Conditions affecting loan accounting

A loan is a transfer of funds (or other means of payment) on debt that occurs between individuals or legal entities, as well as between a legal entity and an individual.

A credit institution never participates in this procedure, since operations with its participation, despite the same nature of the relationship, have different names: loan and deposit (for an individual) or deposit (for a legal entity). Accounting entries arise only for legal entities that can both borrow funds from legal entities or individuals and give them to the same entities, but the nature of the accounting entries does not depend on with whom exactly (a legal entity or individual) the borrowing agreement was concluded. At the same time, there are points that affect the correspondence of accounts used in these records.

For the organization giving the loan, it matters:

- Whether the loan is interest-bearing or interest-free;

- what types of activities (usual or other) does this process include for her?

It is important for the recipient of funds:

- for how long they were taken: less or more than a year;

- whether borrowed funds are invested in the creation of an investment asset.

Each of these conditions will affect the selection of account correspondence in the record of transactions performed in connection with the loan.

You will find a selection of forms for drawing up a loan agreement in various situations in ConsultantPlus. If you do not already have access to this legal system, a full access trial is available for free.

Accounting

The following accounts can be used to account for the deposit:

- 58 (according to PBU 19/2 -3);

- 55.3.

The chosen methodology should be recorded in the accounting policy. Money is credited to the deposit and the deposit is closed on these accounts in transactions with accounts 51, 52. Interest is also taken into account using accounts 91 and 76.

Postings when calculating interest using the simple option:

- D 55.3(58) K51(52) - deposit transferred for storage.

- D 76 K91.1 - interest accrued on the deposit.

- D 51 (52) K76 - interest on the deposit was received into the account (depending on the terms of the agreement - for the entire period of the agreement or monthly, quarterly).

- D 51(52) K 55.3(58) - return of money from the deposit.

Postings when calculating compound interest:

- D 55.3(58) K51(52) - deposit transferred for storage.

- D 55.3(58) K91.1 - interest has been accrued on the deposit for the month (each month the base increases by the amount of interest calculated in the previous period).

- D 51(52) K 55.3(58) - return of money from the deposit and interest.

When terminating a contract early, you need to take into account the frequency with which interest is paid, whether a simple or complex calculation method was used, whether the termination and conclusion of the contract took place in the same year or in different years.

Let's use the data from the example above. Invested 20,000 rubles at 9% per annum, calculated using the simple interest method. For the 1st, 2nd, and 3rd months of one quarter, the organization accrued: 1800/365 * (30+30+31) = 448.77 rubles. The bank calculated the same period at a reduced rate of 0.01%:

- 20000*1%= 200 per annum.

- 200/365 *(30+30+31)= 49.86 rubles.

- 448.77- 49.86 = 398.91 – interest excessively accrued by the organization, adjusted amount.

The amount is reversed in accordance with PBU 9/99-6.4: D 76 (55, 58) K91.1 - 398.91 “reversal” if the contract affects only the current year, and is written off as losses of previous years in accordance with PBU PBU 10/99-11 in otherwise: D91-2 K76 (55, 58) - 398.91.

Interest on a loan issued - postings

Funds issued as a loan, subject to the accrual of interest on them by the transferring party, are always taken into account as part of financial investments, i.e. in account 58. The issue is recorded by posting Dt 58 Kt 51 (50, 52).

IMPORTANT! An interest-free loan will not be shown on account 58, since it does not correspond to the very idea of financial investments (to generate income). Its amount should be shown on account 76 (Dt 76 Kt 51 (50, 52)).

At the same time, in transactions for calculating interest on a loan issued, another account will be used - 76. Its use will lead to the appearance of a transaction - interest accrued on a loan issued - with correspondence Dt 76 Kt 91 (90). The choice of account in the credit part of this record will determine which types of activities for the lender include issuing a loan: other (in which case account 91 will be used) or ordinary (in this case account 90 will be used).

Interest calculations by organizations are carried out monthly on the last date of this period (clauses 12, 16 of PBU 9/99, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 32n).

Neither the loan amount itself nor the interest on it are subject to VAT (subclause 15, clause 3, article 149 of the Tax Code of the Russian Federation), i.e., there will be no postings regarding this tax on the debit of account 91 (90). If the lender has any costs associated with issuing a loan (for example, a fee to the bank for funds transfer services), then during the period of their implementation they will be debited to account 91 (90).

The receipt of interest payments will be expressed by posting Dt 51 (50, 52) Kt 76.

Which accounts are involved in accounting entries for accounting for deposit transactions?

The deposit account refers to the so-called special accounts in the bank, for the accounting of which account 55 is intended in the accounting department. The Chart of Accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, as amended on November 8, 2010) provides for several sub-accounts for this account. Deposits are accounted for in subaccount 55.3 “Deposit accounts”.

Since deposits are recognized as financial investments in accordance with clause 3 of PBU 19/02, they can also be taken into account in account 58 “Financial investments” by opening the corresponding sub-account.

The organization establishes the method of accounting for the movement of money on deposit in its accounting policy.

Accounts 55 and 58 are active, so an increase in funds on deposit will be by debit, and a decrease in the deposit account or returned to the owner to the current account will be by credit.

