Is it possible to issue a receipt from the PKO to the client along with the cash receipt? Is it even legal to issue such a document? The questions posed are quite interesting.

The reason for this is simple: there are real examples when an individual entrepreneur, selling a product to a client, does not give him a check punched by cash register, but only provides a receipt from the receipt (cash receipt order) and, for example, an invoice. Can an entrepreneur do this? In what cases can a check be replaced with another document? Let's start to figure it out in order.

Why is payment confirmation required?

When depositing money for a loan or paying taxes annually, citizens are advised to keep the receipts issued by the operator (or terminal). They are proof of the transaction in case of disputes.

For example, a tenant received a notification about the existence of a debt from the Federal Tax Service. Having a document in hand, issued after the transaction, will be proof of payment of taxes.

The absence of receipts greatly complicates the ability to prove the authenticity of the payment. Despite the transition to electronic payment mode, in 50% of cases government agencies accept claims for consideration only if they have a “paper” copy of the certificates.

What is proof of payment?

According to Article 861 of the Civil Code of the Russian Federation, in Russia there are 2 payment methods: using real money and non-cash. Settlements between legal entities must be 100% made in non-cash form. The legislation of the Russian Federation does not apply strict requirements to individuals.

As confirmation of payment, according to Article 220 of the Tax Code of the Russian Federation, it is allowed to use:

- cash receipt order;

- check, sales or cash register;

- extract;

- act of transfer of funds;

- other certificates, properly executed and certified.

Accounting and legal services

When services and goods are paid for at the cash desk of a third-party enterprise, receipts can serve as documents that confirm the payment of funds, and as documents on which accountable persons in their company report. In such a situation, a receipt is needed.

We recommend reading: Income tax benefit 2022 in Russia

The receipt can be written out by hand or filled out electronically using a PC. It must be prepared in 1 copy, without errors. If errors are made, the receipt order is rewritten.

Proof of transaction in the bank

Financial institutions that issue loans require customers to deposit funds into the lender's account on time. Delays lead to the accrual of fines and penalties.

In rare cases, for example, in the event of a technical failure in the system, payment may be delayed or not received. To save yourself from having to re-deposit funds, the payer must prove the fact of replenishing the account.

Confirmation of payment at Sberbank and other credit institutions can be an order, check or account statement.

A cash receipt order is issued by the operator when funds are deposited into the client’s personal account. It must indicate the full name of the depositor, the date of the transaction and the amount, account, and name of the financial organization. At the bottom of the order are the signatures of the participants in the transaction: client, manager and cashier, and, if provided, the bank’s seal.

The statement is a list of banking transactions on the client's account. It displays 1 or several transactions for a specified period of time (for example, the current month), the owner’s full name, the name and account number of the organization, the date of the statement and the details of the authorized person. It is allowed to print out an electronic document when making a payment in remote service channels (RSC): online banking, terminals, mobile version of the site.

A check is issued when repaying a debt to the account of a legal entity. It contains (partially or completely) the details of the recipient of funds, the name of the company, information about the payer, amount, date and purpose. The receipt printed after the transaction at UCO is also confirmation of payment of the invoice.

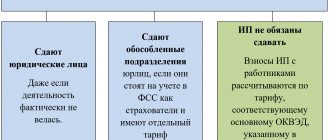

Individual entrepreneurs on the simplified tax system are required to use cash registers

There may be money in the cash register within the limit that you set yourself in the manner prescribed by the above provision No. 373-P, and Everything in excess is surrendered on the day of excess, because, in accordance with clause 1.4. of the specified provision (373-P): “A legal entity or an individual entrepreneur is obliged to keep cash in bank accounts in banks in excess of the cash balance limit established in accordance with paragraphs 1.2 and 1.3 of this Regulation (hereinafter referred to as available funds). Accumulation by a legal entity or individual entrepreneur of cash in the cash register in excess of the established cash balance limit is allowed on days of payment of wages, scholarships, payments included in accordance with the methodology adopted for filling out federal state statistical observation forms, into the wage fund and social payments (hereinafter referred to as other payments), including the day of receipt of cash from a bank account for the specified payments, as well as on weekends and non-working holidays if a legal entity or individual entrepreneur conducts cash transactions on these days. In other cases, accumulation of cash in the cash register in excess of the established cash balance limit by a legal entity or individual entrepreneur is not allowed.” Up to the limit, money can be kept in the cash register as long as you like.

