Violation of tax laws leads to fines and penalties. You can receive a sanction for underestimating the taxable base or late submission of declarations. If payment is not made, penalties will be calculated automatically. Fines and penalties according to 1C 8.3 are calculated manually. There are no separate templates created for them. You can make them yourself. It is important to correctly select the account to which fines and penalties will be transferred and make entries in the process of accruing them. Thus, a fine for violating the provisions of tax legislation can be classified as tax sanctions. They do not reduce the amount of taxable profit.

What are penalties and how are they calculated?

Insurance premiums from 2022 are divided in relation to the legislative norms establishing the rules for working with them:

- the bulk of contributions (for compulsory health insurance, compulsory medical insurance, compulsory health insurance for disability and maternity) began to be subject to the Tax Code of the Russian Federation and the requirements that apply to tax payments;

- contributions for injuries remained under the provisions of the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ.

However, the requirements for their payment have remained unchanged: insurance premiums must be paid by the payer on time and in full. If due to any circumstances they are not paid or not paid in full, not only the arrears are collected from the payer, but also a sanction for late payment, which is called a penalty.

The basis for payment of penalties (if they are not paid voluntarily) are the requirements presented to the payer by the body supervising the relevant contributions (IFTS or Social Insurance Fund). Thus, penalties are the estimated amount that must be paid by a payer who has violated the deadline for paying contributions. They are calculated as a percentage for each day of delay, starting from the day following the payment deadline, which is established by law.

You can calculate penalties using our calculator .

Read about the specifics of calculating penalties in the material “How to correctly calculate tax penalties (nuances).”

You will always find the KBC for contributions and taxes in ConsultantPlus. Get a free trial and jump into the content.

Reporting

Calculation of insurance premiums, both in paper and electronic form, is submitted to the Federal Tax Service within the time limits established by Chapter. 34 Tax Code of the Russian Federation:

- persons making payments to individuals no later than the 30th day of the month following the quarter (clause 1, clause 1, article 419, clause 7, article 431 of the Tax Code of the Russian Federation);

- heads of peasant and farm enterprises report until January 30 of the calendar year following the reporting year (clause 3 of Article 432 of the Tax Code of the Russian Federation).

In addition, it is necessary to submit accounting reports to the Pension Fund of the Russian Federation.

You must pay contributions for injuries and report in Form 4-FSS to the FSS (Letter dated August 17, 2016 No. 02-09-11/04-03-17282).

Methods for collecting penalties and the negative consequences of their late payment

If the payer has neglected the opportunity to voluntarily fulfill the requirement to pay penalties, they are collected using the following methods:

- sending a collection order to the payer’s bank;

To learn about which accounts penalties can be collected, read the article “From which accounts can tax authorities collect penalties?” .

- recovery from property.

In addition, if the terms and completeness of payment of insurance premiums are violated, we are talking not only about sanctions, but also about a violation of the pension rights of the insured persons.

The negative consequences of non-payment of contributions are:

- reducing the possibility of obtaining investment income from investing pension savings;

- reduction in the amount of pension savings when indexing them.

Read about the consequences of non-payment of insurance premiums due to their failure to be reflected in the calculation in the article “What is the liability for non-payment of insurance premiums?”

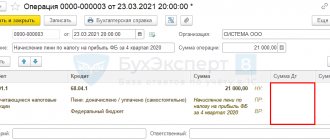

Calculation of penalties for taxes: accounting entries

Each of the taxes existing for a legal entity must be paid on time. Consequently, it does not matter for what type of payment the tax penalty was accrued. The postings are identical. Each day of delay in any of the obligatory contributions to the budget is punished equally strictly.

Accounting recognizes penalties as another expense, which in no way participates in determining the tax base when calculating income tax. Clause 83 of the PBU and the Instructions for the use of the standard chart of accounts make it possible to verify that obligations of this kind should really be reflected in account 99.

Penalty is a term that has approximately the same meaning as interest on loans in a banking institution. But compared to any bank, penalties have a government background, expressed in their calculation using the refinancing rate. The amount of the penalty is 1/300 of the refinancing rate for each day, starting from the day following the last day of voluntary payment.

If the facts of accrual and payment of penalties occur, then an explanatory note is drawn up attached to the report in Form No. 2 “Profit and Loss Statement”, where these indicators are deciphered. This issue is especially relevant if the penalty is large enough.

Reflection of penalties on insurance premiums in accounting

Clause 7 of PBU 1/2008 states that the enterprise itself has the opportunity to choose the method of reflecting expenses in accounting, if it is not expressly established by law. PBU 10/99 does not specifically specify the reflection of penalties for taxes and fees; it only indicates penalties for violation of the terms of contracts.

Moreover, we draw your attention to the fact that the amounts of taxes and contributions additionally accrued during the audit can be attributed to past periods, and fines and penalties - to the periods when the decision was made on the audit report (court decision). As for the accounts in which they should be taken into account, the Ministry of Finance of Russia in its latest clarifications (letter dated December 28, 2016 No. 07-04-09/78875) recommends that penalties accrued on payments other than income taxes and the simplified tax system be attributed to accounts cost accounting:

Dt 26 (44) Kt 69.

