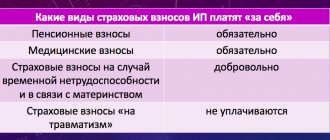

Calculation of insurance premiums to extra-budgetary funds

Calculate insurance premiums on the last day of each month separately for each insured person and each type of contribution. In 2022, insurance premiums are paid for:

- compulsory pension insurance (OPI) at a rate of 22%;

- compulsory health insurance (CHI) at a rate of 5.1%;

- compulsory social insurance (OSI) for temporary disability and in connection with maternity (VNIM) – 2.9%.

Above are the basic contribution rates. For some policyholders, reduced and additional rates are provided. For details, see the material “Insurance premium rates in the table.”

Read about reduced tariffs for small and medium-sized businesses in ConsultantPlus. Get trial access to the K+ system and upgrade to the Ready Solution for free.

The employer pays insurance premiums at his own expense to the tax office no later than the 15th day of the month following the month in which insurance premiums are calculated.

In addition to the above contributions, the employer pays insurance premiums against accidents at work to the Social Insurance Fund. The rate varies from 0.2% to 8.5% and depends on the main type of activity of the policyholder.

How to determine the tariff size, see here.

To calculate contributions, use the formula:

ATTENTION! When calculating the contribution base, take into account the approved limits. In 2022, the limits for VNIM are 1,032,000 rubles, for OPS – 1,565,000 rubles. Read more about applying limits here.

Employers must keep records of contributions for all funds separately.

To obtain information about contributions, account 69 “Social insurance payments” is divided into three sub-accounts, namely:

- 69.1 - information on contributions to OSS;

- 69.2 - information on contributions to compulsory pension insurance;

- 69.3 - information on contributions to compulsory medical insurance.

Subaccount 69.1 is further divided into second-order accounts (69.1.1 - social insurance for VNIM; 69.1.2 - injury insurance) or an additional subaccount of account 69 is used (for example, 69.11) to account for contributions for injuries.

This grouping by accounts allows you to track all movements of funds for each fund.

Social taxes in 2022: rates

Social fees include:

- pension insurance;

- social insurance in case of illness or maternity;

- health insurance;

- injury tax.

Until 2022, the administration of each type of deduction was carried out by the Funds. However, now the Federal Tax Service is in charge of all of them. The only exception was the fees for injuries, which remained under the jurisdiction of the FSS. Tariffs for the period from 2022 to 2022 are established in Article 426 of the Tax Code of the Russian Federation. The size of deductions for social needs, the total rate of which is 30%, is most conveniently presented in the table.

| Type of contribution | OPS, % | VNIm (OSS), % | Compulsory medical insurance, % |

| If the maximum base value does not exceed the limit of RUB 1,021,000. — for OPS, 815,000 rub. - for OSS | 22 | 2,9 | 5,1 |

| If the amount of the base exceeds the limit for OPS | 10 | — | 5,1 |

Please note that payments in excess of the maximum base are not subject to VNIM contributions. The amount of contributions for injuries, which, as we remember, must be transferred to the Social Insurance Fund, depends on the main type of activity of the company. It must be confirmed annually, depending on this the deduction rate will be from 0.2 to 8.5%.

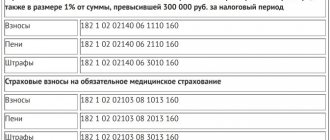

Contributions listed: what kind of postings are made?

Insurance premiums are transferred monthly no later than the 15th day of the month following the month of accrual (clause 3 of Article 431 of the Tax Code of the Russian Federation and clause 4 of Article 22 of the Law “On Mandatory Social Insurance” dated July 24, 1998 No. 125-FZ). When transferring funds to pay contributions, indicate the subaccount number of the corresponding fund in debit, and account 51 in credit, which reflects the current accounts of the company. The posting for payment of contributions (using the example of a pension fund) is as follows: Dt 69.2 Kt 51. Postings are made similarly for other subaccounts of each fund.

The accountant of Smiley LLC transferred the contributions untimely.

How to make a payment for insurance premiums, see here.

She reflected the following entries in accounting:

Dt 69.2 Kt 51 - 19,340.16 rubles;

Dt 69.3 Kt 51 – 6,708.58 rub.;

Dt 69.1 Kt 51 – RUB 1,483.88;

Dt 69.11 Kt 51 – 264 rub.

Transfer of insurance premiums for each fund must be carried out in separate payment orders. When paying contributions to funds, you need to pay special attention to the timing of their payment. For late payment of insurance premiums, organizations are charged penalties. Penalties are calculated for each day of late payment from the day following the payment due date until the day of payment inclusive. The amount of the penalty interest is taken at the rate of 1/300 of the Central Bank refinancing rate, and for companies - 1/300 for the first 30 days of delay and 1/150 of the refinancing rate starting from 31 days.

Also, the accountant of Smiley LLC calculated the penalties using our calculator and transferred them to the budget. She reflected the following entries in accounting:

Dt 99 Kt 69 (for subaccounts) - penalties accrued.

Dt 69 (for subaccounts) Kt 51 – penalties are transferred to the budget.