Form of strict accountability

BSO is not only a substitute for a check from a cash register, but a document confirming contractual relations in the field of personal services. According to the BSO, you register each receipt of money during the day, and at the end of the day you issue one PKO for the entire amount, indicating in the base - BSO such and such, such and such. You file all BSOs per day into one PKO. Let me add that the receipt from the PKO is issued to the person who hands over the money to the cash register, that is, to the cashier, and if you and the cashier are the same person, you throw away the receipt. BSO must be ordered from a printing house.

- the supplier's seal (if any) must be affixed simultaneously on both elements of the PQS - thus, approximately half of it will be visible on the receipt;

- in the “Amount” column of the PKO receipt, the amount of funds should be recorded in numbers, in the column below - in words.

NOTE! Currently, most sellers must use online cash register systems and issue buyers a cash register receipt that meets all the requirements of the Law “On Cash Register Systems” dated May 22, 2003 No. 54-FZ. Only persons exempt from the use of cash register systems can work without a cash register and issue other payment documents. If the seller ignores his cash obligation, he breaks the law, not the buyer. Therefore, the buyer should not bear the negative consequences of not having a cash register receipt, and is also not obliged (and does not have the opportunity) to check whether the seller does not use the cash register lawfully and issues him another document. Therefore, you can now attach any of the following documents confirming payment to the advance report. But it should be remembered that this is associated with certain risks. Mainly in terms of confirming expenses for tax purposes.

Advance report without cash receipt: attached BSO

- serial number, date of compilation;

- name of the company or full name of an individual entrepreneur - supplier of goods or services;

- supplier's tax identification number;

- a list of goods and services paid for by the employee with accountable funds, their quantity;

- the amount that the employee deposited into the supplier’s cash desk in rubles;

- position, full name, initials of the employee who issued the sales receipt, his signature.

Sometimes entrepreneurs do not see the difference between a sales receipt and an invoice and believe that one document can be replaced with another. The main purpose of the invoice is to confirm the fact that the goods have been transferred to the buyer. It is usually used when carrying out a transaction between a supplier and a customer. The invoice does not indicate the amount of payment and cannot serve as confirmation of receipt of funds for the goods.

You may be interested in:: Benefits for people living in the Chernobyl zone

To issue funds for business trips, business needs and other expenses, an application from the employee, drawn up in any form and signed by the manager, or an order from the manager himself (also in any form) is required.

Receipt Cash Order Instead of Cash Receipt From July 01, 2021

And now about cash transactions. In accordance with the Regulations on the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation dated October 12, 2011 N 373-P, which entered into force on January 1, 2012, individual entrepreneurs are required to conduct cash transactions and this obligation is not related to the absence the need for cash register for individual entrepreneurs providing services. It is imperative to keep a cash book. A cash book is not a book of a cashier-operator; the latter is used only by those who are required to have a cash register (see Article 2 of the Federal Law of May 22, 2003 N 54-FZ “On the use of cash register equipment when making cash payments and (or) payments using payment cards"). You are not required to have a cash register, but you are required to maintain a cash book. According to clause 1.8. provisions, cash transactions carried out by a legal entity or individual entrepreneur are formalized by incoming cash orders 0310001, outgoing cash orders 0310002. RKO and PKO - cash documents.

The issue of cash circulation in the Russian Federation in terms of cash posting is regulated, among other things, by the Letter of the Central Bank of the Russian Federation dated October 4, 1993 N 18 (as amended on February 26, 1996) “On approval of the “Procedure for conducting cash transactions in the Russian Federation.” According to paragraph 13 of this letter, which is currently in force, cash is accepted by the cash desks of enterprises according to cash receipt orders signed by the chief accountant or a person authorized to do so by written order of the head of the enterprise. About the receipt of money, a receipt is issued for the cash receipt order, signed by the chief accountant or a person authorized to do so, and the cashier, certified by the seal (stamp) of the cashier or the imprint of the cash register.

Obtaining a duplicate if a document is lost

The bank provides for the restoration of client checks in the event of their absence to confirm payment of the invoice. If the transaction was performed by the payer himself in terminals or online banking, the employee can reprint the account statement or issue a copy of the check.

If paper documents are lost, the recovery period can be up to 30 days. To speed up the transaction search, the client must know the date, approximate time, payment amount and recipient details. Lack of information may result in a refusal to provide a duplicate document.

