into account in total terms and as a percentage of turnover. Analytical accounting of distribution costs is carried out by structural divisions and items of the established nomenclature.

“Methodological instructions for the composition and accounting of distribution (production) costs, financial results of the activities of trade and public catering organizations” provides the following nomenclature of items of distribution costs in trade and

Transportation costs associated with the delivery of goods to trade and catering organizations.

1. Transportation costs for delivering goods to customers.

2. Staff costs.

3. Expenses for rent (leasing) of fixed assets and intangible assets.

4. Expenses for the maintenance of structures, premises and equipment.

5. Depreciation of fixed assets and intangible assets.

6. Costs and deductions for repairs of fixed assets.

7. Wear and tear of low-value and high-wear items.

8. Costs of fuel, gas and electricity for production needs in public catering organizations.

9. Expenses for storage, part-time work, sorting and packaging of goods.

10. Trade advertising expenses.

11. Interest on credits and loans.

12. Losses of goods during transportation, storage and sale within the limits of norms, technological waste.

13. Costs for packaging.

14. Taxes, deductions and fees included in distribution (production) costs.

15. Other standardized costs included in distribution (production) costs.

16. Expenses to ensure working conditions for personnel.

17. Costs of managing and operating a trade organization.

18. Other expenses.

Synthetic accounting of distribution costs is maintained on account 44 “Sales expenses” (subaccount 44/2 “Distribution costs”). The source of reimbursement for these expenses is the gross income of the trading enterprise. The debit of subaccount 44/2 reflects all costs included in distribution costs according to the nomenclature of items in correspondence with the credit of accounts 02, 05, 10, 60, 68, 69, 70, 71, 76, 96, etc. On the credit of subaccount 44/2 the amount of income that partially compensates for distribution costs is reflected, as well as the write-off of distribution costs for the financial result. Subaccount 44/2 for the loan corresponds with the debit of accounts 50, 51 and subaccount 90/2 “Cost of sales”, and the balance on this subaccount reflects the amount of distribution costs attributable to the balance of goods not sold at the end of the month.

The amount of distribution costs related to the balance of unsold goods is determined by calculation, and not the entire amount of distribution costs accounted for in subaccount 44/2 is distributed, but only the costs of rail, water, air, road and horse-drawn transportation associated with the delivery of goods (Article 1) and interest on loans (Article 12).

The calculation of distribution costs related to the balance of unsold goods at the end of the month is carried out in retail trade organizations according to their average percentage for the billing month, taking into account the carryover balance at the beginning of the month to the total cost of the goods.

To determine the average percentage of distribution costs, it is necessary to divide the distribution costs at the beginning of the month (item 1 + item 12) for the month for these items by the cost of goods sold during the month and the balance of unsold goods at the end of the month.

To calculate the amount of distribution costs for the balance of goods, it is necessary to multiply the cost of the balance of unsold goods at the end of the month by the average percentage of distribution costs.

The amount of distribution costs related to sold goods is determined as follows: opening balance on the debit of subaccount 44/2 + turnover on the debit of subaccount 44/2 – turnover on the credit of subaccount 44/2 – ending balance on the debit of subaccount 44/2 (i.e. . the amount of distribution costs related to the balance of unsold goods).

At the end of the month, distribution costs related to goods sold are written off to financial results by posting:

Account debit 90/2

Account credit 44/2

Distribution costs are the costs of trading organizations associated with promoting goods to the final consumer. They characterize labor, material and other costs in the sphere of circulation.

Distribution costs are taken into account in total terms and as a percentage of turnover. Analytical accounting of distribution costs is carried out by structural divisions and items of the established nomenclature.

“Methodological instructions for the composition and accounting of distribution (production) costs, financial results of the activities of trade and public catering organizations” provides the following nomenclature of items of distribution costs in trade and

Transportation costs associated with the delivery of goods to trade and catering organizations.

