Garden non-profit partnerships (SNT) keep records in accordance with the requirements and rules of law established for all enterprises. Document flow is aimed at processing operations that serve the needs of the organization. Entrepreneurial activity is permitted only to achieve the goals specified in the constituent documents. In this article we will look at how accounting is carried out in SNT.

The association was created to meet current needs and solve social and economic problems. Members of the partnership are not liable for the obligations of the SNT, and the association is not liable for the debts of the participants. Similarly, with enterprises of other forms, the conduct of activities must be taken into account and formalized according to the conditions of accounting and tax accounting. SNT is a full-fledged legal entity with a Charter that determines the procedure for conducting activities.

Choosing the SNT taxation system

The volume of supporting documents when maintaining accounting records of partnerships depends on the taxation system chosen by the organization. SNT has the opportunity to choose a general or simplified taxation regime.

| Position | General system | Simplified system |

| Selection order | Assigned by default upon registration | Appointed upon submission of application |

| Accounting | Complete, using all accounts | Limited, using part of accounts |

| Number limits | Not available | Available |

| Tax accounting | Registers for main accounting items are used | A book of income and expenses is used |

| The procedure for accounting for income and expenses | Accrual or cash method | Cash method |

The complexity of document flow with OSNO is much higher. The best option for accounting is to use the simplified tax system, which is allowed according to the main indicators. The transition to a simplified system is subject to compliance with the average number limit. Read the article: → review of the simplified taxation system.

The concept of SNT

SNT (garden non-profit partnership) is a non-profit structure established on a voluntary basis with the aim of helping its members in solving various economic and social problems when conducting vegetable gardening, horticulture or dacha farming.

Such issues include providing the participants of the association with water, electricity, heat, gas, etc. The main regulatory act regulating the activities of SNT, since 2019, is the law “On the conduct of gardening and vegetable gardening by citizens...” dated July 29, 2017 No. 217-FZ. Before this, the law “On gardening, gardening and dacha non-profit associations of citizens” dated April 15, 1998 No. 66-FZ was in force.

NOTE! SNT is not subject to the Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ (clause 3 of Article 1 of Law No. 7-FZ). But for the purposes of applying accounting standards, SNT is considered as a non-profit structure.

The procedure for maintaining accounting records in SNT is not defined by individual provisions of the law. Therefore, it is necessary to be guided by uniform standards in the field of accounting, on the basis of which a local regulatory document should be developed - the company’s accounting policy.

Using the simplified tax system in accounting

The limit on the average number of employees in the simplified tax system enterprises should not exceed 100 people. It is not allowed to change the object of taxation of the simplified tax system or the system during the year. In SNT, the most convenient object for accounting is the “income” form. Accounting for expenditure indicators by item is carried out in the transaction log.

When maintaining the simplified tax system, the partnership pays:

- A single tax calculated when conducting commercial activities.

- Insurance premiums accrued to the Pension Fund of the Russian Federation and the Social Insurance Fund for payments made to the manager, accountant, security guards and other employees receiving wages.

- Personal income tax paid by the tax agent.

- Land tax, the amount of which is paid from member contributions.

For taxes paid, SNT submits declarations and calculations to the Federal Tax Service and funds. The balance sheet is presented in a simplified form established for small enterprises. It is mandatory to submit a report on the intended use of the funds received.

When carrying out business activities, separate accounting of income and expenses is necessary. Separate accounting is carried out for funds received and spent on targeted programs and commercial activities.

Taxation

As for taxation, in accordance with the current legislation, SNT are payers of VAT, profit tax and property tax. The Partnership also has the right to choose a special regime in the form of a simplified tax (subclause 14, clause 3, Article 346.12 of the Tax Code of the Russian Federation), choosing one of the available options for the object of taxation: income or income minus expenses.

Accounting for income and expenses from commercial activities is carried out in the book of income and expenses using the cash method (Clause 1, Article 346.17 of the Tax Code of the Russian Federation).

