Home — Articles

In the article we will talk about how to fill out an advance report when an employee was given an advance in cash foreign currency.

In this case, the advance report must be prepared simultaneously in this currency and in rubles. That is, you need to reflect amounts in foreign currency in the report, and then convert them into rubles (Clause 4, 6, 7, 13 PBU 3/2006). And for this you will need to decide on the conversion rate. And this is more difficult than it might seem at first glance.

Currency issued for reporting: advance or not advance - that is the question

To determine the conversion rate, you must first understand: the amount issued to the employee on account is a foreign currency advance (the same one that does not need to be recalculated either in accounting or tax accounting) (Clause 9 of PBU 3/2006; clause 11 Article 250, paragraph 5, paragraph 1, Article 265 of the Tax Code of the Russian Federation) or not . But this is not easy to understand, because there is no direct answer either in the “accounting” or in the tax legislation.

Approach 1. Foreign currency issued for reporting is a foreign currency advance that does not need to be recalculated

The employee was given currency to pay for upcoming expenses of the organization itself. In addition, historically such amounts are called advances - and the report is also an advance. This means we can talk about a foreign currency advance.

Based on this, if all travel expenses fit into the amount issued to the employee on account, then they must be recalculated into rubles at the Central Bank exchange rate on the date of issue of this advance.

But the amount of overexpenditure - it occurs when travel expenses are greater than the advance payment received by the employee - must be converted into rubles at the Central Bank exchange rate on the date of approval of the advance report. That is, on the date of recognition of the expense in accounting and tax accounting (Subclause 5, clause 7, clause 10, Article 272 of the Tax Code of the Russian Federation).

Approach 2. Foreign currency issued on account is simply the employee’s debt

This approach can be based on the explanations of the Ministry of Finance. He believes that the provisions of paragraph 11 of Art. 250 and pp. 5 p. 1 art. 265 of the Tax Code of the Russian Federation (in the part establishing that advances received/issued are not revalued for profit tax purposes) regulate only relations related to the revaluation of advance payment amounts for the sale/purchase of goods, work, services, and property rights. When it comes to a business trip, the money is given on account to our employee (and not to the performer of work or services) and the employee himself then manages it. From this point of view, a “non-revalued” foreign currency advance does not arise at the time of issuing money on account to the employee.

This means that all travel expenses that the organization incurs (that is, all expenses paid at its expense and not covered by daily allowances) will not be paid by us in advance at the time of transfer of money to the employee. If an advance appears, it will only be at the time of advance payment by the employee for some services of hotels, agencies or other performers and sellers. Or maybe the employee will pay for goods, work or services upon delivery - then there will be no advance payment at all.

It turns out that foreign currency travel expenses (both those covered by the amounts issued for the report and those exceeding them) must be recalculated into rubles at the Central Bank exchange rate on the date of approval of the advance report (Clause 10 of Article 272 of the Tax Code of the Russian Federation).

For reference

The amount of daily allowance for an employee is determined by the border crossing marks in the international passport. Therefore, in addition to documents confirming expenses, copies of the pages of the employee’s international passport with these marks must be attached to the advance report.

When leaving Russia, the date of crossing the border is included in the days for which “foreign” daily allowances are paid. And when returning to Russia, the date of crossing the border is included in the days for which “Russian” daily allowances are paid. Moreover, it doesn’t matter what time of day the border was crossed - at least at 00.10, at least at 23.50.

If the employee has been to several EU countries, movement within which does not require additional visas, then additional air or train tickets may be required to confirm the date of crossing the borders of these countries.

What you need to know about the trip report

Upon returning from a business trip, including a foreign one, the employee is obliged to report on it and submit an advance report to the accounting department.

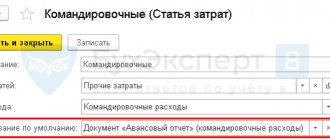

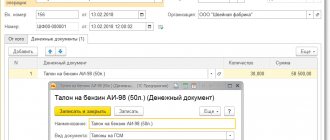

The form of the advance report can be approved by the local act of the company. Or, the old-fashioned way, they use a report in form AO-1.

Regardless of the form, you must comply with the deadline for submitting the report - 3 business days after the end of the business trip.

The employee attaches all documents confirming expenses to the advance report for a business trip abroad. Namely:

- travel tickets and boarding passes (if tickets are electronic, you need to print them);

- receipts for the use of bed linen;

- hotel invoices and receipts (residential rental agreement), receipts;

- receipts of fees (agent's commission for purchasing a ticket, receipt for baggage transportation, etc.);

- documents confirming payment of visa or consular fees;

- other supporting documents.

ADVICE

For the convenience of preparing and conducting an advance report, supporting documents can be pasted onto blank A4 sheets with a field for filing documents on the left.

