Types of property of a budgetary institution

According to paragraph 9 of Art. 9.2 of the Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ, all property of the BU is under its operational management, and the owner is the state. The table below discusses how a BU can manage its OS objects.

| Types of property | Property disposal rules |

| Real estate | |

| Any real estate | It is necessary to obtain the consent of the owner for any transactions with this property |

| Movable property | |

| Particularly valuable property transferred and assigned by the owner to the BU | It is necessary to obtain the consent of the owner for any transactions with this property |

| Particularly valuable property purchased with funds received from the owner of the used property | |

| Particularly valuable property purchased with funds earned by the BU independently in carrying out operations that generate income | Manages independently. Exceptions:

|

| Other movable property | |

Particularly valuable property is movable property that ensures the activities of the BU and in the absence of which the statutory activities will be carried out with significant difficulties (Clause 11 of Article 9.2 of Law No. 7-FZ). The list of especially valuable movable property is fixed by the founding body.

Recycling of computer equipment

Computer equipment contains various elements, including:

- substances hazardous to the environment, i.e., subject to the Law “On Waste” dated June 24, 1998 No. 89-FZ;

- precious metals - thanks to the precious “filling”, the decommissioned computer is subject to the Law “On Precious Metals” dated March 26, 1998 No. 41-FZ, as well as the instructions of the Ministry of Finance on the special accounting of precious metals.

Thus, computer equipment is one of the objects that cannot simply be thrown into a landfill when decommissioned. They must be handed over to a licensed specialist company for disposal. The disposal procedure should be indicated and approved in the set of documents for disposal.

NOTE! If, as a general rule, the process of decommissioning computers looks quite simple, then the need to attract a licensed company for disposal may entail the need for additional examination of the equipment by specialists of the recycling company.

Read about why waste control is required and how to fill out a waste inventory report here.

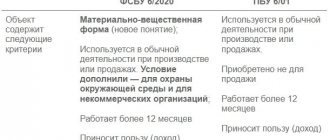

Rules for writing off fixed assets in budgetary institutions in 2022 -2021

Decommissioning of the OS can occur for the following reasons:

- The OS has lost its properties completely or partially and cannot function properly,

- The OS is no longer in use due to its destruction or loss.

The following are not grounds for writing off the OS:

- 100% depreciation of the asset;

- expiration of useful life;

- transfer of the OS into operation.

After the expiration of the useful life of a fixed asset, it is subject to write-off only if it is truly unsuitable for further use and its restoration is impossible or economically impractical (for example, if the cost of restoration exceeds the benefits that can be obtained from the use of this object).

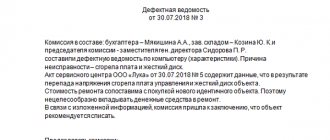

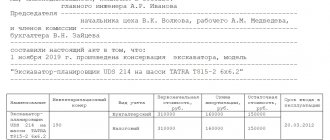

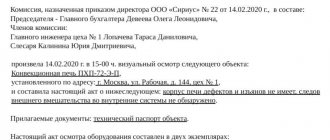

To write off fixed assets, an institution must organize a special commission that operates constantly to make decisions on such issues (clause 34 of the Unified Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n). The commission must draw up and approve the write-off act:

- non-financial assets (except for vehicles) (form according to OKUD 0504104);

- vehicle (form according to OKUD 0504105);

- soft and household equipment (form according to OKUD 0504143);

- excluded objects of the library collection (form according to OKUD 0504144).

These forms were approved by order of the Ministry of Finance of Russia dated March 30, 2015 No. 52n. These forms began to be used by BU in 2015 and continue to be used in 2020-2021.

The act must be agreed upon with the founder of the BU, if required by law. Next, the head of the accounting department endorses the act, after which actions are taken to uninstall, disassemble, liquidate the OS, and only after that the write-off is reflected in accounting on the basis of the act (clause 52 of the Unified Chart of Accounts).

A sample of filling out an act on write-off of fixed assets according to form 0504105 is available in ConsultantPlus. Get free demo access to K+ and download the document.

The list of documents that must be prepared by the commission to approve the disposal of fixed assets depends on who is the founder of the BU, that is, the owner of its property. If the BU is created on the basis of the property of a constituent entity of the Russian Federation or a municipality, then it is necessary to be guided by the legislative acts adopted by the relevant constituent entity or municipality.

If the property of the BU is federal, then the rules are established by the federal executive body to which the institution is responsible. The general document for accounting institutions managing federal property is the provision “On the specifics of writing off federal property”, approved by Decree of the Russian Federation dated October 14, 2010 No. 834, as well as the Procedure for submitting documents for approval of the write-off of federal property, approved by order of the Ministry of Economic Development and the Ministry of Finance of the Russian Federation dated March 10, 2011 No. 96/30n.

When auxiliary equipment is faulty

The monitor, keyboard, and mouse also fail. Among their faults there are also removable and irreparable ones.

The cause of monitor failure may be damage to the matrix, screen processor, etc. They can occur due to even a small impact, overheating of the monitor, moisture and dust getting into it.

The keyboard and mouse are particularly vulnerable, and therefore the most frequently replaced elements.

The most common causes of damage to the keyboard are sticking of contact groups and their oxidation, as well as combustion. This happens due to moisture getting into the equipment.