In this case, accounting for targeted revenues and expenses is also kept on account 86 “Targeted Financing” and is not subject to taxation (subclause 1, clause 1, article 346.15, clause 2, article 346.16 of the Tax Code of the Russian Federation).

Author of the material: Elena Pozdeeva

Accounting for objects of a gardening partnership

SNT document flow is carried out by groups of assets and liabilities.

| Group name | Credentials | Documentation |

| Special-purpose financing | Accounting for income, expenses, registration of relations with third parties | Statements, cash orders, estimates, contracts |

| Partnership property | Accounting for creation, receipts for registration, retrofitting | Acts, cards, contracts, purchase and sale |

| General documents | Accounting for general forms | Orders, estimates, minutes of meetings, accounting policies |

| Cash and banking operations | Accounting for receipts and expenditures of funds | PKO, RKO, cash book, account statements, advance reports |

| SNT employees | Accounting for employment and work records | Employment contracts, accounting journals |

| Wage | Accounting for remuneration payments | Statements, cards |

| commercial activity | Accounting for income received and expenses incurred | Accounting and tax documents |

The responsibilities of the SNT accounting department include tax accounting and reporting for regulatory organizations. The chairman of the SNT may assume responsibility for record keeping. The Federal Tax Service is quite wary of situations where the positions of chairman, accountant and other employees are held on a voluntary basis, without receiving remuneration.

Objectives of the partnership. Control

Is it possible to own a plot of land without joining the SNT, and why organize it at all? Yes, the law allows not only owners, but also those who use the land on the right of lifelong ownership, lease, etc. not to enter into a partnership. (Clause 1, Article 5 of Law 217-FZ), but at the same time retains for such owners the rights and obligations almost similar to ordinary members of SNT:

- Use of common property.

- Payment of fees.

- Participation in meetings and voting (not on all issues) and others.

Reasons why the creation of an SNT is justified and more convenient for a group of owners (the number of members of the partnership must be at least 7):

- Simplifying the resolution of issues with general communications: electricity, water, gas, etc., solid waste removal, security and other pressing problems. It is easier to conclude contracts and order work on behalf of the organization.

- Protecting the interests of SNT members before third parties, resolving conflict situations whenever possible by voting, and not through legal proceedings. Providing consulting and legal support.

- Defending the interests of SNT before government agencies.

- Assistance in developing sites on the territory of the partnership, organizing land surveying, establishing boundaries, etc.

- Minimization of costs for maintaining common property (water supply, electrical networks, roads, coastal strip, if SNT is located next to a reservoir), more opportunities to improve the territory (for example, build a playground) through joint fees and membership fees.

In order for such a community to work effectively, responsibilities and rights are distributed between three governing bodies, which I have already named above: the general meeting of SNT members, the board and the chairman, and one control body - the audit commission.

General meeting

Once a year or more often (as provided by the charter), a regular general meeting is held. If necessary, it can be extraordinary and convened by the board, auditor (commission) or a team of members of the partnership (in this case there must be at least 1/5 of the total number), as well as the local administration.

The procedure is very similar to that established for an LLC: preparing an agenda with a list of issues for consideration, warning all interested parties about the place and time (two weeks or more), voting and recording the progress of the meeting and its results in the minutes.

Note! You can notify about a meeting in different ways: place information on the website, SNT bulletin board, in local media, send out notices by mail (including electronic mail).

A week before the meeting, the board is obliged to provide those who wish to familiarize themselves with the various documents on which decisions are made.

The meeting is valid with a minimum 50 percent turnout of SNT members or their representatives. A list with the signatures of those present is attached to the protocol with the decisions. Issues within the competence of the general meeting: selection of auditors, chairman, approval of reports (including audit reports) and estimates, making decisions on common property, determining the policy on contributions (size, justification, procedure for making, spending) and others.

Having an approved estimate and documents on contributions is very important for accounting and tax purposes. The primary source on which to rely in the formation of accounting will be, among other things, the charter and minutes of general meetings of SNT members.

Governing body

Next in the hierarchy is the board of the partnership. The chairman is one of the members of the board (at least three and no more than 5% of the number of members of the partnership) and heads it. The timing and frequency of meetings are determined by the charter.

