What is the difference between an advance and a prepayment?

The difference between an advance payment and an advance payment is the ability to determine what exactly the buyer paid the seller for. This nuance affects the choice of the cash receipt attribute “payment method attribute”.

If it is possible to count the number of goods (or services) for which money was paid, then this is an advance payment. For example, a client paid in advance for 5 visits to the gym or swimming pool. Each visit is tied to a date and time and has a fixed cost. This means that an advance payment has been made.

There are situations when it is impossible to clearly determine what exactly the money was received for. For example, a buyer entered into an agreement with a store to purchase kitchen furniture with built-in appliances, with delivery and assembly. According to the agreement, he paid 50% of the cost of the entire order. For what exactly is not clear. This means an advance has been made.

When issuing a check for an advance or prepayment, you must indicate the “payment method indicator”. There are several options (see Appendix No. 2 to the order of the Federal Tax Service of the Russian Federation dated March 21, 2017 No. MMV-7-20 / [email protected] ).

If, when paying, you can determine the list of goods, works or services, then this is an advance payment. If you make a 100% prepayment, we will indicate in the check “Full prepayment until the item of payment is transferred.” If the prepayment is partial, then we enter “Partial prepayment until the goods are transferred or the service is provided.”

If during payment it is impossible to determine the list of goods, works or services to be transferred, then an advance has been made. In the check we indicate “Partial or full prepayment of goods or services.”

Which payment method indicator should I choose on the receipt?

Today we will try to understand the signs of a payment method in clear language. The cash receipt uses tags 1214 - this is a sign of the payment method and 1215 - crediting the prepayment. A detail indicating whether full payment or partial payment, prepayment or postpayment, or the goods are transferred on credit is called the payment method attribute. And the offset of previous payments in the check is an offset of the prepayment, and it is used only if money was previously paid for the goods for this order.

Signs of the calculation method

The first surprise for accountants: advance and prepayment, from the point of view of cash register online, have different meanings. Advance – when we haven’t chosen what we are buying, but for some reason we are eager to pay. Prepayment - when we have paid and chosen, but for some reason we do not pick it up.

The second surprise awaits those who make postpaid payments between legal entities. When a legal entity picks up the goods, it can still choose a payment method: to a bank account or pay in cash. In the first case, there is no need to make checks, in the second - two at once: transfer on credit when shipping the goods and payment of the loan at the time of settlement.

Prepayment 100%:

We take the money and give the goods back later.

Prepayment:

We take part of the money and give back the goods when the balance is paid.

Prepaid expense:

money first (they haven’t even chosen the product yet).

Full calculation:

the entire amount of money and goods. The sign of the payment method “full payment” is also used when part of the amount or the entire amount was transferred earlier, but now you need to return the goods and offset the advance payment. In this case, we receive tag 1215 in the check - credit for the prepayment.

Partial payment and credit:

We take part of the money and give back the goods (the buyer pays the rest later).

Transfer on credit:

We give the goods without money, payment later. This check is technical; in the OFD, cash and non-cash amounts are displayed as 0.00, and only the total total of the check is visible.

Credit:

payment for previously shipped goods. Prepayment offset is also used here.

What to find on a receipt

Many people are afraid of several amounts in one check. It is important to learn how to read them correctly. The price of a product always remains its full value. There is no need to divide and split the price if the client wants to pay part of the purchase.

The TOTAL in the receipt shows the full amount of the order, regardless of how much was paid. You can also see in the receipt the amount of the prepayment and the amount received today. So, in a check that uses the “advance payment offset” tag, the amount paid earlier will be in the “advance payment (advance)” line. The amount that the buyer contributed is in the line “received”, and it is duplicated in the line “method of payment” in cash or non-cash. The amount that the buyer still owes is in the “subsequent payment (credit)” line.

Offset of prepayment

Offset of prepayment - tag 1215, effective in FFD 1.05 from July 1, 2019. We offset the prepayment when we issue the second check. There is already some amount paid and we need to take it into account and reflect it on the check.