1. Transportation costs for delivering goods to customers.

2. Staff costs.

3. Expenses for rent (leasing) of fixed assets and intangible assets.

4. Expenses for the maintenance of structures, premises and equipment.

5. Depreciation of fixed assets and intangible assets.

6. Costs and deductions for repairs of fixed assets.

7. Wear and tear of low-value and high-wear items.

8. Costs of fuel, gas and electricity for production needs in public catering organizations.

9. Expenses for storage, part-time work, sorting and packaging of goods.

10. Trade advertising expenses.

11. Interest on credits and loans.

12. Losses of goods during transportation, storage and sale within the limits of norms, technological waste.

13. Costs for packaging.

14. Taxes, deductions and fees included in distribution (production) costs.

15. Other standardized costs included in distribution (production) costs.

16. Expenses to ensure working conditions for personnel.

17. Costs of managing and operating a trade organization.

18. Other expenses.

Synthetic accounting of distribution costs is maintained on account 44 “Sales expenses” (subaccount 44/2 “Distribution costs”). The source of reimbursement for these expenses is the gross income of the trading enterprise. The debit of subaccount 44/2 reflects all costs included in distribution costs according to the nomenclature of items in correspondence with the credit of accounts 02, 05, 10, 60, 68, 69, 70, 71, 76, 96, etc. On the credit of subaccount 44/2 the amount of income that partially compensates for distribution costs is reflected, as well as the write-off of distribution costs for the financial result. Subaccount 44/2 for the loan corresponds with the debit of accounts 50, 51 and subaccount 90/2 “Cost of sales”, and the balance on this subaccount reflects the amount of distribution costs attributable to the balance of goods not sold at the end of the month.

The amount of distribution costs related to the balance of unsold goods is determined by calculation, and not the entire amount of distribution costs accounted for in subaccount 44/2 is distributed, but only the costs of rail, water, air, road and horse-drawn transportation associated with the delivery of goods (Article 1) and interest on loans (Article 12).

The calculation of distribution costs related to the balance of unsold goods at the end of the month is carried out in retail trade organizations according to their average percentage for the billing month, taking into account the carryover balance at the beginning of the month to the total cost of the goods.

To determine the average percentage of distribution costs, it is necessary to divide the distribution costs at the beginning of the month (item 1 + item 12) for the month for these items by the cost of goods sold during the month and the balance of unsold goods at the end of the month.

To calculate the amount of distribution costs for the balance of goods, it is necessary to multiply the cost of the balance of unsold goods at the end of the month by the average percentage of distribution costs.

The amount of distribution costs related to sold goods is determined as follows: opening balance on the debit of subaccount 44/2 + turnover on the debit of subaccount 44/2 – turnover on the credit of subaccount 44/2 – ending balance on the debit of subaccount 44/2 (i.e. . the amount of distribution costs related to the balance of unsold goods).

At the end of the month, distribution costs related to goods sold are written off to financial results by posting:

Account debit 90/2

Account credit 44/2

Maintaining analytical accounting of distribution costs

Analytical accounting of art products in trading companies is carried out for each of their types and for individual articles. The list is unified and includes all possible areas of art: from delivery costs to other costs.

Trading companies can supplement and change this list. But it is important to take into account the provisions of regulatory documents. Analytical accounting covers types of costs. For example, on the debit of the account. 94 collects information about the accounting value of goods that are missing. The amount is contained in account loans. 41 and 60.

Shortages arising during the sale of goods are indicated as follows:

Dt sch. 94 Kt. 44

Loss of goods due to emergencies, natural disasters, is written off from credit account 44 to Dt account. 99.

