What is the difference between fixed assets and inventories - in essence and lines in the balance sheet

The assets in question should be distinguished from fixed assets. The latter are represented by the following assets (clause 4 of PBU 6/01):

- intended for use in the production of goods, works, services, for the management needs of the company or for rental by the company;

- intended for use for a period exceeding 12 months;

- not originally intended for subsequent resale;

- capable of bringing economic benefits to the company in the future.

In general, fixed assets are values that are used as means of labor, which are used for the purpose of processing material reserves or using them as a finished surplus product.

Inventory and fixed assets are reflected in different lines of the balance sheet. The asset of the first type is in line 1210, the second is in line 1150.

Important! From 2022, PBU 6/01 will no longer be in force, and accounting for fixed assets will be regulated by two new Federal Accounting Standards: 6/2020 “Fixed Assets” and 26/2020 “Capital Investments”. The main provisions of these standards and their differences from PBU 6/01 are discussed in detail by ConsultantPlus experts. Get free access to K+ and go to Review.

How do fixed assets appear?

The receipt of fixed assets determines their initial cost. The material assets of an enterprise can be:

- purchased from suppliers for a certain fee, which is the original cost;

- contributed by the founders as a contribution to the authorized capital (the value will be the monetary value of the founders);

- created (built) – production costs are taken into account;

- transferred free of charge - the initial value will be the current market value;

- received under an exchange agreement - the cost is determined according to the norms of clause 11 of PBU 6/01.

Received funds are formalized by an acceptance certificate, and then by an order from the manager to put them into operation. At the same time, their initial cost is formed, which accountants will reflect on account 01 “Fixed Assets”.

How are inventories accounted for in account 10?

All legal entities are required to keep accounting records of material inventories - this is a mandatory requirement for their business activities (Clause 1, Article 2 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ). In this case, business transactions reflecting the turnover of inventories are recorded on account 10 of the Chart of Accounts. Various sub-accounts are opened for it (for raw materials, fuel, containers, etc.). The corresponding business transactions are registered using supporting documents (invoices, orders, acts, etc.).

Other inventories - what applies to them

The term “other inventories” mainly characterizes the accounting of budgetary institutions. In budget accounting - carried out by state and municipal organizations - other inventories include (clause 118 of the order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n):

- special equipment for research,

- young animals of all types of animals and fattening animals, birds, rabbits, fur-bearing animals, bee families, regardless of their cost,

- offspring of young animals in the presence of draft animals in institutions,

- planting materials,

- reagents and chemicals, glass and chemical utensils, metals, electrical materials, radio materials and radio components, photographic equipment, experimental animals and other materials for educational purposes and research work, precious and other metals for prosthetics, as well as disabled equipment and vehicles for disabled people,

- household materials (light bulbs, soap, brushes, etc.), office supplies (paper, pencils, pens, rods, etc.),

- dishes,

- container,

- stern,

- books,

- spare parts for the repair and replacement of worn parts in machinery and equipment, vehicles, industrial and household equipment,

- special purpose materials,

- other similar assets.

Resources classified as other inventory are assets of budgetary institutions, which, as in the case of inventories of commercial organizations, are accounted for in separate accounting accounts. According to the Unified Chart of Accounts (common for all budgetary organizations), account 105 06 is used.

Moreover, in many cases it is supplemented by a 3-digit analytical code of KOSGU. For example, reflecting an increase in the cost of inventories.

In commercial accounting, “other” in the manner determined by local regulations, as a rule, includes inventories with the least degree of significance from the point of view of use in the production process (based on the criteria established by the responsible specialists of the company).

Cost limit for accounting as part of OS

Property may have all the characteristics of a fixed asset and have an initial cost of no more than 40,000 rubles. The organization has the right to take into account any object within this cost group:

- as part of fixed assets;

- as part of material and industrial reserves (MPI).

Set a specific value limit for classifying property as a particular asset category in the accounting policy for accounting purposes. This procedure is provided for in paragraph 5 of PBU 6/01.

If the value limit changes, its new value can only be applied to fixed assets accepted for accounting after its adjustment. Such clarifications are contained in the letter of the Ministry of Finance of Russia dated January 10, 2012 No. 07-02-06/3.