If the check contains the line “advance payment” and in it the amount of the previously made advance payment, this is tag 1215 - offset of the advance; it appears when the cashier indicates the amount paid earlier when punching the check. And today's amount is the balance that the buyer brought. In this case, the price of the product and the TOTAL in the receipt will always be the same. Changing the price by dividing the amounts into prepayment and subsequent payments is incorrect.

For example

We conducted an experiment with one cake and seven different indicators of the payment method to help cashiers and accountants understand the situation.

Here we have a store and there is a cake in it. Delicious and big. It costs, for example, a thousand rubles. And buyers of these same cakes come to us. Some bring the money right away, others take the cake and then pay.

When to punch two checks through an online cash register

Why do you need an additional check at all, when and how to draw them up correctly.

Why are two checks needed?

Since 2022, a seriously updated law No. 54-FZ has been in force in Russia.

It obliges entrepreneurs who accept non-cash payments from individuals to use so-called online cash registers. They generate checks for the buyer and send information about the monetary transaction (fiscal data) to the fiscal data operator (FDO). The tax office has access to all OFD data. In 2022, many changes to this federal law were adopted, one of which is precisely related to the need to generate two cash receipts. The regulator has obliged sellers who accept funds as an advance or prepayment to issue two checks to buyers. The first is immediately after receiving the money, the second is after the delivery of the product or service.

The main change to 54-FZ in 2022 was the seller’s obligation to include in the receipt full information about the goods sold or services provided. If the buyer makes an advance payment or advance payment, then the receipt cannot reflect the entire list of goods or services with their final prices, which is why it was decided that additional receipts were necessary.

What is the difference between advance and prepayment

If at the time of generating the check it is possible to determine the list of goods, works or services for which the buyer pays and their cost, then this is an advance payment. It can be either full or partial. On the contrary, if the list of goods and services is not precisely known, then such a transaction is considered an advance.

An example of a prepayment would be a subscription for 10 lessons to the pool (the service is provided not at the time of payment, but later, but you know exactly what the payment is for).

An example of an advance payment is payment of 30% of the cost under a contract for the supply of a kitchen with built-in appliances. In this case, it is not entirely clear which particular product was credited for the amount, and it is impossible to list the goods sold or services provided with their specific value.

Depending on the type of payment, the process of generating checks changes.

By the way, there won’t necessarily be two checks. If, for example, an advance payment or advance payment is made in several parts, then there will be exactly as many checks as there will be payments + another one after the service is provided or the goods are shipped or issued to the buyer.

How to offset an advance and prepayment

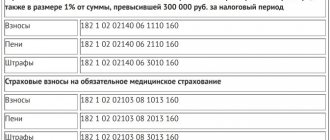

Each cash receipt contains the attribute “Indicator of payment method”. With its help, the tax office understands what form of payment was used when concluding the transaction. According to the order of the Federal Tax Service, this detail can take the following values: “ADVANCE”, “ADVANCE PAYMENT”, “ADVANCE PAYMENT 100%”, as well as “FULL PAYMENT”.

- Having received an advance payment or advance payment, the seller generates a check with one of the first three characteristics.

- Having delivered the goods or provided the service, the seller punches a second check with the sign “FULL PAYMENT”.

You are required to punch two receipts both in retail outlets or service enterprises, and in online stores or online services.

To issue checks in non-standard situations, for example, when using gift certificates or purchasing goods in installments, you can refer to the guides compiled by specialists from the tax office. Instructions will help you pre-pay for goods using gift cards

and

loans

.

For its clients, Robokassa has implemented a simple procedure for issuing a second check - we have prepared a special service for this purpose.

How to punch a second check using Robokassa

Robokassa can automatically generate a second cash receipt for its clients with the sign “FULL PAYMENT” if you have previously accepted an advance or prepayment online through Robokassa. The new receipt will reflect the full amount of the buyer's previous advance payments (or prepayments) and will be automatically sent to the buyer.