Important! At least half of the board members must be present to make decisions. Regular voting takes place. If the result is 50/50, then the chairman's vote will be decisive.

Makes decisions on holding a general meeting, on current activities, concluding agreements with resource supply organizations, etc. The competence of the board also includes the preparation of reports, including annual ones.

The chairman actually acts as an analogue of a director in a regular organization: he acts on behalf of the partnership without a power of attorney, has the right of first signature, concludes contracts, and hires employees.

Audit committee

The commission must consist of at least three people - members of the partnership. However, they cannot be:

- Chairman.

- Board members.

- Close relatives of the above persons.

The responsibilities of the commission include: checking the legality of transactions concluded by the partnership, implementing decisions of management bodies, auditing activities, identifying violations and preparing proposals for their elimination. The commission is obliged to report all detected inconsistencies and errors to the general meeting.

Source of income SNT

The receipt of funds for servicing activities is made by membership fees of the participants of the partnership. The amount is determined according to the estimate proposed at the general meeting of members or in the presence of a quorum, the sufficient number of which is determined by the constituent documents. The amount of membership fees is established for a calendar year or other period determined by the partnership. Membership fees are taken into account as targeted income, tax-free.

Receipt of membership fees is carried out according to a cash receipt order. SNT organizations are required to comply with the rules for conducting cash transactions. If the day of receipt of funds at the cash desk coincides with a number of persons, reception can be carried out according to a statement indicating the data of the area, the person and if there is a signature. A PKO (receipt cash order) must be issued for the document and subsequently reflected in the cash book.

Job responsibilities

In addition to maintaining direct accounting records, an SNT accountant may be tasked with:

- Personnel records in relation to full-time employees of SNT;

- Management accounting, necessary for managing SNT funds and preparing estimates and budgets;

- Preparation of reporting documentation for the board and chairman, who will present it to the general meeting of SNT members.

The accountant's responsibilities must be precisely defined in the contract with him. You cannot require him to perform actions that, according to the documents, are not the responsibilities of an accountant - employee or external specialist.

A description of what an accountant does in SNT should be contained in his job description. It is advisable to draw it up with the involvement of a lawyer in order to define all the functions of an accountant in a correct and comprehensive manner.

Accountant or bookkeeper - cashier

Despite the widespread use of non-cash payments, many gardeners continue to pay fees in cash. In this regard, the only accountant in SNT usually must also take on the functions of a cashier - receiving and collecting cash.

These responsibilities must be enshrined in the job description of the accountant - SNT cashier. The degree of detail may depend on the wishes of the SNT management bodies. The job description may include responsibilities for receiving and accounting for contributions, transferring them to the bank, maintaining cash accounting documents and other similar functions.

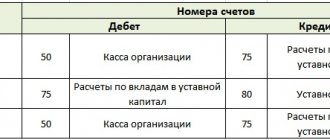

Income Accounts

The working chart of accounts used by the partnership is approved in the appendix to the accounting policy. Receipts are accounted for using account 86 “Targeted financing” and sub-accounts opened for analytical accounting. An account is opened:

- 86/1 to account for the entrance fee funds allocated for documentation.

- 86/2 to account for membership fees used to cover operating expenses.

- 86/3 for accounting for funds allocated for the implementation of target programs, for example, the acquisition of fixed assets.

Let's consider an example with a typical accounting situation in SNT "Uchastok". The general meeting of the partnership members established the need for road construction. The contribution of each person was 1,500 rubles. The target amount is accumulated in account 86/3 for the loan by participants. The following entries are reflected in accounting by person:

Debit 76/5 Credit 86/3 – 1500 rubles – debt accrued in the amount of the target contribution.

Debit 50 Credit 76/5 – 1500 rubles – a cash contribution was made to the target program.

Account 86/3 will be closed after the construction of the SNT “Plot” road. Debt due to counterparties can be determined using account 76/5.

