Why do you need a product report?

The report is necessary so that the accounting department can make sure that all goods are supplied with the necessary accounting papers, as well as verify inventory balances. Since it reflects complete information about the movement of inventory items with the attachment of all the documents specified in it in a specific area of the enterprise, the reconciliation takes place in the shortest possible time. The report is also convenient because information about goods is entered into it in the form of specific amounts, which makes it possible to quickly calculate the final financial data on incoming and outgoing goods.

Who should sign and certify the TORG-29 document

The commodity report is signed by two persons:

- the first signature belongs to the person who accepted the completed TORG-29 report with documents and checked the correctness of its execution. It is necessary to indicate the person’s profession (accountant, chief accountant, manager), surname and initials;

- the second signature of the financially responsible person, who is responsible for the commodity values.

Next, the report is submitted to the manager or designated authorized person (a special order is created) for approval. One of the certified copies, along with the rest of the shipping invoices (only originals are provided), is transferred to the accounting department for entry into a special register and its further storage in the database. The second copy remains for storage of the person who compiled it.

Based on the entries in the register, further records are kept of all trading periods, all postings of goods, and their turnover in this area. To systematize the accumulated information in the accounting departments of enterprises, there are entire registration books. Such an in-depth analysis allows us to draw conclusions about the overall profitability of a particular product.

Report writing rules

To date, there is no single, unified sample of such a report, so organizations and enterprises can use their own template or write it in free form. However, most companies prefer to continue to use the TORG-29 form, which has convenient and understandable sections and includes all the necessary information. In particular, it contains

- company information,

- the structural unit for which the report is being prepared,

- information about the financially responsible person.

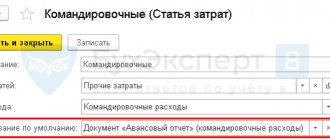

In addition, there are tables in which information is entered

- on documents accompanying the movement of goods,

- their numbers,

- dates of compilation and other parameters.

Moreover, the inflow and outflow of inventory items are distributed across different tables. Documents recorded in the report include invoices, acceptance certificates, receipts, expenditure documents, etc.

Where can I find a sample report?

You can download the TORG-29 form on our website.

A sample of filling out this document can also be found on our website.

Get free trial access to ConsultantPlus and find out how to properly organize warehouse accounting at your enterprise.

Rules for preparing a product report

The document can be written either by hand or printed on a computer; it is drawn up in two copies, both of which must be signed by the responsible person.

If errors are made, they can be corrected. To do this, just carefully cross out the incorrect information, and write the corrected version on top, then enter information about the person who made the corrections and put the date. However, if there are too many errors, it is better to simply create a new document.

It is not necessary to put a seal on the report, since since 2016 legal entities have the right not to certify their papers with seals and stamps. Next, one copy of the report is transferred to the specialists of the accounting department (together with the originals of all documents included in it), and the second remains with the compiler.

The report is regular, and its frequency is approved by the head of the enterprise in accordance with his needs.

It largely depends on how active the trade turnover is in the company, and therefore how large the number of accompanying papers is. The numbering of product reports starts from the beginning of the year and ends at the end of the year, without transferring to the next reporting period. The document must be stored according to the standards that are legalized for this type of primary paper.

How to compose

The commodity report has a unified form - TORG 29 (approved by Resolution of the State Statistics Committee No. 132 of December 25, 1998). If necessary, the organization modifies the current form or uses its own form; this is not prohibited. If you developed the form yourself, fix it in an order or accounting policy.

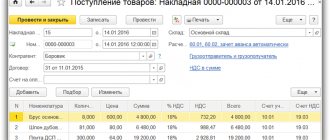

A correct product report consists of several parts - introductory information, receipt information and consumption information. In the TORG-29 tables, primary accounting data is indicated: details of incoming and outgoing documentation (invoices, acts).

Fill out the OKUD form 0330229 from ConsultantPlus for free.

Income and expenditure of inventory items are posted in two different tables. Information is entered manually or filled out on a computer. In TORG-29, compiled by hand, corrections are allowed. If you make a mistake, cross out the inaccuracy and write the correct option at the top. Please confirm the corrections: you must enter the date and full name. the employee who made the adjustments.

Here's how to create a material report for retail and catering organizations:

- The introductory part indicates the name of the enterprise and the structural unit for which TORG-29 is formed. Document details are entered - number, date, reporting period.

- The financially responsible employee is separately noted: his full name, position and personnel number.

- The first table records information on receipt. The balance at the beginning of the reporting period is entered. Receipt transactions are described - their dates, document numbers, amounts of goods and containers. Space is left for the accountant's notes. The totals for the income are summed up and the results are calculated taking into account the opening balance.

- The second table reflects similar expense transactions. Indicate the number and date of consumable documents, the cost of goods and materials and packaging. The total expense and balance at the end of the reporting period are determined.

- TORG-29 is signed by the accountant and financially responsible employee. The seal is placed only when it is used in an organization.