How it works? To generate a check, it is enough to create a special request in JSON format indicating payment information. You can find an example in the documentation

.

To connect the service to the site, you may need the help of a web developer, but our specialists from the competence center are always ready to provide advice

and answer questions.

The service for issuing a second check is free, but only entrepreneurs who accept payments through Robokassa can use it.

Crediting of advance and prepayment via online cash register

When the buyer has received what he paid for in advance, the seller issues a second check. It also uses the “calculation method attribute” attribute.

When registering an advance or prepayment at an online checkout, you should always indicate “full payment” in the “payment method indication” column. If the final payment amount differs from the preliminary payment, there will be problems with making additional payments in other ways. When issuing a check, the prepayment made is debited against the completed shipment.

Further, the check indicates that the payment was made against an advance payment (prepayment), and not in cash or non-cash.

How to issue a check for prepayment offset

The seller punches this check and issues it when the buyer receives the paid goods, work or services.

Attention! A check to offset the prepayment is needed only for settlements with individuals (Letter of the Federal Tax Service of Russia dated August 21, 2019 No. AS-4-20 / [email protected] ). If you have received an advance payment from an organization or individual entrepreneur, then you do not need to issue a second check at the time of transfer of goods, since there is no fact of payment in cash or electronic means of payment.

The check for offset indicates the full amount of the settlement, taking into account the previously transferred prepayment. The details will be as follows:

The sign of calculation for offset is the same - “ARRIAGE”.

The indicator of the payment method for offset is usually “FULL SETTLEMENT” or “4” (in FFD 1.05, the value “full settlement” can not be filled in on either paper or electronic checks.

The name of the subject of payment is now indicated in any case, since during offset the seller knows exactly what he is receiving money from the buyer for.

The attribute of the subject of payment depends on what the buyer purchased: “1” or “goods”; "2" or "work"; "3" or "service".

Unit prices and item prices are filled in with actual prices, not amounts paid at the time of shipment.

The settlement amount will be equal to the cost of the goods (work or service).

VAT is now indicated at the standard rates of “20%” or “10%”, and not at the estimated rate, as in the prepayment receipt.

The amount of a prepaid check indicates the amount of money that the seller received from the buyer at the first settlement.

Sample receipt for prepayment offset

If, upon receiving the goods, the buyer does not make the remaining payment, then in the “Settlement Attribute” column “5” or “Partial payment and credit” is indicated. Then the check is additionally filled in the column “Amount for postpaid check” (tag 1216), which indicates the amount not paid by the buyer on the day the goods were transferred.

An online check for an advance payment can be accepted by the institution for accounting

Home → Articles → An online check for an advance can be accepted by an institution for accounting

A budgetary institution, through an accountable entity, purchased spare parts in an online store from an individual entrepreneur, paying in advance (100% in advance) using a bank card. The individual entrepreneur provided an online receipt for the advance payment and a delivery note (printed) to the employee’s email. The individual entrepreneur operates in wholesale and retail trade using non-cash payments. The individual entrepreneur refused to provide the final receipt with the product range. Can an institution accept an accountable person's advance report with this online advance receipt as the main one?

In accordance with clause 216 of the Instruction, approved by Order of the Ministry of Finance of Russia dated December 1, 2010 N 157n, the amount of expenses incurred by the accountable person is reflected in the accounts of settlements with accountable persons in accordance with the Advance Report (f. 0504505) of the accountable person approved by the head of the institution (or his authorized person) and documents attached to it confirming the expenses incurred. The amounts actually spent by the accountable person and the details of the documents confirming the expenses incurred are indicated on the reverse side in columns 1-6 (see Guidelines for filling out the Advance Report (f. 0504505), approved by Order of the Ministry of Finance of Russia dated March 30, 2015 N 52n).

Thus, in the general case, to confirm the expenses incurred by the accountable person, it is necessary to fill out an Advance Report (f. 0504505) with attached documents confirming: – the fact of receipt of the NFA object, provision of services, performance of work; – fact of payment by the accountable person.

