Definition of two types of accounting

The definition of NU is contained in Article 313 of the Tax Code of the Russian Federation. This is a structure for collecting information necessary to establish the tax base. When establishing this base, a primary is used, combined into groups based on the rules of the Tax Code of the Russian Federation. If a company uses a general taxation system, accounting is carried out to establish income tax.

How to take into account the differences between accounting and tax accounting according to PBU 18/02?

Accounting is the creation of a system of information about certain objects and operations. It is regulated by Federal Law No. 402 “On Accounting” dated December 6, 2011. The purpose of its existence is the formation of finance. reporting, on the basis of which one can draw a conclusion about the results of the company’s work. Accounting, unlike tax accounting, allows one to judge the results of a company’s functioning.

Accounting statements are a document on the basis of which decisions can be made.

For example, on the basis of accounting data, a decision is made on whether to issue a loan to a company. Reporting will be required to participate in competitions.

Financial statements may be requested by external users: creditors, partners, credit institutions, auditors. These users can only obtain a complete picture of the financial position of the company based on accounting data. Reporting is no less often used by internal users. These are managers, employees, founders. It is on the basis of accounting data that key management decisions are made.

Question: An organization buys goods, the cost of which, according to the contract, is expressed in euros, and payments are made in rubles at the official euro exchange rate established by the Bank of Russia on the day of payment. How to reflect these transactions in the buyer’s accounting and tax records if the euro exchange rate on the date of payment differs from the euro exchange rate on the date the goods were accepted for accounting and the goods are paid for in the month following the month they were accepted for accounting? The organization applies the accrual method for profit tax purposes. View answer

Already on the basis of the definitions of the two forms of accounting, one can understand the differences. Tax accounting is needed mainly for government agencies. It makes it easy to control your taxes. It is needed to track the timeliness of tax payments and their completeness. Reporting is generated on the basis of accounting. It is needed for third-party and internal users. On its basis, various decisions are made: from issuing loans to managing the company.

Accounting Objectives

In order to see the most reliable picture of the organization, its financial condition, the presence of assets and liabilities, it is necessary to analyze the situation using accounting (AC). It assumes the availability of systematized information about all objects. It is possible to judge the activities of an enterprise as a whole on the basis of the data obtained, which is often impossible to do using only tax accounting.

The information that accounting reveals is relevant to many stakeholders, both internal and external. Guided by the data obtained, business owners choose further development paths. Most management decisions are made using available accounting information.

This type of accounting is of great interest to external stakeholders. Investors and creditors attach particular importance to it. Assessing the current financial and economic condition of the organization, decisions are made on additional investments, issuance of loans, as well as further interactions with the enterprise in question.

There are several types of accounting - regular (in full compliance with current legislation) and simplified. The latter allows you to keep records in a lightweight mode, which is available to small businesses, non-profit associations and other organizations, if this complies with current legislation.

Differences between accounting and tax

The differences apply to almost all areas of accounting.

Revenue recognition

Recognition in accounting is regulated by PBU 9/99, established by Order No. 32 of May 6, 1999. Paragraph 2 of PBU 9/99 states that a company’s income is an increase in economic benefits based on the receipt of assets and coverage of liabilities. At the same time, the capital of the subject increases. Contributions from company participants/owners will not be considered income.

The definition of income within the framework of tax accounting is contained in Article 41 of the Tax Code of the Russian Federation. This is an economic benefit that is recorded when it can be measured. It must comply with Chapter 23 of the Tax Code of the Russian Federation.

Both definitions are closely related to the concept of economic benefit. But the laws do not define this term. It is only in the Concept of Accounting in a Market Economy (clause 7.2.1). In particular, this is the ability of objects to be a factor in the flow of money into the company. That is, benefit is an influx of money.

Classification of receipts

Income within accounting:

- Income from standard areas of the company's work. For example, this is money from the sale of goods, performance of services (clause 5 of PBU 9/99).

- Other income. Their list is contained in paragraph 7 of PBU 9/99. It is not exhaustive. That is, income not included in this list may be considered other. Examples of other income: rental of property, payment of penalties by partners, differences between exchange rates.

Income within the framework of NU:

- Income from the sale of services and property rights. The exercise of rights means the sale of goods both of one’s own production and those previously purchased in bulk.

- Non-operating income. A list of them is contained in Article 250 of the Tax Code of the Russian Federation. It is closed. This category includes, for example, income from equity participation.

Classification in accounting and NU has its differences and similarities. In both forms of accounting, revenue appears. However, the list of other income in accounting is open, and the list of non-operating income is closed.

Restrictions on revenue recognition

Let's look at the limitations within accounting. These are incomes that are not recorded as part of accounting and are specified in paragraph 3 of PBU 9/99. In particular, these are receipts from legal entities and individuals. For example, this is a returned loan that was previously given to the borrower.

