The goal of any enterprise is to obtain the highest possible level of income with minimal costs. When running a company, it is extremely important to avoid using unnecessary financial resources during the production of goods or provision of services, so as not to increase costs. However, there should be no supply interruptions or shortages. There needs to be a balance. To do this, you should carefully monitor the amount of materials that the company currently has. To achieve this goal, it is necessary to conduct high-quality accounting of the availability and movement of inventories in the organization. Most often, these operations are carried out by qualified employees. Proper monitoring makes it possible to optimize the company's performance and increase profits. This article will discuss what it is, what types there are, and how calculations should be made to avoid possible errors.

Concept

Before describing the procedures and giving the specification, it is necessary to find out what we are dealing with. The abbreviation MPZ is often used in scientific sources and documents. In short, accounting of inventories at an enterprise is the totality of all assets of the company used as raw materials or materials in the process of producing goods or services, specifically for sale. For example, the ingredients from which dishes are prepared in a cafe. In addition, this list includes funds that are involved in management. If they are purchased for further sale, then they must also be included in this list. It is important to note that their full cost is included in the final price of the product on the market.

Reflection in the balance

Regardless of what specific goods received will be intended for in the activities of an economic entity, it is always taken into account in the balance sheet according to the key factor. This is the cost, the totality of the actual costs incurred by the company. Often there are no problems with the definition, because the purchase and sale agreement with the counterparty easily provides all the necessary information.

Another point is that inventories include those that have already lost their value. For example, during transportation. Or they are outdated or excluded from circulation. Then the main assessment will be the selling price, not the purchasing price.

And in addition, some materials not received through a purchase and sale agreement. In the first case, this is a direct contribution from the founders in the form of capital replenishment. When capitalizing, you should be guided by the price recommendations of the founders themselves. There are also often cases of gratuitous delivery. In the form of a share, as an option. Then, for capitalization, you will need to calculate the current market price at the time of acceptance and focus on it. Moreover, if the assessment requires additional monetary costs, such as payment for the work of an appraiser, these costs are also included in the cost of the products received.

What are the tasks and features?

What is primary accounting of the receipt and disposal of inventories at an enterprise - this is a way to achieve several main goals. Among them:

- monitoring the safety of material assets in appropriate condition at all stages of the process;

- clear and timely documentation of the amount of expenses at each stage of production of goods, calculation of costs, as well as recording of the resources remaining after all cycles;

- detection of unused assets and their subsequent sale;

- uninterrupted implementation of agreements with suppliers, control of materials that are in transit.

Inventory accounting tasks

The main tasks of accounting in this area:

- control over the safety of material assets in places of their storage and at all stages of processing;

- correct and timely documentation of all operations on the movement of material assets; identification and reflection of costs associated with their procurement; calculation of the actual cost of consumed materials and their balances by storage location and balance sheet items;

- systematic monitoring of compliance with established stock standards, identification of excess and unused materials, their sale;

- timely settlements with suppliers of materials, control over materials in transit, uninvoiced deliveries.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

ENTERPRISE INVENTORIES

In accordance with clause 2 of the Accounting Regulations “Accounting for inventories” (PBU 5/01), approved by Order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n (as amended on 05/16/2016), for accounting purposes -material reserves include :

- productive reserves;

- containers for storing material assets in a warehouse;

- goods purchased for sale;

- material assets used for the economic needs of the organization;

- finished products.

Industrial inventories are raw materials and materials, spare parts and components, semi-finished products used in main and auxiliary production.

Finished products are material assets produced at the enterprise, which have gone through all stages of processing, are fully equipped, delivered to the warehouse in accordance with the approved procedure for their acceptance and are ready for sale.

Goods are material assets purchased from other organizations intended for sale.

NOTE

Accounting for inventories in the warehouse is carried out in natural and cost units by batches, item numbers, groups, etc.