Distribution costs

Reflection of distribution costs in the accounting of trade organizations.

| № | Debit | Credit | Contents of operation |

| Accounting entries when using materials for the needs of organizing trade | |||

| 1 | 44 subaccount “Distribution costs” | 10 | The actual cost of materials consumed was written off as expenses of the trading organization |

| Accounting entries when calculating depreciation of fixed assets used in trade | |||

| 1 | 44 subaccount “Distribution costs” | 02 subaccount “Depreciation of fixed assets accounted for on account 01” | The amount of depreciation of a fixed asset object is reflected |

| Accounting entries when calculating depreciation of intangible assets used in trade | |||

| 1 | 44 subaccount “Distribution costs” | 05 | The amount of depreciation of an intangible asset object is reflected with the accumulation of depreciation amounts in a separate account |

| Accounting entries when calculating wages and contributions from the accrued wages of employees of a trade organization | |||

| 1 | 44 subaccount “Distribution costs” | 70, 69 | Reflects the accrued amount of wages and contributions from the accrued wages of employees of a trade organization |

| Accounting entries when reflecting debts for taxes and fees included in distribution costs | |||

| 1 | 44 subaccount “Distribution costs” | 68 | Taxes and fees charged on distribution costs |

| 44 subaccount “Distribution costs” | 68 | or Overpayment of taxes and fees on distribution costs is reversed | |

| Accounting entries for work (services) provided by third-party organizations for trade enterprises with payment through accountable persons | |||

| 1 | 71 | 50 | Funds were issued on account to pay for work (services) of third-party organizations |

| 2 | 44 subaccount “Distribution costs” | 71 | The cost of consumed work (services) with VAT for the reporting period (month) is written off for distribution costs |

| 3 | 97 | 71 | The cost of consumed work (services) with VAT is written off as costs (expenses) of future periods |

| Accounting entries for work (services) provided by third parties for trade enterprises selling goods with VAT | |||

| 1 | 44 subaccount “Distribution costs” | 60, 76 | The cost of consumed work (services) without VAT for the reporting period (month) is written off as distribution costs |

| 2 | 97 | 60, 76 | The cost of consumed work (services) without VAT is written off as costs (expenses) of future periods |

| 3 | 19 subaccount “VAT on work performed (services) of third parties” | 60, 76 | Accounted for (accrued) VAT on work (services) performed by a third party |

| 4 | 68 subaccount “VAT calculations” | 19 subaccount “VAT on work performed (services) of third parties” | Accepted for deduction from the budget of VAT on work (services) performed by a third party |

| 5 | 60, 76 | 50, 51 | The cost of work (services) consumed by the trade enterprise was paid to a third party |

| Accounting entries for work (services) provided by third parties for trade enterprises selling goods without VAT | |||

| 1 | 44 subaccount “Distribution costs” | 60, 76 | The cost of consumed work (services) with VAT for the reporting period (month) is written off for distribution costs |

| 2 | 97 | 60, 76 | The cost of consumed work (services) with VAT is written off as costs (expenses) of future periods |

| 3 | 60, 76 | 50, 51 | The cost of work (services) consumed by the trade enterprise was paid to a third party |

| Accounting entries for payments of money to individuals for the provision of services (minor repairs, cleaning of premises, etc.) that are not part of the duties of regular staff | |||

| 1 | 44 subaccount “Distribution costs” | 76 | The cost of consumed work (services) is written off as distribution costs |

| 2 | 76 | 68 subaccount “Calculations for personal income tax” | Reflects the amount of income tax (NDFL) withheld from the wages (income) of an individual |

| 3 | 76 | 50-1 | The amount to be issued (paid) is reflected |

| 4 | 68 subaccount “Calculations for personal income tax” | 51 | Personal income tax (NDFL) transferred to the budget |

| Accounting entries when writing off transferred samples of goods | |||

| 1 | 97 | 41-1 | The actual (purchase) cost of the transferred samples of the goods sold was written off for the organization’s expenses related to advertising or |

| 44 subaccount “Distribution costs” | 41-1 | The actual (purchase) cost of product samples distributed by the organization during its advertising campaign was written off | |

| Accounting entries when writing off deferred expenses for the reporting period (month) for distribution costs | |||

| 1 | 44 subaccount “Distribution costs” | 97 | Current expenses (expenses) of future periods are written off as distribution costs |

| Accounting entries when writing off advertising expenses for the reporting period (month) in a trade organization (advertising through the media, outdoor advertising, participation in exhibitions and other similar expenses) | |||