Within the framework of the NU, income specified in Article 251 of the Tax Code of the Russian Federation is not recognized. This is income that came in the form of property and rights to it as part of the prepayment. For example, this is property that is collateral.

The restrictions in both forms of accounting are similar. The lists are closed.

Revenue recognition sequence

In accounting, the sequence of income recognition is regulated by Section 4 of PBU 9/99. Revenue is recognized only if the conditions contained in paragraph 12 of PBU 9/99 are met. If not all conditions are met, the funds are recognized not as revenue, but as accounts payable. Typically, accounting is done through accrual accounting. But if the subject can maintain simplified accounting, then he is allowed to use the cash method.

Within the framework of NU, the procedure for recognizing receipts is specified in Article 271 of the Tax Code of the Russian Federation.

IMPORTANT! The dates for recognizing the receipt of funds in different forms of accounting differ.

Difference between tax and accounting

Despite the similarity of operations, tax and accounting have many differences.

The main ones are as follows:

- Accounting tasks. Accounting is designed to provide the most complete and reliable information about the financial condition of an enterprise. Tax accounting allows you to determine the basis for calculating income tax.

- Regulatory and legislative acts that form the principles of accounting.

- The procedure for determining income and expenses. In the case of the same transactions, accounting and tax profits may differ significantly, although often the meanings of these concepts coincide.

Organizations are required to maintain both tax and accounting records. At the same time, not all business entities are required to use accounting. We are talking about individual entrepreneurs. In relation to them, there is no need to determine accounting profit. All income of an entrepreneur after paying mandatory payments is his personal, which he has the right to dispose of completely at his own discretion.

When determining income and expenses, one of the following methods is used:

- Accrual method. Reflects the very fact of the transaction. It does not matter whether these actions were actually paid for by the enterprise itself or its counterparties. In the absence of payment, accounts payable or receivable are formed.

- The cash method assumes that the fact of income or expenses appears after the actual payment or receipt of funds.

Organizations have the right to use both methods in accounting and accounting. But some restrictions apply. For example, the cash method in accounting is not available to everyone. Small businesses and non-profit organizations with a social orientation have the right to use it. However, traditionally the accrual method is still the most convenient and widespread. It is used by most companies, even those conducting simplified accounting.

Almost the same rules apply to tax accounting. The main method of determining profit here is the accrual method. Income and expenses are determined by cash method for persons on preferential tax regimes and small businesses with low turnover.

The formation of the accounts in question is regulated by various legislative acts. For accounting purposes, the main law is the “Accounting Law”, PBU Regulations, and other regulations. The definition of transactions in terms of tax accounting is subject primarily to the Tax Code of the Russian Federation, as well as other documents, clarifications, and letters from departments such as the Ministry of Finance.

Table. Main differences between accounting and tax accounting

| Accounting | Regulatory acts | Who applies | Recognition of income and expenses | Definition of depreciation of fixed assets | Creation of reserves |

| Accounting | Law on Accounting, PBU | Organizations | Accrual or cash method | All ways | Creation of reserves for doubtful debts is a right for accounting purposes |

| Tax | Tax Code of the Russian Federation | Organizations and individual entrepreneurs | Accrual or cash method in accordance with the requirements of the Tax Code of the Russian Federation | Linear and nonlinear | Obligation to form certain reserves |

General conclusions

Information from NU and accounting may coincide. However, not all provisions coincide. In particular, recognition in tax accounting differs in a number of nuances. Let's look at all the differences:

- Classification. Income in accounting may include funds from participation in the capital of other entities, if this is the main activity of the company. If this is not the main area of work, then the funds will be considered other income. Within the framework of NU, funds from equity participation are always considered non-operating income. The provision on this is contained in paragraph 1 of Article 250 of the Tax Code of the Russian Federation.

- Scroll. The number of incomes that are not taken into account when establishing the tax base exceeds the number of incomes that do not need to be taken into account for accounting purposes.

- Date of recognition of funds. Accounting is carried out in standard situations through accrual. NU is performed in two ways: both cash and accrual.

IMPORTANT! Accounting can also be done using the cash method. However, this is only relevant for small businesses.

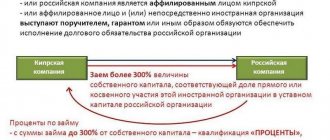

Accounting and tax accounting when determining profit

Despite the fact that the methods for determining expenses and income may be the same in accounting and tax accounting, the resulting discrepancies in determining profit arise quite often. This happens because not all expenses, according to the Tax Code, can be taken into account as reducing the tax base. The same applies to income.

Examples of non-NU expenses include the following:

- penalties, fines;

- amounts for excess emissions of pollutants;

- contributions for voluntary insurance, non-state pension provision;

- voluntary membership fees;

- costs of gratuitous transfer of property;

- others.

Income, the amount of which is not taxed, includes contributions from participants, property rights obtained in this way, and gratuitous assistance.

Differences in expense recognition

To recognize expenses, a certain list of conditions must be met. It will be different for accounting and NU. Let's consider the conditions for NU:

- Justification for spending.