The mouse may become unusable due to failure of the infrared sensor, mechanical failure, etc.

Damage to auxiliary equipment can also occur due to a breakdown of the system unit.

The mechanism for writing off such computer components is similar to writing off a faulty system unit.

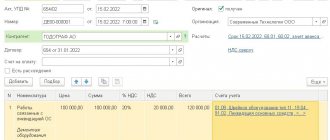

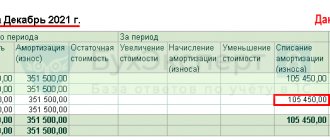

Accounting for write-off of fixed assets

Accounting entries for the disposal of fixed assets are given in paragraph 10 of the section “Non-financial assets” of the Instructions for the use of the budget chart of accounts, approved. by order of the Ministry of Finance of the Russian Federation dated December 6, 2010 No. 162n. Here are the main entries:

| Description | Dt | CT |

| Write-off of assets due to loss, shortage, destruction for reasons not related to natural disasters | 010400000 “Depreciation” (010411410–010413410, 010415410, 010418410, 010421410–010428410, 010431410–010438410, 010441410–010448410), 0 40110172 “Income from operations with assets” | 010100000 “Fixed assets” (010111410–010113410, 010115410, 010118410, 010121410–010128410, 010131410–010138410, 010141410–010148410) |

| Write-off of fixed assets in connection with emergencies and natural disasters | 010400000 “Depreciation” (010411410–010413410, 010415410, 010421410–010428410, 010431410–010438410, 010441410–010448410), 040120273 “Through extraordinary expenses on transactions with assets" | 010100000 “Fixed assets” (010111410–010113410, 010115410, 010121410–010128410, 010131410–010138410, 010141410–010148410) |

| Write-off of the OS for other reasons, including in connection with the decision of the commission to end the use of the OS due to loss of technical properties | 010400000 “Depreciation”, 040110172 “Income from operations with assets” | 010100000 “Fixed assets” |

| Assets for which a decision has been made to write off, but dismantling measures have not yet been carried out, are reflected on the balance sheet | 02 “Material assets accepted for storage” | |

| Materials remaining after write-off of fixed assets have been accepted for accounting | 010500000 “Inventories” (010521340–010526340, 010531340–010536340) | 040110172 “Income from operations with assets” |

| The costs of carrying out work to write off the operating system are reflected | 040120200 “Expenses of an economic entity” | 030211730 “Increase in payables for wages”, 030306730–030311730 “Increase in payables for insurance premiums”, etc. |

A sample act on the liquidation of an asset was provided by ConsultantPlus experts. If you do not have access to the K+ system, get a trial online access for free.

For general information about fixed assets in budget accounting, read the article “Budget accounting of fixed assets in 2020-2021 (nuances)” .

Read about innovations in budget accounting in the article “Working chart of accounts for budget accounting for 2020 - 2022” .

What is harmful about old office equipment that ends up in a landfill?

Any electronic device that ends up in a landfill becomes a time bomb.

After all, those substances emitted by household appliances cause irreparable damage to the environment and human health.

Let's take a closer look at the environmental hazards office equipment poses.:

- Computer technology:

- the period of decomposition of a metal case in nature is more than 10 years;

- the plastic panel will decompose for more than 500 years, releasing toxic substances throughout the entire period;

- PVC, a durable material from which the wires are made, practically does not decompose in natural conditions;

- Boards, connectors, and circuits are made of metals that emit hazardous substances when in contact with the environment.

- Printers, scanners, copiers and other MFPs:

- aluminum and iron oxide are the filling of seemingly harmless cartridges;

- the toner contains cyanide particles that can cause serious allergies and respiratory diseases in humans;

- when heated, polystyrene releases the most dangerous substance styrene, which has a negative effect on the human nervous and circulatory system and provokes diseases;

- Electronic components contain chemicals, metals and compounds that, when exposed to different climatic conditions, emit dangerous poisons.

- Faxes and telephones:

- several hundred years - the decomposition period of a plastic case;

- the wires consist of polyvinyl chloride, which, when decomposed, releases chlorine, dioxins, etc.;

- chemicals and compounds included in boards and circuits are extremely dangerous for the soil and atmosphere.

Old office equipment rotting in a landfill can sit for several centuries, emitting hazardous substances and poisoning the soil and atmosphere.

Environmental consequences will affect not only those living today, but also many future generations.

Results

The write-off of fixed assets should be carried out solely upon the consideration of a commission that meets and is appointed by order of the head of the institution.

Documents must be drawn up in accordance with the legal regulations of federal, municipal bodies or bodies of constituent entities of the Russian Federation. In accounting, write-off is carried out after the actual liquidation of the asset. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to determine aging equipment

But it's not that simple. The aging of a computer requires confirmation by facts, which may include the following:

- with normal processing of information volume in 1 hour, the computer does this for several hours;

- The purchased program cannot be installed on an existing computer due to its outdated parameters, etc.

However, the impossibility of modernization must be proven. The argument here may be the fact that the production of components compatible with the existing computer configuration has ended. In addition, when the service life of the unit specified by the manufacturer expires, its failure can cause significant harm to production.