| 1 | 44 subaccount “Distribution costs” | 97 | Current expenses (costs) for advertising are written off as distribution costs |

| Accounting entries when writing off entertainment expenses for the reporting period (month) in a trade organization | |||

| 1 | 44 subaccount “Distribution costs” | 97 | Current expenses (expenses) associated with holding an official reception (breakfast, lunch or other similar event) of representatives (participants), their transportation, visiting cultural and entertainment events, buffet service during negotiations and cultural program events, payment services of translators who are not on staff of the organization, other similar expenses |

| Accounting entries when writing off expenses for training and retraining of personnel on a contractual basis with educational institutions for the reporting period (month) in a trade organization | |||

| 1 | 44 subaccount “Distribution costs” | 97 | Costs (expenses) for training and retraining of personnel on a contractual basis with educational institutions during the term of the contract are evenly written off on the last day of each month as distribution costs |

| Accounting entries when writing off payments (insurance premiums) for voluntary (including medical) insurance for the reporting period (month) in a trade organization | |||

| 1 | 44 subaccount “Distribution costs” | 97 | The amount of insurance premium (insurance contributions) for voluntary (including medical) insurance during the term of the contract is written off evenly on the last day of each month for distribution costs |

Reflection in accounting of operations for the design of shop windows and sales areas.

| № | Debit | Credit | Contents of operation |

| Accounting entries when transferring goods from a warehouse for its use in the design of display window(s) | |||

| 1 | 41 sub-accounts “Goods displayed in showcases” | 41-1 | Reflects the display of goods in the display window of a trade organization |

| Accounting entries when returning goods to the warehouse | |||

| 1 | 41-1 | 41 sub-accounts “Goods displayed in showcases” | The removal of goods from the display case and their return to the warehouse is reflected |

| Accounting entries when writing off goods from a display case that have completely or partially lost their consumer (initial) qualities | |||

| 1 | 94 | 41 sub-accounts “Goods displayed in showcases” | The loss of goods as a result of its display in a showcase is reflected |

| Accounting entries for work performed by design organizations when decorating shop windows, sales floors and service areas for retail enterprises | |||

| 1 | 44 subaccount “Distribution costs” | 60, 76 | The cost of consumed work (services) excluding VAT, performed by a design organization for window dressing, has been written off |

| 2 | 19 subaccount “VAT on work performed (services) of third parties” | 60, 76 | Accounted for (accrued) VAT on work (services) performed by a third party |

| Accounting entries when transferring goods to a design organization to perform work on the design of shop windows, sales floors and service areas | |||

| 1 | 44 subaccount “Distribution costs” | 41 sub-accounts “Goods displayed in showcases” | The accounting value of goods used for the decoration of shop windows, sales floors and service areas has been written off |

| Accounting entries when transferring your own materials to a design organization to carry out work on decorating shop windows, sales areas and service areas | |||

| 1 | 10-7 | 10-1 | The actual cost of materials transferred for processing (processing) to other organizations was written off to a separate sub-account (for separate accounting) |

| 2 | 44 subaccount “Distribution costs” | 10-7 | The actual cost of materials used for decorating shop windows, sales areas and service areas has been written off |

| Accounting entries when including in the cost of sales the organization's expenses for decorating display windows, sales areas and service areas | |||

| 1 | 90 subaccount “Business expenses” | 44 subaccount “Distribution costs” | Costs for decorating shop windows, sales areas and service areas, reflected as part of sales expenses, are written off as selling expenses |

| NOTE. Money spent on the purchase of durable New Year's paraphernalia is written off to account 91-2 “Other expenses” as non-production expenses. The amount of VAT on these expenses is not deductible. Decorative items and other consumables purchased for display windows, sales areas and service areas are mainly materials used for non-production purposes. In accounting, expenses for the purchase of such materials are written off to account 91-2 “Other expenses”. VAT paid on the purchase of these materials is also subject to write-off to account 91-2 “Other expenses” | |||

Reflection in accounting of the fact of provision of information, consulting, legal and auditing services by third-party organizations with payment through accountable persons. Services are related to the implementation of current activities subject to VAT.