An example of classifying property as fixed assets in accounting. The useful life of the property is more than 12 months

Alpha LLC purchased a drill and a vacuum cleaner for household needs. The cost of the drill (excluding VAT) was 7,500 rubles. Its useful life, according to the instructions supplied by the manufacturer, is 36 months. The cost of the vacuum cleaner (excluding VAT) is 41,800 rubles, its useful life is 48 months.

For accounting purposes, the organization’s accounting policy states that objects costing less than 40,000 rubles. are taken into account as part of the inventory. Therefore, when receiving property, the organization’s accountant took into account:

- drill - as part of MPZ (household equipment);

- vacuum cleaner - part of fixed assets.

Situation: is it possible to apply different values of the cost limit in relation to certain groups of fixed assets, and not to all fixed assets?

The organization has the right to establish only a single value of the cost limit. At the same time, assets whose value does not exceed the established limit can be accounted for as fixed assets.

This is explained as follows.

Assets that simultaneously meet the criteria specified in paragraph 4 of PBU 6/01 are classified as fixed assets. In this case, the organization has the right to independently determine the procedure for accounting for property whose value does not exceed 40,000 rubles. and meets all the characteristics of a fixed asset object, both as part of fixed assets and as part of inventories (paragraph 4, clause 5 of PBU 6/01).

From a literal reading of paragraph 5 of PBU 6/01, it follows that an organization can set a single limit for recognizing the accounting of assets as inventory. In this case, the organization has the right, but not the obligation, to apply a uniform accounting procedure for all assets that meet the criteria for classification as fixed assets.

Thus, with the established cost limit of 40,000 rubles. and compliance with other conditions, the organization can accept individual assets or groups of assets for accounting as part of fixed assets. The organization must provide for the characteristics of such assets or their groups in its accounting policies for accounting purposes.

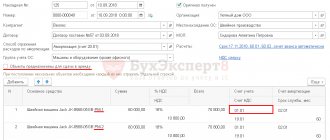

An example of reflecting computer equipment and computer desks acquired by an organization as fixed assets

In January, Alpha LLC purchased a computer and an office desk. The cost of the computer (excluding VAT) was 37,500 rubles. Its useful life, according to the instructions supplied by the manufacturer, is 36 months. The cost of an office desk (excluding VAT) is 20,800 rubles, its useful life is 25 months.

For accounting purposes, the organization’s accounting policy states that objects costing less than 40,000 rubles. and those that sharply lose their consumer qualities are taken into account as part of the MPZ. Therefore, when receiving property, the organization’s accountant took into account:

- computer – as part of fixed assets;

- office table - part of the MPZ (household equipment).

Increase in the cost of inventory (which is included in account 340 of budget accounting)

The term “increase in the value of inventories” can be considered in several aspects. Thus, in budget accounting, it is understood as the fact that expenses for payment of contracts for the purchase of inventories are allocated to the article code KOSGU 340.

The corresponding code for KOSGU is used by government, budgetary institutions, as well as organizations that have the authority to receive budgetary funds. It records the expenses of a state or municipal organization for the purchase or production of materials and equipment. They can be represented by objects such as:

- medicines and medical equipment,

- Food,

- fuel,

- building materials,

- furniture,

- spare parts,

- special equipment for research,

- stern.

In commercial accounting, an increase in the cost of inventories is understood as the fact of writing off certain expenses associated with the purchase of inventories to increase their value. Each such write-off is recorded as a separate entry.

Order size optimization involves determining inventory requirements

This area of analysis deals with the calculation of the standard indicator of the company’s need for certain material reserves - so as to optimize their purchases in the required volume when ordering from suppliers. In this case, the task of responsible specialists comes down to finding such a quantity of reserves that, on the one hand, is sufficient to maintain the production process, and on the other hand, is not too much in terms of the cost of their acquisition and maintenance.

Thus, in most enterprises, determining the standard for inventory is a necessary part of analyzing the state of inventories, coupled with determining the factors influencing their volume.

Rationing the consumption of inventories of material resources and factors influencing the amount of inventories

In terms of assessing the need for them, inventories can be classified on various grounds. Thus, a common approach is to divide reserves:

- for those that are necessary to ensure an assortment of goods or stable shipment of finished products under contracts (they are, as a rule, the least in volume);

- for those that are necessary to maintain the full production cycle (usually they are second in volume);

- for those needed to maintain production between deliveries of inventory from suppliers (it is assumed that there will be the most of them);

- for insurance - which are applied in the event of a supply interruption or an increase in the need for supplies not provided for by calculations (as a rule, they are about 10% of those that belong to the previous category).

