Costs for compulsory motor liability insurance relate to other expenses for ordinary activities. Enterprises using the simplified tax system “Income minus expenses” when calculating the single tax base have the right to reduce income by the amount of costs listed in Art. 346.16 Tax Code of the Russian Federation. Clause 7 indicates the costs of compulsory insurance; therefore, compulsory motor liability insurance is included in the costs of the simplified tax system. According to paragraph 2 of Art. 263 of the Tax Code, compulsory insurance in the expenses of the “simplified” is recognized within the framework of insurance tariffs approved in accordance with the law. If such tariffs are not approved, the entire amount of costs can be offset against expenses.

For your information! It is impossible to take into account the costs of voluntary vehicle insurance in the tax base, since such a policy is purchased on the company’s own initiative.

For example, if a company purchased and put into operation a car for which a compulsory motor liability insurance policy worth 25,000 rubles was paid. and CASCO in the amount of 55,000 rubles, the accountant has the right to take into account only 25,000 rubles in expenses. for compulsory insurance. The base cannot be reduced by the cost of the CASCO policy.

Accounting for compulsory motor liability insurance under the simplified tax system

In accounting, expenses for compulsory motor liability insurance can be recognized simultaneously in the reporting period when they were incurred, or written off throughout the entire term of the contract, distributed in equal parts (clause PBU 10/99). An acceptable method is fixed in the accounting policies. In tax accounting, such costs are recognized upon payment (Article 346.17 of the Tax Code).

Accounting for compulsory motor liability insurance under the simplified tax system “Income minus expenses” is carried out in the accounts of the relevant industries - 20th account (main), 23rd, 25th, 26th, 29th, 44th (auxiliary, commercial, servicing), corresponding to account 76 on a specially designated sub-account “Insurance settlements”.

The use of account 76 is due to the specifics of settlements with the insurance company: payment for the purchased policy does not mean that the insurance service has been fully provided, since there is always the possibility of returning part of the insurance premium upon early termination of the insurance contract, or upon compensation for damage incurred in an accident.

Rules for accepting insurance costs into the calculation of the simplified tax system base

Acceptance of insurance costs as expenses under the simplified tax system - income minus expenses is subject to general rules for simplification: the expense must be mentioned in the list of those allowed to be accepted as a reduction in the tax base and paid.

The list of such expenses is contained in paragraph 1 of Art. 346.16 Tax Code of the Russian Federation. It deals directly with insurance in subsection. 7, containing the clause that insurance should be classified as mandatory. The mentioned subclause lists what can be insured:

- employees (including compulsory health insurance, compulsory medical insurance, compulsory social insurance);

- property;

- responsibility.

However, there is another type of expense, some of which is related to insurance. These are labor costs (subclause 6, clause 1, article 346.16 of the Tax Code of the Russian Federation). The list of such costs, according to Art. 255 of the Tax Code of the Russian Federation (clause 16), which is prescribed by clause 2 of Art. 346.16 of the Tax Code of the Russian Federation, includes the costs of insurance not only compulsory, but also voluntary, associated with payment:

- additional insurance contributions for a pension provided by the state, with the condition that pension payments be made for life from the moment the right to them is obtained;

- pension agreements with non-state support, with the condition that pension payments begin upon the onset of the right to a pension and for more than 5 years;

- long-term (over 5 years) life insurance contracts, under which no payments are made during the validity period (except in the event of an insured event);

- personal insurance for a period of more than 1 year, which covers the medical expenses of employees;

- personal insurance in connection with death or injury to health.

For information about what simplified tariffs can be applied to compulsory types of employee insurance, read the article “What are insurance premiums for the simplified tax system in 2022?”

In addition to contributions for individual entrepreneurs’ employees, incl. those using the simplified tax system are required to pay fixed insurance premiums.

ConsultantPlus experts explained in detail how individual entrepreneurs can calculate and pay fixed payments for insurance premiums. Get free demo access to K+ and go to the Ready-made solution to find out all the details of this procedure.