| № | Debit | Credit | Contents of operation |

| Accounting entries at the time of issuing money for reporting | |||

| 1 | 71 | 50 | Advance payment of funds to pay for work (services) of third-party organizations is reflected |

| Accounting entries when accounting for information, consulting, legal and auditing services | |||

| 1 | 44 subaccount “Distribution costs” | 76 | The cost of consumed information, consulting, legal and auditing services excluding VAT for distribution costs has been accrued |

| 2 | 19 subaccount “VAT on work performed (services) of third parties” | 76 | The amount of VAT on information, consulting, legal and audit services provided by third parties is reflected |

| 3 | 68 subaccount “VAT calculations” | 19 subaccount “VAT on work performed (services) of third parties” | The amount of VAT on information, consulting, legal and audit services provided by third parties has been accepted for deduction |

| Accounting entries when an accountable person repays debts for payment for services of third-party organizations | |||

| 1 | 76 | 71 | The cost of information, consulting, legal and audit services was paid to the performers through accountable persons |

| Accounting entries when including in the cost of sales expenses of an accountable person for payment for services of third-party organizations | |||

| 1 | 90 subaccount “Business expenses” | 44 subaccount “Distribution costs” | Costs for payment of information, consulting, legal and audit services reflected in selling expenses are written off as selling expenses |

Reflection in accounting of the fact of provision of marketing services.

| № | Debit | Credit | Contents of operation |

| Accounting entries in case of provision of marketing services by an in-house marketing service | |||

| 1 | 44 subaccount “Distribution costs” | 70, 69 | Reflects the accrued amount of wages and contributions from the accrued wages of employees involved in marketing research |

| Accounting entries in case of provision of marketing services by a third party | |||

| 1 | 44 subaccount “Distribution costs” | 60, 76 | Expenses excluding VAT for marketing services are reflected |

| 2 | 19 subaccount “VAT on work performed (services) of third parties” | 60, 76 | The amount of VAT on the cost of marketing services is reflected |

| 3 | 68 subaccount “VAT calculations” | 19 subaccount “VAT on work performed (services) of third parties” | The amount of VAT on marketing services provided has been accepted for deduction from the budget. |

| 4 | 60, 76 | 51 | Funds were transferred to a third party for marketing services |

| Accounting entries when including in the cost of sales the organization's expenses for conducting marketing research | |||

| 1 | 90 subaccount “Business expenses” | 44 subaccount “Distribution costs” | The costs of conducting marketing research reflected in selling expenses are written off as selling expenses. |

Reflection in accounting of the use of a corporate payment card by a trade organization to pay expenses (expenses) associated with holding an official breakfast (lunch) in a restaurant with a business partner during negotiations. The restaurant bill was paid by an employee of the organization in cash received by him using a payment card.

| № | Debit | Credit | Contents of operation |

| Accounting entries when issuing a corporate card to an employee of an organization | |||

| 1 | 71 | 50-3 | The accounting value of a corporate card issued to an employee of an organization to pay for restaurant services is reflected. |

| Accounting entries when purchasing services by an employee of an organization | |||

| 1 | 71 | 57 | Received cash to pay the invoice issued by the restaurant |

| 2 | 44 subaccount “Distribution costs” | 71 | The funds spent by the accountable person on holding an official breakfast (lunch) have been written off |

| 3 | 19 subaccount “VAT on work performed (services) of third parties” | 71 | VAT is charged on the cost of restaurant services |

| 4 | 68 subaccount “VAT calculations” | 19 subaccount “VAT on work performed (services) of third parties” | Accepted for deduction of VAT from the cost of an official breakfast (lunch) in full on the basis of paragraph 7 of Article 171 of the Tax Code of the Russian Federation |

| 5 | 57 | 55 subaccount “Special card account” | Reflected payment for restaurant services |

| Accounting entries when returning a corporate card by an employee of an organization | |||

| 1 | 50-3 | 71 | The accounting value of the corporate card returned by the employee to the organization is reflected |

| Accounting entries when including in the cost of sales the expenses of an accountable person for holding a formal dinner | |||

| 1 | 90 subaccount “Business expenses” | 44 subaccount “Distribution costs” | The costs of holding a formal dinner, reflected in selling expenses, are written off as selling expenses. |

Continued >>

Accounting for distribution costs: features of accounting for transportation costs

Costs arising during the delivery of goods to the company's warehouses are included in the IO.