Inventories are acquired and created for:

- ensuring production activities (stocks of raw materials, semi-finished products);

- sales (inventories of finished products, goods for sale);

- the needs of auxiliary production (for example, spare parts and components for equipment repair);

- provision of administrative and management activities (stationery, office equipment, etc.).

Inventory structure

The company's reserves can be divided into three main groups:

- main stock;

- temporary stock;

- forced reserve.

The main stock serves to support production activities (raw materials and supplies) and sales (goods and finished products) and consists of several parts:

- current stock of raw materials and materials - necessary to fulfill the plan for the production of finished products, focused on consumer demand. The size of this stock depends on the technological cycle of product manufacturing;

- current inventory (goods and finished products) - intended for the normal functioning of the sales process, timely implementation of the plan for the sale of finished products and goods. For manufacturing companies, its size depends on the sales time, frequency of deliveries, for trade organizations - on what batches of goods are received from the supplier, as well as on the frequency and time of its delivery;

- safety stock of raw materials and materials - needed in order to compensate for the uncertainties associated with the production process (for example, when releasing defective products, to be able to quickly eliminate defects or produce high-quality products instead of defective ones);

- safety stock of finished products and goods - focused on organizing emergency deliveries.

Temporary inventory is an excess stock that is created for a specific period and consists of three main types:

- seasonal stock - formed during the period of seasonal growth of consumption on the market (during the season it should be sold);

- marketing stock - is formed during the period of marketing promotions (during the promotions this stock is sold);

- opportunistic - they mainly create trading organizations in order to gain additional profit due to the difference between the old and new purchase prices (the company retains part of the goods previously purchased at a lower price, and when prices for goods from suppliers increase, it throws it onto the market).

Forced stock occurs when the warehouse is stocked. This includes illiquid goods (goods of normal quality, but in a volume that is difficult to sell quickly).

The required level of production and sales is ensured only by the main stock, so we will calculate the standards specifically for it.

When rationing inventories, the following conditions should be taken into account:

- frequency of inventory acquisition, volumes of delivery lots, possible trade credits;

- sales of finished products (changes in sales volumes, price discounts, state of demand, development and reliability of the dealer network);

- technology of the production process (duration of the preparatory and main processes, features of production technology);

- costs of storing inventory (warehouse costs, possible spoilage, freezing of funds).

Classification of inventory accounting according to PBU

Accounting regulations are a normative act that regulates the composition of inventories. The document was approved by the Ministry of Finance of the Russian Federation. According to the information contained in it, values are divided into the following categories:

- raw materials used in production;

- support resources;

- purchased semi-finished products;

- energy sources, returnable waste;

- packaging, as well as components;

- household equipment used in work.

It is worth mentioning what can be considered a unit of accounting for inventory materials. First of all, the code in the nomenclature is used. However, a party or group can perform. The main thing is to ensure that the full scope of information and control capabilities are provided.

Methods for assessing inventories when they are written off

When materials are released into production at actual prices or disposed of for other reasons, the assessment is made using:

- average cost indicator - the total cost of materials is divided by quantity, used for those stocks whose price is difficult to calculate separately;

- the cost value of each unit - relevant for accounting for expensive materials (for example, jewelry);

- FIFO method - the first outgoing lot is written off at the cost of the first incoming lot;

- LIFO method - the first batch is sold at the prices of the last receipt.

The enterprise applies one of the possible methods for each group or type of inventory, recommended by the accounting policy and job description of the accountant. When preparing financial statements, inventory balances are reflected in accordance with the established accounting method.

If the company uses planned prices, then at the end of each month there is a need to calculate deviations of the actual cost from the established one. The value is determined for each group of materials. After finding it, it is possible to calculate the actual cost of inventories used in production. To do this, the accounting value is adjusted by the amount of the deviation.

In accounting documents

To carry out transactions clearly and efficiently, synthetic accounts are used. Among them:

- “Materials” - used to summarize data on the movement of fuel, components, raw materials involved, packaging and other assets. The documentation indicates the actual cost. In some cases - discount prices. Divided into 11 subaccounts.