OSAGO under the simplified tax system “Income minus expenses”: postings

Let's look at how to take into account the purchase of an MTPL policy using an example:

On April 1, 2019, I purchased a car for production needs, paying on the same day for a compulsory motor liability insurance policy worth 15,000 rubles. for a year. According to the company's accounting policy, the entire amount of costs for compulsory motor liability insurance is written off at a time after payment.

The company's accountant will document in the accounting records on the date of payment for the transaction:

| Operation | D/t | K/t | Sum |

| MTPL policy purchased (insurance premium paid) | 76 | 51 | 15 000 |

| Purchase costs included | 20 | 76 | 15 000 |

If the company’s accounting records the write-off of the cost of the policy in parts, then by posting D/t 20 K/t 76 during the year the due share will be written off monthly in an amount depending on the number of days in the month of write-off. For example, in April 1232.88 rubles will be written off. (15000 / 365 x 30), in May 1273.97 rubles. (15000 / 365 x 31), etc.

Equal distribution of expenses simplifies the accounting for the return of a portion of the insurance amount if there is a need for early termination of the contract, since at the time of return the expenses will not yet be included in expenses, and, therefore, the returned portion of the insurance will not have to be included in income.

Read also: OSAGO reform 2019

Leasing payments

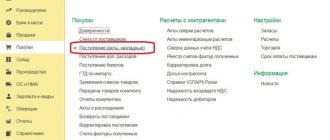

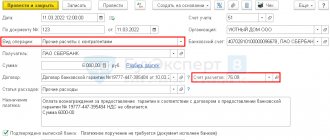

- Calculation of leasing payments. Using the document “Manual Operation” (“Accounting and NU Operation”), the accrued monthly payment is reflected by postings Dt 76.05 Kt 76.09 for the payment amount. For tax accounting purposes under the simplified tax system, this amount is accepted in full in accordance with the act issued by the lessor. But since in this case “Manual Operation” is used, you should not wait for the expense to be automatically registered in KUDiR when paying for it. To do this, you need to perform an additional operation.

- Payment of the lease payment. The payment itself is recorded by the bank statement document “Write-off from the current account”, but given the specifics, the type of transaction should be selected “Other write-off” to be able to indicate the corresponding account 76.09 and, using the KUDiR button, indicate the amount to be reflected in the book of income and expenses, unchecking the “Reflect” flag automatically".

Compensation for losses under the MTPL policy under the simplified tax system

The company has the right to terminate the contract with the insurer, for example, when selling a vehicle. In this case, part of the previously transferred premium (minus the amount attributable to the period during which the contract was actually in force) is returned to the policyholder’s account and reflected in the accounting debit of the account. 51 from credit account 76.

Example:

Let's go back to the previous example. Let’s assume that the car was sold on May 20, 2019. The company notified the insurance company of this in writing, declaring the termination of the contract and the return of funds paid for the period from 05/21/2019 to 03/31/2020.

The refund amount is calculated as follows:

CB = 15000 - 15000 / 365 days. x 50 days (30 days in April + 20 days in May) = 12945.21 rubles.

Also, in case of early termination of the contract, insurance companies can withhold the amount of expenses for conducting the case (23% of the premium amount), but the exact conditions of the return must be clarified with your insurer.

In accounting, the received amount of compensation is reflected in the structure of other income by postings:

| Operation | D/t | K/t | Sum |

| The insurer has decided to pay the balance under compulsory motor liability insurance | 76 | 91/1 | 12945,21 |

| Receipt of insurance compensation | 51 | 76 | 12945,21 |

In the same way, insurance compensation for damage from an accident is recorded in accounting, provided that the driver is innocent.