As documents confirming the fact that the accountable person has received material assets, in particular, an invoice for the release of goods can be provided. It must indicate the names of the purchased goods, unit price and quantity. This data is needed to take into account paid material assets and justify the legality and efficiency of expenses. On the basis of the consignment note, in order to accept assets for balance sheet accounting, an Act on the acceptance and transfer of non-financial assets (form 0504101) or a Receipt Order for the acceptance of material assets (non-financial assets) (form 0504207) can be drawn up in the manner established by the accounting policy of the institution.

As a general rule, the fact of payment for goods in cash and (or) using payment cards must be confirmed by checks of cash register equipment provided by accountable persons (clause 2 of article 1.2, clause 2 of article 5 of the Federal Law of May 22, 2003 N 54- Federal Law, hereinafter referred to as Law No. 54-FZ).

In accordance with paragraph 5 of Art. 1.2 of Law N 54-FZ, the user of a cash register when making payments using electronic means of payment, excluding the possibility of direct interaction between the buyer (client) and the user or his authorized person, and the use of devices connected to the Internet and providing the possibility of remote interaction between the buyer (client) and The user or his authorized person, when making these payments, is obliged to ensure that the buyer (client) receives a cash receipt or a strict reporting form in electronic form to the subscriber number or email address specified by the buyer (client) before making payments. In this case, the cash register receipt or strict reporting form on paper is not printed by the user (see also letters of the Department of Tax and Customs Policy of the Ministry of Finance of Russia dated September 28, 2017 N 03-01-15/63180, dated June 22, 2017 N 03-01-15/39028 , dated 06/14/2017 N 03-01-15/36793, dated 05/10/2017 N 03-01-15/28293, dated 02/02/2017 N ED-4-20/ [email protected] ).

Along with this, specialists from the financial department note that to use when paying for goods or services on the Internet using electronic means of payment, which exclude the possibility of direct interaction between the buyer and the seller, a special online cash register is required (letter from the Department of Tax and Customs Policy of the Ministry of Finance of Russia dated 01.03. 2017 N 03-01-15/11618). Such cash registers are used as part of automatic devices; they may not contain elements of printing fiscal documents (Article 4 of Law No. 54-FZ).

Clause 4 of Art. 1.2 of Law N 54-FZ provides that a cash receipt sent to the buyer in electronic form to the subscriber number or email address provided by him prior to payment is equivalent to a cash receipt printed by cash register equipment on paper.

The cash receipt must contain the mandatory details established by clause 1 of Art. 4.7 of Law N 54-FZ (letters of the Ministry of Finance of Russia dated 05/12/2017 N 03-01-15/28910, dated 05/02/2017 N 03-01-15/26812).

Note that for individual entrepreneurs who are taxpayers using the patent taxation system and the simplified tax system, the taxation system for agricultural producers, the taxation system in the form of UTII when carrying out the types of business activities established by clause 2 of Art. 346.26 of the Tax Code of the Russian Federation, with the exception of individual entrepreneurs carrying out trade in excisable goods, the obligation to indicate on the cash receipt the name of the goods (work, services) and their quantity (paragraph nine of clause 1 of Article 4.7 of Law No. 54-FZ) applies from February 1, 2022 of the year (Part 17, Article 7 of Federal Law dated 07/03/2016 N 290-FZ, clause 25 of Appendix No. 2 to the order of the Federal Tax Service dated 03/21/2017 N ММВ-7-20/ [email protected] ).

On the issue related to the implementation of settlements in the form of advance and prepayment, it should be taken into account that the order of the Federal Tax Service of Russia dated March 21, 2017 N ММВ-7-20 / [email protected] provides for the corresponding characteristics of the payment method, including “advance” and “partial advance payment until the item of settlement is transferred” (see also the letter of the Federal Tax Service dated July 12, 2017 N ED-3-20/ [email protected] “On consideration of the appeal”).

