Determination of the thirteenth salary

The thirteenth salary is a measure of employee incentives at the end of the year, which is not a full salary, but an annual bonus. Most often, such a payment is made before the New Year holidays, and its name has been preserved from the Soviet past of Russians.

Basically, 13 salaries are equal in size to standard monthly income. The law does not necessarily regulate such premium payments. Whether or not to reward employees is at the discretion of each employer. Also, the legislation does not specify the procedure for calculating wages. There is no single formula for calculating 13 salaries; this also depends on the decision of the employer. The charter or agreement must specify the conditions and procedure for calculating the bonus if it is regular.

Most often 13 salaries are given to employees:

- Government agencies.

- Military.

- In large productions.

The amount of bonus payments is set by the head of the enterprise, the ministry, the board of directors or the meeting of shareholders.

Legal basis

Labor legislation does not contain information about such payments. Including how the 13th salary is calculated. But Article 191 of the Labor Code of the Russian Federation stipulates the possibility of encouraging labor in any of the following ways:

- declare gratitude;

- issue a diploma or certificate;

- give a valuable gift;

- award a cash prize.

Moreover, the rights of the organization (IP) are not limited to the listed points. It is possible to introduce other forms of incentives. For more information, see “Types of bonuses and rewards: making a choice.” In this regard, we can say that 13 salaries can be paid at the employer’s discretion to anyone: a pensioner, someone resigning of their own free will, or anyone else.

How the 13th salary is calculated

Since the law does not have a uniform regulation for calculating the annual bonus, this is determined by the employer. Typically, the manager sets the total amount that the payroll department distributes among the company's employees. In this case, accounting is based on internal rules and charter.

The provisions of the agreement specify the method of calculating incentive payments. But for some employees, the immediate supervisor or head of a department has the right to deprive them of their salaries. Managers also decide who should receive bonus payments. It can be:

- all employees of the enterprise;

- only those who have made a significant contribution to the development of the company;

- only qualified workers or those who already have a long overall work experience or long experience at a given enterprise.

Common methods of calculating incentive payments:

| Accrual method | Characteristic |

| Fixed amount | 13 salaries are calculated based on fixed amounts. With this calculation method, managers receive more than subordinates. |

| Payments based on salary | All employees are paid a bonus based on their salary. |

| Calculation by odds | When calculating bonuses, the length of service at a given enterprise or the number of days worked during the reporting year is taken into account. |

Each method of calculating incentive additional payments has advantages and disadvantages. For example, one of the main disadvantages of calculating a fixed amount is that it does not take into account actual days worked. And the advantage of accrual using coefficients is that they take into account the individual merits of the employee and personal contribution to the overall process.

Mandatory bonus at the end of the year

The employer pays 13 salaries on a voluntary basis. Whether there will be progress in its direction or not depends not only on the performance of employees, but also:

- organization capabilities;

- current remuneration system.

If at the end of 2022 the company suffered losses, additional remuneration is usually not paid. And this is not a violation.

A different situation arises if there is a clause on annual bonuses in the company’s internal documents. Do they have the right to deprive 13 of their salaries in this case? The answer is clear: no. After all, this rule was established by the enterprise itself. It has undertaken to encourage high-quality work with monetary rewards, for which a special financial reserve must be created. If an employee deserved a bonus but did not receive it, when he goes to court, he will be able to restore justice.

The thirteenth salary is the annual payment to employees of the enterprise at the end of the calendar year. They are paid during the New Year holidays and are an unregulated form of incentives and bonuses.

Example of calculating 13 salaries based on salary

The company employs 3 employees:

- The salary of 1 employee is 20 thousand rubles, work experience is 5 years.

- The salary of 2 employees is 17 thousand rubles, work experience is 2 years.

- The 3rd employee’s salary is 11 thousand rubles, work experience is 10 months.

For example, the bonus amount is 10% of the employee’s annual income. Then the 13th salary for 1 employee is: 20,000 * 12 * 10% = 24 thousand rubles. Incentive salary for 2 employees: 17,000 * 12 * 10% = 20,400 rubles. 13th payment for 3rd employee: 11000 * 10 * 10% = 11 thousand rubles.

If, according to the company’s charter 13, salaries are paid only to those who have worked at the enterprise for at least a year, and with 1-3 years of experience they pay 1.4 monthly salaries, and from 3 years - 1.5 monthly salaries, then:

- bonus for 1 employee - 20,000 * 1.5 = 30 thousand rubles;

- incentive for 2 employees - 17,000 * 1.4 = 23,800 rubles;

- bonus for 3 employees - 0 rubles.