- “Animals for growing and fattening” is a list of animals, birds, and bee families that participate in the commercial activities of the organization. All information about young animals, adults that are fattened, as well as herds intended for marketing is entered.

- “Procurement and acquisition of material assets” is a set of information about the purchase of inventories that are involved in production cycles.

- “Deviation in value” - it displays all the data on the difference in the price of assets that were accepted into the enterprise. Their actual cost is indicated.

- “Products” - here the situation regarding the availability and movement of products that were purchased for further resale is described.

- "Finished products".

In addition to synthetic accounts, off-balance sheet accounts are also used in accounting for the movement of inventories. These include:

- “Materials accepted for processing” - here we monitor customer-supplied raw materials, which are not paid for by the company. This includes assets that are kept in warehouses for certain reasons. For example, if the customer received unpaid resources from the supplier, which, according to the terms of the contract, are prohibited from being put into operation until full payment is made.

- “Goods accepted for commission.” The terms of the concluded contract are taken into account.

Accounting for inventories: principles of organization

The accounting procedure for MPZ is established by PBU 5/01. In accordance with this provision, the following items are recognized as inventory:

- materials, raw materials and other assets that are completely consumed in the manufacture of products or performance of work (provision of services);

- intended for further sale (goods, finished products);

- assets necessary for the management needs of the enterprise.

It is worth noting that the category of inventories in Russian accounting practice does not include work in progress, as well as real estate intended for resale. IFRS 2, on the contrary, classifies these types of assets as inventories. According to international standards, industrial inventories also include funds that are used in the process of manufacturing products (providing services or performing work) for more than a year or one standard operating cycle.

PBU recognizes as part of the inventory only those assets that participate in the production process once, as well as goods and finished products stored for sale (resale).

Primary documents

The papers that are used when accounting for inventories in the warehouse and in the accounting department are standard.

When assets come into the possession of an enterprise, a receipt order in form M-4 is used to register them, as well as an acceptance certificate (in form M-7). The first is upon arrival from the supplier. The responsibilities of the warehouse manager include checking whether the actual quantity corresponds to the officially declared quantity. The second is issued if discrepancies are detected, as well as when working with uninvoiced deliveries. This document is drawn up by a special commission, and a representative of the sending company or an uninterested party must be present. The paper is prepared in two samples. The first one is sent to the accounting department and is used as a reason for depositing the amount into the accounts. The other goes to marketers. Based on this, complaints will be made to the supplier.

If materials were transported by car, the primary documentation is the consignment note. It is issued in 4 copies. The first of them is used to write off assets from the sending company. The second is used so that the recipient can capitalize them. Another one is needed for settlements with the carrier company. The latter serves as an appendix to the route sheet.

There are a number of regulations according to which expenses for production needs are recorded. Among them:

- Limit collection card - issued by the marketing department, used for systematic deliveries.

- Request for release of materials - given in the case of a one-time operation.

- Invoice. When transferring resources to third party organizations, it is issued on the basis of concluded contracts.

It is worth noting that companies have the right to develop their own forms and reduce their number by combining them.

Inventory analysis

The importance of MPZ in the manufacturing process cannot be overestimated. By planning the correct amount of resources needed for production, you can achieve maximum efficiency of the enterprise. Thanks to the analysis of inventories, it is possible to determine reserves for reducing production costs, which leads to increased profits and increased benefits for the organization. For these purposes, the following indicators are considered:

- average values of inventory balances and the dynamics of changes in their values;

- turnover and duration of one revolution of inventories by elements and as a whole;

- the most significant inventory items for production.

Effective planning of expenses for the acquisition of these assets and their management significantly accelerates capital turnover, increasing its profitability. The right approach can reduce the cost of storing materials, leading the company to more income.