Payments made more than six months ago are usually ordered through the bank's archives. The duration of the service is from 3 days. A fee may apply for the restoration of some certificates.

How to prove payment of taxes?

Payments to the Federal Tax Service are the responsibility of every citizen of the Russian Federation. Every year, Russians pay off debt for land, property, and cars. Failure to confirm payment not only entails fines in the form of penalties, but may also result in a ban on traveling abroad.

The Federal Tax Service is a government agency and is required by law to accept the following types of documents as proof of payment:

- Cashier's check.

- An account statement signed and stamped by an authorized person.

- Receipt order.

- Another document confirming the fact of depositing funds.

As another certificate, a check or form in the form of a financial institution is issued, which confirms the repayment of the taxpayer's debt.

Receipt for cash receipt order

In practice, the seal on the receipt should be affixed in such a way that its edge remains on the receipt order. That is, when the receipt is torn off, an incomplete display of the seal should remain on the resulting document. You should also try to ensure that the code and name of the company on the receipt are present and legible.

The (unified) form of the order itself, as well as the receipt for the cash receipt order, was approved by Resolution of the State Statistics Committee of August 18, 1998 No. 88 (hereinafter referred to as Resolution No. 88). And although from 2022 unified forms of primary documents have ceased to be mandatory for use, the use of unified forms for cash documents, in particular form 0310001, continues to remain relevant (directive of the Bank of Russia dated March 11, 2021 No. 3210-U).

Can a financial institution refuse to issue a check?

When paying bills at a bank, the Federal Tax Service or other organizations, the client must require a supporting document. The issuance of receipts is proof of a successful transaction.

A refusal to issue a payment document may be due to the desire of the payer to receive several copies at the same time. According to the Tax Code of the Russian Federation, financial institutions are authorized to issue only original certificates. Issuance of a duplicate is possible only after a written statement from the payer about the loss of the original document.

Company managers have the right to refuse to obtain a certificate for third parties without the presence of confirmed authority of the representative, for example, a notarized power of attorney, which states permission to issue documents in the name of the bearer.

Payment confirmation will not be issued if the transaction is incomplete or canceled during the process. Some types of transactions made in remote service channels do not allow you to reprint a receipt. For example, transferring funds from a plastic card account using the SMS notification service. The client receives a payment confirmation code on his phone, he enters the data, and the money goes to the sender’s account. In this case, the proof of payment is not a check, but an SMS about the sending and completion of the transaction, or an extract from a bank card account.

Cash register receipt as a document for expenses

The Ministry of Finance issued letter No. 03-01-15/63722 dated August 20, 2019, in which it explained what should be reflected in a cash receipt in order to accept it for expenses as a primary document.

According to Article 4.7 of Federal Law No. 54-FZ, a cash receipt must necessarily contain the following details:

- Title of the document;

- serial number for the shift;

- date, time and place (address) of settlement;

- name of the organization or full name of the individual entrepreneur;

- TIN;

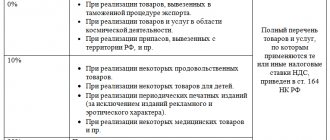

- the taxation system used in the calculation;

- calculation sign;

- name of goods, works, services, their quantity, price per unit, cost taking into account discounts and markups, indicating the VAT rate;

- the calculation amount with a separate indication of the rates and VAT amounts at these rates;

- calculation form;

- position and surname of the person who made the settlement with the client and issued the cash receipt;

- CCP registration number;

- serial number of the fiscal drive model;

- fiscal sign of the document;

- Federal Tax Service website address;

- subscriber number or email address of the client in case of transfer of a cash receipt to him in electronic form;

- e-mail address of the sender of the cash receipt in case of transfer of the cash receipt to the client in electronic form;

- serial number of the fiscal document;

- shift number;

- fiscal sign of the message;

- QR code.

But that's not all the details. Clause 6.1 of the above-mentioned Article 54-FZ describes what additionally should be in the cash receipt when making payments between organizations and individual entrepreneurs :

- name of the buyer (name of organization, full name of individual entrepreneur);

- INN of the buyer (client);

- country of origin of the goods;

- excise tax amount (if applicable);

- registration number of the customs declaration - when making payments for the goods (if applicable).

Thus, when making these calculations, the cash receipt reflects information about both the seller and the buyer.

From all of the above, the Ministry of Finance concludes that expenses can be taken into account for the purpose of calculating income tax if the supporting documents are drawn up in accordance with the legislation of the Russian Federation and from these documents it is clearly and definitely clear what expenses were incurred.

