Procedure

Registration of conservation is regulated additionally for budgetary and state enterprises.

This procedure is less strict for commercial firms.

The process consists of the following steps:

- Stage 1. Decision making

The decision is made by an authorized employee of the organization. If management has the right to make such decisions, the document is replaced by an order to transfer the OS to conservation.

- Stage 2. Drawing up an order

After making a decision, the head of the enterprise issues an order.

The order specifies:

- list of conserved objects;

- causes;

- deadlines;

- OS translation activities;

- a commission is created - persons responsible for the conservation and then re-preservation of the OS;

- responsible for the storage and condition of objects.

Persons responsible for carrying out the procedure must familiarize themselves with the order.

The list of activities makes it possible to justify the economic feasibility of costs. This is considered one of the criteria for accepting expenses when calculating income tax. The deadline will help stop accrual of depreciation on fixed assets.

- Stage 3. Carrying out an inventory of conserved objects

One of the main activities carried out before canning OS is inventory. This procedure allows you to check the presence, condition and completeness of the property.

- Stage 4. Conservation of assets and drawing up an act

After preliminary work, an act of transferring the OS for storage is drawn up. The act is signed by the commission and the head of the enterprise.

- Stage 5. Reflections in accounting

After completing all the necessary documents, the transfer of the object is displayed in accounting.

Fixed assets in storage are accounted for in a special subaccount. A special mark is placed on the inventory card.

- Stage 6. Storage and maintenance of mothballed fixed assets

Specially appointed persons are responsible for the safety of mothballed objects.

Current costs form the expenses of the enterprise. Amounts are recorded in current periods.

- Stage 7. Extension of preservation

To extend the conservation period of objects, a separate order is issued.

Accounting

When preserving a fixed asset for a period of no more than three months, calculate depreciation on it. If a fixed asset is mothballed for a period of more than three months, then suspend depreciation on it. In this case, resume depreciation after reactivation of the fixed asset. This procedure is established in paragraph 23 of PBU 6/01 and paragraph 63 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

For accounting purposes, extension of the useful life in connection with the conservation of a fixed asset for a period exceeding three months is not provided. However, in accounting, depreciation can be calculated even after the end of its useful life (clause 22 of PBU 6/01). Therefore, after re-preservation, depreciation on the fixed asset is calculated in the order that was in effect before the start of mothballing.

Situation: at what point in accounting should you stop and then resume depreciation on a fixed asset transferred to conservation for a period of more than three months?

The month from which the accrual of depreciation for accounting purposes stops and resumes must be established independently by the organization. The chosen option for suspending and resuming the calculation of depreciation should be reflected in the organization’s accounting policies for accounting purposes.

For accounting purposes, the specific moment of termination and resumption of depreciation on fixed assets transferred to conservation for a period of more than three months is not established by law. The organization determines the procedure for conservation independently (paragraph 2, clause 63 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

You can specify one of the following options in your accounting policy:

- depreciation is suspended from the 1st day of the month in which the fixed asset was transferred for conservation. And it is renewed - from the 1st day of the month in which the main asset was re-opened;

- depreciation is suspended from the 1st day of the month following the month in which the fixed asset was transferred for conservation. And it is resumed from the 1st day of the month following the month in which the main asset was re-opened.

An example of suspending depreciation of a fixed asset transferred to conservation

CJSC Alfa decided to mothball the equipment for the period from June 23 to November 26. The accounting policy of the organization for accounting purposes states that when mothballing objects for a period of more than three months, depreciation is calculated:

- suspended from the month following the month of the start of conservation;

- resumes from the month following the month of removal from conservation.

The estimated conservation period exceeds three months. Therefore, based on the order of the manager, Alpha’s accountant stopped accruing depreciation on mothballed objects from July 1. Depreciation was resumed on December 1 after the facilities were re-opened.

Advice: in your accounting policy for accounting purposes, establish the same procedure for stopping and resuming depreciation on fixed assets mothballed for a period of more than three months, as in tax accounting. In this case, temporary differences will not arise in the organization’s accounting, leading to the formation of a deferred tax liability.

The organization is obliged to keep records of fixed assets according to the degree of their use:

- in operation;

- in stock (reserve);

- for conservation, etc.

This is stated in paragraph 20 of the Methodological Instructions, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Accounting for fixed assets by degree of use can be carried out with or without reflection on account 01 (03). Thus, when mothballing for a period of more than three months, it is advisable to account for fixed assets in a separate sub-account “Fixed Assets for Conservation”. This approach is consistent with paragraph 20 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

Debit 01 (03) subaccount “Fixed assets in conservation” Credit 01 (03) subaccount “Fixed assets in operation” - fixed assets were transferred to conservation.