For each of these reserves, the optimal and, as a result, standard indicator of duration or volume is considered based on factors such as:

- dynamics of consumption of inventories (in relation, for example, to the dynamics of demand for manufactured goods);

- frequency of deliveries of materials from the supplier, completeness of deliveries;

- range of products.

Accounting methods for inventory items

Accounting methods are prescribed in Guidelines No. 119.

Varietal method

Accounting is carried out using grade-type cards. They record the presence of objects, as well as their movement. Paragraphs numbered 136-140 of the Methodological Instructions describe the features of the method. Accounting can be carried out in the following ways:

- Quantitative-sum . It is assumed that numerical and total accounting is simultaneously introduced in warehouses and accounting departments. In this case, inventory numbers of inventory items are used.

- Baldovy . It is assumed that exclusively quantitative accounting by type of inventory items is introduced in warehouses. Accounting uses total accounting. It uses monetary terms. Quantitative accounting is carried out on the basis of primary documentation. In this case, cards and books are used for warehouse accounting. After the end of the reporting year, the primary documentation must be submitted to the accounting department.

The varietal method is used when inventory items are stored by name and grade. In this case, the time of delivery of valuables and their cost are not taken into account. A separate inventory card is created for each item. One nomenclature differs from another in the following indicators:

- Product brand.

- Variety

- Unit of measurement.

- Colors.

The cards will be valid throughout the year. They must contain all the information about the accepted object. They must be registered in the appropriate register. After this, individual numbers are placed on the cards. Registration is required by employees of the accounting department. If the entire sheet of the card is filled, new sheets are opened. They must be numbered.

NOTE! All entries made on cards must be supported by primary documentation.

Pros and cons of the varietal method

The varietal method has the following advantages:

- Saving warehouse space.

- Quick management of inventory balances.

However, there are also significant drawbacks - difficulties in classifying goods of the same type at different prices.

Question: How is the provision of services under a warehousing agreement reflected in the custodian’s accounting, including the receipt of inventory items for safekeeping and their return at the end of the agreement? View answer

Batch method

The batch method involves an accounting procedure similar to the varietal method. The difference is that each batch of inventory items is registered separately. The batch method is described in paragraph 242 of the Directions. It is used both in the warehouse and in the accounting department. Assumes separate storage of each batch. Each shipment must have a corresponding transport document.

IMPORTANT! Products that were transported by one transport, goods with one name and simultaneous receipt from a single supplier - all this can be considered a single batch.

The batch must be registered in the goods and materials receipt journal. She is assigned an individual registration number. It is used to make marks in expenditure documentation. The registration number is placed next to the names of inventory items. You need to open two party cards. One will be used in the warehouse department, the other in the accounting department. The shape of the card is determined by the type of product.

Pros and cons of the batch method

The technique has the following advantages:

- Determination of batch consumption results without inventory.

- Increased control over the safety of inventory items.

- Reducing enterprise losses.

But there are also disadvantages:

- Irrational use of warehouse space.

- There is no possibility of operational control of inventory items.

The choice of a specific method will depend on the priorities of the enterprise and the size of the warehouse.

Results

Material reserves are the resources of an organization on the basis of which a surplus product is created, or used as a surplus product. All organizations, including budget ones, must keep inventory records. Working with inventories, as a rule, involves determining the business entity’s need for them, as well as analyzing the effectiveness of inventory management.

You can learn more about inventory management in an enterprise in the following articles:

- “Other material reserves - what applies to them?”;

- "Inventory of inventories."

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Depreciation and wear

Fixed assets can be received by the organization:

- under a purchase and sale agreement;

- free of charge;

- as a contribution to the authorized capital;

- by barter (under an exchange agreement);

- as a result of construction (manufacturing) by contract and economic methods;

- in the form of surpluses identified during inventory.

Repay the cost of fixed assets by calculating depreciation. Depreciation is accrued for fixed assets of non-profit organizations. This procedure is provided for in paragraph 17 of PBU 6/01 for fixed assets that are depreciable property.