Read more about the latest point of view of the Ministry of Finance in the material “Tax penalties and fines - what is the account in accounting?” .

In earlier recommendations, the Ministry of Finance proposed using account 99 to reflect penalties (letter dated February 15, 2006 No. 07-05-06/31).

In the instructions for using the chart of accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n, account 99 is used to reflect tax sanctions. Penalties do not apply to tax sanctions, but the instructions say that account 99 can also be used to reflect penalties for violation of deadlines for paying contributions in correspondence with account 69.

In practice, they also use the option of assigning penalties to other expenses:

Dt 91 Kt 69.

The amount of the listed penalties is reflected by the posting: Dt 69 Kt 51.

We also emphasize that the amount of penalties on contributions is not involved in calculating the income tax base (clause 2 of Article 270 of the Tax Code of the Russian Federation), therefore, in relation to them, permanent differences arise between accounting and tax accounting (clause 4 of PBU 18/02). These differences correspond to permanent tax liabilities accrued by posting: Dt 99 Kt 68.

Penalty under a supply agreement

Penalties (fines and penalties) can be presented to the counterparty if he violates the terms of the contract (Article 330 of the Civil Code of the Russian Federation).

The amount of the fine is usually fixed, and penalties are charged for a certain amount (amount of debt, amount of delivery). In order to recover legitimate money from the violator, it is necessary to stipulate in the contract the procedure for calculating the amount of penalties and the timing of the transfer of money. A fine can be imposed on both the buyer and the supplier of goods in the following situations:

1. The supplier violated the terms of delivery of goods specified in the contract.

2. The buyer did not pay for the goods within the terms specified in the delivery agreement.

Most often, the violator pays penalties calculated for each day of late payment. If the terms of the contract are violated, the guilty party must pay a penalty in accordance with the contract. The company whose rights have been violated submits a written demand (claim) to the guilty organization for payment of a penalty (Article 331 of the Civil Code of the Russian Federation). The parties can agree to postpone the payment of the fine by signing an additional agreement.

Often the violator of the contract refuses to pay the fine. In this case, you can file a lawsuit. If the court makes a positive decision, the counterparty will be required to pay a fine. Most likely, the violator will be required to reimburse court costs and the state fee paid by the plaintiff for the consideration of the case in court.

Accounting with the injured party

In tax accounting, the penalty received by the injured party is reflected in non-operating income (clause 3 of Article 250 of the Tax Code of the Russian Federation). In accounting, the amount of the penalty is recognized as other income (clause 8 of PBU 9/99 “Income of the organization”).

The postings will be like this:

Debit 76 Credit 91.01 - the amount of the penalty is reflected in the accounting

Debit 91.02 Credit 68 - reflects the state fee for considering a claim in court

Debit 76 Credit 91.01 - the amount of state duty, by court decision, was presented for reimbursement by the violator

Debit 51 Credit 76 - the amount of the penalty was credited to the current account

Violator's account

In tax accounting, the party to the contract who committed the violation includes the penalty as part of non-operating expenses (subclause 13, clause 1, article 265 of the Tax Code of the Russian Federation).

In accounting, the amount of the penalty is recognized as other expenses (clause 12 of PBU 10/99).

The postings will be like this:

Debit 91.02 Credit 76 - penalty accrued

Debit 76 Credit 51 - the amount of the penalty was transferred to the injured party.

Globus LLC shipped a power plant to Mech LLC in the amount of 826,000 rubles, including VAT - 126,000 rubles. According to the terms of the contract, Mech LLC must pay for the goods until May 15, 2017 inclusive. The money was transferred to the account of Globus LLC on May 25, 2017. The amount of the penalty is 0.3% of the contract amount for each day of delay. The accrual of penalties will begin on May 16, 2017. Penalty = 826,000 x 0.3% x 10 days = 24,780 rubles. Globus LLC will reflect the penalty as part of non-operating income: Debit 76 Credit 91.01 - 24,780 Mech LLC will reflect the penalty as non-operating expenses: Debit 91.02 Credit 76 - 24,780

Results

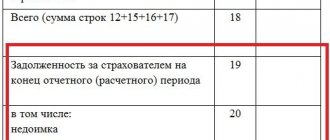

Penalties for late payment of insurance premiums that are not repaid within the period specified in the request of the tax authority are collected forcibly from the policyholder’s funds or from his property if there are insufficient funds in the accounts. The policyholder is recommended to independently choose the method of reflecting penalties in accounting and reflect it in the accounting policy.

Sources:

- Tax Code of the Russian Federation

- PBU 10/99, approved. by order of the Ministry of Finance of Russia dated May 6, 1999 N 33n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Additional tax accruals in accounting

How can additional taxes assessed based on the audit results be assessed?