3 The employee is not paid a bonus because his work experience has not reached the minimum of one year established by the employer.

Content

- What is the thirteenth salary

- Is the employer obligated to pay the 13th salary?

- Who can get 13 salary

- Why can you deprive 13 of your salary?

- How the 13th salary is processed and the calculation procedure

- How is the 13th salary calculated?

- Frequently asked questions about the 13th salary

- Psychological aspects

The concept of 13 salaries, which has taken root in everyday life, has no legal basis, since, by definition, it does not exist in any legal document. And yet, people have called this prize exactly that way since the times of the USSR. At that time, this payment was familiar to workers - no one could imagine that it could be otherwise. Time has changed, and the characteristics of 13 salaries have changed.

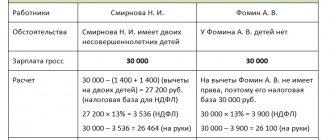

Taxes from 13th salary

Incentive payments from the employer, like all other wages, are subject to taxes. From the thirteenth salary, income tax in the amount of 13% and insurance contributions are deducted.

To calculate the final amount that the employee will receive, you need to multiply the bonus amount by 13% and subtract the resulting amount of taxes from the total amount of 13 salaries. Personal income tax is also deducted from insurance payments: pension and medical benefits. insurance, payments in connection with maternity leave and temporary disability. All contributions and taxes are withheld at the time employees receive their thirteenth salary.

How to reflect in accounting

In the accounting of non-profit organizations 13, salaries are recorded in the same way as other types of remuneration for work - wages, other bonuses and additional payments (clause 5 of PBU 10/99). The accounting entries for the incentive will be as follows:

- Dt 20, 26, 44... Dt 70 - final bonus accrued;

- Dt 70 Kt 50, 51 - funds were issued to employees from the cash register and transferred to bank cards.

Regional and local regulations on remuneration stipulate whether teachers have a salary - yes, if such additional payment is provided for by internal standards. But only on the condition that the budgetary organization still has funds allocated for salaries and taxes. The amount of the incentive depends on the amount of financing and the cash balance at the end of December. These postings reflect the thirteenth salary in a kindergarten, school or any other budgetary institution:

- Dt 0 401 20 211 Kt 0 302 11 730 - calculation of bonus wages;

- Dt 0 30211 830 Kt 0 30301 730 - income tax withholding;

- Dt 0 30211 830 Kt 0 20134 610, Kt 0 20111 610 - issuance of wages from the cash register, transfer to bank cards of employees.

Who may be left without incentive payments?

Who exactly should be paid the thirteenth salary and who not is also decided by the head of the company. At the same time, based on the recommendations of their superiors, employees may be deprived of bonus payments if:

- Violation of discipline and routine at the workplace in the company.

- Failure to implement the plan for an unexcused reason. The indicators under the plan must be agreed upon with the employee and recorded at the beginning of the year so that the employer has strong arguments not to accrue payments to the employee.

- While on maternity leave. Such employees do not take part in the production process, so most often they are not awarded bonuses or incentive payments.

- Miscalculations in work, due to which the company produced defective products.

This is an approximate list of reasons why a premium may not be awarded. The employer may also refuse to pay wages for other reasons or, at its discretion, assign an incentive amount to employees on maternity leave.

How is it calculated?

The calculation of the thirteenth salary may be different and depends on the payment method.

Fixed payment

It is used when remuneration is due only to some workers. The bonus amount is determined in different ways at the request of the manager.

Calculation example: management recorded in internal documents the rules for paying the thirteenth salary to specific workers. At the beginning of 2022 they will receive certain payments, which are:

- sixty thousand rubles to each of the managers;

- twenty-five thousand to each sales agent;

- thirty-two thousand to each accounting specialist.

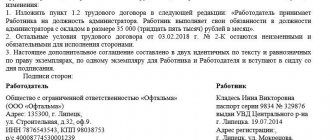

The bonus order is usually drawn up in a single copy. It is prepared by an accountant or personnel officer.

The document must indicate the positions, names, surnames and patronymics of those workers who are entitled to the thirteenth salary. It is also necessary to indicate the structural unit in which they work and the amount of payment to the employee.

You can find a sample bonus order here.

