What happens if you leave the situation to chance?

Accountable money that the director did not return on time is reflected in accounting as a debt to the enterprise. Such a debt can hang for quite a long time - until the expiration of the statute of limitations under Art. 196 of the Civil Code of the Russian Federation (three years).

This money is not the director’s income and is not subject to personal income tax.

An enterprise has the right to withhold tax only in two situations:

- the debt was forgiven;

- the statute of limitations for its recovery has expired

It would seem that everything is not so bad - well, there is an account, it hangs to itself, does not bother anyone, what are the problems? However, not everything is so simple if:

- money is systematically issued for reporting to the director, but he does not return it and does not submit documents on the intended use of these funds;

- the organization does not take any action to collect the accumulated debt, in particular, does not withhold these amounts from the debtor’s salary,

then during a tax audit, inspectors may recognize this debt as the director’s income. The result will be the accrual of insurance premiums, personal income tax, as well as fines and penalties on the amount of debt.

Examples of judicial practice:

- Decision of the Arbitration Court of the Kursk Region. dated 02/05/2019 in case No. A35-12731/2017. As a result of the GNP, the tax authorities recognized the director’s reporting debt as his income and assessed tax, fines and penalties. The organization tried to challenge this decision, but the courts of three instances refused to satisfy the demands. And the Supreme Court refused to transfer the cassation appeal for further consideration.

- By ruling No. 307-ES20-23792 dated February 11, 2021, in a similar situation with the director’s open report, the Supreme Court also recognized the charges and fines as legitimate.

How to reduce “accountable” risks

Recommendation #1: Work with your employees

Conduct explanatory work with employees on receiving, processing and submitting to the accounting service documents confirming expenses on the advance report.

Avoid confirming expenses without receipts. Expenses on an advance report, to which are attached any documents not executed using an online cash register, may be considered undocumented. Pay attention to the form of checks.

Recommendation No. 2. Control the timing of execution of reporting documents

Approve the rules by which you will determine the reporting period and develop a system of internal control over their compliance.

According to general requirements, the employee is required to report on the accountable amounts within 3 working days from the end of the reporting period. The reporting period is determined by the manager upon approval. In fact, today it can be anything.

Please note: accountable amounts for a business trip are limited by its duration. After returning from a business trip, the employee is required to submit an advance report with documents within 3 working days. The company can set a shorter deadline for submitting the expense report, for example, 1 day. However, it cannot be increased.

If an employee does not submit an advance report or does not return unspent accountable funds, then there is a high probability that the tax office will recognize these payments as his income even before the statute of limitations expires (Supreme Court ruling dated 02/03/2020 No. 310-ES19-28047).

Managers are especially often guilty of non-repayment of amounts issued. They act on the principle “I’m in charge here, I do what I want.” If more than three years pass from the day when the employee was supposed to report on the accountable amounts, the statute of limitations will apply, the company will have to calculate personal income tax and contributions.

Recommendation No. 3. If deadlines are missed, issue a debt

Having millions stuck in subordinate accounts is bad form. The tax inspector will definitely pay attention to this.

If the accountant does not report on time, sign a debt repayment agreement with him to avoid additional personal income tax charges and contributions. This action interrupts the statute of limitations (Article 203 of the Tax Code of the Russian Federation, paragraph 20 of the Resolution of the Plenum of the Supreme Arbitration Court of September 29, 2015 No. 43). From this day the period begins to count again. This step means that the company is taking action and has every chance to return the money not spent on the purposes specified when receiving the report. The agreement can specify repayment dates and amounts.

You need to understand that these amounts must ultimately be returned to the company, and not exist only on paper. The endless re-signing of an agreement indicating new terms may one day be recognized as an abuse of law.

The time will come when all amounts will be included in the employee’s income, with all the ensuing consequences for the company.

From January 1, 2022, the company pays additional personal income tax accrued during the audit. Previously, the Tax Code of the Russian Federation established a rule according to which such amounts were collected from the individual himself. Now the situation has changed. Additional personal income tax has ceased to be an individual’s problem and has become a company’s problem. The employer has the right to recover tax from an employee by recourse, citing the fact that the employee committed illegal actions. However, this is not an easy matter. Participants in stories with large sums are unlikely to be ordinary managers.