After reactivating the fixed asset, make the following wiring:

Debit 01 (03) subaccount “Fixed assets in operation” Credit 01 (03) subaccount “Fixed assets in conservation” – the fixed asset has been reactivated.

When carrying out conservation and re-preservation of fixed assets, the organization may incur expenses. For example, material costs (various lubricants and packaging materials), costs for dismantling and installing equipment, etc. Costs for conservation and re-preservation, as well as costs for maintaining mothballed fixed assets, should be reflected in accounting as part of other expenses:

Debit 91-2 Credit 10 (23, 60, 68, 69, 70...) – expenses for conservation, re-preservation and maintenance of mothballed fixed assets are taken into account.

This procedure follows from paragraph 11 of PBU 10/99, Instructions for the chart of accounts (account 91) and letter of the Ministry of Finance of Russia dated January 13, 2003 No. 16-00-14/7.

An example of reflection in accounting and taxation of conservation of fixed assets. Depreciation is calculated using the straight-line method.

In July, by order of the head of OJSC “Proizvodstvennaya”, the production line was placed on mothballing for 4 months. The initial cost of the production line is RUB 780,000.

“Master” applies the accrual method and pays income tax quarterly. Accounting and tax accounting data are the same. Master calculates depreciation in accounting and tax accounting using the straight-line method. The organization does not perform operations that are not subject to VAT.

In July, Master's expenses for work on mothballing the production line amounted to:

– 500 rub. – material costs (various lubricants and packaging materials);

– 1000 rub. – wages of employees who carried out work on the conservation of the production line (including contributions to compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases).

In November, the production line was reopened. “Master”’s expenses for carrying out the re-preservation work consisted of the salaries of the employees who carried out the work on the preservation of the production line (including contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases) in the amount of 1000 rubles.

From August to November, Master's accountant did not accrue depreciation on the mothballed production line in accounting and tax accounting. Since December, the accountant has resumed calculating depreciation on the production line. Both before and after conservation, the monthly amount of depreciation deductions for accounting and tax accounting purposes amounted to 13,000 rubles.

The Master's accountant made the following entries in the accounting.

In July:

Debit 01 subaccount “Fixed assets in conservation” Credit 01 subaccount “Fixed assets in operation” – 780,000 rubles. – the production line was mothballed;

Debit 91-2 Credit 10 (70, 69) – 1500 rub. (1000 rub. + 500 rub.) – the costs of carrying out work to preserve the production line are taken into account;

Debit 25 Credit 02 – 13,000 rub. – depreciation has been accrued on the production line.

In November:

Debit 01 subaccount “Fixed assets in operation” Credit 01 subaccount “Fixed assets in conservation” – 780,000 rubles. – the production line was reactivated;

Debit 91-2 Credit 70 (69) – 1000 rub. – the costs of work on reactivating the production line are taken into account.

December:

Debit 25 Credit 02 – 13,000 rub. – depreciation has been accrued on the production line.

The input VAT on the cost of materials used in the conservation work of the fixed asset was accepted for deduction by the Master's accountant.

Master's accountant took the residual value of the mothballed production line into account when calculating property taxes.

The accountant reduced the tax base for income tax by the costs of performing work on mothballing and re-mothballing the production line:

– 1500 rub. (1000 rubles + 500 rubles) – taken into account when preparing the income tax return for nine months of the current year;

– 1000 rub. – taken into account when preparing the income tax return for the year.

In addition, when preparing the income tax return, the accountant took into account depreciation charges for the production line.

Documenting

Correct documentation is the main condition for recognizing costs when calculating corporate income tax.

Two main documents for formalizing the conservation of OS: an order and an act.

Sample order

The order to transfer OS for storage is signed by the management of the enterprise.

The document states:

- reasons for transfer;

- term of transfer for preservation;

- staff responsible for conservation.

After all measures have been taken, a certificate of transfer of objects for storage is drawn up.

order for conservation of fixed assets – word.

How to draw up a deed?

An act for recording is drawn up after conservation has been completed. The document is not necessary and is carried out at the request of management.

The act is signed by the commission members and the director. It contains the following data:

- a complete list of conserved objects;

- exact start date of the procedure;

- measures taken to transfer fixed assets to conservation;

- expenses.