See also “Accounting entries when calculating penalties for taxes.”

If the policyholder does not also provide a calculation of contributions to the relevant fund, an additional fine will be issued. It will be 5% for each month of delay. It is calculated from the amount of accrued contributions for the last 3 months. The maximum fine is 30% of this amount, the minimum is 1,000 rubles.

The entry when calculating a fine or penalty will be Dt 91 Kt 69.1. Account 91 “Other income and expenses” is used here. True, there is another opinion that in this case you need to use account 99. The choice of account depends on the accounting procedure for such expenses adopted in accounting, which is enshrined in the accounting policy of the organization.

The material “Basic entries when paying penalties on insurance premiums” will help you figure out which account should be used to calculate penalties on insurance premiums.

Accrued penalties and fines do not reduce taxable profit (clause 2 of Article 270 of the Tax Code of the Russian Federation).

For information on what sanctions and fines are provided for non-payment of premiums, see the material “What is the responsibility for non-payment of insurance premiums?”

Find out about liability for late payment of taxes and contributions in the Ready-made solution from ConsultantPlus. If you don't have access to the system, get a free trial online.

When an accountant needs to accrue temporary disability benefits, they use the following entry: Dt 69.1 Kt 70 (for regular sick leave) or Dt 69.1.2 (69.11) Kt 70 (for benefits due to an industrial injury).

ATTENTION! From 2022, a new procedure for paying benefits is in effect. Our experts have prepared a guide for accountants. To avoid making mistakes in your calculations, study this material.

As for temporary disability benefits, the first 3 days are paid for by the organization, the rest - by the Social Insurance Fund. For the calculation, data on earnings for 2 years before the occurrence of the insured event is used. The benefit amount for a calendar month should not be less than calculated from the minimum wage (RUB 13,890 in 2022).

Postings on insurance premiums for public sector employees

Unlike the accounting of non-profit organizations, in which calculated and paid fees are reflected in one accounting account, in the accounting of budgetary organizations, to reflect transactions (for example, insurance premiums are charged), entries are made on other accounts.

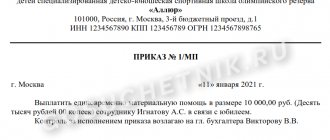

Let's look at the key rules of accrual and payment using an example. GBOU DOD DYUSSHOR "ALLUR" accrued wages for May in the amount of 1,200,000 rubles. To calculate SV, standard rates are used: for compulsory pension insurance (pension provision) - 22%, compulsory medical insurance (medical insurance) - 5.1%, VNIM (social insurance) - 2.9%, for injuries - 0.2%.

The accountant made the following accounting entries:

| Operation | Debit | Credit | Sum |

| Salary accrued | 0 401 20 211 0 109 XX 211 | 0 302 11 730 | 1 200 000 |

| Public pension insurance contributions accrued | 0 401 20 213 0 109 XX 213 | 0 303 10 730 | 264 000 (1 200 000 × 22 %) |

| Compulsory medical insurance accrual reflected | 0 303 07 730 | 61 200 (1 200 000 × 5,1 %) | |

| The accountant reflected accrued contributions for VNiM | 0 303 02 730 | 34 800 (1 200 000 × 2,9 %) | |

| Injuries | 0 303 06 730 | 2400 (1 200 000 × 0,2 %) | |

| CBs were transferred from the current account | 0 303 10 830 0 303 07 830 0 303 02 830 0 303 06 830 | 0 201 11 610 | 264 000 61 200 34 800 2400 |

IMPORTANT!

When calculating SV under civil contracts in accounting records, use KOSGU for the main calculation of wages. For example, when paying an employee for building maintenance services, use KOSGU 225. Consequently, the entry for calculating remuneration for labor: Dt 0 401 20 225 Kt 0 302 25 730. Entries for accruing SV in this case: Dt 0 401 20 225 Kt 0 303 XX 730.

The institution submitted an application for reimbursement of overpayments from extrabudgetary funds. Use insurance compensation entries in accounting:

| Operation | Debit | Credit |

| Funds have been credited to the bank account | 0 201 11 510 | 0 303 XX 730 |

Through insurance against accidents and occupational diseases, employees will be paid insurance premiums and guaranteed payments in the event of an accident or injury at work. The accounting entries for payment of the insurance premium will be the same; read more about this in the article “How is a work-related injury paid in 2022”.

Results

Attribute insurance premiums to cost accounting accounts 20,23,25,26,44, etc. To break down insurance premiums by type, use account 69 and various subaccounts. When transferring contributions to the budget, record the posting Dt 69 (for subaccounts) Kt 51. If during the reporting period there was sick leave paid for from the Social Insurance Fund, reflect it with the posting Dt 69 Kt 70.

Sources:

- tax code

- Law “On the Fund’s Budget...” dated December 2, 2019 No. 384-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Expenses for insurance premiums and taxes

In this article, we will try to consider in as much detail as possible the nuances of recognizing expenses for insurance premiums, the correctness of the program settings at the initial stage, and compare indicators according to tax and accounting data using reports, which will simplify the user’s task when submitting reports.