Trade reporting is generated in two copies: one for the financial officer, the other for the accountant. One copy of the signed TORG-29 and all incoming and outgoing documents remain in the accounting department.

Example of filling out the TORG-29 form

Fill in the company data

At the beginning of the document write

- the full name of the company whose representative is writing the report,

- its code is OKPO (All-Russian Classifier of Enterprises and Organizations)

- and type of activity according to OKDP (analogue of the All-Russian Classifier of Types of Economic Activities)

– this information is available in the organization’s constituent papers. The structural unit in which the product report compiler works is also indicated here.

The table below includes

- Document Number,

- date of its preparation,

- reporting period (indicating specific start and end dates).

Then the author himself is entered here, he is also the financially responsible person :

- his position is written in the required lines,

- Full Name

- and personnel number.

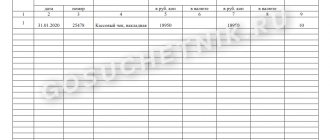

Filling out the table of information about balances

The first table of the report contains information about balances at the time of drawing up the document - here the amount must match that indicated in the previous report. Data on the receipt of goods from all accounting documents are entered into this table carefully, strictly in compliance with chronology:

- Name,

- date and paper number,

- amount of goods and packaging.

The last column is for accounting notes.

It is impossible to combine goods from the same supplier using the same types of documents in any way - all information must be separated.

At the end of the table, the results are entered: two amounts, one of which is the total for this report, and the second is the total of the report plus the remainder.

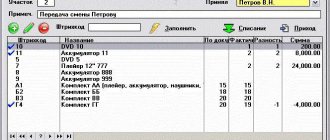

Filling out the expense information table

The second table of the document includes information about the consumption of goods. It is filled out identically to the first one. If a product is returned, this must also be noted. At the end, sales are summarized and the balance at the time of drawing up the report is written.

Below the table is written (in words) the number of documents indicated in the report and documents attached to it, and at the end, the commodity report is signed by the financially responsible person, as well as the accountant who checked the document.

When to use TORG-29

Trading enterprises take into account not only goods, materials and valuables, but also all incoming and outgoing documentation. For the movement of documents, a commodity report is used in retail trade: it is compiled according to the unified, but optional form TORG-29 from State Statistics Committee Resolution No. 132 of December 25, 1998, or on its own form, developed for the local needs of the organization. If you use a register of your own design, then include all the required details in it and secure it in the accounting policy of the organization (Part 2 of Article 9 402-FZ of December 6, 2011).

IMPORTANT!

TORG-29 or the local commodity reporting form is used to register information about documents on receipt and expense. It is filled out by the MOL - the financially responsible person. For example, an employee or warehouse manager, manager, pharmacist in a pharmacy. A single reporting period has not been established: information is reflected for several days, a week, a month - according to the decision of management.

This form of reporting is usually used where accounting is carried out using the balance method (inventory method) - in retail trade, in public catering establishments. MOLs maintain quantitative records of goods in accounting cards and warehouse books based on primary documentation, and the movement of incoming and outgoing documents is reflected in commodity reporting.

ConsultantPlus experts discussed how to organize warehouse accounting of goods. Use these instructions for free.

to read.

Which form to use

Today, organizations have the right to choose the form and procedure for filling out the primary accounting document (clause 4, article 9 of the Federal Law of December 6, 2011 No. 402-FZ).

Order of the Ministry of Finance No. 119n provides a sample product report form. In addition, the State Statistics Committee Resolution No. 132 of December 25, 1998 approved the unified form TORG-29. You can use any of them, or you can independently develop a product report form that meets the specifics of the organization’s activities.

The decision to use one form or another must be approved in a local regulatory act of the company (for example, an order from the manager). It is also advisable to describe the reporting procedure of the financially responsible person.

How to fill out form 1-TORG

Let's look at the procedure for filling out each section of the report.

Title page

Indicate the reporting year, full and abbreviated name of the organization, as given in the constituent documents. In the “Postal Address” line, write down the zip code, subject of the Russian Federation, city, street, house and office. If the actual address of business differs from the legal address, indicate it.

Section 1

Section 1 is fairly easy to complete. Line 01 is the result line. It shows the total turnover of wholesale trade, that is, revenue from the sale of goods that were purchased specifically for resale.

Next, line 01 needs to be distributed among product groups. You don’t have to fill out all the lines; focus only on the types of products you need. To make it easier to find the required groups, OKPD2 codes are given in column 2.

Wholesale trade can be distinguished by the presence of an invoice for shipment. Show in the section turnover in actual sales prices - thousand rubles with one decimal place. Do not exclude markups, VAT, excise taxes, duties, fees, etc.

Section 2

Fill out the second section in the same way as the first. The difference is that it is designed for retail sales reporting.

Line 01 is the result, which is further expanded and specified in detail. The first line includes the entire retail trade turnover - this is revenue from the sale of goods to the public for personal consumption or household use. This also includes the sale of goods of own production through retail establishments.