At the seminar on primary documentation, you will receive a lot of information on this issue, thematic handouts, as well as answers to your questions on this topic.

Sign up! When registering through "Clerk" - discounts.

How to prove payment for services in court?

When filing a statement of claim or complaint with Rospotrebnadzor, the payer must provide evidence of the transaction. Judicial authorities require a documented fact of the transaction indicating the citizen’s full name, details, date and amount of payment.

If the transaction was performed at the office of a financial institution, it is recommended to present the original check or order. Additionally, the bank can issue a transaction confirmation certificate with a branch seal and signature of an authorized person.

When paying online, it is recommended to print receipts and have documents certified at the office where the account is maintained. Despite the presence of an electronic seal on the form, in 15% of cases law enforcement agencies refuse to accept certificates without the organization’s stamp and signatures of the company’s employees.

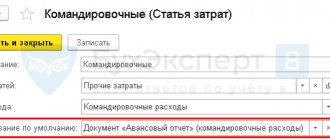

Primary: BU

In accordance with paragraphs 1 and 5 of Article 9 of the Federal Law of December 6, 2011; 402-FZ “On Accounting”, each fact of economic life is subject to registration as a primary accounting document.

The primary accounting document is drawn up on paper or in the form of an electronic document signed with an electronic signature.

The required details of the primary accounting document are:

- Title of the document;

- date of document preparation;

- name of company;

- content of the fact of economic life;

- the value of a natural or monetary indicator;

- position and signature of the person who completed the transaction, operation and is responsible for its execution.

Moreover, if the current legislation establishes mandatory forms of documents for registration of specific transactions, then the forms of documents established by the current legislation must be used.

How long is it recommended to keep payment documents?

In banks and other financial institutions, customer orders are archived for 5 years. Housing and communal services have the right to require subscribers to provide proof of depositing funds into their personal account within 3 years from the date of the transaction. According to the law, the storage period for documents confirming payment is 5 years from the date of receipt.

The advantage of paying online is the ability to print receipts for 10 years or more from the date of the transaction. If the client is unable to find the document on his own, he can contact the financial institution to make a request. Documents older than 3 years are issued from the archive.

Not all transactions can be printed after 6 months or more. If there is no technical capability or the database is updated, financial institutions may refuse to issue a certificate.

The concepts of “cash register” and “cash register”: essence and differences

First, a little theory. Let’s start our discussion with the concepts of “cash register” and “cash register”. Most mistakes and misconceptions are due precisely to the fact that their meaning is often confused.

So, the cash desk is all transactions of an individual entrepreneur (or organization) carried out in cash. These can be either income transactions (receipt of income) or expenditure transactions (spending funds for various purposes). All cash transactions must be recorded on cash register. In fact, all individual entrepreneurs and organizations have a cash register; exceptions are very rare: even if all transactions are carried out by bank transfer, you can withdraw money for some business expenses, for example, for the purchase of office supplies.

“Cashier” is a kind of imaginary “wallet” where money comes in and where it comes from for expenses. For organizations, the concept of “cash” looks easier to understand, since in accounting according to the chart of accounts there is a special account 50 “Cash”, which records all cash transactions.

Cash register is a cash register equipment necessary for making cash payments for goods (or services) sold to a client, that is, the machine itself, which issues a check.

The definition from the law generally goes like this:

Cash register equipment - electronic computers, other computer devices and their complexes that provide recording and storage of fiscal data in fiscal drives, generate fiscal documents, ensure the transfer of fiscal data and print fiscal documents on paper in accordance with the rules established by the legislation of the Russian Federation on application of CCT.

Let's immediately note the important differences:

- According to the cash register, only cash received from customers for goods or services purchased from you is recorded; at the cash register, all cash receipts are considered receipts - revenue from the cash register for the day, withdrawals of money from the current account, and so on.

- You cannot spend money from the cash register - there is no expense part, money for expenses can be issued exclusively from the cash register.

Conclusion: cash register is not equivalent to cash register - these are different concepts that mean different things. Cash desk is all cash transactions of an entrepreneur or organization (a kind of “big wallet”), cash register is the actual machine for accepting money from a client and issuing a check. The connection between the two concepts can be easily shown: at the end of the day, the store’s revenue from the cash register is handed over to the cash register of the individual entrepreneur (organization), the transaction is formalized by the receipt.