A little theory about reporting

Before we discuss possible debt repayment options, we will briefly outline the key points of current legislation.

Today, the rules for cash payments are regulated by Central Bank Directive No. 5348-U dated December 9, 2019. According to the Directive, the organization does not have the right to spend the returned accountable funds for any purposes directly. This money must be deposited into a current account, and only then spent on necessary needs.

Thus, if the cash documents reflect the return of the accountable amount, and then this money is immediately issued from the cash register for some purpose, bypassing the account, this is a violation of current legislation.

What does it threaten?

This violation is punishable under Art. 15.1 of the Code of Administrative Offenses of the Russian Federation: the manager can be punished in the amount of 4 to 5 thousand rubles, and the organization itself - in the amount of 40 to 50 thousand rubles.

However, the organization has the opportunity to avoid a fine . So:

- The period for bringing to justice for violation of cash discipline, if it is not related to the use of an online cash register (and this is not our case) is 2 months (4.5. Code of Administrative Offenses of the Russian Federation).

- According to Art. 3.4 and 4.1.1 of the Code of Administrative Offenses of the Russian Federation, a fine for small and medium-sized businesses can be replaced with a warning if the offense was committed for the first time and did not cause harm to the life and health of people or damage to property.

And another important point :

According to the latest edition of the Central Bank Directives dated March 11, 2014 No. 3210-U, the organization independently sets the deadlines within which the employee must report on accountable amounts. That is, you can issue money on account not only for several days (months), but even for several years.

But you need to understand that such a long period must be justified by production necessity. Otherwise, tax authorities can again reclassify the hanging debt as income. However, it is possible to set a reasonable but fairly long period.

For example: state in the order that the director must report on the report within six months. This period makes it possible to choose the best option for repaying the debt if there are no documents confirming the targeted expenses.

But the deadline for submitting the advance report has expired, and there is no money and documents, how to pay off the debt? Here are a few available options.

How to write off a report from the director

You can issue funds on account not only to the employee, but also to the employer. At the same time, in practice, funds issued to the manager are not always returned, but must be written off to the accountant.

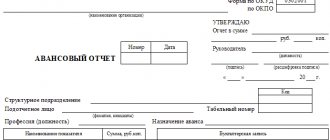

First of all, let us recall the procedure for issuing cash against a report. Thus, according to clause 6.3 of the Bank of Russia Instructions No. 3210-U dated March 11, 2014 “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses” (hereinafter referred to as Instructions No. 3210-U) for cash withdrawal money to an employee for reporting expenses related to the activities of a legal entity, individual entrepreneur, cash order 0310002 is issued in accordance with a written application of the accountable person, drawn up in any form and containing a record of the amount of cash and the period for which cash is issued, signature leader and date.

IMPORTANT IN WORK

Limits on the amount and timing of the issuance of accountable amounts, including for issuance to the director of the organization, are not established by law.

Let us recall that before 06/01/2014, clause 4.4 of the Regulations of October 12, 2011 No. 373-P, it was provided that the issuance of money on account is drawn up according to a written application of the accountable person, drawn up in any form and containing a handwritten inscription of the manager about the amount of cash and the deadline , for which cash is issued, the manager’s signature and date. However, now the head of the organization has the right to enter in his own hand the amount and deadline for issuing money under the report or to put only a signature and date. Let us note that the general director of the company has a special legal status; he is simultaneously the head of the organization and its employee (Article 40 of the Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies”, Articles 11, 16, 20 , 273 of the Labor Code of the Russian Federation) and, therefore, can be an accountable person (clause 6.3 of Instructions No. 3210-U). At the same time, Instruction No. 3210-U does not establish any exceptions for drawing up an application for the issuance of funds, including in cases where the accountable person is the head of the organization himself.

The accountable person's statement may look like this:

Application for receipt of accountable funds.

I hereby declare the need for me to receive an amount of 15,000 (fifteen thousand) rubles on account. for a period of 20 (twenty) calendar days.

To carry out cash payments related to the organization’s activities.

General Director of Romashka LLC D A V Y D O V /D. S. Davydov/ 07/15/2015

Status of settlements with the employee for previously issued amounts: there is no debt of D. S. Davydov for previously issued accountable amounts.