Thus, in the situation under consideration, an online check indicating a 100% advance payment may not contain the name (nomenclature) of the goods and is legitimate for the purpose of confirming payment for the goods. In addition, you can check the authenticity of an online check on the official website of the Federal Tax Service or through a special application from the Federal Tax Service of Russia. The result of checking the authenticity of an online check can be attached to the Advance Report (f. 0504505) as an element of internal control, which will eliminate questions from auditors in the future.

To summarize the above, the Advance report (f. 0504505) with a printed online receipt attached to it indicating that the accountable person has made a 100% advance payment and a bill of lading issued in the prescribed manner can be accepted by a budgetary institution for accounting.

Answer prepared by: Anna Kireeva, expert of the GARANT Legal Consulting Service Quality control of the response: Olga Monaco, reviewer of the GARANT Legal Consulting Service, auditor

Latest news of the digital economy on our Telegram channel

| Do you need to transfer fiscal data to the Federal Tax Service? The Electronic Express company is a fiscal data operator and is included in the register of OFD of the Federal Tax Service of Russia. Connect the cash register to the OFD >> |

New rules 54-FZ: advances

We continue the series of publications that will help you understand the amendments.

In accordance with clause 1 of Article 4.3 of Federal Law N 54-FZ, in most cases, cash register is used at the place of settlement with the buyer (client) at the time of settlement by the same person who makes settlements with the buyer (client), with the exception of settlements carried out non-cash on the Internet. And the term “settlements” now includes not only the receipt of an advance, but also their offset or return .

Until July 1, 2022, it is mandatory to use cash register only when interacting with “money” (or electronic means of payment) - when receiving payment either as an advance or when paying for goods already transferred to the buyer, work rendered, services performed.

You have the right now to issue checks when offsetting advances against goods, works, and services sold, but you are not obliged (Clause 4, Article 4 of Federal Law No. 192-FZ of July 3, 2018). At the same time, the obligation to transfer such a check to the buyer in paper form is established only for settlements when the user and the buyer enter into direct interaction (for example, the buyer pays in cash at the company’s cash desk or with a card at a point of sale). For non-cash payments that exclude the possibility of direct interaction with the buyer (client), when offsetting or returning prepayments (advances) previously made by individuals in full, users have the right to send cash receipts to buyers (clients) also only in electronic form without issuing paper cash receipts (clause 2.1, article 1.2 of the Federal Law of May 22, 2003 N 54-FZ, as amended on July 3, 2018).

With regard to “advance” checks this year, you will also have to take into account the capabilities of the cash register you use, since not all fiscal document formats approved by the Federal Tax Service require the necessary details.

The list of cash receipt details is established in clause 1 of Art. 4.7 Federal Law N 54-FZ. In addition to them, Order of the Federal Tax Service of Russia dated March 21, 2017 N ММВ-7-20/ [email protected] approved additional details of fiscal documents and formats of fiscal documents that are mandatory for use. Moreover, the Ministry of Justice recently registered Order of the Federal Tax Service of the Russian Federation dated 04/09/2018 N ММВ-7-20/ [email protected] with changes in the details and formats of cash receipts, which has been applied since August 6, 2018.

We are particularly interested in the attribute “calculation method attribute” (tag 1214). The values of this detail and the list of grounds for assigning the corresponding values to it are indicated in Table 28 of Appendix 2 to the Order of the Federal Tax Service N ММВ-7-20/ [email protected] (as amended by the Order of the Federal Tax Service of Russia dated 04/09/2018 N ММВ-7-20/ [ email protected] ).

| Props value | List of reasons for assigning the corresponding attribute value to the attribute “calculation method attribute” (tag 1214) | Printed format |

| 1 | Full prepayment before the transfer of the subject of payment | "ADVANCE PAYMENT 100%" |

| 2 | Partial advance payment before the transfer of the settlement item | "PREPAYMENT" |

| 3 | Prepaid expense | "PREPAID EXPENSE" |

| 4 | Full payment, including taking into account the advance payment (prepayment) at the time of transfer of the subject of payment | "FULL PAYMENT" |

| 5 | Partial payment of the settlement item at the time of its transfer with subsequent payment on credit | “PARTIAL SETTLEMENT AND CREDIT” |

| 6 | Transfer of the subject of payment without payment at the time of its transfer with subsequent payment on credit | "TRANSFER ON CREDIT" |

| 7 | Payment for the subject of settlement after its transfer with payment on credit (loan payment) | "LOAN PAYMENT" |