The main sign of retail transactions is a cash receipt or another document that can replace it. Sales of goods to legal entities, individual entrepreneurs and public catering turnover do not fall under Section 2.

Include data at full cost in the report, even if the product was sold at a discount, on credit or at the expense of social security authorities.

Subsection 2.1 is provided for gas stations. In it, show data on the number of gas stations. And separately count how many multi-fuel and gas stations you have. This section includes gas stations owned and leased. Do not count rental properties.

Section 3

The third section is needed to distribute turnover by month. Columns 3 and 4 show wholesale turnover, and column 5 shows retail turnover. Indicate the turnover in thousand rubles with one decimal place.

In the text part it is necessary to provide additional explanations on retail trade. Line 14 shows the volume of sales based on citizen orders collected through TV, radio, telephone or the Internet, as well as sales through vending machines and agents with door-to-door delivery.

In line 15 - show the volume of sales through e-commerce, as a rule, these are online stores.

Line 16 shows the turnover of sales by mail. For example, when the buyer chose a product based on an advertisement, catalog, sample, etc. If you sold goods on credit, indicate their full cost on line 17.

Line 18 is needed for those who sell retail using a car: vans, trailers, tanks, tonars, auto shops, store wagons and ships.

Section 4

In the fourth section, report on retail trade by municipality. In column 1, enter the names of the MO in which you sell the goods, in column 2 - OKTMO code, and in columns 3, 4 and 5 - the cost of goods sold in thousand rubles with one decimal place. Column 3 is for general turnover, 4 - products, drinks and tobacco, 5 - only for tobacco products.

This section is completed differently for paper and electronic reports. In paper column 2 you do not need to fill in, but in electronic form you need to fill in column 2, but do not fill out column 1.

Section 5

As of January 1, 2022, show information about the warehouse network facilities used. The lines are filled in by the owners of warehouses (including leased warehouses or individual premises in them), as well as warehouse tenants who are trading organizations.

Indicate the number of warehouses, and from them, select those that are suitable for storing potatoes and fruits and vegetables. In line 03, calculate the warehouse area, in line 04 - the warehouse volume (area × height). For line 06, calculate how many tons of potatoes and other fruits and vegetables you store at a time.

Form 1-TORG

Sample filling 1-TORG

Check the finished report against the control ratios given in the instructions for completion, and sign in the prescribed manner.

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

Compilation rules

The commodity report shows the volume of receipt of inventory items and their sales in total terms. The period for which the reporting document is drawn up is established by the organization independently. With large volumes of receipts and sales, it can be one day. If the volumes are small, it can be formed weekly or monthly.

It is necessary to draw up a commodity report of the financially responsible person in two copies. One copy is transferred to the accounting department with the attachment of expenditure and receipt documents, which are reflected in the reporting form, and one copy remains with the financially responsible person.

Upon receipt of his copy, the accountant checks the correctness of the reporting form. As well as the formation of documents based on the reports of financially responsible persons. If errors are detected, the accountant makes changes to both copies of the document. The financially responsible person must familiarize himself with the corrections and confirm his agreement with his signature.

Recommendations for filling out a product report

All internal primary documents, which include the TORG-29 trading report form, are compiled directly during the trading operation, but if this is not possible, immediately after its completion, but at least once during the working day. For example, TORG-29 can be compiled based on the description of sales receipts issued by a cash register. This confirms paragraph No. 15 of the Accounting Regulations.

The TORG-29 report, confirming the detailed movement of goods, is always generated in duplicate.

All financial transactions are entered manually in legible handwriting. It is allowed to use blue and black ink (paste). It is also possible to draw up such a document on trade turnover in electronic form. Filling out the form begins by indicating the type of activity according to OKDP, and the type of operation itself. Such a product report must be numbered; at the beginning of each year, the numbering is reset. It is necessary to accurately indicate the date of registration and the start and end dates of the reporting period.

Next, enter your full name on the line of the form. financially responsible person, his profession (department manager, store director, salesperson) and personnel number. This person is the author of this document. On the front side of the product report there is a table to reflect information about the arrival of goods.

The table is divided into seven main columns; their completion is shown in the table:

| Column number | Explanations for filling |

| 1 | The balance of goods as of the starting date of the specified period - the amount in cash equivalent is entered. Below, the incoming product is listed one by one (its name is written in this column). |

| 2 and 3 | A column for recording information about the accompanying document attached by the supplier to incoming valuables. The second column contains the date of the document confirming the movement of goods, and the third column contains the number indicated on this document. |

| 4 | Estimation column – enter the price of the goods according to the shipping document. |

| 5 | The price of the container in which the product is packaged. |

| 6 | The account number to which the received values are debited. |

| 7 | Number of the account corresponding to the loan with the account specified in column 6. |

All accounts are entered into this document line by line, according to the time of the operation.