07/15/2015 Chief accountant: G O L U B E V A /O. U. Golubeva/

Please note: the issuance of cash on account is carried out subject to full repayment by the accountable person of the debt on the amount of cash previously received on account (clause 6.3 of Instructions No. 3210-U). Otherwise, the tax authorities, if they detect an unlawful issuance of funds on account (the director has not yet reported for previously issued amounts), may fine the company for violating the Rules for Conducting Cash Transactions under Art. 15.1 Code of Administrative Offenses of the Russian Federation. Similar conclusions are contained in arbitration practice (for example, decision of the Arbitration Court of the Rostov Region dated January 11, 2013 No. A53-33625/2012).

GOOD TO KNOW

In accordance with Art. 15.1 of the Code of Administrative Offenses of the Russian Federation for non-compliance with the procedure for handling cash and the procedure for conducting cash transactions provides for a fine:

- from 4000 to 5000 rub. – for officials of the organization (for example, a manager);

- from 40,000 to 50,000 rub. - for the organization.

In addition, in practice there are cases when an organization was subject to penalties for the fact that when issuing cash against the report on cash orders, written statements of the accountable person were not drawn up indicating the deadlines for submitting an advance report on the amounts issued, and cash was also issued against the report. funds when the employee did not report on previously received amounts and did not deposit the unspent money into the cash register (resolution of the Ninth Arbitration Court of Appeal dated March 6, 2013 No. 09AP-2451/2013).

Documentary confirmation

In accordance with clause 6.3 of Instructions No. 3210-U, the accountable person is obliged, within a period not exceeding three working days after the expiration date of the period for which cash was issued on account, or from the date of return to work, to present to the chief accountant or accountant (if their absence - to the manager) advance report with attached supporting documents. The check of the advance report by the chief accountant or accountant (in their absence, by the manager), its approval by the manager and the final settlement of the advance report are carried out within the period established by the manager. At the same time, let us recall the provisions of Art. 346.16 of the Tax Code of the Russian Federation, according to which taxpayers using the simplified tax system reduce the income received by the justified and documented expenses they incurred (Article 252 of the Tax Code of the Russian Federation).

The letter of the Federal Tax Service of Russia dated June 25, 2013 No. ED-4-3/ [email protected] considers the situation of confirming expenses incurred with only a cash receipt issued by the seller. The Tax Department notes that a cash receipt printed by cash register equipment on paper confirms only the fact of cash payment between the seller and the buyer (clause 2 of the Regulations on the registration and use of cash register equipment used by organizations and individual entrepreneurs, approved by resolution Government of the Russian Federation dated July 23, 2007 No. 470). In addition, the cash register receipt does not contain all the required details of the primary accounting document, which are listed in clause 2 of Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”. The list of mandatory details of a cash register receipt is determined by clause 4 of the Regulations on the use of cash registers when making cash settlements with the population, approved by Decree of the Government of the Russian Federation of July 30, 1993 No. 745:

- name and TIN of the organization;

- KKM serial number;

- serial number of the check;

- date and time of purchase or provision of services;

- cost of purchase or service;

- a sign of a fiscal regime.

HAVE AN OPINION

If the director does not report on accountable funds within the prescribed period, then he becomes a debtor of the organization. And as long as he is in debt, he does not receive any economic benefit, the funds do not belong to him.

In addition to the details listed in this paragraph, the cash register receipt may contain other information provided for by the technical requirements for the cash register or due to the specifics of its scope of application (paragraph 3, clause 4 of the Regulations on the use of cash register). And, as we see, this list does not contain such details as “position title” and “signature” of the persons who performed the business transaction. In addition, a cash receipt is issued not to an organization, but to an individual - an employee (director) of this organization. The organization's posting of inventory items purchased for it by the director is carried out on the basis of primary accounting documents, in particular, an advance report, sales receipts, as well as documents confirming the fact of payment - KKM checks, receipts for a cash receipt order. However, from all of the above, the tax authorities conclude that the taxpayer has the right to confirm the expenses incurred with a cash receipt, however, in order to account for expenses for tax purposes, along with a cash receipt, other primary documents are necessary that indicate the connection of the expenses incurred with the activities of the organization aimed at generating income.