Without materials and supplies, the activities of no production or agricultural organization are possible. It is important to think through everything: the number of items purchased, rational use, timely recording of transactions and a thorough analysis of the results.

Inventory valuation

To better understand the issue, you can use the given example of inventory accounting. The table shows calculations using the FIFO method.

| Options | Number of units | Unit price | Sum |

| Balance at the beginning of the month | 30 | 15 | 450 |

| Receipts (batch) | |||

| number one | 40 | 18 | 720 |

| number two | 20 | 20 | 400 |

| number three | 80 | 25 | 2000 |

| Sum | 140 | – | 3120 |

| Expenses – 150 kilograms | |||

| Write-offs | 30 | 15 | 450 |

| 40 | 18 | 720 | |

| 20 | 20 | 400 | |

| 60 | 25 | 1500 | |

| Total losses for the specified period | 150 | – | 3070 |

| Remainder | 20 | 25 | 500 |

Posting

Inventories are accepted for accounting at the actual cost of each of them. It recognizes the amount of all expenses incurred by the company in the process of purchasing them. Exceptions include VAT and other refundable taxes, as well as cases regulated by law. The list of costs may include:

- transfer of money to suppliers in accordance with the contract;

- fees for consulting and other services;

- customs duties;

- intermediary remuneration;

- logistics costs;

- other items related to the procurement of inventories.

Organization and features of accounting for disposal of inventories

According to PBU, the company carries out this procedure in one of several available ways. The first is the cost of each unit supplied. In addition, you can calculate the average value for all. The third is the FIFO method. It was demonstrated in the table above.

Each of the described ways is applied for one year.

Composition of inventories

The composition of inventories is shown in the figure.

Composition of inventories

Industrial inventories, first of all, must be characterized as objects of labor that are at the disposal of the enterprise in a certain volume necessary to ensure the continuity of the production process, but which have not yet been used in the production process and have not transferred their value to the cost of the products produced by the enterprise.

1. Raw materials and supplies are assets necessary for the production process. Enterprises purchase raw materials and supplies from suppliers and use them to produce products or provide services.

2. Purchased semi-finished products and components are used by the enterprise in the form of products that have not gone through all stages of the production process. Such purchased semi-finished products and components can be purchased from suppliers in the form of, for example: furniture parts, blanks for windows, fittings, etc.

3. Spare parts are used by enterprises both for the production of products, in the event, for example, of a defect that can be corrected, and for the repair of equipment and vehicles.

4. Containers and packaging material are used for packaging and transportation of products. Due to the fact that manufacturing enterprises, as a rule, produce only a certain range of products, they are forced to purchase packaging from other enterprises specializing in its production.

5. Inventory and household supplies are used in the production process as auxiliary means.

6. Returnable waste is waste that an enterprise can subsequently either use in some form in production or sell.

7. Finished products are products that are fully formed and have gone through all stages of production, ready for sale or delivery to our own retail chains.

8. Goods are a specific product that is involved in exchange for money.

Read also: Material assets of the enterprise

Documenting

As stated above, there are several regulations that can be used to capture motion.

The receipt of assets at the company's warehouse is formalized using a receipt order or a materials acceptance certificate. The decision to use one of these papers is made after carefully calculating the amount of resources and comparing it with that specified in the contract. If the results match, the first option is applied.

The consignment note acts as the primary regulatory document for accounting for inventories if transportation was carried out by cars. Internal movement is specified by the organization's employees in the requirement.

There are limit-fence cards that are used to fix costs.

Documentation of movement of materials

To record the movement of materials, standard documentation is used.

Receipt of materials to the warehouse is documented with the following documents:

- receipt order (f. M-4);

- act on acceptance of materials (form M-7).

When materials are received from suppliers, the warehouse manager checks the compliance of their actual quantity with the supplier’s documentary data and, if there are no discrepancies, issues a receipt order for the entire quantity of incoming cargo in one copy on the day the materials are received.