You can display them like this:

- Include in the actual s/s of the product.

- Take it into account 44 under the title “Sales expenses”.

Where to stop is determined by the trading company. But the choice must be indicated in the accounting policy. When the second method is chosen, the volume of transport costs is subject to distribution between the goods sold, and not yet. Costs incurred during the delivery of already sold units are written off to the account. 90.2.

Checking costs on account 44.01 (Distribution costs)

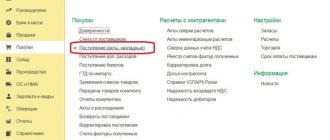

Checking the correct reflection of distribution costs in 1C by cost item (Fig. 314)

Let’s create a balance sheet for account 44.01 “Distribution costs in organizations engaged in trading activities”:

- Menu Reports – Account balance sheet ;

- Specify the period , select Account (in the example – 44.01);

- Click the “Generate report” .

Rice. 314

From the balance sheet for account 44.01 “Distribution costs in organizations engaged in trading activities” it is clear that transport costs are accumulated under the item Transport costs.

Give your rating to this article: (

1 ratings, average: 5.00 out of 5)

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

Registered users have access to more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP

I am already registered

After registering, you will receive a link to the specified address to watch more than 300 video lessons on working in 1C: Accounting 8, 1C: ZUP 8 (free)

By submitting this form, you agree to the Privacy Policy and consent to the processing of personal data

Login to your account

Forgot your password?

Features of accounting for distribution costs in pharmacies

IO in pharmacies is their volume in monetary terms necessary for the delivery of medications to consumers, who are the population of the country and various types of medical institutions.

IO includes costs for:

- delivery of medicines and their safety;

- sale of medicines;

- employee salaries;

- others.

The total amount of pharmacy expenses exceeds the ISO. The latter, for example, do not include:

- entertainment and travel expenses, the amount of which exceeds the norm;

- amounts of financial assistance;

- bonuses from special funds;

- loan fees;

- fines and penalties due to inaccurate payment of taxes;

- additional vacation pay.

To reduce costs, you need to:

- To improve the organizational forms of providing the population with medicines, namely, to sell mainly ready-made medications and not spend money on their production.

- Use modern technologies that increase the productivity of pharmacists.

- Reduce delivery costs and the cost of medicines.

- Rationalize commodity distribution systems, eliminate duplicate links in the delivery of medications.

Pharmacies have a high level of ISO (20-25%) compared to other trading companies (6-9%). There is an explanation for this:

- significant amount of work;

- maintaining a staff of more highly qualified employees compared to a regular store;

- The sale of goods is carried out not in large quantities, but in fractional quantities.

All costs incurred by the pharmacy are reflected in accounting and reporting documents in the period in which they were actually incurred.

In operational accounting (analytical and synthetic accounting accounts), in the accumulative and turnover statements, IO should be recorded only in absolute amounts - in RUB.

The main reporting document for art is the report for the corresponding quarter. It reflects costs both in absolute terms and as a percentage of turnover.

Basics of cost analysis in pharmacies

For qualitative analysis, it is necessary to use the following initial data:

- planned calculations of turnover and inventories of current assets;

- amounts intended for payment of labor;

- wishes of management regarding minimizing the level of ISO based on the experience of more profitable pharmacies;

- results of analytical work on the study of art for the previous time period.

It is necessary to highlight factors that depend on the work of pharmacy organizations and those that cannot be influenced. The main factor that cannot be influenced is prices. Their dynamics affect the amount of trade turnover and the relative level of ISO. Initially, this concerns retail prices for medications.