Calculation of percentage of salary

Reward amounts vary based on specific criteria. This could be the implementation of the plan, work experience, etc. In these cases, the thirteenth salary can be calculated using the following formula:

bonus = (bonus max./days worked)*days neg.

Mask Prize - the greatest monetary remuneration a worker can hope for;

Working days – the sum of working days for the year;

Days negative – actual number of days worked.

Premium max. = salary*%

Please note that the amount may increase over the course of the year. This fact must be taken into account. Internal documents must state how the thirteenth salary is determined, and the employer must transfer payment from it in the form of a tax to the budget.

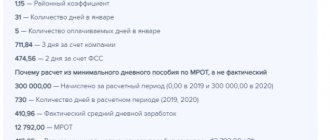

Average annual earnings

This calculation is considered the most labor-intensive. To implement it, the accounting department must have data on the amount of income of the worker during the year, the number of employees in the department, etc.

When taking into account average annual earnings, the thirteenth salary is calculated as follows:

P salary average year + Pstage

P salary average year – this is a remuneration from the average annual income;

Seniority is remuneration for years worked.

Calculation example: calculates remuneration and takes average annual earnings as a basis. How to calculate the thirteenth salary of repairman Ivanov, if the remuneration from the average income is twelve thousand rubles, and the bonus for working years is six thousand three hundred rubles.

Thus, it turns out: 12,000 + 6,300 = 18,300 rubles. This means that she is obliged to give Ivanov the amount of 18,300 rubles.

Do workers on maternity leave get paid 13 salaries?

Since the legislation of the Russian Federation does not indicate mandatory conditions for receiving the 13th salary, all categories of employees can count on it. The complete list is approved by the employer. Since incentive payments are received by those employees who perform their duties during the year and are at work, a separate decision is made regarding those on maternity leave.

Since a woman on maternity leave in most cases does not fulfill her duties, 13 she is not paid a salary. She only receives child care payments. But if a woman partially performed the work for the bonus year, for example, she went on maternity leave in May or September, then she is paid a bonus according to the time worked. Some employers indicate in their contracts that women on maternity leave are required to receive their thirteenth salary at the end of the year. Others are based on the generated profit and the amount that is expected to reward employees. It also happens that one year women on maternity leave receive 13 salaries, but the next year they do not.

5 / 5 ( 4 voices)

about the author

Klavdiya Treskova is an expert in the field of financial literacy and investment. Higher education in economics. More than 15 years of experience in banking. He regularly improves his qualifications and takes courses in finance and investments, which is confirmed by certificates from the Bank of Russia, the Association for the Development of Financial Literacy, Netology and other educational platforms. Collaborates with Sravni.ru, Tinkoff Investments, GPB Investments and other financial publications. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Results

So, the 13th salary is a bonus payment that is accrued to employees based on the results of the past year. 13, wages are paid at the initiative of the employer - he can refuse to pay bonuses to employees without breaking the law. The procedure and rules for calculating payments, as well as the algorithm for calculating its amount, are established by the employer himself - for this he issues the appropriate local regulation.

Source: "Legal ABC"

Print Ask a lawyer

Tags related to payment, salary, bonus

Comments: 16

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Tatiana

12/31/2021 at 01:25 I wrote a letter of resignation on December 28, 29 everyone was paid 13 salaries except me, although I worked the whole year

Reply ↓ Anna Popovich

12/31/2021 at 02:20Dear Tatyana, payment of the 13th salary depends on the internal labor regulations and the collective agreement in your organization. In addition, it is not mandatory and may not be paid.

Reply ↓

12/27/2021 at 22:06

Good evening, I worked as a laundress in a kindergarten, I quit in July, so I worked for half a year, how much should I be paid on the 13th salary?

Reply ↓

- Anna Popovich

12/29/2021 at 03:43

Dear Tatyana, this bonus is paid at the discretion of the employer and is not a mandatory payment upon dismissal of an employee.

Reply ↓

12/22/2021 at 11:52 pm

In December 2022, there was a disciplinary reprimand and naturally I was deprived of savings at the end of the year, for the whole of 2022, I was deprived of a bonus, now I was again deprived of a bonus at the end of the year, but they paid 13 salaries only an order of magnitude less than other colleagues, I can’t understand how is there a calculation?

Reply ↓

- Anna Popovich

12/23/2021 at 02:28

Dear Yulia, this depends on the internal labor regulations and collective agreement in your organization. It is necessary to study it carefully.