After signing by the management of the enterprise, the act becomes the main document for:

- accounting for canning costs in expenses;

- suspension of depreciation for objects that are in storage for more than three months.

There is no specific established form for drawing up an act and an order. They are performed in any form.

act on conservation of OS - word.

Depreciation on mothballed fixed assets

The gradual decrease in the value of a company's fixed assets, associated with wear and tear, through the monthly inclusion of part of its cost in the cost of production, is called depreciation.

After conservation, fixed assets continue to be included in the fixed assets of the enterprise. If the period exceeds 3 months, the object is removed from the list of depreciable objects.

Depreciation stops accruing on the first day of the month. Accrual is suspended one month after the order is published.

One of the main goals of conservation is to temporarily stop the calculation of depreciation.

In accounting, the length of time during which fixed assets are stored does not affect the time of its useful use.

According to accounting law, depreciation can be calculated even after the end of its useful life.

Consequently, after reactivation, accrual can continue in the same amount until the cost is fully paid off.

Depreciation of fixed assets during the conservation period

For assets mothballed for three months or less, depreciation during the mothballing period is accrued in the usual manner.

For fixed assets mothballed for a period of more than three months from the first day of the month following the month of transfer to mothballing, depreciation is stopped.

The period during which the property is mothballed (even if it exceeds a three-month period) will not affect its useful life in relation to accounting.

After reactivation of objects, depreciation can be continued in the same manner until their cost is fully paid off.

Thus, from the first day of the month following the month in which the asset was re-mothballed, depreciation is resumed in the same amount as before mothballing.

Accounting and postings

After the management signs the order and approves the act, the OS is transferred to canning.

After conservation of fixed assets, they remain listed in accounting as part of fixed assets in account 01.

Fixed assets that are in storage are accounted for in one account, along with exploited fixed assets.

To ensure correct accounting, in the enterprise’s chart of accounts it is necessary to provide for the “Fixed Assets” account, a subaccount “Fixed Assets for Conservation”.

When transferring equipment, entries are made to transfer their value from the main sub-account, where fixed assets are accounted, to the sub-account for accounting for mothballed objects - D 01 “OS for conservation” K 01.

During depreservation, reverse wiring is performed.

Consequences of conservation

Conservation is a voluntary procedure. Even if you do not use your building, equipment or vehicle for the needs of the organization, and they become covered with dust, the tax authorities cannot oblige you to carry out this procedure.

This begs the question - if the law does not oblige you to re-register the status of an unused asset, why do you need the extra hassle? Let it sit until you need it again. Only benefits that will significantly outweigh the inconvenience and expense of it can persuade you in favor of documentary conservation.

Each enterprise must calculate the pros and cons for its specific situation and decide which path will be economically justified.

Still, there are some general points:

| Paragraph | If you carry out conservation | If you do without conservation |

| Maintaining the main product | Pay less income tax . Costs for maintenance, security salaries, warehouse depreciation, heating, lighting can be classified as non-operating expenses, since the operating system is no longer used to generate profit. Consequently, the tax base can be reduced by the amount of these expenses when calculating income tax | Pay the same income tax as with the current operation of the OS. Without official conservation, all expenses for this OS will be recognized as expenses for the main activities of the company. Therefore, you will not be able to reduce the tax base by the amount of these expenses when calculating profit |

| Depreciation | Not credited . When mothballing lasts three months or more, depreciation charges stop. Depreciation is resumed when the fixed assets are re-preserved and is completed until all fixed assets are depreciated. The basis for calculating property tax is not reduced, since the residual value of fixed assets is not reduced due to depreciation | Accrued every month based on the useful life. Thus, the base for calculating property tax decreases every month - that is, you pay less and less for a specific OS. And at the same time, we have to reckon with sometimes significant monthly expenses due to depreciation |

| Useful life | Extends over the depreciation period. If, after reactivation, it turns out that the SPI has expired, then depreciation on the object will still be charged, and the SPI will actually be extended for this period. The inconvenience is that, despite the absence of physical wear and tear, there is still moral wear and tear, and such “freezing” will make the OS even older and sometimes unusable due to moral obsolescence | It goes on as usual until it ends. The SPI for a specific OS is approved by the organization itself, but within the time frame for each depreciation group prescribed by law in the Classification |

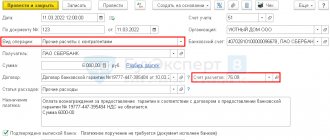

| Reflection in 1C | Subaccount and ticks on depreciation . For convenience, it is customary to add a subaccount 01.1 fixed assets for conservation to the synthetic, that is, general account 01 Fixed Assets. 1C allows you to disable the calculation of depreciation on fixed assets by checking the box “Affects the calculation of depreciation” in the “Preservation” section in the event directory | Accounting is carried out without OS segregation . In 1C, by default, depreciation is charged on the OS |

Tax accounting

The company pays both transport tax and property tax on mothballed property.