If the employer purchases tickets and books a hotel through an agency or directly from the contractor, documents for travel and accommodation (boarding pass or voucher, hotel bill or certificate of accommodation) must be attached to the report.

There is a special approach to daily allowances

The employee receives daily allowances for himself, and their expenditure does not need to be confirmed by documents . This means that they fully fit the definition of a foreign currency advance. Therefore, they must be converted into rubles at the exchange rate on the date of issue to the employee . We, of course, do not purchase any services from the employee, however, even if we do not count the daily allowance as a foreign currency advance, there is another reason to recalculate the daily allowance exactly on the date of issue, regardless of the rate at which you calculate travel expenses.

The fact is that, according to the Ministry of Finance, for the purposes of calculating personal income tax, daily allowances issued in foreign currency before the start of a business trip must be converted into rubles precisely at the Central Bank exchange rate in effect on the date of their issue to the employee. The Ministry of Finance justifies its position by the fact that it is at the moment of receiving the daily allowance that the employee receives income. As everyone remembers, “foreign” daily allowances are not subject to personal income tax if they do not exceed 2,500 rubles. per day. Of course, one can argue with the position of the Ministry of Finance: after all, before the start of a business trip, it is not known for sure whether the employee will go on it at all (maybe he will get sick and will return all the daily allowance). Therefore, it is still too early to talk about the employee receiving income at the time of issuing his daily allowance before a business trip. But, be that as it may, the opinion of the Ministry of Finance must be taken into account.

Note

To avoid problems with calculating personal income tax, organizations often set the norms for “foreign” daily allowances not in currency, but in rubles. Accordingly, daily allowances are paid in rubles. This is also not bad for the employee: he knows whether personal income tax will be withheld from the daily allowance or not, therefore, he knows exactly the amount of the daily allowance, which he can dispose of at his own discretion.

Since for personal income tax purposes it is safer to recalculate foreign currency daily allowances on the date of their issue, it is more logical both in accounting and in accounting for profit tax purposes to recalculate foreign currency daily allowances on the same date.

It turns out that even if you adhere to the second approach, it is better to convert the daily allowance into rubles at the Central Bank exchange rate on the date of issue to the employee, and all other documented expenses in foreign currency - at the Central Bank exchange rate on the date of approval of the advance report. This is exactly what experts from the Ministry of Finance advise to do.

From authoritative sources

Bakhvalova Alexandra Sergeevna, chief specialist-expert of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia

“If the entire amount for the report is issued in foreign currency, in order to be reflected in the accounting documents it is necessary to recalculate it into rubles at the Central Bank exchange rate on the date of issuance of the advance. Upon returning from a business trip, the employee submits receipts confirming the expenses incurred, and also returns the unused amount. All expenses are converted into rubles at the official exchange rate of the Central Bank on the date of transactions (by checks) and are taken into account by the organization on the date of approval of the advance report. Part of the amount attributable directly to daily allowances should also be reflected in the advance report, but justification of expenses in the form of daily allowances by checks is no longer required. And, therefore, the employee has no obligation to return the unspent part of the daily allowance to the organization. Accordingly, the organization reflects the paid daily allowance in rubles at the Central Bank exchange rate on the date of issue of the advance, and then does not track the expenditure of funds in the part attributable to the daily allowance.”

Conclusion

As we see, neither tax nor accounting legislation allows us to say with confidence that any one of the two approaches proposed above is the only correct one. In most cases, your choice of one course or another for converting foreign exchange expenses will not greatly affect the result, so the cost of the issue is not so high. And even if the inspectors decide that you took the course on the wrong date, it is unlikely that this will be a significant loss for you. And if you want to argue with the inspectors, there is also a chance to defend your rightness. After all, as everyone has long since learned by heart, all doubts and contradictions in tax calculations should be interpreted in favor of the taxpayer.

Now let’s look at the procedure for filling out an advance report in two situations:

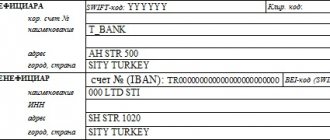

- when the employee received money from the organization in the same foreign currency in which he will spend it;

- when the employee received money in one foreign currency, and he will spend it, having previously exchanged it for another currency.

Advance report

You can see how to correctly fill out an advance report for a foreign business trip here:

As a general rule, the employee must independently fill out the advance report.

In the advance report, it is important to indicate all expenses incurred by the employee during a business trip abroad.

If an employee has incurred any expenses that are not provided for in the company’s organizational and administrative document, it is necessary to attach to the report a memo with a positive resolution from the manager.

On a business trip abroad, unexpected expenses may arise - taxis, dry cleaning, expenses for cellular communications or the Internet, buying a laptop, etc., etc. Each situation must be considered separately.

You can learn about the specifics of work while constantly on business trips abroad from our article “Work related to business trips abroad: what you need to know.”