Reply ↓

12/20/2021 at 11:23 pm

If an employee has been on sick leave for more than 36 days in a year, can he count on his 13th salary?

Reply ↓

- Anna Popovich

12/21/2021 at 01:01

Dear Nadezhda, methods for calculating the 13th salary may be different. Which one to choose and who to reward is determined by the employer. The procedure for calculating the 13th salary should be enshrined in the local bonus act or collective agreement.

Reply ↓

12/20/2021 at 02:22

Hello. I have a question. I didn’t work until the end of the year 3 days, I quit. Will they give me the thirteenth?

Reply ↓

- Olga Pikhotskaya

12/20/2021 at 14:11

Evgeniy, good afternoon. This depends on the system in place at your company. As a rule, employees who have worked for less than a full year can claim remuneration that corresponds to the period actually worked.

Reply ↓

12/19/2021 at 12:21

Hello. While I was on maternity leave at work, there was a staff reduction and I also fall under it. When the child turned 2 years old, I wrote that I was ready to go to work, knowing in advance that they would not be able to provide it for me. I was sent to idle time due to the fault of my employer. The order does not contain specific deadlines for how long I will be down. But we all know that until the child turns 3 years old, I will be idle. My questions: 1. Are they paying me correctly 2/3 of the average? Earning money if they are not going to bring me to work (at work there was a change of management from LLC to individual entrepreneur) and in essence this is a failure to provide a workplace. 2. Am I entitled to 13 salaries? ?

Reply ↓

- Anna Popovich

12/21/2021 at 22:51

Dear Tatyana, according to Article 157 of the Labor Code of the Russian Federation, the employer is obliged to compensate for the time during which you are idle in the amount of 2/3 of your earnings. As for the 13th salary, if local regulations do not provide for the mandatory payment of bonuses at the end of the year, then paying employees the 13th salary is the employer’s right, but not an obligation, and he can pay it at his own discretion.

Reply ↓

01.11.2021 at 13:07

I got a job on January 20. Can they not pay me my 13th salary?

Reply ↓

- Olga Pikhotskaya

01.11.2021 at 16:03

Love, good afternoon. It depends on the system in place at the enterprise. As a rule, employees who have worked for less than a full year have the right to claim remuneration in accordance with the period actually worked.

Reply ↓

08/12/2021 at 20:03

I quit on June 25, 2022, in July they paid me a bonus for 2020, am I entitled to receive a bonus based on the results of the year, have I worked for 20 years in this organization?

Reply ↓

- Anna Popovich

08/12/2021 at 23:31

Dear Natalya, no, because you are no longer an employee of the organization.

Reply ↓

Premium amount

Each employer sets the size of the 13th salary himself. Here, as they say, the master is the master. It is almost impossible to determine in advance the amount intended to reward employees.

When the year turns out to be profitable, there is a chance that employee bonuses will increase. If the organization’s activities turn out to be unprofitable, then it is difficult to count on receiving additional payments. However, usually the 13th salary in size is either the average monthly salary or some percentage of the salary.

Why can they be deprived?

Bonuses are considered the most unstable form of receiving funds. In addition to the universal reason, when the financial condition of the company deteriorates and bonuses are stopped for the entire staff, there may also be a “targeted” deprivation of bonuses - non-payment of salaries to individual employees.

The thirteenth salary may not be given for:

- failure to fully fulfill official duties (failure to comply with standards, etc.);

- gross errors in work resulting in losses to the enterprise;

- violation of labor discipline with subsequent penalties.

13 wages are the employer’s right, not an obligation. If management decides to stop paying bonuses to employees even without good reason, by changing local regulations and making adjustments to the necessary documentation, it will not violate the Labor Code of the Russian Federation.

Sometimes deprivation of a bonus is a kind of warning: when an employee fails to cope with his duties, but not so critical as to fire him. In this case, non-payment of bonuses is a sign that the employee has fallen into the “red zone” and has become the first among candidates for leaving the organization.

How much do Russian companies pay?

Employers prefer not to publish

(except for cases when they “boast” about them to competitors). Therefore, there is no uniform statistics on “New Year’s” and other bonuses at the country level.

Any statistics are based, for the most part, on the results of surveys, the media’s own information and reviews on the Internet from employees.

The latest study was conducted by the Rabota.ru service at the end of 2018. Then it turned out that the business was ready to pay 13 salaries

, this answer option was chosen by more than 40% of the surveyed representatives of 300 Russian companies.