At the same time, the letter of the Federal Tax Service of Russia for Moscow dated April 26, 2011 No. 17-15/041152 states: if the name of the purchased product is indicated on the cash receipt issued to the buyer, the organization engaged in retail trade is not obliged to issue a sales receipt. Consequently, such a check may well be a supporting document for the advance report, as well as the basis for recording inventory items purchased in cash.

However, some categories of taxpayers (sellers) have the right not to use cash register systems when making cash payments or payments using payment cards, for example, “imputers”.

These persons, instead of a cash register receipt, are obliged, at the time of payment for goods, work, or services, to issue, at the buyer’s request, a sales receipt, receipt or other document confirming the receipt of funds. The list of information that must be reflected in this document is approved by clause 2.1 of Art. 2 of the Law on CCP. In the letter of the Federal Tax Service of Russia dated September 14, 2010 No. ShS-37-3/11157, which is mandatory for use by tax authorities, it explained that an organization that purchased goods in cash from a supplier - payer of UTII has the right to use UTII to confirm its expenses for the purpose of taxation document drawn up in accordance with clause 2.1 of Art. 2 of the Law on CCP.

GOOD TO KNOW

Documents confirming the material costs of an accountable individual can be sales receipts, invoices with cash receipts attached, or receipts for receipt orders confirming payment for goods (work, services).

If documents are lost

In practice, there are also quite often situations when a director (accountable person) loses cash and sales receipts. If such a situation arises, when the director was unable to provide supporting documents about the expenditure of accountable amounts, the accountant has several options: either to demand the return of the amount issued and thereby avoid paying any taxes, or, if the inventory items were nevertheless acquired, accept an advance report from the director without supporting documents. Let's consider what actions should be taken if the employer nevertheless decides to take the second path. In the letter of the Federal Tax Service of Russia dated December 24, 2013 No. SA-4-7/23263, the tax department says that in the absence of evidence confirming the expenditure of accountable funds received by the director of the organization or employee, as well as evidence confirming the posting of inventory by the organization in the established order, according to Art. 210 of the Tax Code of the Russian Federation, the specified funds are the income of the accountable person and are subject to inclusion in the tax base for personal income tax. This conclusion is also contained in the resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 5, 2013 No. 14376/12 and No. 13510/12. Moreover, before the adoption of these resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation, the practice in this type of cases developed varied. In particular, in the decisions of the Federal Antimonopoly Service dated April 1, 2013 No. A55-15647/2012, the Federal Antimonopoly Service of the Moscow Region dated June 16, 2010 No. KA-A40/5879-10-3, the Federal Antimonopoly Service dated November 11, 2009 No. KA-A41/11723-09 decisions tax authorities were declared invalid.

POSITION OF THE COURT

In the absence of evidence confirming the expenditure of accountable funds received by the accountable person, as well as the posting by the organization of inventory items in the prescribed manner, the specified funds based on Art. 210 of the Tax Code of the Russian Federation are the income of the accountable person and are subject to inclusion in the personal income tax base.

— Resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 5, 2013 No. 14376/12 and No. 13510/12.

Please note: for organizations using the simplified tax system with the object of taxation “income”, on the basis of clause 1 of Art. 346.18 of the Tax Code of the Russian Federation there is no obligation to take into account expenses. However, such taxpayers, by virtue of clause 5 of Art. 346.11 of the Tax Code of the Russian Federation are not exempt from performing the duties of tax agents. Consequently, the fact that the cost of inventory items acquired by the director due to the application of the simplified tax system by the organization cannot be attributed to the organization’s expenses does not matter for the calculation of personal income tax. Thus, the determination of an employee’s income subject to personal income tax, the calculation, withholding and payment of this tax is carried out by the tax agent organization in the generally established manner, regardless of the tax regime applied. Therefore, if the organization does not store documents confirming expenses, then the accountable person who received the cash becomes obligated to pay personal income tax (letter of the Ministry of Finance of Russia dated October 31, 2013 No. 03-11-11/46739).

Salary deduction

Another way to repay the director’s debt to the organization for unreturned accountable amounts is Art. 137 of the Labor Code of the Russian Federation, which states: if the deadline for submitting a report on accountable amounts is missed, the employer has the right, no later than one month from the end of the established period, to decide to deduct the corresponding accountable amount from the employee’s (i.e. director’s) salary, provided that that the director does not dispute the grounds and amounts of the withholding.