If the company is on the general taxation system, the amount of contributions is reduced by this amount.

There is no need to reinstate value added tax.

But, in some cases there is such a need:

- The company switches to another method of taxation.

- Fixed assets in storage are transferred to the authorized capital of another enterprise.

- The property, after reactivation, will be used in work that will not be subject to value added tax.

In all of the above cases, it is necessary to have primary documentation and then restore the value added tax.

Reasons for preserving the OS

This event is used, for example, in the following cases:

- The end of seasonal work, when the facilities cannot be used at other times (snow removal equipment, harvesting machines);

- Temporary downtime in production (looms with a shortage of threads);

- Reduction in production due to economic realities (non-use of one of the workshops);

- Breakdown of an object and its transfer for repairs, including the absence of necessary parts (tractor repair due to malfunctions).

What does conservation actually mean?

To do this, you must provide an action plan in two directions:

- Actual conservation;

- Reflection in documentation and in the accounting program.

The first point includes all actions related directly to your main asset. While the property is idle, it must be kept safe and in good condition.

For example, in agriculture, special equipment is used to treat fields with herbicide. This equipment is needed only in spring and summer; in cold weather, it needs to be given a place in a closed hangar, the engine should be started periodically, and the hangar should be protected from thieves.

On the other hand, conservation must be recorded in documents - it is not enough just to actually stop using the property and put it under lock and key.

On the procedure for paying taxes when mothballing fixed assets

Conservation of an asset does not exempt an enterprise from paying transport tax (if the asset relates to vehicles); as for property tax, it also remains payable.

Now about VAT. If a company operates under OSNO and is a VAT payer, when purchasing OS, “input VAT” is deducted. This means that this amount of VAT allocated in the invoice from the supplier will ultimately reduce the amount of tax that needs to be paid to the budget.

For some operations with fixed assets, it is necessary to restore VAT, that is, still pay it to the budget, although before that it was accepted for deduction. This must be done, for example, when contributing OS to the authorized capital or when the organization switches to the simplified tax system.

All these cases are regulated by law, but conservation is not among them. Therefore, when preserving an OS, there is no need to look for primary documents with the specified VAT when purchasing an OS and transfer it to the budget.

What is conservation?

Conservation is understood as a set of actions for long-term storage of property, in particular fixed assets, in the event of termination, reduction, or change of production and economic activities by an enterprise with the possibility of their exploitation in the future if conditions change. Conservation is justified when the operation of fixed assets temporarily does not bring economic benefit to the business entity. The period of time for which objects can be mothballed cannot be more than 3 years.

Before starting the procedure, a project should be drawn up based on the recommendations of the commission.

Preservation period

By law, the minimum period for equipment preservation is three months, and the maximum is three years. Calculation begins from the date of approval of the document. If there is a need to extend the period, then the proposal for extension must be put forward no later than a month before the expiration of the conservation period. As for the re-preservation of equipment, the proposal is made no earlier than five months after re-preservation (resumption of operation of previously mothballed equipment).

What property can be conserved?

If the property is classified as fixed assets - that is, it is reflected in account 01 - conservation can be carried out.

Let us remind you that not all company property can be classified as OS.

To do this, four conditions must be met:

| Condition No. | The essence | Examples. Yes – the condition is met (applies to the OS), no – it is not met, does not relate to the OS |

| 1. | The object is used in production, rented out, needed for work or services, and is also involved in management | Yes: company car. Needed in management - transports the manager for official needs No : a marble monument on the territory of the enterprise, left over from the previous owners |

| 2. | The object has been in use for longer than one year | Yes: the building in which the company is located No : product packaging |

| 3. | The company does not intend to resell the property | Yes: computers for office workers No : a batch of computers purchased by the company for sale |

| 4. | The facility may bring economic benefits in the future | Yes: perennial fruit trees (for fruit sales) No : annual plantings to decorate the area |

Examples of fixed assets: houses, structures, transport, tools, office equipment, household equipment, land, water, subsoil.