These expenses are recognized in full in the tax accounting of the simplified tax system. To do this, they must be accrued and paid.

Expenses are accrued at the time of payroll.

The accrual of insurance premiums is reflected in the accounting and tax registers.

Let's look at the register scheme and their impact on accounting and tax reporting:

We will look at what each register is responsible for and how the registers are interconnected while solving the example.

Example

- The employees' salaries were accrued in the amount of 30,000 rubles, insurance premiums were accrued, of which, for one employee, contributions and wages were not accepted as expenses (10,000 rubles);

- Payments of 7,000 rubles were paid.

Before proceeding directly to the calculation of contributions, it is necessary to check the correctness of the settings for wages and the calculation of insurance premiums for tax accounting of the simplified tax system in the program.

Let’s check the register of information “ Cost items for insurance premiums”

«.

By default, insurance premiums are reflected in the same cost items as wages. If payroll is reflected under the item “Wages and salaries”, then all insurance premiums are reflected under the item “ Wages and salaries”

”.

Next, let's move on to setting up salary reflection. According to the conditions of our task, for one employee, wages and contributions will not be accepted as expenses; accordingly, we will create two methods of accounting for wages:

1 — accruals for employee “ Accepted

I” in expenses under the simplified tax system.

2 — accruals for the employee “ Not accepted”

” in expenses under the simplified tax system and the calculation of tax do not have any impact.

Let’s point out that the employee Igor Petrovich Aleksandrov’s accrual method is “Accepted” in expenses for the purposes of the simplified tax system, and the employee Elizaveta Yuryevna Fedulova’s method is “Not accepted” in expenses for the purposes of the simplified tax system.

Calculation of wages and insurance contributions to employees of the organization:

Based on the movement of the document through the accounting and tax registers, we will analyze the calculation of insurance premiums:

1) According to the accounting registers, contributions in the amount of 9,060 rubles were accrued.

For tax purposes, the document makes a movement in the register “Other calculations” and “Expenses under the simplified tax system”:

2) Register “Other calculations”

is intended for accounting of mutual settlements regarding salaries. The occurrence of accounts payable to the organization's employees and insurance funds is reflected in the "" register as expense entries.

According to the “Other settlements” register, there was a payable for insurance premiums in the amount of 9,060 rubles.

Next, we will consider the movements of the document in the register “Expenses under the simplified tax system”

:

3) According to the simplified tax system register

Incoming entries with the status “

Not paid

” are entered for the type of expense “

Taxes and contributions

”.

Let's pay attention to the column “ Reflection in NU

” - for Fedulov’s employee, expenses are not accepted for the purposes of the simplified tax system - the amount of expenses not accepted for insurance premiums amounted to 3,020 rubles. This amount will not be included in expenses that reduce the tax base when calculating tax.

As for employee Alexandrov, the amount of accepted expenses for the purposes of the simplified tax system for this employee amounted to 6,040 rubles.

At this stage, all the conditions for recognizing expenses for insurance premiums have not been met and there are no movements in the “Book of Income and Expenses I” register and no entries are made in the KuDiR.

Payment of tax (PFR)

1. The document makes movements in the accounting registers in the amount of 6,600 rubles.

2. In the “Income and Expenses Accounting Book I” register in the “Expenses”

amounts for recognized expenses are reflected and will be reflected in the KuDiR.

“Total Expenses”

column reflects the amount of expenses indicated in the document (including both recognized and unrecognized expenses).

3. A credit entry is made in the “Other settlements” register—accounts payable for pension insurance expenses in the amount of 6,600 rubles are repaid.

4. In the “STS Expenses” register, an expense entry is made with the status “Unpaid” - this entry indicates that the expense has been paid. The entry for this register is divided into two parts:

- Payment of the “Accepted” part of expenses in the amount of 4,400 rubles.

- Payment of the “not accepted” part of expenses in the amount of 2,200 rubles.

Payment of tax (FSS)

1. According to the accounting registers, the document makes movements in the amount of 400 rubles.

2. According to the register ““Income and Expense Accounting Book I” in the “Expenses”

the recognized part of expenses for tax purposes is reflected in the amount of 400 rubles.

“Total Expenses”

column reflects the amount of expenses indicated on the document (includes recognized and unrecognized expenses).

3. In the “Other settlements” register, a credit entry is made for the amount of repayment of accounts payable for medical insurance in the amount of 400 rubles.

4. In the register “Expenses under the simplified tax system” an expense entry is made in the amount of 400 rubles. You can notice that the first entries in the register are those in the “Accepted” expenses section. Accordingly, the expense was paid in the amount of 400 rubles.

To check the correctness of the balance according to accounting and NU indicators, we will generate an analysis of account 69 and a report “Accounting analysis according to the simplified tax system”:

The amount of outstanding insurance premiums according to accounting data = 2,060 rubles.

Debt on insurance premiums (according to NU indicators) = (470 + 1530 + 60) = 2,060 rubles.

We can conclude that the indicators according to the NU and BU data are equal and, accordingly, we can proceed to the next stage.