Withhold debt from wages

The classic way to pay off debt. The amount of debt can be withheld from wages only with the consent of the director.

The withholding order must be signed within a month from the expiration date for the return of the imputed amount.

The amount of deduction should not exceed 20% of the salary amount. If the amount of debt is large, it will have to be deducted in several stages.

Example: the reporting director’s debt is 200 thousand rubles. His salary is 100 thousand rubles. This means that you can deduct an amount from your salary every month in the amount of:

(100 thousand rubles - 100 thousand rubles * 13%) * 20% = 17.4 thousand rubles.

Thus, every month the director will receive:

100 thousand rubles. — 13 thousand rubles. (personal income tax) - 17.4 thousand rubles. = 69.6 thousand rubles.

Insurance premiums for the amount of wages are calculated in accordance with the general procedure.

The amount of the issued and returned sub-report does not affect the company’s profit in any way, since neither income nor expense arose.

The main nuances of issuing money for reporting

Before allocating funds to the account, the management of the enterprise draws up an order on accountable persons, where the list of these employees is indicated by name. The procedure for issuing funds for reporting is regulated by the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U.

To allocate accountable funds, the employee must provide a statement approved by management, which will indicate the required amount of money, the purpose for issuing it and the period for which it is allocated. This statement is the basis for drawing up a cash order or payment order for the allocation of the required amount of funds to an accountable person.

The funds received can only be used for the business needs of the enterprise - the purchase of materials, payment for services, as well as for travel expenses. The list of expenses that can be included in the report is regulated by current legislation. The employee is given an advance payment within the limits of the amount of upcoming expenses. Transfer of accountable amounts by one person to another is not permitted.

Upon the fact of the funds spent by the employee, within 3 days after the reporting date specified in the application, the employee is obliged to provide the accounting department with an advance report and documents that will confirm the expenses incurred by him (sales receipts, receipts, invoices, certificates of work performed). The amount of unspent funds must be returned to the enterprise's cash desk, which is formalized by a cash receipt order.

Get 267 video lessons on 1C for free:

In case of overspending, if there is documentary evidence, the amount of overspending is reimbursed to the employee through the company's cash desk or in non-cash form to his plastic card (RKO or payment order).

The issuance of money on account is possible if two conditions are met:

- Availability of an order on accountable persons and an agreed statement;

- Full repayment of previous advance reports.

Schematically, the structure of advance transactions can be displayed as follows:

Issue a loan for the amount of debt

We conclude an interest-bearing loan agreement with the director (precisely interest-bearing, in order to remove the problem of monthly income accrual from material benefits). We transfer funds to the director’s card or issue money from the cash register.

Important: borrowed funds cannot be issued directly from the cash register. If for some reason it is impossible to transfer money directly to the borrower’s personal account, then the required amount must be withdrawn from the current account.

Next, the director pays off the account with the funds received. Let us immediately make a reservation that the debt in this case does not disappear anywhere. It simply “moves” to another line of the balance sheet. The loan agreement can be drawn up for any period. Since the agreement is interest-based, that is, there is an economic benefit for the organization, the inspectors, as a rule, do not have any questions.

In the future, the organization can forgive the debt to the director.

Is it possible to write off accountable amounts without supporting documents?

Against the background of the rules set out above, the question of how to write off accountable amounts without documents does not require an answer. Writing off accountable amounts without supporting documents is impossible, since such an operation does not correspond to the very essence of issuing funds for employee actions carried out in the interests of the employer and at his expense.

When the question of failure to submit an advance report arises in relation to accountable funds issued to the director of an organization, it is worth remembering that the director, signed under an employment contract and receiving wages at the place of work, is also considered an employee, and is subject to the same and any other member of the workforce is subject to the obligation to submit a report on the expenditure of funds received by him for reporting. Therefore, before asking the question of how to write off the director’s accountable amounts, you need to find out from him whether he can submit documents to the accounting department about the use of the money given to him.

Forgive debt

Debt forgiveness is formalized through a gift agreement. The amount of forgiven debt is subject to personal income tax. When withholding tax, 4 thousand rubles are deducted from the amount of debt if the director did not receive gifts from the company earlier this year (Clause 28, Article 217 of the Tax Code of the Russian Federation). Tax is withheld upon the next payment of income in cash.