Example:

For the operation of a passenger car in an auxiliary facility, on April 1, 2019, the company purchased an MTPL policy worth 12,000 rubles. for a year. According to the accounting policy, the costs of purchasing a policy are written off in full after payment. In May 2022, an accident occurred, the damage amounted to 20,000 rubles. and was reimbursed by the insurer of the person at fault. The car was repaired for the same amount.

The listed transactions will appear in accounting as follows:

| Operation | D/t | K/t | Sum |

| The insurance premium for compulsory motor liability insurance has been paid. | 76 | 51 | 12 000 |

| The costs of purchasing the policy are taken into account | 29 | 76 | 12 000 |

| Repair work to restore the vehicle was reflected and paid for | 29 60 | 60 51 | 20 000 20 000 |

| Compensation under MTPL: | |||

| — accrued | 76 | 91/1 | 20 000 |

| - received | 51 | 76 | 20 000 |

The amounts of compensation received upon the occurrence of an insured event under compulsory motor liability insurance are taken into account as part of non-operating income for calculating the base for the single tax (clause 1 of article 346.15 and clause 3 of article 250 of the Tax Code) upon receipt of them to the current account or to the cash desk of the company.

Vehicle repair costs are recognized as expenses in the period in which they were incurred, in the amount of actual expenses (clause 1 of Article 260 of the Tax Code of the Russian Federation), even if the amount of insurance compensation established by the contract exceeds (Letter of the Ministry of Finance of the Russian Federation No. 03-03-06/2 /70 dated 03/31/2009).

Expenses of the “simplified” person for insurance

Doing business involves all sorts of risks. In order to smooth out the negative consequences of various events (accidents, thefts, fires, natural disasters), entrepreneurs resort to insurance.

You can insure property, life and health, and liability. In this case, insurance can be either mandatory, that is, provided for by law, or voluntary. In this article we will look at compulsory types of insurance.

Article 346.16 in paragraphs. 7 clause 1 provides that when determining the object of taxation, “simplers” can reduce the income received by expenses for compulsory insurance of employees and property, including insurance contributions for compulsory pension insurance, contributions for compulsory social insurance against accidents at work and occupational diseases made in accordance with the legislation of the Russian Federation. At the same time, the costs of employee insurance are recognized in accordance with Art. 255 of the Tax Code of the Russian Federation, and the norms of Art . 263 Tax Code of the Russian Federation . In addition, we recall that the taxpayer’s expenses must comply with the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation , that is, to be justified and documented ( clause 2 of Article 346.16 of the Tax Code of the Russian Federation ).

Compulsory employee insurance

Contributions to the Pension Fund . The main component of the costs of compulsory insurance of employees is contributions to compulsory pension insurance. The fact that when applying the simplified tax system such contributions must be paid is indicated in Chapter. 26.1 of the Tax Code of the Russian Federation ( paragraph 2 , paragraph 2, paragraph 2, paragraph 3, article 346.11 ). According to Art. 6 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance in the Russian Federation” (hereinafter referred to as Law No. 167-FZ ), insurers are both organizations and individual entrepreneurs. Clause 2 of Art. 10 of the said law, the base for calculating pension contributions is the unified social tax base. Article 237 of the Tax Code of the Russian Federation establishes that it includes all remuneration paid to employees in any form (exceptions in Article 238 of the Tax Code of the Russian Federation ), including the paid cost of utilities, food, rest, training and voluntary insurance.

Mandatory contributions are calculated personally at the rates specified in Art. 22 of Law No. 167-FZ and depending on the size of the base and year of birth of the insured person. The maximum tariff is 14%. Contributions to the insurance and funded parts of the labor pension are calculated and paid separately. Transfers to the Pension Fund of the Russian Federation are made monthly in the form of advance payments, and at the end of the reporting period (quarter) the difference between the amounts accrued from the beginning of the billing period (calendar year) and paid is repaid.