As we can see, the attribute “sign of payment method” covers not only operations directly related to payment, but also the offset of previously made payments when transferring goods (acceptance by the customer of the results of work performed, etc.) and transfer of goods (acceptance of work, services) without payment .

The details are mandatory for formats 1.05 and 1.1 (but may not be included in the printed form in case of full payment, and in the electronic check - in case of full payment and only in FFD 1.05). In format 1.0, it is recommended to include the details in the cash receipt (Table 20).

Also, Order of the Federal Tax Service No. ММВ-7-20/ [email protected] introduced details for indicating in checks amounts corresponding to the above values of the attribute “sign of payment method” (Table 4 of Appendix 2 to Order of the Federal Tax Service N ММВ-7-20/ [email protected] ] ). They specify exactly how the payment was made - in cash, electronically, or in another form.

| Tag | Props name | Props title in printed form | Attribute attribute for fiscal data formats (FFD) | Description of the props |

| Props title in electronic form | ||||

| 1020 | Settlement amount indicated on the check (BSO) | "RESULT" | Mandatory for all FFDs (1.0, 1.05, 1.1), regardless of the form of the check (printed or electronic) | The calculation amount, taking into account discounts, markups and VAT, indicated in the cash register receipt (CSR) or the correction amount specified in the correction cash receipt (CSR correction) |

| <TOTAL:> {Ts}.Ts | ||||

| 1031 | Check amount (BSO) in cash | "CASH" | Included in the printed form of the check if this is provided for this detail (i.e. if the amount is not zero). | The settlement amount indicated in the cash register receipt (CSR), or the settlement adjustment amount indicated in the correction cash receipt (CSR correction), subject to payment in cash |

| <CASH:> or <N.:> {C}.CC | Mandatory for electronic check form for all FFD (1.0, 1.05, 1.1). | |||

| 1081 | Amount on check (BSO) electronic | "ELECTRONIC" | Included in the printed form of the check if this is provided for this detail (i.e. if the amount is not zero). | The settlement amount indicated in the cash register receipt (CSR), or the settlement adjustment amount indicated in the correction cash receipt (CSR correction), subject to payment by electronic means of payment |

| <ELECTRONIC:> or <E.:> {C}.CC | Mandatory for electronic check form for all FFD (1.0, 1.05, 1.1). | |||

| 1215 | Amount on check (BSO) in advance (offset of advance and (or) previous payments) | “ADVANCE PAYMENT (ADVANCE)” or may not be printed | In FFD 1.05, 1.1 is included in the printed form of the check if this is provided for this detail (i.e. if the amount is not zero). In FDF 1.0 it is recommended to include it in printed form. | The settlement amount indicated in the cash register receipt (CSR), or the settlement adjustment amount indicated in the correction cash receipt (CSR correction), subject to payment by a previously made prepayment (advance offset) |

| <ADVANCE:> or <A.:> {C}.CC | Mandatory for electronic check form for FFD 1.05, 1.1. Recommended for FFD 1.0. | |||

| 1216 | Amount on check (BSO) postpaid (on credit) | “NEXT PAYMENT (CREDIT)” or may not be printed | In FFD 1.05, 1.1 is included in the printed form of the check if this is provided for this detail (i.e. if the amount is not zero). In FDF 1.0 it is recommended to include it in printed form. | The settlement amount indicated in the cash register receipt (CSR), or the settlement adjustment amount indicated in the correction cash receipt (CSR correction), subject to subsequent payment (on credit) |