Please note that the director receives income in the form of a forgiven debt under a gift agreement within the framework of civil law, and not labor relations. Consequently, such income cannot be subject to insurance premiums (clause 4 of Article 420 of the Tax Code of the Russian Federation).

However, tax authorities can check debt forgiveness transactions for validity and frequency. If you use this method systematically and without reason, then you will no longer be able to avoid the consequences in the form of charging insurance premiums.

Example: the director’s debt is 200 thousand rubles. On the date of signing the gift agreement, the director has taxable income. Personal income tax:

(200 thousand rubles - 4 thousand rubles) * 13% = 25.48 thousand rubles.

The amount of forgiven debt is not taken into account in the organization’s expenses.

Taxcom gives new clients an annual 50% discount on Online Sprinter electronic reporting when switching from competitors. Change your operator to your advantage.

Connect

Pay dividends and pay off debt with this amount

If your director is a founder, and at the end of the reporting period the organization made a profit, you can pay off the account through dividends.

Important: if you are going to pay dividends to the owner of the LLC before the end of the year (for example: based on the results of the quarter), you first need to make sure that the possibility of paying interim dividends is fixed in the company’s charter.

We draw up a protocol of the founders (the decision of the sole founder) and a certificate of accrual of dividends.

We transfer the amount due for payment to the director - participant of the LLC within the prescribed period. Next, the director again deposits the funds into the cash register or into the organization’s account as a return of the report.

Dividends are subject to personal income tax at a rate of 13% up to an amount of 5 million rubles, and 15% from the excess amount.

Example: the amount of accrued dividends is 200 thousand rubles. Personal income tax payable will be: 200 thousand rubles. * 13% = 26 thousand rubles.

There is no need to pay insurance premiums. Dividends cannot be included in the income tax base or the simplified tax system.

How to correctly reset the director’s report?

The director’s report, like any other accountable employee, can be written off in any amount to reduce income tax (attributed to expenses according to the simplified tax system) and without paying personal income tax and/or contributions to the budget. But this is possible provided that the issued account is spent only on the needs of the company, and the accounting department promptly receives documents confirming the intended use of the accountable amounts (cash and sales receipts, invoices, etc.).

Let us assume that according to Dt 71 at the end of the next month the amount issued to the director for reporting has accumulated in the amount of 700,000 rubles. There are no supporting documents and advance reports for this amount and their appearance is unlikely.

If you act according to the rules of the Tax Code of the Russian Federation, then this amount should be taken into account as the director’s income with the payment of the following taxes and contributions:

- Personal income tax - 91,000 rubles. (700,000 × 13%);

- insurance premiums - 211,400 rubles. (700,000 × ).

In total, the director will have to pay 302,400 rubles to the budget from the income received by the director.

The amount of 911,400 rubles can be reduced for income tax. (700,000 + 211,400). This means that the income tax payable will be RUB 182,280 less. (911,400 × 20%).

In general, from an accountable amount of 700,000 rubles. you will pay taxes and fees in the amount of 120,120 rubles. (302,400 – 182,280). And if the organization has no profit, then it will have to pay all 302,400 rubles.

Let us now consider how much taxes will have to be paid if we use other methods of zeroing out reporting.

Buy from the director of goods and materials

You can buy inventory items from the director: table, chair, cabinet, laptop, spare parts, equipment, building materials for repairs, etc. Or maybe your company already uses the director’s property, which is not accounted for anywhere. It's time to get this right.

We draw up a purchase and sale agreement and a transfer and acceptance certificate. Or we draw up a procurement act that replaces both of these documents (form No. OP-5 or a self-developed form with all the necessary details). We pay the director the value of the property, and then he uses these funds to pay off the suspended account.

The director must pay personal income tax on the cost of the property sold independently. In this situation, the organization does not act as a tax agent. However, if this property was owned by the director for more than 3 years, or its value does not exceed 250 thousand rubles. - then he will not have to pay tax or file a 3-NDFL declaration (law dated 07/02/2021 No. 305-FZ).

In this case, the organization has the right to take into account purchased inventory items in expenses.