The act of acceptance of materials is used to process material assets received without payment documents (uninvoiced deliveries) and in case of discrepancies (quantitative and qualitative) with the data of the supplier’s accompanying documents.

The act is drawn up by a commission with the obligatory participation of a representative of the supplier or a representative of a disinterested organization.

The act is drawn up in two copies: the first is transferred to the accounting department as the basis for accounting entries in the accounts and calculation of the amount of shortage or surplus; the second is transferred to the marketing department to file a claim with the supplier

If materials are transported by road, then the primary document is a consignment note, which is issued by the shipper in 4 copies:

- the first one serves as the basis for writing off materials from the shipper;

- the second - for posting the material by the recipient;

- the third - for settlements with the motor transport organization;

- fourth - to account for transport work and is attached to the waybill

The receipt of production waste at the warehouse, as well as the internal movement of materials, is formalized by a demand invoice, which is issued in duplicate by the supplying workshops.

Materials obtained from the dismantling and dismantling of buildings and structures are received on the basis of an act on the recording of material assets.

Accountable persons purchase materials from retail trade organizations, from other organizations and cooperatives, and from the public for cash. The document confirming the cost of purchased materials is a sales receipt or act (certificate) drawn up by an accountable person, in which he sets out the contents of the business transaction, indicating the date, place of purchase, name, quantity of materials and price, as well as the seller’s passport data.

The act (certificate) is attached to the advance report of the accountable person.

The consumption of material from the warehouse for production and economic needs is documented with the following documents:

- Limit-fence card (form M-8);

- Request-invoice for materials release (form M-11);

- Invoice for the release of materials to the third party (form M-15).

A limit intake card is issued by the marketing department for one or more types of materials related to a specific production order in two copies. One copy is transferred to the warehouse, the other to the workshop - to the recipient. The storekeeper records the amount of material released in both cards and the remaining limit is immediately determined. The calculation of the need for the required type of materials to complete the program is carried out by the production department.

Limit and intake cards are used for constant, systematic supply of materials.

To register a one-time release of materials for business needs, invoice requirements for the release of materials are used. They are issued in two copies, one is transferred to the recipient, the other to the warehouse.

The release of materials to third parties is prepared with an invoice for the release of materials to the third party. It is issued by the marketing department in two copies based on contracts. One copy remains in the warehouse, the other is transferred to the recipient. When transporting materials by road, a consignment note is issued in 4 copies.

According to the Federal Law “On Accounting” (Law No. 402-FZ dated December 6, 2011), from January 1, 2013, organizations can abandon most of the unified forms for accounting for materials and develop their own, having them approved by order of the manager or in the accounting policy.

By developing its own forms of primary documents, an organization has the right to reduce their number by combining several forms into one, thereby simplifying the document flow for accounting for materials.

Documentation of inventory in the warehouse

The procedure depends on the chosen method. There are several options:

- quantitative-sum;

- through reporting by relevant employees;

- operational and accounting.

The latter is considered the most effective. He is the most progressive and rational. It uses special accounting cards. The accounting department issues them for each registration number, and then transfers them to the warehouse manager against signature.

The employee must enter a receipt order into the document in the appropriate column after each arrival. Additionally, the balance after each operation is indicated. In addition, the consumption of assets is recorded based on requirements or limit-taking papers. According to the schedule developed by the company management, the employee will submit the results to the accounting department. There they are transferred to the statement, which is opened for one year.

The described method of accounting for inventories has a number of strengths. The first is the speed of data collection and processing. In addition, the accountant can constantly monitor the correctness of the operation. Another advantage is the regular comparison of information.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Methods for accounting for inventories during procurement

There are two main ways this operation can be performed. The first is to generate the actual cost in the “Materials” account. It is advisable to use it only in certain cases. For example, when a company has a small volume of supplies over a period of time. If the company has a small range of assets or the accounting department receives all the information at a time. The table provides an example of such calculations.

| № | Contents of operation | Debit | Credit |

| 1 | The price of goods and materials was calculated using the invoice and invoice | 10 | 60 |

| 2 | Accounting for value added tax | 19 | 79 |

| 3 | Logistics costs | 10 | 76 |

| 4 | Remuneration for intermediary companies | 10 | 76 |

The second is to use separate accounts. For example, “Accounts payable”.