Accounting in SNT: postings and accounting of results

At the end of the month, the accountant closes the account. 90 to profit account 99 (D/t 90 K/t 99), the balance of which is taken into account in account 84 “Retained earnings” (D/t 99 K/t 84). However, in SNT any activity is carried out for the purposes defined by the charter. Therefore, there is no distribution of profit between participants, and the amount is sent to the account. 86 from debit account 84 (D/84 K/t 86).

Accounting in SNT is not exempt from taxes, but the tax base does not include targeted funds allocated in accordance with the estimate for the implementation of statutory activities.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for partnership expenses

The list of expenses allowed in servicing the activities of SNT must be established in the constituent documents or internal regulations approved by the general meeting of participants. The amount of annual expenses is determined in the estimate. At the end of the year, the chairman submits a report approved at the general meeting.

SNT often uses an accounting journal to maintain operations. The document is necessary for drawing up internal reporting, determining the balance and movement of accounts. Let's look at the features of keeping an accounting journal.

| Position | Characteristic |

| Form used | No. K-1 |

| Procedure for filling out the entry | Chronological |

| Grounds for making an entry | Primary accounting documents |

| Content | Brief description of the operation |

| Procedure for recording amounts | Produced by debit and credit of accounts |

| Removal of residue | At the end of the month and for each account |

The convenience of keeping records in the accounting journal is to obtain accurate indicators that allow you to report on the income and expense parts of the estimate.

Difference between SNT and ONT

The main difference between SNT and ONT is the possibility of constructing permanent buildings and structures on the land plots of the owners:

- Gardeners from SNT can erect capital construction projects on the ground: houses, garages, bathhouses, sheds, carports, greenhouses and gazebos. If the house on the site meets the housing requirements, you can register in it, even if the property is located outside the village. If the construction of an object with an area of >50 sq.m. only in plans, you need to get a technical plan.

- Gardeners from ONT cannot install capital construction projects on their plots. This is the difference between SNT and ONT. On the territory of the garden you can build a shed, a temporary shed, a booth, a toilet - anything that does not have a foundation. If a gardener builds a small house, it will be impossible to obtain ownership of it.

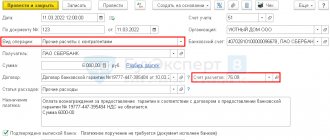

Accounting for utility bills using a practical example

The partnership estimate does not separately reflect utility bills, which must be taken into account. The main type of utility service received by SNT is electricity supplied on the basis of an agreement with a resource supply company. Electricity costs are accounted for on account 26; metered costs are accounted for on account 76/5, broken down by sections or names in correspondence with settlement accounts.

Let's look at examples of transactions when receiving electricity bills and paying them from a service provider.

An invoice was issued to SNT "Ogorodnik" from OJSC "Energosbyt" for June 2016 in the amount of 850 rubles. The chairman of the partnership agreed with the act of receiving energy, which was recorded in the supplier’s copy; the following entries are made:

- Dt 26 Kt60– 850 rubles – the amount of SNT expenses for electricity is accrued according to the act;

- Dt 60 Kt 51 – 850 rubles – payment for the supplied energy has been made;

- Dt 86/2Kt 26 – 850 rubles – costs were covered from targeted revenues.

The debt for the supply of electricity to SNT "Ogorodnik" has been repaid.

The costs of paying utility bills to the service company are covered by the targeted revenues of the participants. The partnership itself does not provide electricity services and proceeds to cover expenses are not income. The responsibilities of the management body of the partnership include collecting funds and transferring them to the company providing the electricity supply service. Accounting in SNT is carried out in strict accordance with the tariffs established for the service.

Nuances of accounting for fixed assets in SNT

Accounting for fixed assets (Fixed Assets) is regulated by FSBU 26/2020 “Fixed Assets”, which has been in effect since 2022. Until the end of 2021, PBU 6/01 “Accounting for fixed assets” was in force.

From 01/01/2022, PBU 6/01 and Methodological guidelines for accounting for fixed assets, approved by order of the Ministry of Finance of the Russian Federation dated 10/13/2003 No. 91n, were replaced by 2 new FSBU 6/2020 “Fixed assets” and 26/2020 “Capital investments”. ConsultantPlus experts explained in detail what has changed in the accounting procedure for fixed assets due to the entry into force of new standards. Get free demo access to K+ and go to the Ready Solution to find out all the details of the innovations.