As for the entries on the receipt of interest on the current account and, accordingly, their accrual, account 91 “Other income and expenses” will be involved in them. Subaccount 1 to this account “Other income” is intended to reflect various income, including interest received, from activities not related to the main one.

Interest accrued on the loan received - postings

The recipient of the borrowed funds will have their receipt recorded either in account 66 (if the loan is short-term - up to a year) or in account 67 (if the funds are taken for a period exceeding 12 months). The wiring will be as follows: Dt 51 (50, 52) Kt 66 (67).

The accrued interest will be credited to these same accounts, separating them in the accounting analytics from the amount of the principal debt. That is, in the entry for calculating interest on a loan received in the credit part there will be an account 66 or 67. The choice of the account that falls into its debit part will determine the fact of use or non-use of the funds received when creating an investment asset (clause 7 of PBU 15/2008, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 107n).

Interest amounts on a loan that is not related to the creation of an asset regarded as an investment (it has a long period of creation and high cost) should always be taken into account in other expenses - Dt 91 Kt 66 (67), accruing the corresponding amounts monthly (clause 6 of PBU 15/2008).

If borrowed funds are involved in expensive long-term investments, then the interest on them will form the cost of property (fixed assets or intangible assets) created with the participation of the corresponding investments: Dt 08 Kt 66 (67). During a long (more than 3 months) break that arose in the process of making investments, and upon completion of investments in the object, the continuing accrual of interest on the loan should be included in other expenses (clauses 11, 13 of PBU 15/2008).

The tax nuances of accounting for interest on loan agreements in various situations are discussed in detail in the Transaction Guide from ConsultantPlus. Get trial access to the system for free and learn how, when taxing, you need to take into account interest on loans related and not related to the acquisition of depreciable property, spent on paying dividends, etc.

Legal entities using simplified accounting methods have the right not to separate expenses associated with the creation of investment assets from other expenses.

Payment of interest will be reflected by posting Dt 66 (67) Kt 51 (50, 52). If their recipient is an individual, then his income should be subject to personal income tax (Dt 66 (67) Kt 68).

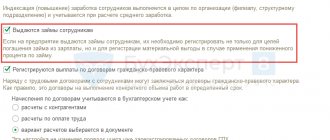

An example of applying for a loan to an employee in 1C

Let us consider in detail the execution of operations for issuing and repaying a loan. Let’s assume that an employee of the organization PromTech LLC, S.V. Larionova. A short-term loan was issued in January 2016.

Our example conditions:

- The loan amount is 120 thousand rubles

- Loan term – 12 months

- Loan percentage – 6%

- Refinancing rate – 11%

We will calculate the amounts of payments, interest and personal income tax using special processing (Fig. 1). If there is no such processing, you will have to count manually.

Debt repayment begins in the month following the month the loan was issued, in our case - from February 2016.

Fig.1

Formulas by which interest and material benefits are calculated:

- Amount of interest = Amount of Debt * Interest * Number of days in a month / Number of days in a year

- Amount of financial benefits = Amount of Debt (2/3 refinancing rate - interest) *Number of days in a month/Number of days in a year;

All calculations have been completed. Now let's see what documents need to be generated in 1C to reflect the loan.

Results

The entry for accrual of interest on a loan occurs both for legal entities giving the loan (to a legal entity or individual) and for those receiving borrowed funds (from a legal entity or individual). The first accounts for the issued debt itself in account 58 (Dt 58 Kt 51 (50, 52)), and the interest on it in account 76, accruing them monthly in correspondence with the financial results account (Dt 76 Kt 91 (90)). The second, depending on the period for which the funds are borrowed, the amount of debt is attributed to account 66 or 67 (Dt 51 Kt 66 (67)) and interest is accrued there. If borrowed funds are not involved in the creation of an investment asset, then they are accrued by posting Dt 91 Kt 66 (67). Participation in the creation of an asset regarded as an investment requires taking into account interest on the loan in the cost of this asset (Dt 08 Kt 66 (67)).

Sources:

- Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated October 6, 2008 N 107n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Obtaining a loan (borrower organization)

Now consider the reverse situation, when an enterprise receives a loan from another organization. Funds received are not included in income. In accounting, short-term loans are reflected in account 66, and long-term loans in account 67:

- Dt 51 (50) Dt 66 (67) - loan received.

In NU, interest is attributed to non-operating expenses within a certain limit. It is calculated by multiplying the refinancing rate by a factor of 1.8. This formula applies if the loan is issued in rubles. Interest must be taken into account monthly, on the date of repayment. If these amounts are transferred to the founder or individual, then additional personal income tax should be withheld at a rate of 13%. In accounting, interest is taken into account as part of other expenses. Loan interest postings:

- D-t 91 K-t 66 - interest accrued on the loan;

- Dt 66 Dt 68 - personal income tax withheld;

- Dt 66 Kt 51 - interest paid.

The exception is loans that a company receives for the purchase or construction of an investment asset. Then these expenses are included in the cost of the property. The amount of returned funds, which is not included in expenses, is reflected by posting D-t 66 K-t 51.