Methods for accounting for materials procurement

In accordance with PBU 5/01, materials are accepted for accounting at actual cost.

The formation of the actual cost of materials can be carried out in the following ways:

- the actual cost is formed directly on account 10 “Materials”;

- using accounts 15 “Procurement and acquisition of materials” and 16 “Deviation in the cost of materials”.

If an organization keeps records of the procurement of materials on account 10 “Materials”, then all data on actual expenses incurred during procurement is collected in the debit of account 10 “Materials”.

This method of forming the actual cost of materials is advisable to use only in organizations that:

- a small number of supplies of materials during the period;

- small range of materials used;

- All data for the formation of the cost of materials, as a rule, arrives at the accounting department at the same time.

If accounting for the procurement of materials in an organization is carried out in the second way, all costs associated with the purchase of materials, based on the suppliers’ settlement documents received by the organization, are recorded as the debit of account 15 and the credit of accounts 60 “Settlements with suppliers”, 76 “Settlements with various debtors and creditors” etc.: D-t 15 K-t 60, 76, 71.

The posting of materials actually received at the warehouse is reflected by the entry:

D-t 10 K-t 15 - at discount prices.

The difference between the actual cost of acquisition and the cost of materials received at accounting prices is written off from account 15 to account 16 “Deviation in the cost of material assets”:

D-t 16(15) K-t 15(16) - reflects the deviation of the accounting price from the actual cost of materials.

When using the second method of accounting for the procurement of an organization, current accounting of the movement of materials is carried out at accounting prices.

Whether to use account 15 to account for procurement operations or keep it directly on account 10 “Materials” is up to the organization itself to decide when choosing an accounting policy for the coming year.

Typical operations for accounting for the procurement of materials on account 10 “Materials”

| No. | Contents of operations | Debit | Credit |

| 1 | The purchase price of materials is reflected based on the invoice and invoice of the supplier | 10 | 60 |

| 2 | VAT on capitalized materials (transport costs, remuneration of the intermediary organization) is taken into account. | 19 | 60 (76) |

| 3 | Transport costs for the purchase of materials are reflected (based on the invoice of the transport organization) | 10 | 76 |

| 4 | The costs of paying for the services of an intermediary organization are reflected (based on the intermediary’s invoice) | 10 | 76 |

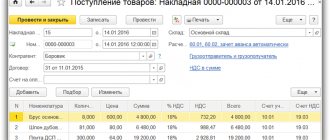

Methods for accepting inventories for accounting during inflows and settlements with suppliers

These operations are carried out on the basis of concluded contracts. During shipment, supply companies draw up settlement papers and hand them over to the customer. In addition, a road invoice is issued. All documents are transferred to the marketing department. Its employees check them, register them, accept them and give their approval for the transfer of funds. Afterwards, each of them is assigned an individual number, and then they are sent to the accounting department for payment. Paperwork related to logistics costs is transferred to the forwarder.

For operations, a special account “Settlements with suppliers and contractors” is used.

Accounting for receipt of materials and settlements with suppliers

Production stocks of materials are replenished through their supply by supplier organizations or other organizations on the basis of contracts.

Suppliers, simultaneously with the shipment, issue settlement documents to the buyer (payment request, invoice), waybill, receipt for the railway waybill, etc. Settlement and other documents are received by the buyer's marketing department. There they check the correctness of their filling out, their compliance with the contracts, register them in the logbook of incoming goods (form No. M-1), accept them, i.e. give consent to payment.