Please note : “Simplified” entrepreneurs pay contributions for their own insurance. According to paragraph 3 of Art. 28 of Law No. 167-FZ, their minimum amount is 150 rubles. At the same time, clause 2 states that the amount of the fixed payment is established based on the cost of the insurance year, annually approved by the Government of the Russian Federation. Thus, for 2008, the cost of the insurance year was determined to be 3,864 rubles. (Resolution of the Government of the Russian Federation dated 04/07/2008 No. 246). Consequently, monthly contributions of individual entrepreneurs in 2008 amount to 322 rubles. (RUB 3,864 / 12 months).

Contributions for compulsory insurance to the Social Insurance Fund . The next type of compulsory insurance for employees is compulsory social insurance against industrial accidents and occupational diseases. The legal, economic and organizational basis, the procedure for compensation for harm caused to the life and health of workers during the performance of their labor duties and in other cases, are established by the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against accidents at work and professional diseases .

In accordance with the rules approved by Decree of the Government of the Russian Federation dated 03/02/2000 No. 184 , contributions are charged on all payments to employees, with the exception of those included in the list approved by Decree of the Government of the Russian Federation dated 07/07/1999 No. 765 .

The FSS sets tariffs for each policyholder individually, depending on the type of activity and class of professional risk. Like pensions, social insurance contributions are paid monthly. At what point should contributions to compulsory pension and social insurance be taken into account for tax purposes? In paragraph 2 of Art. 346.17 of the Tax Code of the Russian Federation states that with “simplified” expenses are recognized after payment. However, it should be remembered that the tax base is reduced only by those contributions that were both accrued and paid, since advance payments are not expenses.

Example.

Matrix LLC, which uses the simplified tax system with the object of taxation “income minus expenses,” made a transfer of contributions to the Pension Fund of the Russian Federation in the total amount of 25,000 rubles in September 2008, including:

– 12,500 rub. – contributions for September 2008 (payment order No. 215 dated September 30, 2008);

– 12,500 rub. – contributions for October 2008 (payment order No. 216 dated September 30, 2008).

In September, the accountant will make the following entries in the Income and Expense Book.

Extract from the Book of Income and Expenses of Matrix LLC for the third quarter of 2008

| No. | Date and number of the primary document | Contents of operation | Income taken into account when calculating the tax base | Expenses taken into account when calculating the tax base |

| 1 | 2 | 3 | 4 | 5 |

| … | ||||

| 315 | 09/30/2008 p/p No. 215 | Contributions to OPS for September 2008 have been transferred. | – | 12 500 |

The remaining contributions to the compulsory pension insurance are in the amount of 12,500 rubles.

can be expensed after accrual in the next quarter. Extract from the Book of Income and Expenses of Matrix LLC for the fourth quarter of 2008

| No. | Date and number of the primary document | Contents of operation | Income taken into account when calculating the tax base | Expenses taken into account when calculating the tax base |

| 1 | 2 | 3 | 4 | 5 |

| … | ||||

| 399 | 09/30/2008 p/p No. 216 | Contributions to compulsory public health insurance for October 2008 are reflected in expenses. | – | 12 500 |

Other types of compulsory employee insurance . If a “simplified worker” carries out a type of activity for which federal legislation establishes compulsory insurance for employees, he can include them in expenses.

If there is no corresponding federal law regarding the type of activity in which the company is engaged, employee insurance will be considered voluntary. Please note : Subclause 7, clause 1, art. 346.16 of the Tax Code of the Russian Federation concerns compulsory insurance of employees. However, “simplified” people can also take into account the funds spent on voluntary insurance: on the basis of clause 16 of Art. 255 of the Tax Code of the Russian Federation, payments under voluntary insurance contracts (that is, non-state provision) concluded by employers with licensed insurance organizations (non-state pension funds) are classified as labor costs. True, for tax purposes it will be possible to take into account not the entire amount paid, but only within the limits of the norms specified in clause 16 of Art. 255 of the Tax Code of the Russian Federation (before January 1, 2009 - 3% of the wage fund, after this date - 6%).