Most of all, employers plan to reward employees who helped achieve good results over the year. Unlike the “Soviet” scheme, not everyone received bonuses, but only 10% of the staff

companies.

One of the businessmen commented on it this way: top managers receive two, three or even six salaries from business owners in the form of an annual bonus. Bonuses for ordinary employees are agreed upon by managers, and the amounts range from one to two average monthly salaries

.

Some companies pay an annual bonus based on the employee’s performance, and in promising industries (for example, in the security or IT field) its amount can be many times higher than the regular salary.

In addition to bonuses, employers began to motivate staff with other bonuses - additional medical insurance, comfortable working conditions, meals, etc.

As for the regions, according to FinExpertiza, the largest annual premiums are paid in Yakutia and Chukotka

(traditionally higher salaries there), Moscow is in third place. In the capital, the average annual bonus was 35,557 rubles, and the least will be received in Ingushetia, Mordovia, the Tambov region and the Kabardino-Balkarian Republic - about 5,000 rubles.

The national average 13 salary in 2022 was 13,159 rubles

.

The real size of the bonus for the year in large companies turned out to be not so easy to find out. AvtoVAZ reported this openly

– they paid the workers about 7,000 rubles each, and not all of them, but only those who did not violate labor discipline.

"Russian Railways"

(the country's largest employer) announced payments in the amount of the average monthly salary of employees. But online people write something completely different. Some received 4 thousand rubles, others did not receive it at all. They also complained that the payment came in February-March (obviously, after the financial results for the year were approved).

Another state giant, Russian Post

, does not disclose indicators. The workers themselves write that their salaries have never been paid in their memory. They only receive a monthly 10-12% bonus for sales of some services, and it is almost impossible to get an 18% bonus for fulfilling the division plan (the plans are too high).

In the already closed bank "Ugra"

, the employees wrote, the amount of the 13th salary was set at 66.7% of the salary, plus a certain “general bank coefficient” from 50 to 100%.

By the way, you can get a really big bonus at the bank. In 2015, Oleg Tinkov purchased 8 BMW 5 Series cars with his own money and gave them to the most dedicated employees who worked at Tinkoff Bank

from the very beginning.

Payments to top managers of companies, including state-owned ones, contrast sharply with the not very large bonuses for ordinary employees.

For example, Sberbank

since 2016, it has been paying each member of the bank’s Board of Directors a remuneration of 5.9 million rubles per year, plus 20-50% bonuses for performing the duties of a member of the Supervisory Board Committee or its chairman.

In general, payments to top managers of banks have always been high. Back in 2013, they wrote that leading managers in state banks receive annual bonuses of up to 48 salaries, plus annual bonuses of up to 18 million rubles.

Forbes has compiled a ranking of company expenses for annual bonuses to top managers of companies for 2022. Norilsk Nickel became the leader

, which spent 6.8 billion rubles for these purposes. For comparison, this is the size of the budget of a city like Tula.

As you can see, the gap between the annual bonuses of managers and ordinary employees is huge, and not only in private companies.

Percentage of salary

How to calculate the 13th salary? Let’s imagine a more “fair” way - differentiating the premium strictly according to the designated criteria. They may be length of service in a given organization, the number of successfully concluded transactions, the average salary of an employee, etc.

The formula can be applied here:

Premium = (Max. bonus / D. worker) x D. neg.

Let's look at the elements:

- Max. bonus - the maximum bonus, the largest amount of money that can be allocated to one worker within the framework of the current remuneration system.

- D. slave — the total number of working days in a year.

- D. neg. — the number of days in a year that this employee worked.

You can also use another formula:

Maximum bonus = Salary x % (set percentage for a specific achievement, category of employees, etc.)

When applying the last formula, the accountant must take into account that the salary is not always static, but can increase/decrease over time.

From the 13th salary, by the way, the employer is also obliged to transfer income tax to the state treasury.

Features of taxation

Regardless of which tax system the organization’s management has chosen, the following types of contributions are mandatory for the bonus at the end of the year:

- to compulsory pension insurance funds (both social and medical);

- for insurance against occupational diseases and accidents.

It is mandatory 13 that wages are included in the tax base for the purpose of calculating personal income tax . This is done in the month when the year-end bonus is paid. Accordingly, it is at the moment of payment that personal income tax is withheld.