According to clause 4 of FSBU 6/2020, non-profit organizations (hereinafter referred to as NPOs) accept fixed assets for accounting if the object is used in activities aimed at achieving the goals of creating an NPO, including business activities. The following conditions must also be met at the same time:

- the period of expected use of the OS object is more than a year;

- the object was purchased for the purpose of further use and not for resale.

An asset is accepted for accounting at its historical cost, which is the sum of the amounts of capital investments incurred in the process of acquiring, constructing or manufacturing the asset. These include amounts paid to the seller under the purchase and sale agreement for the property, as well as transportation costs, information and consulting services, non-refundable taxes, etc.

NOTE! If a fixed asset is acquired strictly for non-commercial activities (that is, they do not plan to associate the receipt of VAT-taxable revenue with its use), then the amount of input VAT is included in the cost of the object (clause 2 of Article 170 of the Tax Code of the Russian Federation).

All costs for the acquisition of an asset are collected on account 08 “Investments in non-current assets”, and upon commissioning of the asset, account 08 is credited to the debit of account 01 “Fixed assets of the organization”.

The wiring looks like this:

Dt 08 Kt 60 - an asset was purchased from the seller (including VAT amounts);

Dt 08 Kt 60, 76 - reflects the direct costs of purchasing an asset (transport, consulting, etc.);

Dt 01 Kt 08 - the asset was put into operation;

IMPORTANT! The use of funds from targeted contributions for capital investments should be reflected using account 83 (according to the instructions to the Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n).

Dt 86 Kt 83 - targeted funds aimed at capital investments are taken into account as an increase in additional capital;

Dt 83 Kt 01 - reflects the disposal of a capital investment item purchased using targeted proceeds.

All operations involving the movement of OS objects are documented with primary documents. For which ones, see the material “Documentation of the movement of fixed assets”.

In accounting, fixed assets, based on a valuation approved by the organization independently, can be taken into account as part of the inventory (clause 5 of FSBU 6/2020 “Fixed Assets”, effective from 2022). Until the end of 2022, the limit on the cost of fixed assets for accounting purposes was 40,000 rubles.

Find out how to independently set a limit on the cost of fixed assets in accounting in accordance with the new FSBU 6/2020 “Fixed Assets” in the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial demo access. It's free.

When disposing of fixed assets acquired through targeted financing, the sources of financing are not repaid and are not taken into account in the financial results of the company. In accounting, such an operation is recorded as Dt 83 Kt 01.

Moreover, if SNT acquired an asset using funds from business activities and uses it to generate income, then depreciation is charged on this property and it is accounted for separately from the target property. Depreciation in this case is written off as expenses by posting Dt 20 (26) Kt 02.

If SNT received an asset at the expense of targeted funds, but uses it in commercial activities, then the cost of the asset is recognized as income of the non-profit organization (clause 14 of Article 250 of the Tax Code of the Russian Federation). The cost of property in this case is repaid by calculating depreciation (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Land plots and property of SNT

SNT lands can be used only for their intended purpose for growing crops and erecting buildings. The land is not used for housing construction. The building on the site is not registered as property with the right of registration and has the status of a garden house.

A plot of land cannot be privatized and is provided to a person for rent after joining the partnership. The property is the property of all participants. Persons have at their disposal:

- Public roads located on the territory of SNT.

- Communications intended for the operation of utility networks.

- Areas intended for parking or placement of waste collection containers.

- Common structures, gates, fences.

Accounting for property created with the funds of members of the partnership is carried out in the accounts of fixed assets and construction in progress. The property created with the funds of the participants of the partnership is the property of a legal entity registered in the form of SNT. The right to dispose of property with restrictions on transactions must be approved in the Charter of the partnership.