| <BY CREDIT:> or <К.:> {Ц}.ЦЦ | Mandatory for electronic check form for FFD 1.05, 1.1. Recommended for FFD 1.0. | |||

| 1217 | Amount on check (BSO) by counter provision | “OTHER FORM OF PAYMENT” or may not be printed | In FFD 1.05, 1.1 is included in the printed form of the check if this is provided for this detail (i.e. if the amount is not zero). In FDF 1.0 it is recommended to include it in printed form. | The settlement amount specified in the cash register receipt (CSR), or the settlement adjustment amount indicated in the correction cash receipt (CSR correction), subject to payment by counter provision by the buyer (client) to the user of the subject of payment, by exchange and in another similar way |

| <EXCHANGE:> or <О.:> {Ц}.ЦЦ | Mandatory for electronic check form for FFD 1.05, 1.1. Recommended for FFD 1.0. |

The department provides the following explanations for including the specified details in the check:

- Any of the details “check amount (BSO) in cash” (tag 1031), “check amount (BSO) electronic” (tag 1081), “check amount (BSO) in advance (offset of advance and (or) previous payments)” (tag 1215), “amount on a check (BSO) postpaid (on credit)” (tag 1216), “amount on a check (BSO) by counter provision” (tag 1217) is included in the cash receipt (BSO) in printed form only in case , if the amount of payment, respectively, in cash or electronic means of payment, prepayment, the amount of payment by credit or counter provision is different from zero .

- The sum of the values of the specified details must be equal to the value of the attribute “settlement amount specified in the check (BSO)” (tag 1020), that is, the total amount of the check (this requirement does not apply to cash registers with fiscal data format 1.0)

Let us remind you that from 01/01/2019 FFD 1.0 will no longer be valid and all users will be required to use version 1.05 or 1.1 formats in cash register equipment. (Clause 2 of the Order of the Federal Tax Service No. ММВ-7-20/ [email protected] ). The tax authorities promise that when switching from FFD 1.0 to 1.05, replacement of the fiscal drive will not be required (Letters of the Federal Tax Service of the Russian Federation dated 02/12/2018 N ED-4-20/2586, dated 01/19/2018 N ED-4-20 / [ email protected] ) .

Thus, from January 1, 2022, all cash register models used will have to provide the ability to generate details with tags 1215, 1216, 1217. And from July 1, 2022 , their indication in checks will become mandatory when using the appropriate payment method.

To make it easier for cash register users to switch to the new procedure, recommendations on the generation of cash receipts for various types of payments were published on the website of the Federal Tax Service of Russia. In particular, in Example 3 “Sale of own goods in wholesale trade”, the procedure for issuing cash receipts for FFD 1.0, 1.05, 1.1 is considered in a situation with prepayment (different options for several goods - 100% and partial prepayment), subsequent shipment and repayment of debt in two stages (that is, in this situation, four cash receipts are issued in total).

Now the recommendations of the Federal Tax Service are partially available on the website - the agency is updating them. Since it is the tax authorities who are entrusted with the responsibility to inform organizations, individual entrepreneurs and individuals on the application of the legislation of the Russian Federation on the use of cash register equipment, the updated recommendations are introduced as “guidelines” - that is, as mandatory documents (clause 5 of article 4.1 , clause 7 of Article 7 of Federal Law N 54-FZ as amended, Letters of the Federal Tax Service of Russia dated 07/03/2018 N ED-4-20/12718, dated 07/03/2018 No. ED-4-20/ [email protected] ).

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

And in the OFD you will see such checks and amounts

Don't be surprised - everything is correct.

Big respect to 1C for implementing the new check breaking algorithm. And also to accountant Olga for her help. We will definitely try, at her request, to find out how to reduce the font on the receipt for the TOTAL field and increase RECEIVED so that buyers do not roll their eyes - asking how much money they actually paid.

Of course, we had to return all three checks on the same day (we cannot leave experiments). I had to do this from the Shtrikh driver directly at the cash register, because... In 1C, check returns do not seem to be implemented yet.