The advance was issued in the same foreign currency in which the expenses were paid

This is the simplest situation from the point of view of drawing up an expense report. In Form N AO-1, you only need to record the amounts in foreign currency from the documents and convert them into rubles. We have already discussed above at what rate this should be done. Let's consider an example when an organization determines the ruble amount of travel expenses paid in advance at the exchange rate on the date the advance was issued.

Example. Filling out a report on a foreign business trip, when the accountable amount is issued and spent in euros

Condition

LLC "Major" sends deputy director S.I. Zvezdochkin. on a business trip to conduct negotiations with a French company. The duration of the business trip is from 09/02/2010 to 09/14/2010. The travel tickets were purchased by the organization by bank transfer.

The organization established daily allowance rates at LLC Major, including for foreign business trips, in rubles (so as not to exceed the standard not subject to personal income tax).

The daily allowance standard for France is 2100 rubles. per day.

The daily allowance standard for Russia is 500 rubles. per day.

From the cash register of LLC "Major" to Deputy Director S.I. Zvezdochkin. 09/01/2010 2,000 euros (to pay cash expenses) and 25,700 rubles were issued for travel expenses. (daily allowance). The Central Bank exchange rate as of September 1, 2010 is 39.01 rubles/euro.

09/14/2010 Zvezdochkin paid for hotel services in the amount of 2340 euros.

He prepared the advance report on 09/15/2010. On the same day, the director approved it.

The Central Bank exchange rate as of September 15, 2010 is 39.53 rubles/euro.

And on the same day, the employee was given 340 euros from the cash register (as repayment of overexpenditure).

Solution

Amount of expenses in rubles (per diem) - 25,700 rubles:

— for days spent in France — 25,200 rubles. (2100 rub. x 12 days);

— for business trip days spent in Russia — 500 rubles. (1 day - day of arrival in Russia from France - 09/14/2010).

The total amount of travel expenses in foreign currency is 2340 euros. This amount is more than the advance payment given to the employee.

Part of the amount of travel expenses within the limits of the advance payment issued (2000 euros) must be converted into rubles at the exchange rate on the date of issue of the advance payment (as of 09/01/2010 - 39.01 rubles/euro). And the remaining part (340 euros) must be converted into rubles at the Central Bank exchange rate on the date of approval of the advance report (39.53 rubles/euro).

As a result, the amount of foreign currency travel expenses in rubles will be 91,460.20 rubles.

(EUR 2,000 x RUB 39.01/EUR + EUR 340 x RUB 39.53/EUR).

The following entries will be made in accounting.

| Contents of operation | Dt | CT | Sum |

| On the date of advance payment (09/01/2010) | |||

| Currency issued from the cash register for travel expenses (2000 euros x 39.01 rubles/euro) | 71 “Settlements with accountable persons” | 50, subaccount 2 “Cashier in euros” | 78 020,00 |

| Rubles issued from the cash register as daily allowance | 71 “Settlements with accountable persons” | 50, subaccount 1 “Cashier in rubles” | 25 700,00 |

| As of the date of approval of the advance report (09/15/2010) | |||

| Travel expenses reflected (RUB 78,020 + EUR 340 x RUB 39.53/EUR) | 26 “General business expenses” | 71 “Settlements with accountable persons” | 91 460,20 |

| Daily allowances reflected | 26 “General business expenses” | 71 “Settlements with accountable persons” | 25 700,00 |

| There is no need to withhold personal income tax from daily allowances, since they do not exceed non-taxable norms (2100 rubles/day < standard 2500 rubles/day, 500 rubles/day < standard 700 rubles/day). Daily allowances are also not subject to insurance premiums. | |||

| The issue of overexpenditure to the employee in euros is reflected (340 euros x 39.53 rubles/euro) | 50, subaccount 2 “Cashier in euros” | 71 “Settlements with accountable persons” | 13 440,20 |

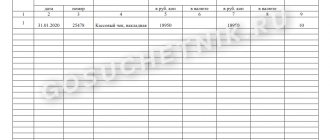

Reverse side of form N AO-1

| Number in order | Document confirming production costs | Name of document (expense) | Expense amount | Debit account, sub-account | ||||

| according to the report | accepted for accounting | |||||||

| date | number | in rub. cop. | in currency (in euros) | in rub. cop. | in foreign currency | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 1 | 14.09.2010 | 85646 | hotel bill | 91 460,20 | 2 340 | 91 460,20 | 2 340 | 26 |

| 2 | 15.09.2010 | a/o N 63 | per diem abroad | 25 200,00 | 25 200,00 | 26 | ||

| 3 | 15.09.2010 | a/o N 63 | daily allowance Russian. | 500,00 | 500,00 | 26 | ||

| Total: | 117 160,20 | 2 340 | 117 160,20 | 2 340 | ||||