After registration, payment documents receive an internal number and are transferred to the accounting department for payment, and receipts and invoices are transferred to the forwarder for receipt and delivery of materials.

From this moment on, the organization’s accounting department begins to settle payments with suppliers. As the cargo arrives at the warehouse, a receipt order is issued, then, when registered, it is submitted to the accounting department, where it is taxed and attached to the payment document. As the bank pays for this document, the accounting department receives an extract from the current account indicating that funds have been written off in favor of the supplier.

If signs are detected that raise doubts about the safety of the cargo, the forwarder, when accepting the cargo at the transport organization, may require an inspection of the cargo. In the event of a shortage of places or damage to the container, a commercial report is formed, which serves as the basis for filing a claim against the transport organization or supplier

Accounting for settlements with suppliers of inventory items is carried out on account 60 “Settlements with suppliers and contractors”. Passive, balance, settlement account.

The credit balance on account 60 indicates the amount of debt the enterprise owes to suppliers and contractors for unpaid invoices and uninvoiced deliveries:

- loan turnover - the amount of accepted supplier invoices for the reporting month;

- debit turnover - the amount of paid supplier invoices.

Accounting for settlements with suppliers of inventory items is kept in journal order No. 6. This is a combined register of analytical and synthetic accounting. Analytical accounting is organized in the context of each payment document, receipt order, and acceptance certificate. Journal order No. 6 is opened with the amounts of unfinished settlements with suppliers at the beginning of the month. It is filled out on the basis of accepted payment requests, invoices, receipt orders, acts of acceptance of materials, and bank statements.

Order journal No. 6 is maintained in a linear positional manner, which makes it possible to judge the status of settlements with suppliers for each document.

Amounts for accounting prices are recorded regardless of the type of incoming valuables - as a total amount, and for payment requests - by type of materials (main, auxiliary, fuel, etc.). The amount of claims is recorded on the basis of materials acceptance certificates. Based on bank statements, a note is made regarding the payment of each payment document.

The amounts of shortages identified during the acceptance of material assets are debited to account 76 “Settlements with various debtors and creditors”, subaccount 2 “Settlements for claims” and is reflected in journal order No. 6 in correspondence: D-t 76/2 K-t 60.

Organizations also use the services of water and gas suppliers, repair contractors, etc. For these payments for services, a separate journal-order No. 6 is maintained.

At the end of the month, the indicators of both order journals are summed up to obtain the turnover for account 60 “Settlements with suppliers and contractors” and transfer them to the General Ledger.

Procedure for accounting for uninvoiced deliveries

Deliveries for which material assets arrived at the organization without a payment document are considered uninvoiced. They arrive at the warehouse, writing out an act of acceptance of materials, which, when registered, goes to the accounting department. Here, the materials according to the act are valued at accounting prices, recorded in journal order No. 6 as values received at the warehouse, and in the same amount are assigned to the group of materials and to the acceptance. Uninvoiced deliveries are recorded in journal order No. 6 at the end of the month (in column B “Account number” the letter N is placed), when the possibility of receiving a payment document in a given month has disappeared. They are not subject to payment in the reporting month, since the basis for payment by the bank is payment documents (which are missing). As payment documents for this delivery are received next month, they are accepted by the organization, paid by the bank and registered by the accounting department in journal order No. 6 in a free line for a group of materials and in the “acceptance” column in the amount of the payment request, and in the balance line (unfinished calculations) the previously recorded amount at accounting prices is also reversed by group and in the “acceptance” column. Payments with the supplier will therefore be completed for this delivery. Example.

In March there was an uninvoiced delivery in the amount of 12,000 rubles.

In April, an invoice was presented for payment in the amount of 14,160 rubles. (including VAT).

In March, an entry will be made: D-t 10 K-t 60 - 12,000 rubles.

In April: D-t 10 K-t 60 - 12,000 rub. D-t 10 K-t 60 - 12,000 rub. D-t 19 K-t 60 - 2160 rub.