Example: the director sold the company 10 office chairs, 2 tables, a copy machine, 2 laptops, 2 grinders and building materials for repairing a workshop for a total amount of 200 thousand rubles. The purchase was formalized by a procurement act. The director is not obligated to report to the tax office and pay tax. An organization may expense the cost of the undervaluation.

Method 2. Calculation of compensation for the use of the director’s property

Who can apply: no restrictions.

The procedure for resetting the report: make a reasonable calculation of the amount of compensation for the use of the director’s property, the costs of which can be taken into account in the company’s activities. For example, his car. To do this, ask the director for documents showing how much he spends on servicing his car per year (month, quarter). Then, on behalf of the director, fill out an application for compensation of expenses for using the car and enter in it the calculated amount for servicing the car. Record the following transactions in accounting:

| Operation | Dt | CT | Amount, rub. |

| Return subreport (fictitious) | 50, 51 | 700 000 | |

| Calculation of compensation | 20, 26, 44 | 700 000 | |

| Payment of compensation (fictitious) | 50, 51 | 700 000 |

Amount of taxes and contributions payable: RUB 0.00. There is no need to pay personal income tax or insurance premiums. But only subject to sufficient documentary justification for the payment of compensation for property (Article 188 of the Labor Code of the Russian Federation, paragraph 3 of Article 217 of the Tax Code of the Russian Federation). Expenses for compensation for the use of personal transport can only be attributed to the reduction of income tax in the amount of 600 to 1,500 rubles. per month (Resolution of the Government of the Russian Federation “On establishing standards for expenses for compensation for the use of personal transport” dated 02/08/2002 No. 92).

Advice: the amount of compensation must be real, i.e., commensurate with market ones. When preparing documents, make sure that they do not contain the word “lease”. The director will have to pay personal income tax on the income received by the director from renting property.

Write off part of the expenses for entertainment expenses

Subject to the availability of primary documents, it is possible to reclassify meals in restaurants, delivery of guests to the venue of the event and back as conducting business negotiations in the interests of business.

Let's say right away that you will need a lot of documents. If the amounts are scanty, then the time spent on paperwork will not justify itself.

In particular, you may need:

- regulations on representation expenses in the organization;

- order (instruction) on the costs of such activities;

- estimate of entertainment expenses;

- a report that should reflect: the purpose of the event, date, time and place of the event, the program of the event, the result of its implementation.;

- minutes of the meeting;

- participant registration log, etc.

Entertainment expenses can be taken into account in income tax expenses, but only within the limits of the standard: no more than 4% of the wage fund for the reporting (tax) period (clause 2 of Article 264 of the Tax Code of the Russian Federation).

Representation expenses cannot be included in expenses under the simplified tax system, since these expenses are not in the closed list of clause 1 of Art. 316.16 Tax Code of the Russian Federation.

Restoring copies of supporting documents

If documents have been lost, you need to try to restore all possible papers that directly or indirectly confirm the costs incurred (clause 1 of Article 252 of the Tax Code of the Russian Federation), and also draw up an advance report, attaching to it:

- an explanatory note in which it is necessary to indicate the dates, names and amounts of purchases, and also state the situation that caused the loss of the primary documentation;

- copies of documents requested again from the counterparty: duplicates of PKO receipts, copies of the cashier’s z-report on the date of purchase, collected cash and sales receipts for the purchase, etc.

Read more about such situations in our publication “An accountable person has lost a cash receipt - what to do?”

Three useful tips at the end

1. Do not try to write off the sub-account amount at once; it is better to do it in parts.

2. Try not to deposit the full amount of the previously issued sub-report into the cash register; at least part of it is worth spending.

Otherwise, inspectors may charge personal income tax on material benefits for interest-free use of funds.

3. To the best of your ability, fight the regular practice of spending the organization’s money for personal purposes. This is an extremely difficult task, but it is important to convey to the manager that thoughtless expenses cause damage to the organization and are fraught with sanctions from the tax inspectorate.

Results

When resetting large director reports to zero, you should not use just one method and write off the entire amount in 1 day. Avoid situations where the full amount of a previously issued sub-report is returned to the company’s current account or its cash desk. Especially if it was issued in large quantities and for quite achievable goals. It is necessary that at least part of this subaccount be spent. Otherwise, the possibility of accrual of personal income tax on material benefits for the interest-free use of accountable funds cannot be excluded.