Compulsory property insurance

According to paragraph 2 of Art. 927 of the Civil Code of the Russian Federation , insurance is recognized as mandatory in cases where the law imposes on the persons specified in it the obligation to insure as insurers the life, health or property of other persons or their civil liability to other persons at their own expense or at the expense of interested parties.

There are not many cases of compulsory property insurance. The most common is insurance of the collateral: in accordance with Art. 38 of the Law of the Russian Federation of May 29, 1992 No. 2872-1 , the pledgor, leaving the pledged property with himself, is obliged to insure it for its full value. If the pledged item is transferred to the pledgee, Art. 50 of the said law already requires him to insure his property for its full value. The “simplified” person who entered into a mortgage agreement as a mortgagee also has the right to recognize the insurance costs incurred in connection with this.

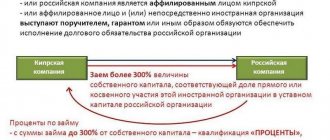

Costs of insuring property pledged to the lender (to secure the fulfillment of the obligation under the loan agreement) . Under a loan agreement, a bank or other credit organization (lender) undertakes to provide funds (loan) to the borrower in the amount and on the terms stipulated by the agreement, and the borrower undertakes to return the amount of money received and pay interest on it ( clause 1 of Article 819 of the Civil Code of the Russian Federation ) . At the same time, one of the ways to ensure the fulfillment of an obligation under a loan agreement is a pledge ( clause 1 of Article 329 of the Civil Code of the Russian Federation ).

Subclause 1 of clause 1 of Art. 343 of the Civil Code of the Russian Federation stipulates that the pledgor or pledgee, depending on which of them has the pledged property, is obliged, unless otherwise provided by law or agreement, to insure, at the expense of the pledgor, the pledged property in its full value against the risks of loss and damage, and if the total value of the property exceeds the amount of the claim secured by the pledge - by an amount not lower than the amount of the claim.

If the agreement provides for the borrower’s obligation to insure the pledged property in favor of the lender, then the organization insures its own property, which means that this insurance is voluntary and not mandatory. Consequently, for the purpose of calculating the tax paid when applying the simplified tax system, such expenses cannot be taken into account.

Does the “simplifier” have the right to include the cost of compulsory motor liability insurance as an expense? Along with the purchase of a vehicle, a “simplified” person must purchase an MTPL policy. According to paragraph 1 of Art. 931 of the Civil Code of the Russian Federation, under an agreement to insure the risk of liability for obligations arising from causing harm to the life, health or property of other persons, the risk of liability of the policyholder himself or another person to whom such liability may be assigned can be insured. Clause 4 of Art. 3 of the Law of the Russian Federation of November 27, 1992 No. 4015-1 “On the organization of insurance business in the Russian Federation” and clause 2 of Art. 927 of the Civil Code of the Russian Federation establishes that the conditions and procedure for the implementation of compulsory insurance are determined by federal laws on specific types of compulsory insurance. Thus, the obligation of vehicle owners to insure the risk of their civil liability, which may arise as a result of causing harm to the life, health or property of other persons when using vehicles, is established in paragraph 1 of Art. 4 of the Federal Law of April 25, 2002 No. 40-FZ “On compulsory insurance of civil liability of vehicle owners” (hereinafter referred to as Law No. 40-FZ ).

The obligation to insure civil liability applies to owners of all vehicles used in the Russian Federation. In accordance with paragraph 2 of Art. 4 of Law No. 40-FZ , when the right to own a vehicle arises, the owner of the vehicle is obliged to insure his civil liability before registering the vehicle, but no later than five days after the right to own it arises.