The following do not apply to fixed assets: finished products, materials and goods in stock. Materials or objects in transit or during installation.

No one is conserving natural resources (land, water, subsoil), which is easily explained: according to the law of the Russian Federation, depreciation is not charged on these objects. Since fixed assets are often preserved in order to suspend depreciation charges, this reason does not apply in this situation.

Why aren't natural resources depreciated? It is believed that they can be used endlessly and will not “wear out”, although in fact they can become depleted with active use.

What documents should I submit?

Documentation of the property conservation process has the following features:

- the manager’s order must contain information about the reasons, the period of conservation, the composition of the commission responsible for this action, as well as a list of employees responsible for the safety of the object during conservation;

- the act of transferring a fixed asset for conservation does not have any unified form, so the enterprise needs to develop it independently and consolidate it in its accounting policies;

- the enterprise needs to develop a form of depreservation act, which will be needed when the conservation period ends.

With simplified tax system

The costs of conservation, re-preservation, as well as the maintenance of the operating system are not taken into account in the tax expenses of the “simplified people”. If an asset is transferred to “freeze” for a period of more than three months, the cost of which has not yet been fully taken into account in expenses, then the inclusion in expenses of the cost of acquiring this asset is suspended for the period of conservation (letter of the Federal Tax Service of Russia dated December 14, 2006 No. 02-6-10 / [email protected] , Federal Tax Service for Moscow dated January 18, 2007 No. 18-03/3/ [email protected] ).

EXAMPLE

An organization acquired production equipment under a sale and purchase agreement and put it into operation in May 2016.

Its contractual cost is 944,000 rubles. (including VAT RUB 144,000). The equipment belongs to the third depreciation group. The useful life is 38 months (based on the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1). Due to a temporary decrease in orders at the end of May 2016, the asset was transferred by decision of the manager for conservation lasting more than three months from June 1 to September 30, 2016. Depreciation is calculated using the straight-line method. Income and expenses are determined using the accrual method. Then, based on the established useful life (38 months), the monthly amount of depreciation charges will be 21,052.63 rubles. (RUB 800,000 / 38 months). Accrual begins on the first day of the month following the month the object was accepted for accounting, in this case, June. At the same time, the accrual of depreciation charges when transferring an asset by decision of the manager to conservation for a period of more than three months is suspended. In this case, by decision, the object was mothballed from June 1 to September 30, 2016. Consequently, depreciation for the period June – September 2016 is not accrued. And starting from October, depreciation on fixed assets is accrued in the generally established manner. The accountant should make the following entries in the accounting: In May 2016: Debit 08 Credit 60

- 800,000 rubles, expenses for the purchase of equipment are reflected;

Debit 19 Credit 60

- 144,000 rubles, VAT presented by the equipment supplier is reflected;

Debit 68-VAT Credit 19

- 144,000 rubles, accepted for deduction of VAT presented by the equipment supplier;

Debit 01 “OS in operation” Credit 08

- 800,000 rubles, purchased equipment is reflected as part of fixed assets;

Debit 60 Credit 51

- 944,000 rubles, payment for equipment was transferred to the supplier.

In June 2016: Debit 01 “Equipment in conservation” Credit 01 “Equipment in operation”

- 800,000 rubles, reflects the initial cost of equipment transferred to conservation.

Upon completion of conservation: Debit “Assets in operation” Credit 01 “Assets in operation”

- 800,000 rubles, the initial cost of the equipment is reflected as part of the fixed asset in operation.

Starting from October 2016 for 38 months: Debit 20 (26.44) Credit 02

- 21,052.63 rubles, depreciation on equipment was accrued.

Period of termination and restoration of depreciation

The period from which depreciation deductions are terminated or, conversely, restored, in accounting is determined by the organization at its discretion. But the chosen method must be recorded in the accounting policy of the enterprise. The legislation does not contain specific instructions on when to stop or resume calculating the depreciation of property after conservation.

Options for calculating depreciation of fixed assets for conservation

| Depreciation cut-off date | Accrual renewal deadline | |

| 1 option | in the month when the property was transferred to conservation | in the month when the property was reactivated |

| Option 2 | in the month following the date of conservation of the property | in the month following the day when the object was reactivated |

When making a choice in favor of one or another calculation method, you should take into account that it is more convenient when accounting and tax accounting in an enterprise are as close to each other as possible. To prevent temporary differences from arising subsequently, the rules for calculating depreciation of property in accounting must be the same as for calculating income tax payments, that is, according to the second version of the table.