These are nothing more than mistakes. It doesn’t matter that they were discovered not by you, but by the inspectors. You will have to fix them. And the order of correction depends on the period to which such an error relates. The options will be:

- taxes additionally assessed for the current year are taken into account as of the date of the tax inspectorate’s decision made based on the results of the audit. They are reflected in the same transactions with which the corresponding taxes are calculated;

- taxes relating to last year, provided that the annual balance has not yet been approved, must be additionally accrued in December of last year;

- taxes related to previous periods, the reporting for which has already been approved, are reflected in accounting depending on the significance of the additional accrued amount (taking into account the requirements of PBU 22/2010 “Correcting errors in accounting and reporting”).

Thus, minor errors are reflected on the date of entry into force of the verification decision, that is, on the date of discovery. In accounting, additionally accrued taxes are included in other expenses, except for additionally accrued income tax - it is included in the financial result.

The postings will be like this:

- Debit 91 Credit 68

- additional taxes were assessed based on the results of the tax audit;

- additional income tax was assessed based on the results of the tax audit.

Significant errors are reflected in the debit of account 84 and the comparative indicators of previous years are recalculated in the current statements.

The wiring is like this:

- Debit 84 Credit 68

- additional taxes were assessed based on the results of the tax audit.

Methods for collecting fines and penalties

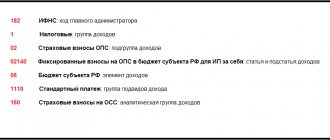

Organizations can pay penalties voluntarily. To do this, you should send a payment order to the fund indicating the amount of the sanction. The document must contain the correct details, including the relevant BCC.

If the payer has not repaid the debt on his own, the regulatory authorities have the right to collect the arrears. The procedure can be carried out by government services using the following methods:

- send a collection order to the bank servicing the company;

- order the bailiffs to recover the required amount from the property of the debtor company;

- file a lawsuit to collect penalties and insurance premiums through confiscation of the payer’s assets, if he is an individual.

However, before taking radical measures, the services issue a demand to the company to pay the debt. The document indicates the period during which the company can independently repay the arrears. If the company does not transfer funds, then the regulatory authorities have the right to recover. In this case, penalties can only be written off from a current account opened on the basis of an agreement between the organization and the bank.

When paying taxes, insurance premiums, and preparing reports, risks may arise that lead to the imposition of penalties and interest. How to reflect these transactions in accounting and generate accounting entries for calculating penalties for income taxes, VAT, personal income tax and insurance premiums will be discussed below.

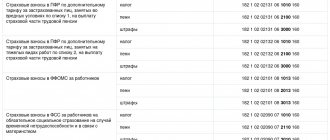

Accounting of insurance premiums

Insurance premiums are calculated monthly. Postings are created in the period to which the calculated amounts relate.

Accruals are displayed on account 69. Organizations must ensure analytical accounting of funds; for this purpose, appropriate sub-accounts are opened.

Postings to account for penalties on insurance premiums

Typical accounting entries are provided in the table below.

| the name of the operation | Debit | Credit |

| Insurance premiums paid to the Pension Fund | 20 (25, 26, 29, 44) | 69.2 |

| Accrued for payment to the Social Insurance Fund | 20 (25, 26, 29, 44) | 69.1 |

| Accrued to the Compulsory Medical Insurance Fund | 20 (25, 26, 29, 44) | 69.3 |

| Late fee charged | 91 | 69 |

| The established amounts were transferred to the funds | 69 | 51 |

Example #1. Calculation of penalties for insurance contributions to the Pension Fund

Ander LLC transferred insurance premiums for March 2016 on April 19. What amount should be paid if the debt is 10 thousand rubles?

The calculation for this situation will look like this:

- It is necessary to determine all unknown indicators of the formula:

- The refinancing rate from January 1, 2016 is 11%;

- The non-payment period is 3 days: April 16, 17 and 18.

- Calculation using the formula: P = S*D*SR*1/300 = 10000*3*11*1/300 = 1100 rub.

- Preparation of postings:

- Contributions in the amount of 10 thousand rubles have been accrued: debit 20, credit 69;

- A penalty of 1,100 rubles was assessed. for overdue: debit 91, credit 69;

- The debt on contributions is listed: debit 69, credit 51;

- Penalty paid: debit 69, credit 51.

We also recommend that you read the article: “Penalties on insurance premiums.”

Example #2. Calculation of penalties for arrears on insurance contributions to the Pension Fund of Russia

Silfida LLC assessed mandatory payments in the amount of 15 thousand rubles. Of these, 10 thousand rubles. were transferred on April 13, and on the 5th - on the 18th.

The calculation in this case will be made using only 5 thousand rubles, since part of the amount was transferred on time:

P = S*D*SR*1/300 = 5000*2*11*1/300 = 366.67 rub.

Postings for the operation:

- Contributions in the amount of 15 thousand rubles were accrued: debit 20, credit 69;

- Paid 10 thousand rubles: debit 69, credit 51;

- A penalty was accrued for late payment in the amount of 366.67 rubles: debit 91, credit 69;

- The debt on contributions in the amount of 5 thousand rubles was transferred: debit 69 credit 51;

- Penalty paid: debit 69, credit 51.

Use the insurance premium penalty calculator in Excel.