- Availability of documentary evidence.

- Expenses are made for work that is needed to generate income.

List of conditions for accounting:

- Expenses were made on the basis of an agreement.

- The amount spent is certain.

- There are signs that the benefits will be reduced as a result of the operation.

If any condition is not met, then expenses cannot be recognized.

Comparison

The main difference between accounting and tax accounting is the purpose of preparation. In the first case, the work of generating reporting is carried out so that the company's management or interested parties have the opportunity to assess the financial condition of the company. Tax accounting, in turn, is needed to provide the relevant documents to the Federal Tax Service, which exercises control over companies’ compliance with the requirements of tax legislation.

The purposes of compiling accounting and tax accounting predetermine the remaining differences between them, which we noted above - related to the recognition of income, classification of expenses, features of legislative regulation of accounting, types of reporting entities, etc.

Having studied where the difference between accounting and tax accounting is most clearly visible, we will record its key criteria in the table.

Depreciation Features

Let's consider options for calculating depreciation based on the type of accounting:

- Accounting: linear, write-off according to the volume of goods, reducing balance method.

- Tax accounting: linear and nonlinear.

If different accrual methods are chosen when maintaining different forms of accounting, a difference is created.

Let's look at other features related to depreciation:

- Billing options. As part of accounting, depreciation is calculated on each item. Accrual begins on the date the item is accepted for accounting. When accruing within the framework of NU, the method specified in the accounting policy is used.

- Useful life. As part of accounting, SPI is determined by the company independently. In this case, a number of nuances are taken into account. For example, expected physical wear and tear. As part of tax accounting, SPI is determined on the basis of the OS Classification.

Discrepancies are possible in all of these areas.

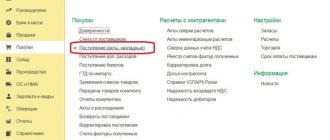

Tax accounting

To correctly calculate tax payments resulting from the determination of profit, tax accounting (TA) is used. The main users of this type of information are tax authorities. Based on tax accounting data, they monitor the completeness of cash receipts into the state treasury.

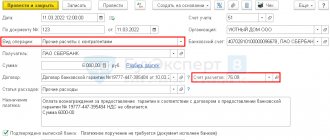

All registered business entities are required to maintain tax records. For completeness and reliability of data when maintaining tax accounting, primary documents, tax registers, and analytical accounting information are used.

When maintaining records of this type, increased requirements are imposed on the preparation of documents. And although almost all unified forms have now been cancelled, documents developed independently must contain all the required details confirming the fact of the transaction. These include the following:

- name of the form;

- date of document preparation;

- definition of operations;

- the presence of a cost and quantitative expression of the actions performed;

- signatures of responsible persons certifying the fact of transactions.

Differences in the formation of reserves

Discrepancies arise in these cases:

- Reserves for vacation pay. The procedure for creating a reserve in NU is not suitable for accounting.

- When creating a reserve for doubtful liabilities. If there is a delay, the company must create a reserve for doubtful liabilities in accounting. In NU, the creation of a reserve is the right of the company, and not its obligation.

FOR YOUR INFORMATION! The latest adjustments being made to the Tax Code of the Russian Federation are necessary, among other things, to bring the two forms of accounting closer together.

Tax Profit Facts

Tax profit is usually understood as the difference between income and expenses, which forms the tax base - if the company uses such systems for calculating fees, such as, for example, the simplified tax system according to the “income minus expenses” scheme or OSN. All those financial indicators that are subject to taxation constitute tax profit.

It may differ, in particular, from economic profit, which is the difference between actual income and expenses, reduced in some cases by the amount of opportunity costs.

It can be noted that in cases where a company’s expenses exceed income (and, accordingly, tax cannot be calculated based on the results of commercial activities), the organization’s financial specialists record a negative tax profit or tax loss.

Profit is always profit

So, income and expense transactions together provide the basis for calculating profit or, if problems arise in the business, loss. The object of accounting in NU and in accounting, as we see, is the same; the result of calculations is the financial result of the company’s work for the period.

Ultimately, tax accounting uses accounting documents and accounting registers to correctly determine the tax base; company analysts use the same data for financial analysis of business success for the reporting period, constructing other calculations based on profits, and determining more complex indicators.

How do the differences between accounting and taxable profit ?

The basic calculation formula remains unchanged: Profit = revenue – expenses.

From the above we can conclude that:

- in the vast majority of cases, both types of profit - tax and accounting - are calculated on the basis of the same data reflected in the primary accounting;

- As a result of calculations, in both cases a loss may be identified, in other words, tax and accounting profit may be negative.

Note ! Both types of profit are calculated without taking into account the so-called opportunity costs, in other words, lost benefits (profit) from the alternative use of financial investments. This indicator is not reflected in the primary accounting documents, therefore, it cannot be included in the calculation of real profit.