Members of the partnership have the right to dispose of property on a general basis. In the case of use of SNT property by third parties, an agreement is concluded with them for the right to use for a fee, the amount of which corresponds to the cost established for members.

Membership in SNT. Contributions

Only individuals can become members of the partnership (clause 1 of Article 17 of the law) on the basis of an application. As mentioned above, not only owners, but also right holders (for example, tenants) can join SNT. In the application form they must indicate:

- FULL NAME.

- Residence and postal address.

- Email (if available).

- Agreement with the rules of the charter.

You will also need copies of title documents: certificates of ownership, lease agreements, etc. Some applicants may be denied membership for the following reasons:

- a friend was previously expelled due to non-payment of contributions and the debt was not repaid;

- there are no documents confirming the right to the plot;

- the applicant is not the owner or legal holder of the site;

- the requirements for filling out the application have been violated.

Special conditions apply to certain categories of citizens: those who were members of the reorganized organization automatically become members of the SNT if it was created before the entry into force of Law 217-FZ. If the land in horticulture is transferred into perpetual possession or lease, users do not require permission from the state authorities - the owners.

Important! From January 1, 2022, when drilling and using wells common to the entire SNT or several partnerships, a license will be required (see Article 51 of Law 217-FZ).

After the applicant’s candidacy has been reviewed and approved, from the moment such a decision is made, he becomes a member of the partnership and within three months receives a membership book or other supporting document.

The accounting of contributions received depends on the status of owners and users of land plots - their acceptance from SNT members and all others differs. An accountant, cashier, or other person responsible for accepting contributions needs to know in what capacity their payer is acting. In particular, this affects the use of online cash registers and tax accounting.

Contributions

Before the advent of the new federal law, there were three types of contributions, but then entrance fees were excluded from them and only two remained: membership and targeted.

The main ones are membership fees , they provide for current needs: the maintenance of common property and the functioning of the SNT (payment of salaries, provision of security, payment of taxes, landscaping, etc.).

Targeted funds are allocated for the creation or acquisition of common property, payment for registration, cadastral documents and work related to the acquisition of land plots for the partnership, expenses for ensuring activities approved by the decision of the general meeting of the SNT.

The amount of contributions may depend on the area of land or real estate, share of ownership, etc. data. Such conditions are included in the charter. Sanctions for late payment (penalties) are allowed.

According to paragraphs 3 and 6 of Article 14 of Federal Law No. 217-FZ, contributions must be transferred to a current account. In fact, they continue to be paid and accepted in cash - not every gardener is ready to specifically pay a receipt or make a transfer, many of them spend the summer outside the city and do not have the opportunity to go to a bank branch, not everyone even has access to the Internet.

In this case, there is some contradiction between the Civil Code, which allows making payments in any form, and the specialized federal law No. 217-FZ, which establishes special rules for SNT. It is usually believed that the code is the head of everything, but do not forget that it sets out the fundamental rules, and they can be specified in industry documents.

Those. From the point of view of the law, accepting cash payments (contributions) in a partnership is a violation, but so far the Federal Tax Service is not going to fine you for it. If you still want to strictly follow the letter of the law, here are the steps you need to take:

- Make changes to the charter and other documents of SNT regarding the form of making contributions. If the partnership has not gone through the renaming procedure (see above), then add the correct wording “real estate owners’ association” to the name. To adjust the charter, you will either have to bring this issue to the next general meeting or initiate an extraordinary one.

- Register the change in the charter in the Unified State Register of Legal Entities.

- Post information about payment options in all possible ways (in a bank branch, through mobile applications, terminals, etc.) - indicate on the website, distribute leaflets, send SMS, post an advertisement with a link to regulations and the decision adopted by the general meeting on the information board . This way you will achieve maximum coverage of SNT members.

- Print sample receipts (forms) and place them in the public domain with an example of how to fill them out. You can issue several forms of receipts to each comrade for later payment, or print individual receipts and present them at the meeting.

Explain to management that at the moment accepting cash does not threaten sanctions from the tax authorities, but everything can change, and now it is possible to teach people to pay as expected with the least loss; doing this in an emergency will be much more difficult.