Procedure for registering uninvoiced supplies

Keeping records of the use of inventories often has to be carried out in the absence of a payment certificate. The regulations provide for a separate procedure for this. Received valuables are first received at the warehouse; later, employees draw up a receipt, which is then handed over to the accounting staff. In this case, the estimated prices of assets are used for the operation. Once entered into the journal, they are accepted. Payment is made in the month following the reporting month. The transaction is registered in a separate line of order number 6.

The concept of inventories and their gradation

Inventories are assets (items of labor) used once in the production process. Their cost is completely transferred to finished products, i.e. they are one of the main elements of cost. Inventory also includes goods and products in warehouses intended for further sale.

The enterprise's reserves are classified according to their purpose and properties (technical characteristics). Depending on the functions performed, there are:

- basic;

- auxiliary.

In the group of auxiliary production inventories, containers and packaging materials, spare parts, fuel and MBP are separately distinguished. This is explained by the peculiarities of their use. Fuel is divided into economic (for heating purposes), motor (fuel) and technological. Container materials are used for transportation, storage and packaging of finished products and other supplies.

Accounting for the organization's inventories that are in transit

This category includes situations in which payment papers were accepted, but resources or part of them did not arrive at the warehouse for various reasons. In this case, the column “For unarrived cargo” is used for registration. The company is obliged to accept them on its balance sheet upon completion.

After the actual receipt of the valuables, an inspection is carried out. If surpluses are identified, they are accounted for and also recorded. Then the supplier issues payment requests. If a shortage is detected, the cost is calculated and a complaint is submitted to the sender. The tariff for rail transportation depends on the weight of the cargo. Allowances and discounts are determined according to the price.

Methods for assessing inventories

Depending on the method used in accounting and enshrined in the accounting policy, the amount of material costs will be different; accordingly, this will affect the cost of production, the amount of value added tax, the financial result and the amount of income tax. At the same time, it is worth noting that the goal of any enterprise is to minimize costs and maximize profits, therefore the choice of method for assessing inventory upon disposal plays an important role in the activities of enterprises.

1. Valuation method “at average cost” . According to this method, the assessment of inventories is carried out by dividing the total cost of a certain type of inventories by the quantity, respectively, consisting of the cost and quantity of the balance at the beginning of the month and of incoming inventory during the month. This method is traditional for domestic accounting practice. This is explained by its convenience in small wholesale and retail trade, since it is quite difficult to determine which batch of a sold unit of any type of product belongs to. This method will also be very useful in case of constant changes in purchase prices. By averaging the cost of goods, an organization can avoid unexpected financial results.

2. “FIFO” method . The essence of the FIFO method is that materials are valued at the cost of the earliest acquisitions. This means that the first thing you need to do is write off inventories at the cost of the balances that are listed at the beginning of the month, then you need to evaluate the materials at the cost of the first purchase, then the second, and so on. Thus, this method allows you to determine a more accurate cost of inventory compared to the previous one. To account for inventories, it is enough to also distribute them into groups

3. Unit cost valuation method . Another method involves valuing materials at the cost of each unit. That is, the accountant in this case must keep individual records of each item. Accordingly, this method is suitable for those companies whose accounts contain a small number of inventories. Typically, this method is used by organizations that produce or sell cars, jewelry, art, or other unique goods. When using this method, the company receives the exact value of the property, which is extremely important for management accounting.

Read also: Audit of material assets

Inventory

At least once a year, according to the requirements, the company undertakes to conduct an inventory of the assets at its disposal. The procedure for conducting it is not regulated. It is designated by the head of the enterprise. The official decides how often the procedure needs to be carried out, on what dates it is carried out, as well as the list of property that is checked. Exceptions are cases when the operation is mandatory under current legislation.

To make the process easier, you can use special software. For example, “Warehouse 15” from Cleverens helps automate many warehouse operations, including inventory.