The best option for resetting a sub-report is to write off the sub-report evenly over several months (possibly years) using all the methods suggested above.

Despite the fact that there are many opportunities to reset the reporting, we strongly advise you to combat the practice of uncontrolled spending of money by management using the language of numbers and a visual representation of the losses that the company incurs in connection with the actions of the director. To do this, you should periodically prepare a calculation of taxes associated with accountable amounts in 2 comparative versions: if the director reports on accountable amounts and if he does not do so. Present this calculation to the director as a proposal for tax optimization (you can enter other items into this calculation, except for the sub-report, so that your actions are not perceived edifyingly by the director). In this way, you can gradually achieve the timely provision of documents on issued sub-reports and prevent a further increase in unconfirmed sub-accountable amounts.

How to close accountable funds?

Let's consider a classic case. Funds were withdrawn from the organization's current account under the director's report.

Withdrawing funds on a report is one of the easiest and most ancient ways to cash out. But it's dangerous. During an on-site tax audit, these amounts may be subject to personal income tax (NDFL) and insurance premiums. Therefore, the mandatory conditions for using accountable funds are:

- return of unspent funds to the organization’s cash desk and bank;

- mandatory documentary evidence of expenses incurred - in the form of a universal transfer document (UDD), delivery note, sales receipt and online cash register receipt.

Convert an accountable debt into a loan

Suitable for: All companies.

Re-issuing a sub-account as an interest-free loan will not require large financial and labor costs, but will not completely solve the problem with the stuck debt. It will only be possible to postpone her decision for a while. After all, sooner or later the director will still have to return the money to the company that he received under the loan agreement.

Another minus. With an interest-free loan, there will be a material benefit from savings on interest that the director would have to pay if, for example, he took out a loan from a bank (subclause 1, clause 1, article 212 of the NKRF). From the amount of this material benefit you will have to calculate and pay personal income tax to the budget at a rate of 35 percent.

Carefully! A frozen report can be converted into a loan. But if it is interest-free, then personal income tax must be withheld from material benefits at a rate of 35 percent.

Of course, you can take out an interest-bearing loan, and set the interest so that the employee does not have any material benefit. But this is an even more time-consuming option, because you will need to document and record not only the loan amount, but also the accrual and payment of interest. In addition, the organization receives income in the form of interest on the loan, on which it is necessary to pay income tax.

As for the form of payment, the safe option here is to transfer the loan to the director by bank transfer, and he will then pay off his accountable debt with this money.

Example 2: How to replace a reporting debt with a loan agreement

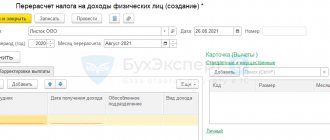

The director's debt to the company for accountable funds is RUB 92,000. They decided to convert this debt into the director’s debt on an interest-free loan. The accountant made the following entry in the accounting:

Debit 73 subaccount “Settlements on loans provided” Credit 51

- 92,000 rub. — a loan was issued to the director;

Debit 51 Credit 71

- 92,000 rub. - the advance was returned by the accountable.

You can do it differently: first give the director a loan from the cash register, and then he will return the money to the company in cash. But there are many restrictions. A loan can be issued to a manager only from cash withdrawn from the current account, and not from cash proceeds (clause 4 of Directive No. 3073-U). In addition, it is safer that the amount of accountable debt returned in cash to the cash desk does not exceed 100,000 rubles. Paragraph 6 of Directive No. 3073-U directly states that the 100 thousand limit does not apply to amounts issued to employees on account. But for accountables returned to the company’s cash desk, there is no such clause.

Sooner or later, the loan agreement will expire. That is, the director will again have a debt to the company. In such a situation, there are two options, but they come with tax risks.

First, you can extend the loan term indefinitely. This will allow you not to pay either personal income tax or contributions. But the company may be accused of hiding the director's taxable income.

The second is to write off a loan not repaid on time after three years as bad. Here, inspectors may doubt that the company was unable to retain the debt from its own director. And they will decide that the debt has actually been forgiven. This means that you have to pay personal income tax (letter of the Federal Tax Service of Russia dated October 11, 2012 No. ED-4-3/17276) and contributions (letter of the Ministry of Health and Social Development of Russia dated May 17, 2010 No. 1212–19).