Currently, the position of regulatory agencies on the issue of recognizing expenses for compulsory motor liability insurance is as follows. In Letter dated 04/01/2008 No. 03-11-0 4/2/63, specialists from the Ministry of Finance indicated that the costs of compulsory civil liability insurance of vehicle owners do not apply to the costs of all types of compulsory insurance of employees and property provided for in paragraphs. 7 clause 1 art. 346.16 of the Tax Code of the Russian Federation , and, accordingly, are not taken into account when calculating the tax base for the tax paid in connection with the use of the simplified taxation system. A similar position was set out in Letter of the Federal Tax Service of the Russian Federation dated October 09, 2006 No. 02-6-0 9/151 “On the simplified taxation system” .

Note that, unlike officials of the financial and tax departments, arbitration judges sided with taxpayers (see, for example, Resolution of the Federal Antimonopoly Service dated September 19, 2006 No. A12-2391 2/05-C3 ).

From January 1, 2009, the situation with the recognition of MTPL expenses will change. Subparagraph “a” of paragraph 9 of Art. 1 of the Federal Law of July 22, 2008 No. 155-FZ “On Amendments to Part Two of the Tax Code of the Russian Federation” in paragraphs. 7 clause 1 art. 346.16 of the Tax Code of the Russian , changes have been made by virtue of which the taxpayer reduces the income received by expenses for all types of compulsory insurance of employees, property and liability.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Accounting for costs and compensation under OSAGO “Income” under the simplified tax system

For enterprises operating under the simplified tax system “Income”, vehicle insurance costs do not affect the calculation of tax, since almost all costs are not taken into account in the tax base, and tax is calculated on the amount of income received.

In accounting, the entries reflecting the purchase of an MTPL policy, the return of funds upon termination of the contract and compensation for damage are identical to the entries that apply the simplified tax system “Income reduced by expenses.”

But compensation under OSAGO under the simplified tax system “Income” is taken into account as part of non-operating income, since clause 3 of Art.

250 of the Tax Code of the Russian Federation includes compensation for losses and damages, including the amount of insurance compensation under compulsory motor liability insurance, although the costs of vehicle repairs are not included in the calculation of the tax. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Expenses that can be taken into account for voluntary insurance

All types of voluntary property insurance, the costs of which can be taken into account when taxing profits, can be found in the Tax Code.

Such expenses can be taken into account if voluntary insurance is one of the conditions for the company’s activities.

According to paragraph 1 of Article 263 of the Tax Code of the Russian Federation, expenses for voluntary property insurance include insurance premiums for all types of compulsory insurance for the following types of voluntary property insurance:

- voluntary insurance of vehicles, the maintenance costs of which are included in the costs associated with production and sales;

- voluntary cargo insurance;

- voluntary insurance of fixed assets, intangible assets, unfinished capital construction projects;

- voluntary insurance of risks during construction and installation work;

- voluntary insurance of inventory;

- voluntary insurance of other property used by the taxpayer in carrying out activities aimed at generating income;

- voluntary insurance of liability for damage.

Paragraph 3 of Article 263 of the Tax Code of the Russian Federation establishes that expenses for the above voluntary types of insurance are included in other expenses in the amount of actual expenses.

In order for payments under a voluntary insurance agreement to be classified as expenses, you need:

- First, make sure it is listed among the permitted species;

- Secondly, find a law requiring you to have a voluntary insurance contract to carry out your activities.

Redemption of the leased asset

The redemption value can be attributed to expenses in the manner applicable for recognizing expenses on fixed assets.

- Payment to the supplier is recorded using the document “Write-off from the current account” indicating the corresponding account 76.05.

- Since payment of the redemption price is recorded in 1C 8.3 after the receipt of equipment (OS) for leasing, there is a general requirement for Registration of payment for OS in KUDiR, where you should additionally enter payment data for automatic entry into KUDiR.

- When closing the period, once a quarter, expenses for the acquisition of fixed assets from up to 1 will be written off (depending on the quarter in which the redemption price will be paid), which will be reflected in sections 1 and 2 of the Income and Expenses Accounting Book.